Intelligent Transportation System Market Size, Share & Trends

Intelligent Transportation System Market by Roadways, Railways, Aviation, Maritime, Advanced Traffic Management Systems, Tolling & Parking Management Systems, Security & Surveillance Systems, Smart Ticketing Systems - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

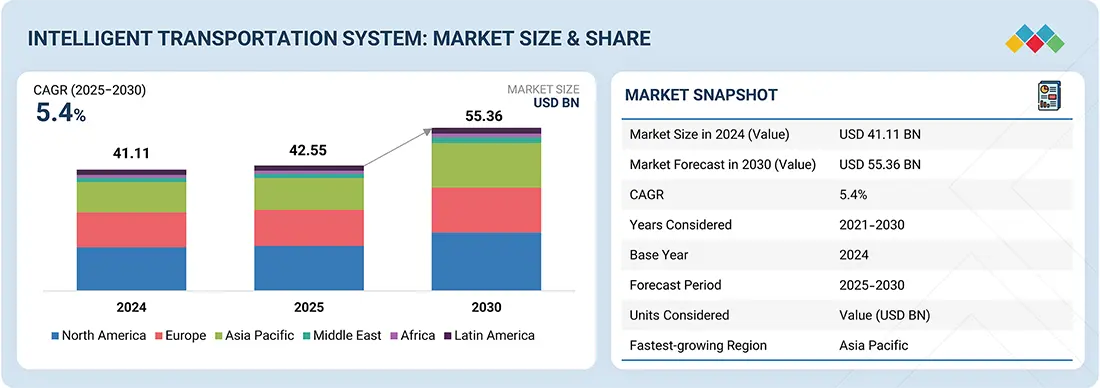

The intelligent transportation system market is projected to reach USD 55.36 billion by 2030 from USD 42.55 billion in 2025, at a CAGR of 5.4% during the forecast period. The market growth is driven by increasing urbanization, rising traffic congestion, and the growing need for road safety and efficient traffic management solutions. AI-based traffic analytics and smart sensors enhance real-time data processing and decision-making. Furthermore, government initiatives to improve transportation infrastructure, reduce emissions, and implement smart city projects are significantly accelerating the adoption of ITS solutions across developed and developing regions globally.

KEY TAKEAWAYS

- The North America intelligent transportation system market dominated, with a share of 36% in 2024.

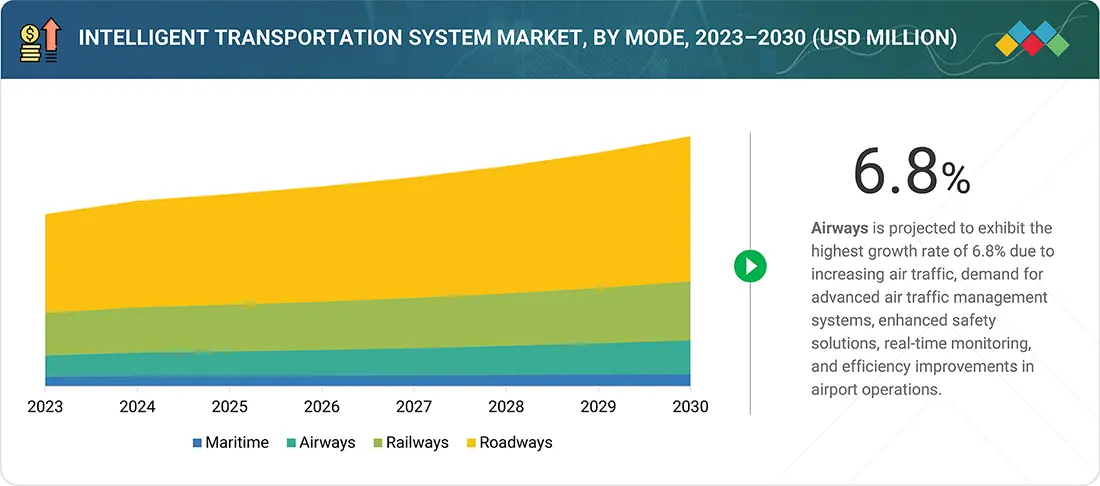

- By Mode, the airways segment is expected to register the highest CAGR of 6.8%.

- By Application, the traffic management segment is expected to dominate the market.

- Siemens, Hitachi Ltd., and Mundys were identified as Star players in the intelligent transportation system market, as they have focused on innovation and have a broad industry coverage, and strong operational & financial strength.

- Carma Technology Corporation, Curbiq, and Cron AI have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The Intelligent Transportation System Market is projected to experience significant growth over the next decade, driven by increasing urbanization, traffic congestion, and the need for enhanced road safety. Adoption of advanced technologies such as AI and IoT enables real-time traffic management, predictive analytics, and smart mobility solutions, making ITS critical in improving transportation efficiency, reducing accidents, and supporting the development of smart cities across automotive, public transit, and infrastructure sectors.

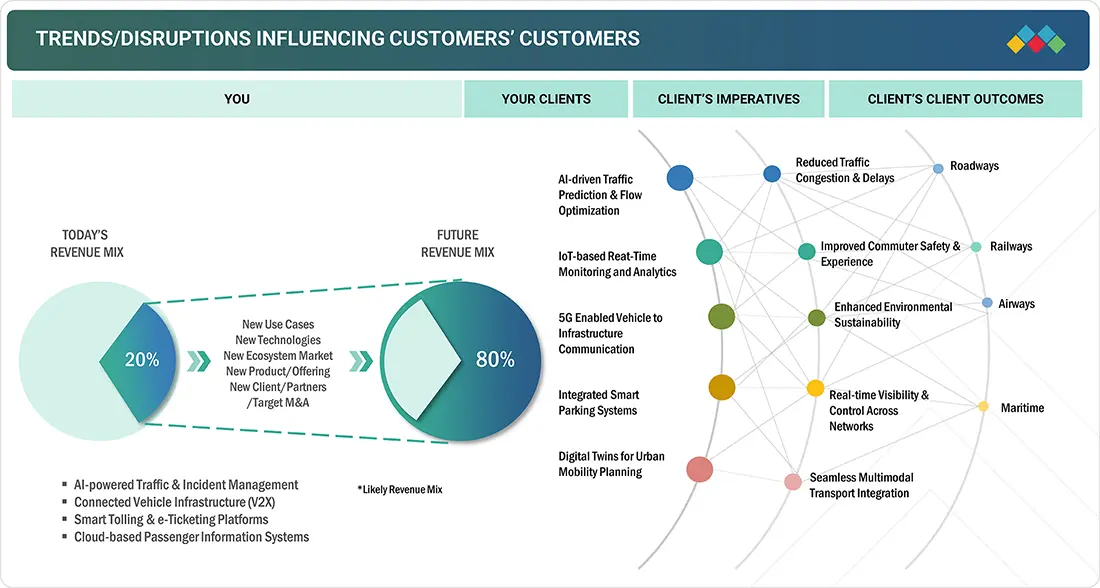

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The intelligent transportation system industry is undergoing a major shift driven by emerging technologies and innovations that will redefine the future revenue mix over the next 4-5 years. Currently, the revenue comes from established solutions such as AI-powered traffic management and smart tolling systems. Key trends driving this shift include AI-driven traffic prediction, IoT-based real-time monitoring and analytics, 5G-enabled vehicle-to-infrastructure communication, digital twins for urban mobility planning, and integrated smart parking systems. These innovations address client demands for reducing congestion, improving commuter safety and experience, enhancing environmental sustainability, enabling real-time visibility and control, and ensuring seamless multimodal transport integration across roadways, railways, airways, and maritime sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing migration from rural to urban areas

-

Government-led initiatives to increase road safety

Level

-

Substantial investments deploying advanced technologies

-

Infrastructure limitations and budgetary constraints in developing countries

Level

-

Growing public-private partnerships

-

Pressing need for smart mobility solutions

Level

-

Complexities associated with data management and privacy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing migration from rural to urban areas

Urbanization is driving the need for efficient transportation as more people move to cities, causing traffic congestion and infrastructure strain. Intelligent Transportation Systems (ITS) help by providing smart traffic monitoring, real-time management, and adaptive control solutions, improving traffic flow, reducing commute times, and supporting sustainable urban mobility.

Restraint: Substantial investments deploying advanced technologies

High upfront costs for deploying Intelligent Transportation Systems (ITS), including sensors, communication networks, and data platforms, and limit market growth. Expensive hardware, software, and skilled labor investments make it hard for governments, especially in developing regions, to adopt ITS, delaying implementation and hindering widespread use despite long-term benefits.

Opportunity: Growing public-private partnerships

Public-private partnerships (PPPs) are boosting Intelligent Transportation System (ITS) growth by combining government support with private innovation. These collaborations help fund and implement smart traffic systems, connected vehicles, and real-time data platforms, enabling faster deployment, improved scalability, and sustainable urban mobility solutions across the globe.

Challenge: Complexities associated with data management and privacy

Managing vast real-time data in Intelligent Transportation Systems (ITS) is complex, involving integration, storage, and analysis from vehicles, sensors, and infrastructure. Privacy concerns arise over personal and location data, with risks of misuse and surveillance. Robust security, anonymization, and clear regulations are needed to address these challenges.

Intelligent Transportation System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of Smart City initiatives integrating connected vehicle technology, real-time traffic monitoring, and adaptive traffic signal control systems. | Enhanced traffic flow efficiency| Reduced congestion| Improved commuter safety| Lower emissions| Optimized infrastructure utilization through data-driven decisions |

|

Integration of automated control centers with real-time monitoring of train movement, energy usage, and passenger flow management for urban transit operations. | Improved commuter safety| Efficient train scheduling| Reduced energy consumption| Enhanced passenger experience| Data-driven maintenance planning for reliable operations |

|

Implementation of IoT-enabled connected logistics platforms to monitor fleet status, traffic conditions, and optimize delivery routes in real time. | Improved delivery speed| Minimized delays| Lower carbon emissions| Enhanced asset utilization| Better customer experience with real-time tracking visibility |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Intelligent Transportation System ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including system manufacturers, system integrators, distributors, and end users. The system manufacturers such as Siemens, Hitachi, and Cubic design and develop critical hardware and software solutions, including traffic control devices, communication systems, and automated infrastructure components. System integrators like Indra and ST Engineering provide specialized services to implement, customize, and integrate ITS solutions for different urban and interurban environments. Distributors such as Parsons and Traficom facilitate the supply chain by connecting manufacturers with system integrators and end users, ensuring efficient delivery and deployment of solutions. End users include government agencies, transportation operators, and logistics companies such as the U.S. Department of Transportation (DOT), Delhi Metro Rail Corporation (DMRC), and FedEx, which implement ITS technologies to enhance traffic management, improve safety, optimize logistics, and ensure sustainable mobility solutions. Collaboration among these stakeholders strengthens operational efficiency, enables seamless data exchange, and drives innovation across the ITS market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Intelligent Transportation System Market, By Mode

The airways is projected to exhibit the highest growth due to increasing air traffic, growing demand for efficient airspace management, and rising focus on passenger safety and operational efficiency. With the surge in global air travel, airports and air traffic control authorities are adopting advanced ITS solutions like real-time flight tracking, predictive maintenance, automated ground handling, and AI-driven airspace management systems. The integration of IoT, big data analytics, and 5G enables seamless communication between aircraft and infrastructure, enhancing operational reliability, reducing delays, and improving passenger experience. Additionally, stringent safety regulations further drive ITS adoption in airways.

Intelligent Transportation System Market, By Application

In the intelligent transportation system market, the information management application is projected to exhibit the highest growth due to the increasing demand for real-time data collection, processing, and analysis across transportation networks. With rising urbanization and vehicle density, managing vast amounts of data from connected vehicles, sensors, cameras, and infrastructure is critical for efficient traffic control, safety monitoring, predictive maintenance, and decision-making. Advanced analytics, cloud computing, and IoT integration enable authorities to optimize traffic flow, reduce congestion, and improve commuter safety. Additionally, government investments in smart city initiatives and growing public-private partnerships further accelerate the adoption of information management solutions in ITS.

Intelligent Transportation System Market for Roadways, By System Type

In the intelligent transportation system market for roadways, tolling & parking management is projected to exhibit the highest growth due to increasing urbanization, rising vehicle ownership, and growing traffic congestion in cities worldwide. Governments and private operators are adopting automated tolling systems and smart parking solutions to improve efficiency, reduce human errors, and enable cashless, contactless transactions. Advanced technologies like IoT sensors, cloud computing, and real-time data analytics help optimize parking space usage, reduce search time for parking, and dynamically adjust toll rates based on traffic conditions. These systems also support sustainability by minimizing idle vehicle emissions and driving market expansion.

REGION

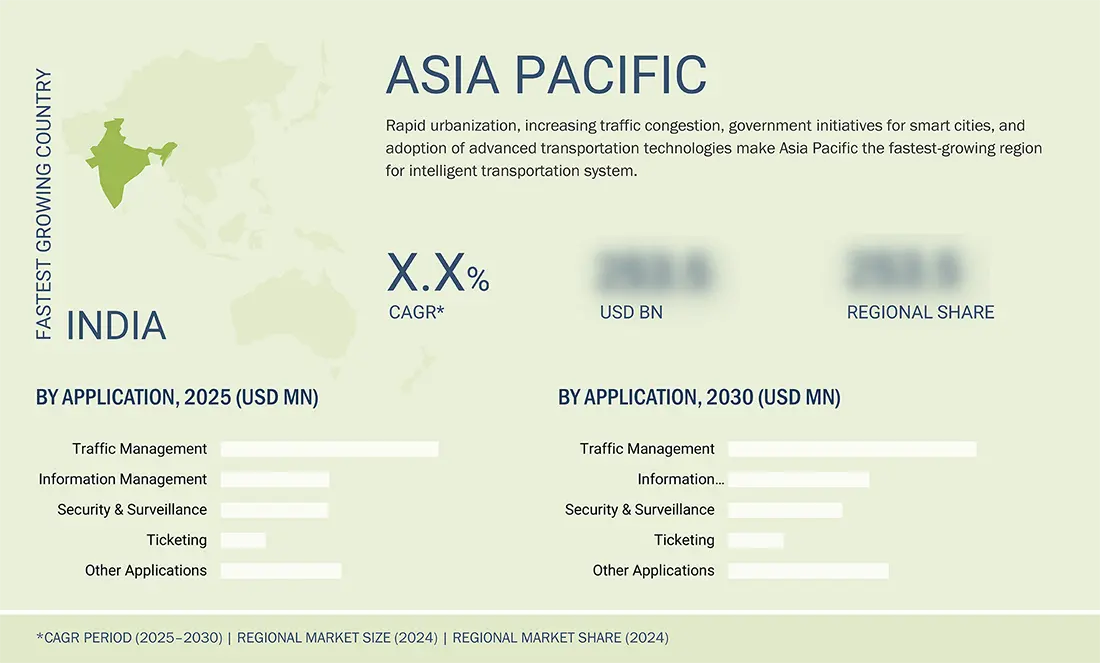

Asia Pacific to be fastest-growing region in global intelligent transportation system market during forecast period

Asia Pacific is the fastest-growing region in the global intelligent transportation system market due to rapid urbanization, rising population, and increasing vehicle ownership in countries like China, India, and Japan. Governments are investing heavily in smart city initiatives and infrastructure development to address traffic congestion, pollution, and road safety issues. The region is also witnessing strong public-private partnerships, driving the adoption of advanced technologies like AI-based traffic management, IoT-enabled monitoring, and 5G communication. Additionally, supportive government policies, growing demand for efficient logistics, and rising awareness of sustainable transport solutions further accelerate ITS deployment, making the Asia Pacific a key growth hub.

The European intelligent transportation system market is expected to grow from USD 12.20 billion in 2025 to USD 15.25 billion by 2030, at a CAGR of 4.6%. The market is expanding as countries adopt AI-driven traffic management, V2X communication, automated tolling, and smart mobility platforms. Growing investments in 5G infrastructure, EV corridors, and smart-city initiatives are driving demand for scalable, sustainable, and connected transport solutions

The intelligent transportation system market in North America is expected to reach USD 19.77 billion by 2030, up from USD 15.29 billion in 2025, growing at a CAGR of 5.3% during this period. Market growth is fueled by increasing urbanization, rising traffic congestion, and the growing need for roadway safety and efficient traffic management solutions.

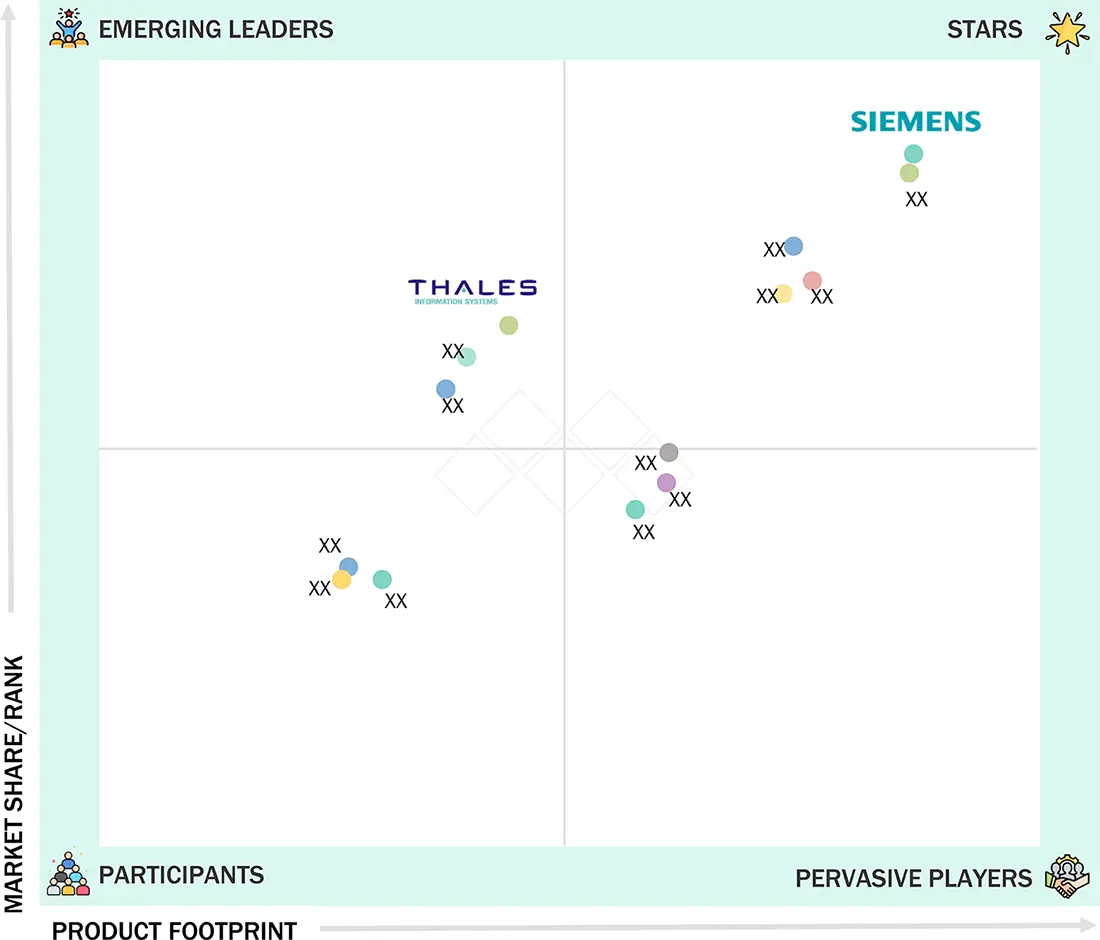

Intelligent Transportation System Market: COMPANY EVALUATION MATRIX

In the intelligent transportation system market matrix, Siemens AG (Star) leads with a robust market presence, comprehensive ITS solutions, and advanced technologies for traffic management, tolling, and public transit systems, driving widespread adoption across smart cities, highways, and urban mobility projects. Thales Group (Emerging Leader) is gaining momentum with innovative offerings in connected vehicle solutions, intelligent signaling systems, and cybersecurity-enabled transportation platforms. While Siemens dominates the market through scale, technological leadership, and global reach, Thales demonstrates significant growth potential, supported by strong R&D capabilities and expanding ITS product offerings, positioning itself to advance toward the leaders’ quadrant in the intelligent transportation system market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY TOP COMPANIES ITS MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 41.11 Billion |

| Market Forecast in 2030 (Value) | USD 55.36 Billion |

| Growth Rate | CAGR of 5.4% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Mode: Roadways, Railways, Aviation, Maritime Intelligent Transportation System Market for Roadways, By System Type: Advanced Traffic Management Systems, Advanced Traveler Information Systems, Tolling & Parking Management Systems |

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

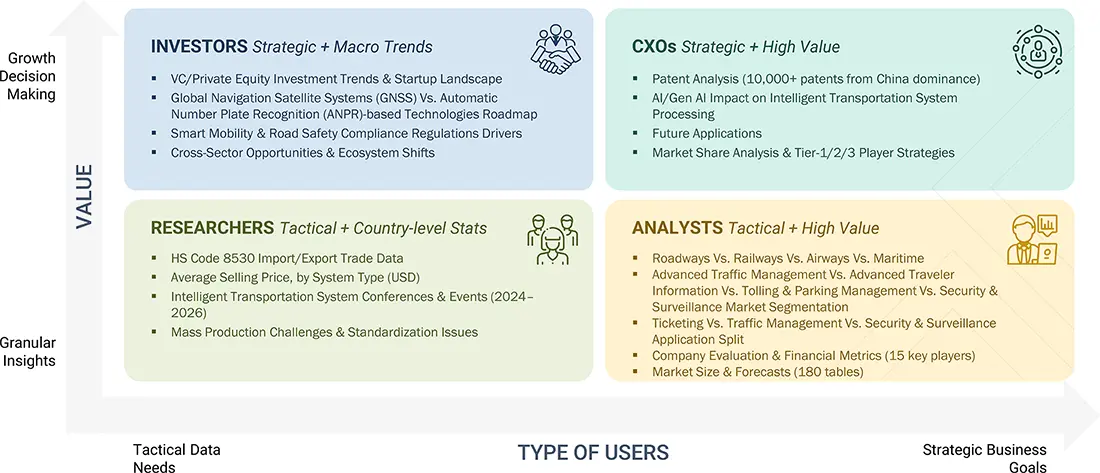

WHAT IS IN IT FOR YOU: Intelligent Transportation System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Urban Mobility Authority | Detailed mapping of existing ITS deployments in urban areas Analysis of traffic monitoring, smart signals, and connected vehicle initiatives Benchmarking of vendor solutions for adaptive traffic management | Identify gaps in current ITS coverage and investment opportunities Detect patterns in congestion reduction and traffic flow improvements Highlight high-potential urban zones for ITS deployment |

| ITS Solution Provider | Comprehensive list of ITS hardware and software vendors segmented by solution type (traffic management, fleet management, tolling, etc.) Adoption rates across smart city, highways, and public transportation sectors Analysis of switching barriers for transport authorities | Insights on revenue shifts towards integrated ITS platforms Pinpoint cross-compatibility risks and integration opportunities Enable targeting of high-margin ITS applications |

| Automotive & Fleet OEM | Review of ITS-based telematics and fleet management solutions | Identify future applications in autonomous fleet operations and smart logistics Highlight areas for partnership with cities and transport authorities |

RECENT DEVELOPMENTS

- July 2025 : Kapsch TrafficCom officially launched its barrier-free tolling system for multi-lane free flow (MLFF) traffic in Norway, implemented for Vegfinans AS on National Road 4, north of Oslo.

- September 2024 : Cubic Corporation launched Umo ScanRide, a new fare payment solution that allows transit agencies to adopt account-based fare collection without installing additional onboard hardware.

- February 2024 : Indra Sistemas partnership with Parsons Corporation aims to advance smart mobility solutions globally and highlights recent successful projects, such as equipping the I-485 Express Lanes with cutting-edge tolling systems.

- June 2023 : Thales launched SelTrac CBTC, an advanced communication-based train control system for metro networks, enhancing safety, capacity, and efficiency with real-time monitoring and automation.

- July 2022 : Hitachi launched the Lumada Intelligent Mobility Management suite, a smart mobility platform that digitally connects an entire city’s transport network.

Table of Contents

Methodology

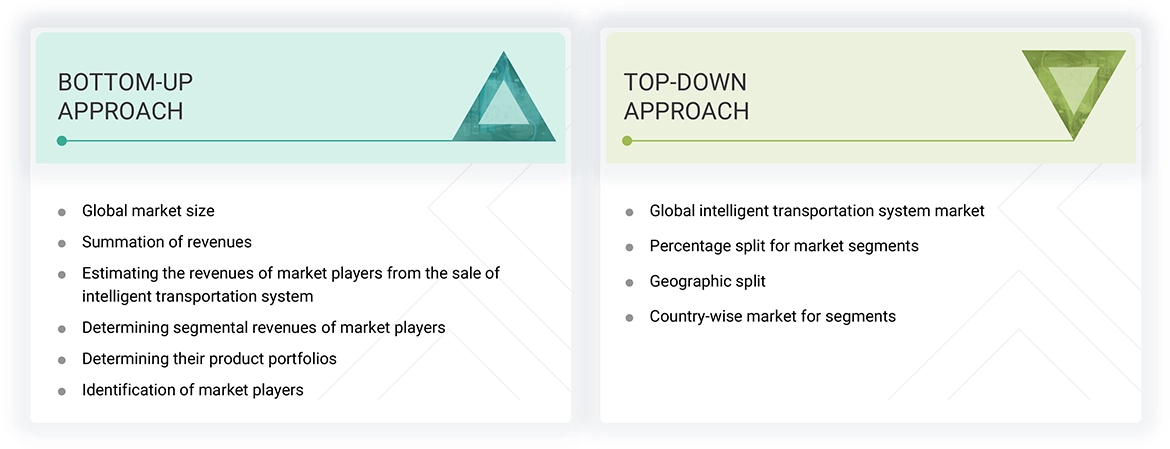

The research study involved four major activities in estimating the intelligent transportation system market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. The market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market's value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

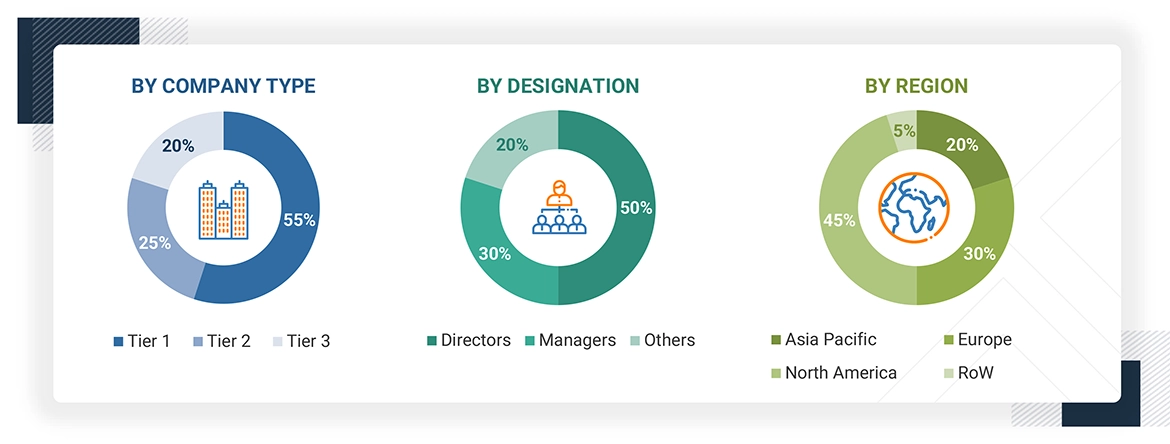

Primary Research

In primary research, various sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the intelligent transportation system market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

Note: "Others" includes sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the intelligent transportation system market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the intelligent transportation system market.

- Major companies that provide intelligent transportation systems were identified. This included analyzing company portfolios, product offerings, and presence across various regions.

- The segment-specific revenues of the companies, particularly those related to intelligent transportation systems, were determined.

- The product-specific revenues of the companies, particularly those related to intelligent transportation systems, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- The global market size for intelligent transportation systems was obtained using this consolidated data.

The top-down approach has been used to estimate and validate the total size of the intelligent transportation system market.

- Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

- Estimated the overall intelligent transportation system market size, then segmented the global market by allocating shares based on the segments considered

- Distributed the segment-level markets into regions and countries by aligning regional intelligent transportation system activity with economic indicators, intelligent transportation system manufacturing presence, and national development initiatives

Intelligent Transportation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides of the intelligent transportation system market.

Market Definition

The intelligent transportation system market involves designing, integrating, and deploying advanced technologies and solutions that enhance transportation networks' efficiency, safety, and sustainability. ITS leverages a combination of communication technologies, sensors, control systems, and data analytics to monitor, manage, and optimize transportation systems across various modes, including roadways, railways, airways, and maritime. These systems are essential for addressing challenges related to traffic congestion, accident prevention, fuel consumption, and environmental impact. Key components of ITS include traffic management systems, advanced traveler information systems, etc. These technologies are integrated with centralized platforms that enable real-time traffic monitoring, predictive analytics, incident detection, and automated response mechanisms. The adoption of ITS is driven by the rising demand for efficient urban mobility, government initiatives to modernize transport infrastructure, and the need for safer and environmentally friendly transportation. With the increasing proliferation of connected vehicles, electric mobility, and 5G connectivity, ITS is evolving to support autonomous transport, integrated multimodal travel, and sustainable urban planning. Intelligent transportation systems play a vital role in reducing traffic congestion, enhancing commuter experience, lowering emissions, and supporting the development of future-ready smart cities.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Raw material suppliers

- Technology investors

- System integrators

- Electronic hardware equipment manufacturers

- Software solution providers

- Distributors

- Research organizations

Report Objectives

- To define, describe, segment, and forecast the intelligent transportation system market size by mode, by application, and by region, in terms of value

- For each mode (roadways, railways, aviation, maritime), a market has been defined, described, and segmented based on system type and offering in terms of value

- To assess the intelligent transportation system market size in four key regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the intelligent transportation system value chain and ecosystem, along with the average selling price by system and region

- To strategically study the regulatory landscape, tariffs, standards, patents, Porter's Five Forces, import & export scenarios, trade values, and case studies pertaining to the market under study

- To understand micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To assess opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To offer the impact of AI/Gen AI on the intelligent transportation system market

- To outline the macroeconomic outlook for the regions under study

- To analyze strategies such as product launches, collaborations, acquisitions, and partnerships adopted by players in the intelligent transportation system market

- To profile key market players and comprehensively analyze their ranking based on their revenue, market share, and core competencies

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and the RoW

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the expected market size of the intelligent transportation system market in 2025?

The intelligent transportation system market is projected to reach USD 55.36 billion by 2030 from USD 42.55 billion in 2025, growing at a CAGR of 5.4% during the forecast period.

Who are the significant players in the global intelligent transportation system market?

Siemens (Germany), Hitachi Ltd. (Japan), Mundys (Italy), Indra Sistemas S.A. (Spain), and Verra Mobility (US) are the major players in the intelligent transportation system market.

Which region is expected to hold the largest market share?

The North American region is expected to hold the largest market share of intelligent transportation systems, with USD 19.77 billion during the forecast period.

What are the major intelligent transportation system market drivers?

Rapid urbanization across regions, government initiatives to increase road safety, rising development of smart cities globally, and increasing demand for mobility services are the major market drivers.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, collaborations, acquisitions, agreements, and expansions to strengthen their position in the intelligent transportation system market.

How does Gen AI/AI impact the intelligent transportation system market on a scale of 1-10 (1 - least impacted, 10 - most impacted)?

The Impacts are as follows:

|

Traffic Management and Congestion Control |

9.0 |

|

Predictive Maintenance and Fleet Management |

8.5 |

|

Autonomous and Connected Vehicles |

9.5 |

|

Incident Detection and Response Systems |

8.0 |

|

Smart Ticketing and Passenger Information Systems |

7.5 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Intelligent Transportation System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Intelligent Transportation System Market

User

Sep, 2019

The deployment of intelligent transportation systems can help reduce the emission of greenhouse gases. It can also deliver environmental benefits by reducing traffic congestion. These factors has led to its high demand in the automotive sector. I'm interested in knowing the market for roadways..

User

Sep, 2019

I can see that the intelligent transportation systems market is witnessing significant growth in the APAC region. We are planning to expand our presence in this region, so would like to know if drivers, restraints, challenges, and opportunities specific to market in APAC available in the report?.

User

Sep, 2019

The intelligent transportation systems market is having huge potential for growth in the APAC region. I want to know if we can get ITS market revenue split by applications for Australia, Singapore, and Hong Kong..

Albin

Dec, 2022

Interested in Road Traffic Signal System Market - Global scope..

User

Nov, 2019

The growth of the intelligent transportation systems market is highly impacted by the rapid developments and advancements in the IoT industry. How will be the growth trend of the market for next 3-5 years owing to these advancements?.

User

Mar, 2019

Roadways is the largest application area for intelligent transportation systems. We want to get insights on other emerging application areas for intelligent transportation systems. Is this type of information covered in the report?.