App Analytics Market by Offering, Type (Mobile Apps and Web Apps), Application (Advertising & Marketing Analytics, App Performance & Operations Management, Conversion Tracking, User Analytics), Vertical and Region - Global Forecast to 2028

App Analytics Market Overview

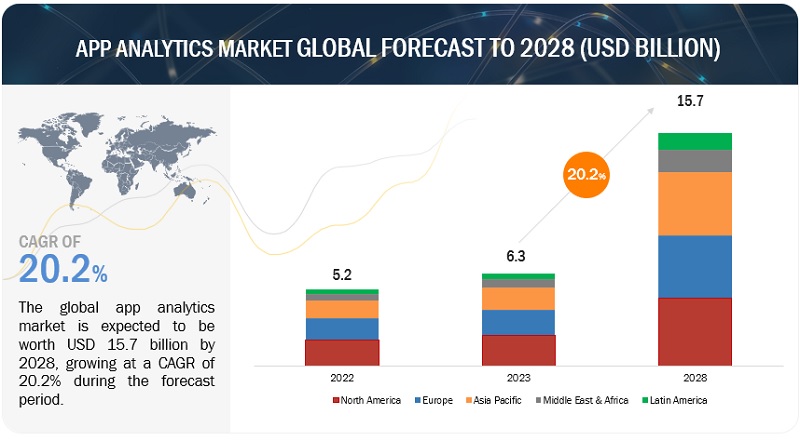

The global App Analytics Market size was valued at US$5.2 billion in 2022 and is projected to grow from US$6.3 billion in 2023 to US$15.7 billion in 2028 at a CAGR of 20.2% during the forecast period.

The app analytics is expected to grow at a significant rate, owing to the implementation of digital transformation strategies, deeper smartphone penetration, increasing number of mobile apps and use of apps for advertising and marketing of businesses, heavy funding by the investors, several government initiatives, and recent market developments (partnerships, mergers, and acquisitions) in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

App Analytics Market Growth Dynamics

Driver: Increase in use of apps for mobile advertising

With the augmentation of the internet and mobile phones, various social media platforms have virtually economized technology. According to a report by Data.ai, advertising represents more than two-thirds of the USD 500 billion mobile app economy, with USD 336 billion (67%) coming from advertising and USD 167 billion (33%) coming from in-app purchases. Hence, the market for mobile advertising is expected to grow significantly. Organizations are spending more on mobile apps to track user activities. Despite regulatory restrictions and tightening budgets, the mobile advertising market remains strong, with ad spending driving USD 2 out of every USD 3 spent on mobile, according to Data.ai’s latest findings.

Restraint: Integration and implementation complexities

Integrating app analytics tools with existing app infrastructure and workflows can be a complex and time-consuming process. Organizations often encounter difficulties when trying to implement and configure app analytics solutions, especially when dealing with legacy systems or multiple third-party integrations. Technical complexities, customization requirements, and compatibility issues with existing app development frameworks can hinder the seamless integration of analytics tools. This can require substantial effort and expertise from development teams, leading to delays in implementation and potentially impacting time-to-market for app analytics initiatives. Moreover, organizations may face challenges in aligning data collection methodologies and tagging mechanisms across different platforms, making it difficult to consolidate and analyze data effectively.

Opportunity: Rise in efforts to enhance customer experience

The growing demand for real-time analytics presents a significant opportunity for the app analytics market. Businesses across various industries are recognizing the value of immediate insights and actionable data to drive their decision-making processes. Real-time app analytics solutions enable businesses to track and monitor user behavior, app performance, and engagement metrics in real time, empowering them to make timely interventions and optimize app experiences. Real-time analytics also provides businesses with a competitive edge by allowing them to respond quickly to changing user needs and market trends.

Challenge: Highly fragmented app ecosystem poses a significant challenge for market

The fragmented app ecosystem poses a significant challenge for the app analytics market. The app ecosystem is characterized by a wide range of operating systems, platforms, and devices, each with its own unique features, policies, and limitations. This fragmentation creates complexities for app analytics providers in terms of compatibility, data consistency, and comprehensive insights. The diverse array of operating systems, such as iOS, Android, and Windows, each have their own rules and regulations regarding data collection and analytics.

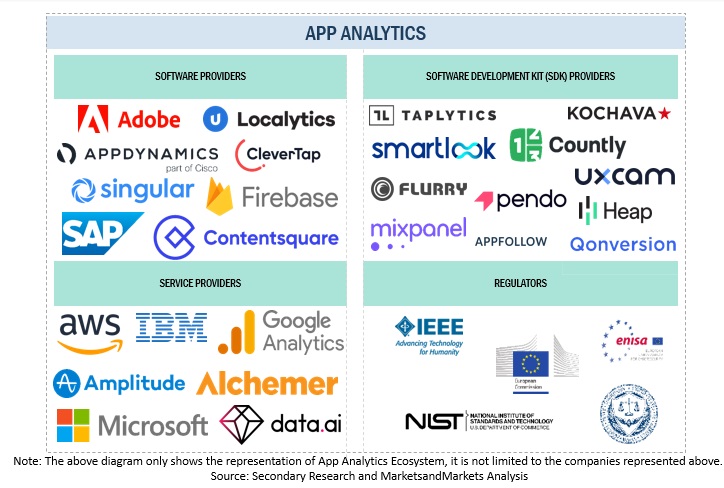

App Analytics Market Ecosystem

The app analytics market report covers market ecosystem which comprises software providers, service providers, Software Development Kit (SDK) providers, and regulators.

By vertical, BFSI segment accounts for the largest market size during the forecast period

App analytics in the Banking, Financial Services, and Insurance (BFSI) vertical refers to the application of app analytics specifically tailored to the unique needs and requirements of the financial industry. It involves tracking and analyzing user behavior, engagement, and transactions within mobile banking, investment, insurance, and other financial applications. App analytics in the BFSI vertical provides valuable insights into user interactions, customer journeys, and app performance metrics, allowing financial institutions to optimize their mobile app experiences and drive customer satisfaction.

By type, web apps segment is projected to grow at the highest CAGR during the forecast period

Web apps offer a flexible and accessible approach to delivering services and functionality to users across different devices and platforms. They are particularly suitable for content-based applications, service-oriented apps, and scenarios where frequent app updates or cross-platform compatibility are crucial. Web analytics also helps businesses evaluate the effectiveness of marketing campaigns, measure user engagement, and identify areas for improvement. It provides valuable data for eCommerce optimization, allowing businesses to track user journeys, identify drop-off points, and optimize the purchase funnel.

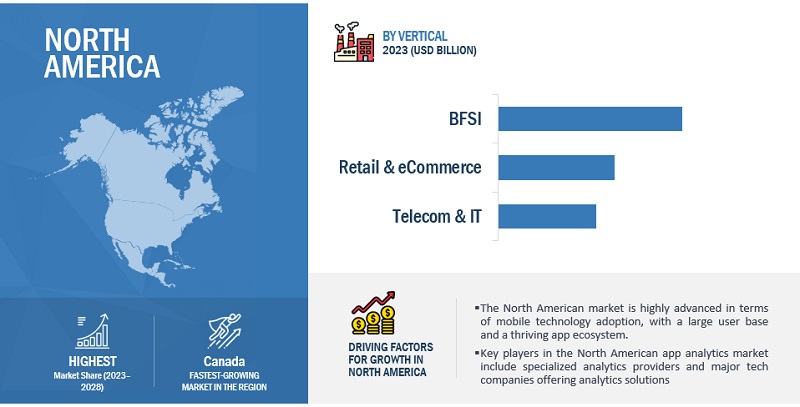

North America to account for the largest market size during the forecast period

The North American market is highly advanced in terms of mobile technology adoption, with a large user base and a thriving app ecosystem. The North American app analytics market growth is fueled by technological advancements across major verticals, such as BFSI; retail; media & entertainment; logistics, travel, and transportation; and telecom & IT. For the advancement of industrial digitization, the US government started many initiative programs and campaigns. Some of the leading providers of app analytics solutions in North America include Google Analytics for Apps, Adobe Analytics and Mixpanel.

Key Market Players

The major app analytics market include Google (US), Microsoft (US), AWS (US), IBM (US), Adobe (US), SAP SE (Germany), Amplitude (US), Upland Software (US), Mixpanel (US) and Kochava (US). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partne

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 6.3 billion |

|

Revenue forecast for 2028 |

USD 15.7 billion |

|

Growth Rate |

20.2% CAGR |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Type, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Companies covered |

Google (US), Microsoft (US), AWS (US), IBM (US), Adobe (US), SAP SE (Germany), Amplitude (US), Upland Software (US), Mixpanel (US), Kochava (US), Flurry (US), UXCam (US), Qonversion (US), Taplytics (Canada), ContentSquare (France), Countly (England), AppDynamics (US), Smartlook (Czech Republic), AppFollow (Finland), CleverTap (US), Singular (US), Heap (US), Data.ai (US), Pendo.io (US), and Alchemer LLC (US). |

This research report categorizes the App analytics market based on Offering, Type, Application, Vertical, and Region.

By Offering:

-

Software

- Android

- iOS

- Windows

- Services

By Type:

- Mobile Apps

- Web Apps

By Application:

- Advertising and Marketing Analytics

- App performance and Operations management

- Conversion tracking

- User Analytics

- Revenue management

- Other Applications

By Vertical:

- BFSI

- Retail and Ecommerce

- Telecom & IT

- Healthcare and Life Sciences

- Media & Entertainment

- Transportations, and Logistics

- Gaming

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments:

- In June 2023, Cisco acquired Smartlook, a provider of user behavior analytics solutions. This acquisition was aimed at enhancing Cisco’s offerings in the application performance monitoring space, particularly for Cisco AppDynamics and Cisco Full Stack Observability.

- In April 2023, Amplitude released new features to help teams collaborate more efficiently, get better insights into user conversion, and track the impact of marketing campaigns. These features included Space edit access, updated funnel charts, and Campaign Reporting.

- In June 2022, Google introduced new product updates to Firebase Crashlytics, including improved Flutter app crash reporting, increased developer productivity, filtering crashes, and unity crash handling.

- In, January 2021, Upland Software acquired Localytics, a leading provider of mobile app personalization and analytics solutions. This acquisition would allow Upland to provide its customers with a more comprehensive and sophisticated mobile app experience. Localytics’ technology will be integrated into Upland’s Customer Experience Management (CXM) Cloud, which will enable businesses to deliver personalized app experiences across all digital channels.

Frequently Asked Questions (FAQ):

What is App analytics?

App analytics refers to the process of collecting, measuring, and analyzing data related to the usage and performance of a mobile application. It provides valuable insights into user behavior, engagement, and overall app performance, helping app developers and businesses make informed decisions to enhance their app’s success.

Which region is expected to hold the highest share in the app analytics market?

North America is expected to dominate the app analytics market in 2028. The growing reliance on mobile apps for various activities such as communication, entertainment, shopping, and productivity fuels the demand for app analytics in North America.

Which are key verticals adopting app analytics software and services?

Key verticals adopting app analytics software and services include BFSI, Retail & eCommerce, Healthcare & Lifesciences, Telecom & IT, Transportation & Logistics, Media & Entertainment, Gaming and others verticals, which comprise Education and Travel & Hospitality.

Which are the key drivers supporting the market growth for app analytics?

The key drivers supporting the market growth for app analytics include the implementation of digital transformation strategies, deeper smartphone penetration and increasing number of mobile apps and use of apps for mobile advertising.

Who are the key vendors in the market for app analytics?

The key vendors in the global App analytics market include are Google (US), Microsoft (US), AWS (US), IBM (US), Adobe (US), SAP SE (Germany), Amplitude (US), Upland Software (US), Mixpanel (US), Kochava (US), Flurry (US), UXCam (US), Qonversion (US), Taplytics (Canada), ContentSquare (France), Countly (England), AppDynamics (US), Smartlook (Czech Republic), AppFollow (Finland), CleverTap (US), Singular (US), Heap (US), Data.ai (US), Pendo.io (US), and Alchemer LLC (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in use of apps for mobile advertising- Implementation of digital transformation strategies- Greater smartphone penetration and increase in number of mobile and web appsRESTRAINTS- Integration and implementation complexities- Users’ skepticism about data securityOPPORTUNITIES- Rise in efforts to enhance customer experience- Integration with marketing technologies- Focus on higher RoICHALLENGES- Highly fragmented app ecosystem- User opt-in and consent with data collection concerns- Concerns over privacy and data protection in mobile apps

-

5.3 CASE STUDY ANALYSISUXCAM AND RECORA: IMPROVING APP PERFORMANCE AND REDUCED CHURNGOOGLE AND DOODLE: DRIVING USER ENGAGEMENT AND STABILITYSMARTLOOK AND DISIVO: IMPROVING USER EXPERIENCE AND PRICING ACCURACY WITH APP ANALYTICSMIXPANEL AND TICKETMASTER ONE: ENHANCING B2B CUSTOMER INSIGHTS AND ENGAGEMENTMIXPANEL AND BOLL & BRANCH: PROGRESSING CONVERSIONS AND ENGAGEMENT USING APP ANALYTICS

- 5.4 BRIEF HISTORY EVOLUTION OF MARKET

- 5.5 TECHNOLOGY ROADMAP OF APP ANALYTICS MARKET LANDSCAPE

- 5.6 SUPPLY/VALUE CHAIN ANALYSIS

- 5.7 PRICING MODEL ANALYSIS

-

5.8 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.9 TECHNOLOGY ANALYSISSMART WEARABLESIOT AND SMART OBJECTSARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGAUGMENT REALITY AND VIRTUAL REALITYCLOUD PLATFORM STORAGE/CLOUD COMPUTING

-

5.10 BY APP ANALYTICS TYPESNATIVE APPSHYBRID APPS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

6.1 INTRODUCTIONOFFERING: APP ANALYTICS MARKET DRIVERS

-

6.2 SOFTWAREGROWING EMPHASIS ON USER ENGAGEMENT AND RETENTIONIOS- Evolving mobile landscape with advancements in iOS technologiesANDROID- Global increase in popularity of Android devicesWINDOWS- Continuous advancements in Windows ecosystemOTHER SOFTWARE

-

6.3 SERVICESRISE IN DEMAND FOR EXPERTISE AND GUIDANCE FROM APP ANALYTICS PROFESSIONALS

-

7.1 INTRODUCTIONTYPE: APP ANALYTICS MARKET DRIVERS

-

7.2 MOBILE APPSINCREASE IN DOMINANCE OF MOBILE DEVICES

-

7.3 WEB APPSEFFECTIVE CROSS-PLATFORM COMPATIBILITY

-

8.1 INTRODUCTIONAPPLICATION: APP ANALYTICS MARKET DRIVERS

-

8.2 REVENUE MANAGEMENTHIGHER FOCUS ON USER-CENTRIC MONETIZATION

-

8.3 APP PERFORMANCE & OPERATIONS MANAGEMENTADOPTION OF AGILE METHODOLOGIESAPI LATENCY & RESPONSE TIMECRASH REPORTING & ERROR TRACKINGCROSS-PLATFORM ANALYSISBOTTLENECK MANAGEMENT

-

8.4 USER ANALYTICSPERSONALIZED EXPERIENCES TO DRIVE USER ENGAGEMENTIN-APP BEHAVIORAL ANALYTICSTOUCH HEATMAPS

-

8.5 CONVERSION TRACKINGPROLIFERATION OF MOBILE ADVERTISING PLATFORMSAPP INSTALLATIONSAPP CHURN RATE MEASUREMENT & ANALYSIS

-

8.6 ADVERTISING & MARKETING ANALYTICSGROWTH IN COMPETITION IN DIGITAL ADVERTISING SPACECAMPAIGN ANALYTICSAD ATTRIBUTION ANALYSISCONVERSION FUNNEL ANALYSIS

- 8.7 OTHER APPLICATIONS

-

9.1 INTRODUCTIONVERTICAL: APP ANALYTICS MARKET DRIVERS

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.3 RETAIL & ECOMMERCE

- 9.4 TELECOM & IT

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.6 MEDIA & ENTERTAINMENT

- 9.7 TRANSPORTATION & LOGISTICS

- 9.8 GAMING

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: APP ANALYTICS MARKET DRIVERSNORTH AMERICA: IMPACT OF RECESSIONUS- Inclination toward innovation and R&D in AICANADA- Advent of new digital economy powered by IoT

-

10.3 EUROPEEUROPE: APP ANALYTICS MARKET DRIVERSEUROPE: IMPACT OF RECESSIONUK- Huge competition and increased social media adoption in retail industryGERMANY- Initiatives for technological developments by various companiesFRANCE- Rise in demand for better and faster predictive resultsREST OF EUROPE

-

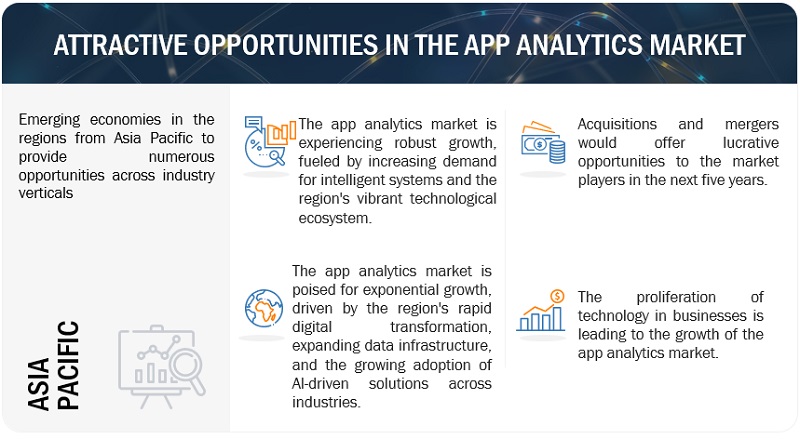

10.4 ASIA PACIFICASIA PACIFIC: APP ANALYTICS MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONCHINA- Relaxed government regulations, investments, and promotion of widespread wireless internet servicesJAPAN- Federal support and strong organic growth capabilitiesASEAN- Funding technological advancements and innovationsREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: APP ANALYTICS MARKET DRIVERSMIDDLE EAST & AFRICA: IMPACT OF RECESSIONMIDDLE EAST- New digital technologies focusing on apps with native languagesSOUTH AFRICA- Investment in research & development in South Africa

-

10.6 LATIN AMERICALATIN AMERICA: APP ANALYTICS MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Government initiatives that include research and policies on AIMEXICO- Increase in customer base and government support for emerging technologiesREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSGOOGLE- Business overview- Products offered- Recent developments- MnM viewMICROSOFT- Business overview- Products offered- Recent developments- MnM viewAWS- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewADOBE- Business overview- Products offered- Recent developments- MnM viewSAP- Business overview- Products offered- Recent developmentsAMPLITUDE- Business overview- Products offered- Recent developmentsUPLAND SOFTWARE- Business overview- Products offered- Recent developmentsMIXPANEL- Business overview- Products offered- Recent developmentsKOCHAVA- Business overview- Products offered- Recent developments

-

12.3 OTHER PLAYERSFLURRYUXCAMTAPLYTICSCONTENTSQUAREPENDO.IOQONVERSIONCOUNTLYAPPDYNAMICSSMARTLOOKAPPFOLLOWCLEVERTAPSINGULARHEAPDATA.AIALCHEMER LLC

-

13.1 ADJACENT AND RELATED MARKETSINTRODUCTIONMOBILE APPS & WEB ANALYTICS MARKET - GLOBAL FORECAST TO 2027- Market definition- Market overviewMOBILE MAPPING MARKET - GLOBAL FORECAST TO 2026- Market definition- Market overview

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 APP ANALYTICS MARKET SIZE AND GROWTH RATE, 2018–2022 (USD MILLION, Y-O-Y)

- TABLE 4 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y)

- TABLE 5 SHORT-TERM ROADMAP, 2023–2025

- TABLE 6 MID-TERM ROADMAP, 2026–2028

- TABLE 7 LONG-TERM ROADMAP, 2029–2030

- TABLE 8 PRICING LEVELS

- TABLE 9 PATENTS FILED, 2013–2023

- TABLE 10 TOP TEN PATENT OWNERS, 2013–2023

- TABLE 11 PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 17 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 19 MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 20 SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 25 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 MOBILE APPS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 MOBILE APPS: APP ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 WEB APPS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 WEB APPS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 31 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 REVENUE MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 REVENUE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 APP PERFORMANCE & OPERATIONS MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 APP PERFORMANCE & OPERATIONS MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 USER ANALYTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 USER ANALYTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 CONVERSION TRACKING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 CONVERSION TRACKING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 ADVERTISING & MARKETING ANALYTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 ADVERTISING & MARKETING ANALYTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 45 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 46 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 RETAIL & ECOMMERCE: APP ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 TELECOM & IT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 TELECOM & IT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 HEALTHCARE & LIFESCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 HEALTHCARE & LIFESCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 GAMING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 GAMING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 77 EUROPE: APP ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2017–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY/REGION, 2017–2022 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: APP ANALYTICS MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 113 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 115 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 117 LATIN AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 119 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 121 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 123 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 124 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 125 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 126 COMPETITIVE BENCHMARKING FOR KEY PLAYERS, 2023

- TABLE 127 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 128 COMPETITIVE BENCHMARKING OF SMES/STARTUPS, 2023

- TABLE 129 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 130 MARKET: DEALS, 2020–2023

- TABLE 131 APP ANALYTICS MARKET: OTHERS, 2020–2023

- TABLE 132 GOOGLE: BUSINESS OVERVIEW

- TABLE 133 GOOGLE: PRODUCTS OFFERED

- TABLE 134 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 135 GOOGLE: DEALS

- TABLE 136 GOOGLE: OTHERS

- TABLE 137 MICROSOFT: BUSINESS OVERVIEW

- TABLE 138 MICROSOFT: PRODUCTS OFFERED

- TABLE 139 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 140 MICROSOFT: DEALS

- TABLE 141 AWS: BUSINESS OVERVIEW

- TABLE 142 AWS: PRODUCTS OFFERED

- TABLE 143 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 144 AWS: DEALS

- TABLE 145 AWS: OTHERS

- TABLE 146 IBM: BUSINESS OVERVIEW

- TABLE 147 IBM: PRODUCTS OFFERED

- TABLE 148 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 149 IBM: DEALS

- TABLE 150 ADOBE: BUSINESS OVERVIEW

- TABLE 151 ADOBE: PRODUCTS OFFERED

- TABLE 152 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 153 ADOBE: DEALS

- TABLE 154 SAP: BUSINESS OVERVIEW

- TABLE 155 SAP: PRODUCTS OFFERED

- TABLE 156 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 157 SAP: DEALS

- TABLE 158 SAP: OTHERS

- TABLE 159 AMPLITUDE: BUSINESS OVERVIEW

- TABLE 160 AMPLITUDE: PRODUCTS OFFERED

- TABLE 161 AMPLITUDE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 162 AMPLITUDE: DEALS

- TABLE 163 UPLAND SOFTWARE: BUSINESS OVERVIEW

- TABLE 164 UPLAND SOFTWARE: PRODUCTS OFFERED

- TABLE 165 UPLAND SOFTWARE: DEALS

- TABLE 166 MIXPANEL: BUSINESS OVERVIEW

- TABLE 167 MIXPANEL: PRODUCTS OFFERED

- TABLE 168 MIXPANEL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 169 MIXPANEL: DEALS

- TABLE 170 MIXPANEL: OTHERS

- TABLE 171 KOCHAVA: BUSINESS OVERVIEW

- TABLE 172 KOCHAVA: PRODUCTS OFFERED

- TABLE 173 KOCHAVA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 174 KOCHAVA: DEALS

- TABLE 175 MOBILE APPS & WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y)

- TABLE 176 MOBILE APPS & WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y)

- TABLE 177 MOBILE APPS & WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 178 MOBILE APPS & WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 179 MOBILE APPS & WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 180 MOBILE APPS & WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 181 MOBILE APPS & WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 182 MOBILE APPS & WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 183 MOBILE APPS & WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 184 MOBILE APPS & WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 185 MOBILE APPS & WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 186 MOBILE APPS & WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 187 MOBILE APPS & WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 188 MOBILE APPS & WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 189 MOBILE MAPPING MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 190 MOBILE MAPPING MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 191 MOBILE MAPPING MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 192 MOBILE MAPPING MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 193 MOBILE MAPPING MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 194 MOBILE MAPPING MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 APP ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 APPROACH 1 (SUPPLY SIDE): REVENUE FROM OFFERING OF MARKET

- FIGURE 4 APPROACH 2 (BOTTOM-UP, SUPPLY-SIDE): COLLECTIVE REVENUE FROM OFFERING OF APP ANALYTICS PLAYERS

- FIGURE 5 APPROACH 3 (BOTTOM-UP, SUPPLY-SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM OFFERING OF APP ANALYTICS

- FIGURE 6 APPROACH 4 (BOTTOM-UP, DEMAND-SIDE): SHARE OF APP ANALYTICS OFFERING THROUGH OVERALL APP ANALYTICS SPENDING

- FIGURE 7 FACTOR ANALYSIS

- FIGURE 8 APP ANALYTICS SOFTWARE TO BE LARGER MARKET OFFERING IN 2023

- FIGURE 9 ANDROID TO BE LARGER SOFTWARE MARKET IN 2023

- FIGURE 10 MOBILE APPS TO BE LARGER TYPE MARKET IN 2023

- FIGURE 11 ADVERTISING & MARKETING ANALYTICS TO BE LARGEST APPLICATION MARKET IN 2023

- FIGURE 12 BFSI VERTICAL TO BE LARGEST MARKET IN 2023

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 14 HIGHER DEMAND FOR MOBILE APPLICATIONS ACROSS VERTICALS DURING FORECAST PERIOD

- FIGURE 15 BFSI TO BE LARGEST VERTICAL DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO BE LARGEST MARKET IN 2023

- FIGURE 17 SOFTWARE AND BFSI TO BE LARGEST IN RESPECTIVE SEGMENTS IN 2023

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 SUPPLY/VALUE CHAIN ANALYSIS

- FIGURE 20 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 21 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 ANDROID SOFTWARE TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 25 WEB APPS TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 CONVERSION TRACKING APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 BANKING, FINANCIAL SERVICES, AND INSURANCE TO BE LARGEST VERTICAL IN 2023

- FIGURE 28 INDIA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS FOR KEY COMPANIES, 2018–2022 (USD MILLION)

- FIGURE 33 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 34 COMPANY EVALUATION MATRIX, 2023

- FIGURE 35 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPS, 2023

- FIGURE 36 GOOGLE: COMPANY SNAPSHOT

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 38 AWS: COMPANY SNAPSHOT

- FIGURE 39 IBM: COMPANY SNAPSHOT

- FIGURE 40 ADOBE: COMPANY SNAPSHOT

- FIGURE 41 SAP: COMPANY SNAPSHOT

- FIGURE 42 AMPLITUDE: COMPANY SNAPSHOT

- FIGURE 43 UPLAND SOFTWARE: COMPANY SNAPSHOT

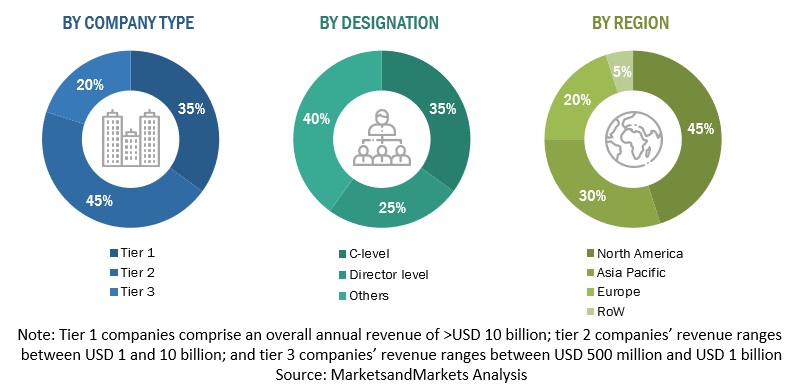

The research methodology for the global app analytics market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering app analytics offerings, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

During the secondary research phase, multiple secondary sources were consulted to identify and gather information for this study. These sources encompassed a range of materials such as annual reports, press releases, investor presentations, whitepapers, technology journals, certified publications, articles authored by recognized experts, directories, and databases. The primary focus of the secondary research was to extract essential details regarding the value chain of the global app analytics industry, the complete spectrum of key players, market categorizations, and industry trends down to the most granular level, regional markets, as well as significant developments from both market and technology perspectives.

Primary Research

For the primary research phase of this report on the global app analytics market, a range of primary sources from both the demand and supply sides were interviewed to acquire qualitative and quantitative information. On the supply side, industry experts including CEOs, VPs, marketing directors, technology and innovation directors, and other key executives from prominent companies and organizations operating in the global app analytics market were consulted. Following comprehensive market engineering, which involved calculations for market statistics, breakdown, size estimation, forecasting, and data triangulation, extensive primary research was conducted. The purpose was to gather information, verify and validate the estimated figures derived from our analysis. Primary research was also carried out to identify segmentation types, industry trends, key players, the competitive landscape of the global market, as well as key market dynamics such as drivers, restraints, opportunities, industry trends, and strategies employed by key players.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

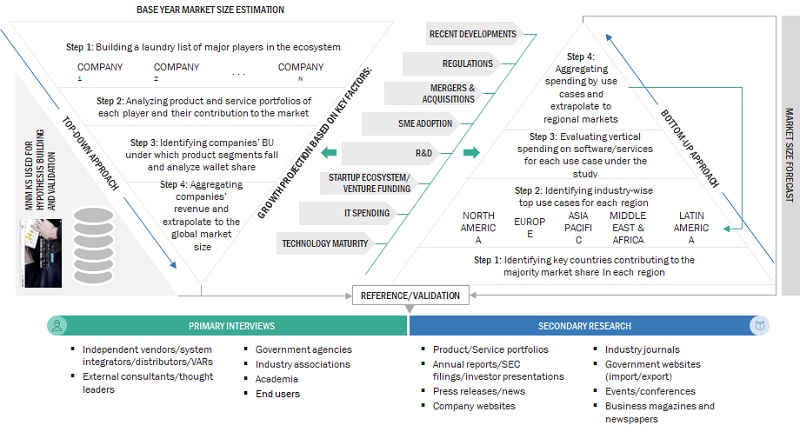

App Analytics Market Size Estimation

The market engineering process was conducted comprehensively, employing both top-down and bottom-up approaches. Multiple data triangulation methods were utilized to estimate and forecast the market for the various segments outlined in the report. Extensive qualitative and quantitative analyses were carried out as part of the market engineering process to provide key information and insights throughout the report. The market size for the global app analytics market was determined by calculating the revenues generated from major regions, namely North America, Europe, APAC, MEA, and Latin America. This calculation involved studying the annual and financial reports of top market players and conducting in-depth interviews with industry leaders such as CEOs, VPs, directors, and marketing executives to gather key insights. All percentage shares, splits, and breakdowns presented in the report were derived from secondary sources and validated through primary sources. Every possible parameter influencing the markets covered in this research study was carefully considered, thoroughly examined through primary research, and analyzed to obtain the final quantitative and qualitative data. The consolidated data, incorporating detailed inputs and analysis from MarketsandMarkets, is presented in this report to provide a comprehensive view of the market.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of app analytics software and services among different end users in major countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of app analytics software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering app analytics was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of software and service offerings and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size.

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Avi Networks, application (app) analytics is the process of capturing, analyzing, and delivering meaningful insights from application usage and metrics within application delivery.

According to MarketsandMarkets, app analytics refers to the process of collecting, measuring, and analyzing data generated by mobile applications (apps) to gain insights into user behavior, app performance, and overall app usage. It involves tracking and interpreting various metrics and data points to understand how users engage with an app, identify areas for improvement, and make informed decisions to optimize the app’s performance and user experience.

Key Stakeholders

- App analytics software providers

- App analytics service providers

- Regulatory agencies

- Government entities

Report Objectives

- To define, describe, and forecast the global app analytics market, based on offering (software and service), types, applications, verticals, and regions, with respect to individual growth trends and contributions toward the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the app analytics market

- To analyze competitive developments, such as mergers & acquisitions, product developments, and research & development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American market for App analytics

- Further breakup of the European market for App analytics

- Further breakup of the Asia Pacific market for App analytics

- Further breakup of the Middle East & Africa market for App analytics

- Further breakup of the Latin America market for App analytics

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in App Analytics Market