Audio Codec Market by Component Type (Hardware and Software), Application (Desktop and Laptop, Mobile Phone and Tablet, Headphones, Headset and Wearable Devices), and Region - Global Forecast to 2025

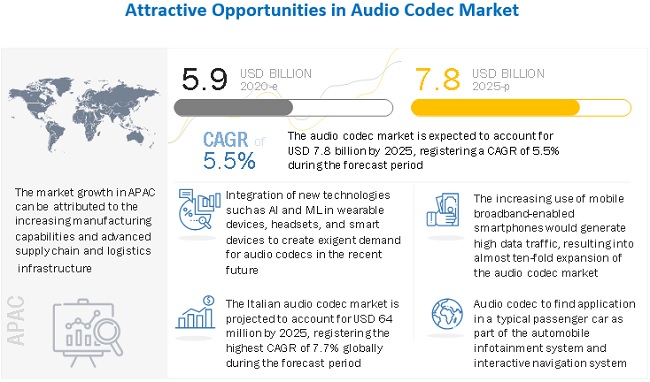

The audio codec market is expected to grow from USD 5.9 billion in 2020 to USD 7.8 billion in 2025, growing at a CAGR of 5.5% during the forecast period.

The primary reasons for this rise in demand are the increasing shift in consumer base for IoT enabled devices, rise in communication devices amidst the global pandemic and pull for wireless entertainment and communication electronic products.

Impact of AI on Audio Codec Market

Artificial Intelligence (AI) is transforming the audio codec market by enhancing sound quality, optimizing compression algorithms, and enabling real-time adaptive audio processing. AI-powered audio codecs can intelligently analyze audio signals to deliver more efficient compression without compromising sound fidelity, making streaming and communication more seamless even over low-bandwidth networks. Machine learning algorithms are being used to reduce noise, echo, and distortion, resulting in clearer and more immersive audio experiences. Additionally, AI enables real-time audio personalization by adapting to user preferences, device capabilities, and acoustic environments. As applications in smart devices, voice assistants, gaming, virtual reality, and teleconferencing expand, the integration of AI is driving innovation in codec development and setting new benchmarks for performance, efficiency, and user experience in the global audio codec market.

To know about the assumptions considered for the study, Request for Free Sample Report

Software audio codec market, by component type, is expected to grow at the highest CAGR during the forecast period.

With the increase in the global adoption of software embedded devices as it provides flexibility for upgradation, consumes less space and is economical. Companies such as Qualcomm and Realtek are working on software capabilities in order to provide up to data solutions to the technological savvy customers so as to fetch high market shares.

The market for headphones, hearables and wearable devices to grow at highest CAGR in audio codec market, by application, in 2020

The shift in demand for wearables such as smart watches, wireless hear phones and headsets is increasing as it is compact, economical and provides easy connectivity to the user. Moreover, the integration of these devices with IoT and ML has enabled the users to buy these goods for communication and entertainment applications.

To know about the assumptions considered for the study, download the pdf brochure

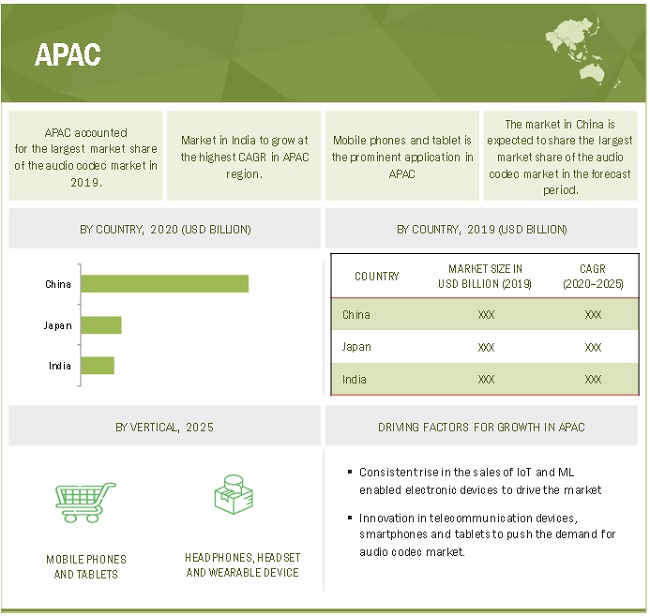

China, by country, is expected to share the largest market share during the forecast period.

China is set to witness the largest market share across the forecast period due to the numerous manufacturing capabilities of the region. The large manufacturing companies such as Xiaomi, Lenovo, oppo and others require audio codec products for smartphones, laptops and computers. Moreover, the automotive companies in China require audio codec products for music systems and communication which is also gaining traction.

Smartphone Audio Codecs Market Insights and Growth Prospects:

The smartphone audio codecs market is experiencing significant growth, driven by the increasing demand for high-quality audio experiences and the growing adoption of smartphones worldwide. Audio codecs are essential for encoding and decoding digital audio signals, ensuring optimal sound quality and efficient data compression. With advancements in technology, audio codecs are evolving to support high-resolution audio, low-latency streaming, and enhanced sound performance, meeting the expectations of consumers for superior audio playback, particularly in gaming, media streaming, and communication applications. Key players in the market are focusing on innovations like Bluetooth audio codecs, AI-driven sound enhancement, and integration of multi-channel audio support to stay ahead in the competitive landscape. As the smartphone industry continues to expand, the demand for advanced audio codecs is expected to further accelerate, creating new opportunities in the market.

Key market players

Key players in the audio codec market include Cirrus Logic (US), Qualcomm (US) and Realtek Semiconductor (Taiwan). Cirrus Logic is a well-known player for providing innovative and customized audio codec solutions and products in the audio market. Strong brand name and customer base are among the key factors that resulted in the leading position of Qualcomm in the market. Apart from the strong brand name and customer base, the company has strong R&D capabilities and geographic presence. Qualcomm focuses on strategies such as product launches and product development to strengthen its product portfolio and maintain its position in the audio codec market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component type, Application, and region |

|

Regions covered |

North America, Europe, Asia Pacific and Rest of the World |

|

Companies covered |

Analog Devices (US), Cirrus Logic (US), Maxim Integrated (US), Qualcomm (US), Realtek Semiconductor (Taiwan), STMicroelectronics (Switzerland), Texas Instruments (US), DSP Group (US), Dolby Laboratories (US), and Technicolor (France) |

This research report categorizes the audio codec market based on offering, end-user application, and region.

Audio codec MARKET, BY COMPONENT TYPE

- Hardware

- Software

Audio codec MARKET, BY APPLICATION

- Desktop and Laptop

- Mobile Phone and Tablet

- Music & Media Device and Home Theatre

- Television and Gaming Console

- Headphone, Headset, and Wearable Devices

- Automotive Infotainment

Aerospace and life sciences MARKET, BY GEOGRAPHY

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- Italy

- France

- UK

- Italy

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- Japan

- China

- India

- South Korea

- Vietnam

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East & Africa

Recent developments

- Qualcomm Technologies launched the aptX voice audio, a new voice codec that provides high-definition voice quality over a connection using Bluetooth wireless technology.

- Qualcomm Technologies launched the WCD9341, which is designed to decode audio formats of up to 32 bits. This new codec from the aptX family is designed to intelligently switch between a high-bit rate mode (for the best audio quality while listening music) or a low-latency mode (while gaming).

- Cirrus Logic launched a low-power voice capture development kit for Alexa Voice Service (AVS) that features CS47L24 smart codec, CS7250B digital MEMS microphone, and SoundClear algorithm for voice control, noise suppression, and echo cancellation. The smart codec uses an on-chip, high-performance digital-to-analog converter (DAC) with a two-watt mono speaker driver to enable high-fidelity audio playback.

Frequently Asked Questions (FAQ):

Where will all these developments take the industry in the mid to long term?

It is anticipated that, the year 2021 will see the development and more investment coming in the electronics industry for research and development. The audio industry is expected to see a slack as there are pending orders which are still in process and travel restrictions has led to unemployment to many people. The audio industry is expected to see some growth not before mid of 2021.

What are the emerging applications of audio codec market?

The emerging applications of audio codec market are hearables, headsets and wearable devices and music & media device and home theatre

How are advancements in audio industry influencing the audio codec market?

As the manufacturing capabilities in the audio industry are increasing amidst the pandemic, the integration of software devices for these products have increased tremendously. Moreover, the amalgamation of technologies like IoT, AI, ML and digital twin on electronics has provoked the audio codec to introduce innovative products and solutions.

Which type of equipment is expected to penetrate significantly in the audio codec market?

the audio codec market is a highly fragmented market as it caters to multiple applications, the decoders and encoders are expected to show a spike in the demand in the audio codec market.

Which countries are expected to witness significant growth in the audio codec market?

Considering the pandemic is at its peak, manufacturing countries such as India, China and Italy are expected to witness significant growth in the coming future. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

FIGURE 2 PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (Demand Side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (Supply Side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTION

3 EXECUTIVE SUMMARY (Page No. - 32)

3.1 AUDIO CODEC MARKET: POST COVID-19

3.1.1 REALISTIC SCENARIO

FIGURE 4 REALISTIC SCENARIO: MARKET, 2017–2025 (USD BILLION)

3.1.2 PESSIMISTIC SCENARIO

FIGURE 5 PESSIMISTIC SCENARIO: MARKET, 2017–2025 (USD BILLION)

3.1.3 OPTIMISTIC SCENARIO

FIGURE 6 OPTIMISTIC SCENARIO: MARKET, 2017–2025 (USD BILLION)

FIGURE 7 IMPACT OF COVID-19 ON MARKET

FIGURE 8 MARKET, BY COMPONENT (USD MILLION)

FIGURE 9 MARKET, BY APPLICATION

FIGURE 10 AUDIO CODEC MARKET, BY GEOGRAPHY

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 INNOVATIONS IN SMARTPHONES AND WEARABLE DEVICES TO CREATE ATTRACTIVE OPPORTUNITIES FOR AUDIO CODEC MARKET

FIGURE 11 INCREASING PRODUCT DEVELOPMENT PRACTICES AND PENETRATION OF INNOVATIVE TECHNOLOGIES ACROSS MULTIPLE APPLICATIONS TO BOOST GROWTH OF MARKET DURING FORECAST PERIOD

4.2 MARKET, BY COMPONENT

FIGURE 12 SOFTWARE AUDIO CODEC SEGMENT TO DOMINATE MARKET IN 2020

4.3 MARKET, BY APPLICATION

FIGURE 13 HEADPHONE, HEADSET, AND WEARABLE DEVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 AUDIO CODEC MARKET, BY GEOGRAPHY

FIGURE 14 APAC TO HOLD LARGEST MARKET SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 AUDIO CODEC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing internet penetration and data traffic

FIGURE 16 MOBILE DATA TRAFFIC PER SMARTPHONE BY 2025 (GB PER MONTH)

5.2.1.2 Increasing adoption of IoT-enabled connected devices for daily users

FIGURE 17 ESTIMATION OF IOT CONNECTIONS BY 2025 (BILLION)

5.2.1.3 Surging demand for telecommunication systems amid COVID-19 outbreak to drive market for audio codecs

FIGURE 18 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Declining use of optical media products

5.2.2.2 Short-term impact on consumer electronics industry due to COVID-19

FIGURE 19 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for android set-top boxes and video-on-demand services

5.2.3.2 Rising demand for infotainment in passenger cars

FIGURE 20 GLOBAL IN-VEHICLE INFOTAINMENT SYSTEM SHIPMENT BETWEEN 2017 AND 2024

FIGURE 21 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Continuous optimization of component size

5.2.4.2 Variations in demand and supply due to COVID-19

FIGURE 22 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND SOFTWARE PROVIDERS

5.4 PORTER’S FIVE FORCE ANALYSIS

TABLE 1 IMPACT OF EACH FORCE ON AUDIO CODEC MARKET

5.5 PRICING ANALYSIS

TABLE 2 PRICE OF AUDIO CODEC (USD)

5.6 TRADE ANALYSIS

5.6.1 EXPORT SCENARIO OF MICROPHONES, STANDS, EARPHONES, HEADPHONES, AND AUDIO AMPLIFIERS

FIGURE 24 EXPORT OF MICROPHONES, STANDS, EARPHONES, HEADPHONES, AND AUDIO AMPLIFIERS

5.6.2 IMPORT SCENARIO OF MICROPHONES, STANDS, EARPHONES, HEADPHONES, AND AUDIO AMPLIFIERS

FIGURE 25 IMPORT OF MICROPHONES, STANDS, EARPHONES, HEADPHONES, AND AUDIO AMPLIFIERS

5.7 AUDIO CODEC MARKET ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.8 CASE STUDY ANALYSIS

5.8.1 MEDIA MAGIC ENABLED LEADING SPEAKER MANUFACTURER TO INTEGRATE MULTI-ROOM/MULTI-ZONE CAPABILITIES INTO ITS SMART WIRELESS SPEAKER

5.8.2 AMERICAN SMARTWATCH BRAND ENHANCES ITS APPEAL AND DELIVERS OUTSTANDING USER EXPERIENCE WITH ITTIAM’S SBC CODEC

5.9 PATENT ANALYSIS

TABLE 4 SOME IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2007–2018

5.10 TECHNOLOGY ANALYSIS

5.10.1 LOSSLESS AUDIO COMPRESSION

5.10.2 SUBSTITUTE TECHNOLOGY/REDUNDANT TECHNOLOGY

5.11 REGULATORY UPDATE

5.11.1 US

5.11.2 EUROPE

6 AUDIO CODEC MARKET, BY COMPONENT (Page No. - 59)

6.1 INTRODUCTION

TABLE 5 MARKET, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 6 MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

6.2 HARDWARE

TABLE 7 AUDIO CODEC MARKET FOR HARDWARE COMPONENT, BY VALUE, 2017–2025

FIGURE 26 MARKET FOR HARDWARE COMPONENT, BY VOLUME, 2020 AND 2025 (MILLION UNITS)

TABLE 8 MARKET FOR HARDWARE COMPONENT, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 9 MARKET FOR HARDWARE COMPONENT, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 10 MARKET FOR HARDWARE COMPONENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR HARDWARE COMPONENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 MARKET FOR HARDWARE COMPONENT IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 13 MARKET FOR HARDWARE COMPONENT IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 14 MARKET FOR HARDWARE COMPONENT IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 15 AUDIO CODEC MARKET FOR HARDWARE COMPONENT IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 16 MARKET FOR HARDWARE COMPONENT IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 17 MARKET FOR HARDWARE COMPONENT IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 18 MARKET FOR HARDWARE COMPONENT IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE COMPONENT IN ROW, BY REGION, 2020–2025 (USD MILLION)

6.2.1 AUDIO CODEC HARDWARE, BY CHANNEL TYPE

TABLE 20 MARKET FOR HARDWARE COMPONENT, BY CHANNEL TYPE, 2017–2019 (USD MILLION)

TABLE 21 AUDIO CODEC MARKET FOR HARDWARE COMPONENT, BY CHANNEL TYPE, 2020–2025 (USD MILLION)

FIGURE 27 STEREO CODEC SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

6.2.1.1 Mono Codec

6.2.1.1.1 Mono codec devices are widely used for personal electronic appliances

6.2.1.2 Stereo Codec

6.2.1.2.1 Different techniques in stereo codec have diversified their use in consumer electronics

6.2.1.2.2 Impact of COVID-19 on stereo codec market

FIGURE 28 IMPACT OF COVID-19 ON STEREO CODEC MARKET

TABLE 22 POST-COVID-19 SCENARIO ANALYSIS: STEREO CODEC MARKET, 2017–2025 (USD MILLION)

6.2.1.3 Multi-channel Codec

6.2.1.3.1 Increasing demand for home entertainment appliances to boost demand for multi-channel codecs

6.3 SOFTWARE

TABLE 23 AUDIO CODEC MARKET FOR SOFTWARE COMPONENT, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 24 MARKET FOR SOFTWARE COMPONENT, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 25 MARKET FOR SOFTWARE COMPONENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 MARKET FOR SOFTWARE COMPONENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 27 MARKET FOR SOFTWARE COMPONENT IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 28 MARKET FOR SOFTWARE COMPONENT IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 29 MARKET FOR SOFTWARE COMPONENT IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 30 MARKET FOR SOFTWARE COMPONENT IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 31 MARKET FOR SOFTWARE COMPONENT IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 32 MARKET FOR SOFTWARE COMPONENT IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 33 MARKET FOR SOFTWARE COMPONENT IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 MARKET FOR SOFTWARE COMPONENT IN ROW, BY REGION, 2020–2025 (USD MILLION)

6.3.1 AUDIO CODEC SOFTWARE, BY COMPRESSION TYPE

FIGURE 29 LOSSLESS COMPRESSION TECHNIQUES TO BE FASTEST-GROWING SEGMENT OF AUDIO CODEC SOFTWARE COMPONENT MARKET DURING FORECAST PERIOD

TABLE 35 AUDIO CODEC MARKET FOR SOFTWARE COMPONENT, BY COMPRESSION TYPE, 2017–2019 (USD MILLION)

TABLE 36 MARKET FOR SOFTWARE COMPONENT, BY COMPRESSION TYPE, 2020–2025 (USD MILLION)

6.3.1.1 Non-compression

6.3.1.1.1 Manufacturing companies are procuring PAM, PCM, and PWM for smartphones and tablets

6.3.1.2 Lossless compression

6.3.1.2.1 Increasing demand for communication-enabled products to drive the market for lossless compression

6.3.1.2.2 Impact of COVID-19 on lossless compression market

FIGURE 30 IMPACT OF COVID-19 ON LOSSLESS COMPRESSION MARKET

TABLE 37 POST-COVID-19 SCENARIO ANALYSIS: LOSSLESS COMPRESSION MARKET, BY SOFTWARE COMPONENT, 2017–2025 (USD MILLION)

6.3.1.3 Lossy compression

6.3.1.3.1 Innovative communication products to drive the demand for lossy compression

7 AUDIO CODEC MARKET, BY APPLICATION (Page No. - 79)

7.1 INTRODUCTION

FIGURE 31 HEADPHONE, HEADSET, AND WEARABLE DEVICES TO BE FASTEST-GROWING APPLICATION SEGMENT OF MARKET DURING FORECAST PERIOD

TABLE 38 MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 39 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 DESKTOP AND LAPTOP

7.2.1 SOFTWARE AUDIO CODEC SEGMENT TO PLAY VITAL ROLE IN GROWTH OF AUDIO CODEC MARKET FOR DESKTOP AND LAPTOP APPLICATIONS

TABLE 40 MARKET FOR DESKTOP AND LAPTOP, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 41 MARKET FOR DESKTOP AND LAPTOP, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 42 MARKET FOR DESKTOP AND LAPTOP, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 MARKET FOR DESKTOP AND LAPTOP, BY REGION, 2020–2025 (USD MILLION)

7.3 MOBILE PHONE AND TABLET

7.3.1 ENTERTAINMENT OPTIONS IN SMARTPHONES TO DRIVE GROWTH OF MARKET

7.4 IMPACT OF COVID-19 ON STEREO CODEC MARKET

FIGURE 32 IMPACT OF COVID-19 ON AUDIO CODEC MARKET FOR MOBILE PHONE AND TABLET APPLICATIONS

TABLE 44 POST-COVID-19 SCENARIO ANALYSIS: MARKET FOR MOBILE PHONE AND TABLET, 2017–2025 (USD MILLION)

TABLE 45 MARKET FOR MOBILE PHONE AND TABLET, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 46 MARKET FOR MOBILE PHONE AND TABLET, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 47 MARKET FOR MOBILE PHONE AND TABLET, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 MARKET FOR MOBILE PHONE AND TABLET, BY REGION, 2020–2025 (USD MILLION)

7.5 MUSIC & MEDIA DEVICE AND HOME THEATER

7.5.1 HOME ENTERTAINMENT PRODUCTS TO CREATE DEMAND FOR AUDIO CODECS

TABLE 49 AUDIO CODEC MARKET FOR MUSIC & MEDIA DEVICE AND HOME THEATER, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 50 MARKET FOR MUSIC & MEDIA DEVICE AND HOME THEATER, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 51 MARKET FOR MUSIC & MEDIA DEVICE AND HOME THEATER, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 MARKET FOR MUSIC & MEDIA DEVICE AND HOME THEATER, BY REGION, 2020–2025 (USD MILLION)

7.6 TELEVISION AND GAMING CONSOLE

7.6.1 EXCELLENT CONSUMER EXPERIENCE OF GAMING CONSOLE TO FUEL DEMAND FOR AUDIO CODEC

TABLE 53 MARKET FOR TELEVISION AND GAMING CONSOLE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 54 MARKET FOR TELEVISION AND GAMING CONSOLE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 55 MARKET FOR TELEVISION AND GAMING CONSOLE, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 MARKET FOR TELEVISION AND GAMING CONSOLE, BY REGION, 2020–2025 (USD MILLION)

7.7 HEADPHONE, HEADSET, AND WEARABLE DEVICES

7.7.1 CHANGE IN CONSUMER BEHAVIOR FROM CONVENTIONAL TO WEARABLES AND HEARABLES

7.8 IMPACT OF COVID-19 ON HEADPHONE, HEADSET, AND WEARABLE DEVICE APPLICATIONS

FIGURE 33 IMPACT OF COVID-19 ON AUDIO CODEC MARKET FOR HEADPHONE, HEADSET, AND WEARABLE DEVICE APPLICATIONS

TABLE 57 POST-COVID-19 SCENARIO ANALYSIS: MARKET FOR HEADPHONE, HEADSET, AND WEARABLE, 2017–2025 (USD MILLION)

TABLE 58 MARKET FOR HEADPHONE, HEADSET, AND WEARABLE DEVICES, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 59 MARKET FOR HEADPHONE, HEADSET, AND WEARABLE DEVICES, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 60 MARKET FOR HEADPHONE, HEADSET, AND WEARABLE DEVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 61 MARKET FOR HEADPHONE, HEADSET, AND WEARABLE DEVICES, BY REGION, 2020–2025 (USD MILLION)

7.9 AUTOMOBILE INFOTAINMENT

7.9.1 INCREASING INTEGRATION OF INFOTAINMENT SYSTEMS, VOICE COMMAND, AND NAVIGATION SYSTEMS TO BOOST DEMAND FOR AUDIO CODECS

TABLE 62 AUDIO CODEC MARKET FOR AUTOMOBILE INFOTAINMENT, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 63 MARKET FOR AUTOMOBILE INFOTAINMENT, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 64 MARKET FOR AUTOMOBILE INFOTAINMENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 65 MARKET FOR AUTOMOBILE INFOTAINMENT, BY REGION, 2020–2025 (USD MILLION)

7.10 OTHERS

TABLE 66 MARKET FOR OTHERS, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 67 MARKET FOR OTHERS, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 68 MARKET FOR OTHERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 69 MARKET FOR OTHERS, BY REGION, 2020–2025 (USD MILLION)

7.10.1 SOFTWARE PLATFORM

7.10.2 BROADCASTING

7.10.3 AUDIO PRODUCTION AND RECORDING

7.10.4 IP TELEPHONY

8 AUDIO CODEC MARKET, BY GEOGRAPHY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 34 MARKET GEOGRAPHIC SNAPSHOT

TABLE 70 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2020–2025 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: AUDIO CODEC MARKET SNAPSHOT

8.3 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 36 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

TABLE 72 POST-COVID-19, MARKET IN NORTH AMERICA, 2017–2025 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 74 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 75 MARKET IN NORTH AMERICA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 76 MARKET IN NORTH AMERICA, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

8.3.1 US

8.3.1.1 Innovation and product development to help US lead North American audio codec market

TABLE 79 MARKET IN US, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 80 MARKET IN US, BY COMPONENT, 2020–2025 (USD MILLION)

8.3.2 CANADA

8.3.2.1 Government initiatives related to electric vehicles to boost sales of audio codecs

TABLE 81 MARKET IN CANADA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 82 MARKET IN CANADA, BY COMPONENT, 2020–2025 (USD MILLION)

8.3.3 MEXICO

8.3.3.1 Manufacturing setup and easy transportation capabilities to support market growth

TABLE 83 MARKET IN MEXICO, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 84 MARKET IN MEXICO, BY COMPONENT, 2020–2025 (USD MILLION)

8.4 EUROPE

FIGURE 37 EUROPE: AUDIO CODEC MARKET SNAPSHOT

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 90 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Automobile application to fuel demand for audio codecs in Germany

TABLE 91 MARKET IN GERMANY, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 92 MARKET IN GERMANY, BY COMPONENT, 2020–2025 (USD MILLION)

8.4.2 UK

8.4.2.1 Growing adoption of consumer electronics and durables is fueling demand for audio codecs

TABLE 93 AUDIO CODEC MARKET IN UK, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 94 MARKET IN UK, BY COMPONENT, 2020–2025 (USD MILLION)

8.4.3 ITALY

8.4.3.1 Innovation in consumer electronics to create demand for audio codecs

TABLE 95 MARKET IN ITALY, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 96 MARKET IN ITALY, BY COMPONENT, 2020–2025 (USD MILLION)

8.4.4 FRANCE

8.4.4.1 Technologically advanced companies to invest and focus more on innovation of audio and video products

TABLE 97 MARKET IN FRANCE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 98 MARKET IN FRANCE, BY COMPONENT, 2020–2025 (USD MILLION)

8.4.5 RUSSIA

8.4.5.1 Large presence of some of major players related to semiconductor and electronics industries

TABLE 99 MARKET IN RUSSIA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 100 MARKET IN RUSSIA, BY COMPONENT, 2020–2025 (USD MILLION)

8.4.6 REST OF EUROPE

TABLE 101 AUDIO CODEC MARKET IN REST OF EUROPE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 102 MARKET IN REST OF EUROPE, BY COMPONENT, 2020–2025 (USD MILLION)

8.5 ASIA PACIFIC (APAC)

FIGURE 38 APAC: MARKET SNAPSHOT

8.5.1 IMPACT OF COVID-19 ON MARKET IN APAC

FIGURE 39 IMPACT OF COVID-19 ON MARKET IN APAC

TABLE 103 POST-COVID-19 SCENARIO ANALYSIS, MARKET IN APAC, 2017–2025 (USD MILLION)

TABLE 104 MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 105 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 106 MARKET IN APAC, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 107 AUDIO CODEC MARKET IN APAC, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 108 MARKET IN APAC, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 109 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

8.5.2 JAPAN

8.5.2.1 High manufacturing capabilities in automobile and electronics industries to fuel demand for audio codecs

TABLE 110 MARKET IN JAPAN, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 111 MARKET IN JAPAN, BY COMPONENT, 2020–2025 (USD MILLION)

8.5.3 SOUTH KOREA

8.5.3.1 Investments in semiconductor industry to create opportunities for innovative audio products in South Korea

TABLE 112 MARKET IN SOUTH KOREA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 113 MARKET IN SOUTH KOREA, BY COMPONENT, 2020–2025 (USD MILLION)

8.5.4 CHINA

8.5.4.1 Massive and automated manufacturing setup in China

TABLE 114 MARKET IN CHINA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 115 MARKET IN CHINA, BY COMPONENT, 2020–2025 (USD MILLION)

8.5.5 INDIA

8.5.5.1 Shifting of production plants from foreign countries to India to boost demand for audio codecs

TABLE 116 AUDIO CODEC MARKET IN INDIA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 117 MARKET IN INDIA, BY COMPONENT, 2020–2025 (USD MILLION)

8.5.6 VIETNAM

8.5.6.1 Economical labor and increasing GDP is helping Vietnam to grow in market

TABLE 118 MARKET IN VIETNAM, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 119 MARKET IN VIETNAM, BY COMPONENT, 2020–2025 (USD MILLION)

8.5.7 REST OF APAC

TABLE 120 MARKET IN REST OF APAC, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 121 MARKET IN REST OF APAC, BY COMPONENT, 2020–2025 (USD MILLION)

8.6 ROW

FIGURE 40 ROW: MARKET SNAPSHOT

TABLE 122 MARKET IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 123 AUDIO CODEC MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 124 MARKET IN ROW, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 125 MARKET IN ROW, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 126 MARKET IN ROW, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 127 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

8.6.1 SOUTH AMERICA

8.6.1.1 Adoption of latest technologies embedded in domestic electronics to play a vital role in growth of audio codec market

TABLE 128 MARKET IN SOUTH AMERICA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 129 MARKET IN SOUTH AMERICA, BY COMPONENT, 2020–2025 (USD MILLION)

8.6.2 MIDDLE EAST & AFRICA

8.6.2.1 Growing adoption of Internet-based electronics to create demand for audio codecs

TABLE 130 MARKET IN MIDDLE EAST & AFRICA, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 131 AUDIO CODEC MARKET IN MIDDLE EAST & AFRICA, BY COMPONENT, 2020–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 130)

9.1 OVERVIEW

FIGURE 41 PRODUCT LAUNCHES EMERGED AS KEY STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2017 TO JUNE 2020

9.2 MARKET SHARE AND RANKING ANALYSIS OF KEY COMPANIES, 2019

TABLE 132 MARKET SHARE ANALYSIS: AUDIO CODEC HARDWARE MARKET, 2019

TABLE 133 MARKET RANKING ANALYSIS: AUDIO CODEC SOFTWARE MARKET, 2019

9.3 FIVE-YEAR REVENUE ANALYSIS

FIGURE 42 FIVE-YEAR REVENUE SNAPSHOT OF MAJOR PLAYERS (USD MILLION)

9.4 COMPANY LEADERSHIP MAPPING, 2019

9.4.1 STAR

9.4.2 EMERGING LEADER

9.4.3 PERVASIVE

9.4.4 PARTICIPANT

FIGURE 43 AUDIO CODEC MARKET, COMPANY EVALUATION MATRIX (2019)

9.5 STARTUP/SME EVALUATION MATRIX, 2019

9.5.1 PROGRESSIVE COMPANY

9.5.2 RESPONSIVE COMPANY

9.5.3 DYNAMIC COMPANY

9.5.4 STARTING BLOCK

FIGURE 44 AUDIO CODEC MARKET, STARTUP/SME EVALUATION MATRIX (2019)

9.6 COMPETITIVE SITUATIONS AND TRENDS

9.6.1 PRODUCT LAUNCHES

TABLE 134 PRODUCT LAUNCHES, JANUARY 2017–JUNE 2020

9.6.2 DEALS

TABLE 135 DEALS, JANUARY 2017–JUNE 2020

10 COMPANY PROFILES (Page No. - 141)

10.1 INTRODUCTION

10.2 KEY PLAYERS

(Business Overview, Products, Recent Developments, SWOT Analysis, MnM View)*

10.2.1 CIRRUS LOGIC

FIGURE 45 CIRRUS LOGIC: COMPANY SNAPSHOT

10.2.2 QUALCOMM

FIGURE 46 QUALCOMM: COMPANY SNAPSHOT

10.2.3 REALTEK SEMICONDUCTOR

FIGURE 47 REALTEK SEMICONDUCTOR: COMPANY SNAPSHOT

10.2.4 DOLBY LABORATORIES

FIGURE 48 DOLBY LABORATORIES: COMPANY SNAPSHOT

10.2.5 TECHNICOLOR

FIGURE 49 TECHNICOLOR: COMPANY SNAPSHOT

10.2.6 ANALOG DEVICES

FIGURE 50 ANALOG DEVICES: COMPANY SNAPSHOT

10.2.7 MAXIM INTEGRATED

FIGURE 51 MAXIM INTEGRATED PRODUCTS, INC.: COMPANY SNAPSHOT

10.2.8 STMICROELECTRONICS

FIGURE 52 STMICROELECTRONICS: COMPANY SNAPSHOT

10.2.9 TEXAS INSTRUMENTS

FIGURE 53 TEXAS INSTRUMENTS INC: COMPANY SNAPSHOT

10.2.10 DSP GROUP

FIGURE 54 DSP GROUP: COMPANY SNAPSHOT

10.3 RIGHT TO WIN

10.4 OTHER COMPANIES

10.4.1 FRAUNHOFER IIS

10.4.2 XIPH

10.4.3 BROADCOM

10.4.4 AMS

10.4.5 TEMPO SEMICONDUCTOR

10.4.6 DIALOG SEMICONDUCTOR

10.4.7 DIGIGRAM

10.4.8 CML MICROCIRCUITS

10.4.9 BARIX

10.4.10 TIELINE

10.4.11 SYNOPSYS

10.4.12 ITTIAM

10.4.13 ATC LABS

10.4.14 AKM (ASAHI KASEI MICRODEVICES)

10.4.15 SONY

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 175)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

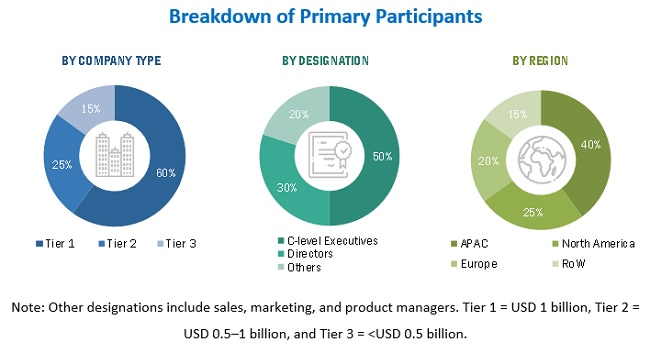

The study involved 4 major activities in estimating the current size of the audio codec market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information relevant for this study. These secondary sources include biometric technologies journals, magazines, and IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information pertinent to this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the audio codec market. After a complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the audio codec market and other dependent submarkets listed in this report.

- Key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures were employed wherever applicable. The data was triangulated by studying various factors and trends identified from both the demand and supply sides—scientific research, technical, suppliers, OEMs, system integrators and others.

Report Objectives

The following are the primary objectives of the study:

- To define, describe, and forecast the audio codec market based on the component type, application, and region

- To forecast the market size of various segments with respect to global market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments, such as agreements, contracts, partnerships, acquisitions, and product launches & developments, carried out in the audio codec market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Audio Codec Market