Alumina Trihydrate Market by Type (Ground, Wet, Dry, Precipitate), Application (Flame Retardant, Filler, Antacid), End-Use Industry (Plastic, Building & Construction, Paints & Coatings, Pharmaceuticals, Glass, Rubber), Region - Global Forecasts upto 2025

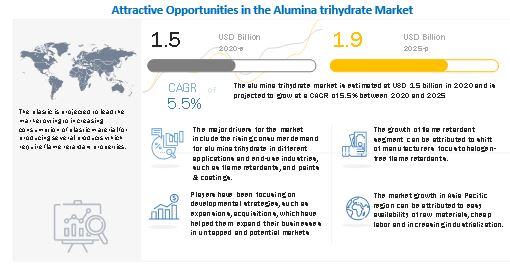

The global alumina trihydrate market size was valued at USD 1.5 billion in 2020 and is projected to reach USD 1.9 billion by 2025, growing at a cagr 5.5% from 2020 to 2025. The major drivers for the market include the rising consumer demand for alumina trihydrate in different applications and end-use industries, such as flame retardants, and paints & coatings. However, the substitutes present in the market, for instance, magnesium hydroxide, can restrain the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Covid-19 Impact On The Global Alumina trihydrate Market

The global alumina trihydrate market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the alumina trihydrate industry witness a significant decline in its production. It has affected the market for alumina trihydrate manufacturers catering to the glass and rubber industries, which were not considered essential. Moreover, most of the global companies operating in this market are based in Asia Pacific, the US, and European countries, which are adversely affected by the pandemic. These companies having their manufacturing units in China and other Asian countries are also severely affected. Therefore, disruptions in the supply chain have resulted in hampering production units due to a lack of raw materials and workforce.

Alumina trihydrate Market Dynamics

Driver:Increasing demand for non-halogenated flame retardants

The growing number of residential and commercial establishments has increased the possibilities of explosions and fire-related accidents. Therefore, several countries across North America and Europe have mandated stringent fire safety regulations and protocols. This has led to the increased use of flame retardants in buildings to meet these government regulations. The major application of flame retardants is in electric wire insulation in building & construction, and transportation. Flame retardants are used in circuit boards, electronic casing, and cables & wire systems. Stringent fire safety standards to reduce the spread of fires in residential and commercial buildings are driving the demand for halogen-free flame retardants. The shift toward more environment-friendly alternatives will increase the demand for non-halogenated flame retardants, which, in turn, will drive market growth

Restraints: Availability of magnesium hydroxide and other alternative products

Magnesium hydroxide is an inorganic hydrate that is more thermally stable than alumina trihydrate. An increase in preference for magnesium hydroxide as substitutes for aluminum hydroxide in medical applications to inhibit the aluminum toxicity issues in patients suffering from chronic kidney diseases can pose a challenge for the alumina trihydrate market. Magnesium hydroxide is also used as a flame retardant. It has a 212°F higher decomposition temperature than alumina trihydrate, allowing a higher processing temperature in compounding and extruding the plastic. Magnesium hydroxide is also preferred as an antacid in the pharmaceuticals industry. It is stable up to temperatures of > 572°F. Hence, it is also used as an alternative to alumina trihydrate in polymers having higher processing temperatures. These factors are expected to restrain the alumina trihydrate market.

Opportunities: Use of aluminum hydroxide in water treatment plants

Aluminum hydroxide (alum) is the most common coagulant used in water and wastewater treatment. The main purpose of using alum in these applications is to improve the settling of suspended solids and color removal. Alum is also used to remove phosphate from wastewater treatment effluent. Thus, the growing urbanization in emerging economies, such as China and India, is expected to fuel the demand for water treatment plants in residential areas. Nevertheless, many people still lack access to safe water and suffer from preventable water-borne microbial diseases leading to the increased demand for wastewater treatment plants. Thus, the use of aluminum hydroxide in water treatment plants in residential areas is expected to act as an opportunity for the growth of the alumina trihydrate market across the globe.

Challenges: Environmental issues related to alumina production

Alumina production leads to bauxite residue, also known as red mud. The disposal of bauxite residue/red mud is a challenge due to relatively large volumes, occupying land areas, and the alkalinity of the residue and the run-off water. Only a very small proportion of the bauxite residue produced are re-used in any way. Although the residue has a number of characteristics of environmental concern, the most immediate and apparent barrier to remediation and utilization is its high alkalinity and sodicity. The high pH of the bauxite residue is a problem from both a health and safety point-of-view. This can pose a challenge for the alumina trihydrate market.

Based on type, the precipitate segment is projected to lead the market during the forecast period

Based on type, the precipitate segment is estimated to account for the largest share of the alumina trihydrate market in 2019 in terms of value. Precipitate alumina trihydrate offers various advantages, such as lower viscosity in polyester SMC and better flame retardancy. It has less surface moisture than ground alumina trihydrate, which means less catalyst is required for surface absorption, and faster cure can be achieved. The decomposition temperature of precipitate alumina trihydrate is higher than that of ground alumina trihydrate because, on heating, the precipitate alumina trihydrate first loses its physically absorbed moisture followed by decomposition. Therefore, it is preferred in applications where short-term exposure to high temperatures during processing is unavoidable. It also has more blocky particles giving better impact resistance. Such factors are expected to drive the demand for precipitate alumina trihydrate.

Based on application, the flame retardant segment is expected to be the fastest growing segment in the market

Based on application, the alumina trihydrate market has been segmented into flame retardant, filler, antacid, and others. The flame retardant application is expected to lead the alumina trihydrate market. The alumina trihydrate market has witnessed a significant increase in the demand for flame retardants, mainly in the automotive and electrical & electronics industries. Stringent fire safety standards to reduce the risk of the spread of fire in residential and commercial buildings is driving the growth of the alumina trihydrate market. The growing consumer electronics industries, coupled with stringent environmental regulations on the materials used in electronics manufacturing, will further fuel the growth of the alumina trihydrate market.

Based on the end-use industry, the plastic segment is projected to lead alumina trihydrate market during 2020-2025

Based on end-use industry, the alumina trihydrate market has been segmented into plastics, building & construction, paints & coatings, pharmaceutical, glass, rubber, and others. The plastic end-use industry contributed the largest share to the alumina trihydrate market in 2019. Increasing plastic consumption in the construction, automotive, and electrical & electronics industries is projected to drive the market for plastic. Regulations to decrease gross vehicle weight to improve fuel efficiency and eventually reduce carbon emissions have promoted the use of plastics as a substitute for metals to manufacture automotive components. The consumption of alumina trihydrate as a flame retardant is high in the building & construction sector. The growing building safety awareness among masses has led to the development of energy-efficient buildings. As such, conventional plastics in these buildings are continuously replaced with flame retardant plastics.

Asia Pacific is expected to witness the fastest growth in the alumina trihydrate market during the forecast period

The Asia Pacific alumina trihydrate market is projected to witness the highest growth during the forecast period. This growth can be attributed to mainly due to the flourishing plastics, building & construction, and paints & coatings industries in emerging economies, such as China and India. Moreover, the formulation and stringent implementation of fire safety regulations in different countries of the Asia Pacific region are also contributing to the increased demand for flame retardants, thereby leading to the growth of the alumina trihydrate market in the Asia Pacific region.

Key Market Players

Major companies such as Sumitomo Chemical Company, Limited (Japan), Hindalco Industries Limited (India), Aluminum Corporation of China Limited (China),Nabaltec AG (Germany), and Huber Engineered Materials (US and among others. These players have been focusing on developmental strategies, investments & expansions, including capacity addition in existing production facilities, expansion, and mergers & acquisitions which have helped them expand their businesses in untapped and potential markets. These players have adopted growth strategies to strengthen their market positions and expand their presence across regions. These companies have a major geographic presence in the North American, European, and Asia Pacific regions and are undertaking organic and inorganic expansion strategies to increase their market shares.

Recent Developments

- In September 2020, The Fire-Retardant Additives division of Huber Engineered Materials (HEM) announced its plans for a major sustainability project and substantial investment in a new power plant at its Martinswerk facility in Bergheim, Germany.

- In April 2020, Sumitomo Chemical Company, Limited acquired four South American subsidiaries of Nufarm Limited in Brazil, Argentina, Chile, and Colombia. Through this acquisition, the company expanded its geographical presence in these countries.

- In April 2020, Hindalco Industries Limited company acquired Aleris Corp for USD2.8 billion. Aleris became a wholly-owned subsidiary of Novelis, USA. Through this acquisition, it strengthened its business operations in the US.

- In October 2018, Nabaltec AG formed Nabaltec (Shanghai) Trading Co., Ltd., with a registered office in Shanghai, China. The company is a wholly-owned subsidiary of Nabaltec AG.

- In October 2018, Huber Engineered Materials acquired Miller Chemical & Fertilizer, LLC. The acquisition helped the company to build a diverse portfolio of small-to-medium size, competitively advantaged businesses in the chemical and mineral markets.

Frequently Asked Questions (FAQ):

What are alumina trihydrate?

Alumina trihydrate or aluminum trihydroxide is a white-colored powdered substance, which is odorless and non-toxic. Alumina trihydrate is mainly used for in fireproof plastics, chemicals, and antacids. It is also widely used as a flame retardant and a smoke suppressant. Alumina trihydrate has very low-water solubility, but it is considered amphoteric, which means it dissolves in both strong alkali and acids. It is usually derived from bauxite ore in different sizes and refined through the Bayer process. The alumina trihydrate market is segmented into type, application, and end-use industry. Alumina trihydrate is used in plastics, building & construction, pharmaceuticals, paints & coatings, glass, rubber, and other end-use industries.

What are the major driving factors for alumina trihydrate?

The major drivers for the market include the rising consumer demand for alumina trihydrate in different applications and end-use industries, such as flame retardants, and paints & coatings.

What is the major end-use industry of alumina trihydrate?

Based on end-use industry, the alumina trihydrate market has been segmented into plastics, building & construction, paints & coatings, pharmaceutical, glass, rubber, and others. Out of these categories, alumina trihydrate is most widely used in plastic end-use industry followed by building & construction.

What is a major application of alumina trihydrate?

Based on application, the alumina trihydrate market has been segmented into flame retardant, filler, antacid, and others. Halogen-free flame retardants are used in various industries, such as electrical & electronics, building & construction, and transportation. They are used in electric wire insulation materials, building materials, automotive parts, textiles, and home furnishings. Halogen-free flame retardants are used in circuit boards, electronic casing, and cables & wires.

Who are the leading alumina trihydrate provider in the world?

Major companies such as Sumitomo Chemical Company, Limited (Japan), Hindalco Industries Limited (India), Aluminum Corporation of China Limited (China), Nabaltec AG (Germany), and Huber Engineered Materials (US), and among others. These players have been focusing on developmental strategies, investments & expansions, including capacity addition in existing production facilities, product launches, and mergers & acquisitions which have helped them expand their businesses in untapped and potential markets. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 ALUMINA TRIHYDRATE MARKET: INCLUSIONS AND EXCLUSIONS

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 LIMITATIONS

1.10 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

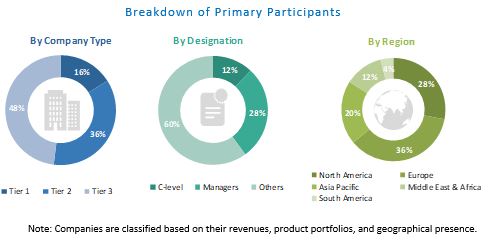

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

FIGURE 3 BASE NUMBER CALCULATION – APPROACH 1

FIGURE 4 BASE NUMBER CALCULATION – APPROACH 2

FIGURE 5 BASE NUMBER CALCULATION – APPROACH 3

FIGURE 6 BASE NUMBER CALCULATION – APPROACH 4

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.6 ASSUMP

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 DISRUPTION IN THE SUPPLY CHAIN TO RESTRAIN THE MARKET GROWTH IN 2020

FIGURE 11 ASIA PACIFIC TO BE THE FASTEST-GROWING SEGMENT

FIGURE 12 FLAME RETARDANT APPLICATION TO LEAD ALUMINA TRIHYDRATE MARKET

FIGURE 13 PLASTIC END-USE INDUSTRY TO LEAD ALUMINA TRIHYDRATE MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ALUMINA TRIHYDRATE MARKET

FIGURE 14 INCREASING DEMAND FROM FLAME RETARDANT SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ALUMINA TRIHYDRATE MARKET, BY TYPE

FIGURE 15 PRECIPITATE TO BE THE FASTEST-GROWING SEGMENT

4.3 ALUMINA TRIHYDRATE MARKET, BY APPLICATION

FIGURE 16 FLAME RETARDANT TO BE THE FASTEST-GROWING APPLICATION SEGMENT

4.4 ALUMINA TRIHYDRATE MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 17 ASIA PACIFIC TO ACCOUNT FOR THE LARGEST MARKET SHARE

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN ALUMINA TRIHYDRATE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for non-halogenated flame retardants

5.2.1.2 Increasing demand for alumina trihydrate in the paints & coatings industry

5.2.1.3 Increasing demand for plastics

5.2.1.4 Plastic consumption, by country, 2015-2018 (kiloton)

5.2.2 RESTRAINTS

5.2.2.1 Availability of magnesium hydroxide and other alternative products

5.2.3 OPPORTUNITIES

5.2.3.1 Use of aluminum hydroxide in water treatment plants

5.2.3.2 Growing use of polymers in the automotive industry

5.2.4 CHALLENGES

5.2.4.1 Environmental issues related to alumina production

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 ALUMINA TRIHYDRATE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM

FIGURE 20 ALUMINA TRIHYDRATE ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.6 TRADE ANALYSIS

TABLE 1 MAJOR EXPORTERS OF ALUMINA TRIHYDRATE IN 2019

5.7 VALUE CHAIN ANALYSIS

5.8 REGULATION & TARIFF LANDSCAPE

TABLE 2 REGULATORY LANDSCAPE

5.9 ALUMINA TRIHYDRATE PATENT ANALYSIS

5.9.1 INTRODUCTION

5.9.2 METHODOLOGY

5.9.3 DOCUMENT TYPE

FIGURE 21 ALUMINA TRIHYDRATE REGISTERED PATENTS

5.9.4 PUBLICATION TRENDS - LAST 5 YEARS

FIGURE 22 PUBLICATION TRENDS - LAST 5 YEARS

5.9.5 INSIGHT

5.9.6 JURISDICTION ANALYSIS

FIGURE 23 JURISDICTION ANALYSIS

5.9.7 TOP 10 COMPANIES/APPLICANTS

FIGURE 24 TOP 10 COMPANIES/APPLICANTS

5.9.8 LIST OF PATENTS BY NATIONAL ALUMINIUM COMPANY LIMITED

5.9.9 LIST OF PATENTS BY DUPONT

5.9.10 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

5.9.11 LIST OF PATENTS BY ECOLAB USA INC

5.9.12 LIST OF PATENTS BY CYTEC INDUSTRIES INC

5.9.13 LIST OF PATENTS BY HUBER CORP J M

5.9.14 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

5.10 IMPACT OF COVID-19

TABLE 3 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021 (PERCENTAGE)

5.10.2 BUILDING & CONSTRUCTION INDUSTRY

5.10.3 PAINTS & COATINGS INDUSTRY

5.10.4 PHARMACEUTICALS INDUSTRY

5.10.5 GLASS INDUSTRY

5.10.6 RUBBER INDUSTRY

5.11 ALUMINA TRIHYDRATE CUSTOMERS

TABLE 4 LIST OF ALUMINA TRIHYDRATE CUSTOMERS – GLOBAL

TABLE 5 LIST OF ALUMINA TRIHYDRATE CUSTOMERS – INDIA

6 ALUMINA TRIHYDRATE MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 25 PRECIPITATE SEGMENT TO BE THE FASTEST-GROWING SEGMENT

TABLE 6 ALUMINA TRIHYDRATE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 7 ALUMINA TRIHYDRATE MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

6.2 GROUND

6.2.1 COST EFFECTIVENESS AND WIDE PARTICLE SIZE DISTRIBUTION ARE DRIVING THE GROWTH OF THE MARKET

TABLE 8 GROUND SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 GROUND SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.3 DRY

6.3.1 INCREASING APPLICATIONS IN VARIOUS END-USE INDUSTRIES TO DRIVE THE SEGMENT

TABLE 10 DRY SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 DRY SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.4 WET

6.4.1 PROPERTIES, SUCH AS HIGH PURITY AND SOLUBILITY IN ACID AND ALKALI, TO DRIVE THE SEGMENT

TABLE 12 WET SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 WET SEGMENT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.5 PRECIPITATE

6.5.1 BETTER FLAME RETARDANCY AND LESS SURFACE MOISTURE TO DRIVE THE SEGMENT

TABLE 14 PRECIPITATE: ALUMINA TRIHYDRATE MARKET SIZE, BY R2018–2025 (USD MILLION)

TABLE 15 PRECIPITATE: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7 ALUMINA TRIHYDRATE MARKET, BY APPLICATION (Page No. - 80)

7.1 INTRODUCTION

FIGURE 26 FLAME RETARDANT SEGMENT TO GROW AT THE HIGHEST CAGR

TABLE 16 ALUMINA TRIHYDRATE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 17 ALUMINA TRIHYDRATE MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

7.2 FLAME RETARDANT

7.2.1 FIRE SAFETY STANDARDS AND REGULATIONS FORMULATED ACROSS THE GLOBE TO DRIVE THE MARKET

TABLE 18 FLAME RETARDANT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 FLAME RETARDANT: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.3 FILLER

7.3.1 GOOD FIRE RETARDANT AND THERMAL CONDUCTIVITY PROPERTIES

TABLE 20 FILLER: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 FILLER: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.4 ANTACID

7.4.1 CHANGING LIFESTYLES AND FOOD HABITS TO BOOST THE MARKET

TABLE 22 ANTACID: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 ANTACID: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.5 OTHERS

TABLE 24 OTHER APPLICATIONS: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 OTHER APPLICATIONS: ALUMINA TRIHYDRATE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

8 ALUMINA TRIHYDRATE MARKET, BY END-USE INDUSTRY (Page No. - 86)

8.1 INTRODUCTION

FIGURE 27 PLASTIC SEGMENT EXPECTED TO LEAD THE ALUMINA TRIHYDRATE MARKET

TABLE 26 ALUMINA TRIHYDRATE MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 27 ALUMINA TRIHYDRATE MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

8.2 PLASTIC

8.2.1 GROWING POPULATION ALONG WITH RAPID URBANIZATION AND INDUSTRIALIZATION IN EMERGING ECONOMIES TO DRIVE THE SEGMENT

TABLE 28 ALUMINA TRIHYDRATE MARKET SIZE IN PLASTIC END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 ALUMINA TRIHYDRATE MARKET SIZE IN PLASTIC END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.3 BUILDING & CONSTRUCTION

8.3.1 INCREASING CONSTRUCTION ACTIVITIES EXPECTED TO DRIVE THE SEGMENT

TABLE 30 ALUMINA TRIHYDRATE MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 ALUMINA TRIHYDRATE MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.4 PAINTS & COATINGS

8.4.1 RISING SPENDING IN THE INDUSTRIAL SECTOR AND INFRASTRUCTURAL DEVELOPMENTS TO DRIVE THE SEGMENT

TABLE 32 ALUMINA TRIHYDRATE MARKET SIZE IN PAINTS & COATINGS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 ALUMINA TRIHYDRATE MARKET SIZE IN PAINTS & COATINGS END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.5 PHARMACEUTICALS

8.5.1 INCREASING GERIATRIC POPULATION AND SEDENTARY LIFESTYLES TO DRIVE THE SEGMENT

TABLE 34 ALUMINA TRIHYDRATE MARKET SIZE IN PHARMACEUTICALS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 ALUMINA TRIHYDRATE MARKET SIZE IN PHARMACEUTICALS END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.6 GLASS

8.6.1 RISE IN THE DEMAND FOR HIGH-PERFORMANCE MATERIALS TO DRIVE THE SEGMENT

TABLE 36 ALUMINA TRIHYDRATE MARKET SIZE IN GLASS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 ALUMINA TRIHYDRATE MARKET SIZE IN GLASS END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.7 RUBBER

8.7.1 INCREASING DEMAND FROM THE AUTOMOTIVE INDUSTRY TO DRIVE THE SEGMENT

TABLE 38 ALUMINA TRIHYDRATE MARKET SIZE IN RUBBER END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 ALUMINA TRIHYDRATE MARKET SIZE IN RUBBER END-USE INDUSTRY, BY REGION, 2018–2025 (KILOTON)

8.8 OTHERS

TABLE 40 ALUMINA TRIHYDRATE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 ALUMINA TRIHYDRATE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTON)

9 ALUMINA TRIHYDRATE MARKET, BY REGION (Page No. - 97)

9.1 INTRODUCTION

TABLE 42 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 28 ASIA PACIFIC IS PROJECTED TO BE FASTEST-GROWING MARKET FOR ALUMINA TRIHYDRATE DURING THE FORECAST PERIOD

TABLE 43 ALUMINA TRIHYDRATE MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2018–2025 (KILOTON)

9.1.1 ALUMINA TRIHYDRATE MARKET, BY END-USE INDUSTRY

TABLE 45 MARKET SIZE, BY END-USE2018–2025 (USD MILLION)

TABLE 46 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.1.2 ALUMINA TRIHYDRATE MARKET, BY TYPE

TABLE 47 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.1.3 ALUMINA TRIHYDRATE MARKET, BY APPLICATION

TABLE 49 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

9.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: ALUMINA TRIHYDRATE MARKET SNAPSHOT

9.2.1 NORTH AMERICA: ALUMINA TRIHYDRATE MARKET, BY COUNTRY

TABLE 51 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

9.2.2 NORTH AMERICA: MARKET, BY TYPE

TABLE 53 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.2.3 NORTH AMERICA: MARKET, BY END-USE INDUSTRY

TABLE 55 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.2.4 NORTH AMERICA: MARKET, BY APPLICATION

TABLE 57 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

9.2.5 US

9.2.5.1 US dominated the alumina trihydrate market in North America

9.2.5.2 US: Alumina trihydrate market, by type

TABLE 59 US: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 US: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.2.5.3 US: Alumina trihydrate market, by end-use industry

TABLE 61 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 62 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.2.6 CANADA

9.2.6.1 Construction industry to boost demand for alumina trihydrate

9.2.6.2 Canada: Alumina trihydrate market, by type

TABLE 63 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.2.6.3 Canada: Alumina trihydrate market, by end-use industry

TABLE 65 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 66 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.2.7 MEXICO

9.2.7.1 Increasing plastics production to drive the growth of the market

9.2.7.2 Mexico: Alumina trihydrate market, by type

TABLE 67 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 68 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.2.7.3 Mexico: Alumina trihydrate market, by end-use industry

TABLE 69 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 70 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3 EUROPE

FIGURE 30 EUROPE: ALUMINA TRIHYDRATE MARKET SNAPSHOT

9.3.1 EUROPE: ALUMINA TRIHYDRATE MARKET, BY COUNTRY

TABLE 71 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

9.3.2 EUROPE: ALUMINA TRIHYDRATE MARKET, BY TYPE

TABLE 73 EUROPE : MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.3 EUROPE: MARKET, BY END-USE INDUSTRY

TABLE 75 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3.4 EUROPE: MARKET, BY APPLICATION

TABLE 77 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

9.3.5 GERMANY

9.3.5.1 Germany to lead the alumina trihydrate market in the region

9.3.5.2 Germany: Alumina trihydrate market, by type

TABLE 79 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: MARKET SIZE, B2018–2025 (KILOTON)

9.3.5.3 Germany: Alumina trihydrate market, by end-use industry

TABLE 81 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTO

9.3.6 UK

9.3.6.1 Increased investment by the government in construction and other industries to boost the market in the UK

9.3.6.2 UK: Alumina trihydrate market, by type

TABLE 83 UK: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 UK: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.6.3 UK: Alumina trihydrate market, by end-use industry

TABLE 85 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 86 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3.7 FRANCE

9.3.7.1 Increase in new construction projects to drive the alumina trihydrate market

9.3.7.2 France: Alumina trihydrate market, by type

TABLE 87 FRANCE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 FRANCE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.7.3 France: Alumina trihydrate market, by end-use industry

TABLE 89 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 90 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3.8 ITALY

9.3.8.1 Growth of Italian automotive industry to drive demand for alumina trihydrate

9.3.8.2 Italy: Alumina trihydrate market, by type

TABLE 91 ITALY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 ITALY: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.8.3 Italy: Alumina trihydrate market, by end-use industry

TABLE 93 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 94 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3.9 RUSSIA

9.3.9.1 Rising demand from construction industry to drive the market growth

9.3.9.2 Russia: Alumina trihydrate market, by type

TABLE 95 RUSSIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 RUSSIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.9.3 Russia: Alumina trihydrate market, by end-use industry

TABLE 97 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 98 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.3.10 REST OF EUROPE

9.3.10.1 Rest of Europe: Alumina trihydrate market, by type

TABLE 99 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.3.10.2 Rest of Europe: Alumina trihydrate market, by end-use industry

TABLE 101 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: ALUMINA TRIHYDRATE MARKET SNAPSHOT

9.4.1 ASIA PACIFIC: ALUMINA TRIHYDRATE MARKET, BY COUNTRY

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

9.4.2 ASIA PACIFIC: MARKET, BY TYPE

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.3 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.4 ASIA PACIFIC: MARKET, BY APPLICATION

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

9.4.5 CHINA

9.4.5.1 China is projected to lead the alumina trihydrate market in the region

9.4.5.2 China: Alumina trihydrate market, by type

TABLE 111 CHINA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 CHINA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.5.3 China: Alumina trihydrate market, by end-use industry

TABLE 113 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 114 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.6 INDIA

9.4.6.1 Availability of cheap labor and rise in flow of FDI in manufacturing industry to drive the market

9.4.6.2 India: Alumina trihydrate market, by type

TABLE 115 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 116 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.6.3 India: Alumina trihydrate market, by end-use industry

TABLE 117 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 118 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.7 JAPAN

9.4.7.1 Rising demand from automotive industry to drive the alumina trihydrate market

9.4.7.2 Japan: Alumina trihydrate market, by type

TABLE 119 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.7.3 Japan: Alumina trihydrate market, by end-use industry

TABLE 121 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 122 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.8 SOUTH KOREA

9.4.8.1 Formulation and stringent implementation of fire safety regulations to boost the market in the country

9.4.8.2 South Korea: Alumina trihydrate market, by type

TABLE 123 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.8.3 South Korea: Alumina trihydrate market, by end-use industry

TABLE 125 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 126 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.9 AUSTRALIA

9.4.9.1 Rising demand from construction and plastic industries to boost the market in the country

9.4.9.2 Australia: Alumina trihydrate market, by type

TABLE 127 AUSTRALIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 AUSTRALIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.9.3 Australia: Alumina trihydrate market, by end-use industry

TABLE 129 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 130 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.10 REST OF ASIA PACIFIC

9.4.10.1 Rest of Asia Pacific: Alumina trihydrate market, by type

TABLE 131 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.4.10.2 Rest of Asia Pacific: Alumina trihydrate market, by end-use industry

TABLE 133 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5 MIDDLE EAST & AFRICA

FIGURE 32 MIDDLE EAST & AFRICA: ALUMINA TRIHYDRATE MARKET SNAPSHOT

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018-2025 (KILOTON)

9.5.1 MIDDLE EAST & AFRICA: ALUMINA TRIHYDRATE MARKET, BY TYPE

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.3 MIDDLE EAST & AFRICA: ALUMINA TRIHYDRATE MARKET, BY APPLICATION

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET BY APPLICATION, 2018–2025 (KILOTON)

9.5.4 SAUDI ARABIA

9.5.4.1 Increasing opportunities in end-use industries to fuel the market

9.5.4.2 Saudi Arabia: Alumina trihydrate market, by type

TABLE 143 SAUDI ARABIA: ALUMINA TRIH2018–2025 (USD MILLION)

TABLE 144 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.5.4.3 Saudi Arabia: Alumina trihydrate market, by end-use industry

TABLE 145 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 146 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.5 UAE

9.5.5.1 Growing real-estate and infrastructure to drive the market

9.5.5.2 UAE: Alumina trihydrate market, by type

TABLE 147 UAE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 UAE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.5.5.3 UAE: Alumina trihydrate market, by end-use industry

TABLE 149 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 150 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.6 SOUTH AFRICA

9.5.6.1 Increase in consumption of plastics to fuel the market

9.5.6.2 South Africa: Alumina trihydrate market, by type

TABLE 151 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.5.6.3 South Africa: Alumina trihydrate market, by end-use industry

TABLE 153 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 154 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.7 REST OF MIDDLE EAST & AFRICA

9.5.7.1 Rest of Middle East & Africa: Alumina trihydrate market, by type

TABLE 155 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.5.7.2 Rest of Middle East & Africa: Alumina trihydrate market, by end-use industry

TABLE 157 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.6 SOUTH AMERICA

FIGURE 33 SOUTH AMERICA: ALUMINA TRIHYDRATE MARKET SNAPSHOT

TABLE 159 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (KILOTON)

9.6.1 SOUTH AMERICA: MARKET, BY TYPE

TABLE 161 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.6.2 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY

TABLE 163 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 165 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

9.6.3 BRAZIL

9.6.3.1 Rising demand for residential construction drives the market

9.6.3.2 Brazil: Alumina trihydrate market, by type

TABLE 167 BRAZIL: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 168 BRAZIL: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.6.3.3 Brazil: Alumina trihydrate market, by end-use industry

TABLE 169 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 170 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.6.4 ARGENTINA

9.6.4.1 Government investments in infrastructural development fueling market growth

9.6.4.2 Argentina: Alumina trihydrate market, by type

TABLE 171 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.6.4.3 Argentina: Alumina trihydrate market, by end-use industry

TABLE 173 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 174 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.6.5 REST OF SOUTH AMERICA

9.6.5.1 Rest of South America: Alumina trihydrate market, by type

TABLE 175 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.6.5.2 Rest of South America: Alumina trihydrate market, by end-use industry

TABLE 177 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 166)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF TOP PLAYERS

10.4 MARKET RANKING

FIGURE 34 MARKET RANKING OF KEY PLAYERS IN 2019

10.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

FIGURE 35 ALUMINA TRIHYDRATE MARKET (TIER 1) COMPETITIVE LEADERSHIP MAPPING, 2019

10.5.4 PRODUCT FOOTPRINT

10.6 COMPETITIVE LEADERSHIP MAPPING (START-UP/SMES)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 DYNAMIC COMPANIES

FIGURE 36 ALUMINA TRIHYDRATE MARKET (STARTCOMPETITIVE LEADERSHIP MAPPING, 2019

10.7 KEY MARKET DEVELOPMENTS

10.7.1 INVESTMENT & EXPANSION

TABLE 179 INVESTMENTS & EXPANSIONS, 2017–2020

10.7.2 MERGER & ACQUISITION

TABLE 180 MERGERS & ACQUISITIONS, 2017–2020

11 COMPANY PROFILES (Page No. - 173)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, and Right to Win)*

11.1 NABALTEC AG

FIGURE 37 NABALTEC AG: COMPANY SNAPSHOT

FIGURE 38 NABALTEC AG: SWOT ANALYSIS

11.2 ALUMINUM CORPORATION OF CHINA LIMITED

FIGURE 39 ALUMINUM CORPORATION OF CHINA LIMITED: COMPANY SNAPSHOT

FIGURE 40 ALUMINUM CORPORATION OF CHINA LIMITED: SWOT ANALYSIS

11.3 SUMITOMO CHEMICAL COMPANY, LIMITED

FIGURE 41 SUMITOMO CHEMICAL COMPANY, LIMITED: COMPANY SNAPSHOT

FIGURE 42 SUMITOMO CHEMICAL COMPANY, LIMITED: SWOT ANALYSIS

11.4 HINDALCO INDUSTRIES LIMITED

FIGURE 43 HINDALCO INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 44 HINDALCO INDUSTRIES LIMITED: SWOT ANALYSIS

11.5 HUBER ENGINEERED MATERIALS

FIGURE 45 HUBER ENGINEERED MATERIALS: SWOT ANALYSIS

11.6 NATIONAL ALUMINIUM COMPANY LIMITED

FIGURE 46 NATIONAL ALUMINIUM COMPANY LIMITED: COMPANY SNAPSHOT

11.7 SCR- SIBELCO NV

FIGURE 47 SCR- SIBELCO NV: COMPANY SNAPSHOT

11.8 LKAB MINERALS AB

11.9 THE R.J. MARSHALL COMPANY

11.10 ALTEO

11.11 TOR MINERALS

11.12 SOUTHERN IONICS INCORPORATED

11.13 KC CORPORATION

11.14 HAYASHI KASEI CO., LTD.

11.15 DADCO ALUMINA AND CHEMICALS LIMITED

11.16 ALUMINA CHEMICALS & CASTABLES

11.17 SPECTRUM CHEMICAL MFG. CORP.

11.18 ALMATIS GMBH

11.19 AKROCHEM CORPORATION

11.20 MAL - MAGYAR ALUMÍNIUM TERMELÕ ÉS KERESKEDELMI ZRT.

11.21 JINAN CHENXU CHEMICAL CO., LTD.

11.22 OTHER PLAYERS

11.22.1 BN INDUSTRIES

11.22.2 ELITE CHEMICALS

11.22.3 PARCHEM – FINE & SPECIALTY CHEMICALS

11.22.4 TAURUS CHEMICALS PRIVATE LIMITED

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, and Right to Win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 207)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current impact of modifiers market size. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary data includes company information acquired from annual reports, press releases, investor presentations; white papers; and articles from recognized authors. In the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to obtain, verify, and validate the market revenues arrived at. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

Primary Research

The alumina trihydrate market comprises stakeholders such as producers, suppliers, and distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in end-use industries such as plastic, building & construction, paints & coatings, glass, rubber, pharmaceuticals and others. The supply side is characterized by market consolidation activities undertaken by alumina trihydrate manufacturers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the alumina trihydrate market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the market size for alumina trihydrate, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To estimate and forecast the alumina trihydrate market size based on type, application, and end-use industry

- To analyze and forecast the alumina trihydrate market based on region – Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Type Analysis

- A further breakdown of the type segments of the alumina trihydrate market with respect to a particular end-use industry

Country-Wise Segmentation With Application Analysis

- A further breakdown of the application segments of the alumina trihydrate market with respect to a particular country

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Application Analysis:

- A further breakdown of ATH derivatives with respect to a particular application.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Alumina Trihydrate Market

Please share analysis of Alumina Trihydrate Market Size. Forecast Report 2028 and 2031