Autotransfusion Systems Market by Type (Autotransfusion Products & Accessories) and Application (Cardiac Surgeries, Orthopedic Surgeries, Organ Transplantation, Trauma Procedures, and Other Procedures) - Global Forecast to 2024

Autotransfusion Systems Market

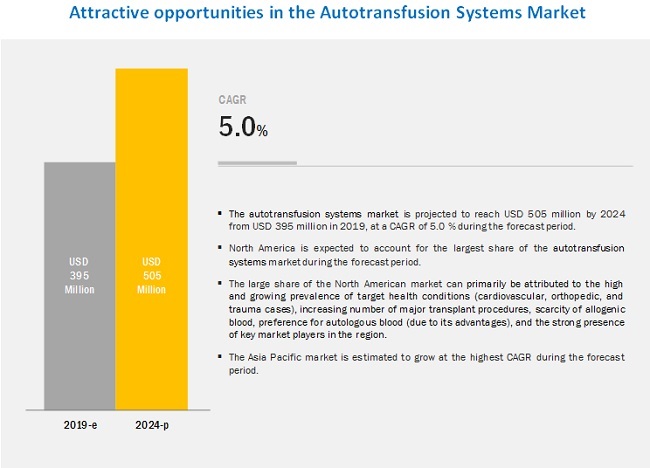

Global Autotransfusion Systems Market is expected to grow at a CAGR of 5.0%.

Autotransfusion Systems Market and Top Companies:

Key market players profiled in the Autotransfusion Systems market report includes:

- Becton, Dickinson and Company (BD) (US)

- LivaNova (UK)

- Fresenius medical Care AG & Co. KGaA (GERMANY)

- Haemonetics Corporation (US)

- Medtronic plc (Ireland)

- Teleflex Incorporated (US)

- Zimmer Biomet Holdings Inc.(US)

- LivaNova - holds a strong position in the autotransfusion systems market. LivaNova offers its autotransfusion systems through its Cardiovascular segment. The company is recognized as a world leader in autotransfusion due to its experience and commitment to innovative solutions research. Since 2010, XTRA, LivaNova’s latest extraordinarily innovative, intuitive, and powerful ATS system, featuring innovative technological characteristics, ease of use, and powerful performance, has been supporting clinicians in meeting patient blood management goals. XTRA has helped over one million patients reduce allogeneic transfusion risks and shorten their hospital stays.

- Fresenius - is one of the leading companies in the autotransfusion systems market. The company offers a strong portfolio for autotransfusion systems through its Fresenius Kabi division. Fresenius Kabi’s CATSmart, a unique continuous red cell separation process based on the continuous flow technology is designed for recycling blood intra- and post-OR during cardiac, orthopedic, or vascular surgery. CATSmart is the only autotransfusion device on the market using the continuous flow technology, which guarantees early access to RBC at any time with reliable quality.

- Haemonetics - has successfully positioned itself as a strong player in autotransfusion systems market. The company has a strong portfolio in providing products for blood, plasma, and whole blood cells. The company’s Cell Saver Elite system provides hospitals with an easy-to-use, reliable way to recover and deliver back a patient’s own high-quality blood during medium to high blood loss procedures, including cardiac, orthopedic, trauma, transplant, vascular, and OBGYN surgeries. On the other hand, in the past three years, the company has not made any significant development in the autotransfusion systems market. This may hamper the company’s position in the coming years. The company generates around 50% of its revenue from the US market. This may result in increased exposure of the company to the risk of demand fluctuations in local markets. With emerging markets such as Asia and Latin America offering strong growth opportunities, the company can focus on these markets.

Autotransfusion Systems Market and Top Product Categories:

- Autotransfusion Products

- Autotransfusion Accessories

- Autotransfusion Products- It includes Intraoperative Systems, Postoperative Systems, Intra- and Postoperative Systems. The advantages of autotransfusion over allogeneic blood transfusion (prevention of transfusion-transmitted blood-borne diseases and provision of more compatible blood for patients) are primarily driving the demand for autotransfusion systems among end users. Some of the complications associated with allogeneic transfusion include acute and delayed hemolytic reactions due to ABO incompatibility, risk of transmission of infectious diseases (such as HIV, Hep-B, Hep-C, Cytomeglo virus, and malaria), and the risk of immuno-suppressive reactions.

- Autotransfusion Accessories - A typical autotransfusion system comprises suction tips, suction/anticoagulant line, filtered collection reservoir, centrifuge bowl and disposable tubing set (tubing, bowl, holding bag, and waste bag), saline wash solution bags, and blood transfer bags, among other accessories.

Autotransfusion Systems Market and Top applications:

- Cardiac surgeries

- Orthopedic Surgeries

- Organ Transplantation

- Cardiac surgeries- Cardiac surgeries form the largest application segment of the autotransfusion systems (ATS) market. Factors such as the high prevalence of cardiac diseases, risks associated with allogenic blood transfusion in cardiac surgeries (such as infections, allergic reactions, blood-type mismatches, and end-organ dysfunctions), and recommendations for autologous transfusion (by entities such as the WHO) during cardiac surgeries are driving market growth in this segment. In the US alone, the Texas Heart Institute estimates that thousands of heart surgeries are performed every day. This indicates the high demand for cardiac surgery and a growing prevalence of cardiac diseases, a trend reflected worldwide.

- Orthopedic Surgeries- Growing awareness on postoperative complications and other potential hazards of allogeneic blood transfusion, the availability of autotransfusion devices designed especially for orthopedic surgery (such as OrthoPAT by Haemonetics) and trauma patients—especially those undergoing knee and hip arthroplasty or spinal surgery—and the rising number of orthopedic surgeries conducted globally are driving market growth in this application segment. For example, as per Becker’s ASC Hospital Review, the number of orthopedic surgeries conducted in the US is expected to reach 6.6 million by 2020 from 5.3 million in 2010. Furthermore, it revealed that adult knee surgery was the most popular subspecialty within orthopedics, with more than 34% of all orthopedic surgeons practicing in the US specializing in orthopedic medicine, followed by arthroscopy.

- Organ Transplantation - Organ transplantation is traditionally associated with major blood loss and, consequently, high blood transfusion requirements. During the last few decades, with improvements in surgical techniques, anesthetic management, and organ conservation, awareness on the spread of hemostatic disorders during the transfusion of donated blood has increased. This has reduced the overall use of allogeneic/donated blood while driving demand for autotransfusion as a viable alternative.

[115 Pages Report] The autotransfusion systems market is estimated to grow at a CAGR of 5.0% to reach USD 505 million by 2024 from USD 395 million in 2019. The growth of this market is driven by the increasing number of surgical procedures, rising number of transplant procedures, advantages of autotransfusion, and scarcity of donated blood/allogenic blood.

The autotransfusion products segment, by type, accounted for the largest share of the autotransfusion systems market.

On the basis of type, the market is segmented into autotransfusion products & accessories. The autotransfusion products segment accounted for the largest share of the market in 2019. The autotransfusion products segment is estimated to grow at the highest CAGR during the forecast period owing to a number of advantages, which are expected to boost its adoption in the coming years. These components prevent the transmission of transfusion-related blood-borne diseases in patients, and they also provide more compatible blood than in the case of autologous blood transfusions. These advantages are likely to increase the demand for autotransfusion products.

The cardiac surgeries segment, by application, held the largest share of the autotransfusion systems market in 2019.

On the basis of application, the market is segmented into Cardiac Surgeries, Orthopedic Surgeries, Organ Transplantation, Trauma Procedures, and Other Procedures. In 2019, the cardiac surgeries segment accounted for the largest share of the market. This segment is estimated to grow at the highest rate during the forecast period due to the high prevalence of cardiac diseases and recommendations for autologous transfusion (by entities such as the WHO) during cardiac surgeries.

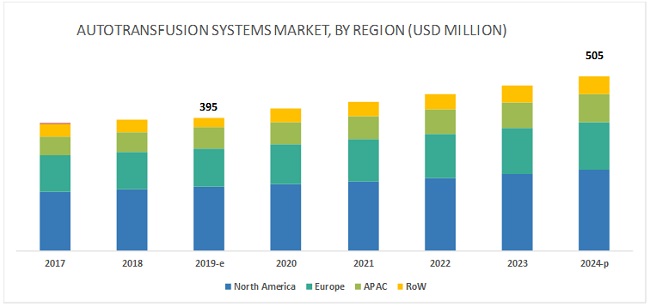

North America accounted for the largest share of the autotransfusion systems market in 2019

This report covers the market across four major geographies—North America, Europe, Asia Pacific, and the Rest of the World. North America commanded the largest share of the market in 2019

Factors such as the increasing prevalence of cancer in the US and Canada and cancer awareness initiatives undertaken by local governments and global health organizations in the North American region are the key factors driving market growth.

Key Market Players

Medtronic Plc (Ireland), Becton, Dickinson and Company (US), Zimmer Biomet Holdings, Inc (US), Teleflex Incorporated (US), LivaNova (UK), Fresenius (Germany), Atrium Medical Corporation (Sweden), Haemonetics Corporation (US), SARSTEDT (Germany), Braile Biomédica (Brazil), Redax (Italy), Beijing ZKSK Technology Co (China), and Gen World Medical Devices (India) are some of the leading players operating in the autotransfusion systems market.

LivaNova (UK) holds a strong position in the market. LivaNova offers its autotransfusion systems through its Cardiovascular segment. The company is recognized as a world leader in autotransfusion due to its experience and commitment to innovative solutions research. Since 2010, XTRA, LivaNova’s latest extraordinarily innovative, intuitive, and powerful ATS system, featuring innovative technological characteristics, ease of use, and powerful performance, has been supporting clinicians in meeting patient blood management goals. XTRA has helped over one million patients reduce allogeneic transfusion risks and shorten their hospital stays.

Haemonetics (US) has successfully positioned itself as a strong player in the market. The company has a strong portfolio in providing products for blood, plasma, and whole blood cells. The company’s Cell Saver Elite system provides hospitals with an easy-to-use, reliable way to recover and deliver back a patient’s own high-quality blood during medium to high blood loss procedures, including cardiac, orthopedic, trauma, transplant, vascular, and OBGYN surgeries. On the other hand, in the past three years, the company has not made any significant development in the autotransfusion systems market. This may hamper Haemonetics’ position in the coming years. The company generates around 50% of its revenue from the US market. This may result in increased exposure of the company to the risk of demand fluctuations in local markets. Haemonetics can also focus on emerging markets such as Asia and Latin America, which offer high growth opportunities.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Currency Used |

Value (USD Million) |

|

Segments Covered |

Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major players, including |

In this report, the market has been segmented based on type, application, and region.

Autotransfusion Systems Market, by Type

- Autotransfusion Products

- Intraoperative Autotransfusion Systems

- Postoperative Autotransfusion Systems

- Dual-Mode Autotransfusion Systems

- Autotransfusion Accessories

Autotransfusion Systems Market, by Application

- Cardiac Surgeries

- Orthopedic Surgeries

- Organ Transplantation

- Trauma Procedures

- Other Procedures (Obstetrics & Gynecological, Neurological, and Urological Procedures)

Autotransfusion Systems Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World (RoW)

- Latin America

- Middle East

- Africa

Recent Developments

Agreements

- In December 2016, Fresenius Kabi signed a five-year distribution agreement with Terumo Group to distribute its CATSmart autotransfusion systems in the US.

Acquisitions

- In December 2017, Becton, Dickinson and Company (US) acquired C. R. Bard, Inc. (US), a medical technology company. Through this acquisition, BD strengthened its autotransfusion product line.

Key Questions Addressed in This Reports

- What are the strategies adopted by the top market players in the market to penetrate emerging markets?

- Who are the major players offering autotransfusion systems across major geographies?

- Emerging countries offer opportunities for the adoption of market. Will this scenario continue for the next five years?

- What are the factors impacting the growth of market globally?

Frequently Asked Questions (FAQ):

What is the expected addressable market value of major autotransfusion systems over a 5-year period?

Based on the prevailing trends and estimated market value data as of 2018, the total market value of major autotransfusion systems is estimated to be about USD 504.9 million as of 2024.

Which component categories are expected to have highest growth rate in the autotransfusion systems market?

Autotransfusion products accounted for the largest share of the autotransfusion systems market in 2018. Autotransfusion products are associated with several advantages those are expected to boost their adoption in the coming years. These components assist provider to avoid the transmission of transfusion-related or blood-borne diseases in patients, and they also provide more compatible blood than in the case of autologous blood transfusions. These advantages are likely to increase the demand for autotransfusion products.

What are the opportunistic areas are available for new and existing players in the autotransfusion systems market to enhance their market share?

Emerging economies offer high growth potential in the key opportunistic areas available in the market.

What are the major revenue pockets in the autotransfusion systems market currently?

The highest market share of autotransfusion systems is estimated to belong to the North America with US garnering ~83.5% share within the region as of 2018. The rising prevalence of target health conditions (such as cardiovascular diseases, orthopedic disorders, cancer, and trauma cases), increasing number of transplant procedures, scarcity of allogeneic blood, declining number of blood donors, and presence of a favorable reimbursement scenario are the major factors driving the growth of the autotransfusion systems market in the US.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Approach

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Product-Based Market Estimation

2.2.2 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Autotransfusion Systems: Market Overview

4.2 Market Share, By Type

4.3 Market, By Application, 2019 vs 2024 (USD Million)

4.4 Market, By Region

5 Market Overview (Page No. - 32)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Number of Surgical Procedures

5.1.1.2 Rising Number of Transplant Procedures

5.1.1.3 Advantages of Autotransfusion

5.1.1.4 Scarcity of Donated Blood/Allogenic Blood

5.1.2 Restraints

5.1.2.1 High Costs Associated With Autotransfusion Systems

5.1.2.2 Risks Associated With Autotransfusion

5.1.2.3 Government Initiatives to Streamline the Allogenic/Donated Blood Supply

5.1.3 Opportunities

5.1.3.1 Emerging Economies Offer High Growth Potential

5.1.4 Challenges

5.1.4.1 Scarcity of Resources Such as Well-Trained Perfusionists and Surgical Technicians in Developing Countries

5.1.5 Market Trends

5.1.5.1 Development of Low-Cost Autotransfusion Devices

6 Autotransfusion Systems Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Autotransfusion Products

6.2.1 Autotransfusion Products Market Split, By Application, 2017–2024 (USD Million)

6.2.2 Intraoperative Autotransfusion Systems

6.2.2.1 Advantages of Intraoperative Blood Autotransfusion to Drive the Growth of This Segment

6.2.2.2 Intraoperative Autotransfusion Systems Market Split, By Application, 2017–2024 (USD Million)

6.2.3 Postoperative Autotransfusion Systems

6.2.3.1 Postoperative Autotransfusion Systems have Wide Usage in Trauma Procedures

6.2.3.2 Postoperative Autotransfusion Systems Market Split, By Application, 2017–2024 (USD Million)

6.2.4 Dual-Mode Autotransfusion Systems

6.2.4.1 Dual-Mode Autotransfusion Systems have Major Applications in Treatment Procedures for Massive Trauma and Malignant Surgeries

6.2.4.2 Dual-Mode Autotransfusion Systems Market Split, By Application, 2017–2024 (USD Million)

6.3 Autotransfusion Accessories

6.3.1 Autotransfusion Accessories Market Split, By Application, 2017–2024 (USD Million)

7 Autotransfusion Systems Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Cardiac Surgeries

7.2.1 Cardiac Surgeries Form the Largest Application Segment in the Market

7.3 Orthopedic Surgeries

7.3.1 Rising Number of Orthopedic Procedures Will Support Market Growth

7.4 Organ Transplantation

7.4.1 Rising Disease Prevalence and Need for Organ Donations Will Drive Demand for Autotransfusion Systems

7.5 Trauma Procedures

7.5.1 High Levels of Blood Loss in Trauma Procedures Will Support Use of Autotransfusion Systems

7.6 Other Procedures

8 Autotransfusion Systems Market, By Region (Page No. - 54)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Rising Number of Transplant Procedures in the US to Drive Market Growth

8.2.2 Canada

8.2.2.1 Rising Concerns Over the Risks Associated With Homologous Blood Transfusion to Support Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Significant Healthcare Spending in the Country to Support Market Growth

8.3.2 France

8.3.2.1 Growing Awareness and Support for Organ Donation to Propel the Growth of the Autotransfusion Systems Market in France

8.3.3 UK

8.3.3.1 Increasing Number of Transplantation Procedures in the UK to Drive Market Growth

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Rising Geriatric Population and Universal Healthcare Coverage—Major Factors Driving Market Growth in Japan

8.4.2 China

8.4.2.1 Scarcity of Donated Blood to Drive the Adoption of Autologous Blood Transfusion in China

8.4.3 India

8.4.3.1 Presence of A Large Patient Population and Growing Access to Healthcare Driving Market Growth in India

8.4.4 Rest of Asia Pacific

8.5 Rest of the World

8.5.1 Latin America

8.5.2 Middle East

8.5.3 Africa

9 Competitive Landscape (Page No. - 85)

9.1 Introduction

9.2 Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Acquisitions

9.3.2 Agreements

9.4 Competitive Leadership Mapping

9.4.1 Competitive Leadership Mapping: Major Market Players (2017)

9.4.1.1 Visionary Leaders

9.4.1.2 Innovators

9.4.1.3 Dynamic Players

9.4.1.4 Emerging Companies

10 Company Profiles (Page No. - 89)

(Business Overview, Products Offered, Recent Developments & MnM View)*

10.1 Atrium Medical Corporation (A Part of Getinge Group)

10.2 Becton, Dickinson and Company

10.3 Beijing ZKSK Technology Co., Ltd.

10.4 Braile Biomédica

10.5 Fresenius Medical Care AG & Co. KGaA

10.6 Gen World Medical Devices

10.7 Haemonetics Corporation

10.8 Livanova PLC

10.9 Medtronic PLC

10.10 Redax

10.11 SARSTEDT AG & Co. Kg

10.12 Teleflex Incorporated

10.13 Zimmer Biomet Holdings Inc.

*Details on Business Overview, Products Offered, Recent Developments & MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 109)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (65 Tables)

Table 1 Market, By Type, 2017–2024 (USD Million)

Table 2 Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 3 Autotransfusion Products Market, By Region, 2017–2024 (USD Million)

Table 4 Autotransfusion Products Market, By Application, 2017–2024 (USD Million)

Table 5 Intraoperative Autotransfusion Systems Market, By Region, 2017–2024 (USD Million)

Table 6 Intraoperative Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 7 Postoperative Autotransfusion Systems Market, By Region, 2017–2024 (USD Million)

Table 8 Postoperative Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 9 Dual-Mode Autotransfusion Systems Market, By Region, 2017–2024 (USD Million)

Table 10 Dual-Mode Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 11 Autotransfusion Accessories Market, By Region, 2017–2024 (USD Million)

Table 12 Autotransfusion Accessories Market, By Application, 2017–2024 (USD Million)

Table 13 Autotransfusion Systems (ATS) Market, By Application, 2017–2024 (USD Million)

Table 14 Market for Cardiac Surgeries, By Region, 2017–2024 (USD Million)

Table 15 Autotransfusion Systems Market for Orthopedic Surgeries, By Region, 2017–2024 (USD Million)

Table 16 Required Units of Blood and Blood Components, By Type of Transplant Surgery

Table 17 Market for Organ Transplantation, By Region, 2017–2024 (USD Million)

Table 18 Autotransfusion Systems Market for Trauma Procedures, By Region, 2017–2024 (USD Million)

Table 19 Market for Other Procedures, By Region, 2017–2024 (USD Million)

Table 20 Total Number of Solid Organ Transplantation Procedures Across Key Countries (2016)

Table 21 Autotransfusion Systems Market, By Region, 2017–2024 (USD Million)

Table 22 North America: Autotransfusion Systems Market, By Country, 2017–2024 (USD Million)

Table 23 North America: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 24 North America: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 25 North America: Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 26 US: Market, By Type, 2017–2024 (USD Million)

Table 27 US: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 28 Canada: Market, By Type, 2017–2024 (USD Million)

Table 29 Canada: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 30 Europe: Autotransfusion Systems Market, By Country, 2017–2024 (USD Million)

Table 31 Europe: Market, By Type, 2017–2024 (USD Million)

Table 32 Europe: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 33 Europe: Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 34 Germany: Market, By Type, 2017–2024 (USD Million)

Table 35 Germany: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 36 France: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 37 France: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 38 Organ Transplantation Procedures Performed in the Uk, 2013 vs 2015

Table 39 UK: Market, By Type, 2017–2024 (USD Million)

Table 40 UK: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 41 RoE: Market, By Type, 2017–2024 (USD Million)

Table 42 RoE: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 43 APAC: Autotransfusion Systems Market, By Country, 2017–2024 (USD Million)

Table 44 APAC: Market, By Type, 2017–2024 (USD Million)

Table 45 APAC: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 46 APAC: Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 47 Japan: Market, By Type, 2017–2024 (USD Million)

Table 48 Japan: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 49 China: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 50 China: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 51 India: Market, By Type, 2017–2024 (USD Million)

Table 52 India: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 53 Solid-Organ Transplantation Procedures Performed in RoAPAC Countries, 2013 vs 2016

Table 54 RoAPAC: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 55 RoAPAC: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 56 RoW: Autotransfusion Systems Market, By Region, 2017–2024 (USD Million)

Table 57 RoW: Market, By Type, 2017–2024 (USD Million)

Table 58 RoW: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 59 RoW: Autotransfusion Systems Market, By Application, 2017–2024 (USD Million)

Table 60 Latam: Market, By Type, 2017–2024 (USD Million)

Table 61 Latam: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 62 Middle East: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 63 Middle East: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

Table 64 Africa: Autotransfusion Systems Market, By Type, 2017–2024 (USD Million)

Table 65 Africa: Autotransfusion Products Market, By Type, 2017–2024 (USD Million)

List of Figures (29 Figures)

Figure 1 Research Design

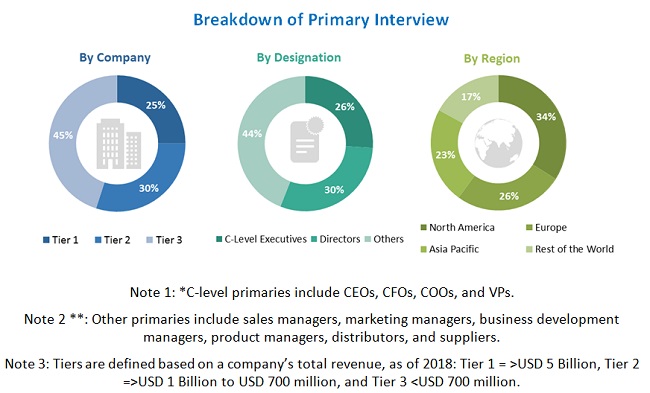

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Research Methodology: Hypothesis Building

Figure 4 Product-Based Market Size Estimation: Autotransfusion System Market

Figure 5 Application-Based Market Size Estimation: Autotransfusion Systems Market

Figure 6 Data Triangulation

Figure 7 Market, By Type, 2019 vs 2024 (USD Million)

Figure 8 Market, By Application, 2019 vs 2024 (USD Million)

Figure 9 Market, By Region, 2019–2024

Figure 10 Rising Number of Transplant Procedures Globally is A Key Driver for Market Growth

Figure 11 Autotransfusion Products Held the Largest Share of the Market in 2018

Figure 12 Cardiac Surgeries Dominated the Autotransfusion Systems Market, By Application

Figure 13 APAC to Grow at the Highest CAGR During the Forecast Period

Figure 14 Market: Drivers, Restraints, Opportunities, Challenges, and Trends

Figure 15 Number of Kidney Transplant Procedures, By Country, 2015 vs 2018

Figure 16 North America: Market Snapshot

Figure 17 Solid-Organ Transplantation Procedures Performed in the Us, 2013–2017

Figure 18 Solid-Organ Transplantation Procedures Performed in Canada, 2015 vs 2016

Figure 19 Asia Pacific: Autotransfusion Systems Market Snapshot

Figure 20 Market Ranking, By Key Player, 2018

Figure 21 Market (Global) Competitive Leadership Mapping (Overall Market)

Figure 22 Getinge Group: Company Snapshot

Figure 23 Becton, Dickinson and Company: Company Snapshot

Figure 24 Fresenius Group: Company Snapshot

Figure 25 Haemonetics Corporation: Company Snapshot

Figure 26 Livanova PLC: Company Snapshot

Figure 27 Medtronic PLC: Company Snapshot

Figure 28 Teleflex Incorporated: Company Snapshot

Figure 29 Zimmer Biomet Holdings: Company Snapshot

This study involved four major activities in estimating the current size of the autotransfusion systems market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was conducted to obtain key information about the market classification and segmentation, geographical scenario, key developments undertaken by major market players, and the identification of key industry trends. The secondary sources used for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized websites, databases, and directories.

Primary Research

Extensive primary research was conducted after acquiring a preliminary understanding of the autotransfusion systems market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (include experts, such as perfusionists, surgeons, surgical technicians, and purchase managers of private & government hospitals) and supply-side respondents (such as C & D-level executives & product managers of key manufacturers, distributors, and channel partners) across North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% and 70% of primary interviews were conducted with both the demand- and supply-side respondents, respectively. Primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

- A detailed market estimation approach was followed to estimate and validate the size of the market and other dependent submarkets.

- The key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of top market players as well as interviews with industry experts to gather key insights on various market segments and subsegments.

- All segmental shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Major macroindicators in play have been accounted for, viewed in detail, verified through primary research, and analyzed to understand their impact on market growth and various segments and subsegments.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall autotransfusion systems market value from the market size estimation process explained above, the total market value data was split into several segments and subsegments. Data triangulation and market breakdown procedures were undertaken to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the market on the basis of type, application, and region

- To provide detailed information regarding the major factors influencing the autotransfusion systems market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the market

- To analyze key growth opportunities in the market for key stakeholders and provide details of the competitive landscape for key market players

- To forecast the market value of various segments and/or subsegments with respect to four major regional segments—North America, Europe, Asia Pacific, and the Rest of the World

- To profile the key players in the autotransfusion systems market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments undertaken by major players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the market.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Autotransfusion Systems Market