Biomarkers Market Size, Growth, Share & Trends Analysis

Biomarkers Market by Offering (Consumables, Software, Services), Type (Safety, Efficacy), Research Area (Genomics, Proteomics), Technology (PCR, MS), Disease (Cancer, Infectious, Neurological), Application (Diagnostic, Research) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

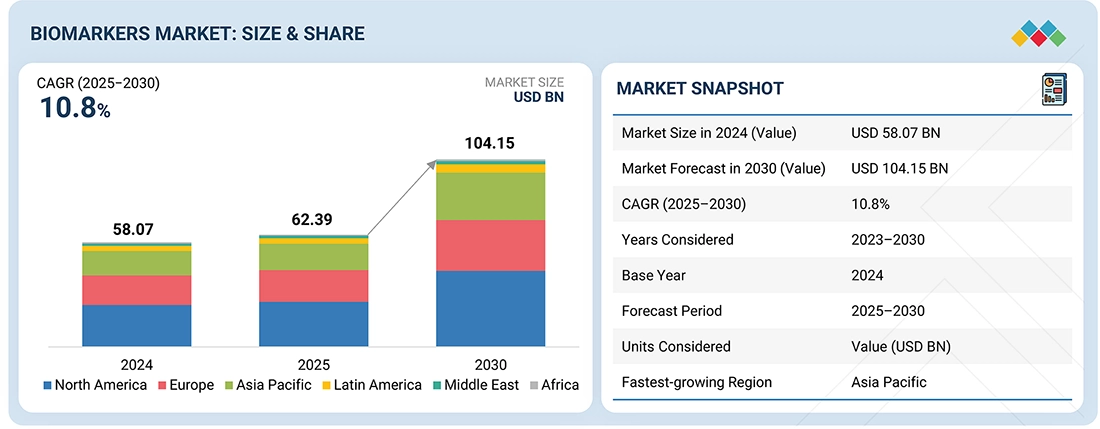

The biomarkers market is projected to reach USD 104.15 billion by 2030 from USD 62.39 billion in 2025 at a CAGR of 10.8% from 2025 to 2030. The market growth is fueled by the increasing use of biomarkers in drug discovery, which helps identify disease mechanisms and enhances the accuracy of clinical trials.

KEY TAKEAWAYS

-

BY REGIONThe North America biomarkers market dominated, with a share of 40.2% in 2024. The large share of North America can be attributed to the presence of key biopharmaceutical research and development facilities and the rising number of drug development projects.

-

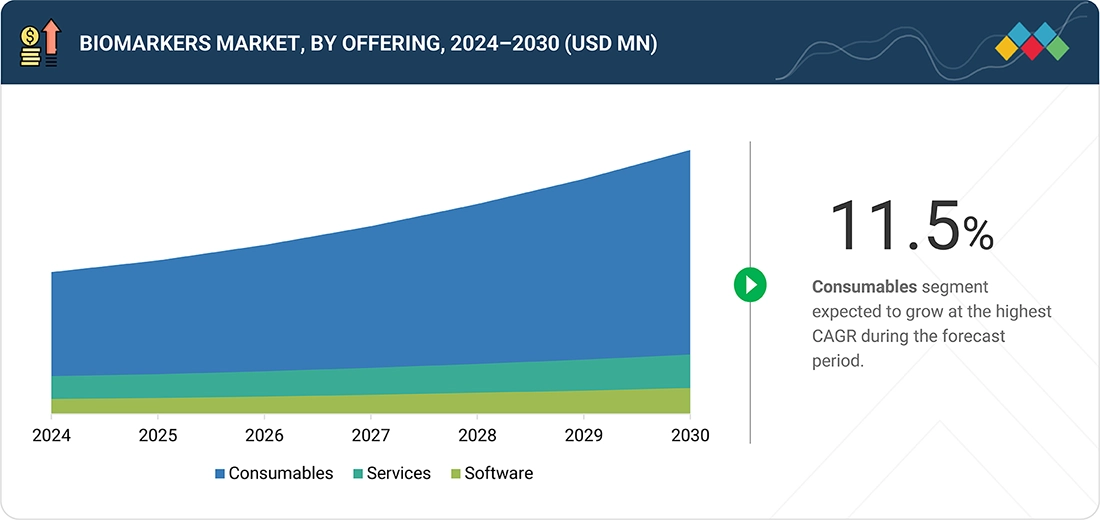

BY OFFERINGBy offering, the consumables segment is expected to dominate the market, growing at the highest CAGR of 11.5%. The growth in this segment is driven by the necessity for high-quality products to ensure accurate test results in research and clinical settings.

-

BY TYPEBy type, the safety biomarkers segment accounted for the largest share of 48.1%. market. The large share of this segment is due to its essential role in ensuring the safety and effectiveness of pharmaceuticals and healthcare interventions.

-

BY RESEARCH AREABy research area, the genomics segment is expected to register the highest CAGR of 11.6%. Increasing advancements in genomics technologies for biomarker testing are expected to drive the growth in this segment.

-

COMPETITIVE LANDSCAPEF. Hoffmann-La Roche Ltd, Merck KGaA, Abbott, Thermo Fisher Scientific Inc. and QIAGEN were identified as Star players in the biomarkers market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

The biomarkers market is projected to grow significantly over the next decade, driven by the increasing use of biomarkers in drug discovery, which helps identify disease mechanisms and enhances the accuracy of clinical trials. Investments in omics technologies, including genomics, proteomics, and transcriptomics, are improving the processes for biomarker identification and validation. Moreover, both governments and private organizations are providing more funding and grants for biomarker research.

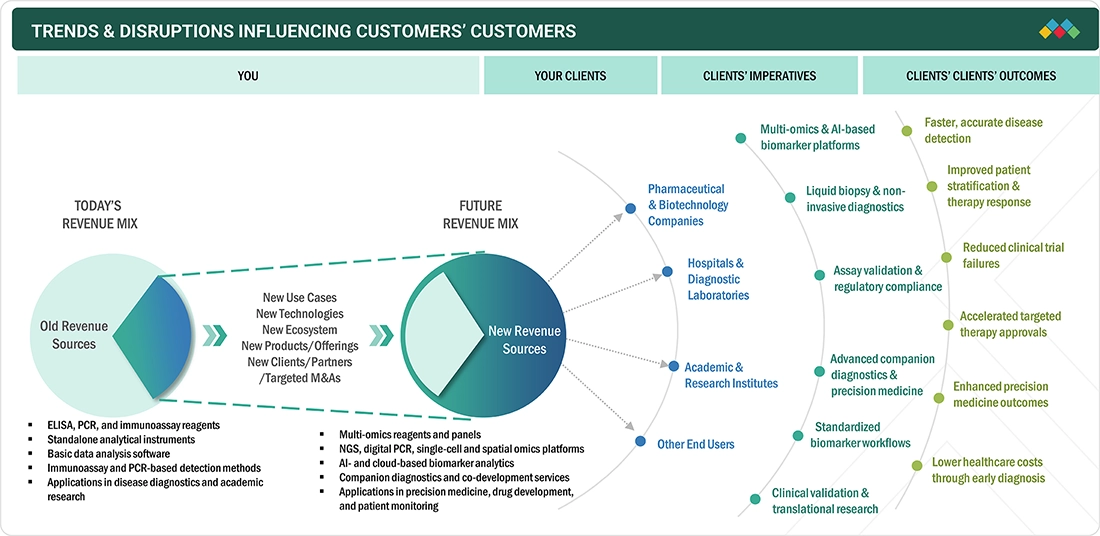

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The biomarkers market is witnessing a major transformation driven by new technologies, evolving applications, and strategic collaborations. The revenue mix is expected to shift significantly as companies move from conventional models toward multi-omics integration, AI-enabled biomarker discovery, and liquid biopsy innovations. Pharmaceutical and biotechnology companies, hospitals, academic institutions, and other end users are prioritizing assay validation, regulatory compliance, and precision diagnostics. These advancements aim to accelerate disease detection, improve patient stratification, reduce clinical trial failures, and enhance precision medicine outcomes, ultimately driving better healthcare efficiency and early diagnosis worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing use of biomarkers in drug discovery & development

-

Growing importance of companion diagnostics

Level

-

High capital investments and extensive timelines for biomarker development

-

Disease complexity and heterogeneity

Level

-

Growing preference for personalized medicine and precision oncology

-

High growth potential of emerging economies

Level

-

Issues associated with quantification & validation of biomarkers

-

Complexities associated with data set integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of biomarkers in drug discovery & development

The growing use of biomarkers in drug discovery and development enhances disease understanding, patient selection, and therapeutic efficacy. Their integration accelerates clinical trials, reduces costs, and improves success rates by enabling more targeted, data-driven drug development strategies across pharmaceutical and biotechnology research programs.

Restraint: High capital investments and extensive timelines for biomarker development

Developing reliable biomarkers requires substantial investment, advanced infrastructure, and long validation timelines. High R&D costs, regulatory complexities, and limited funding restrict smaller players, slowing innovation and commercial adoption. These factors collectively hinder the large-scale implementation of biomarkers in clinical and research applications

Opportunity: Growing preference for personalized medicine and precision oncology

The rising focus on personalized medicine and precision oncology offers strong growth prospects for the biomarkers market. Biomarkers are vital for identifying patient-specific traits, predicting drug response, and monitoring therapy effectiveness, driving their adoption in companion diagnostics and targeted treatment development.

Challenge: Issues associated with quantification & validation of biomarkers

Accurate quantification and validation remain key challenges in biomarker research. Variations in assay performance, lack of standardization, and reproducibility issues impede clinical translation and regulatory approval. Addressing these limitations is crucial to ensure data reliability and accelerate biomarker integration into diagnostic and therapeutic applications.

biomarkers-advanced-technologies-and-global-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Collaborated with the COPD Foundation Biomarker Qualification Consortium, developed and validated plasma fibrinogen as a prognostic biomarker for chronic obstructive pulmonary disease (COPD) | Enabled selection of high-risk patients, reduced trial size and duration, and improved statistical power and regulatory acceptance for biomarker-driven studies |

|

Applied bioinformatics to identify KRAS pathway biomarkers that rescued a failing oncology clinical trial by defining a responder subgroup | Enabled redesign of the trial with biomarker-guided patient selection, demonstrated efficacy in a specific subgroup, and revived a previously non-performing drug candidate |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The biomarkers market ecosystem comprises raw material suppliers (Biosynth, Creative Diagnostics), product manufacturers (Agilent Technologies, Thermo Fisher Scientific), service providers (JSR Corporation, Eurofins), and end users (Novartis,Massachusetts General Hospital). Raw materials like reagents, assay kits, antibodies, and detection enzymes are utilized to develop, validate, and apply biomarkers in disease diagnosis, drug discovery, and clinical research. Product manufacturers ensure standardized assay platforms and analytical instruments, while service providers deliver biomarker validation, testing, and translational research support. End users drive demand for accuracy, clinical relevance, and regulatory compliance, fostering collaboration across the value chain. This integrated ecosystem promotes innovation in precision medicine, early disease detection, and personalized therapeutic development.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biomarkers Market, By Offering

In 2024, the consumables segment accounted for the largest share of the biomarkers market. The high demand for consumables stems from the necessity for high-quality products to ensure accurate and reliable results in biomarker testing.

Biomarkers Market, By Type

In 2024, the safety biomarkers segment accounted for the largest share of the biomarkers market. The large share of this segment is due to its essential role in ensuring the safety and effectiveness of pharmaceuticals and healthcare interventions.

Biomarkers Market, By Application

In 2024, the clinical diagnostics segment accounted for the largest share of the biomarkers market. The large share of this segment can be attributed to the increasing use of biomarkers for disease diagnosis and the rising incidence of chronic diseases such as cancer, infectious diseases, cardiovascular disorders, and neurological disorders.

REGION

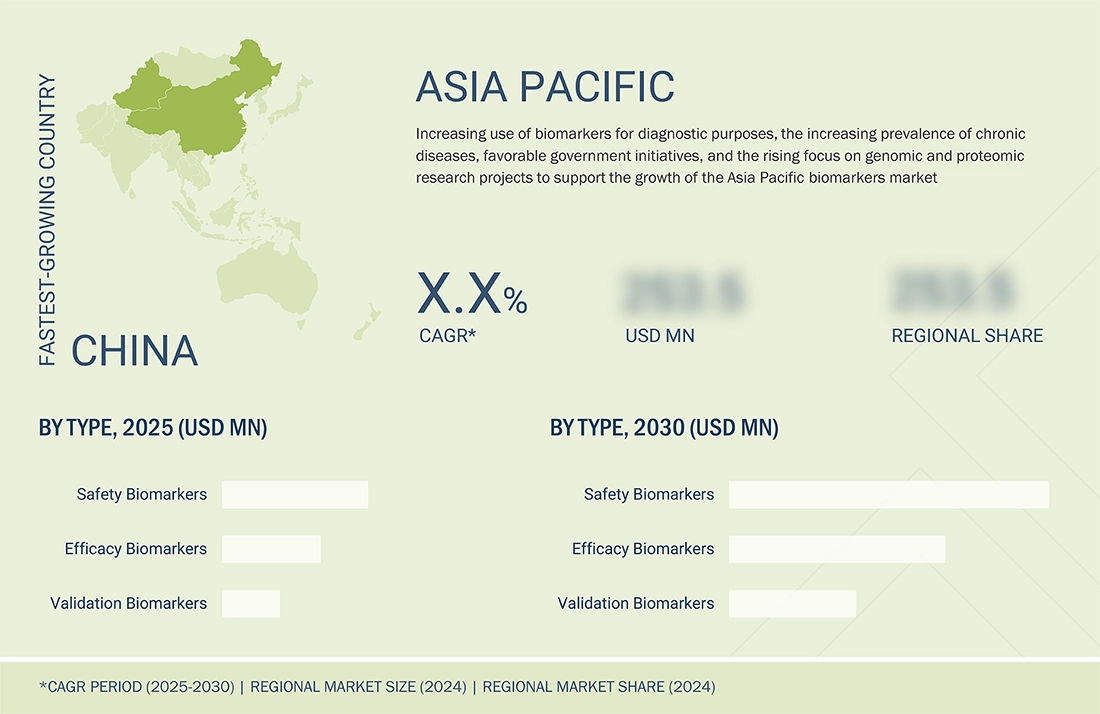

Asia Pacific to be fastest-growing region in global biomarkers market during forecast period

The Asia Pacific biomarkers market is expected to register the highest CAGR during the forecast period, primarily due to the rising incidence of chronic diseases, the rapid expansion of drug discovery & development projects, increasing R&D spending on biopharmaceutical projects, and the growth of the biotechnology industry in emerging economies.

biomarkers-advanced-technologies-and-global-market: COMPANY EVALUATION MATRIX

F. Hoffmann-La Roche Ltd (Star) leads the biomarkers market with a strong global footprint, leveraging its extensive portfolio of biomarker-based diagnostics, companion diagnostics, and precision medicine platforms integrated across its pharmaceutical and diagnostics divisions. The company’s regulatory expertise, clinical validation capabilities, and strategic collaborations reinforce its leadership in biomarker innovation across oncology, neurology, and infectious diseases. Guardant Health (Emerging Leader) is rapidly strengthening its market position through advanced liquid biopsy and genomic profiling technologies, addressing the growing demand for non-invasive, real-time, and clinically actionable biomarker testing solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- F.Hoffmann-La Roche Ltd (Switzerland)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (US)

- Abbott (US)

- QIAGEN (Germany)

- Revvity (US)

- Charles River Laboratories (US)

- Eurofins Scientific (Luxembourg)

- BioMérieux (France)

- Agilent Technologies, Inc. (US)

- Guardant Health (US)

- Bio-Rad Laboratories (US)

- Illumina, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 58.07 Billion |

| Market Forecast in 2030 (Value) | USD 104.15 Billion |

| Growth Rate | CAGR of 10.8% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

North America Biomarkers Market Europe Biomarkers Market Asia Pacific Biomarkers Market Genomic Biomarkers Market Predictive Clinical Biomarkers Market Neurological Biomarkers Market Digital Biomarker Market EPO Biomarkers Market |

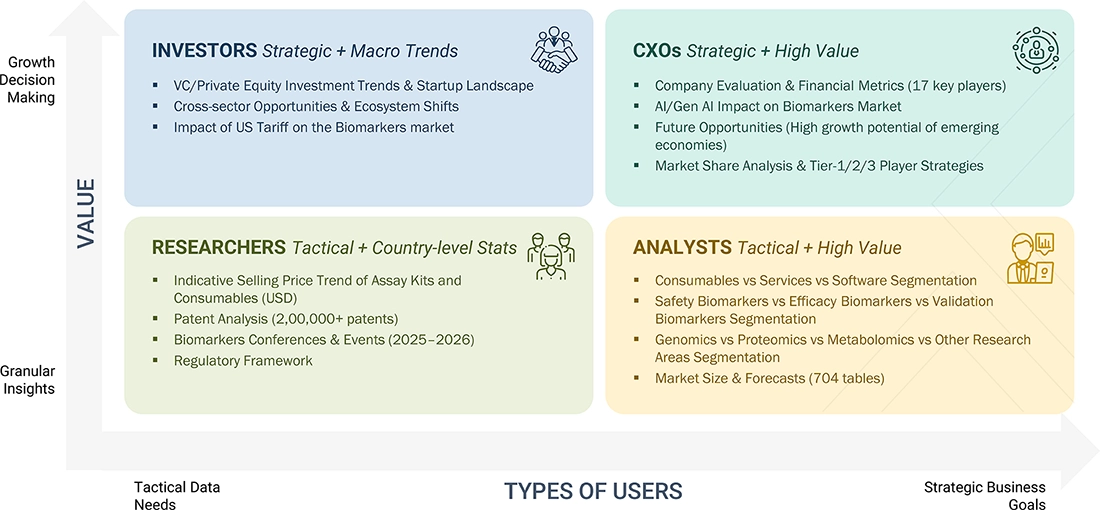

WHAT IS IN IT FOR YOU: biomarkers-advanced-technologies-and-global-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Rest of Asia Pacific Breakdown | Country-level market sizing and growth forecasts (Taiwan, North Korea, New Zealand, Vietnam, the Philippines, Singapore, Malaysia,Thailand, Indonesia, and other Asia Pacific countries) | Provides granular country-level insights, enabling clients to prioritize high-growth markets, and tailor portfolio strategies |

| Company Evaluation |

|

Delivers visibility into competitors, helping clients identify partners, evaluate positioning, and detect market gaps for smarter collaboration, outsourcing, and strategic market entry decisions |

RECENT DEVELOPMENTS

- May 2025 : Roche introduced the Elecsys PRO-C3 test, a biomarker-based diagnostic tool, developed with Nordic Bioscience to evaluate liver fibrosis severity in patients with MASLD (metabolic dysfunction-associated steatotic liver disease).

- April 2025 : Eurofins Scientific acquired SYNLAB's clinical diagnostics operations in Spain, which include genetics and anatomical pathology services. These services complement Eurofins' existing clinical diagnostics capabilities and significantly expand its reach in the Spanish market. The acquisition supports Eurofins' biomarker services by strengthening its access to patient samples, enhancing laboratory throughput, and expanding its capabilities in molecular diagnostics, essential for biomarker discovery, validation, and clinical application.

- January 2025 : Merck established a multi-year partnership with Opentrons Labworks to automate its biology assay kits using the Opentrons Flex robotic workstation. This collaboration aims to enhance workflows related to protein sample preparation, molecular assays, and cell-based research, which are crucial for biomarker discovery and validation.

- January 2025 : Thermo Fisher Scientific teamed up with the UK Biobank Pharma Proteomics Project (UKB-PPP) to conduct the world's largest proteomics study focused on biomarkers. Utilizing Thermo Fisher's Olink Explore Platform, this collaboration will analyze more than 5,400 proteins from 600,000 human samples, aiming to accelerate the discovery of protein biomarkers associated with various diseases.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the global biomarkers market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the biomarkers market. The secondary sources used for this study include American Society of Clinical Oncology (ASCO), Canadian Alliance for Healthy Hearts and Minds (CAHHM), Canadian Institute for Health Information (CIHI), Central Drugs Standard Control Organization (CDSCO), Center for Disease Evaluation and Research (CDER), Centers for Disease Control and Prevention (CDC), Chinese Medical Journal, Clinicaltrials.gov.in, European Medicines Agency (EMA), Food and Drug Administration (FDA), GLOBOCAN, International Agency for Research on Cancer (IARC), National Cancer Institute (NCI), National Center for Biotechnology Information (NCBI), National Institutes of Health (NIH), National Comprehensive Cancer Network (NCCN), Organization for Economic Co-operation and Development (OECD), Population Health Research Institute (PHRI), PubMed, World Bank, World Health Organization (WHO), Corporate and Regulatory Filings, Annual Reports, Sec Filings, Investor Presentations, and Financial Statements; Business Magazines & Research Journals; Press Releases, MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

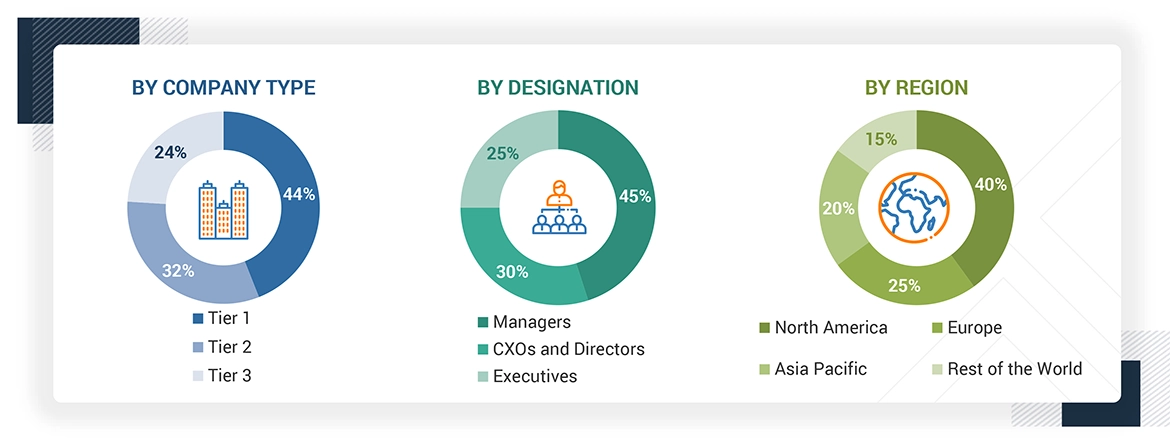

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global biomarkers market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (personnel from pharmaceutical & and biotechnology companies, hospitals & diagnostic laboratories, academic & research institutes, and other end users) and supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, across six major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. Approximately 70% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. This preliminary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biomarkers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues generated from the biomarkers market business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-down Approach

- After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

A biomarker is a measurable indicator of a biological condition or process, often used to diagnose diseases, predict disease progression, and evaluate treatment response. Biomarkers can be molecular, histologic, radiographic, or physiological characteristics that provide valuable insights into normal and pathological processes. The biomarkers market encompasses a broad range of products and services that support biomarker discovery, validation, and application in clinical and research settings. This includes offerings such as consumables (assay kits, reagents, and instruments), software tools, and related services that facilitate biomarker analysis. The market report analyzes biomarker usage across multiple applications, including clinical diagnostics, drug discovery and development, personalized medicine, and clinical research. It also studies the adoption of biomarkers across key research areas, such as oncology, neurology, cardiology, infectious diseases, and metabolic disorders. Furthermore, the report segments the market by type of biomarkers, including safety, efficacy, and validation biomarkers. The study also considers regional trends, end-user adoption, and technological advancements shaping the global biomarker landscape.

Stakeholders

- Academic & Research Institutes

- Biomarkers Assays and Reagents Manufacturers, Vendors, and Distributors

- Contract Research Organizations (CROs)

- Biomarkers Service & Software Providers

- Diagnostics Companies

- Market Research and Consulting Firms

- Pharmaceutical and Biotechnology Companies

- Regulatory Agencies

- Venture Capitalists

- Forensics Labs

- Government organizations

- Private research firms

- Contract development and manufacturing organizations (CDMOs)

- Hospitals and Diagnostic Laboratories

Report Objectives

- To define, describe, and forecast the global biomarkers market based on offering, type, research area, technology, disease indication, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments in six regions: North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the global biomarkers market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the biomarkers market

- To benchmark players in the biomarkers market using the “Company Evaluation Matrix” framework, which analyzes market players based on various parameters, including product portfolio, geographic reach, and market share

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biomarkers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Biomarkers Market

Patrick

Mar, 2022

Looking forward to gain more insights on the global Biomarkers Market.

Raymond

Mar, 2022

What are the growth opportunities in Biomarkers Market?.

Jack

Mar, 2022

Can you enlighten us on the end users in Biomarkers Market?.