Antibacterial Market in Agriculture by Type (Copper-based, Dithiocarbamate, Amide, Antibiotic), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Mode of Application (Foliar Spray and Soil Treatment), Form, and Region - Global Forecast to 2022

[195 Pages Report] The antibacterials market was valued at USD 9.09 billion in 2016 and is projected to reach USD 11.89 billion by 2022, at a CAGR of 4.6% during the forecast period.

The years considered for the study are as follows:

- Base year 2015

- Estimated year 2016

- Projected year 2022

- Forecast period 2016 to 2022

The objectives of the report are as follows:

- To define, segment, and measure the antibacterial market based on type, crop type, mode of application, form, and region

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders

- To analyze competitive developments such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and collaborations in the agricultural bactericides market

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions

- To project the size of the market, in terms of value and volume, on the basis of key crop type (cereals & grains, pulses & oilseeds, fruits & vegetables, and others)

Research Methodology:

- Major regions were identified, along with the countries contributing to the maximum share.

- Secondary research was conducted to obtain the value and volume of antibacterial (agricultural bactericides) market for regions such as North America, Europe, Asia Pacific, South America, and RoW.

- Key players have been identified through secondary sources such as the Bloomberg Businessweek, Factiva, agrigenomic magazines, and companies annual reports, while their market share in their respective regions has been determined through both primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the antibacterial market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the antibacterial market include R&D institutes; agricultural bactericide manufacturers such as BASF SE (Germany), The Dow Chemical Company (US), E. I. du Pont de Nemours and Company (US), Sumitomo Chemicals Co. Ltd. (Japan), and Bayer CropScience AG (Germany); and government bodies & regulatory associations such as the US Department of Agriculture (USDA), the Food and Agriculture Organization (FAO), the Organic Fertilizer Association of California (OFAC), and the Association of American Plant Food Control Officials (AAPFCO).

Target Audience:

The stakeholders for the report are as follows:

- Bactericide manufacturers

- Bactericide importers and exporters

- Bactericide traders, distributors, and suppliers

- Government and research organizations

- Commercial research & development (R&D) institutions and financial institutions

- Trade associations and industry bodies

- Associations and industry bodies such as the Food and Agriculture Organization (FAO), the International Fertilizer Industry Association (IFA), the Fertilizer Association of India (FAI), the Organic Fertilizer Association of California (OFAC), and the Association of American Plant Food Control Officials (AAPFCO)

Scope of the Antibacterial Market Report

This research report categorizes the antibacterial market based on type, crop type, mode of application, form, and region.

Based on type, the antibacterial market has been segmented as follows:

- Copper-based

- Dithiocarbamate

- Amide

- Antibiotic

- Others (triazole, benzamide, and dicarboximide)

Based on crop type, the antibacterial market has been segmented as follows:

- Cereals & grains

- Corn

- Wheat

- Rice

- Others (barley, sorghum, and oats)

- Oilseeds & pulses

- Soybean

- Cotton

- Others (lentils and alfalfa)

- Fruits & vegetables

- Citrus fruits

- Cucurbits

- Leafy vegetables

- Others (apples, berries, and stone fruits)

- Others (spices and bulb crops)

Based on mode of application, the antibacterial market has been segmented as follows:

- Foliar Spray

- Soil Treatment

- Others (trunk injection and fluid immersions)

Based on form, the antibacterial market has been segmented as follows:

- Liquid

- Water dispersible granule

- Wettable powder

Based on region, the antibacterial market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (South Africa, the Middle East, and the Rest of Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis:

- Further breakdown of the Rest of European market for antibacterial into Sweden, Norway, and Greece

- Further breakdown of the Rest of Asia Pacific market for antibacterial into South Korea, North Korea, New Zealand, and Sri Lanka

- Further breakdown of the Rest of South America market for antibacterial into Paraguay, Uruguay, Chile, and Cuba

- Further breakdown of the RoW market for antibacterial by key countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

The global antibacterial market in agriculture is projected to reach USD 11.89 Billion by 2022, at a CAGR of 4.6% during the forecast period. The market growth is driven by multiple factors such as the rise in the need for food security for the growing population, advancement in farming practices and technologies, and ease of application of antibacterial in agriculture. The antibacterial market is further driven by factors such as the increase in demand for fruits & vegetables, increase in acceptance for Integrated Pest Management (IPM) by farmers, and high opportunities in developing countries.

The antibacterial market has been segmented on the basis of type, crop type, form, method of application, and region. Based on type, antibacterial market has been segmented into copper-based, dithiocarbamate, amide, and antibiotics. The dithiocarbamate segment is poised to grow at the fastest rate during the forecast period. In 2015, copper-based antibacterials were dominant in the global market, owing to the high level of bactericidal activity associated with copper. However, the emergence of dithiocarbamate and its effect on a broad spectrum of pathogens have encouraged manufacturers to adopt this class of chemicals for bactericide development.

Based on form, water-dispersible granules accounted for a higher share in the antibacterial market for 2015. Properties such as greater stability, ease in handling during supply chain activities, and convenience in usage in a wide range of crops are the major factors contributing to the dominance of this segment. However, the markets for water-dispersible granules and wettable powder are gradually growing due to ease in transportation and shipping in the form of solid packets.

Based on mode of application, soil treatment has been projected to grow at a higher rate during the forecast period, although foliar spray is the most-preferred method adopted by end-use farmers, owing to the ease in handling and application. The market for soil treatment is rapidly growing, mainly, due to the increasing application of bactericides and other nutrition enhancers as well as due to the emergence of plant growth regulators for protection against pest attacks in the initial stage of crop production.

Based on crop type, the application of antibacterial was the highest in fruits & vegetables, especially in citrus fruits, due to high bacterial infestations, which result in production losses. Since fruits and vegetables are categorized high-value crops, the profit margins for these crops are high; and hence, end-use farmers are willing to invest in crop inputs. Also, the increasing industrial importance of cereals and oilseeds has encouraged the consumption of bactericides for major field crops such as corn and soybean.

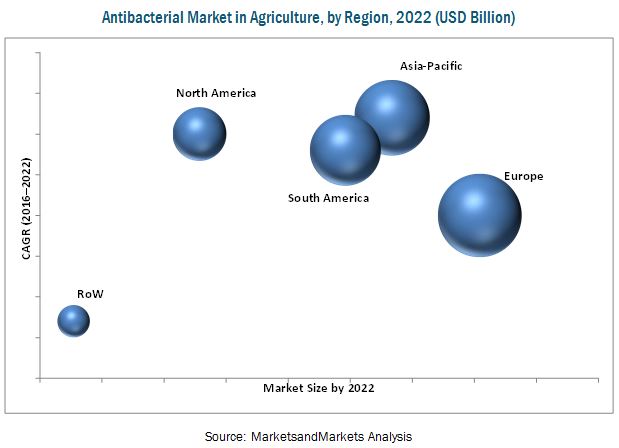

The demand for antibacterials is projected to rise in the Asia Pacific region, particularly in China, India, and Japan. The increase in agricultural activities coupled with the rise in demand for quality crops is driving the growth of the antibacterial market in agriculture. The countries in this region have observed an increase in the consumption of antibacterial, due to the increasing awareness among farmers related to the effects of bacterial infections on crop yields. Key players have concentrated their major R&D efforts to develop products conforming to the European regulations for antibacterial, since these regulations are considered to be benchmarks in terms of quality and environmental impacts.

The antibacterial market is consolidated, with major players operating at regional and local levels. The key players in antibacterial market are BASF SE (Germany), Dow AgroSciences LLC (US), Sumitomo Chemical Co., Ltd (Japan), and Bayer CropScience AG (Germany). Most key participants have been exploring new regions through new product launches, collaborations, and acquisitions across the globe to avail a competitive advantage through combined synergies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Scope of the Study

1.3.2 Geographic Scope

1.3.3 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

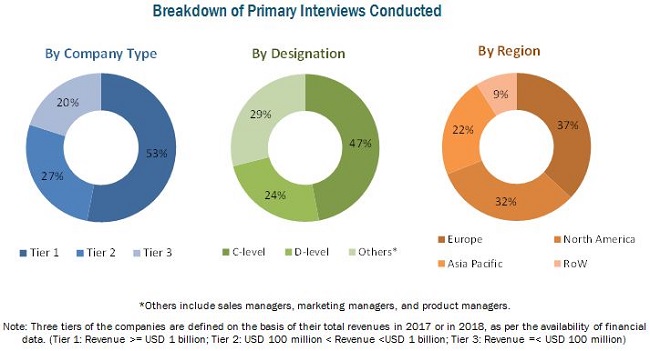

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Antibacterial Market in Agriculture

4.3 Market in Agriculture, By Crop Type

4.4 Market in Agriculture, By Form

4.5 Asia-Pacific Antibacterial Market in Agriculture

4.6 Market in Agriculture, By Type

4.7 Market in Agriculture, By Market Share of Top Countries

4.8 Life Cycle Analysis: Antibacterial Market in Agriculture, By Region

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Antibacterial Market in Agriculture, By Type

5.2.2 By Crop Type

5.2.3 By Mode of Application

5.2.4 By Form

5.3 Antibacterial Market in Agriculture: Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Instances of Bacterial Infections in Crops

5.3.1.2 Shrinking Arable Land Per Capita

5.3.1.3 Shift in Farming Techniques and Technologies

5.3.2 Restraints

5.3.2.1 Harmful Effects of Overdose of Certain Antibacterial Active Ingredients

5.3.2.2 Rising Instances of Environmental Toxicology

5.3.3 Opportunities

5.3.3.1 New Target Market: Latin America & the Middle East

5.3.3.2 Integrated Management Measures for Bacterial Plant Pathogens

5.3.4 Challenges

5.3.4.1 Stringent Regulations Worldwide

5.3.4.2 Long Gestation Period for New Products

5.4 Patent Analysis

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users

6.3.4 Key Influencers

7 Antibacterial Market in Agriculture, By Type (Page No. - 57)

7.1 Introduction7.2 Copper-Based Antibacterial

7.3 Dithiocarbamate Antibacterial

7.4 Amide Antibacterial

7.5 Antibiotic Antibacterial

7.6 Others

8 Antibacterial Market in Agriculture, By Crop Type (Page No. - 66)

8.1 Introduction8.2 Fruits & Vegetables

8.3 Cereals & Grains

8.4 Oilseeds & Pulses

8.5 Other Crop Types

9 Antibacterial Market in Agriculture, By Mode of Application (Page No. - 77)

9.1 Introduction9.2 Foliar Spray

9.3 Soil Treatment

9.4 Others

10 Antibacterial Market in Agriculture, By Form (Page No. - 84)

10.1 Introduction10.2 Water Dispersible Granule

10.3 Wettable Powder

10.4 Liquid

11 Antibacterial Market in Agriculture, By Region (Page No. - 92)

11.1 Introduction11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 Italy

11.3.4 Spain

11.3.5 U.K.

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 South America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South America

11.6 Rest of the World (RoW)

11.6.1 South Africa

11.6.2 Others in RoW

12 Competitive Landscape (Page No. - 136)

12.1 Overview

12.2 Antibacterial Market in Agriculture: Market Share (Value), By Key Player, 2015

12.2.1 Key Market Strategies

12.3 Competitive Situation & Trends

12.3.1 Acquisitions & Mergers

12.3.2 Agreements, Collaborations, Partnerships, and Joint Ventures

12.3.3 Expansions & Investments

12.3.4 New Product Launches

13 Company Profiles (Page No. - 147)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 BASF SE

13.2 The DOW Chemical Company

13.3 E.I. Dupont De Nemours and Company

13.4 Sumitomo Chemical Co., Ltd.

13.5 Bayer Cropscience AG

13.6 Syngenta AG

13.7 FMC Corporation

13.8 Adama Agricultural Solutions Ltd.

13.9 Nufarm Limited

13.10 Nippon Soda Co. Ltd

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 179)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.2.1 More Company Developments

14.2.1.1 Acquisitions & Mergers

14.2.1.2 Expansions

14.2.1.3 Agreements, Collaborations, and Partnerships

14.2.1.4 New Product Launches

14.3 Introducing Rt: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (119 Tables)

Table 1 Degree of Usage of Agricultural Antibacterial in Crops

Table 2 Agriculture Antibacterial Market Size, By Type, 2014-2022 (USD Million)

Table 3 Agriculture Antibacterial Market Size, By Type, 2014-2022 (KT)

Table 4 Copper-Based Bactercides/Antibacterial Market Size, By Region, 2014-2022 (USD Million)

Table 5 Copper-Based Bactercides/Antibacterial Market Size, By Region, 2014-2022 (KT)

Table 6 Dithiocarbamate Antibacterial Market Size, By Region, 2014-2022 (USD Million)

Table 7 Dithiocarbamate Antibacterial Market Size, By Region, 2014-2022 (KT)

Table 8 Amide Antibacterial Market Size, By Region, 2014-2022(USD Million)

Table 9 Amide Antibacterial Market Size, By Region, 2014-2022(KT)

Table 10 Antibiotic Antibacterial Market Size, By Region, 2014-2022 (USD Million)

Table 11 Antibiotic Antibacterial Market Size, By Region, 2014-2022(KT)

Table 12 Other Antibacterial Market Size, By Region, 2014-2022 (USD Million)

Table 13 Other Antibacterial Market Size, By Region, 2014-2022 (KT)

Table 14 Antibacterial Market Size, By Crop Type, 20142022 (USD Million)

Table 15 Antibacterial Market Size, By Crop Type, 20142022 (KT)

Table 16 Fruits & Vegetables Market Size, By Region, 20142022 (USD Million)

Table 17 Fruits & Vegetables Market Size, By Region, 20142022 (KT)

Table 18 Fruits & Vegetables Market Size, By Sub-Type, 20142022(USD Million)

Table 19 Fruits & Vegetables Market Size, By Sub-Type, 20142022(KT)

Table 20 Cereals & Grains Market Size, By Region, 20142022 (USD Million)

Table 21 Cereals & Grains Market Size, By Region, 20142022 (KT)

Table 22 Cereals & Grains Market Size, By Sub-Type, 20142022 (USD Million)

Table 23 Cereals & Grains Market Size, By Sub-Type, 20142022 (KT)

Table 24 Oilseeds & Pulses Market Size, By Region, 20142022 (USD Million)

Table 25 Oilseeds & Pulses Market Size, By Region, 20142022 (KT)

Table 26 Oilseeds & Pulses Market Size, By Sub-Type, 20142022 (USD Million)

Table 27 Oilseeds & Pulses Market Size, By Sub-Type, 20142022 (KT)

Table 28 Other Crop Types Market Size, By Region, 20142022 (USD Million)

Table 29 Other Crop Types Market Size, By Region, 20142022 (KT)

Table 30 Antibacterial Market Size, By Mode of Application, 20142022 ( USD Million)

Table 31 Antibacterial Market Size, By Mode of Application, 20142022 (KT)

Table 32 Foliar Spray Market Size, By Region, 20142022 (USD Million)

Table 33 Foliar Spray Market Size, By Region, 20142022 (KT)

Table 34 Soil Treatment Market Size, By Region, 20142022 (USD Million)

Table 35 Soil Treatment Market Size, By Region, 20142022 (KT)

Table 36 Other Modes of Application Market Size, By Region, 20142022 (USD Million)

Table 37 Other Modes of Application Market Size, By Region, 20142022 (KT)

Table 38 Market Size, By Form, 20142022 (USD Million)

Table 39 Market Size, By Form, 20142022 (KT)

Table 40 Water-Dispersible Granule Market, By Region, 20142022 (USD Million)

Table 41 Water-Dispersible Granule Market, By Region, 20142022 (KT)

Table 42 Wettable Powder Market Size, By Region, 20142022 (USD Million)

Table 43 Wettable Powder Market Size, By Region, 20142022 (KT)

Table 44 Liquid Market Size, By Region, 20142022 (USD Million)

Table 45 Liquid Market Size, By Region, 20142022 (KT)

Table 46 Antibacterial Market Size, By Region, 20142022 (USD Million)

Table 47 Antibacterial Market Size, By Region, 20142022 (KT)

Table 48 North America: Antibacterial Market Size, By Country, 20142022 (USD Million)

Table 49 North America: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 50 North America: Antibacterial Market Size, By Crop Type, 20142022 (USD Million)

Table 51 North America: Antibacterial Market Size, By Mode of Application, 20142022 (USD Million)

Table 52 North America: Antibacterial Market Size, By Form, 20142022 (USD Million)

Table 53 U.S.: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 54 U.S.: Antibacterial Market Size, By Type, 20142022 (KT)

Table 55 Canada: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 56 Canada: Antibacterial Market Size, By Type, 20142022 (KT)

Table 57 Mexico: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 58 Mexico: Antibacterial Market Size, By Type, 20142022 (KT)

Table 59 Europe: Antibacterial Market Size, By Country, 20142022 (USD Million)

Table 60 Europe: Market Size, By Type, 20142022 (USD Million)

Table 61 Europe: Antibacterial Market Size, By Crop Type, 20142022 (USD Million)

Table 62 Europe: Market Size, By Mode of Application, 20142022 (USD Million)

Table 63 Europe: Antibacterial Market Size, By Form, 20142022 (USD Million)

Table 64 Germany: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 65 Germany: Antibacterial Market Size, By Type, 20142022 (KT)

Table 66 France: Market Size, By Type, 20142022 (USD Million)

Table 67 France: Antibacterial Market Size, By Type, 20142022 (KT)

Table 68 Italy: Market Size, By Type, 20142022 (USD Million)

Table 69 Italy: Market Size, By Type, 20142022 (KT)

Table 70 Spain: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 71 Spain: Market Size, By Type, 20142022 (KT)

Table 72 U.K.: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 73 U.K.: Market Size, By Type, 20142022 (KT)

Table 74 Rest of Europe: Market Size, By Type, 20142022 (USD Million)

Table 75 Rest of Europe:Antibacterial Market Size, By Type, 20142022 (KT)

Table 76 Key Crops Cultivated, By Country

Table 77 Asia-Pacific: Antibacterial Market Size, By Country, 20142022 (USD Million)

Table 78 Asia-Pacific: Market Size, By Type, 20142022 (USD Million)

Table 79 Asia-Pacific: Antibacterial Market Size, By Crop Type, 20142022 (USD Million)

Table 80 Asia-Pacific: Market Size, By Mode of Application, 20142022 (USD Million)

Table 81 Asia-Pacific: Antibacterial Market Size, By Form, 20142022 (USD Million)

Table 82 China: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 83 China: Market Size, By Type, 20142022 (KT)

Table 84 India: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 85 India: Market Size, By Type, 20142022 (KT)

Table 86 Japan: Market Size, By Type, 20142022 (USD Million)

Table 87 Japan: Antibacterial Market Size, By Type, 20142022 (KT)

Table 88 Australia: Market Size, By Type, 20142022 (USD Million)

Table 89 Australia: Antibacterial Market Size, By Type, 20142022 (KT)

Table 90 Rest of Asia-Pacific: Market Size, By Type, 20142022 (USD Million)

Table 91 Rest of Asia-Pacific: Antibacterial Market Size, By Type, 20142022 (KT)

Table 92 South America: Antibacterial Market Size, By Country, 20142022 (USD Million)

Table 93 South America: Market Size, By Type, 20142022 (USD Million)

Table 94 South America: Antibacterial Market Size, By Crop Type, 20142022 (USD Million)

Table 95 South America: Market Size, By Mode of Application, 20142022 (USD Million)

Table 96 South America: Antibacterial Market Size, By Form, 20142022 (USD Million)

Table 97 Brazil: Market Size, By Type, 20142022 (USD Million)

Table 98 Brazil: Antibacterial Market Size, By Type, 20142022 (KT)

Table 99 Argentina: Market Size, By Type, 20142022 (USD Million)

Table 100 Argentina: Antibacterial Market Size, By Type, 20142022 (KT)

Table 101 Rest of South America: Market Size, By Type, 20142022 (USD Million)

Table 102 Rest of South America: Market Size, By Type, 20142022 (USD Million)

Table 103 RoW: Antibacterial Market Size, By Country, 20142022 (USD Million)

Table 104 RoW: Market Size, By Type, 20142022 (USD Million)

Table 105 RoW: Market Size, By Crop Type, 20142022 (USD Million)

Table 106 RoW: Market Size, By Mode of Application, 20142022 (USD Million)

Table 107 RoW: Market Antibacterial Market Size, By Form, 20142022 (USD Million)

Table 108 South Africa: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 109 South Africa: Market Size, By Type, 20142022 (KT)

Table 110 Others in RoW: Antibacterial Market Size, By Type, 20142022 (USD Million)

Table 111 Others in RoW: Market Size, By Type, 20142022 (KT)

Table 112 Acquisitions & Mergers, 20112016

Table 113 Agreements, Collaborations, Partnerships, and Joint Ventures, 20112016

Table 114 Expansions & Investments, 20112016

Table 115 New Product Launches, 2011-2016

Table 116 Acquisitions & Mergers, 20112016

Table 117 Expansions, 20112016

Table 118 Agreements, Collaborations, and Partnerships, 20112016

Table 119 New Product Launches, 20112016

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Antibacterial Market in Agriculture: Research Design

Figure 3 Antibacterial Market in Agriculture: Breakdown of Primary Interviews

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Dithiocarbamate Antibacterial is Projected to Be the Fastest-Growing Agricultural Antibacterial Type During the Forecast Period

Figure 8 Agricultural Antibacterial are Widely Applied to Fruit & Vegetable Crops

Figure 9 The Foliar Spray Segment is Projected to Account for the Largest Share During the Forecast Period

Figure 10 Water-Dispersible Granule Segment is Estimated to Be the Most Largely Applied Form of Agricultural Antibacterials in 2016

Figure 11 Agriculture Antibacterial Market Trend, By Region, 2015

Figure 12 European & Asia-Pacific Regions Were the Largest Markets in 2015

Figure 13 Attractive Opportunities in the Agriculture Antibacterial Market, 2016-2022

Figure 14 Fruits & Vegetables are Projected to Be the Largest Segment During the Forecast Period

Figure 15 Water-Dispersible Granule Segment to Be the Largest During the Forecast Period

Figure 16 Fruits & Vegetables Segment Accounted for the Largest Share in the Asia-Pacific Antibacterial Market in Agriculture, 2015

Figure 17 Europe Will Continue to Dominate the Antibacterial Market in Agriculture for All Types

Figure 18 Brazil Dominated the Global Agriculture Antibacterial Market, 2015

Figure 19 Agriculture Antibacterial Market in the Asia-Pacific Region is Witnessing High Growth

Figure 20 Agricultural Antibacterial: Market Dynamics

Figure 21 Arable Land, 19502020 (Hectares/Person)

Figure 22 Value Chain Analysis of Agricultural Antibacterial (2015): A Major Contribution From Manufacturing & Assembly Phase

Figure 23 Regulatory Approvals Form A Vital Component of the Supply Chain

Figure 24 Copper Antibacterials to the Largest Segment, 2016 vs 2022 (USD Million)

Figure 25 Asia-Pacific is Projected to Grow With the Highest CAGR During the Forecast Period

Figure 26 Fruits & Vegetables is Projected to Dominate the Antibacterial Market in Agriculture Through 2022

Figure 27 Asia-Pacific is the Fastest Growing Market for Fruits & Vegetables

Figure 28 Foliar Spray Segment is Expected to Dominate, 2016-2022 (USD Million)

Figure 29 Asia-Pacific is Projected to Grow With the Highest CAGR During the Forecast Period

Figure 30 Antibacterial Market in Agriculture Share, By Form, 2015 (By Value)

Figure 31 Asia-Pacific is Projected to Be the Fastest Growing Market in the Liquid Segment

Figure 32 Geographic Snapshot (20162022): Rapidly Growing Markets are Emerging as New Hotspots

Figure 33 Italy Recorded the Largest Market for Agricultural Antibacterials in Europe

Figure 34 Asia-Pacific: Agriculture Antibacterial Market Snapshot

Figure 35 Key Companies Preferred Strategies Such as Acquisitions & Agreements From 2011 to 2016

Figure 36 Antibacterial Market in Agriculture, 2015

Figure 37 Antibacterial Market in Agriculture Developments, By Growth Strategy, 20112016

Figure 38 BASF SE: Company Snapshot

Figure 39 BASF SE : SWOT Analysis

Figure 40 The DOW Chemical Company : Company Snapshot

Figure 41 The DOW Chemical Company: SWOT Analysis

Figure 42 E.I. Dupont De Nemours and Company: Company Snapshot

Figure 43 E. I. Dupont De Nemours and Company: SWOT Analysis

Figure 44 Sumitomo Chemical Co., Ltd: Company Snapshot

Figure 45 Sumitomo Chemical Co., Ltd: SWOT Analysis

Figure 46 Bayer Cropscience AG: Company Snapshot

Figure 47 Bayer Cropscience AG: SWOT Analysis

Figure 48 Syngenta AG: Company Snapshot

Figure 49 FMC Corporation: Company Snapshot

Figure 50 Adama Agricultural Solutions Ltd: Company Snapshot

Figure 51 Nufarm Limited: Company Snapshot

Figure 52 Nippon Soda Co. Ltd : Company Snapshot

Growth opportunities and latent adjacency in Antibacterial Market