The research encompassed four primary actions in assessing the present market size of cathode materials. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the cathode materials value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and subsegments.

Secondary Research

The research approach employed to assess and project the cathode materials market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of the secondary research, many secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The cathode materials market includes various stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations. On the demand side, the market is characterized by multiple end-use sectors, including automotive, consumer electronics, industrial applications, and others. The supply side is defined by technological advancements. To gather qualitative and quantitative information, interviews were conducted with various primary sources from both the supply and demand sides of the market.

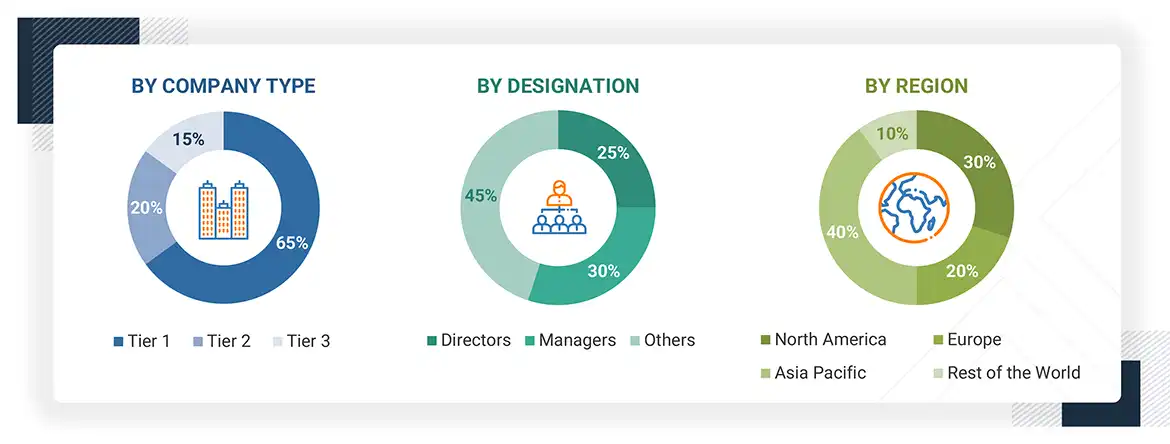

Below is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the cathode materials market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

-

The key players were identified through extensive primary and secondary research

-

The value chain and market size of the cathode materials market, in terms of value, were determined through primary and secondary research

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

Global Cathode Materials Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Cathode materials are active chemical compounds that make up the positive electrode of a rechargeable battery and serve as the main source and host for lithium ions during charge and discharge cycles. These materials, classified by material type such as lithium nickel manganese cobalt (NMC), lithium iron phosphate (LFP), nickel cobalt aluminum (NCA), lithium cobalt oxide (LCO), and lithium manganese oxide (LMO), directly determine a battery’s energy density, voltage, safety, and cycle life. Cathode materials are produced through specific manufacturing processes, including solid-state synthesis, co-precipitation, and other advanced techniques, to ensure purity, structural stability, and consistent performance. They are used across multiple battery types, primarily lithium-ion but also in certain lead-acid and next-generation chemistries, and support diverse end-use industries such as automotive, consumer electronics, stationary energy storage, and industrial power systems. By enabling the electrochemical reactions that store and release electrical energy, cathode materials form the core component that defines the efficiency and reliability of modern rechargeable batteries.

Stakeholders

-

Cathode Material Manufacturers

-

Cathode Material Suppliers

-

Cathode Material Traders, Distributors, and Suppliers

-

Investment Banks and Private Equity Firms

-

Raw Material Suppliers

-

Government and Research Organizations

-

Consulting Companies/Consultants in the Chemicals and Materials Sectors

-

Industry Associations

-

Contract Manufacturing Organizations (CMOs)

-

NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

-

To define, describe, and forecast the size of the global cathode materials market in terms of volume and value

-

To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global cathode materials market

-

To analyze and forecast the size of various segments (material, battery type, and end-use) of the cathode materials market based on five major regions—North America, Asia Pacific, Europe, and the Rest of the World—along with key countries in each of these regions

-

To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

-

To strategically profile the key players in the market and comprehensively analyze their core competencies

Growth opportunities and latent adjacency in Cathode Materials Market