Aircraft Braking System Market Size, Share & Industry Growth Analysis Report by Aircraft Type, End Use (OEM, Aftermarket), Actuation (Power Brake, Boosted Brake, Independent Brake), Component (Wheels, Brake Discs, Brake Housing, Valves, Actuators, Accumulator, Electronics), Region - Forecast to 2027

Update: 10/22/2024

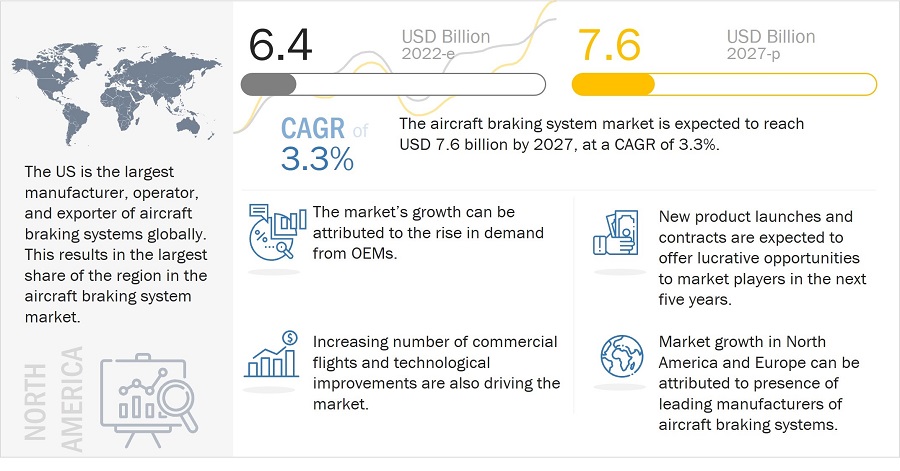

[200 Pages Report] The Aircraft Braking System Market is projected to grow from USD 6.4 Billion in 2022 to USD 7.6 Billion by 2027, at a CAGR of 3.3% during the forecast period. The growth of the Aircraft Braking System Industry can be attributed to several factors, such as the need for frequent replacement of braking units and the growing fleet size across the globe.

Different types of aircraft can use aircraft braking systems to improve their operational efficiency and be safer and more reliable. Some aircraft that use aircraft braking systems as landing gear in their operations are narrow-body aircraft, wide-body aircraft, private jets, transport aircraft, fighter aircraft, commercial and military helicopters, and unmanned aerial vehicles.

Increasing commercial aircraft operations are most likely to drive the growth in demand for aircraft braking systems. Major countries in Asia Pacific, North America, and Europe have witnessed a rise in military operations, which increases the demand for aircraft braking systems in military aircraft. Replacement services will be a factor in driving the market. These systems will also emerge useful in the unmanned aerial vehicle industry as there will be more risk of finding aircraft challenges.

Aircraft Braking system Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Braking system Market Dynamics:

Driver: Technological Improvements in braking components

The technology of aircraft braking systems has evolved considerably. Earlier, only limited products accounted for safety, but now the system is an integral component in the landing gear system. Various types of brakes and components based on the aircraft application with the standards and regulations of the industry are available.

Technological improvement in the aircraft braking system will also be a significant driver as aircraft players will not be willing to compromise on the safety and efficiency of their aircraft, passengers, and employees. As a result, they will continue to subscribe to upgradation and maintenance services to have the highest order of braking systems for their aircraft. For instance, Safran Group (France) developed an efficient braking solution by introducing brake discs that combine both carbon and composite material. This resulted in longer life on brake discs and can be operated at higher braking temperatures, providing higher safety and efficiency.

Opportunity: Emerging market in growing economics

In earlier period, a limited number of players provided MRO services for braking systems to commercial and military aircraft. Brakes and wheels and along with other sub systems in the braking system have very short replacement cycles and are contributing a large revenue to the overall aircraft braking system market. Many countries including China, Japan and a few countries form the Latin American region are witnessing a increasing growth in companies providing the necessary MRO services to commercial as well as military aircraft. This is driving the growth for the aircraft braking systems in Asia Pacific, Middle Eastern and Latin American regions. Major aircraft MRO service providers like AAR Corp. (US) and Boeing (US) are also expanding to these regions due to the increasing demand for MRO services in these regions.

Challenge: Stringent Regulatory Environment

The regulatory bodies of the aerospace industry has established a strict and everchanging regulatory environment to ensure best safety standards for the safety and improvement of the aviation industry. These stringent regulations require aircraft braking system manufacturers and MRO service providers to adhere to some really complex manufacturing and quality assurance procedures.

An example of the strict regulatory standards is also associated with the replacement of steel brakes and carbon brakes in commercial aircraft. The braking system providers need to adhere to various tests and certification processes for their brakes and supporting systems to be able to fit on aircraft.

The OEM segment is estimated to lead the aircraft sensors market in 2022

Based on End Use, the OEM segment of the aircraft braking system market is accounted for the largest growth during the forecast period. Increasing demand for different aircraft across the commercial and military platforms is one of the main reasons for the drive in braking system market growth. Increasing developments in Advanced Air Mobility platforms and Unmanned Aerial Vehicle platforms to drive further growth in the aircraft braking system market.

The Actuators segment to witness largest growth in the forecast period

Based on component, actuators segment is witnessing highest growth in the forecast period. Actuators are used to press the brake discs to create friction to stop apply brakes onto the aircrafts. Traditionally actuators were hydromechanically driven. New technological advancements are making way to electromechanically driven actuators.

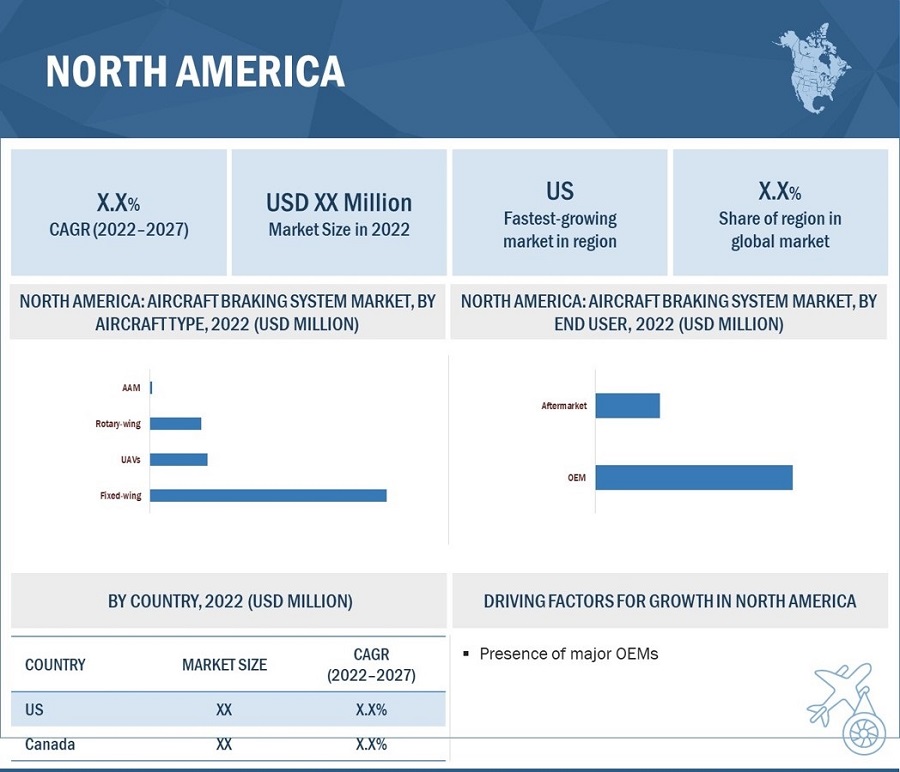

North American region is expected to have the highest market share during the forecast period

North American region constitutes the largest aircraft braking system manufacturers among all the regions. North America region also invests heavily in research and development of advanced braking system technologies required for current aircraft technologies as well as future technologies.

Aircraft Braking system Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Aircraft Braking System Companies are dominated by globally established players such as Safran (France), Collins Aerospace (US), Parker-Hannifin Corporation (US), Crane Co. (US), and Honeywell International Inc. (US) among others. These key players offer aircraft braking system and services to different key stakeholders.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 6.4 Billion in 2022 |

|

Projected Market Size |

USD 7.6 Billion by 2027 |

|

Growth Rate |

3.3% |

|

Market Size Available for Years |

2018-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

End User, Aircraft Type, Actuation. Component and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, the Middle East, Latin America and Africa. |

|

Companies Covered |

Safran (France), Collins Aerospace (US), Parker-Hannifin Corporation (US), Crane Co. (US), and Honeywell International Inc. (US) |

Aircraft Braking System Market Highlights

This research report categorizes the aircraft braking system market into End User, Aircraft Type, Actuation. Component and Region

|

Aspect |

Details |

|

By Component |

|

|

By Actuation |

|

|

By Aircraft Type |

|

|

By End Use |

|

|

Regions |

|

Recent Developments

- In August 2022, RUAG Australia has signed a contract with Honeywell International Inc. to become an Authorized Service Centre for the F-35 Joint Strike Fighter Wheels and Brakes program in Asia Pacific.

- In April 2022, The largest cargo aircraft lessor globally, Air Transport Services Group (ATSG), will upgrade more than thirty Boeing 767Fs in its fleet. This will allow the corporation to use a uniform wheel and brake design across its entire fleet. Safran will supply the conversion kits and maintain the systems once they are in service. Carbon brakes have a competitive edge in weight, strength, and reliability over steel brakes. ATSG and its clients will be able to enhance operating margins, conserve fuel, and save expenses.

Frequently Asked Questions (FAQs):

What is the current size of the aircraft braking system market?

The Aircraft Braking System Market is projected to grow from USD 6.4 Billion in 2022 to USD 7.6 Billion by 2027, at a CAGR of 3.3% during the forecast period.

Who are the winners and small enterprises in the aircraft braking system market?

Major players operating in the aircraft braking system market include Safran (France), Collins Aerospace (US), Parker-Hannifin Corporation (US), Crane Co. (US), and Honeywell International Inc. (US among others. These key players offer aircraft braking system and services to different key stakeholders.

What are some of the technological advancements in the market?

Modern aircraft use carbon disc brakes as they are safer and more efficient than the other two options and have a higher operating temperature than steel and composite disc brakes. Modern aircraft manufacturing companies and OEM manufacturers are trying to find more safety and operational efficiency for aircraft crew and management companies. Hence, companies such as Safran, Honeywell International Inc., and Collins Aerospace are developing more alternatives to the typical aircraft braking system.

Safran has developed one such electric brake, which meets the demand of aircraft makers and provides a safer and more reliable alternative to the traditional aircraft braking system. An electric aircraft brake replaces the hydraulic line and piston and replaces them with electrical wiring and electromechanical actuators. These components convert electrical signals to electromechanical commands and help apply brakes to an aircraft.

What are the factors driving the growth of the market?

Certain Components of the braking system require high frequency of replacement. This high frequency is driving the aftermarket size of the braking system market. The increasing fleet size across regions are also contributing to both OEM and aftermarket size of the market.

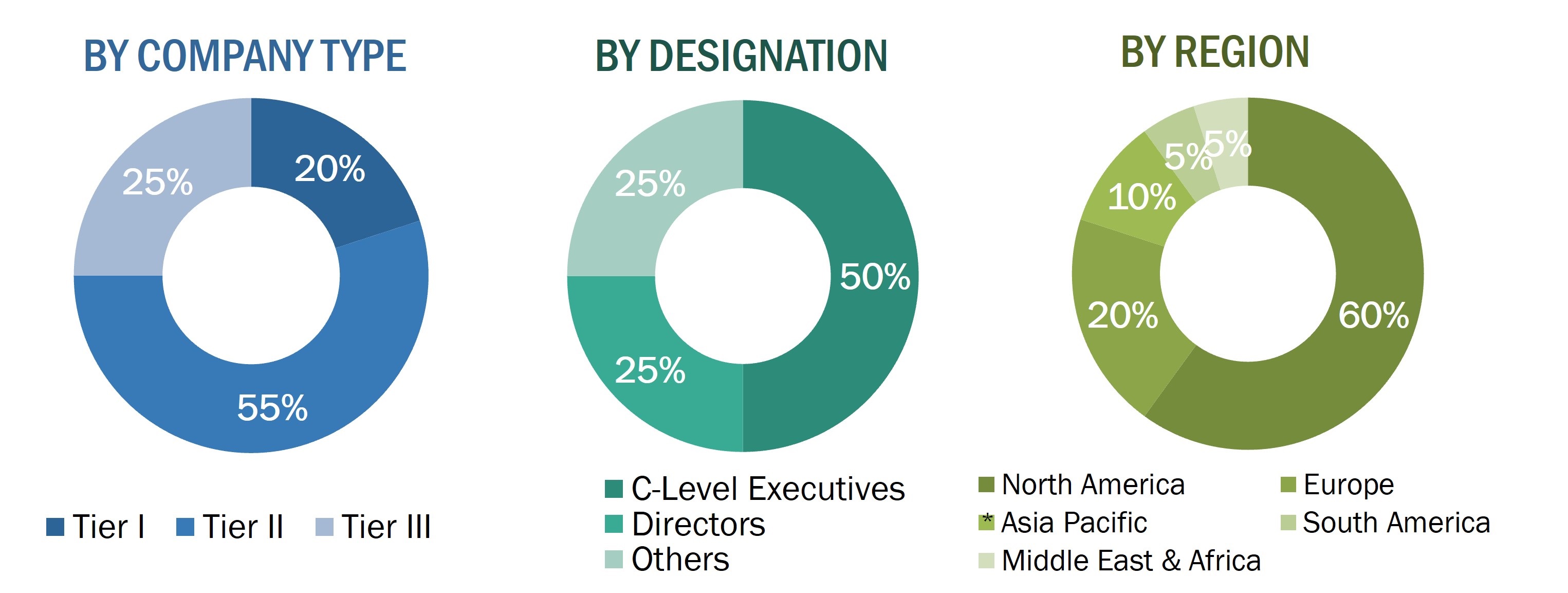

The research study conducted on the aircraft braking system market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the aircraft braking system market. The primary sources considered included industry experts from the aircraft braking system market as well as raw material providers, aircraft braking system manufacturers, solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the aircraft braking system market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the aircraft braking system market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the aircraft braking system market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

Primary Research

The aircraft braking system market comprises several stakeholders, such as raw material providers, aircraft braking system manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

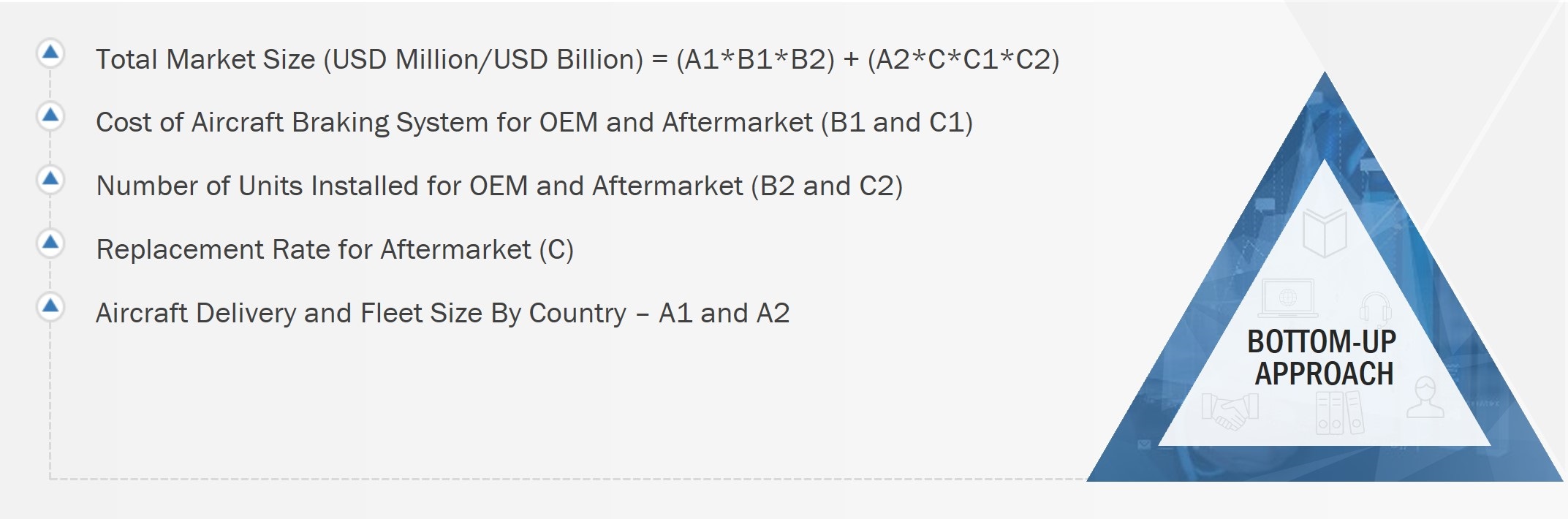

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the aircraft braking system market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the aircraft braking system market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the aircraft braking system market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market Size Estimation Methodology: Bottom-Up Approach

Market Size Estimation Methodology: Top-Down Approach

Data triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the aircraft braking system market based on End User, Aircraft Type, Actuation. Component and Region.

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 6 main regions: North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America

- To analyze technological advancements and new product launches in the market from 2017 to 2022

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Braking System Market