Aircraft Flight Control Systems Market by Component (Cockpit Controls, Flight Control Computer, Actuators, Sensors), Platform (Commercial Aviation, Military Aviation, Business & General Aviation), Fit, Technology, and Region - Global Forecast to 2027

Update: 11/22/2024

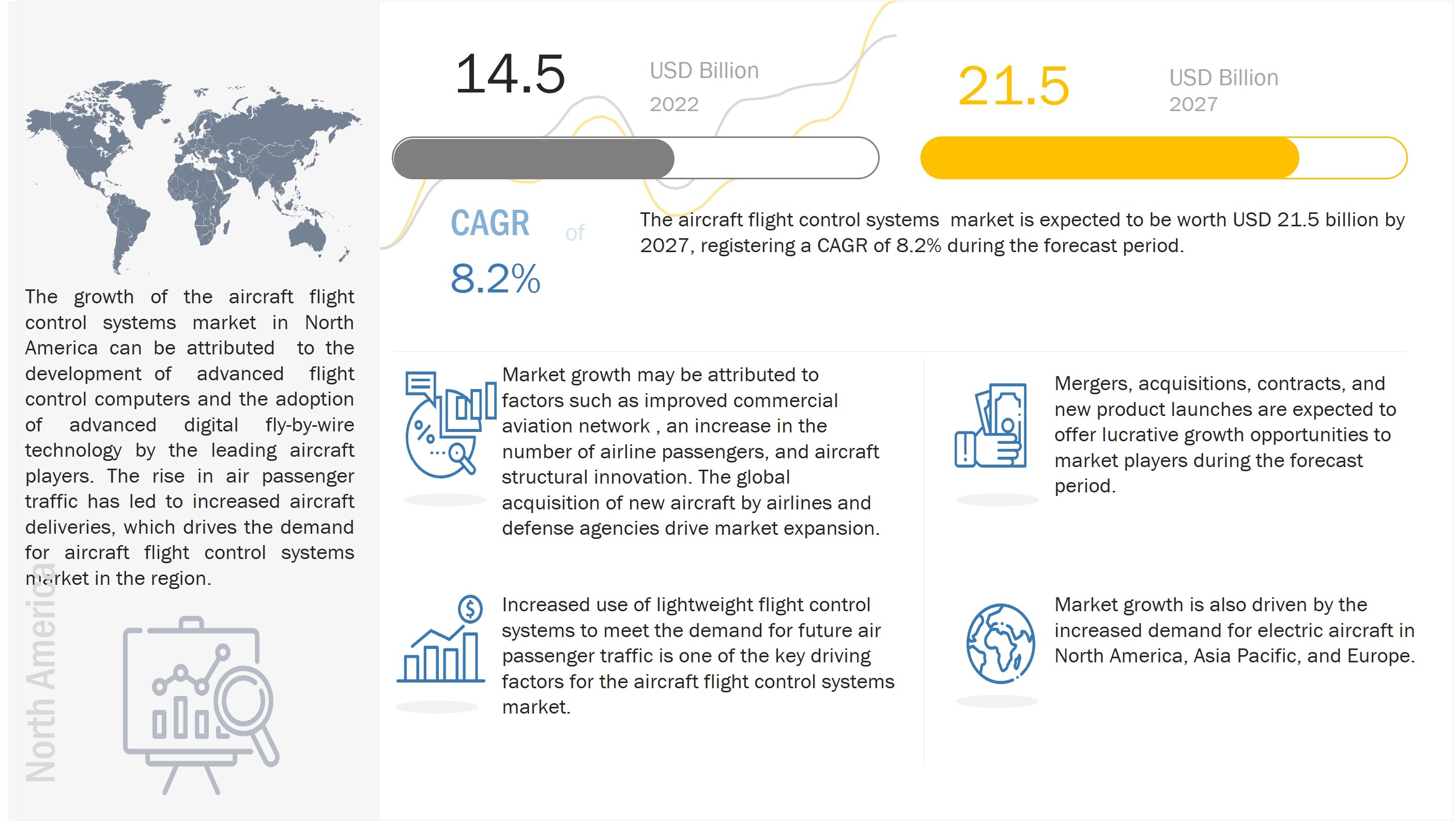

The Global Aircraft Flight Control System Market Size was valued at USD 14.5 Billion in 2022 and is estimated to reach USD 21.5 Billion by 2027, growing at a CAGR of 8.2% during the forecast period. The market is driven by various factors, such as the demand for lightweight flight control systems to meet the demand for modern aircraft , and the increased air traffic footprint is expected to influence the demand for commercial aircraft globally.

Aircraft Flight Control Systems Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Flight Control Systems Market Dynamics

Driver: Enhanced safety and situational awareness

The last generation of aircraft utilized cables to operate the control surfaces. The introduction of fly-by-wire (FBW) technology revolutionized the aviation sector as it replaced the conventional manual controls of an aircraft with an all-electronic interface. FBW is a combination of various subsystems which help enhance the safety and situation awareness of an aircraft. The usage of advanced flight computers enhances the safety of flight significantly since they automate a huge chunk of flight parameter monitoring activities, thereby reducing the pilot’s workload. The plethora of functions that can be easily performed by onboard flight control systems helps enhance the safety envelope of the aircraft by improving the situational awareness of the pilots and reducing fatigue to a great extent. Additionally, the commercial and military aircraft fleet of various countries is growing across commercial airlines, including narrow-body aircraft, wide-body aircraft, and regional jets. This can be attributed to the rise in demand for air travel globally, especially in the emerging economies of Asia Pacific and the Middle East. Therefore, the demand for Aircraft Flight Control Systems Industry is directly influenced by the growth of large fleets of commercial and military aircraft.

Restraint: Design challenges

Flight control systems are essential for ensuring the proper operation of the aircraft, and hence the safety of the crew and passengers is dependent on the optimal functioning of the system and its subcomponents. Thus, the integrated flight control architecture onboard an aircraft model is required to be designed as per the guidelines formulated by aviation regulatory authorities, and their performance and accuracy are required to be validated prior to obtaining installation type certification. As per the US Code of Federal Regulations (FCR), to obtain operational credit, flight component subsystems must meet several requirements pertaining to the information provided and instruments used in the system. Thus, the process of certification is stringent and hence requires R&D expenditure to design a system in compliance with all existing regulations to be deemed fit for installation onboard different aircraft models. The lengthy and capital-intensive process involved in the appropriate certification of related flight control components and subsystems may restrain the growth of the flight control systems market in the near future.

Opportunity: Emergence of new aircraft manufacturers

The emergence of new aircraft manufacturers in the Asia Pacific and Latin American regions is one of the major opportunities for the growth of the aircraft flight control systems market. Commercial Aircraft Corporation of China, Ltd. (COMAC) (China), Embraer SA (Brazil), and Mitsubishi Aircraft Corporation (Japan) are some of the new aircraft manufacturing companies. Mitsubishi Aircraft Corporation is engaged in the production of regional aircraft, while COMAC manufactures commercial, business, and regional aircraft. The demand for commercial aircraft, business jets, and regional transport aircraft, owing to the increased air passenger traffic across the globe, is expected to provide growth opportunities for the new aircraft manufacturers, thereby increasing their production. This, in turn, is expected to result in increased demand for aircraft flight control systems, thereby serving as a growth opportunity for the market during the forecast period.

Challenge: Stringent regulatory framework

The aviation industry is marred by a multitude of bilateral, national, and international regulations and standards that bind the actions of airports and aircraft operators. The International Civil Aviation Organization (ICAO) is tasked with formulating global standards for the commercial aviation sector to ensure the safe operation of aircraft and controlling the risks associated with it to an acceptable level.

The continuous globalization and liberalization of the aviation industry has put substantial pressure on incumbents to compete commercially in an increasingly competitive market. Nevertheless, the industry's primary focus has been the development of improved systems and components with lower failure rates, reduced material costs, and faster R&D cycles. Thus, aircraft components and systems are subjected to demanding quality inspections and rigorous testing in order to improve safety standards. The rising complexity of aircraft construction necessitates the usage of electronic components, causing aircraft OEMs to struggle with delivery deadlines. Moreover, with rapid technological advancements and new technologies and products replacing the old ones every five to seven years, it becomes a challenge for the component and system manufacturers to adhere to the regulatory environment.

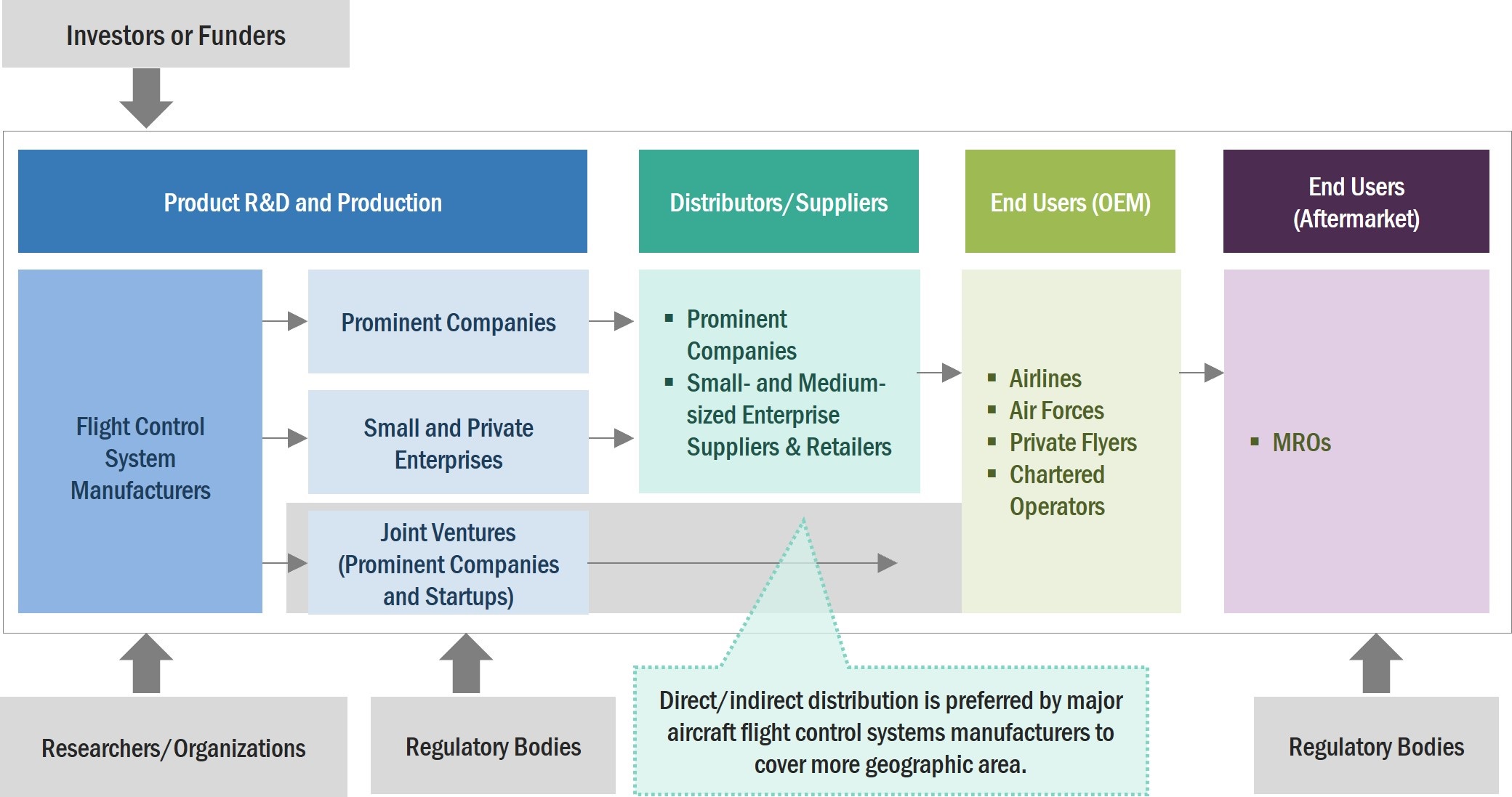

Aircraft Flight Control Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft flight control systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran S.A. (France), Thales (France), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), and BAE Systems PLC (UK). Airlines, global air forces, business jet users, private flyers, MROs, and chartered operators are some of the leading consumers of aircraft flight control systems.

Flight control computers to dominate market share during the forecast period

Based on components, the aircraft flight control system market has been segmented into flight control computers, actuators, cockpit controls, sensors, and others (wires and connectors). The growing inclination of passengers towards air travel is one of the major factors driving the flight control computers segment. Manufacturers of aircraft flight control systems are developing protocols that will reduce wiring and lower the life cycle costs of the systems, increasing system efficiency. With major airlines expanding their aircraft fleet size in the last 5 years, the demand for technologically advanced primary flight control computers will grow. The new-generation technology will improve overall aircraft efficiency and safety while lowering direct operational expenses

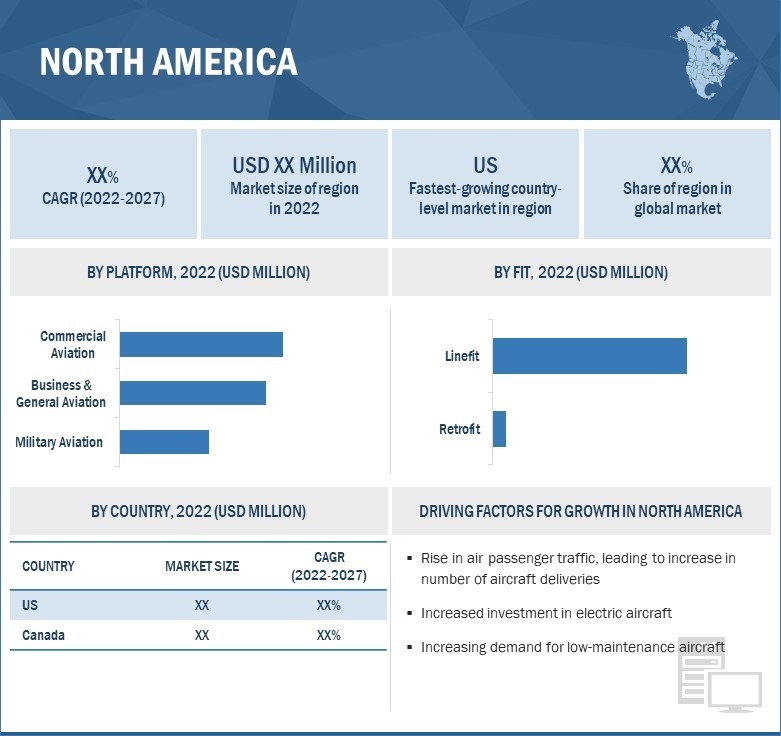

Linefit segment to lead the market for aircraft flight control systems during the forecast period

Based on fit, the aircraft flight control systems market has been segmented into linefit and retrofit. Some of the main factors propelling the fixed-wing aircraft market include rapid urbanization and the increasing focus of aircraft OEMs to manufacture high-performance aircraft with lower weight profiles. Many end users have already announced new fleet expansion plans as a pre-emptive measure to cater to the increasing passenger traffic and capture a greater market share. Thus, the increase in demand for new-generation aircraft is expected to drive the growth of the linefit segment of the aircraft flight control systems market.

Fly-by-Wire segment to witness higher demand during the forecast period

Based on technology, the aircraft flight control systems market has been classified into digital fly-by-wire, fly-by-wire, hydro-mechanical, and power-by-wire. The integration of fly-by-wire flight control technology is steadily becoming standard even in new models of flight aircraft which otherwise used traditional hydro-mechanical controls. Fly-by-wire systems are lighter and less bulky than their mechanical counterparts, which offers aircraft design flexibility and enhances the performance curve of light aircraft, thereby creating the demand for aircraft control systems.

Commercial Aviation to acquire the largest market share during the forecast period

Based on platform, the aircraft flight controls system market has been classified into commercial aviation, military aviation, business & general aviation. The commercial aviation segment market is projected to dominate the market share. The growing size of aircraft fleets is likely to boost the commercial aviation industry over the forecast period.

Fixed-wing segment to hold major market share during the forecast period

Based on aircraft type, the aircraft flight control systems market has been classified into fixed-wing and rotary-wing types. The major aircraft manufacturers are putting efforts to replace heavy, conventional aircraft components with more efficient and contemporary electric components, thus will drive the demand for technologically better aircraft flight control systems. Besides, the rapid growth in global passenger traffic is also expected to drive the demand for fixed-wing aircraft in the commercial and general aviation sectors, thereby creating a parallel demand for aircraft flight control systems for integration into the different systems onboard the aircraft.

North America is projected to witness the highest market share during the forecast period

North America leads the aircraft flight control systems market due to the presence of several large aircraft flight control systems manufacturers in the region. Prominent market players based in this region include Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Parker Hannifin Corporation (US), and Curtiss-Wright Corporation (US). Market growth in the North American region is expected to be fueled by the increase in the number of deliveries of wide-body and narrow-body aircraft during the forecast period. Additionally, the high disposable income of consumers in the region has contributed to the rise in air travel, which has led to an increase in the number of aircraft deliveries in this region, propelling the demand for aircraft flight control systems

Aircraft Flight Control Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Aircraft Flight Control Systems Companies include Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran SA (France), Thales (France), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), and BAE Systems PLC (UK).

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate

|

8.2 %

|

|

Estimated Market Size in 2022 |

USD 14.5 Billion |

|

Projected Market Size in 2027 |

USD 21.5 Billion |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Component, By Fit, By Technology, By Platform, By Aircraft Type, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies Covered |

Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran SA (France), Thales (France), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), and BAE Systems PLC (UK), among others |

Aircraft Flight Control Systems Market Highlights

This research report categorizes the Aircraft Flight control systems Market based on System, Platform, Fit, and Region.

|

Aspect |

Details |

|

By Component |

|

|

By Fit |

|

|

By Technology |

|

|

By Platform |

|

|

By Aircraft Type |

|

|

By Region |

|

Recent Developments

- In January 2020, Honeywell International Inc. announced the development of its new line of electromechanical actuators specifically designed for urban air mobility (UAM).

- In June 2019, Honeywell International Inc. launched a new compact fly-by-wire system, the next step toward autonomous and specifically designed for urban air mobility.

Frequently Asked Questions (FAQs):

What are your views on the growth prospect of the aircraft flight control systems market?

The aircraft flight control systems market is driven by the ongoing fleet modernization programs of end users and the increasing order book and deliveries for new-generation aircraft. The advent of electric aircraft and the concept of urban air mobility (UAM) is likely to bring a paradigm shift in the market.

What are the key sustainability strategies adopted by leading players operating in the aircraft flight control systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft flight control systems market. The major players include Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran S.A. (France), Thales (France), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), and BAE Systems PLC (UK). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Aircraft flight control systems market?

Some of the major emerging technologies and use cases disrupting the market include more electric technology, digital fly-by-wire, and the use of fully electric architecture in aviation applications.

Who are the key players and innovators in the ecosystem of the aircraft flight control systems market?

The key players in the Aircraft flight control systems market include Honeywell International Inc. (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran S.A. (France), Thales (France), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), and BAE Systems PLC (UK).

Which region is expected to hold the highest market share in the aircraft flight control systems market?

The aircraft flight control systems market in North America is projected to hold the highest market share during the forecast period due to the presence of several large aircraft flight control systems manufacturers in the region.

Which technology, such as digital fly-by-wire, fly-by-wire, hydro-mechanical, and power-by-wire is expected to drive the growth of the market in the coming years?

For the aircraft flight control systems market, fly-by-wire technology is projected to grow at the highest CAGR during the forecast period from 2022 to 2027. Significant advancements in flight control technologies for the effective handling of aircraft by controlling the primary and secondary flight surfaces are anticipated to drive market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

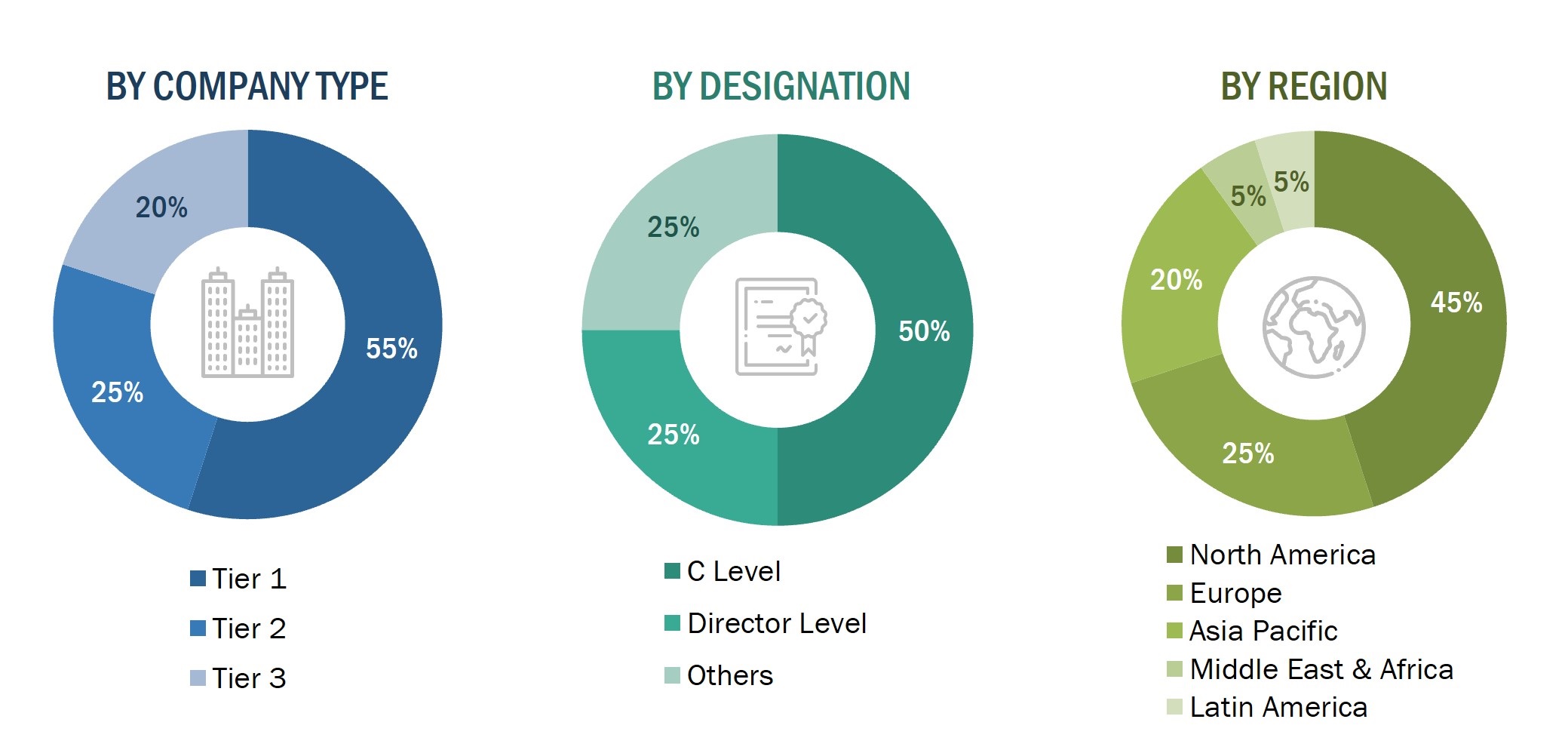

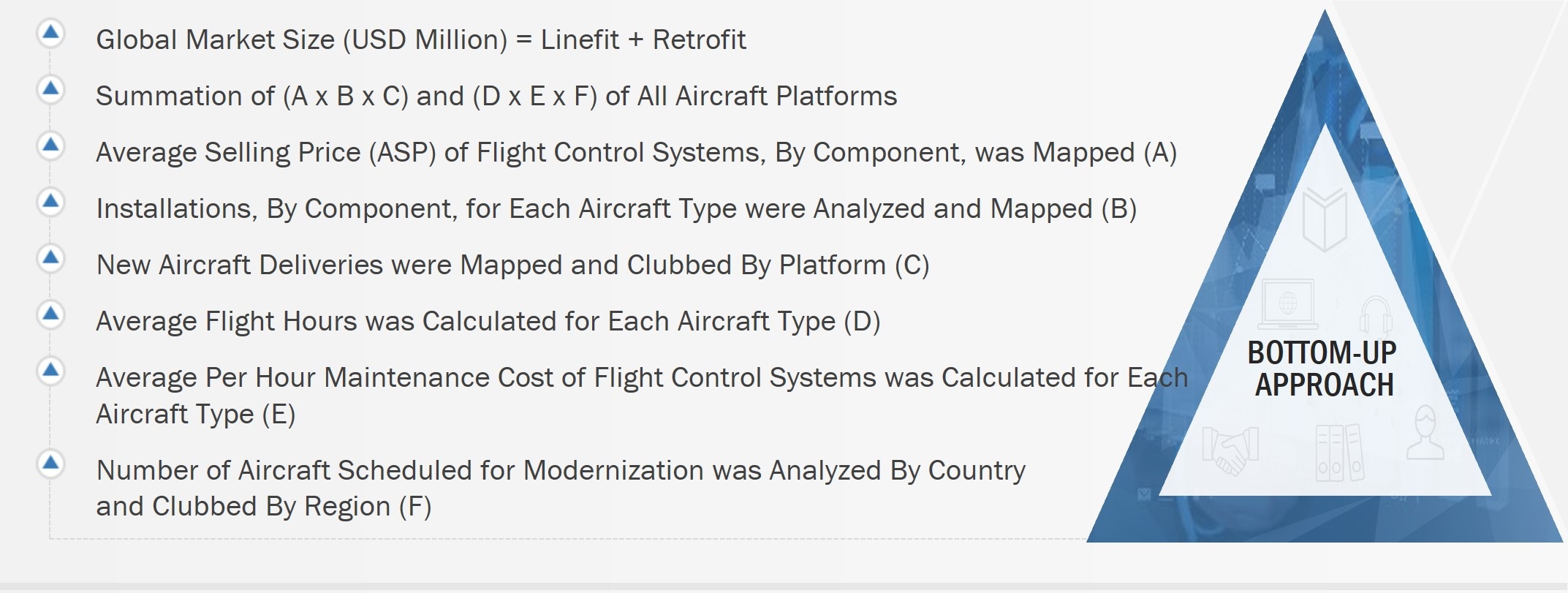

The study involved four major activities in estimating the current market size for the aircraft flight control systems market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The aircraft flight control systems market comprises several stakeholders, such as raw material providers, aircraft flight control systems manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft flight control systems market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the aircraft flight control systems market from the demand for aircraft flight control systems by end users in each country. The average cost of integration for line fit and retrofit installation was multiplied by the new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft flight control systems market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft flight control systems market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Flight Control Systems Market