Automotive Airbags & Seatbelts Market By Airbag Type (Front, Knee and Side & Curtain), Seatbelts (2-point and 3-point), Vehicle (PC, LCV, Buses and Trucks), Electric Vehicle, Component (Airbag Inflator, ACU and Airbag) and Region - Global Forecast to 2025

Automotive Airbags & Seatbelts Market

Airbags are a type of automobile safety restraint system designed to mitigate injuries in the event of an accident. Airbags are strong fabric bags that are folded and concealed behind various parts inside the vehicle. Passenger safety is a vital concern in the automobile industry. Passive safety systems such as airbags and seatbelts have proven to be very effective in minimizing the risk of injuries in an accident. In developed countries, airbags have become mandatory, while seatbelts are considered to be basic safety features in most vehicles. Legal mandates for passenger safety are playing a key role in making passive safety systems an integral part of passenger cars.

Key Drivers:

- Government regulations pertaining to vehicle safety

- Growing demand for safer and more efficient driving experience

Key Restraints & Challenges:

- Increasing development of active safety systems

- Maintaining balance between cost and quality

Top Players

- ZF Friedrichshafen (Germany)

- Autoliv (Sweden)

- Joyson Safety Systems (US)

- Robert Bosch (Germany)

- Continental (Germany)

- Aptiv (Ireland)

- Denso (Japan)

- Hyundai Mobis (South Korea)

- Toshiba Device Corporation (Japan)

- Toyoda Gosei (Japan)

Other Regional Players

- Infineon Technologies (Germany)

- GWR Safety Systems (US)

- Ashimori Industry (Japan)

- Tokai Rika (Japan)

Use Cases:

- ZF Friedrichshafen - ZF Friedrichshafen is a global technology company and supplies systems for passenger cars, commercial vehicles and industrial technology. ZF offers airbags and seatbelts under passive safety segment for both passenger cars and commercial vehicles. Over the years the company has established expertise in developing advance airbag technologies that cover frontal and side impact, rollover, rear occupants. In July 2019, ZF developed external airbag to enhance vehicle safety. This external airbag is engineered to soften the blow of the oncoming vehicle minimizing damage. This smart airbag system can deploy once it senses an oncoming impact.

- Autoliv - Established in 1953 and headquartered in Stockholm, Sweden, Autoliv was formed through the merger of the Swedish company Autoliv AB and the US-based Morton Automotive Safety Products, Inc. The company has two operating segments: Passive Safety and Electronics. The passive safety products include airbags, seatbelts, and components, and active safety products include automotive radars, night driving assist, camera-based vision systems, brake controls, and other active safety systems. According to company’s annual report 2019, it has 42% and 41% global market share for airbags and seatbelts respectively. In January 2020, Autoliv announced that it has completed the first unique crash test with a concept airbag for e-scooters. Initial results indicate the e-scooter airbag reduces injuries to an e-scooter rider's head and chest.

- Joyson Safety Systems - Founded in the year 1986, Joyson Safety Systems is headquartered in Michigan, US. The company offers its products under active safety systems and passive safety systems. The company takes the lead in the design, development and manufacturing of auto safety systems including ADAS, airbags, safety belts and steering wheels and other key part. The company offers products to automotive and non-automotive markets worldwide. In April 2018, Joyson Electronics completed its USD 920 million acquisition of Key Safety Systems (US). The acquisition will help enhance the company’s capabilities in developing safety systems.

Airbags & Seatbelts Market Key Technologies:

- Life cell airbags - Autoliv has introduced life cell airbags that provide protection regardless of the position of occupants in vehicles. Once activated in concert with a steering wheel airbag deployment, the life cell airbag resembles a protective cocoon.

- Mix of active and passive systems - Joyson Safety Systems is currently working on smart airbags with an integrated restraints system, a mix of active and passive safety, based on HMI. New advancements in the field of motorized seatbelts and multi-chambered airbags can be expected soon. Usage of these seatbelts are customer specific and enhance crash rating requirement. OEMs targeting a good star rating will install such systems in the near future.

- External pre-crash airbags - ZF has also introduced external pre-crash airbags, designed to be deployed externally from the side of the vehicle. These airbag helps serve as an additional crumple zone in the event of an accident. Tests have shown it can help reduce occupant injury severity by up to 40%. Also, in the future, autonomous vehicles are expected to enhance the traveling experience. ZF designs restraint systems like seatbelts and airbags to help protect occupants by providing flexible seating positions. ZF has designed airbags to adapt to the occupant position and the new degree of freedom in the passenger compartment.

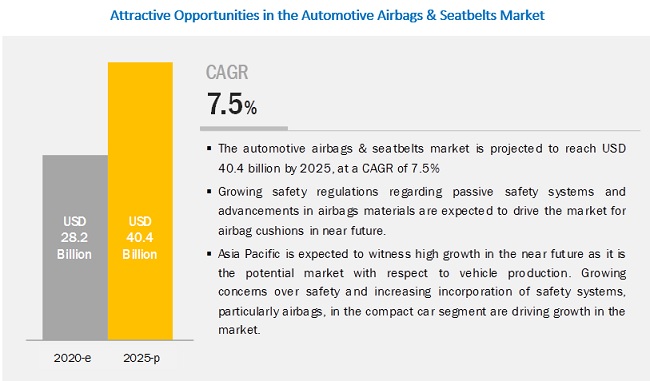

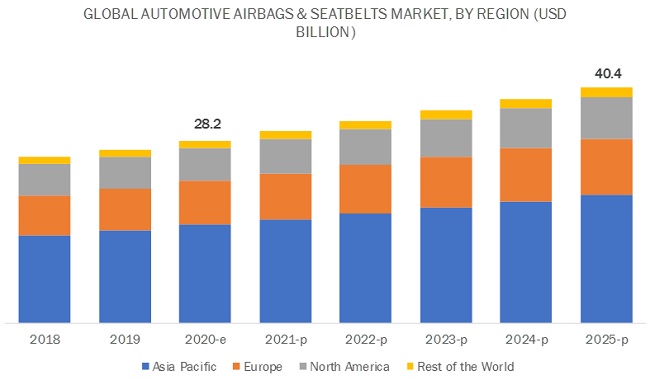

[146 Pages Report] The global automotive airbags & seatbelts market size was valued at USD 28.2 billion in 2020 and is expected to reach USD 40.4 billion by 2025, at a CAGR of 7.5% during the forecast period. Various advancements in vehicle passive safety systems and increased demand for safer, efficient, and convenient driving experience are driving the market for automotive airbags & seatbelts.

By airbag type, side & curtain airbags are projected to be the fastest-growing segment of the automotive airbags & seatbelts market

Side & curtain airbags provide head & neck protection to passengers in side collision crashes. These airbags are effective and give protection to the occupants in case of a rollover crash. These factors boost the growth of the side & curtain airbags market.

Passenger cars to emerge as the fastest-growing segment of the market

The automotive airbags & seatbelts market has been segmented into passenger cars, light commercial vehicles, buses, and trucks. Passenger cars are estimated to be the fastest-growing segment of the automotive airbags & seatbelts industry, by vehicle. The number of passenger cars is growing at a significant rate in the emerging economies of Asia Pacific. This can be attributed to improved lifestyles, the increased purchasing power of consumers, and the development of infrastructure. Airbags and seatbelts are provided as a standard feature in passenger cars in most of the countries for preventing fatalities due to accidents.

By component, airbags to acquire the largest market share in automotive airbags & seatbelts market

The key function of the airbag cushion is to absorb the impact. Nylon has the most superior capability in energy absorption. The balance between the strength and elongation gives desirable properties for airbag cushion materials. Nylon (polyamide) 6.6 is among the most common fabrics used to weave airbag cushions. Growing safety regulations regarding passive safety systems and advancements in airbag materials are expected to drive the market for airbag cushions in the near future.

Asia Pacific is expected to account for the largest market size during the forecast period

The Asia Pacific region is estimated to dominate the global automotive airbags & seatbelts market, in terms of value, in 2020. Asia Pacific is expected to witness high growth in the near future as it holds a tremendous potential market for vehicle production. Growing concerns over safety and increasing incorporation of safety systems, particularly airbags, in the compact car segment are driving growth in the market.

Key Market Players

The automotive airbags & seatbelts market is dominated by a few globally established players such as Autoliv (Sweden), Joyson Safety Systems (US), ZF Friedrichshafen (Germany), Toyota Gosei (Japan), Hyundai Mobis (South Korea), and Denso (Japan).

Autoliv (Sweden) was formed through the merger of the Swedish company Autoliv AB and the US-based Morton Automotive Safety Products, Inc. The company has two operating segments, namely, Passive Safety and Electronics. In January 2020, Autoliv completed the first unique crash test with a concept airbag for e-scooters. Initial results indicate the e-scooter airbag reduces injuries to an e-scooter rider's head and chest. Moreover, the company has also developed a new front-center airbag that is designed to save lives in side-impact crash situations.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Units) |

|

Segments covered |

By Airbags Type, By Seatbelts, By Vehicle, By EV, By Component |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies covered |

The major market players include Autoliv (Sweden), Joyson Safety Systems (US), ZF Friedrichshafen (Germany), Toyota Gosei (Japan), and Hyundai Mobis (South Korea) (Total 24 companies) |

Airbags Type

- Frontal Airbags

- Knee Airbags

- Side & Curtain Airbags

Seatbelts Type

- 2-point Seatbelts

- 3-point Seatbelts

By Vehicle

- Passenger Cars (PC)

- Light Commercial Vehicle (LCV)

- Buses

- Trucks

By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Component

- Airbag Inflator

- Airbag Control Unit

- Airbag

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In July 2019, ZF developed an external airbag to enhance vehicle safety. This external airbag is engineered to soften the blow of the oncoming vehicle, thereby minimizing damage. This smart airbag system gets deployed once it senses an oncoming impact.

- In February 2018, Hyundai Mobis developed the world’s first panoramic roof airbag. The safety device is designed to prevent occupants from being ejected from the vehicle through the glass roof at the time of a rollover.

- In June 2019, Joyson Safety Systems (“JSS”), announced the formation of a Tri-Party Joint Venture to merge its two joint ventures in India. KSS Abhishek Safety Systems Private Limited (“KSSA”), a joint venture of JSS with Abhishek Industries, is being merged with Takata India Pvt. Ltd (“TIPL”). TIPL is a joint venture between ANAND Group and JSS. The new tri-party joint venture will be called “Joyson ANAND Abhishek Safety Systems Private Limited” (“JAASS”). The merger of the two entities is subject to the approval of the National Company Law Tribunal (NCLT).

- In April 2019, ZF signed an investment agreement with the government of the city of Huadu, Guangzhou. ZF is going to build a new R&D center in Haudu as a base for developing automotive electronics, brakes, steering, safety systems, new energy vehicles, and driverless vehicles.

- In January 2019, Continental added a new assembly line to manufacture airbag control units (ACUs) at its Central Electronics Plant in Bangalore, India.

Critical Questions:

- How will the government mandates impact the overall passive safety system market in the long term?

- What impact will advancements of active safety systems have on the overall automotive airbags & seatbelts market?

- What impact will external airbags have on automotive airbags & seatbelts market?

- What are the upcoming trends in the automotive airbags & seatbelts market? What impact would they make in the coming years?

- What are the key strategies adopted by the leading players in this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.6.1 LIMITATION FOR PRIMARY INTERVIEW

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.9 CHANGE IN SCOPE AND CONTENT OF REPORT

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AUTOMOTIVE AIRBAGS AND SEATBELTS MARKET

4.2 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY REGION

4.3 MARKET, BY AIRBAG TYPE

4.4 MARKET, BY SEATBELT TYPE

4.5 MARKET, BY VEHICLE TYPE

4.6 MARKET, BY ELECTRIC VEHICLE

4.7 MARKET, BY COMPONENT

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 IMPACT OF COVID-19 ON AUTOMOTIVE AIRBAGS AND SEATBELTS MARKET

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Government regulations pertaining to vehicle safety

5.3.1.2 Growing demand for safer and more efficient driving experience

5.3.2 RESTRAINTS

5.3.2.1 Increasing development of active safety systems

5.3.3 OPPORTUNITIES

5.3.3.1 Growing demand for electric vehicles

5.3.3.2 Growing demand for pedestrian protection airbags

5.3.4 CHALLENGES

5.3.4.1 Maintaining balance between cost and quality

5.3.4.2 Recalls of multiple vehicle models

5.4 VALUE CHAIN ANALYSIS

5.4.1 PLANNING AND REVISING FUNDS

5.4.2 R&D

5.4.3 MANUFACTURING

5.4.4 ASSEMBLY, SUPPLIER, AND AFTER-SALES SERVICES

5.5 MAJOR PLAYERS IN AIRBAGS AND SEAT-BELTS MARKET ECO-SYSTEM

5.6 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, SCENARIOS (2020-2025)

5.6.1 MOST LIKELY SCENARIO

5.6.2 OPTIMISTIC SCENARIO

5.6.3 PESSIMISTIC SCENARIO

6 INDUSTRY TREND (Page No. - 48)

6.1 INTRODUCTION

6.2 TECHNOLOGICAL ANALYSIS

6.2.1 LIFE CELL AIRBAGS

6.2.2 MIX OF ACTIVE AND PASSIVE SYSTEMS

6.2.3 EXTERNAL PRE-CRASH AIRBAGS

6.3 AIRBAG AND SEATBELT LIFECYCLE

6.4 REGULATORY OVERVIEW

6.5 PORTER’S FIVE FORCES

7 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY AIRBAG TYPE (Page No. - 51)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.2 FRONTAL AIRBAGS

7.3 KNEE AIRBAGS

7.4 SIDE/CURTAIN AIRBAGS

8 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY SEATBELT TYPE (Page No. - 58)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.2 2-POINT SEATBELT

8.3 3-POINT SEATBELT

8.4 FIVE-POINT SEATBELT

8.5 BELT IN SEAT (BIS)

8.6 AUTOMATIC SEATBELT

9 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY VEHICLE TYPE (Page No. - 64)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.2 BUS

9.3 LIGHT COMMERCIAL VEHICLE (LCV)

9.4 PASSENGER CAR (PC)

9.5 TRUCK

10 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY ELECTRIC VEHICLE (Page No. - 72)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.2 BATTERY ELECTRIC VEHICLE (BEV)

10.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

10.4 HYBRID ELECTRIC VEHICLE (HEV)

10.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11 AUTOMOTIVE AIRBAGS SYSTEM MARKET, BY COMPONENT (Page No. - 79)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.2 AIR INFLATOR

11.2.1 ADVANCEMENTS IN TECHNOLOGY TO DRIVE MARKET GROWTH

11.3 AIRBAG CONTROL UNIT

11.3.1 INCREASING AWARENESS ABOUT PASSIVE SAFETY TO DRIVE MARKET GROWTH

11.4 AIRBAG

11.4.1 SAFETY REGULATIONS TO DRIVE MARKET GROWTH

12 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET, BY REGION (Page No. - 84)

12.1 INTRODUCTION

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.1.1 Increasing vehicle production will drive the Chinese market

12.2.2 INDIA

12.2.2.1 Implementation of vehicle passive safety norms will drive the Indian market

12.2.3 JAPAN

12.2.3.1 Strong presence of airbag manufacturers to drive the Japanese market

12.2.4 SOUTH KOREA

12.2.4.1 Adoption of safety programs to drive the South Korean market

12.3 EUROPE

12.3.1 FRANCE

12.3.1.1 Partnerships and collaborations among OEMs and Tier I suppliers will drive the French market

12.3.2 GERMANY

12.3.2.1 Strong presence of auto-ancillary companies to drive the German market

12.3.3 ITALY

12.3.3.1 COVID-19 could have major impact on the Italian market

12.3.4 SPAIN

12.3.4.1 High vehicle production to drive the Spanish market

12.3.5 UK

12.3.5.1 Continuous R&D in vehicle passive safety will drive the UK market

12.4 NORTH AMERICA

12.4.1 CANADA

12.4.1.1 Increasing sales of luxury class vehicles will boost the Canadian market

12.4.2 MEXICO

12.4.2.1 Upcoming safety mandates will boost the Mexican market

12.4.3 US

12.4.3.1 Stringent government safety regulations to drive the US market

12.5 REST OF THE WORLD

12.5.1 BRAZIL

12.5.1.1 Government initiatives related to vehicle passive safety to drive the Brazilian market

12.5.2 RUSSIA

12.5.2.1 Investments from major automobile manufacturers will drive the Russian market

12.5.3 SOUTH AFRICA

12.5.3.1 Increase in number of road accident will increase demand for automotive safety systems

13 COMPETITIVE LANDSCAPE (Page No. - 106)

13.1 OVERVIEW

13.2 MARKET RANKING ANALYSIS

13.3 MARKET EVALUATION FRAMEWORK

13.4 REVENUE ANALYSIS OF TOP 3 MARKET PLAYERS

13.5 COMPETITIVE LEADERSHIP MAPPING

13.5.1 STAR

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 EMERGING COMPANIES

13.6 WINNERS VS. TAIL-ENDERS

13.7 COMPETITIVE SCENARIO

13.7.1 NEW PRODUCT DEVELOPMENTS

13.7.2 MERGERS & ACQUISITIONS

13.7.3 PARTNERSHIPS/AGREEMENTS/SUPPLY CONTRACTS/ COLLABORATIONS/JOINT VENTURES

13.7.4 EXPANSIONS

14 COMPANY PROFILES (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 ZF FRIEDRICHSHAFEN

14.2 DENSO

14.3 AUTOLIV

14.4 CONTINENTAL

14.5 JOYSON SAFETY SYSTEMS

14.6 APTIV

14.7 ROBERT BOSCH

14.8 HYUNDAI MOBIS

14.9 TOSHIBA DEVICE CORPORATION

14.10 TOYODA GOSEI CO.

14.11 INFINEON TECHNOLOGIES

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14.12 KEY PLAYERS FROM OTHER REGIONS

14.12.1 NORTH AMERICA

14.12.1.1 GWR Safety Systems

14.12.1.2 Safety Components

14.12.1.3 Telamon

14.12.2 EUROPE

14.12.2.1 Rhodius GmbH

14.12.2.2 PFAFF Industriesysteme und Maschinen GmBH

14.12.2.3 Klippan

14.12.3 ASIA PACIFIC

14.12.3.1 Sumitomo Electric

14.12.3.2 Ashimori Industry

14.12.3.3 Tokai Rika

14.12.3.4 HMT

14.12.3.5 Shivam Narrow Fabrics

14.12.3.6 Goradia

14.12.3.7 THB Group

15 APPENDIX (Page No. - 140)

15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.4 AUTHOR DETAILS

LIST OF TABLES (101 TABLES)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE AIRBAGS & SEATBELTS MARKET

TABLE 2 GLOBAL REGULATIONS FOR AIRBAGS & SEATBELTS

TABLE 3 MARKET (MOST LIKELY), BY REGION, 2017–2025 (USD MILLION)

TABLE 4 MARKET (OPTIMISTIC), BY REGION, 2017–2025 (USD MILLION)

TABLE 5 MARKET (PESSIMISTIC), BY REGION, 2017–2027 (USD MILLION)

TABLE 6 COUNTRIES AND AIRBAG & SEATBELT REGULATIONS

TABLE 7 AIRBAGS MARKET, BY TYPE

TABLE 8 BY AIRBAG TYPE- MAJOR ASSUMPTIONS

TABLE 9 MARKET, BY AIRBAG TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 10 MARKET, BY AIRBAG TYPE, 2017–2025 (USD MILLION)

TABLE 11 FRONTAL AIRBAGS: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 12 FRONTAL AIRBAGS: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 13 KNEE AIRBAGS: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 14 KNEE AIRBAGS: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 15 SIDE/CURTAIN AIRBAGS: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 16 SIDE/CURTAIN AIRBAGS: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 MARKET, BY SEATBELT TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 18 MARKET, BY SEATBELT TYPE, 2017–2025 (USD MILLION)

TABLE 19 BY SEATBELT TYPE- MAJOR ASSUMPTIONS

TABLE 20 2-POINT SEATBELT: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 21 2-POINT SEATBELT: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 3-POINT SEATBELT: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 23 3-POINT SEATBELT: MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 24 MARKET, BY VEHICLE TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 25 MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 26 BY VEHICLE TYPE- MAJOR ASSUMPTIONS

TABLE 27 BUS: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 28 BUS: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 29 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 30 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 31 PASSENGER CAR: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 32 PASSENGER CAR: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 TRUCK: MARKET, BY REGION, 2017–2025 (THOUSAND UNITS)

TABLE 34 TRUCK: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 35 MARKET, BY ELECTRIC VEHICLE, 2017–2025 (THOUSAND UNITS)

TABLE 36 MARKET, BY ELECTRIC VEHICLE, 2017–2025 (USD MILLION)

TABLE 37 BY ELECTRIC VEHICLE TYPE- MAJOR ASSUMPTIONS

TABLE 38 BEV: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 39 BEV: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 40 FCEV: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 41 FCEV: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 42 HEV: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 43 HEV: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 44 PHEV: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 45 PHEV: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 46 BY COMPONENT - MAJOR ASSUMPTIONS

TABLE 47 AUTOMOTIVE AIRBAGS SYSTEM MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 48 AIR INFLATOR: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 49 AIRBAG CONTROL UNIT: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 50 AIRBAG: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 51 IMPACT OF COVID-19 ON LARGE AUTOMOTIVE MARKETS

TABLE 52 MARKET, BY REGION, 2017–2025 (MILLION UNITS)

TABLE 53 MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2025 (MILLION UNITS)

TABLE 55 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 56 CHINA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 57 CHINA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 58 INDIA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 59 INDIA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 60 JAPAN: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 61 JAPAN: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 62 SOUTH KOREA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 63 SOUTH KOREA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2017–2025 (MILLION UNITS)

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 66 FRANCE: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 67 FRANCE: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 68 GERMANY: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 69 GERMANY: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 70 ITALY: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 71 ITALY: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 72 SPAIN: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 73 SPAIN: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 74 UK: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 75 UK: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (MILLION UNITS)

TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 78 CANADA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 79 CANADA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 80 MEXICO: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 81 MEXICO: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 82 US: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 83 US: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 84 ROW: MARKET, BY COUNTRY, 2017–2025 (THOUSAND UNITS)

TABLE 85 ROW: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 86 BRAZIL: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 87 BRAZIL: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 88 RUSSIA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 89 RUSSIA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 90 SOUTH AFRICA: MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 91 SOUTH AFRICA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 92 NEW PRODUCT DEVELOPMENTS, 2017–2020

TABLE 93 MERGERS & ACQUISITIONS, 2017–2020

TABLE 94 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES

TABLE 95 EXPANSIONS

TABLE 96 ZF - NEW PRODUCT DEVELOPMENT

TABLE 97 ZF - PARTNERSHIPS/COLLABORATIONS/JVS/AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 98 AUTOLIV: KEY FINANCIALS

TABLE 99 APTIV: KEY FINANCIALS

TABLE 100 PRODUCTS OFFERED: APTIV

TABLE 101 ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

LIST OF FIGURES (56 FIGURES)

FIGURE 1 AUTOMOTIVE AIRBAGS & SEATBELTS MARKET SEGMENTATION

FIGURE 2 CHANGE IN CAGR: PREVIOUS REPORT VS LATEST REPORT, 2020–2025

FIGURE 3 MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH DESIGN MODEL

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 6 MARKET: MARKET ESTIMATION

FIGURE 7 GLOBAL MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 8 DATA TRIANGULATION

FIGURE 9 MARKET: MARKET DYNAMICS

FIGURE 10 IMPACT ANALYSIS: MARKET

FIGURE 11 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 GOVERNMENT REGULATIONS PERTAINING TO VEHICLE SAFETY TO DRIVE THE MARKET, 2020–2025

FIGURE 13 ASIA PACIFIC TO WITNESS THE FASTEST GROWTH, 2020–2025

FIGURE 14 FRONTAL AIRBAGS TO BE THE LARGEST SEGMENT, 2020–2025

FIGURE 15 3-POINT SEATBELT TO BE THE LARGEST SEGMENT, 2020–2025

FIGURE 16 PASSENGER CAR TO BE THE LARGEST SEGMENT, 2020–2025

FIGURE 17 HEV TO BE THE LARGEST SEGMENT, 2020–2025

FIGURE 18 AIRBAG SEGMENT TO BE THE LARGEST, 2020–2025

FIGURE 19 PRODUCT LIFECYCLE FOR AIRBAGS MARKET

FIGURE 20 MARKET: MARKET DYNAMICS

FIGURE 21 AVERAGE SELLING PRICE TREND FOR AIRBAGS COMPONENT

FIGURE 22 VALUE CHAIN ANALYSIS: R&D AND MANUFACTURING PHASES ADD MAXIMUM VALUE

FIGURE 23 AIRBAGS AND SEATBELTS LIFECYCLE

FIGURE 24 MARKET, BY AIRBAG TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 25 BY AIRBAG TYPE - KEY PRIMARY INSIGHTS

FIGURE 26 MARKET, BY SEATBELT TYPE, 2020 VS 2025 (USD MILLION)

FIGURE 27 BY SEATBELT TYPE - KEY PRIMARY INSIGHTS

FIGURE 28 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 29 BY VEHICLE TYPE - KEY PRIMARY INSIGHTS

FIGURE 30 MARKET, BY ELECTRIC VEHICLE, 2020 VS. 2025 (USD MILLION)

FIGURE 31 BY ELECTRIC VEHICLE - KEY PRIMARY INSIGHTS

FIGURE 32 AIRBAG TO DOMINATE THE GLOBAL AIRBAGS SYSTEM MARKET DURING THE FORECAST PERIOD

FIGURE 33 BY COMPONENT - KEY PRIMARY INSIGHTS

FIGURE 34 ASIA PACIFIC IS ESTIMATED TO BE THE LARGEST MARKET FOR AUTOMOTIVE AIRBAGS & SEATBELTS MARKET DURING THE FORECAST PERIOD (2020–2025)

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 36 EUROPE: MARKET SNAPSHOT

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 38 ROW: MARKET SNAPSHOT

FIGURE 39 MARKET RANKING 2019

FIGURE 40 MARKET EVALUATION FRAMEWORK:

FIGURE 41 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING

FIGURE 42 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2017–2020

FIGURE 43 ZF FRIEDRICHSHAFEN

FIGURE 44 ZF FRIEDRICHSHAFEN: SWOT ANALYSIS

FIGURE 45 DENSO: COMPANY SNAPSHOT

FIGURE 46 DENSO: SWOT ANALYSIS

FIGURE 47 AUTOLIV: COMPANY SNAPSHOT

FIGURE 48 AUTOLIV: SWOT ANALYSIS

FIGURE 49 CONTINENTAL: COMPANY SNAPSHOT

FIGURE 50 CONTINENTAL: SWOT ANALYSIS

FIGURE 51 JOYSON SAFETY SYSTEMS: SWOT ANALYSIS

FIGURE 52 COMPANY SNAPSHOT: APTIV

FIGURE 53 ROBERT BOSCH: COMPANY SNAPSHOT

FIGURE 54 HYUNDAI MOBIS: COMPANY SNAPSHOT

FIGURE 55 TOYODA GOSEI: COMPANY SNAPSHOT

FIGURE 56 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

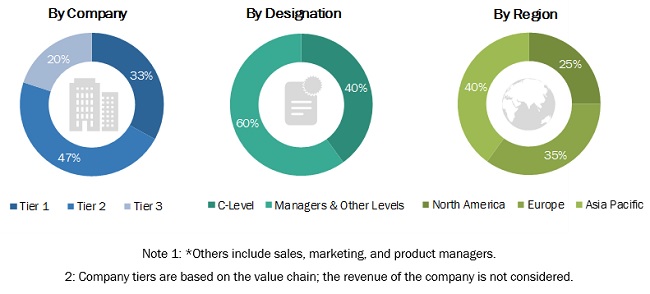

The study involved four major activities in estimating the size for automotive airbags & seatbelts market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive study of the global automotive airbags & seatbelts market. The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive airbags & seatbelts market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (vehicle manufacturers) and supply-side (airbag and seatbelt manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (Brazil and Russia). Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

- The bottom-up approach has been used to estimate and validate the size of the automotive airbags & seatbelts market.

- In this approach, the vehicle production statistics for each vehicle type have been considered at a country and regional level.

- The country-level penetration rate for airbags & seatbelts for each vehicle type as considered under the scope of the study

- Further, average OE Price in USD per country for airbags & seatbelts in each vehicle type has been considered to derive the value market

- Summation of all countries = Regional market size for the market, which further gives global airbags & seatbelts market.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, segment, and analyze the global automotive airbags & seatbelts market based on airbag type, seatbelt type, vehicle type, electric vehicle, component, and region

- To analyze and forecast the market size, in terms of volume (000’/million units) and value (USD million/billion), for the market

- To provide a detailed analysis of various factors influencing the market (drivers, restraints, opportunities, and challenges)

- To segment and forecast the automotive airbags market size by airbag type (frontal, side/curtain, and knee airbags)

- To segment and forecast the size of the automotive seatbelt by seatbelt type (2-point and 3-point)

- To segment and forecast the market size by vehicle type (passenger cars, LCV, bus, and truck)

- To segment and forecast the market size, by electric vehicle (BEV, HEV, PHEV, and FCEV)

- To segment and forecast the market size by component (air inflator, airbag, and airbag control unit)

- To forecast the market size in key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To provide a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of automotive airbags & seatbelts market

- Profiling of additional market players (up to 3)

- Country-level analysis of EV and Off-Highway Segment

Growth opportunities and latent adjacency in Automotive Airbags & Seatbelts Market

I want to understand the details and products covered under Airbag and Seat belts for India. Also will you give data for India only.

Working on a story about the growing airbag manufacturing opportunity in India. Grateful if you could please share a copy of this report. Thanks

We are a spring maker, so any information about components is helpful. Also, any forecast information by company and region through 2020 is of interest to us.

We are interested in information about capacity, market share and product volume regarding as air bag and seat belt.