Hyperscale Data Center Market

Hyperscale Data Center Market by Power Capacity (10-50 MW, 50-100 MW, Above 101 MW), IT Infrastructure (Server, Storage, Network), Electrical Infrastructure (PDUs, UPS Systems), Mechanical Infrastructure (Cooling Systems, Rack) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hyperscale data center market is projected to expand from USD 162.79 billion in 2024 to USD 608.54 billion by 2030, growing at a CAGR of 24.6%. Growth is driven by surging demand for cloud computing, AI, big data analytics, and digital platforms that require massive computing power and storage. E-commerce, social media, and research organizations increasingly depend on hyperscale facilities to handle complex workloads, fueling sustained investment and capacity expansion.

KEY TAKEAWAYS

-

BY COMPONENTHardware dominates market share, driven by demand for high-performance servers, scalable storage, and low-latency networking equipment. Innovations in liquid cooling, accelerated compute, and energy-efficient systems are enabling hyperscale scalability. Software adoption is accelerating with the rise of AI-driven orchestration, virtualization, and software-defined networking (SDN), enhancing resilience, automation, and operational efficiency. Services are expanding as enterprises rely on consulting, integration, and managed services to support cloud migration, compliance, and infrastructure modernization.

-

BY DEPLOYMENT TYPEGreenfield adoption is driven by new large-scale builds, particularly by cloud providers expanding globally. Emphasis is on sustainability, renewable energy, and advanced cooling. Brownfield involves upgrading and expanding existing facilities to meet rising capacity demands. Growth is supported by retrofitting legacy data centers with efficient hardware, automation, and modular upgrades to optimize cost and speed of deployment.

-

BY BATTERY TYPE• Battery type influences modular UPS adoption, with lithium-ion enabling longer lifespan and higher energy density for space-constrained or high-demand installations. • Lead-acid batteries remain preferred for cost-sensitive or conventional-capacity applications.

-

BY END-USERData centers are driving the largest adoption of modular UPS as escalating digital workloads and 24/7 uptime requirements make scalable, fault-tolerant power systems essential for operational continuity.

-

BY REGIONNorth America leads the hyperscale data center market, driven by the presence of major cloud providers, advanced digital infrastructure, and high adoption of AI and cloud services. Strong investment in greenfield developments and modernization of existing facilities further reinforce its dominance.

-

COMPETITIVE LANDSCAPEThe hyperscale data center market is highly competitive, with leading providers such as Google (US), AWS (US), Oracle (US), Microsoft (US), IBM (US) present in market. CMarket These players prioritize strategic expansions, mergers, and the deployment of advanced solutions in energy efficiency, AI integration, and modular infrastructure to maintain a competitive edge. Ongoing technological advancements and increasing demand for scalable, low-latency services continue to drive market rivalry.

Adoption of hyperscale data center is accelerating as enterprises and cloud providers scale infrastructure to support streaming, AI-driven applications, and online services. Hyperscale facilities integrate thousands of servers and millions of components under automated, efficient systems, enabling rapid deployments, cost savings, and operational resilience. The ability to leverage economies of scale, coupled with a focus on energy efficiency and sustainability, positions hyperscale data centers as the foundation of global digital infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the hyperscale data center market the growing adoption of AI and edge computing, increasing reliance on cloud-based services, and the shift toward sustainable, energy-efficient infrastructure. Customers’ customers are also driving demand for low-latency, high-performance applications, real-time analytics, and seamless digital experiences. Rising data volumes and regulatory compliance requirements further influence service expectations and infrastructure investments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Digital transformation initiative

-

Surge in adoption of multi-cloud

Level

-

Shortage of skilled workforce

Level

-

Expansion of 5G infrastructure

-

Deployment of AI & advanced computing

Level

-

Latency and connectivity limitations in remote areas

-

Integration of legacy system with modern infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Digital Transformation

Digital transformation is expected to drive hyperscale data center adoption, as enterprises increasingly rely on cloud, AI, and IoT for modern operations. These data centers provide scalable, high-density, and energy-efficient infrastructure to support demanding workloads with reliability and reduced power consumption. Collaborations, such as CoreSite and Oxide Computer, showcase how advanced rack-scale systems enhance security, efficiency, and control for on-premises and cloud deployments, enabling real-time analytics and seamless operations across industries.

Restraint: Shortage of skilled workforce

Shortage of skilled labor in areas such as electrical engineering, cooling systems, software, and network management is expected to be one of the restraints for hyperscale data center market. This workforce gap, compounded by an aging workforce and limited recruitment from trade schools and high schools, leads to project delays, higher costs, and operational risks. While some organizations increase salaries or collaborate with educational institutions, sustainable workforce development remains limited. Addressing this skills gap is critical to ensuring the scalability, efficiency, and reliability of hyperscale data centers.

Expansion of 5G infrastructure

The global rollout of 5G is expected to present significant growth opportunity for hyperscale data centers, as high-speed, low-latency connectivity will support data-intensive applications like IoT, autonomous vehicles, AR, and cloud gaming. Hyperscale facilities are positioned to provide the required storage, processing power, and distributed infrastructure, including edge computing, to manage increasing data traffic and reduce latency. With 5G connections and IoT subscriptions projected to expand rapidly, these data centers play a crucial role in enabling seamless digital experiences and meeting the evolving connectivity and computational demands of next-generation networks.

Challenge: Limited lifespan of batteries used in modular UPS systems

Latency and connectivity constraints in remote areas pose a key challenge for the hyperscale data center market, limiting the ability to support high-speed, low-latency operations required for cloud computing, AI, and real-time analytics. Inadequate infrastructure, including limited fiber, satellite, and cellular networks, increases latency and reduces service efficiency. Data from Weplan Analytics highlights significant disparities between urban and rural regions in 5G usage, signal strength, and latency, emphasizing the need for targeted investments to enhance connectivity. Addressing these gaps is essential for enabling hyperscale data centers to efficiently manage growing data volumes and meet rising demand.

Hyperscale Data Center Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

China Mobile International leveraged Colt’s Tokyo Inzai 3 Data Centre to rapidly expand its infrastructure and ensure seamless entry into the Japanese market. | This collaboration provided faster market access, improved service reliability, and enhanced customer experiences. It also allowed China Mobile International to scale efficiently while meeting the growing demand for low-latency connectivity in Japan. |

|

Chinese IT powerhouse AOFEI partnered with Colt DCS to harness its hyperscale data centre capabilities and global footprint, enabling AOFEI to expand swiftly into key international markets. | AOFEI leverages Colt’s hyperscale, carrier-neutral data centres to scale rapidly, optimize costs, and ensure high uptime with flexible global connectivity. Access to local expertise and market insights further enables smooth expansion into new regions. |

|

ECMD modernized its storage infrastructure by deploying Infinidat’s InfiniBox across two data centers, consolidating critical applications onto a single high-performance platform. | The deployment delivered pay-as-you-grow scalability, seamless expansion, and simplified management for a lean IT team. ECMD gained high availability, low-latency disaster recovery, and improved cost efficiency, enabling the company to boost reliability and stay competitive. |

|

Radore upgraded its legacy storage infrastructure by implementing Huawei’s advanced storage solutions, enhancing performance, reliability, and operational efficiency. | Huawei’s solutions enabled faster, low-latency data access and continuous uptime with active-active configurations. The scalable, secure, and resilient infrastructure enhanced data management and supported Radore’s future growth. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hyperscale data center ecosystem includes electrical, IT, networking, and mechanical infrastructure to deliver scalable, high-performance, and energy-efficient operations. Key components include UPS and backup power systems, advanced servers and storage, high-speed networking, and energy-efficient cooling solutions. This infrastructure supports end users such as cloud providers and colocation operators, ensuring reliable, efficient, and seamless digital services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hyperscale Data Center Market, By Component

The hardware segment is expected to hold the largest share in the hyperscale data center market due to its critical role in enabling high-performance operations. Key components, including servers, storage systems, networking equipment, and power infrastructure, are essential for processing, storing, and transmitting massive data volumes. Investment in advanced, energy-efficient hardware ensures reliability, scalability, and low latency, making it indispensable for cloud providers, colocation operators, and enterprises. As digital workloads and data traffic grow, demand for robust hardware continues to drive market dominance.

Hyperscale Data Center Market, By Deployment Type

The greenfield segment is expected to hold the largest market share in the hyperscale data center market, driven by the growing demand for customized, state-of-the-art facilities. Greenfield projects allow companies to design and build infrastructure from scratch, optimizing for scalability, energy efficiency, and advanced cooling and power systems. This approach supports the deployment of high-density servers and modern networking equipment tailored to specific operational needs. As cloud adoption and data traffic continue to rise, greenfield developments remain the preferred choice for expanding hyperscale capacity.

Modular UPS Market, By End-User

Cloud service providers are expected to hold the largest market share in the hyperscale data center market, driven by the increasing demand for scalable, on-demand computing and storage services. Providers such as AWS, Microsoft Azure, and Google Cloud require massive, high-performance infrastructure to support diverse workloads, including AI, analytics, and real-time applications. Their continuous expansion and investment in energy-efficient, low-latency data centers position them as the primary drivers of market growth. Growing adoption of cloud services across enterprises further reinforces their dominance in hyperscale deployments.

REGION

North America is expected to hold largest market share in the hyperscale data center market during the forecast period.

The North American hyperscale data center market is experiencing rapid growth due to a combination of infrastructure maturity, technology leadership, and cloud-first enterprise strategies. Key growth drivers include: High data center density and abundant power availability, enabling reliable support for energy-intensive AI and cloud workloads. Early adoption of cloud computing, digital transformation, and Industry 4.0 technologies, positioning the region as a global innovation hub. Strong investment in energy-efficient cooling systems, modular infrastructure, and R&D, ensuring scalability and operational resilience. Presence of leading hyperscale operators—AWS, Microsoft, and Google—who continue to expand capacity and drive demand for multi-megawatt campuses. According to CBRE, the region saw a 10% increase in capacity, record-low availability, and a 69% surge in under-construction activity in H1 2024, reflecting aggressive expansion to meet rising demand. Hyperscale facilities in North America offer low-latency interconnection, fault-tolerant architecture, and space-efficient designs, making them ideal for managing growing data volumes and minimizing downtime.

Hyperscale Data Center Market: COMPANY EVALUATION MATRIX

AWS (Star) leads with a dominant market presence and a broad portfolio of scalable cloud and infrastructure services, supporting large-scale adoption across industries such as BFSI, healthcare, and retail. Oracle (Emerging Leader) is gaining momentum with its next-generation cloud infrastructure and integrated solutions designed for high-performance workloads and enterprise-grade requirements. While AWS maintains leadership with its global footprint, advanced services, and continuous innovation, other providers like Microsoft and Google show strong growth potential to advance further in the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 162.79 BN |

| Revenue Forecast in 2030 | USD 608.54 BN |

| Growth Rate | CAGR of 24.6% from 2024-2030 |

| Actual data | 2019-2030 |

| Base year | 2023 |

| Forecast period | 2024-2030 |

| Units considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Hyperscale Data Center Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American Hyperscale Data Center Market Extended regional breakdowns for: Europe Asia Pacific Middle East & Africa Latin America | Identifies high-growth regional opportunities across hyperscale data centers, industrial automation, and smart infrastructure Enables tailored market entry strategies based on localized demand drivers and regulatory landscapes Supports optimized resource allocation and investment prioritization aligned with region-specific trends in AI infrastructure, cloud adoption, and energy resilience |

| Leading Solution Provider (EU) | Detailed profiling of additional market players (up to 5 vendors), including product portfolios, strategic initiatives, and regional presence | Enhances competitive intelligence for strategic planning and go-to-market execution Reveals market gaps and white spaces for differentiation and innovation Supports targeted growth initiatives by aligning product development and sales strategies with unmet customer needs and emerging demand clusters |

RECENT DEVELOPMENTS

- January 2025 : Oracle introduced the Exadata X11M, a next-generation high-performance database infrastructure engineered for AI-driven workloads and real-time analytics. Delivering up to 55% faster vector search performance and 2.2x acceleration in analytics processing, Exadata X11M significantly reduces total cost of ownership (TCO) by optimizing energy efficiency and infrastructure utilization. Designed for hybrid cloud, multi-cloud, and on-premises deployments, it empowers enterprises to scale mission-critical applications with cloud-native agility and enterprise-grade reliability.

- September 2024 : Uber deepened its strategic collaboration with Oracle Cloud Infrastructure (OCI) to enhance cloud scalability, AI model performance, and cost optimization. OCI now supports over one million trips per hour, enabling Uber to deliver real-time insights, AI-powered personalization, and multi-cloud resilience. This partnership underscores OCI’s capabilities in elastic compute, high-throughput networking, and AI/ML workload orchestration.

- July 2024 : Microsoft and Lumen Technologies joined forces to expand Azure’s AI-optimized infrastructure and deliver low-latency, high-bandwidth cloud connectivity. This collaboration empowers Lumen’s telecom clients with edge-to-cloud integration, cost-effective digital transformation, and enterprise-wide AI enablement. The partnership reinforces Azure’s leadership in intelligent cloud infrastructure and network-aware AI services.

- May 2024 : Google announced a USD 624 million investment in a hyperscale data center in Norway, leveraging 100% renewable hydropower and pioneering sustainable data center design. Scheduled for 2026, the facility will feature heat reuse systems, support grid modernization, and align with Google’s commitment to carbon-free operations and AI infrastructure expansion in Europe.

- March 2024 : Amazon Web Services (AWS) acquired a 960-megawatt hyperscale data center campus from Talen Energy for USD 650 million, powered by carbon-free nuclear energy. This strategic move supports AWS’s roadmap for sustainable hyperscale growth, AI/ML workload scaling, and zero-carbon cloud infrastructure. The acquisition reinforces AWS’s leadership in green cloud innovation and AI-ready compute capacity.

- January 2024 : TAG Video Systems partnered with Tencent Cloud to deliver next-gen cloud-native media solutions across the APAC region. This alliance enhances broadcast performance, real-time video analytics, and scalable media workflows, enabling media companies to embrace cloud transformation, AI-assisted content delivery, and multi-region deployment with confidence.

Table of Contents

Methodology

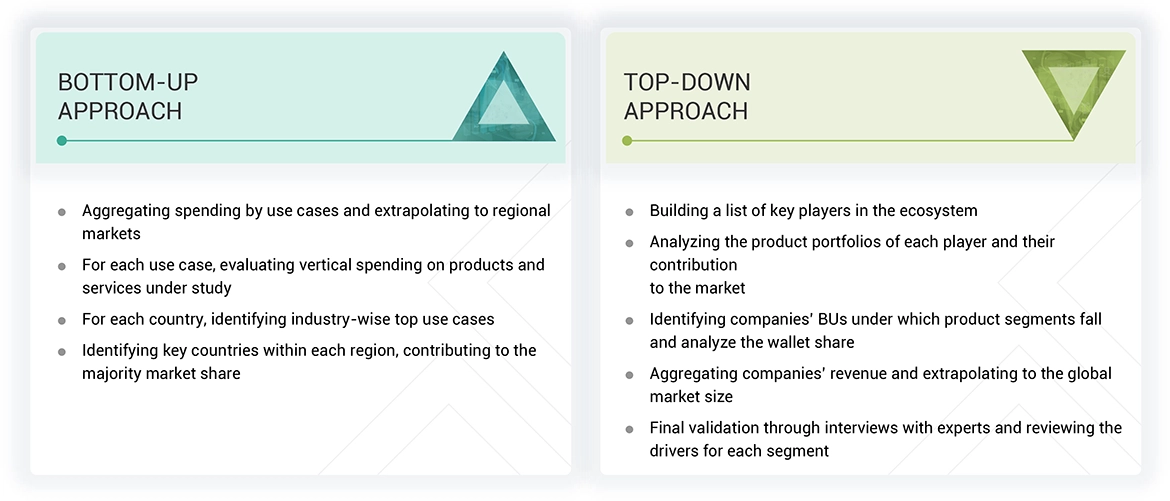

The study comprised four main activities to estimate the hyperscale data center market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various hyperscale data center market segments using the market breakup and data triangulation techniques.

Secondary Research

The market size of companies offering hyperscale data centers was arrived at based on secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain essential information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

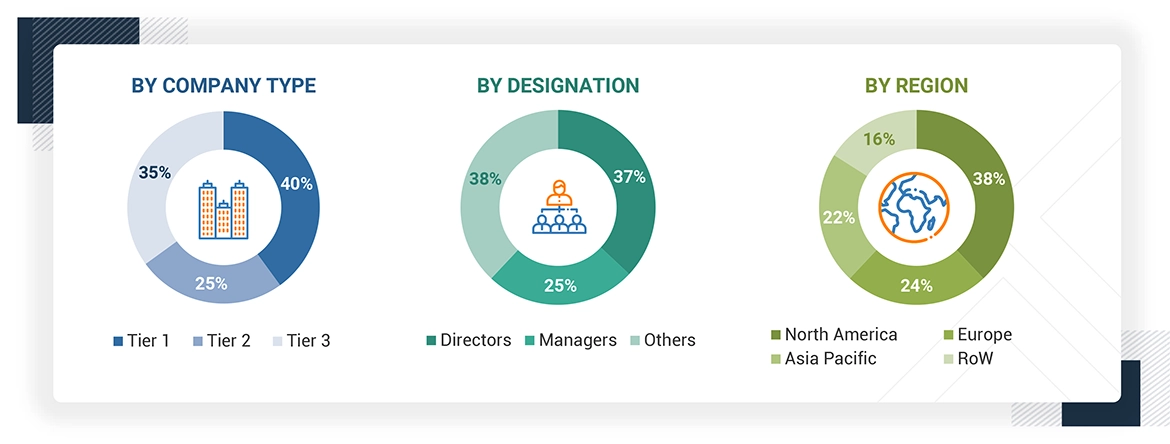

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the hyperscale data center market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various technologies-related trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using hyperscale data center and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall hyperscale data center market.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between USD 1 and 10

billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The hyperscale data center and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

The research methodology used to estimate the market size included the following:

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Hyperscale Data Center Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines a hyperscale data center as a highly advanced and massive facility designed to manage vast amounts of data and computing tasks. By supporting the growing demands of technologies such as cloud computing, artificial intelligence, and big data, hyperscale data centers enable rapid processing, vast storage capacities, and high-speed data transfer to handle increasingly complex workloads. Hyperscale data centers are built with scalable infrastructure that allows seamless expansion and advanced network optimization for efficient and reliable operations.

Stakeholders

- Cloud service providers

- Hardware manufacturers (servers, storage, networking equipment)

- Software providers (data center management, virtualization, and automation software)

- Colocation service providers

- System integrators

- Consulting and advisory firms

- Telecommunication service providers

- Managed service providers

- Construction and engineering firms (specializing in data center design and build)

- Network service providers

- Security solution providers (physical and cybersecurity)

- Government and regulatory bodies

- Environmental and sustainability consultants

- Training and education service providers

- Research organizations

- Distributors and resellers

Report Objectives

- To define, describe, and forecast the global hyperscale data center market based on components (hardware, software, services), capacity, deployment type, end users, and region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the hyperscale data center market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/GenAI on the global hyperscale data center market.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the hyperscale data center market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

Key clients adopting the hyperscale data center platforms include:

- Cloud Service Providers

- Social Media Provider

- E-Commerce Companies

- Streaming Services

- Financial Services

- Healthcare Organizations

- Telecom Providers

- Gaming Companies

- Manufacturing & Automotive

- Educational Institutes

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hyperscale Data Center Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hyperscale Data Center Market