Bioanalytical Testing Services Market by Type, Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology), End User and Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2027

Market Growth Outlook Summary

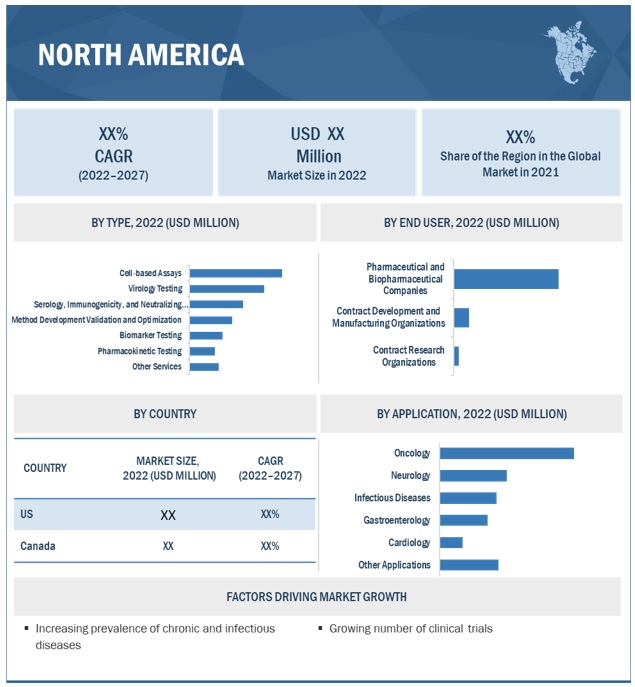

The global bioanalytical testing services market growth forecasted to transform from $2.9 billion in 2022 to $6.0 billion by 2027, driven by a CAGR of 15.6%. The major factors influencing the growth of the market include the well-established pharmaceutical industry, the strong presence of major service providers, the large number of ongoing clinical trial studies, high R&D expenditure, growth in the biosimilars and generics markets, and the rise in the outsourcing of preclinical, clinical, and laboratory testing services by pharmaceutical and biopharmaceutical companies in the region.

To know about the assumptions considered for the study, Request for Free Sample Report

Bioanalytical Testing Services Market Dynamics

Driver: Rising focus on the analytical testing of biologics and biosimilars

Biologics represent one of the most promising new therapeutic areas and are becoming increasingly important in the pharmaceutical market; around 800 products are in the pipeline at present. One of the key reasons for this is the rising prevalence of chronic diseases. However, considering the high cost of biologics and the rising focus of various governments on reducing healthcare costs, the focus on biosimilars has increased in recent years. The impending expiry of the patents and exclusivity periods of biologics have also created opportunities for the development of follow-on biologics or biosimilars. According to GaBi, twelve biologics, with global sales of more than USD 67 billion, are scheduled to go off-patent in major markets by 2020, with more biologics likely to follow.

The expected rise in biosimilar R&D will bring with it a growing demand for the associated bioanalytical testing services—compatibility studies for biosimilars, stability testing, product release testing, and protein analysis of biosimilars—to reduce the risks associated with drug development. Moreover, the introduction of biosimilars and the move toward continuous processing are creating the need for more rapid and sensitive analytical techniques.

Increasing preference for outsourcing analytical testing

Pharmaceutical companies have begun outsourcing several R&D functions that are not core to their internal structure. Companies are trying to be more efficient in the drug development process by focusing on their internal core competencies to bring new products to the market in a more cost-effective manner. Cost reductions, efficiency increases, and optimal staffing are some of the key advantages driving the outsourcing of bioanalytical testing for large companies.

In the pharmaceutical sector, the analytical and testing services were the most-outsourced services, followed by solid-dosage form manufacturing, injectable manufacturing, clinical trials, formulation development, and R&D. This trend is backed by an increase in the numbers, capabilities, and volumes of contract research organization and the liking for specific providers over the long-term as opposed to short-term contracts. In the following years, outsourcing as a strategy is anticipated to gain greater notoriety. When coupled with the growth in biologic and biosimilar R&D, this factor is projected to create a very favorable environment for market development.

The outsourcing of bioanalytical testing services supports pharmaceutical companies lessen risks by avoiding large funds in purchasing analytical equipment and maintaining manpower, particularly when development efforts are in the initial stages. The accessibility of specialized analytical testing service providers with key capabilities to deliver optimal results rapidly has led to growing consideration among pharmaceutical businesses to outsource testing services to third-party service providers.

Growing R&D expenditure in the pharmaceutical and biopharmaceutical industry

Pharmaceutical and biotechnology companies invest heavily in research to come up with breakthrough molecules. The increasing prevalence of infectious and chronic diseases has led to significant investments in the development of new drugs and vaccines among key pharmaceutical companies such as Novartis, Takeda, Sanofi, Eli Lilly, and Pfizer.

Moreover, the outbreak of the COVID-19 pandemic has increased the focus among pharmaceutical and biopharmaceutical companies to develop effective drugs and vaccines against viral infections. In this scenario, establishing effective workflows and processes to reduce the time and costs involved in drug and vaccine development has gained significance. This, in turn, is favoring the outsourcing of bioanalytical testing to specialized service providers.

Rising adoption of the Quality by Design approach

Pharmaceutical companies are progressively adopting the Quality-by-Design (QbD) concept promoted by regulatory agencies such as the EMA and US FDA across the globe to improve the robustness of their manufacturing processes and enhance product quality and manufacturing productivity. The QbD approach in the pharmaceutical industry has evolved over the years with the issuance of ICH Q8 (R2) (Pharmaceutical Development), ICH Q9 (Quality Risk Management), and ICH Q10 (Pharmaceutical Quality System).

QbD ensures product quality and requires process performance characteristics to be scientifically designed to meet specific objectives, not merely empirically derived from the performance of test batches. After recommendations from the FDA in 2013, generic drug manufacturers are also adopting the QbD approach in manufacturing operations.

According to the ICH Q 10 guidelines, analytical methods are a key part of the pharmaceutical quality system. Implementation of analytical QbD (AQbD) in the manufacturing process ensures product quality and performance. There is a huge difference between the traditional and AQbD approaches of analytical method development. The traditional approach does not use statistical calculations and risk assessment, while the AQbD approach utilizes tools such as CQA, ATP, DoE, and risk assessment, which helps to easily identify the risk initially so that quality can be improved.

Furthermore, a rising number of conferences, symposia, workshops, and training courses, especially in emerging countries, have played a crucial role in creating awareness about the benefits of adopting the QbD approach among pharmaceutical and biopharmaceutical manufacturers and research organizations. The increasing acceptance and adoption of the QbD approach among pharmaceutical and biopharmaceutical companies across the globe are expected to play a key role in the growth of the global market in the coming years.

Restraint: Dearth of skilled professionals

The shortage of skilled professionals to handle advanced equipment required for bioanalytical tests is a major factor that is expected to restrain the growth of this market. The US Bureau of Labor Statistics estimated that there would be 18,580 clinical laboratory science (CLS) program vacancies in the country by 2020. However, only 5,000 students graduate from accredited CLS programs each year. This means that educational programs are delivering less than a third of the trained professionals needed. This may hamper the adoption of new technologies and methodologies, thereby limiting the growth of the market in the coming years.

Pricing pressure faced by major players

The market is highly competitive and is expected to grow rapidly in the coming years due to the increasing number of bioanalytical CROs. Additionally, the growing number of contract development and manufacturing organizations (CDMOs) offering bioanalytical services is further expected to intensify the competition in the market. Over the last few years, the number of bioanalytical testing service providers has increased in emerging markets, such as China, India, and Brazil, which is a major challenge for global players. These local or regional analytical testing service providers offer services at lower prices as compared to established bioanalytical testing service providers, thereby increasing the pricing pressure on global players to a certain extent. This is adversely affecting the profit margins of global players, especially in emerging markets. Currently, several global players are focusing on entering into agreements, acquisitions, and collaborations to overcome this challenge, maintain their positions in the global market, and establish a stronghold in local markets characterized by low-priced services. However, the threat of local players will continue to affect the pricing policies of global players in the coming years.

Opportunity: Emerging countries in the Asia Pacific region

Emerging markets present significant growth opportunities for providers of healthcare analytical testing services—particularly India and China. Governments in both countries are extensively emphasizing the development of life science infrastructure by undertaking several projects and initiatives to encourage pharmaceutical and biopharmaceutical companies to develop and manufacture drugs for various infectious and chronic diseases.

According to a report from the Indian Pharmaceutical Alliance (IPA), the Indian pharmaceutical industry was growing at a rate of 7–8% and is estimated to register USD 80–90 billion in annual revenue by 2030. Nevertheless, with the support of the government and regulatory bodies, the industry can expand at a pace of 11–12%. The support from government in the form of regulatory assistance and investments is integral step toward the commencement of innovation-led industry growth. Furthermore, the favorable government scenario has helped start-ups by providing them soft loans for pharma industrial R&D projects and a grant-in-aid for clinical trials for creating drugs for neglected diseases.

Besides this, the government is also offering non-fiscal benefits such as backing in research in all systems of medicines, involving setting up facilities and joint research projects for industries and institutions.

Furthermore, in 2020, the Chinese State Drug Administration (SDA) opened up a large market for bioanalytical CROs across the world by allowing Chinese pharmaceutical companies to use clinical trial data from studies conducted outside China for their drug submissions to the SDA. This encouraged global CROs keen to enter the growing Chinese market for pharmaceutical drug testing to expand their Chinese facilities and provide bioanalytical services to pharmaceutical and biotechnology companies.

Rising demand for specialized bioanalytical testing services

Traditionally, pharmaceutical and biopharmaceutical companies outsourced only late-phase drug development and routine processes to analytical testing service providers and conducted the early-phase method development projects and problem-solving activities in-house. However, in recent years, they are increasingly outsourcing testing services much earlier in the product development cycle to focus on their core strengths. Pharmaceutical companies choose to outsource services to CROs mainly to gain access to innovative technologies that accelerate the development of compounds through the product pipeline. For instance, companies such as Pfizer, Merck, and Roche have reduced their in-house testing services to fuel their R&D pipelines to meet the growing demand for new drug molecules for various therapeutic areas.

Currently, many pharmaceutical and biopharmaceutical companies are focusing on building a diverse product portfolio and developing new small and large molecules. Combination products, delivery devices, and reformulated or re-engineered drugs are being developed by companies to cater to the unmet needs in the market.

Pharmaceutical companies are focusing on various specialized testing services such as Liquid Chromatography-Mass Spectrometry (LC/MS), gene expression analysis, wet chemistry analysis of compendia raw materials, and trace metal analysis with Inductively Coupled Mass Spectrometry (ICP-MS). These tests require high-end equipment and skilled professionals. To save equipment and labor costs, pharmaceutical and biopharmaceutical companies prefer to outsource these specialized testing services to CROs.

Challenge: Innovative formulations demanding a unique bioanalytical testing approach

Over the years, competition in the pharmaceutical and biopharmaceutical market to develop cutting-edge therapies and gain the edge of patent exclusivity by quick drug development has increased significantly. In all phases of pharmaceutical and biopharmaceutical development, bioanalytical testing plays a major role and is the most outsourced process among all the chemistry, manufacturing, and control (CMC) activities. CMC data is also pivotal to meet regulatory expectations and acquire Investigational New Drug (IND) approval.

Diversity of CMC requirements for biopharmaceutical IND and the development of novel drug delivery systems pose a variety of challenges and require a myriad of analytical methods for testing new drug molecules. Currently, several service providers are also enhancing their portfolios of service offerings in line with the demand from the pharmaceutical and biopharmaceutical industries. However, they must still keep pace with the current rate of technological changes.

Growing need to improve the sensitivity of bioanalytical methods

One of the prominent challenges in this field is ensuring sufficient sensitivity, speed of analysis, and robustness of methodologies. Changes, fluctuations, and variations in end-user demands and regulatory requirements make it highly difficult for service providers to ensure sufficient testing capabilities; they must constantly look for and implement innovative and new assays. For instance, the evaluation of the placental transfer of certolizumab pegol (CZP) requires highly sensitive and selective bioanalytical assays to measure low CZP concentrations in infant and umbilical cord blood. For this study, the electrochemiluminescence immunoassay was validated for measuring low CZP concentrations in human plasma.

Similarly, there are many challenges faced when optimizing bioassays for biologics that increase timelines and exceed budgets, ending in results that do not satisfy requirements. The reason behind this is early in the process of assay development for biologics, there is limited production experience and incomplete knowledge about assay capabilities. In recent years, innovative assay formats such as reporter gene and second messenger assays have been emerging in drug discovery, and some of these assays have been tried in cell-based assays for drug development as well. However, it is becoming a challenge for service providers, as they have to constantly seek newer sensitive assays to cater to the changing demands of end users.

The cell-based assays accounted for the largest share of the bioanalytical testing services industry

The cell-based assays segment dominated the bioanalytical testing services market. The increasing prevalence of chronic diseases and the rising number of clinical trials are expected to drive the segment growth.

The Oncology segment dominated bioanalytical testing services industry with the largest share

The oncology accounted for the largest share of the bioanalytical testing services market. and is also expected to grow at the highest CAGR. Surging number of clinical trials conducted for cancer is driving the segment growth.

The pharmaceutical and biopharmaceutical companies segment accounted for the largest share of the bioanalytical testing services industry

The pharmaceutical and biopharmaceutical companies segment accounted for the largest share of the global bioanalytical testing services market. Pharmaceutical and biopharmaceutical companies mainly focus on developing new drugs for the treatment of various diseases. Increased outsourcing of early-phase development, clinical, and laboratory testing services by pharmaceutical companies is expected to drive the segment growth.

Asia Pacific region of the bioanalytical testing services industry is to grow at the fastest CAGR during the forecast period

The APAC bioanalytical testing services market is becoming a key destination for drug development and clinical research. Increase in the number of clinical trial activities in the region is mainly due to reasons such as cost benefits, a large treatment-naïve population, maintenance of participants in clinical trials, and constantly improving regulatory procedures.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the bioanalytical testing services market include Charles River (US), Medpace (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), IQVIA (US), SGS SA (Switzerland), Laboratory Corporation of America Holdings (US), Intertek Group (UK), Syneos Health (US), ICON (Ireland), Frontage Labs (US), PPD (US), PAREXEL International Corporation (US), Almac Group (UK), Celerion (US), Altasciences (US), BioAgilytix Labs (US), Lotus Labs (India), LGS Limited (UK), Sartorius AG (Germany), CD BioSciences (US), Absorption Systems LLC (US), Pace Analytical Services (US), Bioneeds India Private Limited (India) and Vipragen Biosciences (India).

Scope of the Bioanalytical Testing Services Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

USD 2.9 billion |

|

Projected Revenue Size by 2027 |

USD 6.0 billion |

|

Revenue Growth Rate |

Poised to grow at a CAGR of 15.6% |

|

Market Driver |

Rising focus on the analytical testing of biologics and biosimilars |

|

Market Opportunity |

Emerging countries in the Asia Pacific region |

Report categorizes the global bioanalytical testing services market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Cell-based Assays

- Bacterial cell-based assays

- Viral cell-based assays

- Virology Testing

- In Vitro Virology Testing

- In Vivo Virology Testing

- Species-specific Viral PCR Assays

- Method Development, Optimization, and Validation

- Serology, Immunogenicity, and Neutralizing Antibodies

- Biomarker Testing

- Pharmacokinetic Testing

- Other Services

By Application

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Other Applications

By End User

- Pharmaceutical and Biopharmaceutical Companies

- Contract Development and Manufacturing Organizations

- Contract Research Organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

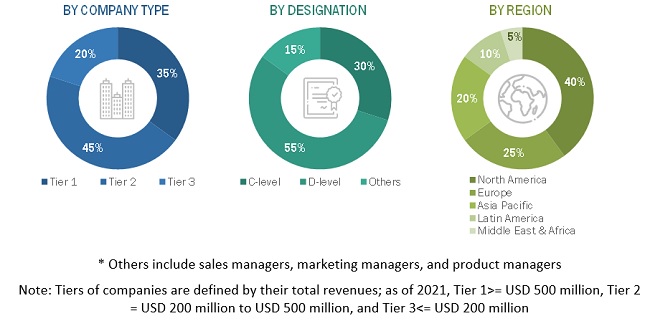

This research study involved the use of extensive secondary sources; directories; databases such as Hoovers, Bloomberg Business, Factiva, and Avention; white papers; annual reports; company house documents; and SEC filings. Insights from societies and organizations such as the Biotechnology and Biological Sciences Research Council (BBSRC) and the Centers for Disease Control and Prevention (CDC) were also taken into consideration while estimating the market size.

Secondary Research

Secondary research was mainly used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the global bioanalytical testing services market. It was also used to obtain key information about the major players and market classification and segmentation according to industry trends. Primary sources mainly included industry experts from core and related industries, preferred service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative insights.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the bioanalytical testing services market. Primary sources from the demand side include experts from pharmaceutical and biopharmaceutical companies, contract development and manufacturing organizations, and contract research organizations.

A breakdown of the primary respondents for bioanalytical testing services market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global market and various other dependent submarkets. The global bioanalytical testing services market size was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size for market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the bioanalytical testing services market on the basis of product, application, end user, and region.

- To define, describe, and forecast the bioanalytical testing services market by type, application, end user, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall bioanalytical testing services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the bioanalytical testing services market

- To track and analyze competitive developments such as partnerships, collaborations, agreements, acquisitions, and service launches & expansions in the bioanalytical testing services market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific bioanalytical testing services market into Australia, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bioanalytical Testing Services Market

What are the challenges that companies will face in Bioanalytical Testing Services Market?

What are the key trends and future growth of Bioanalytical Testing Services Market?

Which segment to dominate the global Bioanalytical Testing Services industry?

Here are 3 use cases of Bioanalytical Testing Services Market in 2030:

what are the top 3 use cases of Bioanalytical Testing Services Market in 2030?