Automotive Communication Technology Market by Bus Module (LIN, CAN, FlexRay, MOST, and Ethernet), Application (Powertrain, Body Control & Comfort, Infotainment & Communication, and Safety & ADAS), Vehicle Class, and Region - Global Forecast to 2025

[144 Pages Report] The global automotive communication technology market size was valued at USD 5.84 billion in 2017 and is expected to reach USD 19.99 billion by 2025, at a CAGR of 16.7% during the forecast period. In this study, 2017 has been considered as the base year, and 2018–2025 the forecast period, for estimating the size of the market. The report analyzes and forecasts the market size, by value (USD million) and volume (million nodes), of the market. The report segments the market and forecasts its size by bus module, application, vehicle class, and region. The report also provides a detailed analysis of various forces acting on the market, including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments, such as joint ventures, mergers and acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

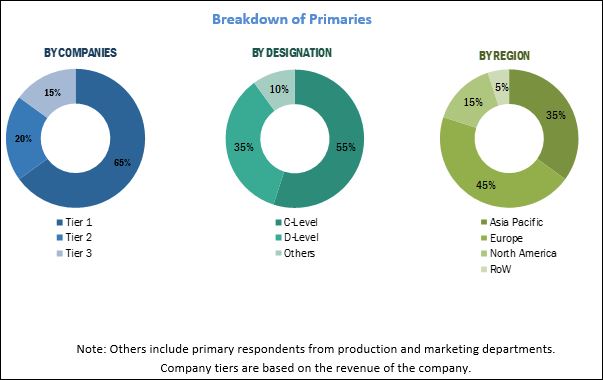

The research methodology used in the report involves various secondary sources, such as Automotive Open System Architecture (AUTOSAR), Automotive Electronics Council (AEC), Driver and Vehicle Standards Agency (DVSA), International Council on Clean Transportation (ICCT), National Highway Traffic Safety Administration (NHTSA), GENIVI Alliance, One-Pair Ether-Net (OPEN) Alliance, Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries, in-vehicle network architecture vendors, and protocol license providers have been interviewed to understand the future trends of the automotive communication technology market. The market size of the individual segments was determined through various secondary sources including industry associations, white papers, and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The top-down and bottom-up approaches have been used to estimate and validate the size of the global market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive communication technology market consists of manufacturers, such as Robert Bosch (Germany), Toshiba (Japan), Broadcom (US), Texas Instruments (US), and NXP (Netherlands), and research institutes such as AUTOSAR, OPEN, AEC, and DVSA.

Target Audience

- Automobile manufacturers

- Automobile organizations/associations

- Cloud service providers

- Compliance regulatory authorities

- Automotive network hardware manufacturers

- Government agencies

- Information Technology (IT) companies and system integrators

- Investors and Venture Capitalists (VCs)

Scope of the Report

Market, by bus module

- Local Interconnect Network (LIN)

- Controller Area Network (CAN)

- FlexRay

- Media-Oriented Systems Transport (MOST)

- Ethernet

Market, by application

- Powertrain

- Body Control & Comfort

- Infotainment & Communication

- Safety & ADAS

Market, by vehicle class

- Economy

- Mid-Size

- Luxury

Market, by region

- Asia Pacific

- Europe

- North America

- Rest of the World (RoW)

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis of the market, by vehicle class

- Detailed analysis of the market by application

- Competitive leadership mapping (Micro-quadrant) for market

Growing digitization in vehicles to boost adoption of ethernet technology enabling market to USD 20 billion by 2025

The Ethernet protocol in automotive provides Ethernet and IP-based routings in vehicles. Ethernet-based technologies find importance and varied usage in different applications of vehicle, as automotive Ethernet incorporates powerful data transmission, is less expensive, and has more flexibility than comparable network technologies.

With the rapid increase in the overall content of electronic and semiconductor components, the amount of data generation has been increased which requires a fast processing protocol. Hence, the new protocols have such introduced for specific applications. For instance, FlexRay is majorly used in safety applications, and on the other hand, MOST is developed specifically for infotainment systems and camera-based ADAS functions. But, the next challenge for OEMs after developing fast and robust protocols is the cost of implementation. As a result, automotive players are developing and implementing Ethernet for vehicles with flexible data transition rate. Ethernet is expected to gain the traction in future similarly as CAN has done that in the past.

Market Dynamics

Drivers

- Rising contribution of electronic systems in passenger cars

- Government mandates and industry norms to reduce emission and improve the safety of vehicles

Restraints

- More complexity and less reliability of electronics architecture

- Higher cost per node with the increase in communication nodes in a vehicle

Opportunities

- Emergence of autonomous vehicles

- Rise in sales of premium vehicles

Challenges

- Increase in cybersecurity threats for connected vehicles

- Maintenance and troubleshooting for vehicle network architecture

Critical Questions would be:

- Which OEMs are leading the transition to ethernet?

- Infotainment will be the most popular application area in future for in-vehicle network. Which protocol will be the best fit to accommodate this future requirement?

- Over 1 million fully autonomous vehicles expected by 2030. How will the in-vehicle communication network change?

The global automotive communication technology market is estimated to be USD 6.78 billion in 2018 and is projected to grow at a CAGR of 16.7% during the forecast period, to reach USD 19.99 billion by 2025. Some of the major growth drivers for the market are the growing number of electronic systems in passenger cars, government mandates, and industry norms to reduce emission and improve the safety of vehicles. The rise in sales of premium vehicles and the emergence of autonomous vehicles can create new revenue generation opportunities for automotive communication technology providers. However, increase in cybersecurity threats for connected vehicles can pose a challenge for automotive communication technology providers.

The global market is segmented by bus module, application, vehicle class, and region. The report discusses five automotive communication technology bus modules, namely, local interconnect network (LIN), controller area network (CAN), FlexRay, media oriented systems transport (MOST), and ethernet. CAN segment is estimated to account for the largest share of the market. This segment is driven by factors such as increasing electronic content for applications such as powertrain, body control & comfort, and infotainment & communication.

The safety & ADAS segment is estimated to be the fastest growing market for automotive communication technology, by application. It is followed by infotainment & communication, body control & comfort, and powertrain. The growth of the safety & ADAS segment can be attributed to the increasing government mandates for safety norms in the automotive industry.

The economy vehicle class segment of the automotive communication technology market is expected to grow at the highest CAGR during the forecast period. It is followed by luxury and mid-size vehicle class segments. The luxury vehicle class segment is estimated to account for the largest share of the market, following its wide application in vehicle electronics.

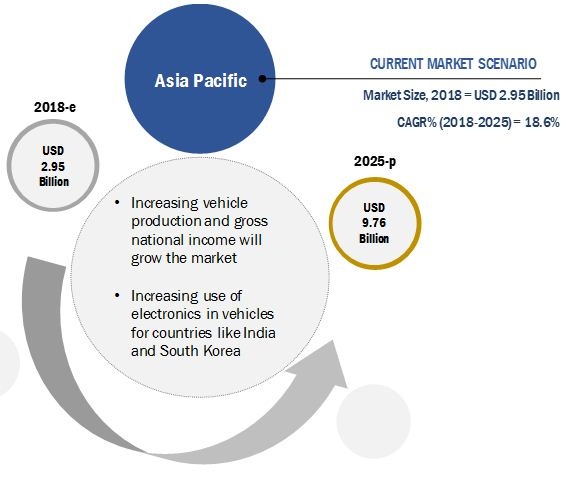

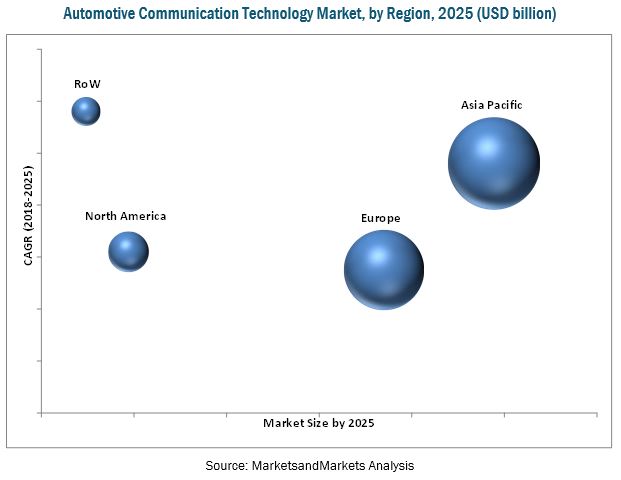

The extensive study has been done on four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW).

The Asia Pacific automotive communication technology market is projected to hold the largest market share and is estimated to grow at a significant CAGR during the forecast period. The market growth in the region can be attributed to the increase in vehicle production and government mandates regarding the active and passive safety of vehicles. In addition, the increasing investment in infrastructure, construction activities, and increasing sales of luxury vehicles are also projected to drive the market growth in this region. Some of the major restraints for the global market are high complexity and less reliability of electronics architecture and higher cost per node with the increase in communication nodes in a vehicle.

Some of the major players in the global automotive communication technology market are Robert Bosch (Germany), Toshiba (Japan), Broadcom (US), Texas Instruments (US), and NXP (Netherlands). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The evaluation of market players is done by taking several factors into account, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

The increasing demand of premium vehicles to create lucrative growth opportunities for communication technology suppliers.

Local Interconnect Network (Lin)

LIN is a Universal Asynchronous Receiver-Transmitter (UART) networking architecture based on a single-master, multiple-slave, flip-flop switch. It was developed for automotive sensor and actuator networking applications. LIN is a more cost-effective networking option than CAN for connecting motors, switches, sensors, and lamps in a vehicle.

Controlled Area Network (Can)

CAN provides a low-cost and durable network that helps multiple CAN devices communicate with one another; an advantage of this is, Electronic Control Units (ECUs) can have a single CAN interface rather than several analog and digital inputs to every device in the system. CAN is estimated to get the largest revenue share globally during the forecast period owing to its unique advantages such as flexible data rate and low cost of integration.

Flexray

The FlexRay automotive communications system is a bus protocol with a dual channel data rate of 10 Mbps for advanced in-vehicle control applications. The protocol operates in an algorithm of deterministic communications and is designed to be faster and more reliable than the CAN protocol, but is also more expensive. The FlexRay Consortium had designed this protocol, and although the consortium was dissolved, the FlexRay standard is now part of ISO standards. FlexRay is estimated to be the largest automotive communication technology market size in Europe due to implementation of safety and ADAS features in the vehicle.

Media Oriented Systems Transport (Most)

The Media-Oriented Systems Transport (MOST) is a high-speed multimedia network technology used in vehicle networking. It operates as a synchronous data communication, which features ring topology, and is used for the transmission of voice, video, and data signals, through both electrical and optical fiber physical layers. The MOST protocol is estimated to get the slow growth rate because of its high cost and emergence of other protocols like ethernet.

Ethernet

The Ethernet protocol in automotive provides Ethernet and IP-based routings in vehicles. Ethernet-based technologies find importance and varied usage in different applications of vehicle, as automotive Ethernet incorporates powerful data transmission, is less expensive, and has more flexibility than comparable network technologies. The Ethernet technology clears the path for the next level of connectivity. It not only provides improved bandwidth for advanced automotive applications such as ADAS application but also lowers latencies for control applications. The ethernet market is at the emerging stage and estimated to be the fastest growing among all protocols. Europe is estimated to record largest revenue share of ethernet with significant CAGR.

Critical Questions would be:

- Will the players form a consortium to standardize Ethernet protocol?

- Will companies redesign or the existing network protocol sufficient for autonomous vehicles?

- Which vehicle class will be the first transits to ethernet

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.5.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Market, 2018 vs 2025

4.2 Market By Region

4.3 Market By Bus Module

4.4 Market By Application

4.5 Market By Vehicle Class

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Contribution of Electronic Systems in Passenger Cars

5.2.1.2 Government Mandates and Industry Norms to Reduce Emission and Improve the Safety of Vehicles

5.2.2 Restraints

5.2.2.1 More Complexity and Less Reliability of Electronics Architecture

5.2.2.2 Higher Cost Per Node With the Increase in Communication Nodes in A Vehicle

5.2.3 Opportunities

5.2.3.1 Emergence of Autonomous Vehicles

5.2.3.2 Rise in Sales of Premium Vehicles

5.2.4 Challenges

5.2.4.1 Increase in Cybersecurity Threats for Connected Vehicles

5.2.4.2 Maintenance and Troubleshooting for Vehicle Network Architecture

6 Market, By Bus Module (Page No. - 43)

6.1 Introduction

6.2 Local Interconnect Network (LIN)

6.3 Controller Area Network (CAN)

6.4 Flexray

6.5 Media-Oriented Systems Transport (MOST)

6.6 Ethernet

7 Market, By Application (Page No. - 51)

7.1 Introduction

7.2 Powertrain

7.3 Body Control & Comfort

7.4 Infotainment & Communication

7.5 Safety & Adas

8 Market By Vehicle Class (Page No. - 58)

8.1 Introduction

8.2 Economy

8.3 Mid-Size

8.4 Luxury

9 Market, By Region (Page No. - 64)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Rest of Asia Pacific

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 Italy

9.3.4 Spain

9.3.5 UK

9.3.6 Rest of Europe

9.4 North America

9.4.1 CANada

9.4.2 Mexico

9.4.3 US

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Russia

9.5.3 South Africa

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Situation & Trends

10.3.1 New Product Development

10.3.2 Collaboration

10.3.3 Partnership

10.3.4 Expansion

11 Company Profiles (Page No. - 97)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

11.1 Robert Bosch

11.2 Toshiba

11.3 Broadcom

11.4 Texas Instruments

11.5 NXP

11.6 Stmicroelectronics

11.7 Infineon

11.8 Renesas

11.9 on Semiconductor

11.10 Microchip

11.11 Continental

11.12 Cypress Semiconductor

11.13 Rohm Semiconductor

11.14 Xilinx

11.15 Melexis

11.16 Elmos Semiconductor

11.17 Vector Informatik

11.18 Intel

11.19 Maxim Integrated

11.20 Qualcomm

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 138)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.4.1 Additional Company Profiles

12.4.1.1 Business Overview

12.4.1.2 SWOT Analysis

12.4.1.3 Recent Developments

12.4.1.4 MnM View

12.4.2 Detailed Analysis of the Market, By Vehicle Class

12.4.3 Detailed Analysis of the Market, By Application

12.4.4 Detailed Analysis of Competitive Landscape (Micro Quadrant) for Market

12.5 Related Reports

12.6 Author Details

List of Tables (80 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Key Premium Vehicle Manufacturers & Their Vehicle Sales in China, Germany, Uk, & Us, 2015–2017 (‘000 Units)

Table 3 Market, By Bus Module, 2016–2025 (Million Nodes)

Table 4 Market By Bus Module, 2016–2025 (USD Million)

Table 5 LIN: Market By Region, 2016–2025 (Million Nodes)

Table 6 LIN: Market By Region, 2016–2025 (USD Million)

Table 7 CAN: Market By Region, 2016–2025 (Million Nodes)

Table 8 CAN: Market By Region, 2016–2025 (USD Million)

Table 9 Flexray: Market By Region, 2016–2025 (Million Nodes)

Table 10 Flexray: Market, By Region, 2016–2025 (USD Million)

Table 11 MOST: Market By Region, 2016–2025 (Million Nodes)

Table 12 MOST: Market By Region, 2016–2025 (USD Million)

Table 13 Ethernet: Market By Region, 2016–2025 (Million Nodes)

Table 14 Ethernet: Market By Region, 2016–2025 (USD Million)

Table 15 Market, By Application, 2016–2025 (Million Nodes)

Table 16 Market By Application, 2016–2025 (USD Million)

Table 17 Powertrain: Market By Region, 2016–2025 (Million Nodes)

Table 18 Powertrain: Market By Region, 2016–2025 (USD Million)

Table 19 Body Control & Comfort: Market By Region, 2016–2025 (Million Nodes)

Table 20 Body Control & Comfort: Market By Region, 2016–2025 (USD Million)

Table 21 Infotainment & Communication: Market By Region, 2016–2025 (Million Nodes)

Table 22 Infotainment & Communication: Market By Region, 2016–2025 (USD Million)

Table 23 Safety & Adas: Market, By Region, 2016–2025 (Million Nodes)

Table 24 Safety & Adas: Market By Region, 2016–2025 (USD Million)

Table 25 Market By Vehicle Class, 2016–2025 (Million Nodes)

Table 26 Market By Vehicle Class, 2016–2025 (USD Million)

Table 27 Economy: Market By Region, 2016–2025 (Million Nodes)

Table 28 Economy: Market By Region, 2016–2025 (USD Million)

Table 29 Mid-Size: Market By Region, 2016–2025 (Million Nodes)

Table 30 Mid-Size: Market By Region, 2016–2025 (USD Million)

Table 31 Luxury: Market By Region, 2016–2025 (Million Nodes)

Table 32 Luxury: Market, By Region, 2016–2025 (USD Million)

Table 33 Market By Region, 2016–2025 (Million Nodes)

Table 34 Market By Region, 2016–2025 (USD Million)

Table 35 Asia Pacific: Market By Country, 2016–2025 (Million Nodes)

Table 36 Asia Pacific: Market By Country, 2016–2025 (USD Million)

Table 37 China: Market By Bus Module, 2016–2025 (Million Nodes)

Table 38 China: Market By Bus Module, 2016–2025 (USD Million)

Table 39 Japan: Market By Bus Module, 2016–2025 (Million Nodes)

Table 40 Japan: Market, By Bus Module, 2016–2025 (USD Million)

Table 41 India: Market By Bus Module, 2016–2025 (Million Nodes)

Table 42 India: Market By Bus Module, 2016–2025 (USD Million)

Table 43 South Korea: Market By Bus Module, 2016–2025 (Million Nodes)

Table 44 South Korea: Market By Bus Module, 2016–2025 (USD Million)

Table 45 Rest of Asia Pacific: Market By Bus Module, 2016–2025 (Million Nodes)

Table 46 Rest of Asia Pacific: Market By Bus Module, 2016–2025 (USD Million)

Table 47 Europe: Market By Country, 2016–2025 (Million Nodes)

Table 48 Europe: Market By Country, 2016–2025 (USD Million)

Table 49 France: Market, By Bus Module, 2016–2025 (Million Nodes)

Table 50 France: Market By Bus Module, 2016–2025 (USD Million)

Table 51 Germany: Market By Bus Module, 2016–2025 (Million Nodes)

Table 52 Germany: Market By Bus Module, 2016–2025 (USD Million)

Table 53 Italy: Market By Bus Module, 2016–2025 (Million Nodes)

Table 54 Italy: Market By Bus Module, 2016–2025 (USD Million)

Table 55 Spain: Market By Bus Module, 2016–2025 (Million Nodes)

Table 56 Spain: Market By Bus Module, 2016–2025 (USD Million)

Table 57 UK: Market By Bus Module, 2016–2025 (Million Nodes)

Table 58 UK: Market By Bus Module, 2016–2025 (USD Million)

Table 59 Rest of Europe: Market, By Bus Module, 2016–2025 (Million Nodes)

Table 60 Rest of Europe: Market By Bus Module, 2016–2025 (USD Million)

Table 61 North America: Market By Country, 2016–2025 (Million Nodes)

Table 62 North America: Market By Country, 2016–2025 (USD Million)

Table 63 Canada: Market By Bus Module, 2016–2025 (Million Nodes)

Table 64 Canada: Market By Bus Module, 2016–2025 (USD Million)

Table 65 Mexico: Market By Bus Module, 2016–2025 (Million Nodes)

Table 66 Mexico: Market By Bus Module, 2016–2025 (USD Million)

Table 67 US: Market By Bus Module, 2016–2025 (Million Nodes)

Table 68 US: Market, By Bus Module, 2016–2025 (USD Million)

Table 69 RoW: Market By Country, 2016–2025 (Million Nodes)

Table 70 RoW: Market By Country, 2016–2025 (USD Million)

Table 71 Brazil: Market By Bus Module, 2016–2025 (Million Nodes)

Table 72 Brazil: Market By Bus Module, 2016–2025 (USD Million)

Table 73 Russia: Market By Bus Module, 2016–2025 (Million Nodes)

Table 74 Russia: Market By Bus Module, 2016–2025 (USD Million)

Table 75 South Africa: Market By Bus Module, 2016–2025 (Million Nodes)

Table 76 South Africa: Market, By Bus Module, 2016–2025 (USD Million)

Table 77 Recent New Product Development (2014–2018)

Table 78 Recent Collaboration (2014-2018)

Table 79 Recent Partnership (2014–2018)

Table 80 Recent Expansion (2014–2018)

List of Figures (41 Figures)

Figure 1 Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Bottom-Up Approach

Figure 5 Market Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Asia Pacific is Estimated to Be the Largest Market, 2018 vs 2025 (USD Billion)

Figure 8 Ethernet is Estimated to Be the Fastest Growing Segment During the Forecast Period, 2018 vs 2025 (USD Billion)

Figure 9 Luxury-Class Vehicles to Dominate the Market, 2018 vs 2025 (USD Billion)

Figure 10 Attractive Opportunities in the Market

Figure 11 Asia Pacific is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 12 Can Bus Module is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 13 Infotainment & Communication Segment is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 14 Luxury Vehicle Segment is Estimated to Lead the Market, 2018 vs 2025 (USD Billion)

Figure 15 Semiconductors Have Acquired Their Place in Every Application

Figure 16 Automotive Communication Technology: Market Dynamics

Figure 17 Percentage Cost of Electronics Per Vehicle, 1950–2030

Figure 18 Types of Cyberattacks Occurred (2016 vs 2017)

Figure 19 Market, By Bus Module, 2018 vs 2025

Figure 20 Market By Application, 2018 vs 2025

Figure 21 Market By Vehicle Class, 2018 vs 2025

Figure 22 Market India is Estimated to Grow at the Highest CAGR (2018–2025)

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Companies Adopted Expansion as the Key Growth Strategy From 2014 to 2018

Figure 26 Market Ranking: 2017

Figure 27 Robert Bosch: Company Snapshot (2017)

Figure 28 Robert Bosch: SWOT Analysis

Figure 29 Toshiba: Company Snapshot (2017)

Figure 30 Toshiba: SWOT Analysis

Figure 31 Broadcom: Company Snapshot (2017)

Figure 32 Broadcom: SWOT Analysis

Figure 33 Texas Instruments: Company Snapshot (2017)

Figure 34 Texas Instruments: SWOT Analysis

Figure 35 NXP: Company Snapshot (2017)

Figure 36 NXP: SWOT Analysis

Figure 37 Stmicroelectronics: Company Snapshot (2017)

Figure 38 Infineon: Company Snapshot (2017)

Figure 39 Renesas: Company Snapshot (2017)

Figure 40 on Semiconductor: Company Snapshot (2017)

Figure 41 Microchip: Company Snapshot (2017)

Growth opportunities and latent adjacency in Automotive Communication Technology Market