Smart Ticketing Market by Component (Hardware, Software, and Services), Application (Parking and Transportation (Roadways, Railways, and Airways), and Sports and Entertainment), Organization Size, and Region - Global Forecast to 2026

Smart Ticketing Market Share & Forecast, Global Industry Size

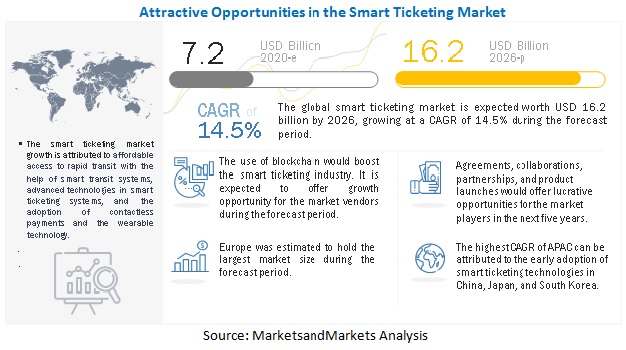

[204 Pages Report] The global Smart Ticketing Market size in terms of revenue was reasonably estimated at US$ 7.2 billion in 2020 and is anticipated to rise to US$ 16.2 billion by 2026, presenting a CAGR of 14.5%.

The smart ticketing industry is gaining grip due to affordable access to rapid transit with the help of smart transit systems, enormous demand for smart ticketing from sports, entertainment, and tourism industries, advanced technologies in the smart ticketing systems, rising adoption of contactless payments, upsurge in the intelligent transportation market, and growing adoption of wearable technologies.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The COVID-19 pandemic has significantly changed the accessibility and use of transportation system in North America. Since March 2020, there has been a substantial reduction in transportation activities in the US and Canada due to travel and public health constraints. The precipitous decrease in ridership during the crisis has caused public transit systems across the US immense financial difficulty. Even with the infusion of USD 25 billion provided by Congress in April 2020 through the CARES Act, transit agencies were still facing a shortfall. The focus of governments has shifted toward the adoption of measures for safeguarding citizens and infrastructure, and therefore, innovation projects have taken a hit. After the outbreak of the pandemic in the US, mobile payments in the country have increased. It is the preferred method of payment as it requires minimal physical interaction, helping in preventing the spread of the virus.

Europe is the most affected region across the globe. As Italy struggled to deal with the rising number of deaths in the country, countries across Europe adopted increasingly strict measures to ensure that their citizens stay at home. The imposition of several restrictions has severely affected the transportation industry, resulting in tremendous revenue losses. After the lockdown restrictions were eased and businesses reopened, the public transport riders started operating for people from essential industries such as healthcare and the food supply chain. They had to practice strict physical distancing; as a result, there was less occupancy in buses and rails. Even after more restrictions were relaxed, limited transport services were provided in many countries.

The COVID-19 pandemic has had a deep impact on transport connectivity in APAC. It has posed a huge challenge for government agencies, raising unknowns, and imposing wrenching trade-offs. The COVID-19 outbreak has slowed down most of the economies, such as China, India, Japan, and Australia. The number of countries imposing travel restrictions more than doubled in March 2020, leading to a sharp fall in passenger demand in the transportation sector. To overcome these challenges, governments have started taking several initiatives in the region to control the spread of the pandemic. In China, all sorts of toll and fare collection have stopped. It has put in place a no-stop, no-check, and toll-free policy for vehicles transporting emergency supplies and essential personnel.

As of 30th March 2020, the top five countries affected due to the COVID-19 pandemic in Latin America were Brazil, Chile, Ecuador, Mexico, and Panama. These countries have reported the highest number of COVID-19 infected cases in the region. In the Middle East, due to mass gatherings and high tourism, countries such as the UAE, Iran, Bahrain, and Kuwait have had a high number of positive cases. In Africa, positive cases are minimum due to less international travel and tourism as compared to developed countries. The pandemic has a negative impact on tourism and overall productivity in countries due to travel and safety restrictions. It is expected that these countries would witness social and economic impacts in the long term and affect the market growth in the region.

Smart Ticketing Market Growth Dynamics

Driver: Huge demand for smart ticketing from sports, entertainment, and tourism industries

In the sports, transit, and entertainmentindustries, smart ticketing is emerging as a ticketing system innovation. Smart tickets are a low cost and efficient way for passengers to mange their public transportation travel. Passengers can also pre load credit into their tickets for future travel. Users may recover and transfer the money to another smart card if the smart ticket is stolen or lost, making it a convenient and safe ticketing application for travellers.

The use of smart technology in the travel and tourism business, such as virtual philanthropy, smartphones, ontactless smart cards, maps, variables, and Artificial Intelligence, has aided countries such as China, India, Singapore, and UAE in acheiving significant economic growth. Smart technologies enable this industry to provide a diverse range of services that appeal to tourists from all over the world. Transportation authorities in many counties, such as Europe and APAC, are promoting the expansion f the travel and tourism industry by enacting ambitious schemes to increase the use of smart ticketing systems.

Restraints: High setup costs for smart tickeing systems

In the public transportation network, smart ticketing systems are frequently deployed. Infrastructure suppliers, component manufacturers, service providers, the public sector, and user groups all need to work together to deploy smart transit systems across the network. The engagement of many stakeholders for the successful deployment of ticketing systems neccesssitates a complex structure, which neccissitates a sih=gnificant financial commitment.

Opportunity: Use of blockchain to boost smart ticketing industry

Stadiums, concernts, and other similar events frequently use smart ticketing systems. This sectors suffers a number of issues, including fraud, scalpes, false tickets, incomplete ticket sales, lack of uniform refund mechanism. In the secondary market, tickets are bought in mass by bot networks and sold at a very high price. In addition, the identity of visitors is unknown to the event organizers, which may lead to security issues. There is no uniformity among different players. With the help of blockchain technology, uniformity among different players can be created, and transparency can be attained in ticket booking processes. Smart ticketing enables event organizers to set terms for crypto-tickets, such as pricing, exchange, refunds, and resales. At the same time, customers can have the assurance that their tickets are not fake and are not used by other people.

Challenge: Data safety and security issues

One of the biggest hurdles affecting the market’s growth is data safety and security risks related with the use of smart ticketing systems. Pn mobile devices, user data held in smart cards might be misused. A few credentials are required when utilising smart ticketing systems for transportation. These include secret cryptographic keys for authentication with the point-of-service terminal to avail travel tickets. The conventional smart card stores user credentials for a longer time in tamper-resistant hardware. Security professionals require certain levels of certification for tamper-resistant hardware used in standard solutions to keep valuable information assets safe. Users with mobile devices that lack secure hardware have the option of storing and retrieving their credentials from the cloud for appropriate authentication. However, for transport ticketing, transaction speed is often vital to provide convenience for users while approaching a gated station or boarding a bus. Hence, the credentials stored on insecure mobile devices raise the risk of security breaches. The impact of this challenge can be subsided with the emergence of blockchain technology in the smart ticketing ecosystem in the near future.

To know about the assumptions considered for the study, download the pdf brochure

APAC to grow at the highest CAGR during the forecast period

Because of the growing economies of countries such as Chna, India, Indonesia, Thailand, and Malaysia, APAC is predicted to grow the the fastest CAGR during the forecast period. Due to high economic growth, population increase, and fast urbanisation, these countries are focusing on developing smart cities. In addition, APAC countries are attracting investments, fostering new technology, and finding innovative solutions to improve people’s quality of life. These developments are fueling the growth of the smart ticketing market in the region. There is an emphasis on the development of advanced and interoperable automated fare collection systems, such as smart cards and NFC-enabled devices, to increase both the efficiency of transport systems and ridership by giving commuters a smooth travel experience. Developed countries such as Japan and Singapore are focusing on technology-enabled transport systems by making heavy technology investments.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the smart ticketing market. Key and innovative vendors in the smart ticketing include ACT (England), Atsuke (France), Cammax (England), Conduent (US), Confidex (Finland), Corethree (England), Cubic (US), Flowbird Group (France), Giesecke+Devrient (Germany), HID Global (US), Hitachi Rail (Italy), IDEMIA (France), Indra (Spain), Infineon Technologies (Germany), INIT (Germany), LIT Transit (Slovenia), Masabi (England), NXP Semiconductors (Netherland), PayiQ (Finland), Scheidt & Bachmann (Germany), SecuTix (Switzerland), Siemens (Germany), Thales (France), Ticketer (England), and Xerox (US). The study includes an in-depth competitive analysis of these key players in the smart ticketing market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Attributes |

Details |

|

Revenue Forecast Size Value in 2026 |

US$ 16.2 billion |

|

Market Size Value in 2020 |

US$ 7.2 billion |

|

Growth Rate |

14.5% CAGR |

|

Market Growth Drivers |

Huge demand for smart ticketing from sports, entertainment, and tourism industries |

|

Key Market Opportunities |

Use of blockchain to boost smart ticketing industry |

|

Market size available for years |

2020-2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2026 |

|

Segments covered |

Component (hardware, software, and services), application, organization size, and region. |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

ACT (England), Atsuke (France), Cammax (England), Conduent (US), Confidex (Finland), Corethree (England), Cubic (US), Flowbird Group (France), Giesecke+Devrient (Germany), HID Global (US), Hitachi Rail (Italy), IDEMIA (France), Indra (Spain), Infineon Technologies (Germany), INIT (Germany), LIT Transit (Slovenia), Masabi (England), NXP Semiconductors (Netherland), PayiQ (Finland), Scheidt & Bachmann (Germany), SecuTix (Switzerland), Siemens (Germany), Thales (France), Ticketer (England), and Xerox (US). |

This research report categorizes the Smart Ticketing Market to forecast revenue and analyze trends by Component (hardware, software, and services), application, organization size, and region.:

Based on Components:

- Hardware

- Software

-

Services

- Consulting

- Implementation

- Support and Maintenance

Based on Application:

- Parking and Transportation

- Sports and Entertainment

Based on Organization size:

- SMEs

- Large Enterprises

Based on regions:

- North America

- Europe

- APAC

- RoW

Recent Developments:

- In February 2021, Infineon Technologies launched 40 nm SLC36/SLC37 security controller platforms with high-performance 32-bit ARM SecurCore SC300 dual interface security chips. These crypto controller platforms provide better performance and flexibility for contactless payments, ticketing, and access applications.

- In February 2021, Cubic’s CTS business division signed a contract with New York Metropolitan Transportation Authority to upgrade the fare payment system for Metro-North Railroad and Long Island Rail Road to a new account-based contactless fare payment system.

- In February 2021, Scheidt & Bachmann partnered with Pyramid Computer, a leading developer and manufacturer of IT solutions for retail and hospitality markets, to promote self-checkout solutions at fuel retail sites. Scheidt & Bachmann developed the SIQMA Smoove smart checkout solution by deploying Pyramid Computer’s hardware solution for self-checkout. The partnership enabled the company to develop intuitive SIQMA applications.

- In February 2021, Conduent and Flowbird, a French company specializing in urban mobility payment methods, signed a 10-year contract with Comutitres and the transport authority Ile-de-France Mobilités to replace all Ile-de-France Mobilites’s bus and tram onboard ticketing platforms with next-generation technologies.

- In February 2021, HID Global acquired TSL UK Ltd, a global provider of RFID handheld readers. The expansion of the RFID component business with TSL readers provides HID Global a one-stop-place for offering RFID hardware and integration tools.

Frequently Asked Questions (FAQ):

How big is the Smart Ticketing market?

What is growth rate of the Smart Ticketing market?

What are the key opportunities in the global Smart Ticketing market?

Who are the key players in Smart Ticketing market?

Who will be the leading hub for Smart Ticketing market?

What is the Smart Ticketing market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 SMART TICKETING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH - SUPPLY-SIDE ANALYSIS

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH - SUPPLY-SIDE ANALYSIS (1/2)

FIGURE 10 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH - SUPPLY-SIDE ANALYSIS (2/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 SMART TICKETING MARKET, 2016–2026

FIGURE 12 TOP LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 13 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2020

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SMART TICKETING MARKET

FIGURE 14 RISING ADOPTION OF THE IOT-ENABLED AUTOMATION SYSTEM TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 15 HARDWARE SEGMENT LED THE MARKET GROWTH IN 2020

4.3 MARKET, BY SERVICE

FIGURE 16 IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 17 PARKING AND TRANSPORTATION SEGMENT TO LEAD THE MARKET GROWTH DURING 2020–2026

4.5 MARKET, BY ORGANIZATION SIZE

FIGURE 18 LARGE ENTERPRISES SEGMENT TO LEAD THE MARKET GROWTH DURING 2020–2026

4.6 MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO GROW AT THE FASTEST GROWTH RATE DURING THE FORECAST PERIOD

4.7 MARKET, BY COUNTRY

FIGURE 20 CHINA AND JAPAN TO ACCOUNT FOR HIGH GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND MARKET TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART TICKETING MARKET

5.2.1 DRIVERS

5.2.1.1 Affordable access to rapid transit with the help of smart transit systems

5.2.1.2 Huge demand for smart ticketing from sports, entertainment, and tourism industries

FIGURE 22 INCREASING NUMBER OF INTERNATIONAL TOURIST ARRIVALS

5.2.1.3 Advanced technologies in smart ticketing systems

5.2.1.4 Rising adoption of contactless payments

FIGURE 23 PREFERENCE FOR CONTACTLESS PAYMENTS AROUND THE WORLD BEFORE THE COVID-19 PANDEMIC, 2020

5.2.1.5 Upsurge in the intelligent transportation market

5.2.1.6 Growing adoption of wearable technologies

FIGURE 24 WEARABLE PAYMENT TRANSACTION VOLUME, 2019

5.2.2 RESTRAINTS

5.2.2.1 High setup costs for smart ticketing systems

5.2.2.2 Centralized framework of smart ticketing systems

5.2.3 OPPORTUNITIES

5.2.3.1 Use of blockchain to boost the smart ticketing industry

5.2.4 CHALLENGES

5.2.4.1 Data safety and security issues

5.2.4.2 Designing an open architecture

5.3 CASE STUDY ANALYSIS

TABLE 4 USE CASE 1: METROPOLITAN TRANSPORTATION AUTHORITY, NEW YORK, IMPLEMENTED CUBIC CORPORATION’S SOLUTION TO MAKE COMMUTING EXPERIENCE MORE INTUITIVE AND SEAMLESS

TABLE 5 CASE STUDY 2: GREATER ANGLIA IMPLEMENTED SCHEIDT & BACHMANN’S SOLUTION TO PROVIDE BETTER CUSTOMER SERVICE DURING TICKET PURCHASES

TABLE 6 USE CASE 3: THE DANISH MINISTRY OF TRANSPORT IMPLEMENTED THALES’ SOLUTION TO UNIFY THE TICKETING SYSTEM FOR BETTER PASSENGER CONVENIENCE

5.4 DISRUPTIVE TECHNOLOGIES

5.4.1 NEAR-FIELD COMMUNICATIONS

5.4.2 QR CODE

5.4.3 WEARABLES

5.5 TRADE ANALYSIS

TABLE 7 IMPORT DATA OF CARDS INCORPORATING ONE OR MORE ELECTRONIC-INTEGRATED CIRCUITS, ‘SMART CARDS, ‘ BY COUNTRY, 2015– 2019 (USD MILLION)

TABLE 8 EXPORT DATA OF CARDS INCORPORATING ONE OR MORE ELECTRONIC-INTEGRATED CIRCUITS, ‘SMART CARDS, ‘ BY COUNTRY, 2015– 2019 (USD MILLION)

5.6 VALUE CHAIN ANALYSIS

FIGURE 25 SMART TICKETING MARKET: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM

TABLE 9 MARKET: ECOSYSTEM

5.8 PORTER’S FIVE FORCES MODEL

TABLE 10 IMPACT OF EACH FORCE ON THE MARKET

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 COMPETITIVE RIVALRY

5.9 PATENT ANALYSIS

FIGURE 26 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 11 TOP 20 PATENT OWNERS (US)

FIGURE 27 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST TEN YEARS

5.10 AVERAGE SELLING PRICE TREND

TABLE 12 AVERAGE SELLING PRICE RANGE OF NFC PRODUCTS

5.11 COVID-19 MARKET OUTLOOK FOR SMART TICKETING MARKET

TABLE 13 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 14 SMART TICKETING SOLUTIONS: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.11.1 CUMULATIVE GROWTH ANALYSIS

TABLE 15 MARKET: CUMULATIVE GROWTH ANALYSIS

6 SMART TICKETING MARKET, BY COMPONENT (Page No. - 66)

6.1 INTRODUCTION

FIGURE 28 HARDWARE SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 17 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 HARDWARE

6.2.1 TICKETING MOBILE TERMINALS/TICKETING MACHINES

6.2.2 READERS

6.2.3 VALIDATORS

6.2.4 HARDWARE: MARKET DRIVERS

6.2.5 HARDWARE: COVID-19 IMPACT

TABLE 18 HARDWARE: SMART TICKETING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 HARDWARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SOFTWARE

6.3.1 SOFTWARE: MARKET DRIVERS

6.3.2 SOFTWARE: COVID-19 IMPACT

TABLE 20 SOFTWARE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 SOFTWARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

6.4.2 SERVICES: COVID-19 IMPACT

TABLE 22 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

FIGURE 29 IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 24 SERVICES: SMART TICKETING MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 25 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.4.3 CONSULTING

TABLE 26 CONSULTING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 CONSULTING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.4.4 IMPLEMENTATION

TABLE 28 IMPLEMENTATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 IMPLEMENTATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.4.5 SUPPORT AND MAINTENANCE

TABLE 30 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 SMART TICKETING MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: MARKET DRIVERS

7.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 30 PARKING AND TRANSPORTATION SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 33 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

7.2 PARKING AND TRANSPORTATION

TABLE 34 PARKING AND TRANSPORTATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 PARKING AND TRANSPORTATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

FIGURE 31 ROADWAYS SEGMENT TO LEAD THE PARKING AND TRANSPORTATION SEGMENT DURING THE FORECAST PERIOD

TABLE 36 PARKING AND TRANSPORTATION: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 PARKING AND TRANSPORTATION: SMART TICKETING MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

7.2.1 ROADWAYS

TABLE 38 ROADWAYS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 ROADWAYS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.2.2 RAILWAYS

TABLE 40 RAILWAYS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 RAILWAYS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.2.3 AIRWAYS

TABLE 42 AIRWAYS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 AIRWAYS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SPORTS AND ENTERTAINMENT

TABLE 44 SPORTS AND ENTERTAINMENT: SMART TICKETING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 SPORTS AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 SMART TICKETING MARKET, BY ORGANIZATION SIZE (Page No. - 86)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 32 LARGE ENTERPRISES SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 48 SMALL AND MEDIUM-SIZED ENTERPRISES: SMART TICKETING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 50 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 SMART TICKETING MARKET, BY REGION (Page No. - 91)

9.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 34 EUROPE TO LEAD THE MARKET DURING THE FORECAST PERIOD

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATIONS

TABLE 52 NORTH AMERICA: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.4 UNITED STATES

TABLE 62 UNITED STATES: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 67 UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 68 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 69 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.2.5 CANADA

TABLE 70 CANADA: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATIONS

FIGURE 35 EUROPE: MARKET SNAPSHOT

TABLE 78 EUROPE: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.5 GERMANY

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 88 ASIA PACIFIC: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.4 CHINA

9.4.5 JAPAN

9.4.6 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD

9.5.1 REST OF THE WORLD: MARKET DRIVERS

9.5.2 REST OF THE WORLD: COVID-19 IMPACT

9.5.3 REST OF THE WORLD: REGULATIONS

TABLE 98 REST OF THE WORLD: SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 99 REST OF THE WORLD: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 100 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 101 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 102 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 103 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 104 REST OF THE WORLD: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 105 REST OF THE WORLD: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 106 REST OF THE WORLD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 REST OF THE WORLD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5.4 MIDDLE EAST AND AFRICA

9.5.5 LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 118)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 MARKET EVALUATION FRAMEWORK, 2019–2021

10.3 KEY MARKET DEVELOPMENTS

10.3.1 PRODUCT LAUNCHES

TABLE 108 SMART TICKETING MARKET: PRODUCT LAUNCHES, JUNE 2020–FEBRUARY 2021

10.3.2 DEALS

TABLE 109 MARKET: DEALS, FEBRUARY 2019–FEBRUARY 2021

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 110 MARKET: DEGREE OF COMPETITION

10.5 HISTORICAL REVENUE ANALYSIS

FIGURE 38 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

10.6 COMPANY EVALUATION QUADRANT OVERVIEW

10.7 COMPANY EVALUATION QUADRANT METHODOLOGY AND DEFINITIONS

TABLE 111 PRODUCT FOOTPRINT WEIGHTAGE

10.7.1 STAR

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE

10.7.4 PARTICIPANTS

FIGURE 39 SMART TICKETING MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

10.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 112 COMPANY PRODUCT FOOTPRINT

TABLE 113 COMPANY APPLICATION FOOTPRINT

TABLE 114 COMPANY INDUSTRY FOOTPRINT

TABLE 115 COMPANY REGION FOOTPRINT

10.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 40 RANKING OF KEY PLAYERS IN THE MARKET, 2020

11 COMPANY PROFILES (Page No. - 133)

11.1 INTRODUCTION

(Business Overview, Products, Key Insights, Recent Developments, COVID-19 Impact, MnM View)*

11.2 CUBIC

TABLE 116 CUBIC: BUSINESS OVERVIEW

FIGURE 41 CUBIC: COMPANY SNAPSHOT

TABLE 117 CUBIC: PRODUCTS OFFERED

TABLE 118 CUBIC: SMART TICKETING MARKET: PRODUCT LAUNCHES

TABLE 119 CUBIC: MARKET: DEALS

11.3 SCHEIDT & BACHMANN

TABLE 120 SCHEIDT & BACHMANN: BUSINESS OVERVIEW

TABLE 121 SCHEIDT & BACHMANN: PRODUCTS OFFERED

TABLE 122 SCHEIDT & BACHMANN: MARKET: DEALS

11.3.5 MNM VIEW

11.4 INDRA

TABLE 123 INDRA: BUSINESS OVERVIEW

FIGURE 42 INDRA: COMPANY SNAPSHOT

TABLE 124 INDRA: PRODUCTS OFFERED

11.5 THALES

TABLE 125 THALES: BUSINESS OVERVIEW

FIGURE 43 THALES: COMPANY SNAPSHOT

TABLE 126 THALES: PRODUCTS OFFERED

TABLE 127 THALES: SMART TICKETING MARKET: DEALS

11.6 GIESECKE+DEVRIENT

TABLE 128 GIESECKE+DEVRIENT: BUSINESS OVERVIEW

TABLE 129 GIESECKE+DEVRIENT: PRODUCTS OFFERED

TABLE 130 GIESECKE+DEVRIENT: MARKET: DEALS

11.7 HITACHI RAIL

TABLE 131 HITACHI RAIL: BUSINESS OVERVIEW

FIGURE 44 HITACHI: COMPANY SNAPSHOT

TABLE 132 HITACHI RAIL: PRODUCTS OFFERED

11.8 ACT (FUJITSU)

TABLE 133 ACT: BUSINESS OVERVIEW

FIGURE 45 FUJITSU: COMPANY SNAPSHOT

TABLE 134 ACT: PRODUCTS OFFERED

TABLE 135 ACT: SMART TICKETING MARKET: PRODUCT LAUNCHES

TABLE 136 ACT: MARKET: DEALS

11.9 CONDUENT

TABLE 137 CONDUENT: BUSINESS OVERVIEW

FIGURE 46 CONDUENT: COMPANY SNAPSHOT

TABLE 138 CONDUENT: PRODUCTS OFFERED

TABLE 139 CONDUENT: MARKET: PRODUCT LAUNCHES

TABLE 140 CONDUENT: MARKET: DEALS

11.10 HID GLOBAL

TABLE 141 HID GLOBAL: BUSINESS OVERVIEW

TABLE 142 HID GLOBAL: PRODUCTS OFFERED

TABLE 143 HID GLOBAL: SMART TICKETING MARKET: DEALS

11.11 XEROX

TABLE 144 XEROX: BUSINESS OVERVIEW

FIGURE 47 XEROX: COMPANY SNAPSHOT

TABLE 145 XEROX: PRODUCTS OFFERED

11.12 INFINEON TECHNOLOGIES

TABLE 146 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 48 INFINEON: COMPANY SNAPSHOT

TABLE 147 INFINEON TECHNOLOGIES: PRODUCTS OFFERED

TABLE 148 INFINEON TECHNOLOGIES: MARKET: PRODUCT LAUNCHES

TABLE 149 INFINEON TECHNOLOGIES: MARKET: DEALS

11.13 SIEMENS

TABLE 150 SIEMENS: BUSINESS OVERVIEW

FIGURE 49 SIEMENS: COMPANY SNAPSHOT

TABLE 151 SIEMENS: PRODUCTS OFFERED

TABLE 152 SIEMENS: SMART TICKETING MARKET: DEALS

11.14 INIT

TABLE 153 INIT: BUSINESS OVERVIEW

FIGURE 50 INIT: COMPANY SNAPSHOT

TABLE 154 INIT: PRODUCTS OFFERED

TABLE 155 INIT: MARKET: DEALS

11.15 NXP SEMICONDUCTORS

TABLE 156 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 51 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 157 NXP SEMICONDUCTORS: PRODUCTS OFFERED

11.16 IDEMIA

TABLE 158 IDEMIA: BUSINESS OVERVIEW

TABLE 159 IDEMIA: PRODUCTS OFFERED

TABLE 160 IDEMIA: SMART TICKETING MARKET: DEALS

*Details on Business Overview, Products, Key Insights, Recent Developments, COVID-19 Impact, MnM View might not be captured in case of unlisted companies.

11.17 MASABI

11.18 LIT TRANSIT

11.19 CORETHREE

11.20 TICKETER

11.21 PAYIQ

11.22 CONFIDEX

11.23 SECUTIX

11.24 CAMMAX

11.25 ATSUKE

11.26 FLOWBIRD GROUP

12 ADJACENT/RELATED MARKETS (Page No. - 174)

12.1 MOBILITY-AS-A-SERVICE MARKET

12.1.1 MARKET DEFINITION

12.1.2 MARKET OVERVIEW

12.1.3 MOBILITY-AS-A-SERVICE MARKET, BY SERVICE TYPE

TABLE 161 MOBILITY-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2020–2030 (USD MILLION)

12.1.4 MOBILITY-AS-A-SERVICE MARKET, BY BUSINESS MODEL

TABLE 162 MOBILITY-AS-A-SERVICE , BY BUSINESS MODEL, 2020–2030 (USD MILLION)

12.1.5 MOBILITY-AS-A-SERVICE MARKET, BY SOLUTION TYPE

TABLE 163 MOBILITY-AS-A-SERVICE MARKET, BY SOLUTION TYPE, 2020–2030 (USD MILLION)

12.1.6 MOBILITY-AS-A-SERVICE MARKET, BY TRANSPORTATION TYPE

TABLE 164 MOBILITY-AS-A-SERVICE MARKET, BY TRANSPORTATION TYPE, 2020–2030 (USD MILLION)

12.1.7 MOBILITY-AS-A-SERVICE MARKET, BY APPLICATION TYPE

TABLE 165 MOBILITY-AS-A-SERVICE MARKET, BY APPLICATION TYPE, 2020–2030 (USD MILLION)

12.1.8 MOBILITY-AS-A-SERVICE MARKET, BY OPERATING SYSTEM

TABLE 166 MOBILITY-AS-A-SERVICE MARKET, BY OPERATING SYSTEM, 2020–2030 (USD MILLION)

12.1.9 MOBILITY-AS-A-SERVICE MARKET, BY REGION

TABLE 167 MOBILITY-AS-A-SERVICE MARKET, BY REGION, 2020–2030 (USD MILLION)

12.2 SMART TRANSPORTATION MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE

TABLE 168 SMART TRANSPORTATION MARKET SIZE, BY TRANSPORTATION MODE, 2016–2019 (USD MILLION)

TABLE 169 SMART TRANSPORTATION MARKET SIZE, BY TRANSPORTATION MODE, 2019–2025 (USD MILLION)

12.2.4 SMART TRANSPORTATION MARKET, BY SOLUTION IN ROADWAYS

TABLE 170 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN ROADWAYS, 2016–2019 (USD MILLION)

TABLE 171 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN ROADWAYS, 2019–2025 (USD MILLION)

12.2.5 SMART TRANSPORTATION MARKET, BY SERVICE IN ROADWAYS

TABLE 172 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN ROADWAYS, 2016–2019 (USD MILLION)

TABLE 173 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN ROADWAYS, 2019–2025 (USD MILLION)

12.2.6 SMART TRANSPORTATION MARKET, BY SOLUTION IN RAILWAYS

TABLE 174 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN RAILWAYS, 2016–2019 (USD MILLION)

TABLE 175 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN RAILWAYS, 2019–2025 (USD MILLION)

12.2.7 SMART TRANSPORTATION MARKET, BY SERVICE IN RAILWAYS

TABLE 176 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN RAILWAYS, 2016–2019 (USD MILLION)

TABLE 177 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN RAILWAYS, 2019–2025 (USD MILLION)

12.2.8 SMART TRANSPORTATION MARKET, BY SOLUTION IN AIRWAYS

TABLE 178 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN AIRWAYS, 2016–2019 (USD MILLION)

TABLE 179 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN AIRWAYS, 2019–2025 (USD MILLION)

12.2.9 SMART TRANSPORTATION MARKET, BY SERVICE IN AIRWAYS

TABLE 180 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN AIRWAYS, 2016–2019 (USD MILLION)

TABLE 181 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN AIRWAYS, 2019–2025 (USD MILLION)

12.2.10 SMART TRANSPORTATION MARKET, BY SOLUTION IN MARITIME

TABLE 182 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN MARITIME, 2016–2019 (USD MILLION)

TABLE 183 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN MARITIME, 2019–2025 (USD MILLION)

12.2.11 SMART TRANSPORTATION MARKET, BY SERVICE IN MARITIME

TABLE 184 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN MARITIME, 2016–2019 (USD MILLION)

TABLE 185 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN MARITIME, 2019–2025 (USD MILLION)

12.2.12 SMART TRANSPORTATION MARKET, BY REGION

TABLE 186 SMART TRANSPORTATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 187 SMART TRANSPORTATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.3 AUTOMATED FARE COLLECTION MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 AUTOMATED FARE COLLECTION MARKET, BY COMPONENT

TABLE 188 AUTOMATED FARE COLLECTION MARKET SIZE, BY COMPONENT, 2014–2021 (USD MILLION)

12.3.4 AUTOMATED FARE COLLECTION MARKET, BY APPLICATION

TABLE 189 AUTOMATED FARE COLLECTION MARKET SIZE, BY APPLICATION, 2014–2021 (USD MILLION)

12.3.5 AUTOMATED FARE COLLECTION MARKET, BY SERVICE TYPE

TABLE 190 AUTOMATED FARE COLLECTION MARKET SIZE, BY SERVICE TYPE, 2014–2021 (USD MILLION)

12.3.6 AUTOMATED FARE COLLECTION MARKET, BY TECHNOLOGY

TABLE 191 AUTOMATED FARE COLLECTION MARKET SIZE, BY TECHNOLOGY, 2014–2021 (USD MILLION)

12.3.7 AUTOMATED FARE COLLECTION MARKET, BY INDUSTRY

TABLE 192 AUTOMATED FARE COLLECTION MARKET SIZE, BY INDUSTRY, 2014–2021 (USD MILLION)

12.3.8 AUTOMATED FARE COLLECTION MARKET, BY REGION

TABLE 193 AUTOMATED FARE COLLECTION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

12.4 NEAR-FIELD COMMUNICATIONS MARKET

12.4.1 MARKET DEFINITION

12.4.2 MARKET OVERVIEW

12.4.3 NEAR-FIELD COMMUNICATIONS MARKET, BY OPERATING MODE

TABLE 194 NEAR-FIELD COMMUNICATIONS MARKET, BY DEVICE OPERATING MODE, 2016–2019 (USD MILLION)

TABLE 195 NEAR-FIELD COMMUNICATIONS MARKET, BY DEVICE OPERATING MODE, 2020–2025 (USD MILLION)

12.4.4 NEAR-FIELD COMMUNICATIONS MARKET, BY OFFERING

TABLE 196 NEAR-FIELD COMMUNICATIONS MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 197 NEAR-FIELD COMMUNICATIONS MARKET, BY OFFERING, 2020–2025 (USD MILLION)

12.4.5 NEAR-FIELD COMMUNICATIONS MARKET, BY APPLICATION

TABLE 198 NEAR-FIELD COMMUNICATIONS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 199 NEAR-FIELD COMMUNICATIONS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.6 NEAR-FIELD COMMUNICATIONS MARKET, BY REGION

TABLE 200 NEAR-FIELD COMMUNICATIONS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 201 NEAR-FIELD COMMUNICATIONS MARKET, BY REGION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 198)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the smart ticketing market. Exhaustive secondary research was done to collect information on the smart market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the smart ticketing market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the Department of Transportation (US), Association for Intelligent Transport Systems, International Ticketing Association (INTIX), American Public Transport Association (APTA), Smart Ticketing Alliance (STA), International Association of Public Transport (UITP), Central Eastern European Smart Card Association (CEESCA), International Road Transport Union (IRU), ITSO, Asia Pacific Smart Card Association (APSCA), and Latin American Railroad Association (ALAF). Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from smart ticketing solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders. Primary sources from the demand side included Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end-users who use smart ticketing solutions.

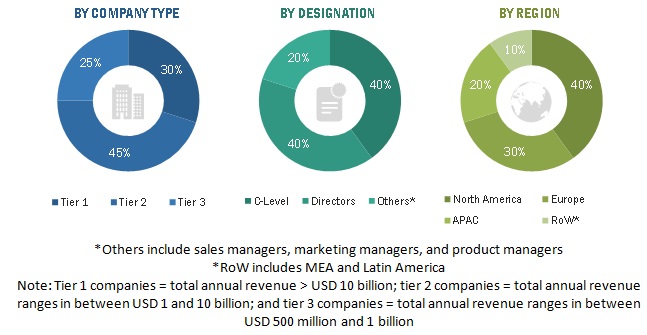

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the smart ticketing market. The first approach involves the estimation of the market size by summing up companies’ revenue generated through the sale of solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the smart ticketing market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer services in the smart ticketing market was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The aggregate of all companies’ revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global smart ticketing market by component, application, organization size, ticketing system, and region from 2020 to 2026, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall smart ticketing market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart ticketing market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European corporate smart ticketing market

- Further breakdown of the APAC corporate market

- Further breakdown of the RoW corporate market

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall smart ticketing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Ticketing Market

We are a software develoing company operational in Western Europe mainly. I am interseted in smart ticketing ticketing market size/growth information regarding Western Europe in upcoming years 2019 to 2025. Also, could you provide a separate breakdown of hardware and software in line with this?

I am a consultant especially looking for connectivity technology wise adoption across various regions and countries. I can see that the report speaks about "By Technology" segment wherein multiple technologeis have been considered. Can I get the data by region/country for NFC, and RFID?

I am looking for smart ticketing market on a more broad appalication like railways, roadways, airways. Do you have more details please ? what is excatly under your section "sports & entertainment" for applications?