Patient Blood Management Market by Product (Instrument (Centrifuge, Transfusion Device, Apheresis, PCR, NGS, Storage Device), Accessories (Syringes, Vials), Reagents, Software)), Component, End User (Blood Bank, Hospital) - Global Forecast to 2024

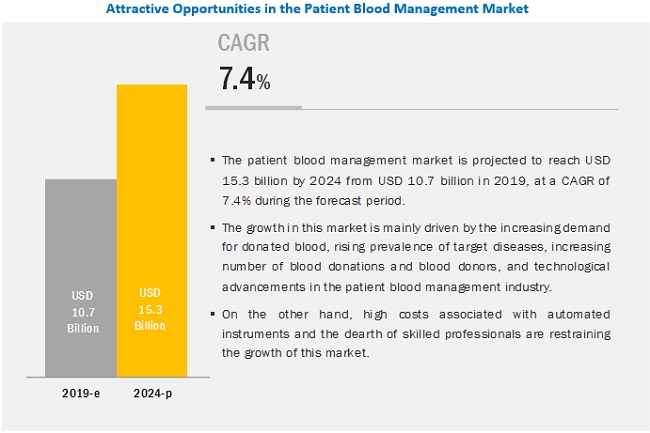

[152 Pages Report] The global patient blood management market size is projected to reach USD 15.3 billion by 2024 from USD 10.7 billion in 2019, at a CAGR of 7.4% from 2019 to 2024. The rising prevalence of blood disorders and the increasing number of blood donations & blood donors will fuel market growth over the forecast period. Moreover, the rising prevalence of target diseases and technological advancements in the patient blood management industry will further fuel the growth of the market in the near future.

The instrument segment accounted for the largest share of the patient blood management market, by product, in 2019

Based on product, the market is segmented into instruments, accessories, reagents & kits, and software. Among these, the instruments segment accounted for the largest share of the market in 2018 owing to factors such as the increasing number of blood donations and blood donors and technological advancements in blood management instruments.

The blood component to register the highest growth rate due to increasing demand for whole blood units during surgical procedures

Based on component, the market is broadly segmented into whole blood and blood component. The whole blood segment accounted for the largest market share. The segment is projected to register the highest growth rate during the forecast period. According to WHO statistics published in 2018, road accidents cause approximately 1.35 million deaths every year across the globe. It further states that 20 million to 50 million more people suffer from non-fatal injuries, which causes heavy blood loss. As much as 90% of all road accidents occur in developing countries. Thus, rising incidences of road accidents coupled with increasing demand for whole blood units during surgical procedures, contribute to the market growth.

The blood banks end user segment garnered the highest revenue in the patient blood management market in 2019

Based on end users, the market is segmented into hospitals and blood banks. The blood bank segment accounted for the largest share of the market in 2019; moreover, the same segment is expected to register significant growth over the forecast period from 2019 to 2024. The significant growth of this segment is attributed to the increasing awareness of blood donations , the high demand for safe blood, and the rising number of blood donations.

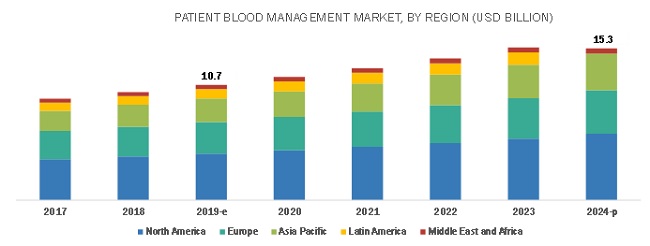

The Asia Pacific market is expected to grow at the highest CAGR during the forecast period

The market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific market is estimated to grow at the highest CAGR during the forecast period. China and India are expected to offer significant growth opportunities for players in the market, mainly due to the rising patient pool, growing support from government bodies, and the rising awareness about blood transfusion. The governments in these countries are making significant investments toward the modernization of their respective healthcare infrastructure, which will greatly benefit the market.

Key Market Players

The major players in the market include Haemonetics Corporation (US), Fresenius SE & Co. KGaA (Germany), Terumo Corporation (Japan), Immucor, Inc. (US), B. Braun Melsungen AG (Ireland), Macopharma (US), bioMérieux SA (France), Asahi Kasei Corporation (Japan), Bio-Rad Laboratories, Inc. (US), Abbott Laboratories (US), Grifols, S.A. (Spain), F. Hoffmann-La Roche LTD (Switzerland), LivaNova PLC (UK), Danaher Corporation (US), Mediware Information Systems (US), Kawasumi Laboratories, Inc. (Japan), Haier Biomedical (China), Diatron (Hungary), and BAG Diagnostics GmbH (Germany), among others.

Haemonetics Corporation (US) is one of the leading players in the global patient blood monitoring market. The company offers a range of solutions that improve the ability of donor collection centers to acquire filter, and separate blood components. In order to grab elevating opportunities in the market, the company continuously focuses on new product developments. For instance, in 2018, the company received the US FDA approval for NexSys PCS embedded software and NexSys PCS plasmapheresis system which is used for blood plasma separation.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Component, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa |

|

Companies Covered |

The major players in the market include Haemonetics Corporation (US), Fresenius SE & Co. KGaA (Germany), Terumo Corporation (Japan), Immucor, Inc. (US), B. Braun Melsungen AG (Ireland), Macopharma (US), bioMérieux SA (France), Asahi Kasei Corporation (Japan), Bio-Rad Laboratories, Inc. (US), Abbott Laboratories (US), Grifols, S.A. (Spain), F. Hoffmann-La Roche LTD (Switzerland), LivaNova PLC (UK), Danaher Corporation (US), Mediware Information Systems (US), Kawasumi Laboratories, Inc. (Japan), Haier Biomedical(China), Diatron (Hungary), and BAG Diagnostics GmbH (Germany), among others. |

This research report categorizes the market, by product, component, end user, and region.

Patient Blood Management Market, by Product

- Instruments

-

Blood Processing Devices

- Centrifuge

- Blood Cell Processors

-

Blood Transfusion Devices

- Apheresis Machines

- Cell Salvage Systems

-

Blood Culture Screening Devices

- Automated Blood Culture Systems

- Supporting Equipment

-

Diagnostic & Testing Instruments

- Polymerase Chain Reaction

- Hematology Analyzer

- Blood Grouping Analyzers

- Next-Generation Sequencing (NGS) Platforms

- Others

-

Blood Storage Devices

- Refrigerator

- Freezers

- Accessories

- Syringes & Needles

- Vials & Tubes

- Blood Bags

- Other Accessories

- Reagents and Kits

- Culture Media

- Blood Typing Reagents

- Slide Staining

- Assay Kits

- Others

- Software

- Blood Bank and Transfusion Software

- Others

Patient Blood Management Market, by Component

- Whole Blood

- Blood Components

Patient Blood Management Market, by End User

- Hospitals

- Blood Banks

Patient Blood Management Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- The Middle East and Africa

Recent Developments:

- In 2019, Abbott (US) received the US FDA approval for its ‘Alinity s’ blood culture screening system as well as the Afinion HbA1c Dx assay kit.

- In 2019, F. Hoffmann-La Roche LTD (Switzerland) received the US FDA approval for its cobas Babesia Test for donor screening.

- In 2018, Terumo BCT (Japan) and Stafa Cellular Therapy (US) entered into a collaborative agreement. Based on this agreement, Terumo BCT expands access to the StafaCT software to healthcare organizations.

- In 2018, B. Braun Melsungen AG (Ireland) acquired the bloodlines business of NxStage Medical, Inc. (US), which operates under the Medisystems brand.

- In 2018, Abbott (US) received a CE mark for its Alinity h-series to be used in the European Union.

Key Questions Addressed by the Report:

- What are the growth opportunities related to the adoption of patient blood management solutions across the globe in the future?

- Which product segment will register the highest adoption rate during the forecast period?

- Where will the advancements in products offered by various companies take the industry in the mid- to long-term?

- Emerging countries have immense opportunities for the growth of the market. Will this scenario continue in the next five years?

- Which end users are estimated to adopt patient blood management systems?

- What are the key strategies adopted by the key players operating in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Product-Based Market Estimation

2.2.2 End User-Based Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 30)

3.1 Introduction

4 Premium Insights (Page No. - 34)

4.1 Patient Blood Management Market Overview

4.2 Market, By Product

4.3 Market, By End User

4.4 Market, By Component

4.5 Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Donated Blood

5.2.1.2 Increasing Number of Blood Donations and Blood Donors

5.2.1.3 Rising Prevalence of Target Diseases

5.2.1.4 Technological Advancements in the Patient Blood Management Industry

5.2.2 Restraints

5.2.2.1 High Cost Associated With Automated Systems

5.2.3 Opportunities

5.2.3.1 Market Penetration Opportunities in Developing Countries

5.2.3.2 Growing Awareness Regarding the Safety of Donated Blood

6 Patient Blood Management Market, By Product (Page No. - 43)

6.1 Introduction

6.2 Instruments

6.2.1 Blood Processing Devices

6.2.1.1 Centrifuges

6.2.1.1.1 Longer Lifespan of Centrifuge Systems to Limit the Growth of This Segment

6.2.1.2 Blood Cell Processors

6.2.1.2.1 Technological Advancements in Centrifugation Systems Might Replace Blood Cell Processors in the Near Future

6.2.2 Blood Transfusion Devices

6.2.2.1 Apheresis Machines

6.2.2.1.1 Favorable Reimbursement for Therapeutic Apheresis Procedures to Support Market Growth

6.2.2.2 Plasma & Plasma Component Separators

6.2.2.2.1 Rising Awareness and Adoption of Hiv Viral Load Testing to Support Market Growth

6.2.2.3 Cell Salvage Systems

6.2.2.3.1 High Cost of Cell Salvage Systems as Well as the Dearth of Trained Professionals to Restrain Market Growth

6.2.2.4 Other Transfusion Devices

6.2.3 Blood Culture Screening Devices

6.2.3.1 Automated Blood Culture Systems

6.2.3.1.1 Automated Blood Culture Systems Segment to Witness Higher Growth During the Forecast Period

6.2.3.2 Supporting Laboratory Equipment

6.2.3.2.1 Growing Automation to Support the Adoption of These Equipment Among End Users

6.2.4 Diagnostic & Testing Instruments

6.2.4.1 PCR Instruments

6.2.4.1.1 Significant Adoption of RT-PCR to Fuel Market Growth

6.2.4.2 Hematology Analyzers

6.2.4.2.1 Product Recalls and Safety Alerts are Expected to Restrain Market Growth

6.2.4.3 NGS Platforms

6.2.4.3.1 Rna-Seq is an Emerging Approach for Cancer Genome Testing

6.2.4.4 Blood Grouping Analyzers

6.2.4.4.1 Increasing Adoption of Blood Grouping Analyzers for Forensic Studies to Support Market Growth

6.2.5 Blood Storage Devices

6.2.5.1 Medical Refrigerators

6.2.5.1.1 Medical Refrigerators Accounted for the Largest Share of the Blood Storage Devices Market in 2018

6.2.5.2 Medical Freezers

6.2.5.2.1 Technological Advancements to Fuel Market Growth

6.3 Accessories

6.3.1 Syringes & Needles

6.3.1.1 Easy Availability and Low Cost of Syringes and Needles Driving Their Adoption

6.3.2 Vials & Tubes

6.3.2.1 Easier Sample Collection Driving the Adoption of Vials and Tubes

6.3.3 Blood Bags

6.3.3.1 Increasing Number of Blood Donations to Support Market Growth

6.3.4 Other Accessories

6.4 Reagents and Kits

6.4.1 Blood Culture Media

6.4.2 Blood Typing Reagents

6.4.3 Slide Staining Reagents

6.4.4 Assay Kits

6.4.5 Other Reagents

6.5 Software

6.5.1 Blood Bank Management Software

6.5.2 Transfusion Management Software

6.5.3 Other Software

7 Patient Blood Management Market, By Component (Page No. - 71)

7.1 Introduction

7.2 Whole Blood & Red Blood Cells

7.2.1 Growing Disease Incidence and Rising Surgical Volumes are Driving Demand for Whole Blood and Erythrocytes

7.3 Plasma

7.3.1 Expanding Applications of Blood Plasma Form a Key Driver of Market Growth

8 Patient Blood Management Market, By End User (Page No. - 74)

8.1 Introduction

8.2 Blood Banks

8.2.1 High Demand for Safe Blood is Driving the Growth of This Segment

8.3 Hospitals

8.3.1 a Large Number of Surgical Procedures Performed in These Facilities is Supporting Market Growth

8.4 Diagnostic Clinics and & Pathology Labs

8.4.1 Stringent Regulatory Compliances for Established Diagnostic Clinics & Pathology Labs is Driving the Demand for Patient Blood Management Products

9 Patient Blood Management Market, By Region (Page No. - 79)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US Dominates the Market Due to the Presence of Well-Developed Healthcare Infrastructure & Growing Adoption of Advanced Technologies

9.2.2 Canada

9.2.2.1 Increasing Number of Surgical Procedures Performed in the Country to Drive the Market for Patient Blood Management Products

9.3 Europe

9.3.1 Germany

9.3.1.1 Rising Geriatric Population to Fuel the Demand for Blood Transfusion

9.3.2 UK

9.3.2.1 a Large Number of Road Traffic Accidents Will Support the Growth of This Market

9.3.3 France

9.3.3.1 Budgetary Constraints are AGfecting the Sale of Advanced Automated Systems

9.3.4 Spain

9.3.4.1 Government Mandate to Deliver Safe Blood for Transfusion to Drive Market Growth

9.3.5 Italy

9.3.5.1 Increasing Awareness About the Need and Safety of Blood Transfusion Will Drive Market Growth

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Well-Developed Healthcare System and Favorable Reimbursement Policy in the Country Will Propel Market Growth

9.4.2 China

9.4.2.1 China is Projected to Register Significant Growth Owing to a Large Patient Pool

9.4.3 India

9.4.3.1 Increasing Prevalence of Target Diseases is Driving the Demand for Patient Blood Management Products in the Country

9.4.4 South Korea

9.4.4.1 Government Initiatives to Support Market Growth

9.4.5 Australia

9.4.5.1 Presence of a Highly Developed Healthcare System to Contribute to Market Growth

9.4.6 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.1.1 Growing Medical Tourism to Support the Growth of the Market in the Region

9.5.2 Mexico

9.5.2.1 Lack of Awareness About Blood Donations is Hampering Market Growth

9.5.3 Rest of Latin America

9.6 Middle East & Africa

10 Competitive Landscape (Page No. - 92)

10.1 Overview

10.2 Market Ranking Analysis, 2018

10.3 Competitive Scenario

10.3.1 Partnerships, Agreements, and Collaborations (2017–2019)

10.3.2 Product Launches (2017–2019)

10.3.3 Expansions (2017–2019)

10.3.4 Acquisitions (2017–2019)

10.4 Competitive Leadership Mapping (2019)

10.4.1 Vendor Inclusion Criteria

10.4.2 Visionary Leaders

10.4.3 Innovators

10.4.4 Dynamic Differentiators

10.4.5 Emerging Companies

11 Company Profiles (Page No. - 97)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Haemonetics Corporation

11.2 Fresenius Se & Co. KGaA

11.3 Terumo Corporation

11.4 Immucor, Inc.

11.5 B. Braun Melsungen AG

11.6 Macopharma

11.7 Biomérieux SA

11.8 Asahi Kasei Medical Co. Ltd. (A Subsidiary of Asahi Kasei Corporation)

11.9 Kaneka Corporation

11.10 Bio-Rad Laboratories, Inc.

11.11 Abbott Laboratories

11.12 Grifols, S.A.

11.13 F. Hoffmann-La Roche LTD.

11.14 Livanova PLC

11.15 Danaher Corporation

11.16 Other Companies

11.16.1 Mediware Information Systems

11.16.2 Kawasumi Laboratories, Inc.

11.16.3 Haier Biomedical

11.16.4 Diatron

11.16.5 Bag Diagnostics GmbH

*Business Overview, Products Offered, Recent Developments, MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 143)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (60 Tables)

Table 1 Leukemia Incidence and Prevalence for Key Countries, 2018

Table 2 Market, By Product, 2017–2024 (USD Million)

Table 3 Patient Blood Management Instruments Market, By Type, 2017–2024 (USD Million)

Table 4 Patient Blood Management Instruments Market, By Region, 2017–2024 (USD Million)

Table 5 Blood Processing Devices Market, By Type, 2017–2024 (USD Million)

Table 6 Blood Processing Devices Market, By Region, 2017–2024 (USD Million)

Table 7 Blood Processing Devices Market for Centrifuges, By Region, 2017–2024 (USD Million)

Table 8 Blood Processing Devices Market for Blood Cell Processors, By Region, 2017–2024 (USD Million)

Table 9 Blood Transfusion Devices Market, By Type, 2017–2024 (USD Million)

Table 10 Blood Transfusion Devices Market, By Region, 2017–2024 (USD Million)

Table 11 Medicare Unadjusted APC Payment Rates for Transfusion Procedure and Therapeutic Apheresis, 2019

Table 12 Blood Transfusion Devices Market for Apheresis Machines, By Region, 2017–2024 (USD Million)

Table 13 Blood Transfusion Devices Market for Plasma & Plasma Component Separators, By Region, 2017–2024 (USD Million)

Table 14 Blood Transfusion Devices Market for Cell Salvage Systems, By Region, 2017–2024 (USD Million)

Table 15 Blood Transfusion Devices Market for Other Transfusion Devices, By Region, 2017–2024 (USD Million)

Table 16 Blood Culture Screening Devices Market, By Type, 2017–2024 (USD Million)

Table 17 Blood Culture Screening Devices Market, By Region, 2017–2024 (USD Million)

Table 18 Blood Culture Screening Devices Market for Automated Blood Culture Systems, By Region, 2017–2024 (USD Million)

Table 19 Blood Culture Screening Devices Market for Supporting Laboratory Equipment, By Region, 2017–2024 (USD Million)

Table 20 Diagnostic & Testing Instruments Market, By Type, 2017–2024 (USD Million)

Table 21 Diagnostic & Testing Instruments Market, By Region, 2017–2024 (USD Million)

Table 22 Diagnostic & Testing Instruments Market for PCR Instruments, By Region, 2017–2024 (USD Million)

Table 23 Diagnostic & Testing Instruments Market for Hematology Analyzers, By Region, 2017–2024 (USD Million)

Table 24 Diagnostic & Testing Instruments Market for NGS Platforms, By Region, 2017–2024 (USD Million)

Table 25 Diagnostic & Testing Instruments Market for Blood Grouping Analyzers, By Region, 2017–2024 (USD Million)

Table 26 Blood Storage Devices Market, By Type, 2017–2024 (USD Million)

Table 27 Blood Storage Devices Market, By Region, 2017–2024 (USD Million)

Table 28 Blood Processing Devices Market for Medical Refrigerators, By Region, 2017–2024 (USD Million)

Table 29 Blood Processing Devices Market for Medical Freezers, By Region, 2017–2024 (USD Million)

Table 30 Patient Blood Management Accessories Market, By Type, 2017–2024 (USD Million)

Table 31 Patient Blood Management Accessories Market, By Region, 2017–2024 (USD Million)

Table 32 Patient Blood Management Accessories Market for Syringes & Needles, By Region, 2017–2024 (USD Million)

Table 33 Patient Blood Management Accessories Market for Vials & Tubes, By Region, 2017–2024 (USD Million)

Table 34 Patient Blood Management Accessories Market for Blood Bags, By Region, 2017–2024 (USD Million)

Table 35 Other Patient Blood Management Accessories Market, By Region, 2017–2024 (USD Million)

Table 36 Patient Blood Management Reagents and Kits Market, By Type, 2017–2024 (USD Million)

Table 37 Patient Blood Management Reagents and Kits Market, By Region, 2017–2024 (USD Million)

Table 38 Patient Blood Management Reagents and Kits Market for Blood Culture Media, By Region, 2017–2024 (USD Million)

Table 39 Patient Blood Management Reagents and Kits Market for Blood Typing Reagents, By Region, 2017–2024 (USD Million)

Table 40 Patient Blood Management Reagents and Kits Market for Slide Staining Reagents, By Region, 2017–2024 (USD Million)

Table 41 Patient Blood Management Reagents and Kits Market for Assay Kits, By Region, 2017–2024 (USD Million)

Table 42 Patient Blood Management Reagents and Kits Market for Other Reagents, By Region, 2017–2024 (USD Million)

Table 43 Patient Blood Management Software Market, By Type, 2017–2024 (USD Million)

Table 44 Patient Blood Management Software Market, By Region, 2017–2024 (USD Million)

Table 45 Blood Bank Management Software Market, By Region, 2017–2024 (USD Million)

Table 46 Transfusion Management Software Market, By Region, 2017–2024 (USD Million)

Table 47 Other Patient Blood Management Software Market, By Region, 2017–2024 (USD Million)

Table 48 Patient Blood Management Market, By Component, 2017–2024 (USD Million)

Table 49 Market for Whole Blood & Red Blood Cells, By Region, 2017–2024 (USD Million)

Table 50 Market for Plasma, By Region, 2017–2024 (USD Million)

Table 51 Market, By End User, 2017–2024 (USD Million)

Table 52 Market for Blood Banks, By Region, 2017–2024 (USD Million)

Table 53 Market for Hospitals, By Region, 2017–2024 (USD Million)

Table 54 Market for Diagnostic Clinics & Pathology Labs, By Region, 2017–2024 (USD Million)

Table 55 Market, By Region, 2017–2024 (USD Million)

Table 56 North America: Market, By Country, 2017–2024 (USD Million)

Table 57 North America: Market, By Component, 2017–2024 (USD Million)

Table 58 Europe: Market, By Country, 2017–2024 (USD Million)

Table 59 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 60 Latin America: Market, By Country, 2017–2024 (USD Million)

List of Figures (34 Figures)

Figure 1 Patient Blood Management Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market: Product-Based Estimation

Figure 5 Market: End User-Based Estimation

Figure 6 Market: Data Triangulation

Figure 7 Patient Blood Mangement Market, By Product, 2019 Vs. 2024 (USD Million)

Figure 8 Patient Blood Mangement Market, By Component, 2019 Vs. 2024 (USD Million)

Figure 9 Patient Blood Management Market, By End User, 2019 Vs. 2024 (USD Million)

Figure 10 Patient Blood Mangementmarket, By Region, 2019–2024

Figure 11 Increasing Demand for Donated Blood to Drive Market Growth

Figure 12 Instruments to Dominate the Patient Blood Management Products Market During the Forecast Period

Figure 13 Blood Banks to Account for the Largest Share of the Market in 2024

Figure 14 Whole Blood & Rbcs to Account for the Largest Share of the Market, By Component

Figure 15 APAC Market to Witness the Highest Growth During the Forecast Period (2019–2024)

Figure 16 Market: Drivers, Restraints, and Opportunities

Figure 17 Rates of Road Traffic Deaths Per 100,000 Population, 2013 vs 2016

Figure 18 Canada: Number of Surgical Procedures, 2014–2017

Figure 19 Key Players Adopted Organic as Well as Inorganic Growth Strategies Between 2016 and 2019

Figure 20 Patient Blood Management Market Ranking Analysis, By Key Player, 2018

Figure 21 Competitive Leadership Mapping

Figure 22 Haemonetics Corporation: Company Snapshot

Figure 23 Fresenius Se & Co. KGaA: Company Snapshot

Figure 24 Terumo Corporation: Company Snapshot

Figure 25 B. Braun Melsungen AG: Company Snapshot

Figure 26 Biomérieux SA: Company Snapshot

Figure 27 Asahi Kasei Medical Co. Ltd.: Company Snapshot

Figure 28 Kaneka Corporation: Company Snapshot

Figure 29 Bio-Rad Laboratories, Inc.: Company Snapshot

Figure 30 Abbott Laboratories: Company Snapshot

Figure 31 Grifols, S.A.: Company Snapshot

Figure 32 F. Hoffmann-La Roche LTD.: Company Snapshot

Figure 33 Livanova PLC: Company Snapshot

Figure 34 Danaher Corporation: Company Snapshot

The study involved four major activities to estimate the current size of the patient blood management market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources, directories, and databases (such as D&B Hoovers, Bloomberg Businessweek, and Factiva), along with government databases, which were used to identify and collect information for this method-based, market-oriented, and commercial study of the market.

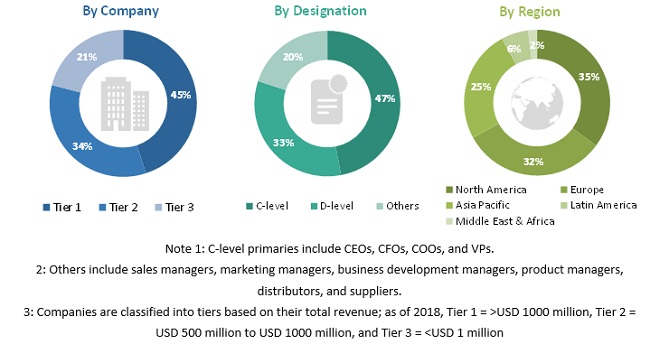

In-depth interviews were conducted with various primary respondents that mainly include key industry participants, medical practitioners, subject-matter experts (SMEs), C-level and D-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects of the market.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the patient blood management market scenario through secondary research. A significant number of primary interviews were conducted with both the demand (healthcare providers, blood bank operators, physicians, and blood bank technicians) and supply sides (developers, manufacturers, and distributors of patient blood management products). The primaries interviewed for this study include experts from the patient blood management industry (such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering patient blood management products across the globe), purchase managers in healthcare provider organizations, blood banks, blood collection centers, plasma collection centers, and CROs.

Around 60% and 40% of primary interviews were conducted with the supply and demand sides, respectively. A robust primary research methodology has been adopted to validate the contents of the report and to fill gaps. Telephonic and e-mail communications were adopted to conduct interviews (questionnaires were designed and sent to primary participants as per their convenience). The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the patient blood management market and other dependent submarkets, as mentioned above. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights (both quantitative and qualitative trends) on the market. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report. The research methodology used to estimate the market size includes the following:

- Product mapping of various manufacturers for each product type of patient blood management at the regional and/or country level

- Relative adoption pattern of each patient blood management system among key end users at the regional and/or country level

- Detailed primary research to gather quantitative information related to segments and subsegments at the region and/or country-level

- Detailed secondary research to gauge prevailing market trends at the region and/or country-level

Data Triangulation

After arriving at the overall market size of the patient blood management industry from the market estimation approach explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact market value data, data triangulation, and market breakdown methodology methods were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-side analysis.

Report Objectives

- To define, describe, and forecast the patient blood management market on the basis of product, component, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product launches; agreements, partnerships, and joint ventures; mergers & acquisitions; business expansions and research & development activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present patient blood management market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Blood Management Market