Automated Machine Learning (AutoML) Market by Offering (Solutions & Services), Application (Data Processing, Model Selection, Hyperparameter Optimization & Tuning, Feature Engineering, Model Ensembling), Vertical and Region - Global Forecast to 2028

Automated Machine Learning (AutoML) Market Overview, Industry Share and Forecast

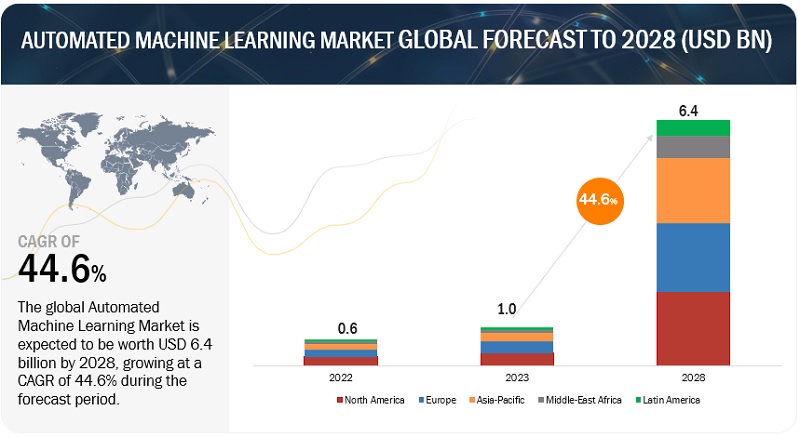

[347 Pages Report] The global Automated Machine Learning (AutoML) Market size was worth approximately $1.0 billion in 2023 and is expected to generate revenue around $6.4 billion by the end of 2028 growing at a CAGR of around 44.6% between 2023 to 2028.

Transfer learning is an important aspect of AutoML that leverages pre-trained models to improve the performance of new models. By transferring the knowledge learned from one task to another, businesses create more accurate models with less training data and reduce the time and cost required to build high-performing models.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automated Machine Learning Market Growth Dynamics

Driver: Rising need to transform businesses with Intelligent automation using AutoML

As businesses increasingly rely on data to drive decision-making and improve operational efficiency, a growing demand for intelligent business processes has been growing. These processes leverage machine learning algorithms to automate decision-making and optimize business operations, leading to improved performance and increased profitability. By leveraging AutoML, businesses can streamline operations, reduce costs, and improve performance, ultimately resulting in a competitive advantage. According to a report by industry experts, it is found that AI-driven automation can improve productivity by up to 40%. Automated Machine Learning Market can help businesses achieve these kinds of results by automating the development and deployment of machine learning models. By using AutoML, businesses can quickly and efficiently develop predictive models that can be integrated into existing business processes. These models can then be used to automate decision-making, optimize processes, and improve performance. Additionally, AutoML can help businesses identify new opportunities for optimization and improvement that were previously difficult to detect. By analyzing large volumes of data, AutoML can identify patterns and trends, enabling businesses to make data-driven decisions to improve performance and drive growth.

Restraint: Machine learning tools are being slowly adopted

The slow adoption of automated machine learning (AutoML) tools is a significant restraint hindering the growth of the AutoML market. Despite the numerous benefits AutoML offers, including increased efficiency, accuracy, and scalability, many organizations hesitate to adopt this technology. One of the primary reasons for this slow adoption is a lack of awareness about Automated Machine Learning (AutoML) Market and its capabilities. A survey by O’Reilly found that only 20% of respondents reported using automated machine learning tools, while 48% had never heard of the technology. This lack of awareness is a significant barrier to its adoption, as many business leaders and decision-makers may not be familiar with the benefits of AutoML and the impact it can have on their business.

Another factor contributing to this slow adoption is a shortage of skilled data scientists and machine learning experts. According to a report by an industry expert, there will be a shortage of up to 250,000 data scientists by 2024. This shortage of skilled experts can make it challenging for organizations to develop and deploy machine learning models, leading to slower adoption rates. Concerns about the transparency and interpretability of machine learning models are also holding back adoption. This lack of transparency can be a barrier to adoption in industries such as healthcare and finance, where decisions based on machine learning models can have significant consequences.

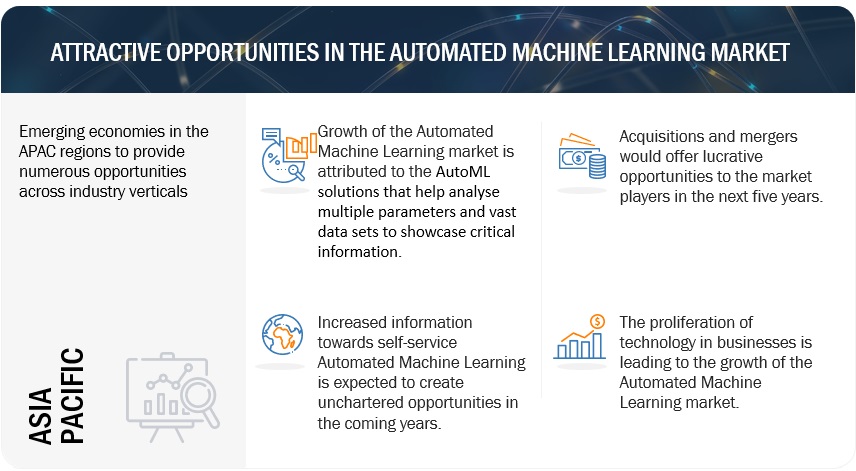

Opportunity: Seizing opportunities for faster decision-making and cost savings

The increased accessibility of machine learning presents a significant opportunity for the AutoML market. Historically, machine learning has been highly specialized, requiring extensive statistics, programming, and data analysis expertise. However, with the development of AutoML tools, businesses no longer need to have a team of data scientists and machine learning experts to build and deploy AI solutions. Instead, AutoML tools enable businesses to democratize the use of machine learning, making it more accessible to a broader range of users and use cases. By using AutoML tools, businesses can quickly build and deploy predictive models that can analyze large amounts of data and identify patterns, anomalies, and insights that may not be apparent to the human eye. For instance, AutoML models can help businesses to predict customer behavior, optimize pricing strategies, and identify opportunities for process improvement.

Moreover, the increased accessibility of machine learning can also lead to significant cost savings for businesses. By using AutoML tools, businesses can reduce the costs associated with hiring specialized talent and investing in expensive infrastructure. Additionally, the faster development and deployment of AI solutions can result in cost savings by increasing operational efficiency and improving decision-making. Furthermore, the increased accessibility of machine learning can also lead to new business innovations and opportunities. As more businesses adopt AutoML tools, there is likely to be a proliferation of new use cases and applications, leading to increased innovation and growth in the market. Additionally, the democratization of machine learning can enable businesses to tap into new markets and expand their offerings, leading to increased revenue and market share.

Challenge: Increasing shortage of skilled talent

One of the biggest challenges facing the AutoML market is the shortage of skilled talent. AutoML platforms require individuals with a strong machine learning, data science, and programming background. However, the demand for these skills has far outpaced the supply, leading to a significant talent shortage in the industry. As a result, organizations struggle to find the right talent to build, deploy, and maintain AutoML models. According to a report by LinkedIn, data scientists and machine learning engineers are among the top emerging jobs in the technology sector. However, the shortage of skilled talent has led to fierce competition among organizations for a limited pool of candidates. The LinkedIn report found that data scientist positions take an average of 42 days to fill, highlighting the challenges of finding qualified candidates.

The rapid pace of technological advancements further compounds the shortage of skilled talent. As new algorithms and techniques are developed, it is essential for individuals working with AutoML platforms to continually upskill and stay up to date with the latest advancements in the field. This requires ongoing training and professional development, which can be costly and time-consuming. Furthermore, the shortage of skilled talent is not limited to data scientists and machine learning engineers. AutoML platforms also require individuals with expertise in areas such as data management, data visualization, and cloud computing. The talent shortage in these areas can also impact the successful implementation and adoption of AutoML solutions.

By application, data processing to account for the largest market size during the forecast period

AutoML can be applied to automate various aspects of data processing, including data cleaning, data normalization, and data transformation. Automated Machine Learning (AutoML) Market can automate the process of detecting and correcting errors in the data. This includes identifying missing values, correcting data formatting errors, and removing outliers that could affect the accuracy of machine learning models. AutoML involves techniques such as standardization and normalization, which can be automatically applied to the data. In transformation, data can be transformed to a more appropriate format, reducing the risk of errors and inconsistencies with the help of AutoML. AutoML can also integrate data from multiple sources, which is often a time-consuming and complex task. This includes techniques such as data merging and joining. By automating the tasks, AutoML can reduce the time and effort required for manual data processing, improving the quality and accuracy of the resulting data.

By deployment, cloud to account for the largest market size during the forecast period

The adoption of cloud computing has increased over the past few years, with internet connections becoming more reliable and remote work becoming the norm. Cloud-based AutoML solutions offer greater flexibility and scalability than on-premises solutions, as they can be easily scaled up or down as needed to accommodate changes in workload or data volume. Cloud-based solutions also typically offer a pay-as-you-go pricing model, which can be more cost-effective for organizations with variable workloads. Installing and supporting traditional software can be very challenging for a decentralized team. However, with cloud-based software, anyone can access the solution remotely. For SMEs, cloud is particularly useful as it provides full functionality at a reasonable rate and requires no upfront investment. Due to its commercial benefits and the world of possibilities, cloud technology has become a popular model for modern automation businesses.

By offering, solutions to account for the largest market size during the forecast period

AutoML solutions are designed to automate the tasks involved in developing and deploying machine learning models. This makes it easier for organizations to leverage the power of machine learning without requiring significant expertise in data science or machine learning. AutoML solutions are becoming an increasingly important tool for organizations looking to leverage the power of machine learning to gain insights from their data and make better decisions. By automating many tedious and time-consuming tasks involved in model development and deployment, AutoML platforms can help organizations accelerate their digital transformation and unlock new opportunities for growth and innovation. AutoML solutions are available in different types and deployment options. By type, AutoML solutions can be classified into AutoML platforms and AutoML software. By deployment, AutoML solutions can be deployed on-premises or on cloud.

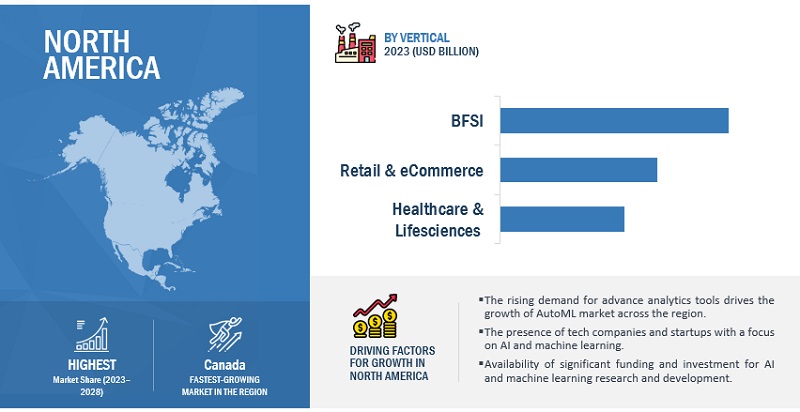

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in Automated Machine Learning. North America has been a major contributor to the development and growth of the Automated Machine Learning market. The US is one of the most developed countries in the region. AutoML is a rapidly growing market in the US, with several key players offering solutions that range from fully automated platforms to ones that assist data scientists in building machine learning models. The market is being driven by the need for faster and more efficient ways to build and deploy machine learning models, as well as the increasing demand for artificial intelligence solutions in various industries. In recent years, there has been a significant increase in the adoption of AutoML solutions in the US, especially in industries such as healthcare, finance, and retail. Healthcare providers are using AutoML to analyze medical images and identify patterns in patient data, while financial institutions are using it to detect fraudulent transactions and assess credit risk. Retailers are using AutoML to personalize recommendations and improve customer engagement.

Key Market Players

The Automated Machine Learning Market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Automated Machine Learning IBM (US), Oracle (US), Microsoft (US), ServiceNow (US), Google (US), Baidu (China), AWS (US), Alteryx (US), Salesforce (US), Altair (US), Teradata (US), H2O.ai (US), DataRobot (US), BigML (US), Databricks (US), Dataiku (France), Alibaba Cloud (China), Appier (Taiwan), Squark (US), Aible (US), Datafold (US), Boost.ai (Norway), Tazi.ai (US), Akkio (US), Valohai (Finland), dotData (US), Qlik (US), Mathworks (US), HPE (US), and SparkCognition (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 1.0 billion |

|

Revenue forecast in 2028 |

USD 6.4 billion |

|

Growth rate |

CAGR of 44.6% from 2023 to 2028 |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments covered |

Offering, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Microsoft (US), ServiceNow (US), Google (US), Baidu (China), AWS (US), Alteryx (US), Salesforce (US), Altair (US), Teradata (US), H2O.ai (US), DataRobot (US), BigML (US), Databricks (US), Dataiku (France), Alibaba Cloud (China), Appier (Taiwan), Squark (US), Aible (US), Datafold (US), Boost.ai (Norway), Tazi.ai (US), Akkio (US), Valohai (Finland), dotData (US), Qlik (US), Mathworks (US), HPE (US), and SparkCognition (US). |

This research report categorizes the Automated Machine Learning (AutoML) Market based on Offering, Cloud Type, Technology, Organization Size, Vertical, and Region.

By Offering:

-

Solutions

-

By Type

- Platform

- Software

-

By Deployment

- Cloud

- On-premises

-

By Type

-

Services

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

By Application:

- Data Processing

- Feature Engineering

- Model Selection

- Hyperparameter Optimization & Tuning

- Model Ensembling

- Other Applications

By Vertical:

- Banking, financial services, and insurance

- Retail & eCommerce

- Healthcare & life sciences

- IT & ITeS

- Telecommunications

- Government & defense

- Manufacturing

- Automotive, Transportations, and Logistics

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In February 2023, IBM integrated StepZen's technology into its portfolio, with the aims to provide its clients with an end-to-end solution for building, connecting, and managing APIs and data sources, enabling them to innovate faster and generate more value from their data.

- In February 2023, AWS launched new features for Amazon SageMaker Autopilot, a tool for automating the machine learning (ML) model creation process. The new features include the ability to select specific algorithms for the training and experiment stages, allowing data scientists more control over the ML model creation process.

- In October 2022, Oracle partnered with NVIDIA, which enabled Oracle to offer its customers access to Nvidia's GPUs for use in machine learning workloads, enhancing the performance and capabilities of Oracle's machine learning tools.

- In February 2022, AWS partnered with Maple Leaf Sports & Entertainment, which enables MLSE to assist its teams and lines of business. MLSE also employs AWS's extensive cloud capabilities, including AutoML, advanced analytics, computing, database, and storage services.

- In December 2020, Salesforce and Google Cloud announced a collaboration to integrate Google Cloud's automl tools with Salesforce's Customer 360 platform. The collaboration aimed to help businesses build a complete view of their customers and use AI to personalize their experiences.

Frequently Asked Questions (FAQ):

How big is the Automated Machine Learning Market?

What is growth rate of the Automated Machine Learning Market?

What are the key trends affecting the Automated Machine Learning Market?

- Data Processing

- Feature Engineering

- Model Selection

- Hyperparameter Optimization & Tuning

- Model Ensembling

Who are the key players in Automated Machine Learning Market?

Who will be the leading hub for Automated Machine Learning Market?

What are the opportunities in Automated Machine Learning Market?

- Banking, financial services, and insurance

- IT & ITeS

- Telecommunications

- Manufacturing

- Automotive, Transportations, and Logistics

- Media & Entertainment

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

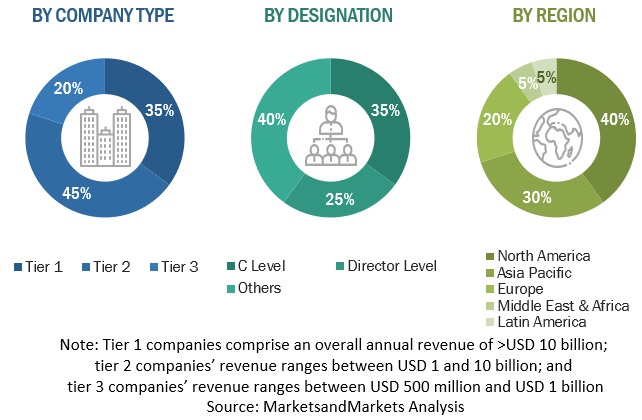

The research methodology for the global AutoML market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering AutoML offerings, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the AutoML market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing AutoML offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the AutoML market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global AutoML market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering AutoML. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding and investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, Applications, and verticals. The aggregate of all the companies’ revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of AutoML solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of automated machine learning solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Automted Machine Learning solutions based on some of the key use cases. These factors for the Automted Machine Learning tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Microsoft, automated machine learning, also referred to as automated ML or AutoML, is the process of automating the time-consuming, iterative tasks of machine learning model development. It allows data scientists, analysts, and developers to build ML models with high scale, efficiency, and productivity all while sustaining model quality.

Key Stakeholders

- Research organizations

- Third-party service providers

- Technology providers

- Cloud services providers

- AI consulting companies

- Independent software vendors (ISVs)

- Service providers and distributors

- Application development vendors

- System integrators

- Consultants/consultancy/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Managed service providers

Report Objectives

- To define, describe, and forecast the automated machine learning market based on offering, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the automated machine learning market

- To analyze competitive developments, such as mergers & acquisitions, product developments, and research & development (R&D) activities, in the market

- To analyze the impact of recession across all the regions across the automated machine learning market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for Automted Machine Learning

- Further breakup of the European market for Automted Machine Learning

- Further breakup of the Asia Pacific market for Automted Machine Learning

- Further breakup of the Latin American market for Automted Machine Learning

- Further breakup of the Middle East & Africa market for Automted Machine Learning

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Machine Learning (AutoML) Market