Battery Packaging Market by Type of Battery (Lithium-ion, Lead-acid), Level of Packaging (Cell & Pack Packaging, Transportation Packaging), and Region (APAC, North America, Europe, South America, Middle East and Africa) - Global Forecast to 2023

The study involved four major activities to estimate the current market size for battery packaging. Exhaustive secondary research was done to collect information of the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Battery Packaging Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Battery Packaging Market Primary Research

The battery packaging market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the automotive, energy storage, and handheld electronics industries and the growth in population. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Battery Packaging Market Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the battery packaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Battery Packaging Market Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the automotive, energy storage, and handheld consumer electronics industries.

Battery Packaging Market Report Objectives

- To define, segment, and project the global market size for battery packaging

- To understand the structure of the battery packaging market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements in the battery packaging market

Battery Packaging Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type of Battery, Level of Packaging, and Region |

|

Geographies covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Nefab Group (Sweden), United Parcel Service Inc. (US), DHL (Germany), Zarges Group (Germany), Heitkamp & Thumann Group (Germany). Total 18 major players covered. |

This research report categorizes the battery packaging market based on the type of battery, level of packaging, and region.

Battery Packaging Market, By Type of Battery

- Lithium-ion battery

- Lead-acid battery

Battery Packaging Market, By Level of Packaging

- Cell & Pack Packaging

- Transportation Packaging

Battery Packaging Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

The Following Customization Options are Available for the Report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

- Further breakdown of Rest of Asia Pacific, Rest of Europe, and Rest of Middle East & Africa

- Detailed analysis and profiling of the additional market players (up to five)

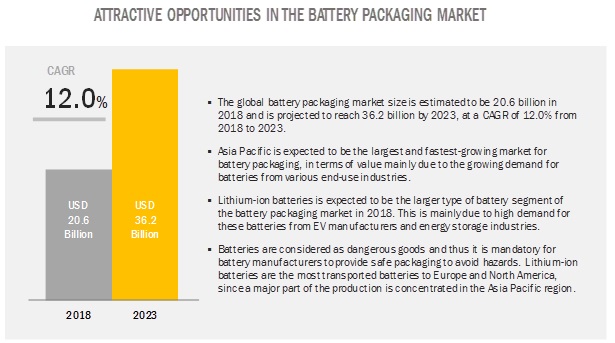

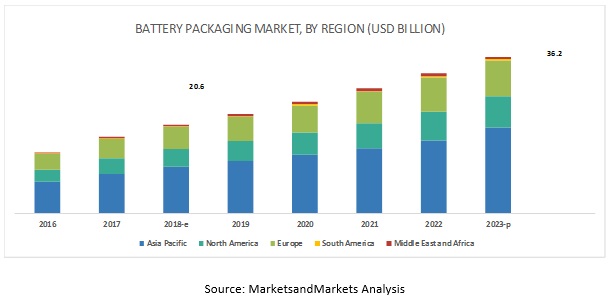

The battery packaging market is projected to reach USD 36.2 billion by 2023, at a CAGR of 12.0%. The growth of the battery packaging market can be attributed to the increased consumption of batteries in the automotive, energy storage, and consumer electronics industries.

Based on type of battery, lithium-ion battery packaging is expected to grow at the higher CAGR during the forecast period.

In terms of value, lithium-ion battery packaging segment is expected to grow at the higher CAGR during the forecast period. Increasing adoption and rising awareness regarding alternative sources of energy and electric vehicles to control the ever-increasing carbon footprint has spurred the demand for lithium-ion batteries globally. Since these batteries have higher efficiency and energy density compared to lead-acid batteries, they are considered ideal for energy storage and EV applications. They also have advantage over the lead-acid battery in terms of cycle life.

Increased investments in the battery manufacturing market have spurred growth in cell & pack packaging segment.

As the adoption of batteries has been growing rapidly, leading battery manufacturers are investing heavily to ramp up their productions for batteries. Recently, leading battery manufacture have started investing in new regions. For instance, Samsung SDI completed the construction of its new lithium-ion battery plant in Hungary. This facility is expected to be operational in the second quarter of 2018. This would increase the demand for cell & pack packaging. Similar investments are being undertaken by other battery manufacturers such as Tesla, SK Innovation, and LG.

APAC battery packaging market is expected to grow at the highest CAGR during the forecast period.

APAC battery packaging market is expected to record the highest growth rate during the forecast period, due to the presence of leading battery manufacturers in the region. This region is home to some of the leading battery manufacturers, including Panasonic, Samsung, GS Yuasa, Exide, and LG, among others. APAC accounts for the largest share of the global automotive market, as it is home to some of the leading automobile consumer countries such as China, Japan, and India. This region also accounts for largest share of the handheld consumer electronics segment which is driving the battery packaging market.

Key Players in Battery Packaging Market

Nefab Group (Sweden), United Parcel Service Inc. (US), DHL (Germany), Zarges Group (Germany), Heitkamp & Thumann Group (Germany), FedEx (US), Rogers Corporation (US), DS Smith (UK), Smurfit Kappa (Ireland), and Umicore (Belgium) are some of the leading players operating in the battery packaging market. These players have adopted the expansion, investment, acquisition, partnership, agreement, and joint venture strategies. These strategies are expected to drive the market for lithium-ion battery during the forecast period, as the demand for these batteries is growing rapidly.

Recent Developments in Battery Packaging Market

- In June 2018, UPS opened a new shipping center in Arlington, Texas (US) by investing USD 200 million. This facility created employment for around 1,400 workers to facilitate shipments. This expansion comes as a strategic investment by UPS to improve its efficiency and connectivity across UPS hubs and transportation network.

- In May 2017, UPS constructed a new distribution center in Edgerton, US. This development helped the company expand its Kansas operations and facilitate smoother shipments.

- In January 2017, H&T Nevada (US), a business unit of H&T, started its production facility in Gigafactory jointly with Tesla (US). This new production facility is embedded in the production line of Tesla, creating a synergy. This development helped H&T increase its market presence in the cell packaging segment.

Key Questions Addressed by the Battery Packaging Market Report

- How are regulations impacting the growth of the battery packaging market?

- Increased demand for batteries in various end-use industries and their impact on the battery packaging market

- How are new investments helping the growth of the battery packaging market?

- Leading players in the battery packaging market

- How recycling packaging can unlock new opportunities of growth in the battery packaging market?

Frequently Asked Questions (FAQ):

How big is the Battery Packaging Market industry?

The battery packaging market is projected to grow from USD 20.6 billion in 2018 to USD 36.2 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 12.0% during the forecast period.

Who leading market players in Battery Packaging industry?

Nefab Group (Sweden), United Parcel Service Inc. (US), DHL (Germany), Zarges Group (Germany), Heitkamp & Thumann Group (Germany), FedEx (US), Rogers Corporation (US), DS Smith (UK), Smurfit Kappa (Ireland), and Umicore (Belgium) are some of the leading players operating in the battery packaging market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Battery Packaging Market

4.2 Battery Packaging Market, By Type of Battery

4.3 Battery Packaging Market, By Level of Packaging

4.4 Battery Packaging Market, By Region

5 Transportation Regulations for Batteries (Page No. - 33)

5.1 Introduction

5.2 Transportation Regulations

5.3 Prototype Battery Regulation

5.4 Damaged Or Defective Battery Regulation

5.5 49 CFR 172.101 Hazardous Materials Table

6 Market Overview (Page No. - 37)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Rising Demand for Batteries From the Sustainable Energy Sector

6.2.1.2 Increasing Awareness of Users Towards Zero Emission Vehicles

6.2.1.3 Favorable Government Policies

6.2.2 Restraints

6.2.2.1 High Cost and Low Efficiency of Sustainable Technologies

6.2.3 Opportunities

6.2.3.1 Increasing Oil Prices

6.2.3.2 Increase in Battery Recycling Activities

6.2.4 Challenges

6.2.4.1 High Cost of Raw Materials

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Economic Indicators

6.4.1 Industry Outlook

6.4.1.1 Electric Vehicles (EVS)

6.4.1.2 Electricity Storage

7 Battery Packaging Market, By Type of Casing (Page No. - 46)

7.1 Introduction

7.2 Cylindrical

7.3 Prismatic

7.4 Pouch

8 Battery Packaging Market, By Type of Packaging (Page No. - 47)

8.1 Introduction

8.2 Corrugated

8.3 Blister

8.4 Others

9 Battery Packaging Market, By Material (Page No. - 48)

9.1 Introduction

9.2 Metals

9.2.1 Aluminum

9.2.2 Steel

9.3 Plastics

9.3.1 Polypropylene

9.3.2 ABS

9.3.3 Polyamide

9.3.4 Polybutylene Terephthalate

9.4 Cardboard

9.5 Others

10 Battery Packaging Market, Import Export Data, 2013-2017 (Page No. - 50)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Australia

10.2.7 Malaysia

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 UK

10.3.5 Spain

10.3.6 Russia

10.3.7 Poland

10.3.8 Hungary

10.3.9 Sweden

10.4 North America

10.4.1 US

10.4.2 Canada

10.4.3 Mexico

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 Israel

10.5.4 South Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Chile

11 Battery Packaging Market, By Type of Battery (Page No. - 68)

11.1 Introduction

11.2 Lithium-Ion Battery

11.3 Lead-Acid Battery

12 Battery Packaging Market, By Level of Packaging (Page No. - 72)

12.1 Introduction

12.2 Cell & Pack Packaging

12.3 Transportation Packaging

13 Battery Packaging Market, By Region (Page No. - 76)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.2.5 Rest of Asia Pacific

13.3 Europe

13.3.1 Germany

13.3.2 France

13.3.3 UK

13.3.4 Spain

13.3.5 Italy

13.3.6 Rest of Europe

13.4 North America

13.4.1 US

13.4.2 Canada

13.4.3 Mexico

13.5 Middle East & Africa

13.5.1 Saudi Arabia

13.5.2 Israel

13.5.3 UAE

13.5.4 Rest of Middle East & Africa

13.6 South America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of South America

14 Competitive Landscape (Page No. - 110)

14.1 Overview

14.2 Market Ranking of Key Players

14.3 Competitive Scenario

14.3.1 Expansions

14.3.2 Acquisitions

14.3.3 Joint Ventures

14.3.4 Agreements

14.3.5 Partnerships

14.3.6 Patent Acquisitions

14.3.7 Investments

14.3.8 New Product Launch

15 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Nefab

15.2 United Parcel Service (UPS)

15.3 DHL

15.4 Zarges

15.5 Heitkamp & Thumann Group

15.6 Fedex

15.7 Rogers Corporation

15.8 DS Smith

15.9 Smurfit Kappa

15.10 Umicore

15.11 Other Key Players

15.11.1 ALLCell Technologies

15.11.2 Texim Europe

15.11.3 Manika Moulds

15.11.4 Veolia Environnement S.A.

15.11.5 Targray

15.11.6 Tesla, Inc.

15.11.7 Johnson Controls

15.11.8 Amara Raja Batteries Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 143)

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.3 Available Customizations

16.4 Related Reports

16.5 Author Details

List of Tables (125 Tables)

Table 1 Battery Packaging Market Snapshot

Table 2 China Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 3 China Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 4 India Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 5 India Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 6 Japan Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 7 Japan Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 8 South Korea Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 9 South Korea Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 10 Indonesia Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 11 Indonesia Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 12 Australia Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 13 Australia Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 14 Malaysia Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 15 Malaysia Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 16 Germany Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 17 Germany Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 18 France Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 19 France Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 20 Italy Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 21 Italy Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 22 UK Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 23 UK Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 24 Spain Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 25 Spain Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 26 Russia Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 27 Russia Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 28 Poland Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 29 Poland Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 30 Hungary Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 31 Hungary Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 32 Sweden Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 33 Sweden Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 34 US Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 35 US Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 36 Canada Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 37 Canada Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 38 Mexico Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 39 Mexico Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 40 Saudi Arabia Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 41 Saudi Arabia Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 42 UAE Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 43 UAE Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 44 Israel Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 45 Israel Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 46 South Africa Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 47 South Africa Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 48 Brazil Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 49 Brazil Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 50 Argentina Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 51 Argentina Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 52 Chile Battery Packaging Market, Export Data for Batteries, 2013–2017 (USD Thousand)

Table 53 Chile Battery Packaging Market, Import Data for Batteries, 2013–2017 (USD Thousand)

Table 54 Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 55 Lithium-Ion Battery Packaging Market, By Region, 2016–2023 (USD Million)

Table 56 Lead-Acid Battery Packaging Market, By Region, 2016–2023 (USD Million)

Table 57 Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 58 Cell & Pack Packaging Market, By Region, 2016–2023 (USD Million)

Table 59 Transportation Packaging Market, By Region, 2016–2023 (USD Million)

Table 60 Battery Packaging Market, By Region, 2016–2023 (USD Million)

Table 61 Asia Pacific Battery Packaging Market, By Country, 2016–2023 (USD Million)

Table 62 Asia Pacific Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 63 Asia Pacific Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 64 China Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 65 China Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 66 India Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 67 India Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 68 Japan Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 69 Japan Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 70 South Korea Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 71 South Korea Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 72 Rest of Asia Pacific Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 73 Rest of Asia Pacific Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 74 Europe Battery Packaging Market, By Country, 2016–2023 (USD Million)

Table 75 Europe Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 76 Europe Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 77 Germany Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 78 Germany Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 79 France Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 80 France Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 81 UK Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 82 UK Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 83 Spain Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 84 Spain Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 85 Italy Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 86 Italy Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 87 Rest of Europe Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 88 Rest of Europe Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 89 North America Battery Packaging Market, By Country, 2016–2023 (USD Million)

Table 90 North America Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 91 North America Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 92 US Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 93 US Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 94 Canada Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 95 Canada Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 96 Mexico Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 97 Mexico Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 98 Middle East & Africa Battery Packaging Market, By Country, 2016–2023 (USD Million)

Table 99 Middle East & Africa Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 100 Middle East & Africa Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 101 Saudi Arabia Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 102 Saudi Arabia Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 103 Israel Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 104 Israel Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 105 UAE Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 106 UAE Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 107 Rest of Middle East & Africa Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 108 Rest of Middle East & Africa Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 109 South America Battery Packaging Market, By Country, 2016–2023 (USD Million)

Table 110 South America Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 111 South America Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 112 Brazil Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 113 Brazil Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 114 Argentina Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 115 Argentina Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 116 Rest of South America Battery Packaging Market, By Type of Battery, 2016–2023 (USD Million)

Table 117 Rest of South America Battery Packaging Market, By Level of Packaging, 2016–2023 (USD Million)

Table 118 Expansions, 2014-2018

Table 119 Acquisitions, 2014-2018

Table 120 Joint Ventures, 2014-2018

Table 121 Agreements, 2014-2018

Table 122 Partnerships, 2014-2018

Table 123 Patent Acquisitions, 2014-2018

Table 124 Investments, 2014-2018

Table 125 New Product Launch, 2014-2018

List of Figures (35 Figures)

Figure 1 Battery Packaging Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Battery Packaging Market: Data Triangulation

Figure 5 Lithium-Ion Battery Packaging Segment Expected to Be the Largest Segment in 2023

Figure 6 Cell & Pack Packaging Expected to Dominate Global Battery Packaging Market Between 2018 & 2023

Figure 7 Asia Pacific Estimated to Account for the Largest Share of Battery Packaging Market in 2018

Figure 8 Growing Demand for Lithium-Ion Batteries Offers Lucrative Opportunities for Market Players

Figure 9 By Type of Battery, Lithium-Ion Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 10 Cell & Pack Packaging Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 11 Battery Packaging Market in Asia Pacific Expected to Grow at Highest CAGR During Forecast Period

Figure 12 Battery Packaging Market: Drivers, Restraints, Opportunities & Challenges

Figure 13 Porter’s Five Forces Analysis

Figure 14 Ev Sales, 2010–2016

Figure 15 Decline in Lithium-Ion Battery Storage Prices, 2010-2016

Figure 16 Lithium-Ion Battery Segment to Lead the Battery Packaging Market During the Forecast Period

Figure 17 Asia Pacific Estimated to Account for the Largest Share of the Lithium-Ion Battery Packaging Market in 2018

Figure 18 Asia Pacific Dominates the Lead-Acid Battery Packaging Market

Figure 19 Cell & Pack Packaging Estimated to Lead the Battery Packaging Market During the Forecast Period

Figure 20 Asia Pacific Estimated to Account for the Largest Share of the Cell & Pack Packaging Market in 2018

Figure 21 Asia Pacific Dominates the Transportation Packaging Segment of the Battery Packaging Market

Figure 22 South Korea Expected to Be the Fastest-Growing Market for Battery Packaging

Figure 23 Asia Pacific Battery Packaging Market Snapshot

Figure 24 Europe Battery Packaging Market Snapshot

Figure 25 North America Battery Packaging Market Snapshot

Figure 26 Middle East & Africa Battery Packaging Market Snapshot

Figure 27 South America Battery Packaging Market Snapshot

Figure 28 Companies Adopted Both Organic and Inorganic Growth Strategies Between January 2014 and October 2018

Figure 29 United Parcel Service: Company Snapshot

Figure 30 DHL: Company Snapshot

Figure 31 Fedex: Company Snapshot

Figure 32 Rogers Corporation: Company Snapshot

Figure 33 Ds Smith: Company Snapshot

Figure 34 Smurfit Kappa: Company Snapshot

Figure 35 Umicore: Company Snapshot

Growth opportunities and latent adjacency in Battery Packaging Market