Aircraft Pumps Market by Type (Hydraulic pumps, Fuel pumps, Lube and scavenge pumps, Water and wastewater pumps, Air conditioning & cooling pumps), Pressure, End Use (OEM, Aftermarket), Technology, Aircraft Type, and Region – Global Forecast to 2028

Update:: 26.09.24

Aircraft Pumps Market Size & Growth

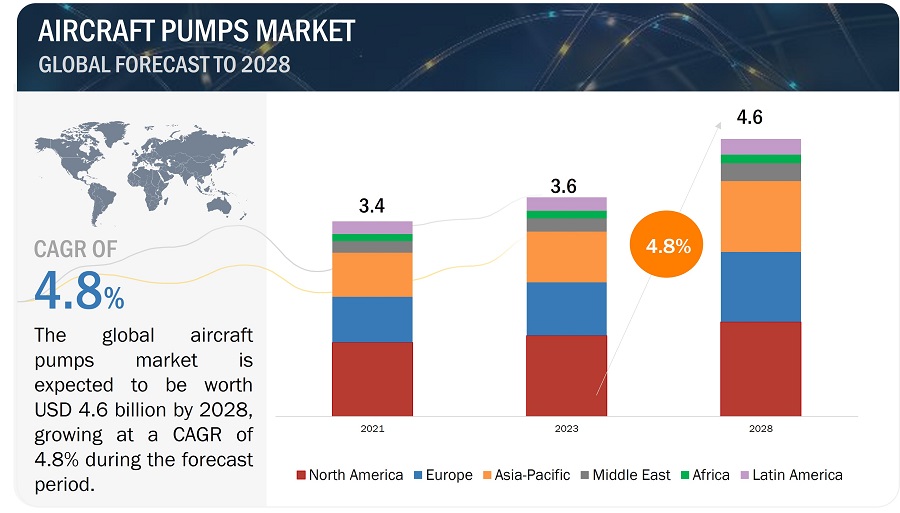

The Global Aircraft Pumps Market size is projected to grow from USD 3.6 billion in 2023 to USD 4.6 billion by 2028, at a CAGR of 4.8% from 2023 to 2028. The market is driven by various factors, such as increase in aircraft renewals and need for more flexible and light aircraft with improved, lightweight systems and compact pumping systems. They serve critical functions such as fuel transfer, lubrication, and hydraulic power generation, ensuring the safe and reliable operation of various aircraft systems. Aircraft pumps are instrumental in fueling the engines, maintaining hydraulic pressure for flight control systems, and facilitating the circulation of lubricants to vital engine components, playing a pivotal role in the overall performance, safety, and functionality of modern aircraft.

Current trends include a growing emphasis on lightweight and compact pumping systems to improve fuel efficiency, alongside the integration of smart sensors for real-time monitoring. OEMs are actively researching advanced materials and additive manufacturing techniques to optimize pump design. Major players in this dynamic market include industry leaders such as Honeywell International Inc., Parker Hannifin Corporation, and Eaton Corporation, who are at the forefront of innovation, striving to meet the aviation industry's demands for higher efficiency, reliability, and sustainability in aircraft pumping systems.

Aircraft Pumps Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Pumps Market Trends

Driver: Need for more flexible and light aircraft with improved light-weighted systems and compact pumping systems

The demand for lightweight and compact pumping systems serves as a crucial driver for the aircraft pumps market. In the aviation industry, the pursuit of increased fuel efficiency and performance improvement is relentless, and these advanced systems contribute significantly by reducing overall aircraft weight, leading to reduced fuel consumption and enhanced operational efficiency. Furthermore, the compact design of these pumping systems addresses the prevalent issue of limited space within modern aircraft, ensuring they can be seamlessly integrated into tight configurations. This synergy of improved fuel efficiency and space utilization makes lightweight and compact pumping systems an indispensable component in the aviation industry, driving their increasing adoption and market growth.

Restraint: High Cost of MRO services

The high cost of Maintenance, Repair, and Overhaul (MRO) services in the Aircraft Pump Market poses a significant constraint, as it places financial burdens on airlines and operators, impacting profitability and competitiveness. These expenses divert capital from strategic investments, erode profit margins, and act as a barrier to market entry for potential newcomers. Additionally, economic fluctuations can exacerbate the strain of high MRO costs, further challenging the industry's financial stability and growth prospects.

Opportunity: Newer technologies in pumps and pumping systems to enhance pumping efficiencies

The advent of novel technologies in pumps and pumping systems, such as the incorporation of additive manufacturing techniques, presents a compelling opportunity within the aircraft pumps market. The use of 3D printing to produce intricate pump components with complex geometries and reduced material waste has revolutionized the industry. This technological advancement not only enhances pumpin efficiency by optimizing component design but also streamlines the manufacturing process, reducing lead times and production costs. These innovative approaches, combined with other efficiency-boosting technologies, offer a promising avenue for growth within the aircraft pumps market, attracting both aircraft manufacturers and operators aiming to capitalize on the benefits of these cutting-edge solutions.Major players like Eaton and Parker Hannifin are actively investing in newer pump technologies and pumping systems. Electromagnetic actuators, such as linear induction motors, are increasingly being employed in next-generation pumping systems. These actuators offer precise control over flow rates and pressures, improving the responsiveness and accuracy of the pumps. Moreover, they reduce the need for traditional mechanical components, resulting in compact and lightweight pumping solutions. This innovative application of electromagnetic technology aligns with the aviation industry's pursuit of weight reduction and enhanced system efficiency.

Challenge: Legal and regulatory barriers

Legal and regulatory barriers pose significant challenges for the aircraft pumps market. Stringent certification requirements, mandated by aviation authorities like the FAA and EASA, demand extensive testing and documentation, causing delays and increased development costs. For instance, the certification process for a new fuel pump design can span several years, hampering market entry for innovative technologies. Additionally, export controls and international trade compliance add complexity. Aircraft pumps are subject to strict regulations, impacting global distribution and sales. Non-compliance can result in severe penalties. As an example, ITAR (International Traffic in Arms Regulations) restrictions in the U.S. restrict the export of certain pump technologies, limiting market access and complicating international business partnerships. These legal and regulatory hurdles necessitate careful navigation and strategic planning for businesses operating in the aircraft pumps market.

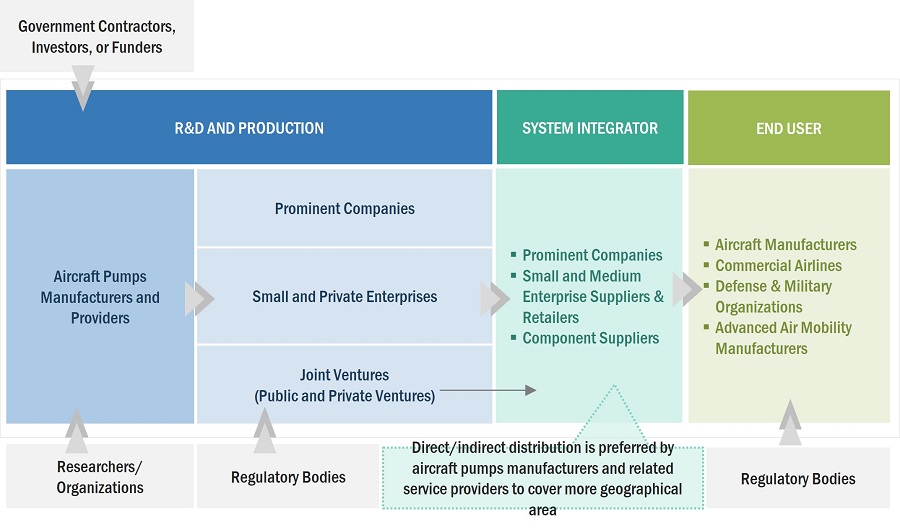

Aircraft Pumps Market Ecosystem

The aircraft pumps market ecosystem comprises aerospace manufacturers, technology firms, and transportation service providers collaborating to drive innovation and commercialization. It involves strategic partnerships, investments, and research efforts to develop advanced propulsion systems, technologies, and flight capabilities. Regulatory bodies, government agencies, and infrastructure developers also play a crucial role in shaping the aircraft pumps market ecosystem by R&D of smart systems, electric pumps, advanced materials, hybrid solutions, fuel efficiency, reduced maintenance, environmental considerations, and ensuring regulatory compliance. The prominent companies are Safran (France), Eaton Corporation plc (Ireland), Parker-Hannifin Corporation (US), Woodward, Inc. (US), and Crane Co. (US).

Aircraft Pumps Market Segmentation

Increasing demand for aircraft renewals and deliveries will drive the demand for fuel pump segment

The fuel pump segment is expected to be the largest market by value. Aircraft renewals and deliveries are poised to be key drivers in the aircraft pumps market, primarily due to the critical role fuel pumps play in modernizing and expanding airline fleets. As airlines seek to enhance operational efficiency and reduce fuel consumption, they often opt for newer aircraft models featuring advanced fuel-efficient technologies. Consequently, the demand for state-of-the-art fuel pumps compatible with these aircraft rises significantly. Furthermore, the growth in air travel, particularly in emerging markets, is propelling a surge in aircraft deliveries, further stimulating the need for fuel pumps to equip these newly manufactured planes.

The above 3,000 psi segment is projected to witness a higher CAGR during the forecast period

Based on pressure, the above 3,000 psi segment is projected to be the highest CAGR rate for the aircraft pumps market during the forecast period. The above 3000 psi segment in the aircraft pumps market is expected to achieve a higher CAGR due to the increasing demand for high-pressure hydraulic systems in advanced commercial and military aircraft. These systems are vital for improving aircraft maneuverability, fuel efficiency, and sustainability. Additionally, the aerospace industry's focus on compact and lightweight hydraulic solutions that operate efficiently at elevated pressures is driving the need for pumps in this segment

The electric motor driven segment is projected to witness a higher CAGR during the forecast period

Based on the technology, the electric motor driven segment is projected to be the highest CAGR rate for the aircraft pumps market during the forecast period. The aviation industry's pursuit of electrification and more electric aircraft (MEA) concepts has led to a shift away from traditional hydraulic systems toward electrically driven alternatives. These electric pumps offer precise control, reduced weight, and increased reliability compared to their hydraulic counterparts. Moreover, they align with the industry's drive for fuel efficiency and emissions reduction, making them essential components in electric and hybrid-electric propulsion systems. As MEA concepts gain momentum and electric aircraft become more mainstream, the demand for electric motor-driven aircraft pumps is expected to surge, contributing significantly to the market's growth trajectory.

The Unmanned Aerial Vehicles segment is projected to witness the highest CAGR during the forecast period

Based on the aircraft type, the unmanned aerial vehicles segment is projected to grow at the highest CAGR rate for the aircraft pumps market during the forecast period. The Unmanned Aerial Vehicle (UAV) segment is poised for a higher Compound Annual Growth Rate (CAGR) within the aircraft pumps market due to the rapid expansion of UAV applications in both military and civilian sectors. UAVs' critical roles in military operations demand specialized pumping systems for fuel transfer, hydraulic actuation, and cooling, while their civilian applications, including precision agriculture and logistics, require efficient pumps for various functions. As the UAV industry diversifies and continues to innovate, the demand for tailored and lightweight aircraft pumps to meet these unique requirements is expected to surge, making the UAV segment a focal point for substantial growth in the aircraft pumps market.

The OEM segment is projected to witness the highest CAGR during the forecast period

Based on the end use, the OEM segment is projected to grow at the highest CAGR rate for the aircraft pumps market during the forecast period. OEMs are increasingly focusing on innovative solutions to meet stringent regulatory standards and address environmental concerns. This includes the development of more energy-efficient and environmentally friendly aircraft systems, which often require advanced pumping technologies. As aircraft manufacturers introduce new models and technologies, the demand for cutting-edge pumping systems, designed and integrated directly into these new aircraft, surges significantly. As a result, OEMs are proactively investing in research and development to create bespoke, high-performance pumps, spurring growth in this segment.

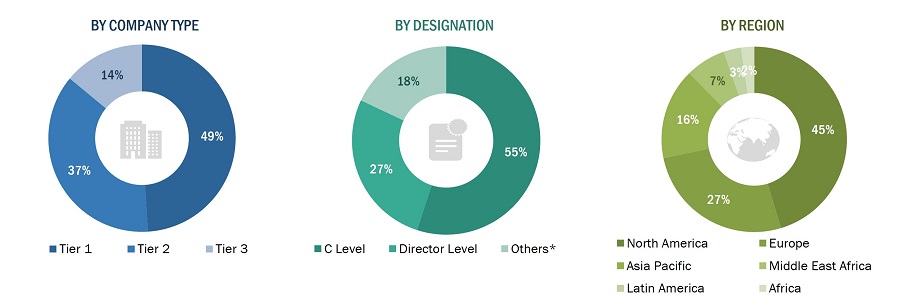

Aircraft Pumps Market Regional Analysis

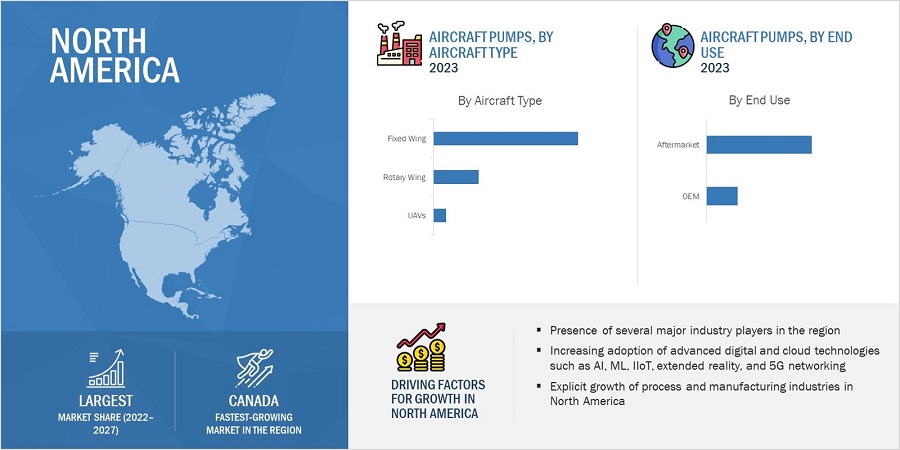

The North America market is projected to contribute the largest share from 2021 to 2026

North America is projected to be the largest regional share of the aircraft pumps market during the forecast period. the region boasts a robust aerospace industry, home to major aircraft manufacturers, such as Boeing and Airbus, who drive substantial demand for advanced pumping systems. Additionally, North America's well-established airline industry continuously seeks cutting-edge technologies to enhance fuel efficiency and operational performance, further propelling the demand for innovative pumps. North America's leadership in the aircraft pumps market is further reinforced by the substantial presence of well-established aircraft pump manufacturers in the region. Prominent industry players like Honeywell International Inc. and Parker Hannifin Corporation have firmly established themselves in the market. Honeywell, renowned for its comprehensive portfolio of aerospace technologies, holds a leading position in delivering efficient pumps designed for various aircraft systems. In contrast, Parker Hannifin specializes in aerospace and defense solutions, offering hydraulic pumps and systems among its array of offerings. the region's commitment to sustainable aviation practices and the integration of eco-friendly solutions, including electric and hybrid-electric aircraft propulsion systems, aligns with the development of advanced electric motor-driven pumps, offering growth opportunities in this segment. These factors collectively position North America as a dominant player in the aircraft pumps market, poised to maintain a higher market share.

Aircraft Pumps Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Pumps Companies: Key Market Players

The aircraft pumps companies is dominated by a few globally established players such as Safran (France), Eaton Corporation plc (Ireland), Parker-Hannifin Corporation (US), Woodward, Inc. (US), and Crane Co. (US).

Aircraft Pumps Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.6 Billion by 2023 |

|

Projected Market Size |

USD 4.6 Billion by 2028 |

|

CAGR |

4.8% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Type, By Pressure, By Technology, By Aircraft Type, By End Use |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies Covered |

Safran (France), Eaton Corporation plc (Ireland), Parker-Hannifin Corporation (US), Woodward, Inc. (US), and Crane Co. (US) |

Aircraft Pumps Market Highlights

The study categorizes the aircraft pumps market based on Type, Pressure, Technology, Aircraft Type, End Use, and Region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Pressure |

|

|

By Technology |

|

|

By Aircraft Type |

|

|

By End Use |

|

|

By Region |

|

Recent Developments

- In May 2023, Parker Aerospace, a division of Parker Hannifin Corporation, a global leader in motion and control technologies, has announced a significant five-year contract with the U.S. Army. Under this agreement, they will be responsible for overhauling and upgrading the hydraulic pump and flight control actuation systems for the UH-60 Blackhawk helicopter. This contract also includes arrangements for fixed pricing and indefinite delivery for the Army's aircraft needs.

- In January 2023, Triumph Group, Inc. has recently announced that its Actuation Products and Services business division has secured a notable contract from Airbus. This contract involves the provision of A220 On Wing Emergency Exit Door (OWEED) control cables. Triumph Actuation Products & Services holds a prominent position in the aerospace and defense industry, excelling in the design, development, manufacturing, and support of complex electro-hydraulic and mechanical systems and equipment. Their product range spans a comprehensive array of critical components, including actuators, pumps, motors, reservoirs, control valves, and various mechanical controls, catering to both commercial and military aircraft applications.

- In June 2021, Eaton successfully executed the acquisition of Cobham Mission Systems. This strategic move aligned with Eaton's overarching objective of bolstering its aerospace business. Cobham Mission Systems, distinguished for its expertise in manufacturing air-to-air refueling systems, environmental systems, and actuation components, primarily serving defense markets, was a strategic addition to Eaton's existing aerospace portfolio. This expanded portfolio now encompasses an array of critical capabilities, including fuel systems, electrical power systems, and hydraulic systems, positioning Eaton as a formidable player in the aerospace industry.

Frequently Asked Questions:

What is the current size of the Aircraft Pumps market?

The Aircraft Pumps market size is projected to grow from USD 3.6 billion in 2023 to USD 4.6 billion by 2028, at a CAGR of 4.8% from 2023 to 2028.

What are some of the technological advancements in the market?

Several key technology trends are shaping the industry's trajectory. The integration of advanced sensors and data analytics is enhancing predictive maintenance capabilities, optimizing pump performance, and minimizing downtime. Concurrently, additive manufacturing techniques are revolutionizing pump design, allowing for intricate geometries and reduced material waste. The adoption of electric and hybrid-electric propulsion systems is driving the development of electric motor-driven pumps, offering increased efficiency and sustainability. Additionally, the implementation of artificial intelligence and machine learning algorithms is streamlining pump control and enhancing overall system efficiency. These trends collectively reflect the industry's commitment to innovation, efficiency, and environmental responsibility, shaping the future of aircraft pump technology.

What are the factors driving the growth of the market?

The increasing demand for efficient and sustainable transportation, advancements in technology, particularly in , the growing focus on environmental sustainability, and strategic collaborations and partnerships among aerospace manufacturers, technology firms, and transportation service providers are accelerating innovation, investment, and market development. The combined effect of these factors is fueling the growth of the aircraft pumps market.

Who are the key players and innovators in the ecosystem of the aircraft pumps market?

The key players in the aircraft pumps market include Safran (France), Eaton Corporation plc (Ireland), Parker-Hannifin Corporation (US), Woodward, Inc. (US), and Crane Co. (US).

What are the growth opportunities in the Aircraft Pumps market?

The aircraft pumps market offers several prospects for expansion to players. The aircraft pumps market presents growth opportunities driven by the electrification of aircraft, emphasizing electric motor-driven pumps. Additionally, fuel efficiency-focused technologies and lightweight materials are in demand, favoring compact and lightweight pump systems. Sustainability initiatives further boost the market, driving the adoption of eco-friendly pumping solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in aircraft renewals and deliveries- Need for more flexible and light aircraft with improved lightweight systems and compact pumping systems- Increase in UAVs and Hybrid VTOLsRESTRAINTS- High cost of MRO servicesOPPORTUNITIES- Newer technologies in pumps and pumping systems to enhance pumping efficienciesCHALLENGES- Legal and regulatory barriers

- 5.3 OPERATIONAL DATA

-

5.4 TECHNOLOGY ANALYSISDIGITAL DISPLACEMENT PUMP IN HYDRAULIC SYSTEMSEMERGENCE OF ADAPTIVE ENGINESUSE OF LOW CORROSIVE STEEL IN PUMPS

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 CASE STUDY ANALYSISHYDRAULIC SYSTEMSFUEL SYSTEMSWATER SUPPLY AND DISPOSAL SYSTEMS

- 5.9 TRADE DATA ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 AVERAGE SELLING PRICE ANALYSIS

- 5.12 VOLUME DATA

-

5.13 TARIFF AND REGULATORY LANDSCAPEFUEL PUMPS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIAKEY BUYING CRITERIA FOR AIRCRAFT PUMPS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023-2024

- 5.16 TARIFF AND REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

-

6.3 EMERGING TECHNOLOGIESDEVELOPMENT OF HIGH-STRENGTH STEELSMART FUEL METERING MOTOR-DRIVEN PUMPSINFORMATION TECHNOLOGY-INTEGRATED PUMPING SYSTEMSSMART MATERIAL USED FOR HYDRAULIC PUMPSSMART PUMPS

- 6.4 IMPACT OF MEGATRENDS

-

6.5 INNOVATIONS AND PATENT ANALYSIS

- 7.1 INTRODUCTION

- 7.2 UP TO 350 PSI

- 7.3 350-1,500 PSI

- 7.4 1,500-3,000 PSI

- 7.5 ABOVE 3,000 PSI

- 8.1 INTRODUCTION

- 8.2 ENGINE DRIVEN

- 8.3 ELECTRIC MOTOR DRIVEN

- 8.4 RAM AIR TURBINE DRIVEN

- 8.5 AIR DRIVEN

- 9.1 INTRODUCTION

-

9.2 FIXED WINGCOMMERCIAL AVIATION- Narrow-body aircraft (NBA)- Wide-body aircraft (WBA)- Regional transport aircraft (RTA)BUSINESS AND GENERAL AVIATION- Business jets- Light aircraftMILITARY AVIATION- Fighter aircraft- Transport aircraft- Special mission aircraft

-

9.3 ROTARY WINGCOMMERCIAL HELICOPTER- Increasing use of commercial helicopters for multiple purposes to drive marketMILITARY HELICOPTER- Technologically advanced military helicopters with next-generation sensors to drive market

-

9.4 UNMANNED AERIAL VEHICLE (UAV)FIXED WING UAV- Ability to fly for long durations to drive marketFIXED-WING VTOL UAV- Ability to carry heavy payloads to drive marketROTARY-WING UAV- Applications in search & rescue operations, precision farming, and law enforcement to drive market

- 10.1 INTRODUCTION

-

10.2 OEMINCREASING AIRCRAFT DELIVERIES TO DRIVE MARKET

-

10.3 AFTERMARKETINCREASING AIRCRAFT FLEET SIZE TO DRIVE MARKET

- 11.1 INTRODUCTION

- 11.2 HYDRAULIC PUMPS

- 11.3 FUEL PUMPS

- 11.4 LUBE AND SCAVENGE PUMPS

- 11.5 WATER AND WASTEWATER PUMPS

- 11.6 AIR CONDITIONING AND COOLING PUMPS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAPESTLE ANALYSISOEM MARKETAFTERMARKETUS- Presence of leading aircraft pump manufacturers to drive market- OEM market- AftermarketCANADA- Investments in R&D of new materials to drive market- OEM market- Aftermarket

-

12.3 EUROPEPESTLE ANALYSISOEM MARKETAFTERMARKETUK- Increase in air travel to drive market- OEM market- AftermarketFRANCE- Considerable investments in aerospace systems and components to drive market- OEM market- AftermarketGERMANY- Investments in aerospace technology and air connectivity to drive market- OEM market- AftermarketITALY- High demand for civil and corporate helicopters to drive market- OEM market- AftermarketRUSSIA- Increase in military budget to manufacture advanced military aircraft to drive market- OEM market- AftermarketREST OF EUROPE- OEM market- Aftermarket

-

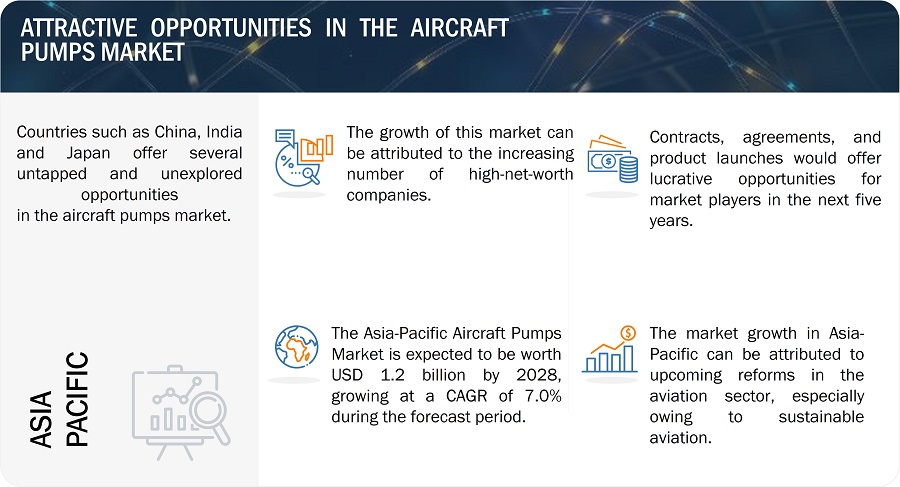

12.4 ASIA PACIFICPESTLE ANALYSIS- OEM market- AftermarketCHINA- Growing demand for aerospace products to drive market- OEM market- AftermarketINDIA- Five-year modernization plan for armed forces to drive market- OEM market- AftermarketJAPAN- Increasing in-house development of aircraft to drive market- OEM market- AftermarketAUSTRALIA- Increase in air traffic and new aircraft deliveries to drive market- OEM market- AftermarketSOUTH KOREA- Modernization programs in aviation industry to drive market- OEM market- AftermarketREST OF ASIA PACIFIC- OEM market- Aftermarket

-

12.5 MIDDLE EASTPESTLE ANALYSISUAE- Increasing demand for private planes to drive market- OEM market- AftermarketSAUDI ARABIA- Modernization of existing fleets to drive market- OEM market- AftermarketISRAEL- Increased spending in R&D of UAVs for military and commercial applications to drive market- OEM market- AftermarketTURKEY- Substantial rise in military spending and development of UAVs to drive market- OEM market- AftermarketREST OF MIDDLE EAST- OEM market- Aftermarket

-

12.6 LATIN AMERICAPESTLE ANALYSIS- OEM market- AftermarketBRAZIL- Increase in air passenger traffic to drive market- OEM market- AftermarketMEXICO- Rising use of UAVs by government to fight organized crimes and carry out surveillance activities to drive market- OEM market- AftermarketREST OF LATIN AMERICA- OEM market- Aftermarket

-

12.7 AFRICAPESTLE ANALYSIS- OEM market- AftermarketSOUTH AFRICA- Increase in air traffic to drive market- OEM- AftermarketNIGERIA- Expansion in aviation industry to drive market- AftermarketREST OF AFRICA- Aftermarket

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS, 2022

- 13.3 COMPETITIVE SCENARIO

-

13.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.5 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSEXPANSIONS

-

14.1 KEY PLAYERSSAFRAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEATON CORPORATION PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPARKER-HANNIFIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWOODWARD, INC.- Business overview- Products/Solutions/Services offered- MnM viewCRANE CO.- Business overview- Products/Solutions/Services offered- MnM viewHONEYWELL INTERNATIONAL, INC.- Business overview- Products/Solutions/Services offeredTRIUMPH GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsITT, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsDIEHL STIFTUNG & CO. KG- Business overview- Products/Solutions/Services offeredAMETEK, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsCOLLINS AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developmentsAEROCONTROLEX- Business overview- Products/Solutions/Services offeredRAPCO, INC.- Business overview- Products/Solutions/Services offeredCEF INDUSTRIES, INC.- Business overview- Products/Solutions/Services offeredCASCON INC.- Business overview- Products/Solutions/Services offeredWELDON PUMP LLC- Business overview- Products/Solutions/Services offeredHFE INTERNATIONAL, LLC- Business overview- Products/Solutions/Services offeredFLYGAS ENGINEERING- Business overview- Products/Solutions/Services offeredFLIGHT WORKS INC.- Business overview- Products/Solutions/Services offeredTEMPEST PLUS- Business overview- Products/Solutions/Services offeredANDAIR LTD.- Business overview- Products/Solutions/Services offeredTECHNODINAMIKA- Business overview- Products/Solutions/Services offeredCRISSAIR, INC.- Business overview- Products/Solutions/Services offeredALLEN AIRCRAFT PRODUCTS, INC.- Business overview- Products/Solutions/Services offeredCJ AVIATION INC.- Business overview- Products/Solutions/Services offered

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 AIRCRAFT PUMPS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019–2038

- TABLE 4 AIRCRAFT PUMPS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 TRADE DATA FOR AIRCRAFT PUMPS MARKET

- TABLE 6 AIRCRAFT PUMPS MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 7 AVERAGE SELLING PRICE: OEM AIRCRAFT PUMPS, BY TYPE (USD)

- TABLE 8 AVERAGE SELLING PRICE: AFTERMARKET AIRCRAFT PUMPS, BY TYPE (USD)

- TABLE 9 OEM: AIRCRAFT PUMPS MARKET SIZE, BY FIXED-WING AND ROTARY-WING AIRCRAFT TYPE (UNITS)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT PUMPS (%)

- TABLE 11 AIRCRAFT PUMPS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INNOVATIONS AND PATENT ANALYSIS

- TABLE 17 AIRCRAFT PUMPS MARKET, BY PRESSURE, 2019–2022 (USD MILLION)

- TABLE 18 AIRCRAFT PUMPS MARKET, BY PRESSURE, 2023–2028 (USD MILLION)

- TABLE 19 AIRCRAFT PUMPS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 20 AIRCRAFT PUMPS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 21 AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 22 AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 23 FIXED WING: AIRCRAFT PUMPS MARKET, BY COMMERCIAL AVIATION TYPE, 2019–2022 (USD MILLION)

- TABLE 24 FIXED WING: AIRCRAFT PUMPS MARKET, BY COMMERCIAL AVIATION TYPE, 2023–2028 (USD MILLION)

- TABLE 25 FIXED WING: AIRCRAFT PUMPS MARKET, BY BUSINESS AND GENERAL AVIATION TYPE, 2019–2022 (USD MILLION)

- TABLE 26 FIXED WING: AIRCRAFT PUMPS MARKET, BY BUSINESS AND GENERAL AVIATION TYPE, 2023–2028 (USD MILLION)

- TABLE 27 FIXED WING: AIRCRAFT PUMPS MARKET, BY MILITARY AVIATION TYPE, 2019–2022 (USD MILLION)

- TABLE 28 FIXED WING: AIRCRAFT PUMPS MARKET, BY MILITARY AVIATION TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ROTARY WING: AIRCRAFT PUMPS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ROTARY WING: AIRCRAFT PUMPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 UAV: AIRCRAFT PUMPS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 UAV: AIRCRAFT PUMPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 AIRCRAFT PUMPS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 34 AIRCRAFT PUMPS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 35 AIRCRAFT PUMPS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 AIRCRAFT PUMPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 AIRCRAFT PUMPS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 AIRCRAFT PUMPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 AIRCRAFT PUMPS OEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 AIRCRAFT PUMPS OEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 AIRCRAFT PUMPS AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 AIRCRAFT PUMPS AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 US: AIRCRAFT PUMPS MARKET BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 68 US: AIRCRAFT PUMPS MARKET BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 69 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 70 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 71 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 72 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 73 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 74 US: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 75 US: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 US: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 US: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 US: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 80 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 81 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 82 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 83 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 84 US: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 85 US: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 US: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 US: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 US: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 90 CANADA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 92 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 93 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 94 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 96 CANADA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 97 CANADA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 CANADA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 CANADA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 102 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 103 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 104 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 105 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 106 CANADA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 107 CANADA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 CANADA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 CANADA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 CANADA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 116 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 118 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 120 EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 122 EUROPE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 EUROPE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 126 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 128 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 130 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 132 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 EUROPE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 UK: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 136 UK: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 137 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 138 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 139 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 140 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 141 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 142 UK: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 143 UK: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 UK: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 UK: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 UK: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 148 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 149 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 150 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 151 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 152 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 153 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 154 UK: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 UK: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 156 UK: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 FRANCE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 158 FRANCE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 159 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 160 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 161 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 162 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 163 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 164 FRANCE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 165 FRANCE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 166 FRANCE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 FRANCE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 168 FRANCE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 170 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 171 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 172 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 173 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 174 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 175 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 176 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 178 FRANCE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 GERMANY: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 180 GERMANY: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 181 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 182 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 183 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 184 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 185 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 186 GERMANY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 187 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 188 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 189 GERMANY: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 190 GERMANY: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 192 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 193 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 194 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 195 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 196 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 197 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 198 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 199 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 200 GERMANY: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 201 ITALY: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 202 ITALY: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 203 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 204 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 205 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 206 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 207 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 208 ITALY: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 209 ITALY: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 210 ITALY: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 211 ITALY: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 212 ITALY: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 214 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 215 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 216 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 217 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 218 ITALY: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 219 ITALY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 220 ITALY: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 221 ITALY: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 222 ITALY: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 RUSSIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 224 RUSSIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 225 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 226 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 227 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 228 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 229 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 230 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 231 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 232 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 233 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 234 RUSSIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 235 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 236 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 237 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 238 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 239 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 240 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 241 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 242 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 243 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 244 RUSSIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 REST OF EUROPE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 246 REST OF EUROPE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 247 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 248 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 249 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 250 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 251 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 252 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 253 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 254 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 255 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 256 REST OF EUROPE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 257 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 258 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 259 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 260 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 261 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 262 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 263 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 264 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 265 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 266 REST OF EUROPE: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 268 ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 269 ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 270 ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 271 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 272 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 273 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 274 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 275 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 276 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 277 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 278 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 280 ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 281 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 282 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 283 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 284 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 285 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 286 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 287 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 288 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 289 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 290 ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 291 CHINA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 292 CHINA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 293 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 294 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 295 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 296 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 297 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 298 CHINA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 299 CHINA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 300 CHINA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 301 CHINA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 302 CHINA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 303 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 304 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 305 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 306 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 307 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 308 CHINA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 309 CHINA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 310 CHINA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 311 CHINA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 312 CHINA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 313 INDIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 314 INDIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 315 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 316 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 317 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 318 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 319 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 320 INDIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 321 INDIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 322 INDIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 323 INDIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 324 INDIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 325 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 326 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 327 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 328 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 329 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 330 INDIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 331 INDIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 332 INDIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 333 INDIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 334 INDIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 335 JAPAN: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 336 JAPAN: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 337 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 338 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 339 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 340 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 341 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 342 JAPAN: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 343 JAPAN: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 344 JAPAN: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 345 JAPAN: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 346 JAPAN: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 347 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 348 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 349 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 350 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 351 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 352 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 353 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 354 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 355 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 356 JAPAN: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 357 AUSTRALIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 358 AUSTRALIA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 359 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 360 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 361 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 362 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 363 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 364 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 365 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 366 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 367 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 368 AUSTRALIA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 369 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 370 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 371 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 372 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 373 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 374 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 375 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 376 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 377 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 378 AUSTRALIA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 379 SOUTH KOREA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 380 SOUTH KOREA: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 381 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 382 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 383 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 384 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 385 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 386 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 387 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 388 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 389 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 390 SOUTH KOREA: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 391 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 392 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 393 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 394 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 395 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 396 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 397 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 398 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 399 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 400 SOUTH KOREA: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 401 REST OF ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 402 REST OF ASIA PACIFIC: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 403 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 404 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 405 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 406 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 407 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 408 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 409 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 410 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 411 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 412 REST OF ASIA PACIFIC: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 413 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 414 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 415 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 416 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 417 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 418 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 419 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 420 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 421 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 422 REST OF ASIA PACIFIC: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 423 MIDDLE EAST: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 424 MIDDLE EAST: AIRCRAFT PUMPS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 425 MIDDLE EAST: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 426 MIDDLE EAST: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 427 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 428 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 429 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 430 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 431 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 432 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 433 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 434 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 435 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 436 MIDDLE EAST: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 437 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 438 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 439 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 440 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 441 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 442 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 443 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 444 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 445 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 446 MIDDLE EAST: AIRCRAFT PUMPS AFTERMARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 447 UAE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 448 UAE: AIRCRAFT PUMPS MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 449 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 450 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 451 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 452 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 453 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 454 UAE: AIRCRAFT PUMPS OEM MARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)

- TABLE 455 UAE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 456 UAE: AIRCRAFT PUMPS OEM MARKET IN ROTARY-WING AIRCRAFT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 457 UAE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 458 UAE: AIRCRAFT PUMPS OEM MARKET IN UAV, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 459 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 460 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY COMMERCIAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 461 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2019–2022 (USD MILLION)

- TABLE 462 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY BUSINESS AND GENERAL AVIATION, 2023–2028 (USD MILLION)

- TABLE 463 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2019–2022 (USD MILLION)

- TABLE 464 UAE: AIRCRAFT PUMPS AFTERMARKET IN FIXED-WING AIRCRAFT, BY MILITARY AVIATION, 2023–2028 (USD MILLION)