ANPR System Market Size, Share, Statistics and Industry Growth Analysis by Type (Fixed, Mobile, Portable), Component (ANPR Cameras, ANPR Software, Frame Grabbers, Triggers), Application, End-User (Government, Commercial, Institutions) & Region (North America, APAC, Europe, RoW) (2022-2027)

Updated on : June 03, 2024

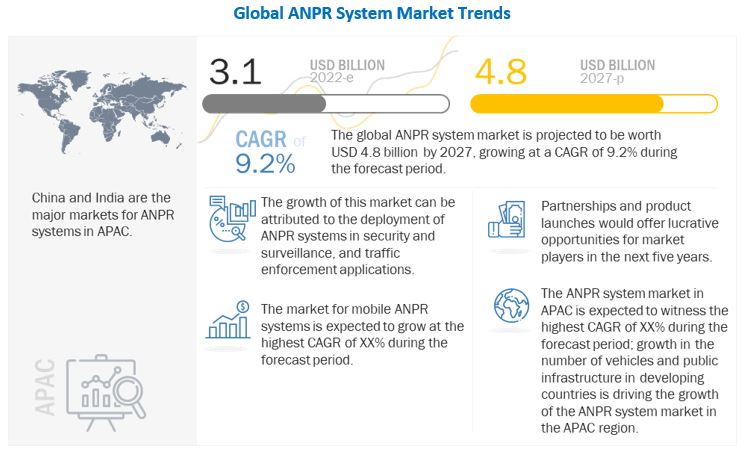

[254 Pages Report] The global ANPR system market size is projected to reach USD 4.8 billion by 2027 from USD 3.1 billion in 2022; it is expected to register a CAGR of 9.2% from 2022 to 2027.

The major factors driving the growth of the ANPR system market include the increasing deployment of ANPR systems in security and surveillance and traffic management applications, infrastructure growth in emerging economies, increasing allocation of funds by various governments on ITS, and the growing use of video analytics technology for intelligent monitoring of vehicles. Additionally, the rapid surge in demand for smart parking solutions is a major driver for the growth of the ANPR system market. The integration of advanced technologies such as IoT, Deep Learning, and AI with the ANPR system is promoting the growth of ANPR systems across applications such as access control and road usage charging. Growing number of infrastructure development projects across the world such as the Smart Cities mission and roadways modernization projects are promoting the growth of the ANPR system market. Moreover, surging use of video analytics technology for intelligent monitoring of vehicles is enhancing the growth of the ANPR system industry .

Attractive Opportunities in ANPR System Market in North America, Europe, APAC and RoW

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on the ANPR System Market in North America, Europe, APAC, and RoW

With the onset of the COVID-19 pandemic, the world witnessed a health and economic crisis, forcing many businesses to shut down their manufacturing plants and halt most of the operations during the initial 1 to 2 months. During this crisis, the main objective of the companies was to sustain their business by finding safer ways to continue manufacturing operations or find other sustainable ways to get the revenue stream flowing. During this period, the traffic management, electronic toll collection, and parking management application segments experienced a decline in demand owing to disruptions in the global supply chain. However, post the pandemic, there has been a significant revival in the demand for ANPR systems worldwide. Owing to the surge in demand due to increasing urbanization, and traffic monitoring & road safety issues, the ANPR system market has made a strong comeback and are almost back to pre-COVID-19 levels. As a result, the ANPR system market can be seen growing steadily.

ANPR systems Market Dynamics

DRIVERS: Rising deployment of ANPR systems in security and surveillance, and traffic enforcement applications

The adoption rate of ANPR systems in security & surveillance and traffic enforcement applications has increased in the recent past to monitor terrorist activities, frauds, and criminal cases. An ANPR system plays an important role in locating vehicles that have been stolen, are involved in criminal offenses, have violated traffic laws, been on the defaulter's list for toll collection, and have expired insurance policies. The essence of security is giving police patrol cars the ability to detect, extract, and research number plates on the go. These ANPR systems are placed above the car’s roof, which then can read at high speeds and have the information processed in a dedicated black box that is placed in the trunk. ANPR cameras are also installed in fixed locations throughout the cities for real-time and large-scale monitoring and effective research in case of incidents related to crime or terror. Developed nations such as the US and the UK are actively using fixed and mobile ANPR systems for security & surveillance and traffic enforcement applications.

RESTRAINT: Inconsistency in number plate designs

A major challenge faced by the developers of ANPR systems worldwide is the inconsistency in number plate designs. Number plates differ in terms of their size or fonts in every part of the world; due to this, it becomes difficult to construct an algorithm that would read all fonts without any discrepancy. If the ANPR software is not accurate, it may misread registration numbers, which may create problems in security and surveillance activities. Certain factors such as different illumination conditions, vehicle shadow, the non-uniformity of license plate characters, different fonts, and background colors affect the performance of ANPR systems. A few systems work in these restricted conditions and might not be accurate.

OPPORTUNITIES: Integration of new technologies such as AI and IoT with ANPR systems

ANPR systems are now being integrated with technologies such as artificial intelligence (AI), and the Internet of Things (IoT), which enables the ANPR systems to work more efficiently and capture more images in less time. Various companies are now providing ANPR systems and software integrated with AI and IoT technology. For instance, EFKON provides ANPR systems based on artificial intelligence, providing a robust and ready-to-integrate system, captures diverse types of license plates. Similarly, Intelligent Integrated video (i2V) provides i2V ANPR, an AI-based license plate detection, recognition, and search system. It helps to detect license plates in the field of view and saves license plate and vehicle images in the database, enables the real-time detection of the license plate in the camera view and the recognition of English alphanumeric characters in standard and non-standard formats, stores license plate data of vehicles which are stolen, wanted, hot-listed or suspicious, and more. AI-based ANPR systems provide more than 90% accurate detection and recognition of number plates, require minimal human intervention with 24X7 real-time operation and fast video processing, and more. IoT-based vehicle license plate recognition systems are also intensively studied and used in several countries.

CHALLENGES: Privacy concerns regarding stored images and records

ANPR works by scanning number plates at a speed of about 3,000 plates an hour and matching them against information stored in databases. The ANPR system can cross-check ANPR data with lists of driver information. These lists include details of those without valid insurance or suspects in ongoing investigations. In addition to immediate cross-checking for problem cases, the data may be retained for future use in criminal investigations. This data can be used for data mining in a number of ways: real-time and retrospective vehicle tracking; identifying all vehicles that have taken a particular route during a particular time frame; identifying all vehicles present in a particular place at a particular time; verifying alibis, locating offenders or identifying potential witnesses; linking individuals to identify vehicles traveling in convoy; and subject analysis when ANPR data is integrated with other sources of data (CCTV, communications analysis, financial analysis) to create an in-depth profile of an individual. Thus, it poses greater risks to individual privacy. The scan identifies vehicles of interest to the police, such as stolen cars or those involved in crime. It will also target those driving without insurance, an MOT certificate, or even a current tax disc.

Fixed ANPR Systems to Account for the Largest Share of the ANPR System Market During Forecast Period

Fixed ANPR systems held the largest share of the ANPR system market in 2021. The increasing usage of fixed ANPR systems for traffic management solutions is a major driver for the sub-segment. With the increasing number of government initiatives across the world to modernize roadways infrastructure, there is a rising demand for improving the monitoring of vehicles and for automated solutions for tolling, which are promoting the growth of the fixed ANPR system market. Fixed ANPR systems are effectively deployed in areas where heavy congestion and traffic are owing to their capability of capturing images in high-speed and high-density traffic environments. Increasing demand for automated parking management solutions is also driving the demand for fixed ANPR systems in airports, car parks, shopping centers, etc. The use of fixed ANPR systems helps reduce the wastage of fuel and time and enhances productivity by reducing excess manpower at toll booths and parking facilities.

ANPR Software to Register Highest CAGR in the ANPR System Market During Forecast Period

ANPR software is an integral part of the system. The integrated image processing software automatically scans the stream of incoming images for any vehicle and its number plate. ANPR software enables the conversion of captured images into a digital format for electronic storage and future reference. Technological advancements have enabled increased rates of detection and have enhanced accuracy by many folds. Increasing demand for automated solutions such as red-light enforcement, speed detection & enforcement, barrier control, vehicle color, model & build recognition, and several such solutions are promoting the growth of advanced ANPR software.

Electronic Toll Collection Application to Register Highest CAGR in ANPR System Market During Forecast Period

The market for the electronic toll collection application is expected to register the highest growth during the forecast period. With an increase in road connectivity, there is an increase in the number of toll booths across the world. To avoid overcrowding and to improve monitoring & detection of vehicles at toll booths, there is an increasing demand for automated solutions, which, in turn, is promoting the usage of ANPR systems for tolling. ANPR systems enable the prevention of scams & frauds and improve the accuracy of road charging systems. Also, the use of ANPR systems helps in reducing the wastage of fuel and the time and excess manpower involved in road charging activities.

To know about the assumptions considered for the study, download the pdf brochure

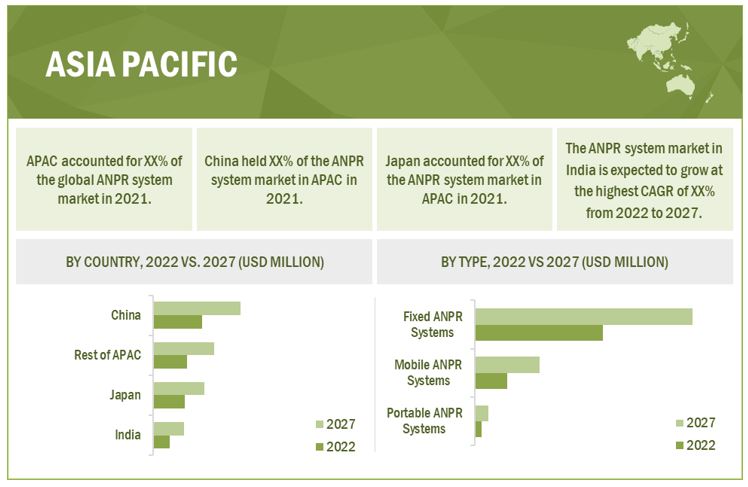

ANPR System Market in APAC to Witness Highest CAGR During Forecast Period

The market in APAC is expected to register the highest growth during the forecast period. The growing population and urbanization in the region have resulted in an increasing number of vehicles. The governments in the region are actively adopting and implementing infrastructure development projects, several of which are aimed at roadways modernization. In addition, there is a rapid growth in the number of shopping centers, recreational & sports facilities, malls & multiplexes, and car parks, etc. in the region. Furthermore, there is an increasing demand for solutions for effective border control and vehicle theft prevention. Owing to these factors, APAC has become one of the fastest-growing markets for ANPR systems.

Top ANPR systems Companies - Key Market Players:

The global ANPR System companies such as Kapsch TrafficCom (Austria), Siemens (Germany), Conduent, Inc. (US), HikVision (China), Q-Free ASA (Norway), Genetec, Inc. (Canada), Adaptive Recognition (Hungary), Jenoptik Group (Germany), Axis Communications (Sweden), and Nedap (Netherlands)

ANPR System Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 3.1 Billion |

| Revenue Forecast in 2027 | USD 4.8 Billion |

| Growth Rate | 9.2% |

|

Forecast Period |

2022–2027 |

|

Base Year |

2021 |

|

Market Size Available for Years |

2018–2027 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Rising deployment of ANPR systems in security and surveillance, and traffic enforcement applications |

| Key Market Opportunity | Integration of new technologies such as AI and IoT with ANPR systems |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Fixed ANPR Systems |

| Highest CAGR Segment | ANPR Software |

| Largest Application Market Share | Electronic Toll Collection Application |

This research report categorizes the global ANPR System Market based on Type, Component, Application, End User, and Region.

By Type

- Fixed ANPR Systems

- Mobile ANPR Systems

- Portable ANPR Systems

By Component

- ANPR Cameras

- ANPR Software

- Frame Grabbers

- Triggers

By Application

- Traffic Management

- Law Enforcement

- Electronic Toll Collection

- Parking Management

- Access Control

By End User

- Government

- Commercial

- Institutions

By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments In ANPR systems Industry:

- In January 2022, Kapsch TrafficCom has been selected by the New Hampshire Department of Transportation (NHDOT) for converting another three NHDOT toll zones into free-flow all-electronic tolling (AET), which would support mixed-mode payment.

- In December 2021, TagMaster, a leading provider of identification and mobility solutions, announced the enhancement of its ANPR technology to enable the management of site capacity at Household Waste Recycling Center (HWRC) sites with high volumes of visitors.

- In November 2021, Bosch Security Systems launched a video analytics software, named Traffic Detector primarily for traffic applications such as number plate recognition, incident detection, and intersection monitoring.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the global ANPR System Market during 2022-2027?

The global ANPR System Market is expected to record the CAGR of 9.2% from 2022–2027.

Does this report include the impact of COVID-19 on the global ANPR System Market?

Yes, the report includes the impact of COVID-19 on the global ANPR System Market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the global ANPR System Market?

The major factors driving the growth of the ANPR system market include the increasing deployment of ANPR systems in security and surveillance and traffic management applications, infrastructure growth in emerging economies, increasing allocation of funds by various governments on ITS, and the growing use of video analytics technology for intelligent monitoring of vehicles.

Which are the significant players operating in the global ANPR System Market?

Kapsch TrafficCom (Austria), Siemens (Germany), Conduent, Inc. (US), HikVision (China), Q-Free ASA (Norway), Genetec, Inc. (Canada), Adaptive Recognition (Hungary), Jenoptik Group (Germany), Axis Communications (Sweden), and Nedap (Netherlands) are a few major players in global ANPR System Market.

Which country will lead the global ANPR System Market in the future?

India is expected to grow at the highest growth rate, yet the US is expected to keep leading the global ANPR System Market during the forecast period .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION & SCOPE

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 ANPR SYSTEM MARKET: INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 ANPR SYSTEM MARKET SEGMENTATION

FIGURE 2 MARKET, BY REGION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 ANPR SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM ANPR SYSTEMS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Arriving at market size by bottom-up approach (demand side)

FIGURE 5 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Arriving at market size by top-down approach (supply side)

FIGURE 6 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 9 ANALYSIS OF IMPACT OF COVID-19 ON ANPR SYSTEM MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 10 MOBILE ANPR SYSTEMS TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 11 ANPR CAMERAS TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 12 ELECTRONIC TOLL COLLECTION APPLICATION TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

FIGURE 13 ANPR SYSTEM MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ANPR SYSTEM MARKET, 2022–2027 (USD MILLION)

FIGURE 14 INCREASING NECESSITY FOR TRAFFIC MANAGEMENT AND ROAD SAFETY MANAGEMENT SOLUTIONS TO BOOST ANPR SYSTEM MARKET

4.2 MARKET, BY TYPE

FIGURE 15 MOBILE ANPR SYSTEMS TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

4.3 MARKET, BY COMPONENT

FIGURE 16 ANPR CAMERAS TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.4 ANPR SYSTEM MARKET, BY APPLICATION

FIGURE 17 TRAFFIC MANAGEMENT APPLICATION TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.5 MARKET, BY GEOGRAPHY

FIGURE 18 US TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 ANPR SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 20 IMPACT ANALYSIS: DRIVERS

5.2.1.1 Rising deployment of ANPR systems in security and surveillance, and traffic enforcement applications

5.2.1.2 Growing number of infrastructures in emerging economies

5.2.1.3 Increasing allocation of funds by various governments on ITS

5.2.1.4 Surging use of video analytics technology for intelligent monitoring of vehicles

5.2.1.5 Worldwide development of smart cities

TABLE 3 GLOBAL INNOVATIVE SMART CITY PROJECTS

5.2.2 RESTRAINTS

FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

5.2.2.1 Inconsistency in number plate designs

5.2.2.2 Incorrect cameras, lenses, or positioning of cameras

5.2.3 OPPORTUNITIES

FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

5.2.3.1 Integration of smart parking technology and tolling application

5.2.3.2 Increase in use of cloud-based storage services

TABLE 4 TOP 10 CLOUD STORAGE SERVICES

5.2.3.3 Integration of new technologies such as AI and IoT with ANPR systems

5.2.4 CHALLENGES

FIGURE 23 IMPACT ANALYSIS: CHALLENGES

5.2.4.1 Misinterpretation of ambiguous characters on number plates

5.2.4.2 Privacy concerns regarding stored images and records

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING STAGE

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END USERS

5.3.5 AFTER-SALES SERVICE PROVIDERS

5.4 ECOSYSTEM

FIGURE 25 GLOBAL ANPR SYSTEM MARKET: ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ANPR SYSTEM MANUFACTURERS

FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF EACH FORCE ON MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 KEY STAKEHOLDERS & BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

5.7.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.8 CASE STUDIES

5.8.1 DISTRICT DEPARTMENT OF TRANSPORTATION (DDOT) OF WASHINGTON D.C. PARTNERED WITH CONDUENT, INC. TO OBTAIN BETTER PARKING MANAGEMENT THROUGH IMPLEMENTATION OF ANPR

5.8.2 BURJ KHALIFA ADOPTED ANPR SOLUTION BY ADAPTIVE RECOGNITION TO ENSURE BETTER SAFETY AND SECURITY

5.9 TECHNOLOGY TRENDS

5.9.1 GROWTH OF IMAGE PROCESSING SOLUTIONS

5.9.2 IMPLEMENTATION OF DEEP LEARNING AND ARTIFICIAL INTELLIGENCE (AI) TECHNIQUES IN ANPR SYSTEMS

5.9.3 USE OF SMARTPHONES TO FACILITATE VIDEO-BASED TOLL COLLECTION

5.9.4 IMPLEMENTATION OF NO TOUCH AND NO QUEUE IN PARKING MANAGEMENT

5.10 PRICING ANALYSIS

5.10.1 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY MARKET PLAYERS, BY COMPONENT

FIGURE 29 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT

TABLE 9 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT (USD)

5.11 PATENTS ANALYSIS

FIGURE 30 ANALYSIS OF PATENTS GRANTED FOR MARKET

5.11.1 A FEW PATENTS PERTAINING TO ANPR SYSTEMS IN 2021

5.12 TRADE ANALYSIS

5.12.1 EXPORTS SCENARIO OF ANPR SYSTEMS

FIGURE 31 ANPR SYSTEM EXPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.12.2 IMPORTS SCENARIO OF ANPR SYSTEMS

FIGURE 32 ANPR SYSTEM IMPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.13 STANDARDS

5.13.1 EUROPEAN COMMITTEE FOR STANDARDISATION (CEN)

5.13.2 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

5.13.3 AMERICAN ASSOCIATION OF MOTOR VEHICLE ADMINISTRATORS (AAMVA)

5.13.4 INTERNATIONAL ORGANIZATION OF STANDARDIZATION (ISO)

5.13.5 STANDARDS AUSTRALIA

5.14 KEY CONFERENCES & EVENTS TO BE HELD DURING 2022–2023

TABLE 10 ANPR SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 TARIFF AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 ANPR SYSTEM MARKET, BY TYPE (Page No. - 92)

6.1 INTRODUCTION

FIGURE 33 ANPR SYSTEM MARKET, BY TYPE

FIGURE 34 FIXED ANPR SYSTEMS TO HOLD LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 17 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 18 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

6.2 FIXED ANPR SYSTEMS

6.2.1 INCREASING DEMAND FOR FIXED ANPR SYSTEMS FOR TRAFFIC MANAGEMENT AND ELECTRONIC TOLL COLLECTION APPLICATIONS DRIVING GROWTH OF ANPR SYSTEM MARKET

TABLE 19 MARKET FOR FIXED TYPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR FIXED TYPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 21 MARKET FOR FIXED TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 MARKET FOR FIXED TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 FIXED ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 MARKET FOR LAW ENFORCEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR LAW ENFORCEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 FIXED ANPR SYSTEM MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 MARKET FOR PARKING MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR PARKING MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 31 MARKET FOR ACCESS CONTROL, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR ACCESS CONTROL, BY REGION, 2022–2027 (USD MILLION)

6.3 MOBILE ANPR SYSTEMS

6.3.1 MOBILE ANPR SYSTEMS EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET FOR MOBILE TYPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR MOBILE TYPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 35 MARKET FOR MOBILE TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 36MARKET FOR MOBILE TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 MOBILE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 39 MARKET FOR LAW ENFORCEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR LAW ENFORCEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022–2027 (USD MILLION)

TABLE 43 MARKET FOR PARKING MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR PARKING MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR ACCESS CONTROL, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR ACCESS CONTROL, BY REGION, 2022–2027 (USD MILLION)

6.4 PORTABLE ANPR SYSTEMS

6.4.1 EFFORTLESS DEPLOYMENT AT VEHICLE CHECKPOINTS DUE TO FLEXIBLE HARDWARE IS DRIVING DEMAND FOR PORTABLE ANPR SYSTEMS

TABLE 47 MARKET FOR PORTABLE TYPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR PORTABLE TYPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 MARKET FOR PORTABLE TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR PORTABLE TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 PORTABLE ANPR SYSTEM MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR LAW ENFORCEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR LAW ENFORCEMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 55 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 MARKET FOR PARKING MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 MARKET FOR PARKING MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

7 ANPR SYSTEM MARKET, BY COMPONENT (Page No. - 109)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY COMPONENT

FIGURE 36 ANPR CAMERAS TO HOLD LARGEST SHARE OF ANPR SYSTEM MARKET DURING FORECAST PERIOD

TABLE 59 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 ANPR CAMERAS

7.2.1 RAPID SURGE IN DEMAND FOR DEPLOYMENT OF ANPR SYSTEMS FOR TRAFFIC MONITORING AND TOLL COLLECTION APPLICATIONS DRIVING DEMAND FOR ANPR CAMERAS

7.3 ANPR SOFTWARE

7.3.1 ANPR SOFTWARE IS EXPECTED TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

7.4 FRAME GRABBERS

7.4.1 INCREASING DEMAND FOR COMPUTER VISION SYSTEMS TO HANDLE VIDEO PROCESSING AND STORING ENABLING GROWTH OF FRAME GRABBER MARKET

7.5 TRIGGERS

7.5.1 INCREASING NECESSITY OF AUTOMATIC SYSTEM TRIGGERING IN CASE OF EMERGENCY IS PROMOTING USE OF TRIGGERS

7.6 OTHERS

8 ANPR SYSTEM MARKET, BY APPLICATION (Page No. - 115)

8.1 INTRODUCTION

FIGURE 37 ANPR SYSTEM MARKET, BY APPLICATION

FIGURE 38 TRAFFIC MANAGEMENT APPLICATION TO HOLD LARGEST SHARE OF OVERALL MARKET DURING FORECAST PERIOD

TABLE 61 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 62 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 TRAFFIC MANAGEMENT

8.2.1 INCREASING NECESSITY FOR INTELLIGENT TRANSPORTATION SYSTEMS TO MANAGE TRAFFIC CONGESTION DRIVING DEMAND FOR ANPR SYSTEMS

TABLE 63 MARKET FOR TRAFFIC MANAGEMENT, BY TYPE, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR TRAFFIC MANAGEMENT, BY TYPE, 2022–2027 (USD MILLION)

TABLE 65 MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR TRAFFIC MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

8.3 LAW ENFORCEMENT

8.3.1 GROWING NECESSITY FOR CAPTURING AND PROCESSING EVIDENCE ON REAL-TIME BASIS DRIVING DEMAND FOR ANPR SYSTEMS

TABLE 67 MARKET FOR LAW ENFORCEMENT, BY TYPE, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR LAW ENFORCEMENT, BY TYPE, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR LAW ENFORCEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR LAW ENFORCEMENT, BY REGION, 2022–2027 (USD MILLION)

8.4 ELECTRONIC TOLL COLLECTION

8.4.1 ELECTRONIC TOLL COLLECTION APPLICATION TO REGISTER HIGHEST CAGR IN ANPR SYSTEM MARKET DURING FORECAST PERIOD

TABLE 71 MARKET FOR ELECTRONIC TOLL COLLECTION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR ELECTRONIC TOLL COLLECTION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR ELECTRONIC TOLL COLLECTION, BY REGION, 2022–2027 (USD MILLION)

8.5 PARKING MANAGEMENT

8.5.1 GROWING DEMAND FOR SMART PARKING SOLUTIONS ACCELERATING DEMAND FOR ANPR SYSTEMS

TABLE 75 MARKET FOR PARKING MANAGEMENT, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR PARKING MANAGEMENT, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR PARKING MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR PARKING MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

8.6 ACCESS CONTROL

8.6.1 EXTENSIVE USAGE OF ANPR SYSTEMS FOR AUTOMATING ENTRANCE AND BARRIER CONTROL FOR ENTERING AND EXITING OPERATIONS PROPELLING GROWTH OF ANPR SYSTEM MARKET

TABLE 79 MARKET FOR ACCESS CONTROL, BY TYPE, 2018–2021(USD MILLION)

TABLE 80 MARKET FOR ACCESS CONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR ACCESS CONTROL, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 MARKET FOR ACCESS CONTROL, BY REGION, 2022–2027 (USD MILLION)

9 ANPR SYSTEM MARKET, BY END USER (Page No. - 128)

9.1 INTRODUCTION

FIGURE 39 ANPR SYSTEM MARKET, BY END USER

9.2 GOVERNMENT

9.2.1 INITIATIVES FOR SAFER ROADS AND EFFICIENT TOLL CHARGING DRIVING DEMAND FOR ANPR SYSTEMS

TABLE 83 GLOBAL ANPR PROJECTS ADOPTED BY GOVERNMENT AUTHORITIES

9.2.2 SUCCESS STORIES

9.2.2.1 ANPR systems helped track over 200 vehicles on account of involvement in international crime deterrence operation in Gloucestershire

9.3 COMMERCIAL

9.3.1 RAPID GROWTH IN DEMAND FOR ANPR SYSTEMS FOR PARKING MANAGEMENT SOLUTIONS

FIGURE 40 PARKING MANAGEMENT SOLUTION BY SMART PARKING LIMITED

9.3.2 SUCCESS STORIES

9.3.2.1 Tivoli hotel in Copenhagen used ANPR technology to implement smart parking systems

9.4 INSTITUTIONS

9.4.1 SURGING DEMAND FOR AUTOMATED ENTRY AND EXIT BARRIERS AT BUSINESS PARKS AND EDUCATIONAL CAMPUSES DRIVING DEMAND FOR ANPR SYSTEMS

FIGURE 41 ACCESS CONTROL SOLUTION BY ADAPTIVE RECOGNITION

9.4.2 SUCCESS STORIES

9.4.2.1 University Of Hertfordshire deployed ANPR systems to automate rising bollards

10 GEOGRAPHIC ANALYSIS (Page No. - 134)

10.1 INTRODUCTION

FIGURE 42 INDIA TO EXHIBIT HIGHEST CAGR IN OVERALL MARKET DURING FORECAST PERIOD

TABLE 84 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 43 SNAPSHOT OF ANPR SYSTEM MARKET IN NORTH AMERICA

TABLE 86 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rapid surge in demand for traffic management solutions is driving growth of ANPR system market in US

10.2.2 CANADA

10.2.2.1 Increasing necessity for use of ANPR systems for law enforcement applications is propelling ANPR system market growth in Canada

10.2.3 MEXICO

10.2.3.1 Mexico is expected to register highest CAGR in market in North America during forecast period

10.3 EUROPE

FIGURE 44 SNAPSHOT OF MARKET IN EUROPE

TABLE 92 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Surging demand for automated parking management solutions driving adoption of ANPR systems

10.3.2 GERMANY

10.3.2.1 Increasing demand for intelligent transportation systems promoting growth of ANPR system market in Germany

10.3.3 FRANCE

10.3.3.1 Rising government measures to improve security and surveillance accelerating growth of ANPR system market

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 45 SNAPSHOT OF ANPR SYSTEM MARKET IN APAC

TABLE 98 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 MARKET IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 MARKET IN APAC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 102 MARKET IN APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China held largest share of market in APAC during forecast period

10.4.2 JAPAN

10.4.2.1 Growing demand for effective traffic management solutions driving growth of market in Japan

10.4.3 INDIA

10.4.3.1 Increasing necessity for effective enforcement of road safety regulations to drive market in India

10.4.4 REST OF APAC

10.5 ROW

TABLE 104 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 107 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 South America is expected to register highest growth in ANPR system market during forecast period

10.5.2 MIDDLE EAST

10.5.2.1 Government initiatives to modernize roadways infrastructure to drive demand for ANPR systems

10.5.3 AFRICA

10.5.3.1 Initiatives to improve road safety and manage traffic congestion to boost demand for ANPR systems

11 COMPETITIVE LANDSCAPE (Page No. - 153)

11.1 OVERVIEW

11.1.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MARKET

11.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 46 TOP PLAYERS IN ANPR SYSTEM MARKET, 2016–2020

11.3 MARKET SHARE ANALYSIS

TABLE 110 ANPR SYSTEMS: MARKET SHARES OF KEY COMPANIES

11.4 COMPANY EVALUATION QUADRANT, 2021

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 47 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 48 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

11.5.5 ANPR SYSTEM MARKET: COMPANY FOOTPRINT

TABLE 111 TYPE FOOTPRINT

TABLE 112 COMPONENT FOOTPRINT

TABLE 113 APPLICATION FOOTPRINT

TABLE 114 END USER FOOTPRINT

TABLE 115 REGION FOOTPRINT

TABLE 116 COMPANY FOOTPRINT

11.5.6 ANPR SYSTEM MARKET: STARTUP/SME MATRIX

TABLE 117 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 118 ANPR SYSTEM: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES

TABLE 119 MARKET: PRODUCT LAUNCHES, MARCH 2020–DECEMBER 2021

11.6.2 DEALS

TABLE 120 MARKET: DEALS, MARCH 2020–JANUARY 2022

12 COMPANY PROFILES (Page No. - 181)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.2.1 KAPSCH TRAFFICCOM

TABLE 121 KAPSCH TRAFFICCOM: BUSINESS OVERVIEW

FIGURE 49 KAPSCH TRAFFICCOM: COMPANY SNAPSHOT

TABLE 122 KAPSCH TRAFFICCOM: PRODUCT OFFERINGS

TABLE 123 KAPSCH TRAFFICCOM: DEALS

12.2.2 SIEMENS

TABLE 124 SIEMENS: BUSINESS OVERVIEW

FIGURE 50 SIEMENS: COMPANY SNAPSHOT

TABLE 125 SIEMENS: PRODUCT OFFERINGS

TABLE 126 SIEMENS: DEALS

12.2.3 CONDUENT, INC.

TABLE 127 CONDUENT, INC.: BUSINESS OVERVIEW

FIGURE 51 CONDUENT, INC.: COMPANY SNAPSHOT

TABLE 128 CONDUENT, INC.: PRODUCT OFFERINGS

TABLE 129 CONDUENT, INC.: DEALS

12.2.4 GENETEC, INC.

TABLE 130 GENETEC, INC.: BUSINESS OVERVIEW

TABLE 131 GENETEC, INC.: PRODUCT OFFERINGS

TABLE 132 GENETEC, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 133 GENETEC, INC.: DEALS

12.2.5 Q-FREE ASA

TABLE 134 Q-FREE ASA: BUSINESS OVERVIEW

FIGURE 52 Q-FREE ASA: COMPANY SNAPSHOT

TABLE 135 Q-FREE ASA: PRODUCT OFFERINGS

TABLE 136 Q-FREE ASA: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 137 Q-FREE ASA: DEALS

12.2.6 ADAPTIVE RECOGNITION

TABLE 138 ADAPTIVE RECOGNITION: BUSINESS OVERVIEW

TABLE 139 ADAPTIVE RECOGNITION: PRODUCT OFFERINGS

TABLE 140 ADAPTIVE RECOGNITION: PRODUCT LAUNCHES AND DEVELOPMENTS

12.2.7 VIGILANT SOLUTIONS

TABLE 141 VIGILANT SOLUTIONS: BUSINESS OVERVIEW

TABLE 142 VIGILANT SOLUTIONS: PRODUCT OFFERINGS

TABLE 143 VIGILANT SOLUTIONS: PRODUCT LAUNCHES AND DEVELOPMENTS

12.2.8 NEOLOGY

TABLE 144 NEOLOGY: BUSINESS OVERVIEW

TABLE 145 NEOLOGY: PRODUCT OFFERINGS

TABLE 146 NEOLOGY: DEALS

12.2.9 TAGMASTER

TABLE 147 TAGMASTER: BUSINESS OVERVIEW

TABLE 148 TAGMASTER: PRODUCT OFFERINGS

TABLE 149 TAGMASTER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 150 TAGMASTER: DEALS

12.2.10 BOSCH SECURITY SYSTEMS

TABLE 151 BOSCH SECURITY SYSTEMS: BUSINESS OVERVIEW

TABLE 152 BOSCH SECURITY SYSTEMS: PRODUCT OFFERINGS

TABLE 153 BOSCH SECURITY SYSTEMS: PRODUCT LAUNCHES AND DEVELOPMENTS

12.2.11 JENOPTIK GROUP

TABLE 154 JENOPTIK GROUP: BUSINESS OVERVIEW

FIGURE 53 JENOPTIK GROUP: COMPANY SNAPSHOT

TABLE 155 JENOPTIK GROUP: PRODUCT OFFERINGS

TABLE 156 JENOPTIK GROUP: DEALS

12.2.12 HIKVISION

TABLE 157 HIKVISION: BUSINESS OVERVIEW

FIGURE 54 HIKVISION: COMPANY SNAPSHOT

TABLE 158 HIKVISION: PRODUCT OFFERINGS

TABLE 159 HIKVISION: PRODUCT LAUNCHES AND DEVELOPMENTS

12.2.13 VIVOTEK, INC.

TABLE 160 VIVOTEK, INC.: BUSINESS OVERVIEW

FIGURE 55 VIVOTEK, INC.: COMPANY SNAPSHOT

TABLE 161 VIVOTEK, INC.: PRODUCT OFFERINGS

TABLE 162 VIVOTEK, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 163 VIVOTEK, INC.: DEALS

12.2.14 AXIS COMMUNICATIONS

TABLE 164 AXIS COMMUNICATIONS: BUSINESS OVERVIEW

TABLE 165 AXIS COMMUNICATIONS: PRODUCT OFFERINGS

12.2.15 NEDAP

TABLE 166 NEDAP: BUSINESS OVERVIEW

FIGURE 56 NEDAP: COMPANY SNAPSHOT

TABLE 167 NEDAP: PRODUCT OFFERINGS

TABLE 168 NEDAP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 169 NEDAP: DEALS

12.3 OTHER KEY PLAYERS

12.3.1 TATTILE

TABLE 170 TATTILE: COMPANY OVERVIEW

12.3.2 EFKON GMBH

TABLE 171 EFKON GMBH: COMPANY OVERVIEW

12.3.3 DIGITAL RECOGNITION SYSTEMS

TABLE 172 DIGITAL RECOGNITION SYSTEMS: COMPANY OVERVIEW

12.3.4 NDI RECOGNITION SYSTEM

TABLE 173 NDI RECOGNITION SYSTEM: COMPANY OVERVIEW

12.3.5 ALERTSYSTEMS

TABLE 174 ALERTSYSTEMS: COMPANY OVERVIEW

12.3.6 QRO SOLUTIONS

TABLE 175 QRO SOLUTIONS: COMPANY OVERVIEW

12.3.7 FF GROUP

TABLE 176 FF GROUP: COMPANY OVERVIEW

12.3.8 SENSYS GATSO GROUP

TABLE 177 SENSYS GATSO GROUP: COMPANY OVERVIEW

12.3.9 CLEARVIEW COMMUNICATIONS

TABLE 178 CLEARVIEW COMMUNICATIONS: COMPANY OVERVIEW

12.3.10 BELTECH

TABLE 179 BELTECH: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 236)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 ITS MARKET FOR ROADWAYS, BY SYSTEM

13.3.1 INTRODUCTION

TABLE 180 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2017–2020 (USD BILLION)

TABLE 181 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2021–2026 (USD BILLION)

13.3.2 ADVANCED TRAFFIC MANAGEMENT SYSTEM (ATMS)

13.3.2.1 ATMS segment Currently holds largest share of ITS market

TABLE 182 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 183 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 184 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 185 ROADWAYS: ITS MARKET FOR ADVANCED TRAFFIC MANAGEMENT SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

13.3.3 ADVANCED TRAVELER INFORMATION SYSTEMS (ATIS)

13.3.3.1 Vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-everything (V2X) communication

13.3.3.1.1 V2V, V2I, and V2X technologies are vital for connected vehicles

TABLE 186 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 187 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 188 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 189 ROADWAYS: ITS MARKET FOR ADVANCED TRAVELER INFORMATION SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

13.3.4 ITS-ENABLED TRANSPORTATION PRICING SYSTEMS (ITPS)

13.3.4.1 Market for ITPS is expected to witness significant growth during forecast period

TABLE 190 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 191 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 192 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 193 ROADWAYS: ITS MARKET FOR ITS-ENABLED TRANSPORTATION PRICING SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

13.3.5 ADVANCED PUBLIC TRANSPORTATION SYSTEMS (APTS)

13.3.5.1 Impact of COVID-19 on APTS may be greater as compared to other systems

TABLE 194 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 195 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 196 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 197 ROADWAYS: ITS MARKET FOR ADVANCED PUBLIC TRANSPORTATION SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

13.3.6 COMMERCIAL VEHICLE OPERATIONS (CVO) SYSTEMS

13.3.6.1 Commercial vehicle operation systems expected to record highest CAGR of market during forecast period

TABLE 198 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 199 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 200 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 201 ROADWAYS: ITS MARKET FOR COMMERCIAL VEHICLE OPERATIONS SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 247)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

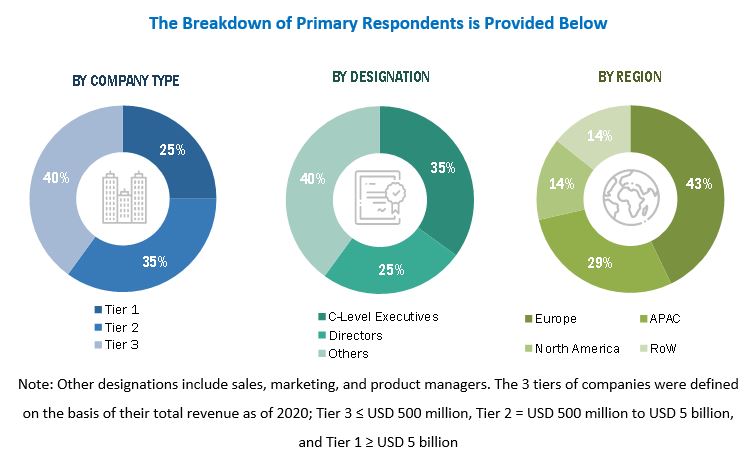

The study involved four major activities in estimating the current size of the global ANPR System Market. Primary sources and secondary sources are the two basic sources of information that have been used to identify and collect information for an extensive technical and commercial study of the ANPR system market. Secondary sources include company websites, magazines, associations, and databases (OneSource and Factiva). Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The key players in the ANPR system market have been identified through secondary research, and their market shares have been determined through primary and secondary research. This research includes the study of annual reports of market players to identify the top players and interviews with key opinion leaders such as CEOs, directors, and marketing personnel. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Primary sources such as experts from related industries and suppliers were interviewed to obtain and verify critical information, as well as to assess prospects of the market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the global ANPR System Market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries as well as ANPR system have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from ANPR system manufacturers, such as Kapsch TrafficCom (Austria), Siemens (Germany), Conduent, Inc. (US), HikVision (China), Q-Free ASA (Norway), Genetec, Inc. (Canada), Adaptive Recognition (Hungary), Jenoptik Group (Germany), Axis Communications (Sweden), and Nedap (Netherlands) and others; research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

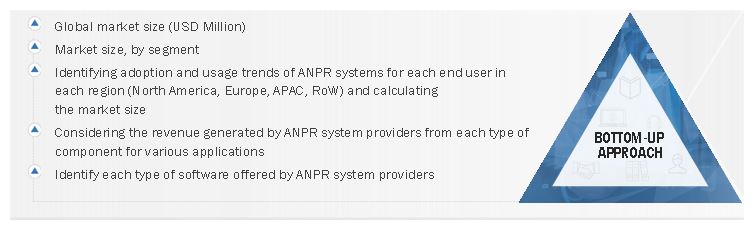

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the global ANPR System Market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global ANPR System Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the ANPR system market, in terms of value, segmented by type, component, application, and end user

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To provide a detailed overview of the value chain of the ANPR system ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide the competitive landscape of the market

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships, of the leading players

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ANPR System Market

To whom it may concern, I am interested to know which companies/ products you analyse in the ANPR software market and what kind of information you provide on them. If we are interested only in this part of the report, what would be the price of it?

Interested in market insights and potential of ANPR systems in electronic tolling on highways.

I am a researcher and intereseted in this report. Please let me know how much discount you offer for the complete report?