Anti Lock Braking System (ABS) and Electronic Stability Control (ESC) System Market For Passenger Cars - by Geography - Trends and Forecasts 2014 - 2019

[250 Pages Report] The major factors driving the demand for automotive anti lock braking system and electronic stability control systems are stringent safety norms, increased safety awareness, technological advancement, affordability as well as institutions such as the New Car Assessment Program (NCAP) awarding safety ratings to cars based on safety performance.

In the coming years, the increasing demand for luxury cars in the regions such as Europe and Asia-Pacific, mainly in China, India and Japan, is expected to drive the market. Sustainable growth in the electronic stability control system and anti lock braking system market will largely depend upon upcoming legislations in various countries. ABS and ESC systems are mandatory in developed countries, while legislations in developing countries are rapidly catching up creating high growth opportunities.

This report classifies and defines the automotive electronic stability control system and anti lock braking system market in terms of volume and value. This report provides comprehensive analysis and insights on the ABS and ESC systems (both - qualitative and quantitative). The report highlights potential growth opportunities in the coming years as well as it covers review of the - market drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects w.r.t. automotive active safety systems market. The key players in the automotive ABS and ESC systems market have also been identified and profiled.

Scope Of The Report

The report covers the automotive electronic stability control system and anti lock braking system market in terms of volume and value. Market size in terms of volume is provided from 2011 to 2019 in thousand units, whereas the value of the market is provided in $millions. The automotive electronic stability control system and anti lock braking system market is broadly classified by geography (Asia-Pacific, Europe, North America, and RoW), focusing on key countries in each region.

Source: MarketsandMarkets Analysis

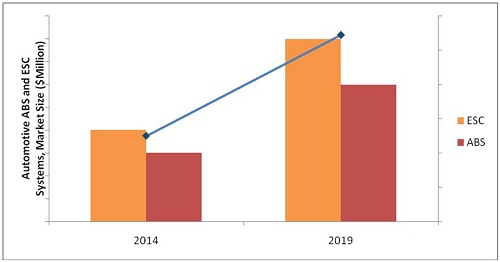

Automotive Anti-Lock Braking System (ABS): The market size, in terms of value, is projected to grow at a promising CAGR of 8.6% to reach $34 billion in 2019.

Automotive Electronic Stability Control System (ESC): The market size, in terms of value, is projected to grow at a promising CAGR of 10.9% to reach $42 billion in 2019.

The automotive industry, in this era driven by hi-tech innovation, is more inclined to use advanced technologies to reduce crashes and mitigate the impact of accidents on a vehicle’s occupants. Hence, the automotive safety systems play an important role in achieving both targets.

These safety systems have evolved from anti-lock braking systems and electronic stability control to driver monitoring and similar systems. These transitions took place due to several reasons such as the increase in awareness of consumers towards safety, rating systems of organizations such as NCAP, and the highly competitive market. These factors prompted companies to invest extensively in passenger safety R&D.

In Europe and North America, ABS and ESC systems are well-established and have a high penetration rate. The use of these systems is also growing significantly in the Asia-Pacific and RoW regions, due to the increase in the consumer purchasing power and their preference for better safety measures and the introduction of legislation and policy framework mandating the installation of safety equipment in cars. China, Germany, and U.K., are expected to be the largest market for anti lock braking system and electronic stability control systems. Developing countries such as India, Russia, Brazil, and Mexico are expected to show a high growth rate in the demand for automotive ABS and ESC systems from 2014 to 2019.

The global automotive electronic stability control system and anti lock braking system market is dominated by players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Autoliv, Inc. (Sweden), and TRW Automotive (U.S.).

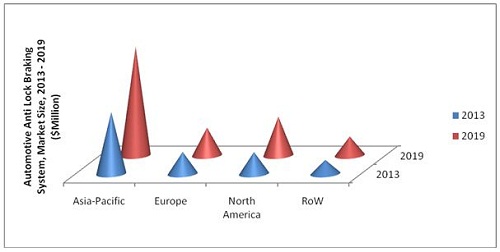

Automotive Anti-Lock Braking System Market Size, by Region, 2013 VS. 2019 ($Million)

Source: MarketsandMarkets Analysis

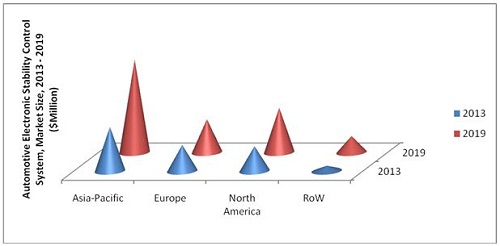

Automotive Electronic Stability Control System Market Size, by Region, 2013 VS. 2019 ($Million)

Source: MarketsandMarkets Analysis

Table of Content

1 Introduction

1.1 Introduction and Background

1.2 Objective and Value Proposition

1.3 Key Take Aways

1.4 Scope

1.4.1 By Geography

1.4.2 By Product Type

1.4.3 Product Definition

1.5 Stakeholders

2 Research Methodology

2.1 Global Electronic Stability Control System and Anti Lock Braking System Market

2.2 Market Crackdown and Data Triangulation

2.3 Market Size Estimation

2.3.1 Key Data Points Taken From Secondary Sources

2.3.2 Key Data Points From Primary Sources

2.3.2.1 Key Industry Insights

2.4 Assumptions

3 Executive Summary

4 Market Overview

4.1 Market Dynamics

4.1.1 Drivers

4.1.1.1 Legislations

4.1.1.2 New Car Assessment Program

4.1.1.3 Focus on Occupant Safety

4.1.1.4 Buyer’s Preferences

4.1.1.5 Consumer Value of Safety Technologies

4.1.1.6 Increasing Number of Auto Collision

4.1.2 Restraints

4.1.2.1 Cyclic Nature of Automotive Sales and Production

4.1.2.2 Raw Material and Commodity Prices

4.1.3 Challanges

4.1.3.1 Price Increase to Consumers

4.1.3.2 Cost Incurred At the Design and Testing Phase

4.2 Growth Indicators

4.3 Value Chain Analysis

4.4 Legislation Analysis

4.5 Collision Trend Analysis

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Row

4.6 Economic Growth in Terms of Gdp, By Geography

5 Technological Evolution

5.1 Technology Roadmap: Anti Lock Braking System (ABS)

5.2 Technology Roadmap: Electronic Stability Control (ESC) System

6 Anti Lock Braking System Market for Passenegr Cars, By Geography (2011 - 2019)

6.1 Global Anti Lock Braking System (ABS) Market Share, By Geography

6.2 Global Anti Lock Braking System (ABS) Market Size, By Geography

6.3 North America

6.3.1 U.S.A

6.3.2 Canada

6.3.3 Mexico

6.4 Europe

6.4.1 Germany

6.4.2 France

6.4.3 U.K.

6.4.4 Spain

6.4.5 Italy

6.5 Asia Pacific

6.5.1 Australia

6.5.2 Japan

6.5.3 South Korea

6.5.4 India

6.5.5 Thailand

6.5.6 China

6.6 Row

6.6.1 Brazil

6.6.2 Russia

6.6.3 South Africa

7 Electronic Stability Control (ESC) System Market for Passenger Cars, By Type and Geography (2011 – 2019)

7.1 Global Electronic Stability Control (ESC) System Market Share, By Geography

7.2 Global Electronic Stability Control (ESC) System Market Size, By Geography

7.3 North America

7.3.1 U.S.A

7.3.2 Canada

7.3.3 Mexico

7.4 Europe

7.4.1 Germany

7.4.2 France

7.4.3 U.K.

7.4.4 Spain

7.4.5 Italy

7.5 Asia Pacific

7.5.1 Australia

7.5.2 Japan

7.5.3 South Korea

7.5.4 India

7.5.5 Thailand

7.5.6 China

7.6 Row

7.6.1 Brazil

7.6.2 Russia

7.6.3 South Africa

8 Opportunity and Installation Trend Analysis

8.1 Introduction

8.2 Installation Trend Analysis for North America

8.3 Installation Trend Analysis for Europe

8.4 Installation Trend Analysis for Asia Pacific

8.5 Installation Trend Analysis for Rest of the World

8.6 Opportunity Analysis

8.6.1 U.S.

8.6.2 Canada

8.6.3 Mexico

8.6.4 European Countries

8.6.5 China

8.6.6 Japan

8.6.7 India

8.6.8 Australia

8.6.9 South Korea

8.6.10 Thailand

8.6.11 Russia

8.6.12 Brazil

8.6.13 South Africa

8.7 Product Life Cycle Analysis, By Geography

8.8 Pestel Analysis

8.8.1 North America

8.8.2 Europe

8.8.3 Asia Pacific

8.8.4 Row

9 Competitive Landscape

9.1 Introduction

9.2 Key Growth Strategies

10 Company Profiles

10.1 Introduction

10.2 Robert Bosch GMBH

10.3 Autoliv Inc.

10.4 TRW Automotive

10.5 Delphi Automotive Plc

10.6 Densocorporation

10.7 Contenental Ag

10.8 Hyundai Mobis

11 Appendix

11.1 List of Acronyms

11.2 List of Sources

List of Tables (83 Table)

Table 1 Introduction and Background

Table 2 Product Definitions

Table 3 Global Market Outlook for Automotive ABS and ESC

Table 4 Global Market Outlook for Automotive ABS By Geography

Table 5 Global Market Outlook for Automotive ESC By Geography

Table 6 Technology Roadmap : ABS

Table 7 Technology Roadmap : ESC

Table 8 Global Anti Lock Braking System Market Size, 2011-2019 ($Million)

Table 9 North America : Anti Lock Braking System Market Size, 2011-2019 (Million Units)

Table 10 North America : ABS Market Size, 2011-2019 ($Million)

Table 11 U.S. : Anti Lock Braking System Market Size, 2011-2019 ($Billion and Million Units)

Table 12 Canada : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 13 Mexico : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Table 14 Europe : Anti Lock Braking System Market Size, 2011-2019 (Million Units)

Table 15 Europe : ABS Market Size, 2011-2019 ($Million)

Table 16 Germany : ABS Market Size, 2011-2019 ($Billion and Million Units)

Table 17 France : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 18 U.K. : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 19 Spain : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 20 Italy: ABS Market Size, 2011-2019 ($Million and Million Units)

Table 21 Asia Pacific : Anti Lock Braking System Market Size, 2011-2019 (Million Units)

Table 22 Asia Pacific : ABS Market Size, 2011-2019 ($Million)

Table 23 Australia : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 24 Japan : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Table 25 South Korea : ABS Market Size, 2011-2019 ($Mllion and Million Units)

Table 26 India : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 27 Thailand : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 28 China : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 29 Rest of the World : Anti Lock Braking System Market Size, 2011-2019 (Million Units)

Table 30 Rest of the World : ABS Market Size, 2011-2019 ($Million)

Table 31 Brazil : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 32 Russia : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Table 33 South Africa : ABS Market Size, 2011-2019 ($Million and Million Units)

Table 34 Global Electronic Stability Control System Market Size, 2011-2019 ($Million)

Table 35 North America : Electronic Stability Control System Market Size, 2011-2019 (Million Units)

Table 36 North America : ESC Market Size, 2011-2019 ($Million)

Table 37 U.S. : ESC Market Size, 2011-2019 ($Billion and Million Units)

Table 38 Canada : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Table 39 Mexico : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 40 Europe : ESC Market Size, 2011-2019 (Million Units)

Table 41 Europe : Electronic Stability Control System Market Size, 2011-2019 ($Million)

Table 42 Germany : ESC Market Size, 2011-2019 ($Billion and Million Units)

Table 43 France : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Table 44 U.K. : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 45 Spain : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 46 Italy: ESC Market Size, 2011-2019 ($Million and Million Units)

Table 47 Asia Pacific : Electronic Stability Control System Market Size, 2011-2019 (Million Units)

Table 48 Asia Pacific : ESC Market Size, 2011-2019 ($Million)

Table 49 Australia : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 50 Japan : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Table 51 South Korea : ESC Market Size, 2011-2019 ($Mllion and Million Units)

Table 52 India : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 53 Thailand : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 54 China : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 55 Rest of the World : Electronic Stability Control System Market Size, 2011-2019 (Million Units)

Table 56 Rest of the World : ESC Market Size, 2011-2019 ($Million)

Table 57 Brazil : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Table 58 Russia : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 59 South Africa : ESC Market Size, 2011-2019 ($Million and Million Units)

Table 60 Pestel Analysis : Global

Table 61 List of Acronyms

Table 62 List of Sources

Table 63 Finantials: Robert Bosch GMBH

Table 64 Product and Services: Robert Bosch GMBH

Table 65 Developments: Robert Bosch GMBH

Table 66 Finantials: Autolive Inc

Table 67 Product and Services: Autolive Inc

Table 68 Developments: Autolive Inc

Table 69 Finantials: Denso Corporation

Table 70 Product and Services: Denso Corporation

Table 71 Developments: Denso Corporation

Table 72 Finantials: Delphi Automotive Plc

Table 73 Product and Services: Delphi Automotive Plc

Table 74 Developments: Delphi Automotive Plc

Table 75 Finantials: Contenental Ag

Table 76 Product and Services: Contenental Ag

Table 77 Developments: Contenental Ag

Table 78 Finantials: Hyundai Mobis

Table 79 Product and Services: Hyundai Mobis

Table 80 Developments: Hyundai Mobis

Table 81 Finantials: TRW Automotive

Table 82 Product and Services: TRW Automotive

Table 83 Developments: TRW Automotive

List of Figures (137 Figure)

Figure 1 Introduction and Background

Figure 2 Objectives & Value Proposition

Figure 3 Key Take Aways

Figure 4 Scope

Figure 5 Scope of the Report – By Geography

Figure 6 Product Type

Figure 7 Stake Holders

Figure 8 Global ABS and ESC Market: Research Methodology

Figure 9 Data Collection Model

Figure 10 Market Estimation

Figure 11 Key Data Points Taken From Secondary Sources

Figure 12 Key Data Points Taken From Primary Sources

Figure 13 Key Industry Insight

Figure 14 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 15 Assumptions

Figure 16 Global Market Outlook for Automotive ABS and ESC

Figure 17 Global Market Outlook for Automotive ABS and ESC

Figure 18 Global Market Outlook for Automotive ABS By Geography

Figure 19 Market Outlook: Compound Annual Growth Rate of ABS for 2014-2019 (By Value)

Figure 20 Market Outlook: Compound Annual Growth Rate of ABS for 2014-2019 (By Value)

Figure 21 Global Market Outlook for Automotive ESC By Geography

Figure 22 Market Outlook: Compound Annual Growth Rate of ESC for 2014-2019 (By Value)

Figure 23 Market Outlook: Compound Annual Growth Rate of ESC for 2014-2019 (By Value)

Figure 24 Market Drivers

Figure 25 Market Restraints

Figure 26 Market Challenges

Figure 27 Growth Indicators – Legislation Applicable for ABS

Figure 28 Growth Indicators- Growing Automobile Collision Rate

Figure 29 Value Chain Analysis

Figure 30 Legislation Analysis

Figure 31 Collision Trend Analysis: North America

Figure 32 Collision Trend Analysis: Europe

Figure 33 Collision Trend Analysis: Asia Pacific

Figure 34 Collision Trend Analysis: Rest of the World

Figure 35 Economic Growth in Terms of Gdp - Europe

Figure 36 Economic Growth in Terms of Gdp – North America

Figure 37 Economic Growth in Terms of Gdp - Asia Pacific

Figure 38 Economic Growth in Terms of Gdp - Rest of the World

Figure 39 Technology Roadmap : ABS

Figure 40 Technology Roadmap : ESC

Figure 41 Global: Anti Lock Braking System Market Share, 2013, By Geography

Figure 42 Global: ABS Market Share, 2013, By Geography

Figure 43 Global ABS Market Size, 2011-2019 ($Million)

Figure 44 North America : Anti Lock Braking System Market Size, 2011-2019 (Million Units)

Figure 45 North America : ABS Market Size, 2011-2019 ($Million)

Figure 46 U.S. : ABS Market Size, 2011-2019 ($Billion and Million Units)

Figure 47 Canada : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 48 Mexico : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 49 Europe : ABS Market Size, 2011-2019 (Million Units)

Figure 50 Europe : ABS Market Size, 2011-2019 ($Million)

Figure 51 Germany : ABS Market Size, 2011-2019 ($Billion and Million Units)

Figure 52 France : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 53 U.K. : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 54 Spain : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 55 Italy: ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 56 Asia Pacific : ABS Market Size, 2011-2019 (Million Units)

Figure 57 Asia Pacific : Anti Lock Braking System Market Size, 2011-2019 ($Million)

Figure 58 Australia : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Figure 59 Japan : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 60 South Korea : ABS Market Size, 2011-2019 ($Mllion and Million Units)

Figure 61 India : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 62 Thailand : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 63 China : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Figure 64 Rest of the World : ABS Market Size, 2011-2019 (Million Units)

Figure 65 Rest of the World : ABS Market Size, 2011-2019 ($Million)

Figure 66 Brazil : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 67 Russia : ABS Market Size, 2011-2019 ($Million and Million Units)

Figure 68 South Africa : Anti Lock Braking System Market Size, 2011-2019 ($Million and Million Units)

Figure 69 Global: Electronic Stability Control System Market Share, 2013, By Geography

Figure 70 Global: ESC Market Share, 2013, By Geography

Figure 71 Global ESC Market Size, 2011-2019 ($Million)

Figure 72 North America : Electronic Stability Control System Market Size, 2011-2019 (Million Units)

Figure 73 North America : ESC Market Size, 2011-2019 ($Million)

Figure 74 U.S. : Electronic Stability Control System Market Size, 2011-2019 ($Billion and Million Units)

Figure 75 Canada : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Figure 76 Mexico : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 77 Europe : ESC Market Size, 2011-2019 (Million Units)

Figure 78 Europe : ESC Market Size, 2011-2019 ($Million)

Figure 79 Germany : ESC Market Size, 2011-2019 ($Billion and Million Units)

Figure 80 France : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 81 U.K. : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Figure 82 Spain : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 83 Italy: ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 84 Asia Pacific : Electronic Stability Control System Market Size, 2011-2019 (Million Units)

Figure 85 Asia Pacific : ESC Market Size, 2011-2019 ($Million)

Figure 86 Australia : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 87 Japan : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 88 South Korea : ESC Market Size, 2011-2019 ($Mllion and Million Units)

Figure 89 India : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 90 Thailand : Electronic Stability Control System Market Size, 2011-2019 ($Million and Million Units)

Figure 91 China : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 92 Rest of the World : ESC Market Size, 2011-2019 (Million Units)

Figure 93 Rest of the World : ESC Market Size, 2011-2019 ($Million)

Figure 94 Brazil : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 95 Russia : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 96 South Africa : ESC Market Size, 2011-2019 ($Million and Million Units)

Figure 97 ABS & ESC : Installation Trend Analysis for North America

Figure 98 ABS & ESC : Installation Trend Analysis for Europe

Figure 99 ABS & ESC : Installation Trend Analysis for Asia Pacific

Figure 100 ABS & ESC : Installation Trend Analysis for Rest of the World

Figure 101 Opportunity Analysis for U.S.

Figure 102 Opportunity Analysis for Canada

Figure 103 Opportunity Analysis for Mexico

Figure 104 Opportunity Analysis for Europe

Figure 105 Opportunity Analysis for China

Figure 106 Opportunity Analysis for Japan

Figure 107 Opportunity Analysis for India

Figure 108 Opportunity Analysis for Australia

Figure 109 Opportunity Analysis for South Korea

Figure 110 Opportunity Analysis for Thailand

Figure 111 Opportunity Analysis for Russia

Figure 112 Opportunity Analysis for Brazil

Figure 113 Opportunity Analysis for South Africa

Figure 114 Product Life Cycle Analysis, ABS, By Geography

Figure 115 Product Life Cycle Analysis, ESC, By Geography

Figure 116 North America : Pestel Analysis

Figure 117 Europe : Pestel Analysis

Figure 118 Asia Pacific: Pestel Analysis

Figure 119 Rest of the World : Pestel Analysis

Figure 120 Key Growth Strategies

Figure 121 Key Growth Strategies Share, 2011-2014

Figure 122 Percentage Share of Active Players in Developments in the Market, 2011-2014

Figure 123 Company Progiles: Introduction

Figure 124 Company Overview: Robert Bosch GMBH

Figure 125 SWOT Analysis: Robert Bosch GMBH

Figure 126 Company Overview: Autolive Inc

Figure 127 SWOT Analysis: Autolive Inc

Figure 128 Company Overview: TRW Automotive

Figure 129 SWOT Analysis: TRW Automotive

Figure 130 Company Overview: Denso Corporation

Figure 131 SWOT Analysis: Denso Corporation

Figure 132 Company Overview: Delphi Automotive Plc

Figure 133 SWOT Analysis: Delphi Automotive Plc

Figure 134 Company Overview: Contenental Ag

Figure 135 SWOT Analysis: Contenental Ag

Figure 136 Company Overview: Hyundai Mobis

Figure 137 SWOT Analysis: Hyundai Mobis

Growth opportunities and latent adjacency in Anti Lock Braking System (ABS) and Electronic Stability Control (ESC) System Market