Airflow Management Market by Offerings (Component (Blanking Panels, Grommets, Containment, and Air Filled Kits), and Services), Cooling System (Chilled Water, Direct Expansion), Data Center Type, Industry, and Geography - Global Forecast to 2023

The airflow management market was valued at USD 419.8 Million in 2016 and is expected to reach USD 807.3 Million by 2023, at a CAGR of 9.24% between 2017 and 2023. The market is mainly driven by the growing demand for green data centers globally. Factors such as increasing number of data centers worldwide and improving cooling efficiency and thermal management in data centers are driving the growth of the market. For this study, the base year considered is 2016, and the market forecast is provided for 2017–2023.

The airflow management market is projected to grow from USD 475.2 Million in 2017 to reach USD 807.3 Million by 2023, at a CAGR of 9.24% between 2017 and 2023. Factors such as increasing number of data centers worldwide and improving cooling efficiency and thermal management in data centers are driving the growth of the airflow management market.

The airflow management market has been segmented on the basis of offerings, which is further classified into component and service. The service market is expected to grow at a high rate. Services support customers and partners in the effective implementation and application of products by capitalizing on emerging opportunities and developing strategies to deliver value to clients. By component, the market for containment is expected to experience high growth between 2017 and 2023. Containment solutions can prevent the mixing of hot air and cold air as well as eliminate hot spots and enhance energy savings in data centers. The benefits associated with data center containment solutions are anticipated to drive the growth of the containment market.

In 2016, the IT and telecom industry accounted for the largest share of the market. However, the BFSI industry is expected to grow at the highest CAGR during the forecast period. The growing demand for cloud services and data storage in the banking sector has contributed to the increased adoption of airflow management solutions in the BFSI industry.

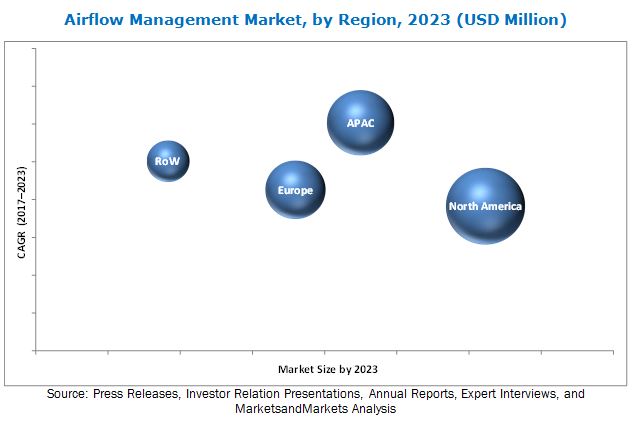

APAC is expected to grow at a highest CAGR in the airflow management market. Increasing investments in advanced technologies, growing data center infrastructure, and increasing focus on commercial and IT and telecom industries are driving the growth of the market in APAC. The use of airflow management solutions in IT and telecom and BFSI industries is the major factor driving the growth of the market in APAC.

The key factor restraining the growth of the airflow management market is requirement of specialized infrastructure. Key players in the ecosystem of the market profiled in this report are Upsite Technologies (US), Kingspan Group (Ireland), Schneider Electric (France), Eaton Corporation (Ireland), Subzero Engineering (US), Polargy, Inc. (US), Geist (US), AdaptivCOOL (US), 42U (US), Data Clean Corporation (US), EDP Europe (UK), Triad Floors (US), Conteg (Czech Republic), Unitile (India), Halton Group (Finland), E Technologies (US), ProSource Technical Services (US), Critical Environments Group (US), 2bm Ltd. (England), and Tripp Lite (US).

Upsite Technologies (US) is one of the industry leaders in the airflow management market. The company provides world class range of products and services focused on optimizing data center cooling systems, allowing managers to maximize cooling capacity while reducing energy costs. The company provides its solutions worldwide through its distributors. The company focuses on product innovation by upgrading its existing products or developing new products according to its customers’ requirements.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Geographic Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Breakdown of Primaries

2.1.2.4 Key Industry Insights

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand-Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply-Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Airflow Management Market

4.2 Market, By Offering

4.3 Airflow Management Market, By Industry

4.4 Market, BFSI and IT & Telecom Industries

4.5 Market, By Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Number of Data Centers Worldwide

5.1.1.2 Improving Cooling Efficiency and Thermal Management in Data Centers

5.1.2 Restraints

5.1.2.1 Requirement of Specialized Infrastructure

5.1.3 Opportunities

5.1.3.1 Growing Demand for Green Data Centers

5.1.3.2 Increasing Focus on Reducing Power Usage Effectiveness (PUE) Levels

5.1.4 Challenges

5.1.4.1 Challenges at Data Centers During Power Outages

5.2 Value Chain Analysis

6 Methodologies Used for Airflow Management (Qualitative) (Page No. - 39)

6.1 Introduction

6.2 Raised Floor

6.3 Room

6.4 Rack/RoW

7 Airflow Management Market, By Offering (Page No. - 40)

7.1 Introduction

7.2 Components

7.2.1 Blanking Panels

7.2.2 Grommets

7.2.3 Air Filled Kits

7.2.4 Containment

7.2.4.1 Cold Aisle Containment

7.2.4.2 Hot Aisle Containment

7.2.5 Enhanced Brush/Top & Bottom Covers

7.2.6 Air Diverters

7.2.7 High-Flow Doors

7.2.8 Others

7.3 Services

7.3.1 Consulting Services

7.3.2 Installation & Deployment Services

7.3.3 Support & Maintenance Services

8 Airflow Management Market, By Cooling System (Page No. - 54)

8.1 Introduction

8.2 Chilled Water System

8.3 Direct Expansion System

9 Airflow Management Market, By Data Center Type (Page No. - 58)

9.1 Introduction

9.2 Enterprise Data Center

9.3 Hyperscale Data Center

10 Airflow Management Market, By Industry (Page No. - 62)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance (BFSI)

10.3 IT and Telecom

10.4 Government and Defense

10.5 Research and Academic

10.6 Retail

10.7 Energy

10.8 Manufacturing

10.9 Healthcare

10.10 Others

11 Airflow Management Market, By Geography (Page No. - 72)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 UK

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 RoW

11.5.1 Middle East and Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 97)

12.1 Introduction

12.2 Ranking Analysis of Top Players

12.3 Competitive Scenario

12.4 Competitive Situations and Trends

12.4.1 Product Launches and Developments

12.4.2 Partnerships

12.4.3 Expansions

13 Company Profiles (Page No. - 102)

13.1 Introduction

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments,)*

13.2 Key Players

13.2.1 Schneider Electric

13.2.2 Upsite Technologies

13.2.3 Eaton

13.2.4 Kingspan Group

13.2.5 Subzero Engineering

13.2.6 Polargy, Inc.

13.2.7 Geist

13.2.8 Adaptivcool

13.2.9 Conteg

13.2.10 42U

13.3 Other Key Players

13.3.1 Data Clean Corporation

13.3.2 EDP Europe

13.3.3 Triad Floors

13.3.4 Unitile India

13.3.5 Halton Group

13.3.6 E Technologies

13.3.7 Prosource Technical Services

13.3.8 Critical Environments Group

13.3.9 2BM Ltd.

13.3.10 Tripp Lite

13.4 Key Innovators

13.4.1 Xyber Technologies

13.4.2 Netrack Enclosures

13.4.3 Cableseal Data Centre Airflow Management Solutions

13.4.4 Fairbanks Energy Services

13.4.5 Data Center Solutions, Inc.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 132)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (62 Tables)

Table 1 Airflow Management Market, By Offering, 2014–2023 (USD Million)

Table 2 Market, By Component, 2014–2023 (USD Million)

Table 3 Market for Blanking Panels, By Region, 2014–2023 (USD Million)

Table 4 Market for Grommets, By Region, 2014–2023 (USD Million)

Table 5 Market for Air Filled Kits, By Region, 2014–2023 (USD Million)

Table 6 Market for Containment, By Type, 2014–2023 (USD Million)

Table 7 Market for Containment, By Type, 2014–2023 (Thousand Units)

Table 8 Market for Containment, By Region, 2014–2023 (USD Million)

Table 9 Market for Enhanced Brush/Top & Bottom Covers, By Region, 2014–2023 (USD Million)

Table 10 Market for Air Diverters, By Region, 2014–2023 (USD Million)

Table 11 Market for High-Flow Doors, By Region, 2014–2023 (USD Million)

Table 12 Market for Other Components, By Region, 2014–2023 (USD Thousand)

Table 13 Market, By Service, 2014–2023 (USD Million)

Table 14 Market for Consulting Services, By Region, 2014–2023 (USD Million)

Table 15 Market for Installation & Deployment Services, By Region, 2014–2023 (USD Million)

Table 16 Market for Support & Maintenance Services, By Region, 2014–2023 (USD Million)

Table 17 Comparison Between Direct Expansion Systems and Chilled Water Systems

Table 18 Market, By Cooling System, 2014–2023 (USD Million)

Table 19 Market for Chilled Water, By Region, 2014–2023 (USD Million)

Table 20 Market for Direct Expansion, By Region, 2014–2023 (USD Million)

Table 21 Market, By Data Center Type, 2014–2023 (USD Million)

Table 22 Market for Enterprise Data Centers, By Region, 2014–2023 (USD Million)

Table 23 Market for Hyperscale Data Centers, By Region, 2014–2023 (USD Million)

Table 24 Market, By Industry, 2014–2023 (USD Million)

Table 25 Market for BFSI Industry, By Region, 2014–2023 (USD Million)

Table 26 Market for IT & Telecom Industry, By Region, 2014–2023 (USD Million)

Table 27 Market for Government and Defense Industry, By Region, 2014–2023 (USD Million)

Table 28 Market for Research and Academic Industry, By Region, 2014–2023 (USD Million)

Table 29 Market for Retail Industry, By Region, 2014–2023 (USD Million)

Table 30 Market for Energy Industry, By Region, 2014–2023 (USD Million)

Table 31 Market for Manufacturing Industry, By Region, 2014–2023 (USD Million)

Table 32 Market for Healthcare Industry, By Region, 2014–2023 (USD Million)

Table 33 Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 34 Market, By Region, 2014–2023 (USD Million)

Table 35 Market in North America, By Offering, 2014–2023 (USD Million)

Table 36 Market in North America, By Component, 2014–2023 (USD Million)

Table 37 Market in North America, By Service, 2014–2023 (USD Million)

Table 38 Market in North America, By Data Center Type, 2014–2023 (USD Million)

Table 39 Market in North America, By Industry, 2014–2023 (USD Million)

Table 40 Market in North America, By Country, 2014–2023 (USD Million)

Table 41 Market in Europe, By Offering, 2014–2023 (USD Million)

Table 42 Market in Europe, By Component, 2014–2023 (USD Million)

Table 43 Market in Europe, By Service, 2014–2023 (USD Million)

Table 44 Market in Europe, By Data Center Type, 2014–2023 (USD Million)

Table 45 Market in Europe, By Industry, 2014–2023 (USD Million)

Table 46 Market in Europe, By Country, 2014–2023 (USD Million)

Table 47 Market in APAC, By Offering, 2014–2023 (USD Million)

Table 48 Market in APAC, By Component, 2014–2023 (USD Million)

Table 49 Market in APAC, By Service, 2014–2023 (USD Million)

Table 50 Airflow Management Market in APAC, By Data Center Type, 2014–2023 (USD Million)

Table 51 Market in APAC, By Industry, 2014–2023 (USD Million)

Table 52 Market in APAC, By Country, 2014–2023 (USD Million)

Table 53 Market in RoW, By Offering, 2014–2023 (USD Million)

Table 54 Market in RoW, By Component, 2014–2023 (USD Million)

Table 55 Market in RoW, By Service, 2014–2023 (USD Million)

Table 56 Market in RoW, By Data Center Type, 2014–2023 (USD Million)

Table 57 Market in RoW, By Industry, 2014–2023 (USD Million)

Table 58 Market in RoW, By Region, 2014–2023 (USD Million)

Table 59 Ranking of Top 5 Players in the Market

Table 60 Product Launches and Developments, 2014–2017

Table 61 Partnerships, 2014–2016

Table 62 Expansions, 2015–2017

List of Figures (40 Figures)

Figure 1 Airflow Management Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, 2014–2023 (USD Million)

Figure 7 Market for Top Four Components (2017 vs 2023)

Figure 8 Hyperscale Data Centers Expected to Lead the Market From 2017 to 2023

Figure 9 Market for BFSI Industry Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 10 North America Estimated to Account for the Largest Share of the Market in 2017

Figure 11 The Need for Efficient Cooling and Thermal Management in Data Centers is Anticipated to Drive the Growth of the Market

Figure 12 Market for Services Expected to Grow at A Higher Rate Between 2017 and 2023

Figure 13 Containment to Account for the Largest Size of the Market By 2023

Figure 14 Government & Defense Industry to Account for the Largest Share of the Market in North America in 2017

Figure 15 Market for BFSI and IT & Telecom Industries in APAC Expected to Grow at the Highest Rates During the Forecast Period

Figure 16 Market in China to Grow at the Highest CAGR Between 2017 and 2023

Figure 17 Increased Demand for Cooling Efficiency and Low Power Consumption in Data Centers is Driving the Growth of the Market

Figure 18 Value Chain Analysis (2016): Major Value Added By Component Manufactures and Original Equipment Manufacturers

Figure 19 Market for Services Expected to Grow at A Higher CAGR as Compared to Components Between 2017 and 2023

Figure 20 Market for Blanking Panels, 2014–2023 (Thousand Units)

Figure 21 Airflow Management Market for Grommets, 2014–2023 (Thousand Units)

Figure 22 Market for Hot Aisle Containment Expected to Grow at A Higher CAGR as Compared to Cold Aisle Containment Between 2017 and 2023

Figure 23 Market for High-Flow Doors, 2014–2023 (Thousand Units)

Figure 24 Market for Maintenance & Support Services to Grow at the Highest CAGR Between 2017 and 2023

Figure 25 Chilled Water System is Expected to Boost the Market During Forecast Period

Figure 26 Market for Hyperscale Data Centers Expected to Grow at A Higher Rate Between 2017 and 2023

Figure 27 Market for BFSI Industry Expected to Grow at Highest CAGR Between 2017 and 2023

Figure 28 Market for Energy Industry in RoW to Grow at Highest CAGR Between 2017 and 2023

Figure 29 Market for Healthcare Industry in APAC to Grow at Highest CAGR Between 2017 and 2023

Figure 30 Geographic Snapshot: Market in APAC Expected to Witness the Highest Growth Between 2017 and 2023

Figure 31 Market in China Projected to Grow at the Highest Rate Between 2017 and 2023

Figure 32 Market Snapshot: North America

Figure 33 Market Snapshot: Europe:

Figure 34 Market Snapshot: APAC

Figure 35 Companies Adopted Product Launch as the Key Growth Strategy Between 2015 and 2017

Figure 36 Battle for Market Share: Product Launches and Developments Were Majorly Adopted By Key Players in the Market

Figure 37 Geographic Revenue Mix of Leading Players

Figure 38 Schneider Electric: Company Snapshot

Figure 39 Eaton: Company Snapshot

Figure 40 Kingspan Group: Company Snapshot

This report provides a detailed analysis of the airflow management market segmented on the basis of offerings, cooling system, data center type, industry, and geography (North America, Europe, APAC, and RoW). The report provides detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report also profiles key players and comprehensively analyzes their market ranking and core competencies, along with details of the competitive landscape of the market leaders.

To estimate the size of the airflow management market, top-down and bottom-up approaches have been used. This research study involves an extensive use of secondary sources, directories, and paid databases such as Factiva and OneSource to identify and collect information useful to study the technical, market-oriented, and commercial aspects of the market. The research methodology is explained below.

- The entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- The high-growth segments have been identified to analyze opportunities in the overall market.

- Competitive developments such as contracts, agreements, mergers and acquisitions, product launches, and research and development (R&D) in the overall market have been analyzed.

- All the percentage splits and breakdowns of the market segments have been analyzed based on secondary and primary research.

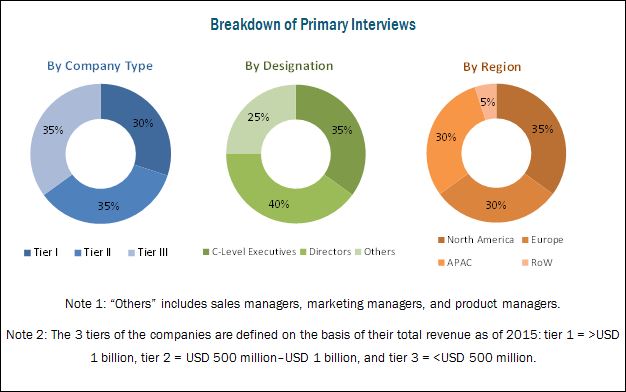

The following figure depicts the breakdown of primaries by company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

This report provides valuable insights regarding the ecosystem of the airflow management market. This includes airflow management manufacturers such as Upsite Technologies (US), Eaton Corporation (Ireland), Kingspan Group (Ireland), Schneider Electric (France), and Subzero Engineering (US); and data center service providers such as are Geist (US), AdaptivCOOL (US), 42U (US), Data Clean Corporation (US), EDP Europe (UK), and Triad Floors (US).

Target Audience:

- Raw Material and Manufacturing Equipment Suppliers

- Airflow Management Systems and Solutions Providers

- Airflow Management Related Service Providers

- Suppliers and Distributors

- Data Center Vendors

- Middleware Providers

- Assembly, Testing, and Packaging Vendors

- Lock Manufacturers

- Research Institutes and Organizations

- Technology Standards Organizations, Forums, Alliances, and Associations

- Technology Investors

- Governments, Financial Institutions, and Regulatory Bodies

“The study answers several questions of the target audience with regard to the market segments to focus on in the next 2–5 years to prioritize efforts and investments.”

Scope of the Report:

This research report categorizes the overall airflow management market as follows:

By Offerings

-

Component

- Blanking Panels

- Grommets

- Air Filled Kits

- Enhanced Brush/Top & Bottom Covers

- Air Diverters

- Containment

- High-Flow Doors

- Others (Seal taps, Fans, and Dampers)

-

Services

- Consulting

- Installation & Deployment

- Maintenance & Support

By Cooling System

- Chilled Water

- Direct Expansion

By Data Center

- Enterprise

- Hyperscale

By Industry

- Banking, Financial services, & Insurance

- IT & Telecom

- Research & Academic

- Government & Defense

- Retail

- Energy

- Manufacturing

- Healthcare

- Others

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, Netherlands, and Sweden)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Airflow Management Market