Ambient Lighting Market with COVID-19 Impact by Offering (Hardware, Software & Services), Type (Surface-mounted, Strip Lights, Track Lights, Recessed Lights), End Users (Residential, Industrial, Office Buildings), and Geography - Global Forecast to 2025

Updated on : October 06 , 2023

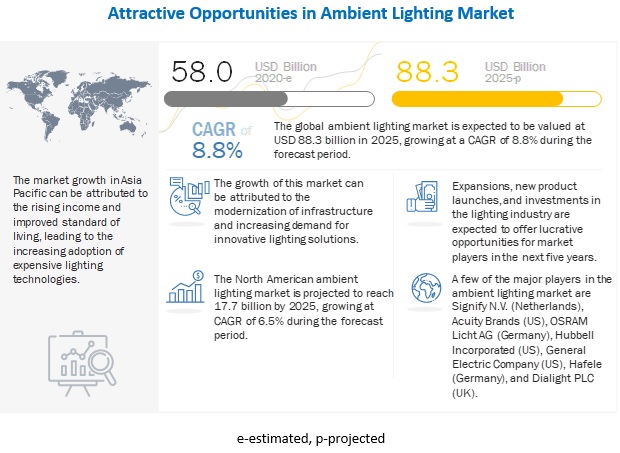

The ambient lighting market is estimated to be USD 58.0 billion in 2020 and projected to reach USD 88.3 billion by 2025, at a CAGR of 8.8%. The key factors contributing to the growth of the market are modernization of infrastructure and upcoming smart city projects in developing economies, government initiatives and policies for energy savings, and increasing consumer preferences for better interior designing with energy-efficient lighting systems. Increasing awareness regarding energy-efficient lighting solutions and stringent government regulations for the implementation of such solutions across the US, the UK, Germany, and China are proving to be some of the other factors driving the growth for the ambient lighting market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Ambient lighting market

In the realistic scenario approach, it has been assumed that the first two quarters in 2020 will witness lackluster growth, and there will be some sort of recovery in the second half of FY20–21. Major companies such as Signify N.V. (Netherlands), GE (GE Lighting) (US), Acuity Brands (US), Hubbell Lighting (US), and OSRAM Licht AG (Germany) operating in ambient lighting market have witnessed subdued demand for lighting products between March and May of 2020, mainly due to the supply chain disruption triggered by the COVID-19 pandemic. These companies are operating with reduced capacity in some of their manufacturing facilities. This is expected to impact their sales negatively in the short term. In the realistic scenario, it is expected that smart ambient lighting manufacturers will be affected the most due to the reduced demand for lighting fixtures such as surface-mounted lights, recessed lights, track lights, strip lights, and suspended lights.

The hardware component market for ambient lighting is expected to witness a substantial dip in 2020 owing to the subdued demand as a result of the COVID-19 pandemic. The first quarter of 2020 has shown negative growth for lighting systems. The second and third quarters of 2020 are also expected to witness lackluster demand for these products.

Ambient lighting market Dynamics

Driver: Government initiatives and policies for energy savings

Increasing use of energy is resulting in a rising level of energy dissipation and carbon emissions, which creates the need for sustainable and efficient use of energy. Electricity generation accounts for almost one-fourth of carbon emissions. Rising concerns over global warming and ozone depletion have accelerated the efforts by the governments to control their carbon footprint. Governments around the world are imposing stringent regulations to limit carbon emissions. According to the Electric Power Research Institute (EPRI), the integration of renewable energy sources in smart grids could reduce the greenhouse gas (GHG) emissions by 19–37 million metric tons (MMT) Co2e/year by 2030. Rising concerns to reduce GHG emissions have driven the transformation of traditional utility grids into smart grids, which use renewable sources for energy generation.

Governments, through several initiatives, are encouraging people for energy savings. For instance, the Indian government’s initiative—National Program for LED-based Home and Street Lighting—is aimed to increase the adoption of LED lamps in homes and cities. The goal is to replace conventional lamps, which typically use more power. LED lamps consume about 80% less energy than incandescent bulbs, and conserving power is imperative for the Indian government, given the country’s annual power shortfall of 3.6%.

Restraint: Disruptions in supply chain creating demand-supply gap and higher prices

The COVID-19 pandemic has significantly impacted the lighting industry, as the supplies of electronic components are hit due to an earlier shutdown in China. Most of the lighting OEMs and integrators are starting to see a significant shortage of chips, LED drivers, and other electronic components. This has created a demand-supply gap, leading to an increase in the prices of lighting products. For instance, Signify has announced a price hike on all LED and lamp electronics as the costs in its logistics chains keep rising due to the pandemic. The rise in prices would burden the customers, pushing them to keep the upcoming projects on hold. This would lead to delays in the completion of ongoing projects and skeptical attitude in terms of the initiation of new projects. While the supply is encountering real-time impact, demand would witness a severe effect for a longer duration when the upcoming lighting projects would halt owing to the cost-cutting measures by companies.

Opportunity: Potential opportunities for new vendors due to the localization of components

In most cases, as the factories are running under capacity in China, and the supply chain has been disrupted, lighting components are in short supply. It is hard to anticipate when the supply will resume to normal levels, as the whole value chain has gone for a toss. In some cases, factories are open, but they are not running at 100% capacity. They also do not have an adequate workforce. This would take a minimum of 3 to 6 months to normalize on both production and cost sides. Considering these factors, lighting manufacturers are looking at other destinations, such as Hong Kong, Taiwan, and South Korea, for importing components, thus opening huge opportunities for them. Additionally, most of the companies are taking COVID-19 as a wake-up call for the entire lighting industry to focus more on the localization of components in the long term. This will generate ample opportunities for vendors to earn a significant market share in local markets.

Challenge: Lack of common standards

One of the major challenges in the ambient lighting market is the lack of common standards. The standards and protocols for LED and other light sources are not defined clearly. Due to this, manufacturers provide different products for different regions and countries that fulfill the respective regulations. Manufacturers of lighting systems are focusing on the development of open protocol devices. Currently, it is mandatory for the lighting manufacturers to match the industry standards across the world pertaining to the light source. Zhaga Consortium (US) is among the initiators to set up general lighting standardization for LEDs. The lack of common standards often results in inefficiency in the industry. For example, manufacturers of LED modules cannot benefit from economies of scale, and designers and manufacturers of fixtures cannot design their products with efficiency due to the lack of extensive coordination among various part suppliers. The Lighting Industry Association (UK), has launched an independent verification program for LED production defining standards for LED products in the country.

Hardware held the larger share in the global ambient lighting market in 2019

The ambient lighting market for hardware held a larger market share in 2019. The increasing demand for energy-efficient lighting solutions is contributing to the growth of the market for hardware offerings. The demand for automation and control of lighting components is also boosting the demand for the hardware segment of market. The hardware component market for ambient lighting is expected to witness a substantial dip in 2020 owing to the subdued demand as a result of the COVID-19 pandemic.

Recessed lights to hold larger market share during the forecast period

The ambient lighting market for recessed lights holds a larger market share. The market growth can be attributed to the flexibility of these lights to fit in surfaces and their increasing use in the residential and commercial sectors. The surging demand for recessed lighting from residential buildings, hotels, retail showrooms, and offices is propelling the growth. Availability in variant colors and installation flexibility are some of the other factors fueling the growth of this market.

Residential sector to hold larger market share during the forecast period

The ambient lighting market for the residential sector holds the larger market share in 2019 and the same tred is expected to be followed throughout the forecast period. The increasing number of infrastructural projects worldwide is driving the growth of the market for the residential sector. The hospitality and retail segment is expected to grow at the highest rate during the forecast period, driven by the increasing demand for comfort and proper ambiance.

APAC holds the largest market for the ambient lighting in 2019 and is expected to dominate during the forecast period

APAC accounted for the largest share of 37% of the overall ambient lighting market in 2019, followed by Europe and North America, with a share of 26% and 23%, respectively. The growth of the market in APAC can be attributed to the increasing demand for energy-efficient lighting sources and the rising number of smart city projects in India, China, Japan, and South Korea. Also, the increasing infrastructural activities are contributing to the growth of the market for ambient lighting in APAC. Stringent government regulations in countries such as the US, Mexico, the UK, and India pertaining to the adoption of energy-efficient

To know about the assumptions considered for the study, download the pdf brochure

The ambient lighting market is dominated by a few globally established players such as Signify N.V. (Netherlands), GE Lighting (US), Acuity Brands (US), Hubbell Lighting (US), and OSRAM Licht AG (Germany).

Ambient Lighting Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 2.8 billion in 2020 |

| Projected Market Size | USD 88.3 billion by 2025 |

| Growth Rate | CAGR of 8.8% |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Million Units) |

|

Segments covered |

By Offering, By Type, By End User |

|

Geographies covered |

Asia Pacific, Europe, Americas (North America, South America), and Rest of World |

|

Companies covered |

The major players in the ambient lighting market are Signify N.V. (Netherlands), GE (GE Lighting) (US), Acuity Brands (US), Hubbell Lighting (US), and OSRAM Licht AG (Germany). Some of the other players in this market are Hafele (Germany), Helvar (Finland), Wipro Enterprises (P) Ltd (India), Zumtobel Group AG (Austria), and Dialight PLC (UK). |

The study categorizes the ambient lighting market based on offering, type, end user at the regional and global level.

-

By Offering

-

Hardware

- Lamps and luminaires

- Lighting controls

- Software & Services

-

Hardware

-

By Type

- Recessed Lights

- Surface-Mounted Lights

- Suspended Lights

- Track Lights

- Strip Lights

-

By End User

- Residential

- Hospitality & Retail

- Healthcare

- Office Buildings

- Industrial

- Automotive

-

By Region

- Americas

- Europe

- Asia Pacific

- Rest of World

Recent Developments

- Osram introduced the new OSRAM 24V TEC Flex family, which provides uniform illumination for a broad range of indoor and outdoor applications with robust, durable, flexible LED strips. With the introduction of TEC Flex LED strips, the company aims to strengthen its LED strip portfolio.

- Signify launched its brand-new Philips Hue Filament collection. Hue Filament light bulbs can be controlled either by the Philips Hue Bluetooth app, or a compatible voice device, or with the ZigBee-based Philips Hue Bridge

- Acuity Brands signed an agreement with Ushio America, Inc. (Ushio), a vertically integrated solutions company for lighting systems and subsidiary of Ushio Inc., in Tokyo, Japan. With this agreement, the company plans to introduce lighting fixtures featuring the Care222 module to simultaneously illuminate and reduce pathogens on surfaces in occupied spaces.

- Osram concluded a comprehensive business combination agreement with Austrian sensor maker ams AG and recommended its shareholders to accept the current takeover offer. The offer price of 41 Euro per share in cash represents an appropriate valuation of the company at around 4.6 billion

- Signify acquired Cooper Lighting Solutions (US) from Eaton. Eaton is a leading provider of professional lighting, lighting controls, and connected lighting. With this acquisition, the company can strengthen its position in the North American lighting market with increased innovation power and more competitive product offerings.

Frequently Asked Questions (FAQ):

What is the current size of the global ambient lighting market?

The global ambient lighting market is estimated to be USD 58.0 billion in 2020 and projected to reach USD 88.3 billion by 2025, at a CAGR of 8.8%. The key factors contributing to the growth of the market are modernization of infrastructure and upcoming smart city projects in developing economies, government initiatives and policies for energy savings, and increasing consumer preferences for better interior designing with energy-efficient lighting systems.

Who are the winners in the global ambient lighting market?

Companies such as Signify N.V. (Philips Lighting N.V.) (Netherlands), General Electric Company (US), Acuity Brands Inc. (US), Hubbell Incorporated (US), and OSRAM Licht AG (Germany) fall under the winners category. These companies cater to the requirements of their customers by providing ambient lighting products and solutions with a presence in majority of countries.

What is the COVID-19 impact on ambient lighting products and service providers ?

The industry is expected to witnessed a marginal dip due to the COVID-19 pandemic as the movement restriction and lockdowns has resulted in the disruptions in the supply chain, and subduded demand. The hardware component market for ambient lighting is expected to witness a substantial dip in 2020 owing to the subdued demand as a result of the COVID-19 pandemic. The first quarter of 2020 has shown negative growth for lighting systems. The second and third quarters of 2020 are also expected to witness lackluster demand for these products. The software and services segment is also expected to be negatively impacted as it goes hand-in-hand with that of hardware. However, the impact would be relatively less owing to the nature of the offering, which can be controlled remotely (online) to a great extent.

Which end users are expected to drive the growth of ambient lighting market in the next 5 years ?

The demand for ambient lighting from the residential sector has been on the rise in the recent years, and is expected to grow at the highest rate during the forecast period. Major factors contributing to the growth of the ambient lighting market include modernization of infrastructure and upcoming smart city projects in developing economies, government initiatives and policies for energy savings, and increasing consumer preferences for better interior designing with energy-efficient lighting systems.

Which sector is expected to be impacted the most during COVID-19 period in ambient lighting market ?

The automotive sector was already coping with a downshift in global demand prior to COVID-19. With the COVID-19 pandemic, the impact on the automotive sector is severe as compared with other verticals in the ambient lighting market. Disruptions in the supply chain, large scale manufacturing interruptions due to lockdowns and full shutdown of manufacturing plants across Europe during first quarter of 2020, and the temporary closure of assembly plants in the US are placing intense pressure on the automotive sector. This will have a severe impact on the ambient lighting market for the automotive segment, and recovery in this segment will also be time-consuming. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MARKET SCOPE

1.3 STUDY SCOPE

FIGURE 1 AMBIENT LIGHTING MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 AMBIENT LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM SOLUTIONS/PRODUCTS/ SERVICES OFFERED IN AMBIENT LIGHTING MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE) FOR MARKET

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

TABLE 1 CRITERIA IMPACTING THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

3.1 POST-COVID-19: REALISTIC SCENARIO

3.2 POST-COVID-19: OPTIMISTIC SCENARIO

3.3 POST-COVID-19: PESSIMISTIC SCENARIO

FIGURE 8 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: MARKET, 2016–2025 (USD BILLION)

FIGURE 9 SOFTWARE & SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 10 MARKET FOR RECESSED LIGHTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 RESIDENTIAL END USER SEGMENT TO HOLD LARGEST SHARE OF AMBIENT LIGHTING MARKET BY 2025

FIGURE 12 APAC TO HOLD LARGEST SHARE OF MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET

FIGURE 13 INCREASING DEMAND FOR AMBIENT LIGHTING IN RESIDENTIAL AND HOSPITALITY & RETAIL SECTOR TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 AMBIENT LIGHTING MARKET, BY OFFERING

FIGURE 14 HARDWARE TO HOLD LARGER SHARE OF MARKET IN 2020

4.3 MARKET IN APAC, BY END USER AND COUNTRY

FIGURE 15 CHINA AND RESIDENTIAL SEGMENT HELD LARGEST SHARE IN MARKET IN APAC

4.4 MARKET, BY TYPE

FIGURE 16 RECESSED LIGHTS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 AMBIENT LIGHTING MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 17 MARKET IN AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS: AMBIENT LIGHTING MARKET

FIGURE 18 MARKET DYNAMICS: OVERVIEW

5.2.1 DRIVERS

5.2.1.1 Surging demand for ambient lighting due to modernization of infrastructure and upcoming smart city projects in developing economies

FIGURE 19 GLOBAL SMART CITIES MARKET, 2018–2025 (USD BILLION)

5.2.1.2 Government initiatives and policies for energy savings

5.2.1.3 Increasing consumer preferences for better interior designing with energy-efficient lighting systems

FIGURE 20 AMBIENT LIGHTING PROJECT CYCLE

5.2.1.4 Rising preference for smart lighting

FIGURE 21 AMBIENT LIGHTING MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Disruptions in supply chain creating demand-supply gap and higher prices

5.2.2.2 High costs involved in replacing traditional lighting with ambient lighting

5.2.2.3 Security and reliability issues with IoT-based lighting systems

FIGURE 22 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Potential opportunities for new vendors due to localization of components

5.2.3.2 Rapid transition from traditional lighting to connected lighting solutions

5.2.3.3 Growing awareness of benefits of OLED in ambient lighting

TABLE 2 GLOBAL MARKET SHARE OF LED LIGHTING MEASURED AS PERCENTAGE OF TOTAL LIGHTING MARKET REVENUE

5.2.3.4 Advent of integrated lighting control systems

FIGURE 23 AMBIENT LIGHTING MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of common standards

5.2.4.2 Lack of awareness about payback period

FIGURE 24 MARKET CHALLENGES AND THEIR IMPACT

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 25 AMBIENT LIGHTING MARKET: VALUE CHAIN ANALYSIS, 2019

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 COMPONENT SUPPLIERS

6.2.3 MANUFACTURERS & ASSEMBLERS

6.2.4 KEY TECHNOLOGY PROVIDERS/SYSTEM INTEGRATORS

6.2.5 DISTRIBUTION AND SALES

6.2.6 END USERS

6.3 KEY TECHNOLOGY TRENDS

6.4 AVERAGE SELLING PRICE (ASP) TRENDS FOR LAMPS AND LUMINAIRES (USD)

6.5 LIGHTING PRODUCTS: TARIFF RELATED DATA

TABLE 3 ELECTRIC LAMPS AND LIGHTING FITTINGS TARIFF DATA FOR MAJOR COUNTRIES IN 2019

6.6 US: IMPORT AND EXPORT DATA FOR ELECTRIC LAMPS AND LIGHTING FITTINGS, 2008–2019 (USD BILLION)

6.7 CASE STUDIES RELATED TO AMBIENT LIGHTING MARKET

6.7.1 CASE STUDY 1: LUTRON ENERGI TRIPAK CONTROL SYSTEM

6.7.2 CASE STUDY 2: UC DAVIS CAMPUS RETROFITTING

6.7.3 CASE STUDY 3: CALIFORNIA LIGHTING TECHNOLOGY CENTER (CLTC)

7 AMBIENT LIGHTING MARKET, BY OFFERING (Page No. - 71)

7.1 INTRODUCTION

FIGURE 26 AMBIENT LIGHTING MARKET, BY OFFERING

FIGURE 27 HARDWARE TO HOLD LARGER SHARE OF MARKET, BY 2025

TABLE 4 MARKET, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 5 MARKET, BY OFFERING, 2020–2025 (USD BILLION)

7.2 HARDWARE

TABLE 6 AMBIENT LIGHTING HARDWARE MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 7 AMBIENT LIGHTING HARDWARE MARKET, BY REGION, 2020–2025 (USD BILLION)

FIGURE 28 MARKET, BY HARDWARE

FIGURE 29 LIGHTING CONTROLS SEGMENT TO GROW AT HIGHER CAGR IN MARKET FROM 2020 TO 2025

TABLE 8 MARKET, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 9 MARKET, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 10 AMBIENT LIGHTING LAMPS & LUMINAIRES HARDWARE MARKET, BY TYPE, 2016–2019 (USD BILLION)

TABLE 11 AMBIENT LIGHTING LAMPS & LUMINAIRES HARDWARE MARKET, BY TYPE, 2020–2025 (USD BILLION)

TABLE 12 AMBIENT LIGHTING LAMPS & LUMINAIRES HARDWARE MARKET, BY TYPE, 2016–2019 (BILLION UNITS)

TABLE 13 AMBIENT LIGHTING LAMPS & LUMINAIRES HARDWARE MARKET, BY TYPE, 2020–2025 (BILLION UNITS)

7.2.1 LAMPS AND LUMINAIRES

7.2.1.1 Incandescent lamps

7.2.1.2 Halogen lamps

7.2.1.3 Fluorescent lamps

7.2.1.4 Light-emitting diode (LED)

TABLE 14 LAMPS AND LUMINAIRES MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 15 LAMPS AND LUMINAIRES MARKET, BY REGION, 2020–2025 (USD BILLION)

7.2.2 LIGHTING CONTROLS

7.2.2.1 Sensors

7.2.2.2 Switches and dimmers

7.2.2.3 Relay units

7.2.2.4 LED drivers

7.2.2.5 Gateways

TABLE 16 LIGHTING CONTROLS MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 17 LIGHTING CONTROLS MARKET, BY REGION, 2020–2025 (USD BILLION)

7.3 SOFTWARE AND SERVICES

7.3.1 SOFTWARE AND SERVICES TO EXHIBIT HIGH GROWTH DURING FORECAST PERIOD

TABLE 18 AMBIENT LIGHTING SOFTWARE AND SERVICES MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 19 AMBIENT LIGHTING SOFTWARE AND SERVICES MARKET, BY REGION, 2020–2025 (USD BILLION)

7.4 IMPACT OF COVID-19 ON OFFERING SEGMENT

FIGURE 30 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR HARDWARE MARKET

FIGURE 31 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR SOFTWARE & SERVICES MARKET

8 AMBIENT LIGHTING MARKET, BY TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 32 TYPES OF AMBIENT LIGHTING

FIGURE 33 RECESSED LIGHTS TO HOLD LARGEST SIZE IN MARKET BY 2025

TABLE 20 MARKET, BY TYPE, 2016–2019 (USD BILLION)

TABLE 21 MARKET, BY TYPE, 2020–2025 (USD BILLION)

8.2 SURFACE-MOUNTED LIGHTS

8.2.1 APAC TO HOLD LARGEST SHARE OF MARKET FOR SURFACE-MOUNTED LIGHTS

TABLE 22 MARKET FOR SURFACE-MOUNTED LIGHTS, BY REGION, 2016–2019 (USD BILLION)

TABLE 23 MARKET FOR SURFACE-MOUNTED LIGHTS, BY REGION, 2020–2025 (USD BILLION)

8.3 SUSPENDED LIGHTS

8.3.1 RISING DEMAND FOR SUSPENDED LIGHTS FROM HOSPITALITY & RETAIL TO DRIVE MARKET GROWTH

TABLE 24 MARKET FOR SUSPENDED LIGHTS, BY REGION, 2016–2019 (USD BILLION)

TABLE 25 AMBIENT LIGHTING MARKET FOR SUSPENDED LIGHTS, BY REGION, 2020–2025 (USD BILLION)

8.4 TRACK LIGHTS

8.4.1 APAC TO HOLD LARGEST SHARE IN MARKET FOR TRACK LIGHTS FROM 2020 TO 2025

TABLE 26 MARKET FOR TRACK LIGHTS, BY REGION, 2016–2019 (USD BILLION)

FIGURE 34 APAC TO HOLD LARGEST SIZE IN MARKET BY 2025

TABLE 27 MARKET FOR TRACK LIGHTS, BY REGION, 2020–2025 (USD BILLION)

8.5 STRIP LIGHTS

8.5.1 INCREASING DEMAND FOR STRIP LIGHTS IN AUTOMOTIVE SECTOR TO DRIVE MARKET GROWTH

TABLE 28 MARKET FOR STRIP LIGHTS, BY REGION, 2016–2019 (USD BILLION)

TABLE 29 MARKET FOR STRIP LIGHTS, BY REGION, 2020–2025 (USD BILLION)

8.6 RECESSED LIGHTS

8.6.1 MARKET FOR RECESSED LIGHTS TO EXHIBIT HIGHEST GROWTH IN ROW DURING FORECAST PERIOD

TABLE 30 MARKET FOR RECESSED LIGHTS, BY REGION, 2016–2019 (USD BILLION)

TABLE 31 MARKET FOR RECESSED LIGHTS, BY REGION, 2020–2025 (USD BILLION)

9 AMBIENT LIGHTING MARKET, BY END USER (Page No. - 93)

9.1 INTRODUCTION

FIGURE 35 AMBIENT LIGHTING MARKET, BY END USER

FIGURE 36 RESIDENTIAL SECTOR TO HOLD LARGEST SHARE OF MARKET BY 2025

TABLE 32 MARKET, BY END USER, 2016–2019 (USD BILLION)

TABLE 33 MARKET, BY END USER, 2020–2025 (USD BILLION)

9.2 RESIDENTIAL

FIGURE 37 APAC TO HOLD LARGEST SHARE OF MARKET FOR RESIDENTIAL END USER BY 2025

TABLE 34 MARKET FOR RESIDENTIAL END USER, BY REGION, 2016–2019 (USD BILLION)

TABLE 35 MARKET FOR RESIDENTIAL END USER, BY REGION, 2020–2025 (USD BILLION)

9.2.1 IMPACT OF COVID-19 ON RESIDENTIAL SEGMENT

FIGURE 38 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: AMBIENT LIGHTING MARKET FOR RESIDENTIAL END USER

9.3 HOSPITALITY AND RETAIL

TABLE 36 MARKET FOR HOSPITALITY AND RETAIL END USER, BY REGION, 2016–2019 (USD BILLION)

TABLE 37 MARKET FOR HOSPITALITY AND RETAIL END USER, BY REGION, 2020–2025 (USD BILLION)

9.4 HEALTHCARE

TABLE 38 MARKET FOR HEALTHCARE, BY REGION, 2016–2019 (USD BILLION)

TABLE 39 MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (USD BILLION)

9.5 INDUSTRIAL

FIGURE 39 MARKET FOR INDUSTRIAL END USER TO GROW AT HIGHEST CAGR IN ROW FROM 2020 TO 2025

TABLE 40 MARKET FOR INDUSTRIAL END USER, BY REGION, 2016–2019 (USD BILLION)

TABLE 41 MARKET FOR INDUSTRIAL END USER, BY REGION, 2020–2025 (USD BILLION)

9.5.1 IMPACT OF COVID-19 ON INDUSTRIAL SEGMENT

FIGURE 40 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: AMBIENT LIGHTING MARKET FOR INDUSTRIAL END USER

9.6 OFFICE BUILDINGS

TABLE 42 MARKET FOR OFFICE BUILDINGS END USER, BY REGION, 2016–2019 (USD BILLION)

TABLE 43 MARKET FOR OFFICE BUILDINGS END USER, BY REGION, 2020–2025 (USD BILLION)

9.7 AUTOMOTIVE

TABLE 44 MARKET FOR AUTOMOTIVE END USER, BY REGION, 2016–2019 (USD BILLION)

TABLE 45 MARKET FOR AUTOMOTIVE END USER, BY REGION, 2020–2025 (USD BILLION)

9.7.1 IMPACT OF COVID-19 ON AUTOMOTIVE SEGMENT

FIGURE 41 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: MARKET FOR AUTOMOTIVE END USER

10 GEOGRAPHIC ANALYSIS (Page No. - 108)

10.1 INTRODUCTION

FIGURE 42 GEOGRAPHIC SNAPSHOT OF AMBIENT LIGHTING MARKET

TABLE 46 MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 47 MARKET, BY REGION, 2020–2025 (USD BILLION)

TABLE 48 MARKET FOR LAMPS AND LUMINAIRES, BY REGION, 2016–2019 (USD BILLION)

TABLE 49 MARKET FOR LAMPS AND LUMINAIRES, BY REGION, 2020–2025 (USD BILLION)

TABLE 50 MARKET FOR LIGHTING CONTROL, BY REGION, 2016–2019 (USD BILLION)

TABLE 51 MARKET FOR LIGHTING CONTROL, BY REGION, 2020–2025 (USD BILLION)

10.2 NORTH AMERICA

FIGURE 43 SNAPSHOT OF AMBIENT LIGHTING MARKET IN NORTH AMERICA

TABLE 52 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY TYPE, 2016–2019 (USD BILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY TYPE, 2020–2025 (USD BILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY END USER, 2016–2019 (USD BILLION)

TABLE 61 MARKET IN NORTH AMERICA, BY END USER, 2020–2025 (USD BILLION)

10.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 44 PRE- AND POST-COVID-19 ANALYSIS: NORTH AMERICA AMBIENT LIGHTING MARKET

10.2.2 US

10.2.2.1 Government initiatives to implement energy-efficient lighting systems to drive market in US

TABLE 62 MARKET IN US, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 63 MARKET IN US, BY OFFERING, 2020–2025 (USD BILLION)

10.2.3 CANADA

10.2.3.1 Promotion of energy conservation by Canadian government to boost demand for energy-efficient lighting products

10.2.4 MEXICO

10.2.4.1 Government initiatives to implement energy-efficient lighting systems to drive market in Mexico

10.3 EUROPE

FIGURE 45 SNAPSHOT OF MARKET IN EUROPE

TABLE 64 MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 65 MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 66 MARKET IN EUROPE, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 67 MARKET IN EUROPE, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 68 MARKET IN EUROPE, BY TYPE, 2016–2019 (USD BILLION)

TABLE 69 AMBIENT LIGHTING MARKET IN EUROPE, BY TYPE, 2020–2025 (USD BILLION)

TABLE 70 MARKET IN EUROPE, BY END USER, 2016–2019 (USD BILLION)

TABLE 71 MARKET IN EUROPE, BY END USER, 2020–2025 (USD BILLION)

TABLE 72 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 73 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD BILLION)

10.3.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 46 PRE- AND POST-COVID-19 ANALYSIS: EUROPE MARKET

10.3.2 UK

10.3.2.1 Demand for energy-saving lighting solutions and reduction in CO2 emission to drive ambient lighting market in UK

TABLE 74 MARKET IN UK, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 75 MARKET IN UK, BY OFFERING, 2020–2025 (USD BILLION)

10.3.3 GERMANY

10.3.3.1 High demand for ambient lighting in smart homes to drive German market

TABLE 76 MARKET IN GERMANY, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 77 MARKET IN GERMANY, BY OFFERING, 2020–2025 (USD BILLION)

10.3.4 FRANCE

10.3.4.1 Growing awareness about energy conservation to boost demand for market in France

TABLE 78 MARKET IN FRANCE, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 79 MARKET IN FRANCE, BY OFFERING, 2020–2025 (USD BILLION)

10.3.5 REST OF EUROPE

10.3.5.1 Rest of Europe to exhibit highest growth in European ambient lighting market

TABLE 80 MARKET IN REST OF EUROPE, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 81 MARKET IN REST OF EUROPE, BY OFFERING, 2020–2025 (USD BILLION)

10.4 APAC

FIGURE 47 SNAPSHOT OF AMBIENT LIGHTING MARKET IN APAC

TABLE 82 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 83 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 84 MARKET IN APAC, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 85 MARKET IN APAC, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 86 MARKET IN APAC, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 87 MARKET IN APAC, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 88 MARKET IN APAC, BY TYPE, 2016–2019 (USD BILLION)

TABLE 89 MARKET IN APAC, BY TYPE, 2020–2025 (USD BILLION)

TABLE 90 MARKET IN APAC, BY END USER, 2016–2019 (USD BILLION)

TABLE 91 MARKET IN APAC, BY END USER, 2020–2025 (USD BILLION)

10.4.1 IMPACT OF COVID-19 ON APAC

FIGURE 48 SCENARIO ANALYSIS: PRE- AND POST-COVID-19 ANALYSIS: APAC MARKET

10.4.2 CHINA

10.4.2.1 Increasing government expenditure on environment protection and public infrastructure to drive market in China

TABLE 92 MARKET IN CHINA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 93 MARKET IN CHINA, BY OFFERING, 2020–2025 (USD BILLION)

10.4.3 JAPAN

10.4.3.1 Ambient lighting software & services market to grow at high CAGR in Japan during forecast period

TABLE 94 AMBIENT LIGHTING MARKET IN JAPAN, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 95 MARKET IN JAPAN, BY OFFERING, 2020–2025 (USD BILLION)

10.4.4 INDIA

10.4.4.1 National program for LED-based home lighting uplifting ambient lighting opportunities in India

TABLE 96 MARKET IN INDIA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 97 MARKET IN INDIA, BY OFFERING, 2020–2025 (USD BILLION)

10.4.5 REST OF APAC

10.4.5.1 South Korean energy-efficient labels & standards programs to boost growth of market

TABLE 98 MARKET IN REST OF APAC, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 99 MARKET IN REST OF APAC, BY OFFERING, 2020–2025 (USD BILLION)

10.5 REST OF THE WORLD

TABLE 100 MARKET IN ROW, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 101 MARKET IN ROW, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 102 MARKET IN ROW, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 103 MARKET IN ROW, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 104 MARKET IN ROW, BY TYPE, 2016–2019 (USD BILLION)

TABLE 105 AMBIENT LIGHTING MARKET IN ROW, BY TYPE, 2020–2025 (USD BILLION)

TABLE 106 MARKET IN ROW, BY END USER, 2016–2019 (USD BILLION)

TABLE 107 MARKET IN ROW, BY END USER, 2020–2025 (USD BILLION)

TABLE 108 MARKET IN ROW, BY REGION, 2016–2019 (USD BILLION)

TABLE 109 MARKET IN ROW, BY REGION, 2020–2025 (USD BILLION)

10.5.1 IMPACT OF COVID-19 ON ROW

FIGURE 49 PRE- AND POST-COVID-19 ANALYSIS: ROW MARKET

10.5.2 SOUTH AMERICA

10.5.2.1 Surging demand for LED light sources in South America to drive market

TABLE 110 MARKET IN SOUTH AMERICA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 111 MARKET IN SOUTH AMERICA, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 112 AMBIENT LIGHTING MARKET IN SOUTH AMERICA, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 113 MARKET IN SOUTH AMERICA, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 114 MARKET IN SOUTH AMERICA, BY TYPE, 2016–2019 (USD BILLION)

TABLE 115 MARKET IN SOUTH AMERICA, BY TYPE, 2020–2025 (USD BILLION)

TABLE 116 MARKET IN SOUTH AMERICA, BY END USER, 2016–2019 (USD BILLION)

TABLE 117 MARKET IN SOUTH AMERICA, BY END USER, 2020–2025 (USD BILLION)

10.5.3 MIDDLE EAST

10.5.3.1 Upcoming events in region to boost growth of ambient lighting market

TABLE 118 MARKET IN MIDDLE EAST, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 119 MARKET IN MIDDLE EAST, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 120 MARKET IN MIDDLE EAST, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 121 MARKET IN MIDDLE EAST, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 122 MARKET IN MIDDLE EAST, BY TYPE, 2016–2019 (USD BILLION)

TABLE 123 MARKET IN MIDDLE EAST, BY TYPE, 2020–2025 (USD BILLION)

TABLE 124 MARKET IN MIDDLE EAST, BY END USER, 2016–2019 (USD BILLION)

TABLE 125 AMBIENT LIGHTING MARKET IN MIDDLE EAST, BY END USER, 2020–2025 (USD BILLION)

10.5.4 AFRICA

10.5.4.1 Growing awareness regarding energy-efficient solutions to drive market in Africa

TABLE 126 MARKET IN AFRICA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 127 MARKET IN AFRICA, BY OFFERING, 2020–2025 (USD BILLION)

TABLE 128 MARKET IN AFRICA, BY HARDWARE, 2016–2019 (USD BILLION)

TABLE 129 MARKET IN AFRICA, BY HARDWARE, 2020–2025 (USD BILLION)

TABLE 130 MARKET IN AFRICA, BY TYPE, 2016–2019 (USD BILLION)

TABLE 131 AMBIENT LIGHTING MARKET IN AFRICA, BY TYPE, 2020–2025 (USD BILLION)

TABLE 132 MARKET IN AFRICA, BY END USER, 2016–2019 (USD BILLION)

TABLE 133 MARKET IN AFRICA, BY END USER, 2020–2025 (USD BILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 152)

11.1 INTRODUCTION

FIGURE 50 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS KEY GROWTH STRATEGY

11.2 MARKET SHARE AND RANKING ANALYSIS, 2019

TABLE 134 MARKET SHARE AND RANKING OF TOP 5 PLAYERS IN MARKET, 2019

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.3.4 EMERGING PLAYERS

FIGURE 51 AMBIENT LIGHTING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

11.4 MARKET EVALUATION FRAMEWORK

FIGURE 52 PRODUCT LAUNCHES FUELED GROWTH AND INNOVATION BETWEEN 2016 AND 2019 IN MARKET

11.5 RECENT DEVELOPMENTS

11.5.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 135 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2020

11.5.2 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 136 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2017-2020

11.5.3 MERGERS AND ACQUISITIONS

TABLE 137 MERGERS AND ACQUISITIONS, 2017–2020

12 COMPANY PROFILES (Page No. - 162)

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

12.1 SIGNIFY N.V.

FIGURE 53 SIGNIFY N.V. COMPANY SNAPSHOT

12.2 ACUITY BRANDS, INC.

FIGURE 54 ACUITY BRANDS: COMPANY SNAPSHOT

12.3 HUBBELL INCORPORATED

FIGURE 55 HUBBELL INCORPORATED: COMPANY SNAPSHOT

12.4 GENERAL ELECTRIC COMPANY

FIGURE 56 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

12.5 OSRAM LICHT AG

FIGURE 57 OSRAM LICHT AG: COMPANY SNAPSHOT

12.6 IDEAL INDUSTRIES, INC. (CREE LIGHTING)

12.7 HAFELE

12.8 LUTRON ELECTRONICS CO., INC.

12.9 ZUMTOBEL GROUP AG

FIGURE 58 ZUMTOBEL GROUP AG: COMPANY SNAPSHOT

12.10 HONEYWELL INTERNATIONAL INC.

FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12.11 OTHERS

12.11.1 WIPRO ENTERPRISES (P) LIMITED

12.11.2 DIALIGHT PLC

12.11.3 CURRENT (PART OF AMERICAN INDUSTRIAL PARTNER)

12.11.4 HELVAR

12.11.5 RAB LIGHTING INC.

12.11.6 SPI LIGHTING INC.

12.12 START-UP ECOSYSTEM

12.12.1 ILUMINARC

12.12.2 TAO LIGHT

12.12.3 NUALIGHT LIMITED

12.12.4 LAFIT LIGHTING

12.13 RIGHT TO WIN

13 ADJACENT & RELATED MARKETS (Page No. - 204)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 SMART LIGHTING ECOSYSTEM

FIGURE 60 SMART LIGHTING ECOSYSTEM

13.4 SMART LIGHTING MARKET, BY INSTALLATION TYPE

13.4.1 INTRODUCTION

TABLE 138 SMART LIGHTING MARKET, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

13.4.2 NEW INSTALLATIONS

13.4.3 RETROFIT INSTALLATIONS

13.4.3.1 Key insights on impact of COVID-19

13.5 SMART LIGHTING MARKET, BY APPLICATION

13.5.1 INTRODUCTION

TABLE 139 SMART LIGHTING MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

13.5.2 INDOOR

FIGURE 61 INDOOR APPLICATION SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

TABLE 140 SMART LIGHTING MARKET FOR INDOOR APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

13.5.3 RESIDENTIAL

FIGURE 62 RESIDENTIAL APPLICATION SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

13.5.4 COMMERCIAL

FIGURE 63 COMMERCIAL APPLICATION SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

13.5.5 INDUSTRIAL

13.5.6 KEY INSIGHTS ON IMPACT OF COVID-19

13.5.7 OUTDOOR

TABLE 141 SMART LIGHTING MARKET FOR OUTDOOR APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

13.5.7.1 Lighting for streets & roadways

FIGURE 64 LIGHTING FOR STREETS & ROADWAYS SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

13.5.7.2 Lighting for public places

13.5.8 KEY INSIGHTS ON IMPACT OF COVID-19

13.6 POTENTIAL SHIFT IN CLIENTS’ REVENUES

FIGURE 65 USE CASE: SHIFT IN CLIENTS’ REVENUES WITH EXTENDED LENS ON GROW LIGHTS

13.7 SMART LIGHTING MARKET, BY GEOGRAPHY

13.7.1 INTRODUCTION

TABLE 142 SMART LIGHTING MARKET, BY REGION, 2017–2025 (USD MILLION)

13.7.2 NORTH AMERICA

FIGURE 66 NORTH AMERICA SCENARIO ANALYSIS: PRE-COVID-19 AND POST-COVID-19

TABLE 143 SMART LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

13.7.2.1 US

13.7.2.2 Canada

13.7.2.3 Mexico

13.7.2.4 Key insights on impact of COVID-19

13.7.3 EUROPE

TABLE 144 SMART LIGHTING MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

13.7.3.1 UK

13.7.3.2 Germany

13.7.3.3 France

13.7.3.4 Italy

13.7.3.5 Rest of Europe

13.7.3.6 Key insights on impact of COVID-19

13.7.4 APAC

TABLE 145 SMART LIGHTING MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

13.7.4.1 China

13.7.4.2 Japan

13.7.4.3 India

13.7.4.4 Australasia

13.7.4.5 Rest of APAC

13.7.4.6 Key insights on impact of COVID-19

13.7.5 ROW

TABLE 146 SMART LIGHTING MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

13.7.5.1 Middle East & Africa

13.7.5.2 Key insights on impact of COVID-19

13.8 HUMAN-CENTRIC LIGHTING MARKET, BY OFFERING

13.8.1 INTRODUCTION

TABLE 147 HUMAN-CENTRIC LIGHTING MARKET, BY OFFERING, 2016–2024 (USD MILLION)

13.8.2 HARDWARE

TABLE 148 HUMAN-CENTRIC LIGHTING MARKET FOR HARDWARE, BY COMPONENT, 2016–2024 (USD MILLION)

TABLE 149 HUMAN-CENTRIC LIGHTING MARKET FOR HARDWARE, BY REGION, 2016–2024 (USD MILLION)

13.8.2.1 Lighting fixtures

TABLE 150 HUMAN-CENTRIC LIGHTING MARKET FOR LIGHTING FIXTURES, BY REGION, 2016–2024 (USD MILLION)

13.8.3 LIGHTING CONTROLLERS

TABLE 151 HUMAN-CENTRIC LIGHTING MARKET FOR LIGHTING CONTROLLERS, BY TYPE, 2016–2024 (USD MILLION)

TABLE 152 HUMAN-CENTRIC LIGHTING MARKET FOR LIGHTING CONTROLLERS, BY TYPE, 2016–2024 (THOUSAND UNITS)

TABLE 153 HUMAN-CENTRIC LIGHTING MARKET FOR LIGHTING CONTROLLERS, BY REGION, 2016–2024 (USD MILLION)

13.8.3.1 Sensors

13.8.3.2 Drivers

13.8.3.3 Microprocessors and microcontrollers

13.8.3.4 Switches and dimmers

13.8.3.5 Transmitters and receivers

13.8.4 SOFTWARE COMPONENTS

TABLE 154 HUMAN-CENTRIC LIGHTING MARKET FOR SOFTWARE COMPONENTS, BY REGION, 2016–2024 (USD MILLION)

13.8.5 SERVICES

TABLE 155 HUMAN-CENTRIC LIGHTING MARKET, BY SERVICE, 2016–2024 (USD MILLION)

TABLE 156 HUMAN-CENTRIC LIGHTING MARKET FOR SERVICES, BY REGION, 2016–2024 (USD MILLION)

13.8.5.1 Design and engineering

TABLE 157 HUMAN-CENTRIC LIGHTING MARKET FOR DESIGN AND ENGINEERING SERVICES, BY REGION, 2016–2024 (USD MILLION)

13.8.5.2 Installation services

TABLE 158 HUMAN-CENTRIC LIGHTING MARKET FOR INSTALLATION SERVICES, BY REGION, 2016–2024 (USD MILLION)

13.8.5.3 Post-installation services

TABLE 159 HUMAN-CENTRIC LIGHTING MARKET FOR POST-INSTALLATION SERVICES, BY REGION, 2016–2024 (USD MILLION)

13.9 HUMAN-CENTRIC LIGHTING MARKET, BY APPLICATION

13.9.1 INTRODUCTION

TABLE 160 HUMAN-CENTRIC LIGHTING MARKET, BY APPLICATION, 2016–2024 (USD MILLION)

13.9.2 WHOLESALE AND RETAIL

TABLE 161 HUMAN-CENTRIC LIGHTING MARKET FOR WHOLESALE AND RETAIL, BY REGION, 2016–2024 (USD MILLION)

13.9.3 ENTERPRISES AND DATA CENTERS

TABLE 162 HUMAN-CENTRIC LIGHTING MARKET FOR ENTERPRISES AND DATA CENTERS, BY REGION, 2016–2024 (USD MILLION)

13.9.4 RESIDENTIAL

TABLE 163 HUMAN-CENTRIC LIGHTING MARKET FOR RESIDENTIAL APPLICATION, BY REGION, 2016–2024 (USD MILLION)

13.9.5 EDUCATIONAL INSTITUTIONS

TABLE 164 HUMAN-CENTRIC LIGHTING MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2016–2024 (USD MILLION)

13.9.6 HEALTHCARE

TABLE 165 HUMAN-CENTRIC LIGHTING MARKET FOR HEALTHCARE, BY REGION, 2016–2024 (USD MILLION)

13.9.7 INDUSTRIAL

TABLE 166 HUMAN-CENTRIC LIGHTING MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2016–2024 (USD MILLION)

13.9.8 HOSPITALITY

TABLE 167 HUMAN-CENTRIC LIGHTING MARKET FOR HOSPITALITY, BY REGION, 2016–2024 (USD MILLION)

14 APPENDIX (Page No. - 243)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

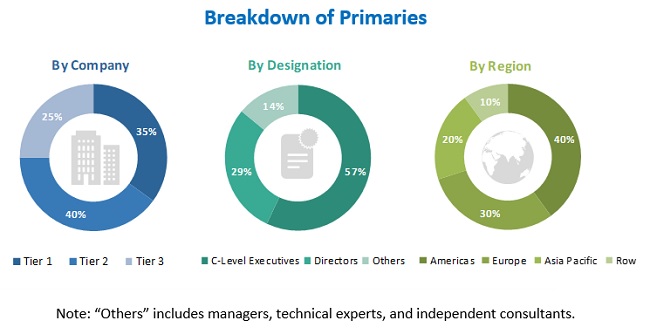

The study involved 4 major activities in estimating the size of the ambient lighting market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include government sources (World Bank), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

In the ambient lighting market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the ambient lighting market, along with other dependent submarkets. The key players in the ambient lighting market have been identified through secondary research, and their market presence have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the ambient lighting market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand side (end users) and the supply side (manufacturers, and semiconductor, connectivity, and application providers) across four major geographic regions—North America, Europe, APAC, and RoW. Approximately 60% and 40% of the primary interviews have been conducted with supply and demand sides, respectively. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

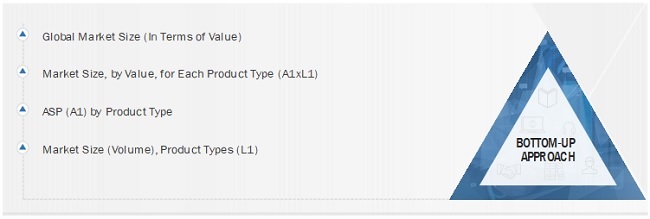

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the ambient lighting market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying market Identifying different ambient lighting system components, and analyzing their demand in various geographic regions and end user segments

- Analyzing the adoption rate of ambient lighting solutions based on different product types in several end-use applications

- Analyzing the usage trend of ambient lighting solutions in different geographic regions

- Referring to various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to validate the market estimations

- Conducting discussions with key opinion leaders about different technological trends, changing market environments, and emerging processing technologies to analyze the breakup of the scope of work by major ambient lighting systems hardware, software, and service providers

- Analyzing the impact of COVID-19 on the end user segments of the market and verifying it from industry experts before estimating the global market size

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are as follows:

- To define, describe, and forecast the ambient lighting market, in terms of value and volume, by offering, type, end user, and region

- To forecast the market, for various segments with respect to 4 main regions—the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value and volume

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall ambient lighting market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the ambient lighting market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the ambient lighting market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the ambient lighting market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the ambient lighting market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of ambient lighting market

- Profiling of additional market players (up to 5)

- Country-level analysis of component, and system type Segment

Growth opportunities and latent adjacency in Ambient Lighting Market

I am interested to know about the lighting trends currently prevailing in India. About the major competitors and about the Indian lighting industry.

We are the provider of attractive project financing for most energy efficient upgrades including lighting, solar, and CHP costing from $25K to $5million. We are in business for almost 45 years. Can you help us identify the potential clients within this?

Willing to understand current penetration of ambient lighting in commercial application. Comparative analysis for ambient vs non-ambient lighting in commercial application.