Antimicrobial Hospital Textiles Market by Material, Usability (Disposable, Reusable), FDA Class (Class I, Class II, Class III), Application (Attire, Surgical supplies & Wipes, Sheets & Blankets), Hospital Department, Region - Global Forecast to 2025

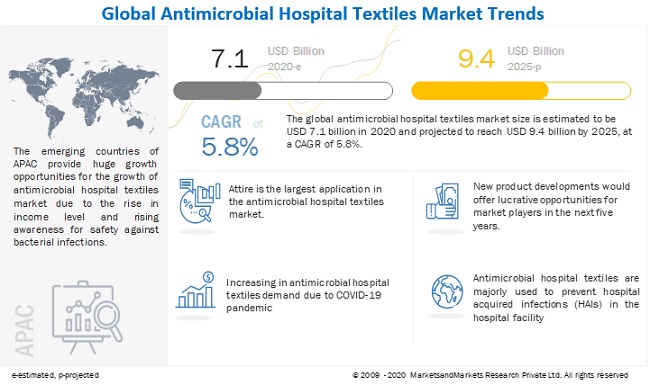

[186 Pages Report] The global antimicrobial hospital textiles market size is estimated at USD 7.1 billion in 2020 and is projected to reach USD 9.4 billion by 2025, at a CAGR of 5.8%. Increasing population, medical infrastructure development & health promotion by government authorities, and increasing affordability are major key driving factors for the growth of the antimicrobial hospital textiles market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Antimicrobial Hospital Textiles Market

COVID-19 has created disruption in various industries. Due to the disruption, the demand for various products has reduced drastically. Production facilities are either forced to close due to government regulations or due to a lack of demand. The demand for various antimicrobial hospital products such as mattresses, masks, caps, surgical supplies & wipes, sheets & blankets has surged in this pandemic situation. Still, manufacturers are facing difficulty in sourcing raw material for various antimicrobial hospital products production. The surge in antimicrobial hospital products is low to fill the gap in production volume cause due to the COVID-19 pandemic. Export activities have reduced drastically or completely shut down to prevent the spread of COVID-19 across the world. Subsequently, transportation through air, water, and land were suspended for almost three months across the world. All these factors have lowered the demand for various products across industries, but the demand for antimicrobial hospital textiles has increased drastically. The use of antimicrobial hospital textiles has increased to prevent hospital-acquired infections (HAIs). They are used in new quarantine centers and hospitals established to service the increased number of patients. Antimicrobial hospital textile manufacturers have increased production to cater to the increased demand in the healthcare industry.

Antimicrobial Hospital Textiles Market Dynamics

Driver: Growing consumer awareness about hygiene in emerging markets

With rising literacy rate and awareness campaigns, consumers are becoming aware of the potential dangers of microorganisms on textiles as well as on the user of textiles. The demand for antimicrobial hospital textiles is rising due to the increased awareness about hygiene, rising disposable income, changing lifestyle, growing concern about health, and increasing pollution. The growth of the healthcare industry is also propelling the demand for antimicrobial hospital textiles significantly. All these factors are expected to drive the market for antimicrobial hospital textiles.

Restraint: Fluctuations in raw material prices

The raw materials for antimicrobial hospital textiles include different types of fibers such as cotton, which are treated with antimicrobial agents such as silver, copper, zinc, and quaternary ammonium compounds (QACs). The price of some raw materials is listed in the commodity market, which is tradable on the stock exchange, resulting in day-to-day fluctuations in the prices. As a result, the prices depend on market forces. Fluctuations in the prices may add to the already high cost of production. This may further affect the demand and supply of the product, which will act as a restraint to the market.

Opportunity: Continuous research and technological advancement

Antimicrobial textiles are gaining popularity among researchers and manufacturers because of their ability to provide safety and quality to the users. Researchers are constantly trying to develop products that are skin-friendly, cost-effective, and environment-friendly. New active agents and fabrics are in the process of development, which can replace the existing, environmentally harmful active agents such as triclosan and PHMB. Manufacturers are trying to differentiate their products by using different active agents or fabrics to gain market share. They are using a different methodology to deliver antimicrobial properties to the fabric. Continuous research and technological advancement are expected to create vast opportunities for the manufacturers of antimicrobial hospital textiles.

Challenges: Environmental and health concerns

Antimicrobial chemicals come in different compositions with a variety of physical and chemical properties. A certain amount of antimicrobial agents are used to impart antimicrobial properties. These chemicals are used on finished products that come in contact with skin, thus, posing a risk to the health of the individual. Furthermore, antimicrobial agents such as QAC, triclosan, and PHMB are released when washed. These chemicals contaminate water bodies and ultimately harm the aquatic life. The challenge for the manufacturer is to overcome the environmental as well as health concerns associated with the release of the antimicrobial content into the surrounding.

To know about the assumptions considered for the study, download the pdf brochure

The cotton segment is estimated to dominate the overall antimicrobial hospital textiles market.

Cotton was the largest material type in the overall antimicrobial hospital textiles market. This is because cotton is susceptible to microbial attack, as is it a naturally occurring plant fiber. Cotton is very soft in nature and renders comfort when it is in contact with the skin. Due to comfort property, it is used more as compared to other antimicrobial hospital textiles material. This factor is driving the demand for cotton in the antimicrobial hospital textiles market.

Attire is the largest application for the antimicrobial hospital textiles market.

Attire is the largest application during the forecast period. The attire worn by the doctors, patients, and staff members in a hospital should be hygienic as it can act as a source of HAIs. Patients with lower immunity are highly susceptible to infections. Attire is used to protect hospital staff and prevent HAIs and is a mandatory practice in hospitals. Hence, the demand for antimicrobial textiles is high in the attire application.

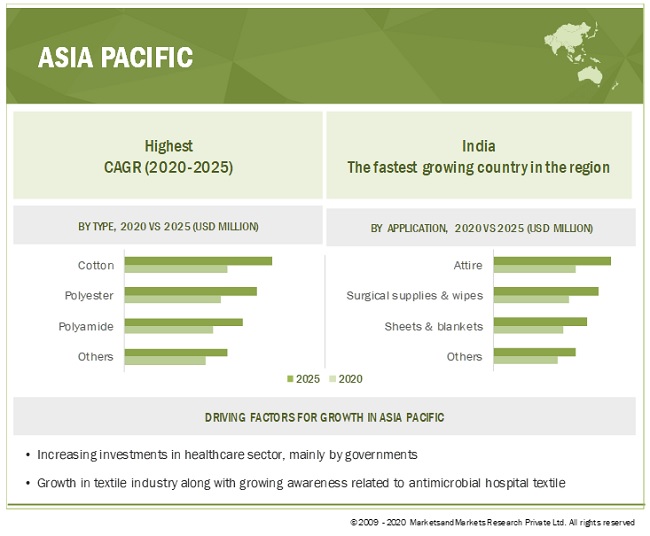

APAC is projected to be the fastest-growing antimicrobial hospital textiles market.

In APAC, the growing population, along with rising investment in the healthcare sector to provide effective and efficient medical service, is expected to drive the market. The demand for high-quality fabric in the region, with textile being one of the major industries in countries such as China and India, is expected to support the demand for antimicrobial hospital textiles in the region. The emerging economies of APAC, such as China, India, and Indonesia, will play a major role in the growth of the antimicrobial hospital textiles market. The expansion of the healthcare industry and the rising awareness regarding health and hygiene will also drive the market during the forecast period.

Key Market Players

Milliken & Company (US), Trevira GmbH (Germany), Unitika Trading Co. Ltd. (Japan), Thai Acrylic Fiber Co. Ltd. (Thailand), PurThread Technologies, Inc. (US), LifeThreads LLC (US), Sinterama (Italy), Smith & Nephew Plc. (UK), and Herculite Inc. (US) are the key players operating in the antimicrobial hospital textiles market. These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for antimicrobial hospital textiles from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year |

2019 |

|

Forecast period |

20202025 |

|

Units considered |

Value (USD) |

|

Segments |

Material, Usability, FDA Class, Application, Hospital Department, and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

Milliken & Company (US), Trevira GmbH (Germany), Unitika Trading Co. Ltd. (Japan), Thai Acrylic Fiber Co. Ltd. (Thailand), PurThread Technologies, Inc. (US), LifeThreads LLC (US), Sinterama (Italy), Smith & Nephew Plc. (UK), and Herculite Inc. (US) |

This research report categorizes the antimicrobial hospital textiles market based on material, usability, FDA class, application, hospital department, and region.

By Material:

- Cotton

- Polyester

- Polyamide

- Others (Polyethylene, Polypropylene, Acrylic, and Cellulose Acetate)

By Usability:

- Disposable

- Reusable

By FDA Class:

- Class I

- Class II

- Class III

By Application:

- Attire

- Surgical Supplies & Wipes

- Sheets & Blankets

- Others (Curtains, Upholstery)

By Hospital Department:

- General Ward

- Surgical Room

- Infectious Disease Ward

- ICU

- Others (Casualty (emergency service), Geriatrics, and Gastroenterology)

By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2020, Milliken & Company acquired Borchers Group Limited (Borchers) (US). This acquisition is aimed at joining Borchers's capabilities with the companys long-term focus on sustainability and innovation. This acquisition will help the company to increase its presence in the North American region.

- In August 2018, Thai Acrylic Fibre Co. Ltd. launched an environmentally friendly solution with its new product called Radianza acrylic fiber.

- In February 2018, Thai Acrylic Fibre Co. Ltd. acquired PyroTex Industries GmbH (Germany), which is a flame and heat resistant fiber manufacturer. This acquisition will help the company to increase its presence in Europe.

- In February 2018, PurThread Technologies, Inc. and Mitsui & Co. (US) entered into an agreement to use PurThreads patented permanent antimicrobial fibers and yarns for textiles and soft goods across Mitsui & Co.s vast production and distribution networks in Japan.

- In March 2017, PurThread Technologies, Inc. collaborated with Cotton Incorporated (US) to bring PurThreads embedded anti-odor solution to woven fabrics and cotton knit.

- In January 2016, Milliken & Company developed an advanced version of the product AlphaSan named AlphaSan AF VT, providing cost-effective antimicrobial and antifungal action.

- In March 2015, Unitika Ltd. decided to increase the production of polyester spun-bond nonwoven fabric from 4,000 tons per year to 10,000 per year at its Pathum Thani, Thailand production facility. This growth strategy is aimed to meet the growing demand for polyester spun bond nonwoven fabric in the APAC region.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the antimicrobial hospital textiles market?

Antimicrobial textiles are gaining popularity among researchers and manufacturers because of their ability to provide safety and quality to the users. Researchers are constantly trying to develop products that are skin-friendly, cost-effective, and environment-friendly. New active agents and fabrics are in the process of development, which can replace the existing, environmentally harmful active agents such as triclosan and PHMB. Continuous research and technological advancement are expected to create vast opportunities for the manufacturers of antimicrobial hospital textiles.

What are the market dynamics for the different types of antimicrobial hospital textiles?

The antimicrobial textiles market is segmented based on material into cotton, polyester, polyamide, and others. Cotton is the largest segment and is also expected to witness the fastest growth rate due to its comfort and easy availability.

What are the market dynamics for the different forms of antimicrobial hospital textiles?

Cotton was the largest material type in the overall antimicrobial hospital textiles market. Cotton is very soft in nature and renders comfort when it is in contact with the skin. Due to comfort property, it is used more as compared to other antimicrobial hospital textiles material. This factor is driving the demand for cotton in the antimicrobial hospital textiles market.

What are the market dynamics for different applications of antimicrobial hospital textiles?

Attire is the largest application during the forecast period. The attire worn by the doctors, patients, and staff members in a hospital should be hygienic as it can act as a source of HAIs. Patients with lower immunity are highly susceptible to infections. Attire is used to protect hospital staff and prevent HAIs and is a mandatory practice in hospitals. Hence, the demand for antimicrobial textiles is high in the attire application.

Who are the major manufacturers of antimicrobial hospital textiles?

Milliken & Company (US), Trevira GmbH (Germany), Unitika Trading Co. Ltd. (Japan), Thai Acrylic Fiber Co. Ltd. (Thailand), PurThread Technologies, Inc. (US), LifeThreads LLC (US), Sinterama (Italy), Smith & Nephew Plc. (UK), and Herculite Inc. (US) are the key players operating in the antimicrobial hospital textiles market.

What are the major factors which will impact market growth during the forecast period?

The demand for antimicrobial hospital textiles is rising due to the increased awareness about hygiene, rising disposable income, changing lifestyle, growing concern about health, and increasing pollution. The growth of the healthcare industry is also propelling the demand for antimicrobial hospital textiles significantly. All these factors are expected to drive the market for antimicrobial hospital textiles.

What are the effects of COVID-19 on the antimicrobial hospital textiles market?

COVID-19 has lowered the demand for various products across industries, but the demand for antimicrobial hospital textiles has increased drastically. The use of antimicrobial hospital textiles has increased to prevent hospital-acquired infections (HAIs). They are used in new quarantine centers and hospitals established to service the increased number of patients. Antimicrobial hospital textile manufacturers have increased production to cater to the increased demand in the healthcare industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH 1

2.2.2 SUPPLY-SIDE APPROACH 2

2.2.3 SUPPLY-SIDE APPROACH 3

2.2.4 DEMAND-SIDE APPROACH 1

2.2.5 DEMAND-SIDE APPROACH 2

2.3 MARKET SIZE ESTIMATION

2.4 DATA TRIANGULATION

2.4.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ANTIMICROBIAL HOSPITAL TEXTILES MARKET

4.2 ANTIMICROBIAL HOSPITAL TEXTILES MARKET GROWTH, BY MATERIAL

4.3 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY USABILITY

4.4 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY FDA CLASS

4.5 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY APPLICATION AND REGION

4.6 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY APPLICATION

4.7 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY HOSPITAL DEPARTMENT

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising demand in healthcare industry for improved healthcare services

5.2.1.2 Growing consumer awareness about hygiene in emerging markets

5.2.1.3 Increasing demand due to COVID-19 pandemic

5.2.2 RESTRAINTS

5.2.2.1 Fluctuations in raw material prices

5.2.2.2 Low efficiency of active agents

5.2.3 OPPORTUNITIES

5.2.3.1 Continuous research and technological advancement

5.2.3.2 Microencapsulation of antimicrobial agents to enhance durability and safety

5.2.4 CHALLENGES

5.2.4.1 Compliance with stringent regulations for protection of the environment

5.2.4.2 Environmental and health concerns

5.3 PORTERS FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 CONTRIBUTION OF HEALTHCARE SECTOR TO GDP

6 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY MATERIAL (Page No. - 47)

6.1 INTRODUCTION

6.2 COTTON

6.2.1 AFFORDABILITY AND WELL-ESTABLISHED MEDICAL INFRASTRUCTURE DRIVE THE SEGMENT IN NORTH AMERICA

6.3 POLYESTER

6.3.1 LESS SUSCEPTIBLE NATURE TO MICROBIAL ATTACK DRIVES ITS DEMAND IN HOSPITAL APPLICATIONS

6.4 POLYAMIDE

6.4.1 SILVER OR COPPER PARTICLES ARE USED TO IMPART ANTIMICROBIAL PROPERTIES ON POLYAMIDE HOSPITAL TEXTILES

6.5 OTHERS

7 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY USABILITY (Page No. - 54)

7.1 INTRODUCTION

7.2 REUSABLE

7.2.1 LONGER LIFETIME OF REUSABLE ANTIMICROBIAL HOSPITAL TEXTILES ATTRIBUTED TO ITS LARGE MARKET

7.3 DISPOSABLE

7.3.1 PROTECTIVE ADVANTAGES OF DISPOSABLE OVER REUSABLE ANTIMICROBIAL HOSPITAL TEXTILES DRIVES THE DEMAND

8 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY FDA CLASS (Page No. - 59)

8.1 INTRODUCTION

8.2 CLASS I

8.2.1 CLASS I MEDICAL DEVICES ARE EASY AND FAST TO BRING TO MARKET DUE TO LITTLE FDA REGULATIONS

8.3 CLASS II

8.3.1 CLASS II MEDICAL DEVICES ARE SUBJECTED TO GENERAL AND SPECIAL CONTROLS

8.4 CLASS III

8.4.1 CLASS III MEDICAL DEVICES ARE SUBJECTED TO GENERAL CONTROLS, SPECIAL CONTROLS AND PREMARKET NOTIFICATION PROCESS

9 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY APPLICATION (Page No. - 65)

9.1 INTRODUCTION

9.2 ATTIRE

9.2.1 ATTIRE TO BE THE LARGEST SEGMENT IN THE ANTIMICROBIAL HOSPITAL TEXTILES MARKET

9.3 SURGICAL SUPPLIES & WIPES

9.3.1 THE DEMAND FOR ANTIMICROBIAL TEXTILES IN SURGICAL SUPPLIES & WIPES IS INCREASING DUE TO HAI

9.4 SHEETS & BLANKETS

9.4.1 USE OF ANTIMICROBIAL SHEETS & BLANKETS CAN PREVENT THE SPREAD OF INFECTIOUS DISEASES

9.5 OTHERS

10 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY HOSPITAL DEPARTMENT (Page No. - 73)

10.1 INTRODUCTION

10.2 GENERAL WARD

10.2.1 LARGE NUMBER OF PATIENTS AND EFFORT TO MINIMIZE INFECTION TO DRIVE THIS SEGMENT

10.3 SURGICAL ROOM

10.3.1 INITIATIVES TO MINIMIZE SURGICAL SITE INFECTION TO DRIVE THE MARKET

10.4 INFECTIOUS DISEASE WARD

10.4.1 SPREAD OF COVID-19 EXPECTED TO DRIVE THE MARKET IN THIS SEGMENT

10.5 ICU

10.5.1 GROWING INVESTMENTS IN HEALTHCARE SECTOR WILL ENHANCE DEMAND IN ICU SEGMENT

10.6 OTHERS

10.6.1 GROWING NUMBER OF HOSPITALS AND BED WILL PROPEL THE MARKET

11 ANTIMICROBIAL TEXTILES MARKET, BY REGION (Page No. - 81)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 High expenditure on healthcare driving the market

11.2.2 CANADA

11.2.2.1 Cotton is most-widely used material for antimicrobial hospital textiles in Canada

11.2.3 MEXICO

11.2.3.1 Growth of healthcare industry fueling demand for antimicrobial hospital textiles

11.3 APAC

11.3.1 CHINA

11.3.1.1 Increasing investments in healthcare sector

11.3.2 JAPAN

11.3.2.1 Aging population requiring better medical facilities to propel market growth

11.3.3 INDIA

11.3.3.1 Growing investment by the government in healthcare sector

11.3.4 INDONESIA

11.3.4.1 Growing investments in healthcare sector to increase demand for antimicrobial hospital textile

11.3.5 AUSTRALIA

11.3.5.1 Increasing expenditure on hospitals by government

11.3.6 REST OF APAC

11.4 EUROPE

11.4.1 GERMANY

11.4.1.1 Demand for hospital antimicrobial textiles likely to increase due to growing healthcare

11.4.2 FRANCE

11.4.2.1 France provides best overall healthcare service in the world

11.4.3 UK

11.4.3.1 Healthcare industry witnessing growth with investment from government and private players

11.4.4 ITALY

11.4.4.1 Expansion of hospitals driving the demand for antimicrobial hospital textiles

11.4.5 SPAIN

11.4.5.1 Growing healthcare expenditure will drive demand for antimicrobial hospital textiles in the country

11.4.6 RUSSIA

11.4.6.1 Governmental initiatives likely to improve demand for antimicrobial textiles in Russia

11.4.7 REST OF EUROPE

11.5 MIDDLE EAST & AFRICA

11.5.1 SAUDI ARABIA

11.5.1.1 Growing population and demand for efficient healthcare services to drive the market

11.5.2 SOUTH AFRICA

11.5.2.1 Public awareness and government programs expected to drive the market

11.5.3 UAE

11.5.3.1 High demand for hospitals and beds expected to propel the demand

11.5.4 REST OF MIDDLE EAST & AFRICA

11.5.4.1 Growing investment related to healthcare will enhance demand for antimicrobial hospital textiles market

11.6 SOUTH AMERICA

11.6.1 134

11.6.2 BRAZIL

11.6.2.1 Investment in healthcare and well-equipped textile industry fueling the demand

11.6.3 ARGENTINA

11.6.3.1 Investment in healthcare infrastructure expected to drive the market

11.6.4 REST OF SOUTH AMERICA

11.6.4.1 Increase in population and growing investment in healthcare to fuel the market

12 IMPACT OF COVID-19 PANDEMIC ON ANTIMICROBIAL HOSPITAL TEXTILES MARKET (Page No. - 140)

13 COMPETITIVE LANDSCAPE (Page No. - 143)

13.1 OVERVIEW

13.2 MARKET RANKING

13.3 COMPETITIVE SCENARIO

13.3.1 NEW PRODUCT DEVELOPMENT

13.3.2 EXPANSION

13.3.3 PARTNERSHIP/COLLABORATION/AGREEMENT

13.3.4 MERGER & ACQUISITION

14 COMPANY PROFILES (Page No. - 147)

14.1 MILLIKEN & COMPANY

14.1.1 BUSINESS OVERVIEW

14.1.2 PRODUCTS OFFERED

14.1.3 RECENT DEVELOPMENTS

14.1.4 SWOT ANALYSIS

14.1.5 WINNING IMPERATIVES

14.1.6 CURRENT FOCUS AND STRATEGIES

14.1.7 THREAT FROM COMPETITION

14.1.8 RIGHT TO WIN

14.2 UNITIKA LTD.

14.2.1 BUSINESS OVERVIEW

14.2.2 PRODUCTS OFFERED

14.2.3 RECENT DEVELOPMENTS

14.2.4 SWOT ANALYSIS

14.2.5 WINNING IMPERATIVES

14.2.6 CURRENT FOCUS AND STRATEGIES

14.2.7 THREAT FROM COMPETITION

14.2.8 RIGHT TO WIN

14.3 TREVIRA GMBH

14.3.1 BUSINESS OVERVIEW

14.3.2 PRODUCTS OFFERED

14.3.3 RECENT DEVELOPMENTS

14.3.4 SWOT ANALYSIS

14.3.5 WINNING IMPERATIVES

14.3.6 CURRENT FOCUS AND STRATEGIES

14.3.7 THREAT FROM COMPETITION

14.3.8 RIGHT TO WIN

14.4 THAI ACRYLIC FIBRE CO. LTD.

14.4.1 BUSINESS OVERVIEW

14.4.2 PRODUCTS OFFERED

14.4.3 RECENT DEVELOPMENTS

14.4.4 SWOT ANALYSIS

14.4.5 WINNING IMPERATIVES

14.4.6 CURRENT FOCUS AND STRATEGIES

14.4.7 THREAT FROM COMPETITION

14.4.8 RIGHT TO WIN

14.5 PURTHREAD TECHNOLOGIES INC.

14.5.1 BUSINESS OVERVIEW

14.5.2 PRODUCTS OFFERED

14.5.3 RECENT DEVELOPMENTS

14.5.4 SWOT ANALYSIS

14.5.5 WINNING IMPERATIVES

14.5.6 CURRENT FOCUS AND STRATEGIES

14.5.7 THREAT FROM COMPETITION

14.5.8 RIGHT TO WIN

14.6 LIFETHREADS LLC

14.6.1 BUSINESS OVERVIEW

14.6.2 PRODUCTS OFFERED

14.6.3 RECENT DEVELOPMENTS

14.6.4 MNM VIEW

14.7 HERCULITE INC.

14.7.1 BUSINESS OVERVIEW

14.7.2 PRODUCTS OFFERED

14.7.3 RECENT DEVELOPMENTS

14.7.4 MNM VIEW

14.8 SMITH & NEPHEW PLC

14.8.1 BUSINESS OVERVIEW

14.8.2 PRODUCTS OFFERED

14.8.3 RECENT DEVELOPMENTS

14.8.4 MNM VIEW

14.9 SINTERAMA

14.9.1 BUSINESS OVERVIEW

14.9.2 PRODUCTS OFFERED

14.9.3 RECENT DEVELOPMENTS

14.9.4 MNM VIEW

14.10 SWICOFIL AG

14.10.1 BUSINESS OVERVIEW

14.10.2 PRODUCTS OFFERED

14.10.3 MNM VIEW

14.11 OTHER KEY PLAYERS

14.11.1 SMARTFIBER AG

14.11.2 TOYOBO CO. LTD.

14.11.3 MEDTRONIC

14.11.4 SURGICOTFAB TEXTILES PRIVATE LIMITED

14.11.5 MEDITEX TECHNOLOGY

14.11.6 BALVIGNA WEAVING MILLS PVT. LTD.

14.11.7 INNOVA TEX

14.11.8 SUN DREAM ENTERPRISE CO. LTD.

14.11.9 MAINE-LEE TECHNOLOGY GROUP, LLC

14.11.10 STAFFORD TEXTILE LTD.

14.11.11 A WORLD OF WIPES

14.11.12 BARJAN MANUFACTURING LTD.

14.11.13 SUZHOU CHUNSHEN ENVIRONMENT PROTECTION FIBER CO. LTD.

14.11.14 BALTEX

15 APPENDIX (Page No. - 178)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (128 TABLES)

TABLE 1 CONTRIBUTION OF HEALTHCARE INDUSTRY TO GDP, 2018 AND 2019 (PERCENTAGE)

TABLE 2 ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 3 COTTON: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 4 POLYESTER: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 5 POLYAMIDE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 6 OTHERS: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 7 ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY, 20182025 (USD MILLION)

TABLE 8 REUSABLE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 9 DISPOSABLE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 10 ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 11 CLASS I: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 CLASS II: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 CLASS III: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 14 ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 15 ATTIRE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 16 SURGICAL SUPPLIES & WIPES: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 SHEETS & BLANKETS: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 18 OTHERS: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 19 ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 20 GENERAL WARD: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 21 SURGICAL ROOM: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 22 INFECTIOUS DISEASE WARD: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 23 ICU: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 24 OTHER: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 25 ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 26 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 27 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 28 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY, 20182025 (USD MILLION)

TABLE 29 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 30 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 31 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 32 US: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 33 US: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 34 US: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 35 CANADA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 36 CANADA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 37 CANADA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 38 MEXICO: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 39 MEXICO: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 40 MEXICO: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 41 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 42 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 43 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY 20182025 (USD MILLION)

TABLE 44 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 45 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 46 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 47 CHINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 48 CHINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 49 CHINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 50 JAPAN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 51 JAPAN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 52 JAPAN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 53 INDIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 54 INDIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 55 INDIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 56 INDONESIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 57 INDONESIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 58 INDONESIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 59 AUSTRALIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 60 AUSTRALIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 61 AUSTRALIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 62 REST OF APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 63 REST OF APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 64 REST OF APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 65 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 66 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 67 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY, 20182025 (USD MILLION)

TABLE 68 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 69 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 70 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 71 GERMANY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 72 GERMANY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 73 GERMANY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 74 FRANCE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 75 FRANCE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 76 FRANCE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 77 UK: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 78 UK: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 79 UK: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 80 ITALY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 81 ITALY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 82 ITALY: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 83 SPAIN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 84 SPAIN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 85 SPAIN: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 86 RUSSIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 87 RUSSIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 88 RUSSIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 89 REST OF EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 90 REST OF EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 91 REST OF EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY 20182025 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 98 SAUDI ARABIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 99 SAUDI ARABIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 100 SAUDI ARABIA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 101 SOUTH AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 102 SOUTH AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 103 SOUTH AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 104 UAE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET, BY MATERIAL SIZE, 20182025 (USD MILLION)

TABLE 105 UAE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 106 UAE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 107 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 109 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 110 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 111 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY METERIAL, 20182025 (USD MILLION)

TABLE 112 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY USABILITY, 20182025 (USD MILLION)

TABLE 113 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY FDA CLASS, 20182025 (USD MILLION)

TABLE 114 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 115 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 116 BRAZIL: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 117 BRAZIL: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 118 BRAZIL: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 119 ARGENTINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 120 ARGENTINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 121 ARGENTINA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 122 REST OF SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY MATERIAL, 20182025 (USD MILLION)

TABLE 123 REST OF SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 124 REST OF SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SIZE, BY HOSPITAL DEPARTMENT, 20182025 (USD MILLION)

TABLE 125 NEW PRODUCT DEVELOPMENT, 20152020

TABLE 126 EXPANSION, 20152020

TABLE 127 PARTNERSHIP/COLLABORATION/AGREEMENT, 20152020

TABLE 128 MERGER & ACQUISITION, 20152020

LIST OF FIGURES (74 FIGURES)

FIGURE 1 MARKET DEFINITION

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: RESEARCH DESIGN

FIGURE 4 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: SUPPLY-SIDE APPROACH - 1

FIGURE 5 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: SUPPLY-SIDE APPROACH - 2

FIGURE 6 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: SUPPLY-SIDE APPROACH 3

FIGURE 7 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: DEMAND-SIDE APPROACH 1

FIGURE 8 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: DEMAND-SIDE APPROACH 2

FIGURE 9 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 10 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 11 ANTIMICROBIAL HOSPITAL TEXTILES MARKET: DATA TRIANGULATION

FIGURE 12 COTTON IS MOST-WIDELY USED SEGMENT IN THE OVERALL MARKET

FIGURE 13 ATTIRE IS LARGEST APPLICATION OF ANTIMICROBIAL HOSPITAL TEXTILES

FIGURE 14 APAC TO BE FASTEST-GROWING ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 15 ATTIRE APPLICATION TO DRIVE DEMAND FOR ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 16 COTTON TO BE LARGEST AND FASTEST-GROWING MATERIAL DURING FORECAST PERIOD

FIGURE 17 REUSABLE SEGMENT ACCOUNT FOR LARGER SHARE OF MARKET IN 2019

FIGURE 18 CLASS I WAS THE DOMINANT SEGMENT IN 2019

FIGURE 19 NORTH AMERICA WAS THE LARGEST MARKET IN 2019

FIGURE 20 ATTIRE TO BE LARGEST APPLICATION DURING FORECAST PERIOD

FIGURE 21 GENERAL WARD WAS THE LARGEST SEGMENT IN 2019

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 23 PORTERS FIVE FORCES ANALYSIS: ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 24 CONTRIBUTION OF HEALTHCARE INDUSTRY TO GDP, 2018 AND 2019

FIGURE 25 COTTON TO BE THE LARGEST MATERIAL IN THE ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 26 NORTH AMERICA TO BE THE LARGEST MARKET IN THE COTTON SEGMENT

FIGURE 27 APAC TO BE THE FASTEST-GROWING REGION IN THE POLYESTER SEGMENT

FIGURE 28 NORTH AMERICA TO BE THE LARGEST REGION IN THE POLYAMIDE SEGMENT

FIGURE 29 APAC TO BE THE FASTEST-GROWING MARKET IN THE OTHERS SEGMENT

FIGURE 30 REUSABLE TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 31 NORTH AMERICA TO BE THE LARGEST REGION IN THE USABILITY SEGMENT

FIGURE 32 APAC TO BE LARGEST MARKET FOR DISPOSABLE ANTIMICROBIAL HOSPITAL TEXTILES

FIGURE 33 CLASS I TO BE THE LARGEST SEGMENT IN ANTIMICROBIAL HOSPITAL TEXTILES MARKET

FIGURE 34 NORTH AMERICA TO BE LARGEST MARKET FOR CLASS I SEGMENT

FIGURE 35 APAC TO BE FASTEST-GROWING MARKET FOR CLASS II SEGMENT

FIGURE 36 NORTH AMERICA TO BE LARGEST MARKET FOR CLASS III SEGMENT

FIGURE 37 ATTIRE TO BE THE LARGEST APPLICATION OF ANTIMICROBIAL HOSPITAL TEXTILES

FIGURE 38 APAC TO BE THE FASTEST-GROWING MARKET IN SURGICAL SUPPLIES & WIPES APPLICATION

FIGURE 39 APAC TO BE THE LARGEST MARKET IN THE SHEETS & BLANKETS APPLICATION

FIGURE 40 APAC TO BE THE LARGEST MARKET IN THE OTHERS APPLICATION

FIGURE 41 GENERAL WARD TO DOMINATE OVERALL ANTIMICROBIAL HOSPITAL TEXTILES MARKET BETWEEN 2020 TO 2025

FIGURE 42 NORTH AMERICA DOMINATED MARKET IN GENERAL WARD SEGMENT

FIGURE 43 NORTH AMERICA DOMINATED ANTIMICROBIAL HOSPITAL TEXTILES IN SURGICAL ROOM SEGMENT OF

FIGURE 44 APAC DOMINATED MARKET IN INFECTIOUS DISEASE WARD SEGMENT

FIGURE 45 APAC DOMINATED ANTIMICROBIAL HOSPITAL TEXTILES MARKET IN ICU SEGMENT

FIGURE 46 APAC DOMINATES MARKET IN THE OTHERS SEGMENT

FIGURE 47 INDIA TO BE FASTEST-GROWING MARKET FOR ANTIMICROBIAL HOSPITAL TEXTILES

FIGURE 48 NORTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SNAPSHOT

FIGURE 49 APAC: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SNAPSHOT

FIGURE 50 EUROPE: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SNAPSHOT

FIGURE 51 MIDDLE EAST & AFRICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SNAPSHOT

FIGURE 52 SOUTH AMERICA: ANTIMICROBIAL HOSPITAL TEXTILES MARKET SNAPSHOT

FIGURE 53 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AS THE KEY GROWTH STRATEGY, 20152020

FIGURE 54 MARKET RANKING

FIGURE 55 MILLIKEN & COMPANY: COMPANY SNAPSHOT

FIGURE 56 MILLIKEN & COMPANY: SWOT ANALYSIS

FIGURE 57 MILLIKEN & COMPANY: WINNING IMPERATIVES

FIGURE 58 UNITIKA LTD.: COMPANY SNAPSHOT

FIGURE 59 UNITIKA LTD.: SWOT ANALYSIS

FIGURE 60 UNITIKA LTD.: WINNING IMPERATIVES

FIGURE 61 TREVIRA GMBH: COMPANY SNAPSHOT

FIGURE 62 TREVIRA GMBH: SWOT ANALYSIS

FIGURE 63 TREVIRA GMBH: WINNING IMPERATIVES

FIGURE 64 THAI ACRYLIC FIBRES CO. LTD.: COMPANY SNAPSHO

FIGURE 65 THAI ACRYLIC FIBRES CO. LTD.: SWOT ANALYSIS

FIGURE 66 THAI ACRYLIC FIBRES CO. LTD.: WINNING IMPERATIVES

FIGURE 67 PURTHREAD TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 68 PURTHREAD TECHNOLOGIES INC.: SWOT ANALYSIS

FIGURE 69 PURTHREAD TECHNOLOGIES INC.: WINNING IMPERATIVES

FIGURE 70 LIFETHREADS LLC: COMPANY SNAPSHOT

FIGURE 71 HERCULITE INC.: COMPANY SNAPSHOT

FIGURE 72 SMITH & NEPHEW PLC: COMPANY SNAPSHOT

FIGURE 73 SINTERAMA: COMPANY SNAPSHOT

FIGURE 74 SWICOFIL AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for the antimicrobial hospital textiles. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

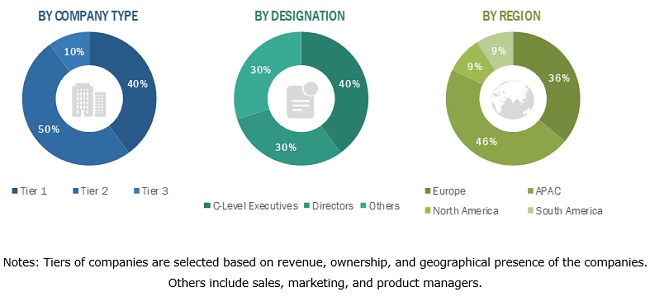

The antimicrobial hospital textiles market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The antimicrobial hospital textiles market is witnessing high growth owing to growth in per capita income level, increasing affordability of healthcare services, and due to COVID-19. Growth in the market is also backed by the increasing healthcare expenditure by governmental authorities, the growing healthcare industry, and the rising awareness of consumers regarding health and hygiene. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the antimicrobial hospital textiles market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global antimicrobial hospital textiles market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the antimicrobial hospital textiles market based on material, usability, FDA class, application, and hospital department

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America, along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Growth opportunities and latent adjacency in Antimicrobial Hospital Textiles Market