The study involved four major activities to estimate the current size of the automotive ethernet market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information for this study. The secondary sources include annual reports; press releases, and investor presentations of companies; whitepapers, certified publications, articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

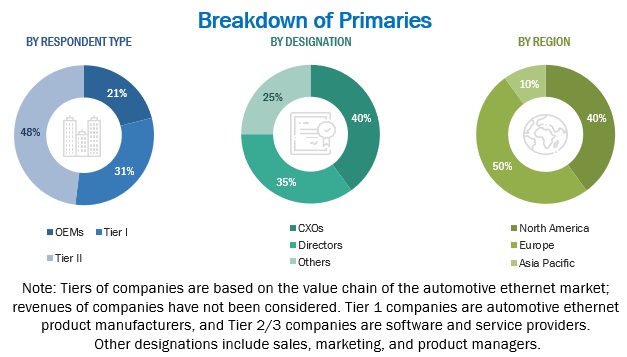

Extensive primary research has been conducted after understanding the automotive ethernet market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side automotive ethernet product and solution providers and supply-side OEMs across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primary interviews, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive ethernet market. Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research. The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources, model mapping, and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

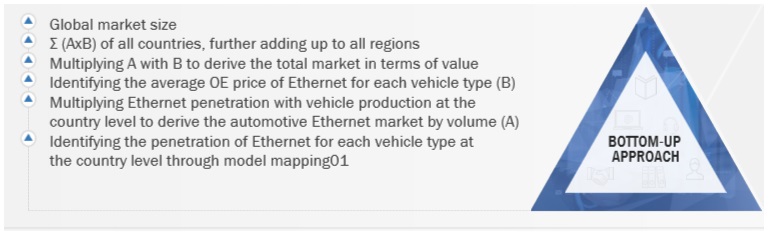

Global Automotive ethernet Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, download the pdf brochure

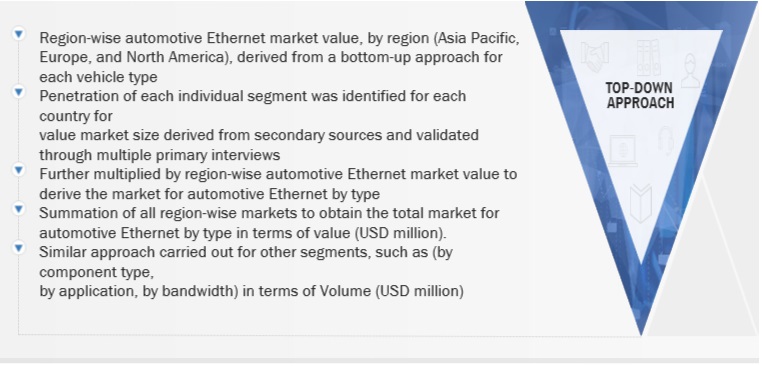

Global Automotive ethernet Market Size: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

Automotive ethernet:

The automotive Ethernet market is defined as the specialized sector dedicated to developing and supplying Ethernet-based networking solutions customized specifically for vehicles. This market encompasses a range of components, including switches, PHYs, and controllers, engineered to facilitate high-speed, dependable data communication within vehicles. Its primary focus is meeting the escalating demand for advanced connectivity solutions within vehicles, supporting functionalities such as infotainment systems, ADAS, autonomous driving capabilities, diagnostics, and seamless over-the-air updates.

Key Stakeholders

-

Associations, Forums, and Alliances related to Automotive Ethernet

-

Automotive Ethernet Component Manufacturers

-

Automotive Investors

-

Automotive Ethernet Service Providers

-

Companies Operating in Autonomous Vehicle Ecosystem

-

Ethernet Cable Manufacturers

-

Government Agencies and Policy Makers

-

Government and Research Organizations

-

Original Equipment Manufacturers (OEMs)

-

Raw Material Suppliers of Semiconductor Components

-

Tier 1 Hardware Suppliers

-

Transport Authorities

-

Technology Providers

Report Objectives

-

To segment and forecast the size of the global automotive Ethernet market, by value, based on type (Automotive Ethernet: Network and Automotive Ethernet: Testing)

-

To segment and forecast the size of the global market, by value, based on component (Hardware, Software, and Service)

-

To segment and forecast the size of the global market, by value, based on bandwidth (10 Mbps, 100 Mbps, 1 Gbps, and 2.5/5/10 Gbps)

-

To segment and forecast the size of the global market, by value, based on application (ADAS, Infotainment, Powertrain, Chassis, and Body and Comfort)

-

To segment and forecast the size of the global market, by value, based on vehicle type (Passenger Cars and Commercial Vehicles)

-

To segment and forecast the size of the market, by value, based on region (Asia Pacific, Europe, and North America)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

-

Automotive ethernet Market, By Service Type (Consulting Implementation, Training & Support) at Country Level

-

Automotive ethernet Market, By Type Breakdown

-

Component

-

Bandwidth

-

Application

-

Vehicle Type

Growth opportunities and latent adjacency in Automotive Ethernet Market