Automotive Valves Market by Propulsion and Component (ICE, EV), Vehicle Type (Passenger Cars, LCV, Trucks, and Buses), EV (BEV, PHEV, HEV), Application (Engine, HVAC, Brake), Function, Engine Valve Type and Region - Global Forecast to 2027

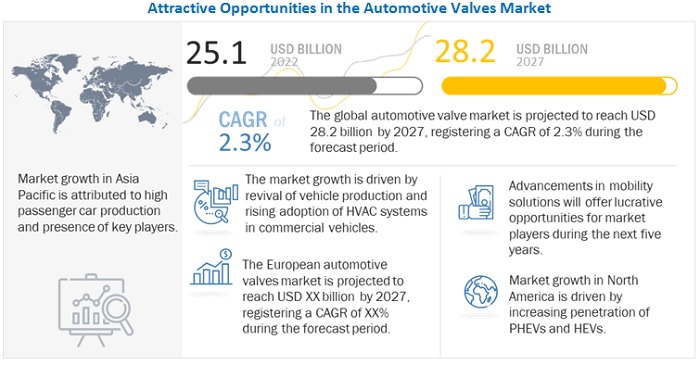

[324 Pages Report] The global automotive valves market was valued at USD 25.1 billion in 2022 and is expected to reach USD 28.2 billion by 2027 and grow at CAGR of 2.3% over the forecast period (2022-2027). Factors such as increasing vehicles sales, growing adoption of hybrid electric vehicles (HEVs), rising demand for comfort as well as increasing automation in vehicle drive the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Revival of Automotive Industry

Automotive valves are among the integral components which are important for vehicle functioning and are irreplaceable (having no substitute). For instance, a gasoline engine cylinder uses approximately four valves for inlet and exhaust function. The number of valves used, size, shape, and material can differ for different engine designs, but the valves are necessarily used to complete the seamless functioning of the engine. As discussed earlier, a standard car contains around 40–60 valves, which are irreplaceable. The growth of valves is directly linked to the vehicle production. An increase in the level of production causes uplift in demand for valves. The Indian and Chinese automobile markets are witnessing higher growth as compared to other countries due to changing demographics and improving economy at large. In year 2021, the passenger car production in China stood at 21.4 million units, while commercial vehicle production was 4.7 million. India recorded the total vehicle production at around 22.7 million units.

Increasing demand for solenoid valves and electric vehicles

Solenoids are used in several applications in modern cars to improve their performance and efficiency. A few of the major applications are Door locks and trunk release , Starter solenoid functions, automatic transmission control, dual-clutch transmission control, turbocharger control, and variable valve timing, EGR control, evaporative emission control (EVAP) system, fuel ignition coils, and engine fuel shut off valve, ABS, air suspension system, and HVAC system, Increasing consumer preference for new improved transmission systems, such as AMT, DCT, and CVT, which provide an enhanced driving experience with better control and acceleration of the vehicle is expected to support the demand for solenoids. This is mainly because transmission systems enable real-time control of torque with each gearshift. The friction losses created during the shifting of gears are reduced, and they are quickly synchronized with the torque required for the new gear, which, in turn, increases the time taken for the torque to synchronize with the new gear. This has further improved the fuel efficiency of vehicles along with the elimination of any scope for human error as most of the work while shifting the gears is controlled by sensors, solenoids, and computers.

Rise in cost of raw materials

Over the year, the cost of raw material has increased. For instance, in year 2021-22, the cost of key raw material such as pig iron and steel have risen 35-40% year on year in April-December. The increase in the cost of raw material is restraining the market growth of automotive valves market. Steel makes up 39% of the average car, whereas aluminum makes up 11%. The rise in raw material costs has been focused on high steel prices; according to a Bank of America analysis released last month, the average cost per pound of steel used in automobile manufacture has risen 106 percent year over year. Given the large steel content of the average vehicle, this is "quite concerning," according to the analysis. The impact of increased material costs is projected to fall on suppliers and original equipment manufacturers (OEMs), with the latter bearing even more indirect expenses from the former. Both groups face issues as a result of rising inflation costs and pre-existing supply chain damage caused by the pandemic. "In addition to growing raw material costs, the automotive value chain is already suffering major headwinds from supply chain disruptions and manufacturing stoppages.

Technical problems associated with valves

There are a few problems that consistently affect the performance of valves. A few of the common problems that are associated with valves include part closure of valves, valves not opening properly, valves making erratic sounds, and coil problems in solenoid valves. For instance, part closure of valves occurs due to manual override, pressure difference, residual coil power, damaged armature tube, and damaged valve seats. For instance, a few solenoid valves do not open because of power failure, wrong voltage, dirt gathering under the diaphragm, and uneven pressure. Similarly, the valves make erratic sounds during the opening and closing operation. The sound is due to the difference in the inlet or outlet pressure inside the system. Additionally, a few other factors such as the flow factor of the valve and compatibility with the media also affect its operation. Thus, the above-mentioned technical problems are surfacing challenges for automotive valves market.

By Function type: Mechanical segment is expected to be the largest segment

As of 2021, the mechanical function segment accounted for the largest share followed by the electric function segment in the global automotive valves market. The ranking of the shares is anticipated to remain same while the electric function segment is expected to exhibit higher CAGR than the other functions. As the engine valves remain predominant in volume, the mechanical valves will exhibit higher volume and vice versa. On the other hand, electric functions cater all solenoid valves; this segment is expected to grow at a higher CAGR during the forecast period due to increased electrification of vehicles, for example, ABS, auto door lock, and other safety and security features.

By Vehicle type: Passenger car segment is estimated to be the biggest in the market during the forecast period

The passenger car segment is estimated to dominate the automotive valve market by volume and value. This is due to the sheer amount of passenger cars sold around the world compared to other vehicle types. In addition, the strong adoption of air conditioning, exhaust gas recovery (EGR), etc. in passenger cars is also expected to augment revenues for this segment. The light commercial vehicle segment is projected to grow at the fastest rate with a growing demand for vans and pickups around the world.

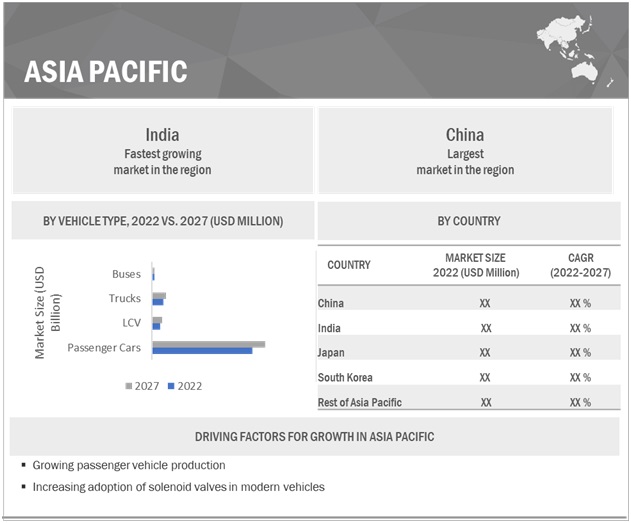

Asia Pacific is expected to account for the largest market size during the forecast period

China is expected to be the largest market for automotive valves during the forecast period, whereas India is estimated to be the fastest-growing market during the forecast period. High demand for passenger vehicles will be the major driver for growth of the market. The increase in demand for LCVs and heavy trucks in India is also expected to be crucial factor in growth of automotive valves market over the next few years. The Japanese market is expected to be the second largest in Asia Pacific, followed by India and South Korea.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major market players include Robert Bosch (Germany), Continental AG (Germany), Denso Corporation (Japan), Aisin Corporation (Japan) and BorgWarner (US). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive range of products. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Million Units) |

|

Segments covered |

Propulsion & Component, Application, Function, EV Type, Vehicle Type, Engine Valve Type |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies covered |

The major market players include Robert Bosch (Germany}, Continental AG (Germany), Denso Corporation (Japan), Aisin (Japan), BorgWarner (US). Total 27 major players are profiled in the report. |

Based on propulsion & component, the market has been segmented as follows:

-

ICE

- Engine (inlet and outlet) valves

- A/c valve

- Brake valve

- Thermostat valve

- Fuel system valve

- Solenoid valve

- Exhaust gas recirculation valve

- Tire valve

- Water valve

- AT control valve

-

EV

- Engine (inlet and outlet) valves

- A/c valve

- Brake valve

- Thermostat valve

- Fuel system valve

- Solenoid valve

- Exhaust gas recirculation valve

- Tire valve

- Water valve

- AT control valve

- Battery valve

Based on application, the market has been segmented as follows:

- Engine System

- HVAC System

- Brake System

- Other (Tyrel, Body, etc.)

Based on function, the market has been segmented as follows:

- Electric

- Pneumatic

- Hydraulic

- Others (Mechanical, Pilot-operated)

Based on vehicle type, the market has been segmented as follows:

- Passenger Cars

- Light Commercial Vehicles

- Buses

- Truck

Based on EV type, the market has been segmented as follows:

- BEV

- HEV

- PHEV

Based on Engine valve type, the market has been segmented as follows:

- Monometallic

- Bimetallic

- Hollow

Based on region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

-

North America

- Canada

- US

- Mexico

-

Rest of the World

- Brazil

- Russia

- South Africa

- Others

Recent Developments

- In February 2022, BorgWarner signed an equity transfer agreement with Santroll Electric Auto and Santroll Automotive Components. Under this agreement BorgWarner will acquire Santroll Automotive Components. This acquisition is expected to strengthen the portfolio of light vehicle e-motors.

- In November 2021, Continental AG invested in production facility in Novi Sad. The facility features 30,000 sq meter of production and office area. With this company is planning to grow its production and export of complex electronic systems for automotive industry

- In July 2021, Denso Corporation invested USD 9.8 million to construct a new facility. The facility will be used to produce automotive components such as windshield wipers, alternators, radiators and air conditioning equipment will be produced and warehoused.

- July 2021, Robert Bosch signed a strategic alliance with Dayun Automobiles. The alliance will focus on areas such as integrated chassis, autonomous driving, connected mobility, smart transportation, and electronic control systems

- In June 2021, BorgWarner acquired AKASOL AG, which strengthened BorgWarner’s commercial vehicle and industrial electrification capabilities, and positioned the company to capitalize on a fast-growing battery pack market.

- In March 2021, Denso Corporation signed an agreement with Honeywell (US), an aerospace company to develop electric propulsion system for aircraft and urban air mobility (UAM) segment with major focus on air taxis and delivery vehicles.

- In March 2020, Continental AG invested USD 226 million in its operations in Romania and inaugurated a new production module and a new building for research and development activities in Sibiu Braking system, pneumatic suspensions, electronic control units for automatic gearboxes are some of the products developed, manufactured and tested here.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive valves market?

The global automotive valves market is estimated to be USD 25.1 billion in 2022 and projected to reach USD 28.2 billion by 2027, at a CAGR of 2.3%

Who are the winners in the global automotive valves market?

Companies such as Robert Bosch (Germany), Continental AG (Germany), Denso Corporation (Japan), Aisin Corporation (Japan) and BorgWarner (US) fall under the winners' category. These companies have been competing for developing automotive valves. With advanced R&D facilities, large production capacities, and strong distribution networks (geographical presence), these companies have managed to stay ahead of other companies.

What are the new market trends impacting the growth of the automotive valves market?

New valve technology promises cheaper and greener engines progressive developments in automotive valves are expected to lead to the steady growth of this market. Fuel efficiency and emission reduction are the key directions for these developments.

Decrease in number of cylinders used in modern engines, Rise in cost of raw material and low preference for diesel passenger cars are some of the restraints for the EV charging cables market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 AUTOMOTIVE VALVES MARKET DEFINITION, BY COMPONENT (ICE AND EV)

TABLE 2 MARKET DEFINITION, BY FUNCTION

TABLE 3 MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

TABLE 4 MARKET DEFINITION, BY VEHICLE TYPE

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 5 MARKET: INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 6 CURRENCY EXCHANGE RATES

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 1 AUTOMOTIVE VALVES MARKET: RESEARCH DESIGN

FIGURE 2 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 List of primary participants

2.2 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 6 MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ICE VEHICLES - DEMAND SIDE

FIGURE 7 MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ELECTRIC VEHICLES – DEMAND SIDE

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

FIGURE 9 FACTOR ANALYSIS: MARKET

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 65)

FIGURE 10 AUTOMOTIVE VALVES MARKET OVERVIEW

FIGURE 11 MARKET, BY REGION, 2022–2027

FIGURE 12 PASSENGER CARS TO HOLD LARGEST MARKET SIZE, 2022 VS. 2027

FIGURE 13 KEY PLAYERS IN MARKET

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE VALVES MARKET

FIGURE 14 STEADY SURGE IN PASSENGER CAR PRODUCTION TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC PROJECTED TO BE DOMINANT MARKET DURING FORECAST PERIOD

4.3 MARKET, BY PROPULSION

FIGURE 16 ICE ESTIMATED EXPECTED TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY COMPONENT (ICE + EV)

FIGURE 17 ENGINE VALVES EXPECTED TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY FUNCTION

FIGURE 18 MECHANICAL SEGMENT EXPECTED TO ACQUIRE LARGEST MARKET SHARE IN FORECAST PERIOD

4.6 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 19 HEV TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

4.7 MARKET, BY VEHICLE TYPE

FIGURE 20 PASSENGER CARS TO HAVE HIGHEST GROWTH, 2022 VS. 2027 (USD MILLION)

4.8 MARKET, BY APPLICATION

FIGURE 21 ENGINE SYSTEM VALVES TO BE DOMINANT SUBSEGMENT, 2022 VS. 2027 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 75)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AUTOMOTIVE VALVES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Revival of automotive industry

FIGURE 23 CHINA PASSENGER VEHICLE SALES (2012–2021)

FIGURE 24 GLOBAL VEHICLE SALES AND PRODUCTION, 2020 AND 2021

5.2.1.2 Rise in demand for vehicle electrification

FIGURE 25 TOP 10 PREMIUM BRAND REGISTRATIONS IN EUROPE, BY FUEL TYPE

FIGURE 26 GLOBAL PHEV CAR SALES, 2016–2021

5.2.1.3 Stringent government regulations

FIGURE 27 COMPARISON OF EMISSIONS OF EVS AND GASOLINE VEHICLES

TABLE 7 EMISSION NORM SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

5.2.2 RESTRAINTS

5.2.2.1 Decrease in number of cylinders in modern engines

TABLE 8 INDIAN CARS WITH TURBO PETROL ENGINES AND THEIR POWER FIGURES

5.2.2.2 Rise in cost of raw materials

TABLE 9 COMMODITY PRICES

5.2.2.3 Declining preference for diesel passenger cars

FIGURE 28 SHARE OF DIESEL AND NON-DIESEL CARS IN PASSENGER VEHICLES SEGMENT IN INDIA

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for solenoid valves and electric vehicles

5.2.3.2 Increased market demand due to electric vehicles

FIGURE 29 GLOBAL BEV SALES

FIGURE 30 ELECTRICAL ARCHITECTURE OF CARS IN 1980S

FIGURE 31 ELECTRICAL ARCHITECTURE OF CARS IN 2020S

FIGURE 32 GLOBAL PHEV CAR STOCK, 2017–2020, BY REGION

5.2.4 CHALLENGES

5.2.4.1 Technical problems associated with valves

5.2.4.2 Upcoming emission norms for EGR valves and intercoolers

FIGURE 33 ON-ROAD LIGHT AND HEAVY-DUTY VEHICLE EMISSIONS REGULATION OUTLOOK

5.2.5 IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

TABLE 10 IMPACT OF PORTER’S FIVE FORCES ON AUTOMOTIVE VALVES MARKET

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 THREAT OF NEW ENTRANTS

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 4 VALVES

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 4 VALVES (%)

5.4.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.5 MARKET ECOSYSTEM

FIGURE 37 MARKET: ECOSYSTEM ANALYSIS

TABLE 13 ROLE OF COMPANIES IN AUTOMOTIVE VALVES ECOSYSTEM

5.6 MARKET: CONFERENCES AND EVENTS

TABLE 14 MARKET: LIST OF CONFERENCES AND EVENTS

5.7 TECHNOLOGY ANALYSIS

5.7.1 SMART ACTUATORS

5.7.2 VALVE BY WIRE

5.7.3 NEW VALVE TECHNOLOGY PROMISES CHEAPER AND GREENER ENGINES

5.7.4 VALVEMATIC

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

FIGURE 38 PUBLICATION TRENDS (2012–2021)

5.8.2 LEGAL STATUS OF PATENTS

FIGURE 39 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE VALVES

5.8.3 TOP PATENT APPLICANTS

FIGURE 40 AUTOMOTIVE VALVES PATENTS, TREND ANALYSIS, 2012-2021

TABLE 15 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE VALVES MARKET

5.9 VALUE CHAIN ANALYSIS

FIGURE 41 MAJOR VALUE ADDITION DURING MANUFACTURING AND ASSEMBLY PHASES

5.10 CASE STUDIES

5.10.1 EATON LAUNCHED COMPACT COMBO VALVE FOR FUEL TANKS

5.10.2 TLX TECHNOLOGIES DEVELOPED CUSTOMIZED COMPACT LATCHING SOLENOID

5.10.3 BORGWARNER INC. LAUNCHED SMART INTEGRAL MAGNETIC SWITCH (IMS) FOR ON/OFF-HIGHWAY COMMERCIAL VEHICLES

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO OF AUTOMOTIVE VALVES

FIGURE 42 IMPORTS OF AUTOMOTIVE VALVES, BY KEY COUNTRY (2017–2021) (USD MILLION)

TABLE 16 IMPORT TRADE DATA, BY KEY COUNTRY, 2021 (USD MILLION)

5.11.2 EXPORT SCENARIO OF AUTOMOTIVE VALVES

FIGURE 43 EXPORTS OF MARKET, BY KEY COUNTRY (2017–2021) (USD MILLION)

TABLE 17 EXPORT TRADE DATA, BY KEY COUNTRY, 2021 (USD MILLION)

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY LANDSCAPE FOR AUTOMOTIVE EMISSIONS

TABLE 18 REGULATIONS FOR AUTOMOTIVE EMISSIONS

5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 PRICING ANALYSIS

FIGURE 44 AVERAGE PRICING OF AUTOMOTIVE VALVES IN ASIA PACIFIC, 2022 AND 2027

FIGURE 45 AVERAGE PRICING OF AUTOMOTIVE VALVES IN EUROPE, 2022 AND 2027

FIGURE 46 AVERAGE PRICING OF AUTOMOTIVE VALVES IN NORTH AMERICA, 2022 AND 2027

FIGURE 47 AVERAGE PRICING OF AUTOMOTIVE VALVES IN REST OF THE WORLD, 2022 AND 2027

5.14 MACROECONOMIC INDICATORS

5.14.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 23 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.14.2 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021

TABLE 24 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021 (THOUSAND UNITS)

5.15 MARKET, SCENARIOS (2022–2027)

FIGURE 48 MARKET– FUTURE TRENDS & SCENARIOS, 2022–2027 (USD MILLION)

5.15.1 MOST LIKELY SCENARIO

TABLE 25 MARKET (MOST LIKELY), BY REGION, 2022–2027 (USD MILLION)

5.15.2 OPTIMISTIC SCENARIO

TABLE 26 MARKET (OPTIMISTIC SCENARIO), BY REGION, 2022–2027 (USD MILLION)

5.15.3 PESSIMISTIC SCENARIO

TABLE 27 MARKET (PESSIMISTIC), BY REGION, 2022–2027 (USD MILLION)

5.16 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 49 REVENUE SHIFT DRIVING MARKET GROWTH

6 AUTOMOTIVE VALVES MARKET, BY PROPULSION AND COMPONENT (Page No. - 118)

6.1 INTRODUCTION

FIGURE 50 ICE TO HOLD LARGER MARKET SHARE IN TERMS OF VALUE, 2022–2027

TABLE 28 MARKET, BY PROPULSION, 2018–2021 (MILLION UNITS)

TABLE 29 MARKET, BY PROPULSION, 2022–2027 (MILLION UNITS)

TABLE 30 MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 32 MOTOR VEHICLE SALES, BY VEHICLE TYPE (THOUSAND UNITS)

6.1.2 ASSUMPTIONS

TABLE 33 ASSUMPTIONS: BY PROPULSION TYPE AND COMPONENT

6.1.3 RESEARCH METHODOLOGY

6.2 ICE

6.2.1 REVIVAL OF ICE VEHICLE PRODUCTION TO BOOST SEGMENT

TABLE 34 MARKET, BY COMPONENT, 2018–2021 (MILLION UNITS)

TABLE 35 MARKET, BY COMPONENT, 2022–2027 (MILLION UNITS)

TABLE 36 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 37 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2.2 ENGINE (INLET AND OUTLET) VALVES

6.2.3 A/C VALVES

6.2.4 BRAKE COMBINATION VALVES

6.2.5 THERMOSTAT VALVES

6.2.6 FUEL SYSTEM VALVES

6.2.7 SOLENOID VALVES

6.2.8 EXHAUST GAS RECIRCULATION (EGR) VALVES

6.2.9 TIRE VALVES

6.2.10 SELECTIVE CATALYST REDUCTION (SCR) VALVES

6.2.11 AUTOMATIC TRANSMISSION (AT) CONTROL VALVES

6.3 ELECTRIC VEHICLES (BEV, PHEV, AND HEV)

6.3.1 GROWING ADOPTION OF ELECTRIC VEHICLES WORLDWIDE TO DRIVE SEGMENT

TABLE 38 GLOBAL ELECTRIC VEHICLE VALVES MARKET, BY COMPONENT, 2018–2021 (MILLION UNITS)

TABLE 39 GLOBAL ELECTRIC VEHICLE VALVES MARKET, BY COMPONENT, 2022–2027 (MILLION UNITS)

TABLE 40 GLOBAL ELECTRIC VEHICLE VALVES MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 41 GLOBAL ELECTRIC VEHICLE VALVES MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.3.2 ENGINE (INLET AND OUTLET) VALVES

6.3.3 A/C VALVES

6.3.4 BRAKE COMBINATION VALVES

6.3.5 THERMOSTAT VALVES

6.3.6 FUEL SYSTEM VALVES

6.3.7 SOLENOID VALVES

6.3.8 EXHAUST GAS RECIRCULATION (EGR) VALVES

6.3.9 TIRE VALVES

6.3.10 SELECTIVE CATALYST REDUCTION (SCR) VALVES

6.3.11 AUTOMATIC TRANSMISSION (AT) CONTROL VALVES

6.3.12 BATTERY & COOLING SYSTEM VALVES

6.4 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE VALVES MARKET, BY APPLICATION (Page No. - 132)

7.1 INTRODUCTION

FIGURE 51 HVAC SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 43 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 44 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.1.1 OPERATIONAL DATA

7.1.2 ASSUMPTIONS

TABLE 46 ASSUMPTIONS: BY APPLICATION

7.1.3 RESEARCH METHODOLOGY

7.2 ENGINE SYSTEMS

7.2.1 STEADY INCREASE IN ICE VEHICLE PRODUCTION TO SUPPORT MARKET GROWTH

TABLE 47 ENGINE SYSTEMS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 48 ENGINE SYSTEMS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 49 ENGINE SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 ENGINE SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 HVAC SYSTEMS

7.3.1 HIGH PENETRATION AIR CONDITIONING SYSTEMS TO ENSURE CONSISTENT DEMAND

TABLE 51 HVAC SYSTEMS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 52 HVAC SYSTEMS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 53 HVAC SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 HVAC SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 BRAKE SYSTEMS

7.4.1 GROWING PENETRATION OF SAFER BRAKE SYSTEMS TO DRIVE SEGMENT

TABLE 55 BRAKE SYSTEMS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 56 BRAKE SYSTEMS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 57 BRAKE SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 BRAKE SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHER VALVES (TIRE, SAFETY, SCR SYSTEM, BODY)

7.5.1 DEMAND FOR SAFETY SYSTEMS TO DRIVE MARKET

TABLE 59 OTHER VALVES (TIRE, SAFETY, SCR SYSTEM, BODY): MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 60 OTHER VALVES (TIRE, SAFETY, SCR SYSTEM, BODY): MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 61 OTHER VALVES (TIRE, SAFETY, SCR SYSTEM, BODY): MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 OTHER VALVES (TIRE, SAFETY, SCR SYSTEM, BODY): MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE VALVES MARKET, BY FUNCTION (Page No. - 144)

8.1 INTRODUCTION

FIGURE 52 MECHANICAL VALVE SEGMENT TO HOLD LARGEST MARKET SHARE, BY 2027 (USD MILLION)

TABLE 63 MARKET, BY FUNCTION, 2018–2021 (MILLION UNITS)

TABLE 64 MARKET, BY FUNCTION, 2022–2027 (MILLION UNITS)

TABLE 65 MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 66 MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

8.1.2 ASSUMPTIONS

TABLE 67 ASSUMPTIONS: BY FUNCTION

8.1.3 RESEARCH METHODOLOGY

8.2 ELECTRIC

8.2.1 DEMAND FOR QUICK RESPONSIVE VALVES TO DRIVE MARKET

TABLE 68 ELECTRIC VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 69 ELECTRIC VALVES MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 70 ELECTRIC VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 ELECTRIC VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 HYDRAULIC

8.3.1 CONTROLS LIQUID FLOW

TABLE 72 HYDRAULIC VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 73 HYDRAULIC VALVES MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 74 HYDRAULIC VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 HYDRAULIC VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 PNEUMATIC

8.4.1 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 76 PNEUMATIC VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 77 PNEUMATIC VALVES MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 78 PNEUMATIC VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 PNEUMATIC VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 MECHANICAL

8.5.1 RISE IN DEMAND FOR ICE VEHICLES TO ASSIST GROWTH OF MECHANICAL VALVES

TABLE 80 MECHANICAL VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 81 MECHANICAL VALVES MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 82 MECHANICAL VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MECHANICAL VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHERS (THERMAL AND PILOT OPERATED)

8.6.1 DEMAND FOR COMFORTABLE DRIVING TO LEAD SEGMENT

TABLE 84 OTHER VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 85 OTHER VALVES MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 86 OTHER VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 OTHER VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE VALVES MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 156)

9.1 INTRODUCTION

FIGURE 53 HEV SEGMENT TO HOLD LARGEST MARKET SHARE BY 2027 (USD MILLION)

TABLE 88 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 89 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 90 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 91 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 92 ELECTRIC VEHICLE SALES, BY PROPULSION TYPE, 2018–2021 (MILLION UNITS)

9.1.2 ASSUMPTIONS

TABLE 93 ASSUMPTIONS: BY ELECTRIC VEHICLE TYPE

9.1.3 RESEARCH METHODOLOGY

9.2 BATTERY ELECTRIC VEHICLES (BEVS)

9.2.1 HIGH BEV SALES IN CHINA TO DRIVE SEGMENT GROWTH

TABLE 94 BATTERY ELECTRIC VEHICLES: AUTOMOTIVE VALVES MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 95 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 96 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

9.3.1 TAX BENEFITS AND INCENTIVES FROM GOVERNMENTS TO BENEFIT SEGMENT

TABLE 98 PHEVS LAUNCHED BY VARIOUS OEMS

TABLE 99 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 100 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 101 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HYBRID ELECTRIC VEHICLES (HEVS)

9.4.1 HIGH HEV SALES FROM JAPAN AND US TO SUPPORT SEGMENT GROWTH

TABLE 103 HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 104 HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 105 HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE VALVES MARKET, BY VEHICLE TYPE (Page No. - 168)

10.1 INTRODUCTION

FIGURE 54 PASSENGER CAR TO HOLD LARGEST MARKET SHARE, BY VALUE, 2022 VS. 2027

TABLE 107 MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 108 MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 109 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 110 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 111 GLOBAL PASSENGER CARS AND COMMERCIAL VEHICLES PRODUCTION DATA, 2021 (MILLION UNITS)

10.1.2 ASSUMPTIONS

TABLE 112 ASSUMPTIONS: BY VEHICLE TYPE

10.1.3 RESEARCH METHODOLOGY

10.2 PASSENGER CARS

10.2.1 GROWING DEMAND FOR PREMIUM VEHICLES TO DRIVE SEGMENT GROWTH

TABLE 113 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 114 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 115 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 LIGHT COMMERCIAL VEHICLES (LCVS)

10.3.1 NORTH AMERICA TO DOMINATE LCVS SEGMENT

TABLE 117 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 118 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 119 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TRUCKS

10.4.1 HIGH DEPENDENCE ON LONG-HAUL ROAD TRANSPORTATION TO FUEL SEGMENT GROWTH

FIGURE 55 US SHIPMENT OF GOODS

TABLE 121 TRUCKS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 122 TRUCKS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 123 TRUCKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 TRUCKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 BUSES

10.5.1 HIGH DEPENDENCE OF PEOPLE ON PUBLIC TRANSPORT TO AID SEGMENT GROWTH

TABLE 125 BUSES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 126 BUSES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 127 BUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 128 BUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE VALVES MARKET, ENGINE VALVE TYPE (Page No. - 181)

11.1 INTRODUCTION

FIGURE 56 MONOMETALLIC VALVES TO HOLD LARGEST MARKET SHARE IN TERMS OF VALUE, 2022–2027

TABLE 129 MARKET, BY ENGINE VALVE TYPE, 2018–2021 (MILLION UNITS)

TABLE 130 MARKET, BY ENGINE VALVE TYPE, 2022–2027 (MILLION UNITS)

TABLE 131 MARKET, ENGINE VALVE TYPE, 2018–2021 (USD MILLION)

TABLE 132 MARKET, ENGINE VALVE TYPE, 2022–2027 (USD MILLION)

11.1.1 ASSUMPTIONS

TABLE 133 ASSUMPTIONS: BY ENGINE VALVE TYPE

11.1.2 RESEARCH METHODOLOGY

11.2 MONOMETALLIC

11.3 BIMETALLIC

11.4 HOLLOW

11.5 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE VALVES MARKET, BY REGION (Page No. - 186)

12.1 INTRODUCTION

FIGURE 57 MARKET (ICE), BY REGION, 2022 VS. 2027

TABLE 134 MARKET (ICE), BY REGION, 2018–2021 (MILLION UNITS)

TABLE 135 MARKET (ICE), BY REGION, 2022–2027 (MILLION UNITS)

TABLE 136 MARKET (ICE), BY REGION, 2018–2021 (USD MILLION)

TABLE 137 MARKET (ICE), BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 58 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 138 ASIA PACIFIC: MARKET, BY COMPONENT (ICE + EV), 2018–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY COMPONENT (ICE + EV), 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY COMPONENT (ICE), 2018–2021 (MILLION UNITS)

TABLE 141 ASIA PACIFIC: MARKET, BY COMPONENT (ICE), 2022–2027 (MILLION UNITS)

TABLE 142 ASIA PACIFIC: MARKET, BY COMPONENT (ICE), 2018–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY COMPONENT (ICE), 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET (ICE), BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 145 ASIA PACIFIC: MARKET (ICE), BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 146 ASIA PACIFIC: MARKET (ICE), BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET (ICE), BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Growing passenger vehicle demand to drive market

TABLE 148 CHINA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 149 CHINA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 150 CHINA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 151 CHINA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.2 INDIA

12.2.2.1 Growth in vehicle sales across categories to drive market

TABLE 152 INDIA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 153 INDIA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 154 INDIA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 155 INDIA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.3 JAPAN

12.2.3.1 Presence of major automobile manufacturers to fuel market

TABLE 156 JAPAN: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 157 JAPAN: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 158 JAPAN: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 159 JAPAN: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Increasing demand for passenger cars to drive market

TABLE 160 SOUTH KOREA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 161 SOUTH KOREA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 162 SOUTH KOREA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 163 SOUTH KOREA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.5 REST OF ASIA PACIFIC

TABLE 164 REST OF ASIA PACIFIC: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 165 REST OF ASIA PACIFIC: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 166 REST OF ASIA PACIFIC: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 59 EUROPE: MARKET, BY COUNTRY

TABLE 168 EUROPE: MARKET, BY COMPONENT (ICE + EV), 2018–2021 (USD MILLION)

TABLE 169 EUROPE: MARKET, BY COMPONENT (ICE + EV), 2022–2027 (USD MILLION)

TABLE 170 EUROPE: MARKET, BY COMPONENT (ICE), 2018–2021 (MILLION UNITS)

TABLE 171 EUROPE: MARKET, BY COMPONENT (ICE), 2022–2027 (MILLION UNITS)

TABLE 172 EUROPE: MARKET, BY COMPONENT (ICE), 2018–2021 (USD MILLION)

TABLE 173 EUROPE: MARKET, BY COMPONENT (ICE), 2022–2027 (USD MILLION)

TABLE 174 EUROPE: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 175 EUROPE: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 176 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 177 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 FRANCE

12.3.1.1 High production of passenger cars and LCVs to drive market

TABLE 178 FRANCE: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 179 FRANCE: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 180 FRANCE: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 181 FRANCE: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Emission norms and shift toward BEVs and PHEVs to drive market

TABLE 182 GERMANY: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 183 GERMANY: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 184 GERMANY: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 185 GERMANY: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.3 ITALY

12.3.3.1 Growth in automotive production to drive market

TABLE 186 ITALY: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 187 ITALY: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 188 ITALY: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 189 ITALY: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.4 SPAIN

12.3.4.1 Demand for heavy trucks to positively impact market

TABLE 190 SPAIN: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 191 SPAIN: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 192 SPAIN: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 193 SPAIN: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.5 UK

12.3.5.1 Demand for premium passenger cars to drive market

TABLE 194 UK: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 195 UK: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 196 UK: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 197 UK: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 198 REST OF EUROPE: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 199 REST OF EUROPE: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 200 REST OF EUROPE: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 201 REST OF EUROPE: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

FIGURE 60 TURKEY AUTOMOTIVE INDUSTRY SNAPSHOT

12.4 NORTH AMERICA

FIGURE 61 NORTH AMERICA: MARKET SNAPSHOT

TABLE 202 NORTH AMERICA: MARKET, BY COMPONENT (ICE + EV), 2018–2021 (USD MILLION)

TABLE 203 NORTH AMERICA: MARKET, BY COMPONENT (ICE + EV), 2022–2027 (USD MILLION)

TABLE 204 NORTH AMERICA: MARKET, BY COMPONENT (ICE), 2018–2021 (MILLION UNITS)

TABLE 205 NORTH AMERICA: MARKET, BY COMPONENT (ICE), 2022–2027 (MILLION UNITS)

TABLE 206 NORTH AMERICA: MARKET, BY COMPONENT (ICE), 2018–2021 (USD MILLION)

TABLE 207 NORTH AMERICA: MARKET, BY COMPONENT (ICE), 2022–2027 (USD MILLION)

TABLE 208 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 209 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 210 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 211 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 CANADA

12.4.1.1 Emission regulations to drive market

TABLE 212 CANADA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 213 CANADA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 214 CANADA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 215 CANADA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.2 MEXICO

12.4.2.1 Steady growth in automotive and auto parts production in Mexico to support market growth

TABLE 216 MEXICO: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 217 MEXICO: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 218 MEXICO: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 219 MEXICO: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.3 US

12.4.3.1 Strong LCV production drives market growth

TABLE 220 US: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 221 US: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 222 US: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 223 US: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5 REST OF THE WORLD

FIGURE 62 REST OF THE WORLD: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 224 REST OF THE WORLD: MARKET, BY COMPONENT (ICE), 2018–2021 (MILLION UNITS)

TABLE 225 REST OF THE WORLD: MARKET, BY COMPONENT (ICE), 2022–2027 (MILLION UNITS)

TABLE 226 REST OF THE WORLD: MARKET, BY COMPONENT (ICE), 2018–2021 (USD MILLION)

TABLE 227 REST OF THE WORLD: MARKET, BY COMPONENT (ICE), 2022–2027 (USD MILLION)

TABLE 228 REST OF THE WORLD: MARKET (ICE), BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 229 REST OF THE WORLD: MARKET (ICE), BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 230 REST OF THE WORLD: MARKET (ICE), BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 231 REST OF THE WORLD: MARKET (ICE), BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Robust demand for passenger cars and LCVs to drive market

TABLE 232 BRAZIL: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 233 BRAZIL: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 234 BRAZIL: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 235 BRAZIL: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.2 RUSSIA

12.5.2.1 Decline in vehicle production and heavy economic sanctions to hamper market

TABLE 236 RUSSIA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 237 RUSSIA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 238 RUSSIA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 239 RUSSIA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.3 SOUTH AFRICA

12.5.3.1 Presence of key OEMs and demand for passenger cars drive market

TABLE 240 SOUTH AFRICA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 241 SOUTH AFRICA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 242 SOUTH AFRICA: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 243 SOUTH AFRICA: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.4 OTHERS

TABLE 244 OTHERS: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 245 OTHERS: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 246 OTHERS: MARKET (ICE), BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 247 OTHERS: MARKET (ICE), BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 243)

13.1 OVERVIEW

13.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 63 TOP PUBLIC/LISTED PLAYERS DOMINATING AUTOMOTIVE VALVES MARKET DURING LAST FIVE YEARS

13.3 MARKET RANKING ANALYSIS, 2021

FIGURE 64 MARKET: MARKET RANKING ANALYSIS

13.3.1 BORGWARNER INC.

13.3.2 ROBERT BOSCH GMBH

13.3.3 CONTINENTAL AG

13.3.4 AISIN CORPORATION

13.3.5 DENSO CORPORATION

13.4 COMPETITIVE LEADERSHIP MAPPING OF MARKET, 2021

13.4.1 STARS

13.4.2 PERVASIVE PLAYERS

13.4.3 EMERGING COMPANIES

13.4.4 PARTICIPANTS

FIGURE 65 MARKET: COMPANY EVALUATION MATRIX, 2021

13.5 COMPANY EVALUATION QUADRANT

TABLE 248 REGION FOOTPRINT (27 COMPANIES)

TABLE 249 VEHICLE TYPE FOOTPRINT (27 COMPANIES)

TABLE 250 APPLICATION AND GEOGRAPHIC FOOTPRINT

13.6 SME EVALUATION MATRIX, 2021

FIGURE 66 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SME, 2021

13.7 COMPETITIVE SCENARIO AND TRENDS

13.7.1 PRODUCT LAUNCHES

TABLE 251 MARKET: PRODUCT LAUNCHES, 2019–2022

13.7.2 DEALS

TABLE 252 MARKET: DEALS, 2019–2022

13.7.3 OTHERS

TABLE 253 MARKET: OTHERS, 2019–2022

14 COMPANY PROFILES (Page No. - 258)

(Business overview, Products offered, Recent Developments, MNM view)*

14.1 KEY PLAYERS

14.1.1 CONTINENTAL AG

TABLE 254 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 67 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 68 CONTINENTAL AG: BUSINESS SEGMENTS

FIGURE 69 CONTINENTAL AG: BUSINESS EXPECTATIONS FROM 2022

TABLE 255 CONTINENTAL AG: MAJOR CUSTOMERS

TABLE 256 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 257 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 258 CONTINENTAL AG: DEALS

TABLE 259 CONTINENTAL AG: OTHERS

14.1.2 DENSO CORPORATION

TABLE 260 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 70 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 261 DENSO CORPORATION: KEY CUSTOMERS

FIGURE 71 DENSO CORPORATION: SALES PERCENTAGES OF CUSTOMERS

FIGURE 72 DENSO CORPORATION: SHAREHOLDERS (2020)

TABLE 262 DENSO CORPORATION: PRODUCTS OFFERED

TABLE 263 DENSO CORPORATION: DEALS

TABLE 264 DENSO CORPORATION: OTHERS

14.1.3 ROBERT BOSCH GMBH

TABLE 265 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 73 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 266 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 267 ROBERT BOSCH GMBH: MAJOR CUSTOMERS

TABLE 268 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 269 ROBERT BOSCH GMBH: DEALS

TABLE 270 ROBERT BOSCH GMBH: OTHERS

14.1.4 BORGWARNER INC.

TABLE 271 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 74 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 272 BORGWARNER INC.: PRODUCTS OFFERED

TABLE 273 BORGWARNER INC.: MAJOR CUSTOMERS

TABLE 274 BORGWARNER INC.: NEW PRODUCT DEVELOPMENTS

TABLE 275 BORGWARNER INC.: DEALS

TABLE 276 BORGWARNER INC.: OTHERS

14.1.5 VALEO

TABLE 277 VALEO: BUSINESS OVERVIEW

FIGURE 75 VALEO: COMPANY SNAPSHOT

TABLE 278 VALEO: KEY CUSTOMERS

TABLE 279 VALEO: BUSINESS GROUPS WITH MAJOR COMPETITORS

TABLE 280 VALEO: PRODUCT OFFERINGS

TABLE 281 VALEO: DEALS

TABLE 282 VALEO: OTHERS

14.1.6 HITACHI

TABLE 283 HITACHI AUTOMOTIVE: BUSINESS OVERVIEW

FIGURE 76 HITACHI: COMPANY SNAPSHOT

TABLE 284 HITACHI: PRODUCTS OFFERED

TABLE 285 HITACHI: DEALS

14.1.7 AISIN CORPORATION

TABLE 286 AISIN CORPORATION: BUSINESS OVERVIEW

FIGURE 77 AISIN CORPORATION: COMPANY SNAPSHOT

TABLE 287 AISIN CORPORATION: PRODUCTS OFFERED

TABLE 288 MAJOR CUSTOMERS

TABLE 289 AISIN CORPORATION: DEALS

TABLE 290 AISIN CORPORATION: OTHERS

14.1.8 CUMMINS INC.

TABLE 291 CUMMINS INC.: BUSINESS OVERVIEW

FIGURE 78 CUMMINS INC.: COMPANY SNAPSHOT

TABLE 292 CUMMINS INC.: MAJOR CUSTOMERS

TABLE 293 CUMMINS INC.: PRODUCTS OFFERED

TABLE 294 CUMMINS INC.: DEALS

14.1.9 TENNECO INC.

TABLE 295 TENNECO INC.: BUSINESS OVERVIEW

FIGURE 79 TENNECO INC.: COMPANY SNAPSHOT

TABLE 296 TENNECO INC.: PRODUCTS OFFERED

TABLE 297 TENNECO INC.: NEW PRODUCT DEVELOPMENTS

14.1.10 EATON CORPORATION PLC

TABLE 298 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 80 EATON CORPORATION PLC: COMPANY SNAPSHOT

TABLE 299 EATON CORPORATION PLC: MAJOR CUSTOMERS

TABLE 300 EATON CORPORATION PLC: PRODUCTS OFFERED

TABLE 301 EATON CORPORATION PLC: DEALS

14.1.11 JOHNSON ELECTRIC HOLDINGS LIMITED

TABLE 302 JOHNSON ELECTRIC HOLDINGS LIMITED: BUSINESS OVERVIEW

FIGURE 81 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 303 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCTS OFFERED

TABLE 304 JOHNSON ELECTRIC HOLDINGS LIMITED: MAJOR CUSTOMERS

14.2 OTHER KEY PLAYERS

14.2.1 STONERIDGE, INC.

TABLE 305 STONERIDGE, INC.: BUSINESS OVERVIEW

14.2.2 GKN GROUP

TABLE 306 GKN GROUP: BUSINESS OVERVIEW

14.2.3 MITSUBISHI ELECTRIC CORPORATION

TABLE 307 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

14.2.4 TLX TECHNOLOGIES

TABLE 308 TLX TECHNOLOGIES: BUSINESS OVERVIEW

14.2.5 ROTEX AUTOMATION

TABLE 309 ROTEX AUTOMATION: BUSINESS OVERVIEW

14.2.6 GIDEON AUTOMOTIVE INDUSTRIES

TABLE 310 GIDEON AUTOMOTIVE INDUSTRIES: BUSINESS OVERVIEW

14.2.7 SOLENOID SYSTEMS

TABLE 311 SOLENOID SYSTEMS: BUSINESS OVERVIEW

14.2.8 KENDRION

TABLE 312 KENDRION: BUSINESS OVERVIEW

14.2.9 MZW MOTOR

TABLE 313 MZW MOTOR: BUSINESS OVERVIEW

14.2.10 BICOLEX

TABLE 314 BICOLEX: BUSINESS OVERVIEW

14.2.11 ZONHEN ELECTRIC APPLIANCES

TABLE 315 ZONHEN ELECTRIC APPLIANCES: BUSINESS OVERVIEW

14.2.12 PADMINI VNA MECHATRONICS

TABLE 316 PADMINI VNA MECHATRONICS: BUSINESS OVERVIEW

14.2.13 JAKSA

TABLE 317 JAKSA: BUSINESS OVERVIEW

14.2.14 EMERSON ELECTRIC

TABLE 318 EMERSON ELECTRIC: BUSINESS OVERVIEW

14.2.15 MAHLE GMBH

TABLE 319 MAHLE GMBH: BUSINESS OVERVIEW

14.2.16 AISAN INDUSTRY CO., LTD.

TABLE 320 AISAN INDUSTRY CO., LTD.: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 316)

15.1 CHINA AND INDIA TO BE PROMISING MARKETS FOR MANUFACTURERS IN COMING YEARS

15.2 BEV TO EMERGE AS FASTEST-GROWING SEGMENT

15.3 BATTERY AND COOLING SYSTEM VALVES TO EMERGE AS PROMISING SEGMENTS DURING FORECAST PERIOD

15.4 CONCLUSION

16 APPENDIX (Page No. - 317)

16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.4 CUSTOMIZATION OPTIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

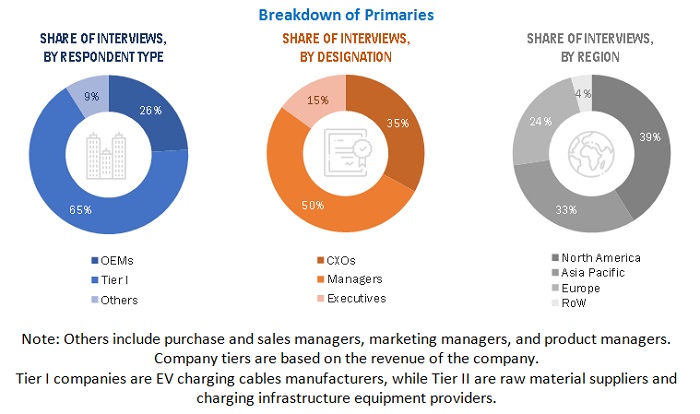

The study involved four major activities to estimate the market size for automotive valves market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive study of the global EV charging cables market. The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), the Alternative Fuels Data Center (AFDC), European Alternative Fuels Observatory [EAFO], corporate filings (such as annual reports, investor presentations, and financial statements), product catalogs from market players, and other associations/organizations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research, trade websites, technical articles, and databases (MarkLines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive valves market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side [vehicle manufacturers, Tier I companies, country-level government associations, and trade associations] and supply-side (automotive valves manufacturers) across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been used to estimate and validate the size of the automotive valves market

- In this approach, the vehicle production statistics have been considered at a country level to determine the market size, by volume, of automotive valves.

- Summation of country level markets has been done to derive the regional market of automotive valves in terms of volume.

- The regional level volume data has been multiplied with the ASP of automotive valves to estimate the market, in terms of value, at regional level. Global market has been derived by summation of regional level data, in terms of value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

The ecosystem of the automotive valves market consists of manufacturers such as Robert Bosch (Germany), Continental AG (Germany), Denso Corporation (Japan), Aisin Coroporation (Japan) BorgWarner (US) and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automobile OEMs

- Automotive Valves Distributors and Dealers

- Automotive Electronics System Integrators

- Automotive Parts Manufacturers

- Electric Vehicle Hardware Suppliers

- Manufacturers of Automotive Valves

- Manufacturers of Automotive Valves Components

- Organizations, Forums, Alliances, and Associations

- Raw Material Suppliers

- R&D Centers

- Regulatory Bodies

- State and National Regulatory Authorities

- Traders and Distributors of Electric Vehicles

- Vehicle Safety Regulatory Bodies

Report Objectives

- To define, segment, and forecast the global automotive valves market in terms of volume (million units) and value (USD Million/Billion)

- To segment the global market and forecast its size by propulsion and component, application, function, vehicle type, electric vehicle type, and region

- To segment the global market and forecast the market size, by volume and value, based on the propulsion and component – ICE (engine valves, A/C valves, brake combination valves, thermostat valves, fuel system valves, solenoid valves, EGR valves, tire valves, SCR valves, and AT valves) and EV (engine valves, A/C valves, brake combination valves, thermostat valves, fuel system valves, solenoid valves, EGR valves, tire valves, SCR valves, AT valves, and cooling system valves)

- To segment the global market and forecast the market size, by volume and value, based on application – engine systems, HVAC valves, brake valves, and others (tire, safety, SCR system, body)

- To segment the global market and forecast the market size, by volume and value, based on electric vehicle type – BEV, HEV, and PHEV

- To segment the global market and forecast the market size, by volume, and value, based on vehicle type – passenger cars, light commercial vehicles, trucks, and buses

- To segment the global market, and forecast the market size, by volume, and value, based on function — electric, hydraulic, pneumatic, mechanical, and others (thermal and pilot operated)

- To segment the global market, and forecast the market size, by volume, and value, based on engine valve type — Monometallic, Hollow, Bimetallic

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- By Component at regional level for each vehicle type

- By Electric Vehicle Type at country level

- By Electric Vehicle Type in terms of volume

-

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Valves Market