The research study involved four major steps in estimating the size of the electronic toll collection market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

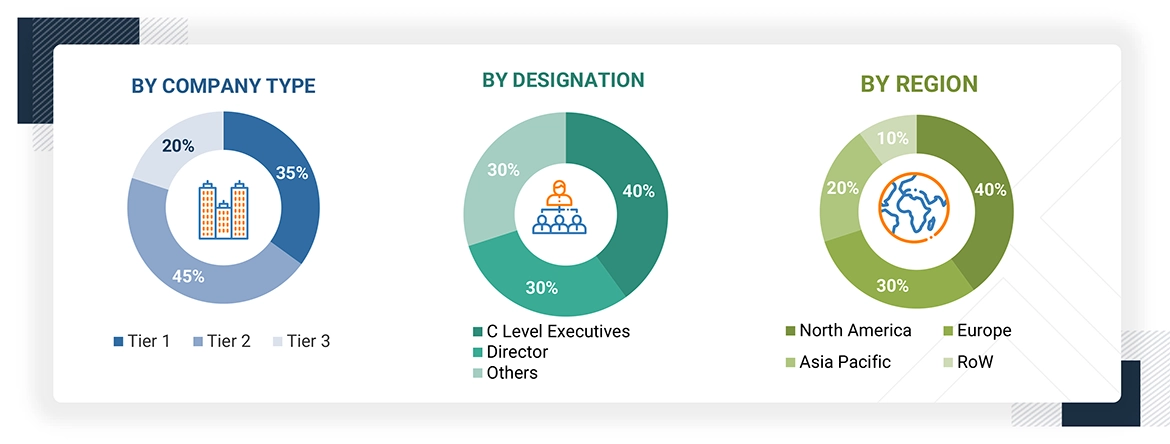

Extensive primary research has been conducted after understanding the electronic toll collection market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across major regions— North America, Europe, Asia Pacific, and RoW. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been

Note: Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the electronic toll collection market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying applications wherein electronic toll collection systems are deployed or are expected to be used

-

Analyzing major providers of electronic toll collections and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

-

Analyzing the average selling price of electronic toll collection systems powered by different technologies

-

Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

-

Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

-

Tracking the ongoing developments and identifying the upcoming developments in the market that include investments, research and development activities, product launches, contracts, collaborations, and partnerships undertaken, and forecasting the market size based on these developments

-

Carrying out multiple discussions with the key opinion leaders to understand the installation of electronic toll collection systems and the sales of related raw materials and products to analyze the break-up of the scope of work carried out by the key companies manufacturing panels

-

Verifying and cross-checking the estimate at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

Electronic Toll Collection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the electronic toll collection market.

Market Definition

The electronic toll collection system automates the process of collecting tolls on roads, bridges, tunnels, etc. The system eliminates the need for drivers to stop and pay tolls manually by using cash or tokens, thereby reducing traffic congestion and improving the efficiency of toll collection. In an ETC system, vehicles equipped with electronic transponders or tags can pass through toll booths or designated lanes without stopping. These transponders communicate with overhead gantries or roadside equipment, allowing tolls to be automatically deducted from a prepaid account linked to the transponder. Alternatively, some ETC systems utilize license plate recognition technology to identify vehicles and calculate the toll amount accordingly.

The benefits of an ETC system include reduced travel times, increased convenience for drivers, improved traffic flow, and lower operational costs for toll authorities. Additionally, ETC systems can support dynamic toll pricing strategies, where toll rates vary based on factors such as time of day, level of congestion, or vehicle type, helping to manage traffic demand more effectively. The ETC system is crucial in modern transportation infrastructure as it streamlines toll collection processes and enhances the overall driving experience.

Key Stakeholders

-

Original device manufacturers (ODMs)

-

System integrators

-

Software providers

-

Raw material and manufacturing equipment suppliers

-

Electronic toll collection system manufacturers

-

Government departments, such as municipal corporations, transport agencies, highway authorities, and road construction corporations

-

Research organizations

-

Technology standards organizations, forums, alliances, and associations

-

End users

-

Technical universities

-

Government/private research institutes

-

Market research and consulting firms

Report Objectives

-

To describe and forecast the size of the electronic toll collection market, by type, technology, offering, application, and region, in terms of value

-

To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To forecast the size of the electronic toll collection market for RFID tags, by region, in terms of volume

-

To describe the payment methods through which the toll can be paid electronically

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the electronic toll collection market

-

To analyze the electronic toll collection value chain and ecosystem, along with the average selling price of electronic toll collection systems

-

To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, AI/Gen AI impact, trade values, the 2025 US Tariff, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments

-

To provide details of the competitive landscape for market leaders

-

To provide details of the macroeconomic outlook for regions

-

To analyze strategies such as product launches, contracts, collaborations, acquisitions, and expansions adopted by players in the electronic toll collection market

-

To profile key players in the electronic toll collection market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

shrutiahuja

Apr, 2021

very nice study for Electronic Toll Collection (ETC) system..

User

Sep, 2019

I am looking for a section of this report that specifies what % of toll roads by country/region are using electronic tolling. As an example for the India and Australia, I would like to know how many toll transactions are processed a year (in any form) and how many of those are processed through electronic tolling. Is that included within this report? .

User

Sep, 2019

I am a technology provider for ETC in the Europe region. I am interested in your overview of the international ETC market and what market trends you have identified. Does your report include information specific to top regional countries in each region such as UK, Germany, France, Italy,US, Canada, China, India, Australia, Japan, Middle Eastern countries etc.? .

User

Sep, 2019

I am a consultant working on RFID technology. Could your report help me in analyzing the newest RFID based toll collection solutions currently used? Is there a solution that can be made to secure encryption / decryption on the servers of the relevant authority without the need to install an encryption key to the RFID reader with the software and network infrastructure to be produced within the scope of the project? .

User

Nov, 2019

I am looking for latest e-toll market report that informs about market dynamics, company profiles and shares, tecnological trends etc. Does the report provide infromation about countrywise ETC projects, entities involved, cost of project and other related information? .

Ravi

Oct, 2022

More Information is required on Global Electronic Toll Collection systems .

User

Mar, 2019

We are the biggest back office service providers in the Central Europe. Looking forward to information about the competitive landscape of the major players in the back-office segment of the ETC. Could you provide market share/ranking of such companies globally? Also, could you share the list of contracts of these companies for last 2-3 years?.