Biodegradable Films Market by Type (PLA, Starch Blends, Biodegradable Polyesters, PHA), Application (Food Packaging, Agriculture & Horticulture, Cosmetic & Personal Care Products Packaging, Industrial Packaging) and Region - Global Forecast to 2026

Updated on : August 25, 2025

Biodegradable Films Market

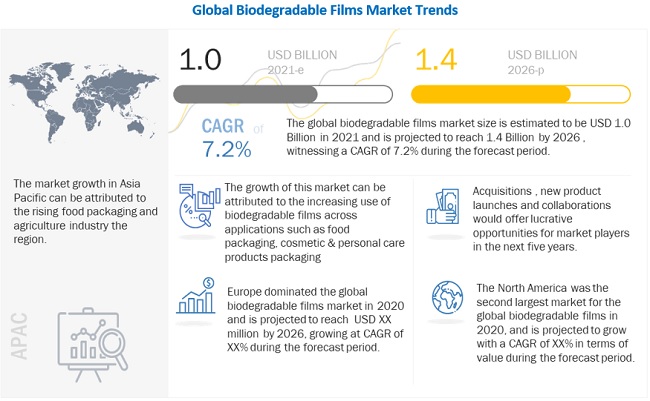

The global biodegradable films market was valued at USD 1.0 billion in 2021 and is projected to reach USD 1.4 billion by 2026, growing at 7.2% cagr from 2021 to 2026. The growing awareness regarding plastic waste and its adverse impact on the environment is one the primary factors driving market growth. Moreover, factors like growing demand from the food packaging industry, and high demand from the agriculture & horticulture sector are also contributing toward the market growth of biodegradable films.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Biodegradable Films Market

The primary application segments of biodegradable films market are the agriculture & horticulture and food packaging. COVID-19 is expected to have a mixed impact on these applications.

- The demand for biodegradable films is estimated to experience a dip due to the outbreak of COVID-19 around the world in 2020. However, the food industry has remained operational throughout; thus, the impact on the biodegradable films market is assumed to be negligible.

- The impact of COVID-19 outbreak on demand for biodegradable films in the agricultural industry is considered to be slightly affected at the global level, due to disruption in the supply chain.

Biodegradable Films Market Dynamics

Driver: High demand from food packaging industry

Polylactic acid (PLA), starch-based plastics, and polyhydroxyalkanoates (PHA) are being increasingly used as raw materials to manufacture food & beverage packaging products due to their ease of disposability, degradability, and recyclability. This has led companies to adopt green packaging labels as a strategy for branding and customer acquisition, thereby increasing the demand of biodegradable films for food packaging & compostable bags applications.

Restraint: Higher cost of biodegradable plastic films compared to conventional plastic films

The major restraint to the growth of the biodegradable films market is cost-competitive inability. Generally, the production cost of biodegradable plastic films is 20-80% higher than that of conventional plastic films. This is primarily due to the high polymerization cost of biodegradable plastics, as most of the processes are still in the development stage and, hence, have not achieved economies of scale.

Opportunity: Steadily growing bioplastic industry worldwide

The bioplastic industry is witnessing an impressive growth rate around the world, which can be considered as an opportunity for the biodegradable films market. For instance, as per data provided by Packaging Europe in December 2019, the global bioplastics production capacity is projected to increase from around 2.1 million tons in 2019 to 2.4 million tons by 2024.

Challenge: Performance issues related to biodegradable films

Low barrier properties to air, water, and oxygen and low resistance to heat, when compared to conventional plastic films, are some of the major performance issues related to biodegradable plastic films.

Starch blends is projected to grow at a very high CAGR during the forecast period.

Starch blends are considered excellent biodegradable fillers as they have thermal stability and make minimal interference with the melt-flow properties of most materials. They can be used to reduce the cost and accelerate the biodegradation of the composite materials. The growth of the starch blends segment is attributed starch blends being considered as an effective and renewable alternative to the plastics derived from petroleum derivatives.

Food Packaging is projected to be a large consumer of biodegradable films during the forecasted period.

Egg trays, edible coating, paper boards, wrapping films, and food containers are some of the common applications of biodegradable films for food packaging industry. PLA, starch blends, PBS, PHA, and cellulose are the most widely used biodegradable films in the food packaging industry. Biodegradable films are mainly used in fresh & frozen food packaging as well as the packaging of dried snacks & candy, bakery goods, water & juice bottles, meat trays, and coatings for beverages cups, and films & card stock.

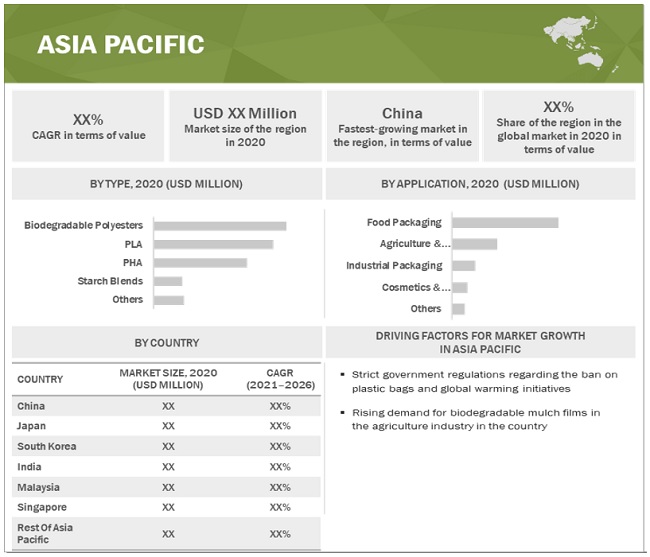

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing market for biodegradable films during the forecast period. Factors such as, adoption of application of various environmental regulations as well as the rising government regulations regarding the ban on conventional plastic bags and global warming initiatives are expected to drive the demand for biodegradable films for packaging applications in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Biodegradable Films Market Players

BASF SE (Germany), Futamura Chemical Co. Ltd. (Japan), Taghleef Industries (UAE), Walki Group Oy (Finland), Kingfa Sci. & Tech. Co., Ltd. (China), BioBag Americas, Inc. (US), Avery Dennison Corporation (US), Plascon Group (US), Bi-Ax International Inc. (Canada), Cortec Corporation (US), Clondalkin Group (Netherlands), TRIOWORLD INDUSTRIER AB (Sweden), Groupe Barbier (France), Paco Label (US), Layfield Group (Canada), and Polystar Plastics Ltd. (UK) are some of the leading players operating in the biodegradable films market.

Biodegradable Films Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.0 billion |

|

Revenue Forecast in 2026 |

USD 1.4 billion |

|

CAGR |

7.2% |

|

Market Size Available for Years |

2018–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million and USD Billion) and Volume (Kilotons) |

|

Segments Covered |

Application, Type, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include BASF SE (Germany), Futamura Chemical Co. Ltd. (Japan), Taghleef Industries (UAE), Walki Group Oy (Finland), and Kingfa Sci. & Tech. Co., Ltd. (China) (Total of 19 companies) |

This research report categorizes the Biodegradable Films Market based on application, type, and region.

Based on Application, the biodegradable films market has been segmented as follows:

- Food Packaging

- Agriculture & Horticulture

- Cosmetic & Personal Care Products Packaging

- Industrial Packaging

- Others (Composting, Service Ware, and Carrier Bags)

Based on Type, the biodegradable films market has been segmented as follows:

- PLA

- Starch Blends

-

Biodegradable Polyesters

- PCL

- PBAT

- PBS

- PHA

- Others (Regenerated Cellulose, and Cellulose Derivatives)

Based on Region, the biodegradable films market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2020, BASF SE partnered with Fabbri Group (Italy) to develop a new cling film for fresh food packaging. As part of the partnership, Fabbri Group will develop the stretch film, Nature Fresh, by using the certified compostable films and bio-based bioplastic, Ecovio, which is offered by BASF SE. This partnership is expected to help increase the share of BASF SE in the biodegradable films market in Italy.

- In April 2021, Walki Group acquired Plasbel, the Spanish leader in sustainable packaging solutions. Plasbel helped Walki to expand its reach in Europe by offering a diverse range of food packaging solutions, as well as post-consumer recycled and compostable films for use in the retail and hospitality industries. As part of Walki's objective to increase circularity and recyclability of packaging materials, this acquisition is a significant step. The combined entity's complementing R&D skills enabled it becomes a leading biofilm converter with significant expansion potential across.

Frequently Asked Questions (FAQ):

What is the current size of the global biodegradable films market?

The global biodegradable films market is estimated to be USD 1.0 billion in 2021 and is projected to reach USD 1.4 billion by 2026, at a CAGR of 7.2%.

Who are the winners in the global biodegradable films market?

Companies such as BASF SE (Germany), Futamura Chemical Co. Ltd. (Japan), Taghleef Industries (UAE), Walki Group Oy (Finland), Kingfa Sci. & Tech. Co., Ltd. (China), BioBag Americas, Inc. (US), Avery Dennison Corporation (US), Plascon Group (US), Bi-Ax International Inc. (Canada), Cortec Corporation (US), Clondalkin Group (Netherlands), TRIOWORLD INDUSTRIER AB (Sweden), Groupe Barbier (France), Paco Label (US), Layfield Group (Canada), and Polystar Plastics Ltd. (UK) fall under the winners’ category. The products offered by these companies are mostly for the packaging and agriculture sectors, which are the largest application areas of the biodegradable films market. Also, one of the most important differentiating factors providing a competitive edge to the winners is the extensive adoption of growth strategies, which have given the winners a head-start in enhancing their presence in the evolving biodegradable films market. Hence, these players have been recognized as winners.

What is the COVID-19 impact on biodegradable films value chain?

COVID-19 outbreak on demand for biodegradable films in the agricultural industry is considered to be slightly affected at the global level, due to disruption in the supply chain. However, the impact will not be very huge, as the industry and the crop production have not been suspended. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BIODEGRADABLE FILMS MARKET SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 BIODEGRADABLE FILMS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 BIODEGRADABLE FILMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

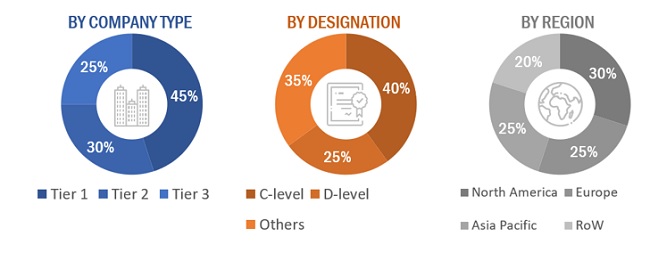

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON THE GLOBAL MARKET)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2 APPROACH TWO (BASED ON TYPE, BY REGION)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 PLA SEGMENT TO LEAD BIODEGRADABLE FILMS MARKET

FIGURE 9 FOOD PACKAGING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 EUROPE TO BE LARGEST MARKET FOR BIODEGRADABLE FILMS DURING FORECAST PERIOD

FIGURE 11 EUROPE ACCOUNTED FOR LARGEST SHARE OF BIODEGRADABLE FILMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 SIGNIFICANT OPPORTUNITIES IN BIODEGRADABLE FILMS MARKET

FIGURE 12 BIODEGRADABLE FILMS MARKET TO WITNESS MODERATE GROWTH BETWEEN 2021 AND 2026

4.2 BIODEGRADABLE FILMS MARKET, BY REGION

FIGURE 13 BIODEGRADABLE FILMS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 EUROPE BIODEGRADABLE FILMS MARKET, BY COUNTRY AND APPLICATION

FIGURE 14 FOOD PACKAGING SEGMENT TO DOMINATE EUROPE BIODEGRADABLE FILMS MARKET IN 2020 BY VOLUME

4.4 BIODEGRADABLE FILMS MARKET, BY TYPE

FIGURE 15 PLA SEGMENT TO LEAD BIODEGRADABLE FILMS MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET DYNAMICS: BIODEGRADABLE FILMS MARKET

5.2.1 DRIVERS

5.2.1.1 High demand from food packaging industry

5.2.1.2 Shift in consumer preference toward eco-friendly plastic products

TABLE 1 ADVERSE HEALTH EFFECTS DUE TO USE OF CONVENTIONAL PLASTICS

5.2.1.3 Focus of governments on green procurement policies

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of biodegradable films than that of conventional plastic films

5.2.3 OPPORTUNITIES

5.2.3.1 Steadily growing global bioplastic industry

5.2.3.2 Growing demand for biodegradable films in composting applications

5.2.4 CHALLENGES

5.2.4.1 Performance issues related to biodegradable films

5.2.4.2 Adverse impact of COVID-19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 BIODEGRADABLE FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ADJACENT AND INTERCONNECTED MARKETS

TABLE 2 ADJACENT AND NTERCONNECTED MARKETS (USD MILLION)

6 IMPACT OF COVID-19 ON BIODEGRADABLE FILMS MARKET (Page No. - 49)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

6.2 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6.2.1 IMPACT ON END-USE INDUSTRIES

6.2.1.1 Food packaging

6.2.1.2 Consumer & personal care goods packaging

6.2.1.3 Industrial packaging

6.2.1.4 Agriculture & horticulture

7 BIODEGRADABLE FILMS MARKET, BY TYPE (Page No. - 51)

7.1 INTRODUCTION

FIGURE 18 BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2021 & 2026 (USD MILLION)

TABLE 3 BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 4 BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

7.2 PLA

7.2.1 INCREASING DEMAND FOR PLA IN FOOD PACKAGING APPLICATIONS DRIVE THE GROWTH OF THIS SEGMENT

TABLE 5 BIODEGRADABLE PLA FILMS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 6 BIODEGRADABLE PLA FILMS MARKET SIZE, BY REGION, 2018–2026 (KILOTON)

7.3 STARCH BLENDS

7.3.1 GROWING DEMAND FOR STARCH AS AN EFFECTIVE ALTERNATIVE TO PETROLEUM DERIVED PLASTICS DRIVE THIS SEGMENT

TABLE 7 BIODEGRADABLE STARCH BLENDS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 8 BIODEGRADABLE STARCH BLENDS MARKET SIZE, BY REGION, 2018–2026 (KILOTON)

7.4 BIODEGRADABLE POLYESTER

7.4.1 PCL

7.4.1.1 Demand for PCL to grow in biomedical applications

7.4.2 PBAT

7.4.2.1 Flexibility and resilience of PBAT ideal for blending with other biodegradable polymers

7.4.3 PBS

7.4.3.1 Cost-effective production of PBS to drive its demand during forecast period

TABLE 9 BIODEGRADABLE POLYESTER FILMS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 10 BIODEGRADABLE POLYESTER FILMS MARKET SIZE, BY REGION, 2018–2026 (KILOTON)

7.5 PHA

7.5.1 LIQUID PACKAGING OF HIGH-QUALITY MATERIALS TO INFLUENCE MARKET GROWTH

TABLE 11 BIODEGRADABLE PHA FILMS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 12 BIODEGRADABLE PHA FILMS MARKET SIZE, BY REGION, 2018–2026 (KILOTON)

7.6 OTHERS

TABLE 13 OTHER BIODEGRADABLE FILMS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 14 OTHER BIODEGRADABLE FILMS MARKET SIZE, BY REGION, 2018–2026 (KILOTON)

8 BIODEGRADABLE FILMS MARKET, BY APPLICATION (Page No. - 59)

8.1 INTRODUCTION

FIGURE 19 BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2021 & 2026 (USD MILLION)

TABLE 15 BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 16 BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

8.2 FOOD PACKAGING

8.2.1 LARGEST SEGMENT OF BIODEGRADABLE FILMS MARKET

TABLE 17 BIODEGRADABLE FILMS MARKET IN FOOD PACKAGING, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 BIODEGRADABLE FILMS MARKET IN FOOD PACKAGING, BY REGION, 2018–2026 (KILOTON)

8.3 AGRICULTURE & HORTICULTURE

8.3.1 BIODEGRADABLE FILMS REQUIRED TO MANUFACTURE MULCHES, SEEDING STRIPS, AND TAPES

TABLE 19 BIODEGRADABLE FILMS MARKET IN AGRICULTURE & HORTICULTURE, BY REGION, 2018–2026 (USD MILLION)

TABLE 20 BIODEGRADABLE FILMS MARKET IN AGRICULTURE & HORTICULTURE, BY REGION, 2018–2026 (KILOTON)

8.4 COSMETICS & PERSONAL CARE PRODUCTS PACKAGING

8.4.1 LOW RECYCLING RATE IN COSMETIC PACKAGING INDUSTRY FUELING DEMAND

TABLE 21 BIODEGRADABLE FILMS MARKET IN COSMETICS & PERSONAL CARE PRODUCTS PACKAGING, BY REGION, 2018–2026 (USD MILLION)

TABLE 22 BIODEGRADABLE FILMS MARKET IN COSMETICS & PERSONAL CARE PRODUCTS PACKAGING, BY REGION, 2018–2026 (KILOTON)

8.5 INDUSTRIAL PACKAGING

8.5.1 RISING CONCERNS OF GLOBAL WARMING AND PLASTIC WASTE TO INCREASE ADOPTION OF BIODEGRADABLE FILMS

TABLE 23 BIODEGRADABLE FILMS MARKET IN INDUSTRIAL PACKAGING, BY REGION, 2018–2026 (USD MILLION)

TABLE 24 BIODEGRADABLE FILMS MARKET IN INDUSTRIAL PACKAGING, BY REGION, 2018–2026 (KILOTON)

8.6 OTHERS

TABLE 25 BIODEGRADABLE FILMS MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2026 (USD MILLION)

TABLE 26 BIODEGRADABLE FILMS MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2026 (KILOTON)

9 BIODEGRADABLE FILMS MARKET, BY REGION (Page No. - 67)

9.1 INTRODUCTION

FIGURE 20 EUROPE TO REMAIN LARGEST MARKET

TABLE 27 BIODEGRADABLE FILMS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 28 BIODEGRADABLE FILMS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

9.2 EUROPE

FIGURE 21 EUROPE: BIODEGRADABLE FILMS MARKET SNAPSHOT

TABLE 29 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 30 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (KILOTON)

TABLE 31 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 32 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 33 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 34 EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.1 GERMANY

9.2.1.1 Various government regulations for reducing plastic packaging waste to boost biodegradable films market

TABLE 35 GERMANY: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 36 GERMANY: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 37 GERMANY: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 38 GERMANY: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.2.2 ITALY

9.2.2.1 Increasing use of biodegradable films in agriculture industry

TABLE 39 ITALY: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 40 ITALY: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 41 ITALY: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 42 ITALY: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.3 SPAIN

9.2.3.1 Increasing investments related to bio-based plastics to enhance market

TABLE 43 SPAIN: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 44 SPAIN: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 45 SPAIN: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 46 SPAIN: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.4 UK

9.2.4.1 Growing food & beverage packaging industry boosting market

TABLE 47 UK: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 48 UK: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 49 UK: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 50 UK: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.5 FRANCE

9.2.5.1 Cosmetic & personal care products packaging

TABLE 51 FRANCE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 52 FRANCE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 53 FRANCE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 54 FRANCE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.6 RUSSIA

9.2.6.1 Estimated to be fastest-growing biodegradable films market in Europe during forecast period

TABLE 55 RUSSIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 56 RUSSIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 57 RUSSIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 58 RUSSIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.2.7 REST OF EUROPE

TABLE 59 REST OF EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 60 REST OF EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 61 REST OF EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 62 REST OF EUROPE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.3 NORTH AMERICA

FIGURE 22 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (KILOTON)

TABLE 65 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 67 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.3.1 US

9.3.1.1 Accounted for largest share of North American biodegradable films market in 2020

TABLE 69 US: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 70 US: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 71 US: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 72 US: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.3.2 CANADA

9.3.2.1 PLA type segment led Canada biodegradable films market in 2020

TABLE 73 CANADA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 74 CANADA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 75 CANADA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 76 CANADA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.3.3 MEXICO

9.3.3.1 Growing environmental concerns fueling demand for sustainable alternatives

TABLE 77 MEXICO: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 78 MEXICO: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 79 MEXICO: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 80 MEXICO: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SNAPSHOT

TABLE 81 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (KILOTON)

TABLE 83 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 85 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.1 CHINA

9.4.1.1 China to be largest and fastest-growing market for biodegradable films in Asia Pacific

TABLE 87 CHINA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 88 CHINA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 89 CHINA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 90 CHINA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.2 JAPAN

9.4.2.1 Rising pollution caused by plastics to fuel demand for biodegradable films

TABLE 91 JAPAN: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 92 JAPAN: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 93 JAPAN: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 94 JAPAN BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.3 INDIA

9.4.3.1 Extensive use of biodegradable mulch films in agriculture industry

TABLE 95 INDIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 96 INDIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 97 INDIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 98 INDIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.4 SOUTH KOREA

9.4.4.1 Use of biodegradable plastics gaining momentum with increasing environmental concerns

TABLE 99 SOUTH KOREA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 100 SOUTH KOREA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 101 SOUTH KOREA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 102 SOUTH KOREA BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.5 MALAYSIA

9.4.5.1 High demand from food packaging industry to propel market growth

TABLE 103 MALAYSIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 104 MALAYSIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 105 MALAYSIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 106 MALAYSIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.6 SINGAPORE

9.4.6.1 Increased demand in food packaging industry to drive demand for biodegradable films

TABLE 107 SINGAPORE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 108 SINGAPORE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 109 SINGAPORE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 110 SINGAPORE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.4.7 REST OF ASIA PACIFIC

TABLE 111 REST OF ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 113 REST OF ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 115 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (KILOTON)

TABLE 117 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 119 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.5.1 SAUDI ARABIA

9.5.1.1 Oxo-biodegradable regulation to drive biodegradable films market

TABLE 121 SAUDI ARABIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 122 SAUDI ARABIA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 123 SAUDI ARABIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 124 SAUDI ARABIA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.5.2 UAE

9.5.2.1 Focus on reducing plastic waste fueling demand for biodegradable films in packaging industry

TABLE 125 UAE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 126 UAE: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 127 UAE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 128 UAE: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.5.3 SOUTH AFRICA

9.5.3.1 Increased packaging applications to drive biodegradable films market

TABLE 129 SOUTH AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 130 SOUTH AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 131 SOUTH AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 132 SOUTH AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 133 REST OF MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 134 REST OF MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 135 REST OF MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.6 SOUTH AMERICA

TABLE 137 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 138 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY COUNTRY, 2018–2026 (KILOTON)

TABLE 139 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 140 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 141 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 142 SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Abundant raw material resources to support market growth

TABLE 143 BRAZIL: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 144 BRAZIL: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 145 BRAZIL: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 146 BRAZIL: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

9.6.2 REST OF SOUTH AMERICA

TABLE 147 REST OF SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 148 REST OF SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY APPLICATION, 2018–2026 (KILOTON)

TABLE 149 REST OF SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (USD MILLION)

TABLE 150 REST OF SOUTH AMERICA: BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 124)

10.1 OVERVIEW

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.2 WINNERS VS. TAIL-ENDERS

10.2.1 WINNERS

10.2.2 TAIL-ENDERS

FIGURE 24 COMPANIES ADOPTED BOTH ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN 2018 AND 2020

10.3 COMPETITIVE LANDSCAPE MAPPING, 2020

10.3.1 VISIONARY LEADERS

10.3.2 INNOVATORS

10.3.3 DYNAMIC DIFFERENTIATORS

10.3.4 EMERGING COMPANIES

FIGURE 25 BIODEGRADABLE FILMS MARKET: COMPETITIVE LANDSCAPE MAPPING, 2020

10.4 COMPETITIVE BENCHMARKING

10.4.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 26 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN BIODEGRADABLE FILMS MARKET

10.4.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 27 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN BIODEGRADABLE FILMS MARKET

10.5 MARKET RANKING OF KEY PLAYERS

FIGURE 28 TOP 6 PLAYERS OF BIODEGRADABLE FILMS MARKET, 2020

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES

TABLE 151 BIODEGRADABLE FILMS MARKET: PRODUCT LAUNCHES, 2018-2021

10.6.2 DEALS

TABLE 152 BIODEGRADABLE FILMS MARKET: DEALS, 2018-2021

10.6.3 OTHER DEVELOPMENTS

TABLE 153 BIODEGRADABLE FILMS MARKET: OTHER DEVELOPMENTS, 2018-2021

11 COMPANY PROFILES (Page No. - 138)

11.1 KEY COMPANIES

11.1.1 BASF SE

TABLE 154 BASF SE: COMPANY OVERVIEW

FIGURE 29 BASF SE: COMPANY SNAPSHOT

TABLE 155 BASF SE: PRODUCT OFFERINGS

TABLE 156 BASF SE: PRODUCT LAUNCHES

TABLE 157 BASF SE: DEAL

11.1.2 PLASCON GROUP

TABLE 158 PLASCON GROUP: COMPANY OVERVIEW

TABLE 159 PLASCON GROUP: PRODUCT OFFERINGS

TABLE 160 PLASCON GROUP: DEAL

11.1.3 WALKI GROUP OY

TABLE 161 WALKI GROUP OY: COMPANY OVERVIEW

TABLE 162 WALKI GROUP OY: PRODUCT OFFERINGS

TABLE 163 WALKI GROUP OY: DEALS

11.1.4 FUTAMURA GROUP

TABLE 164 FUTAMURA GROUP: COMPANY OVERVIEW

TABLE 165 FUTAMURA GROUP: PRODUCT OFFERINGS

TABLE 166 FUTAMURA GROUP: PRODUCT LAUNCHES

TABLE 167 FUTAMURA GROUP: DEALS

TABLE 168 FUTAMURA GROUP: OTHERS

11.1.5 CORTEC CORPORATION

TABLE 169 CORTEC CORPORATION: COMPANY OVERVIEW

TABLE 170 CORTEC CORPORATION: PRODUCT OFFERINGS

TABLE 171 CORTEC CORPORATION: PRODUCT LAUNCHES

TABLE 172 CORTEC CORPORATION: OTHERS

11.1.6 BI-AX INTERNATIONAL INC.

TABLE 173 BI-AX INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 174 BI-AX INTERNATIONAL INC.: PRODUCT OFFERINGS

11.1.7 BIOBAG AMERICAS, INC.

TABLE 175 BIOBAG AMERICAS, INC.: COMPANY OVERVIEW

TABLE 176 BIOBAG AMERICAS, INC.: PRODUCT OFFERINGS

11.1.8 TAGHLEEF INDUSTRIES

TABLE 177 TAGHLEEF INDUSTRIES: COMPANY OVERVIEW

TABLE 178 TAGHLEEF INDUSTRIES: PRODUCT OFFERINGS

TABLE 179 TAGHLEEF INDUSTRIES: PRODUCT LAUNCHES

TABLE 180 TAGHLEEF INDUSTRIES: DEALS

TABLE 181 TAGHLEEF INDUSTRIES: OTHERS

11.1.9 CLONDALKIN GROUP

TABLE 182 CLONDALKIN GROUP: COMPANY OVERVIEW

TABLE 183 CLONDALKIN GROUP: PRODUCT OFFERINGS

11.2 OTHER PLAYERS

11.2.1 TIPA LTD

TABLE 184 TIPA LTD: COMPANY OVERVIEW

11.2.2 POLYPAK S.R.O.

TABLE 185 POLYPAK S.R.O.: COMPANY OVERVIEW

11.2.3 PLASTIKA KRITIS S.A.

TABLE 186 PLASTIKA KRITIS S.A.: COMPANY OVERVIEW

11.2.4 TRIOWORLD INDUSTRIER AB

TABLE 187 TRIOWORLD INDUSTRIER AB: COMPANY OVERVIEW

11.2.5 GROUPE BARBIER

TABLE 188 GROUPE BARBIER: COMPANY OVERVIEW

11.2.6 KINGFA SCI. & TECH. CO., LTD.

TABLE 189 KINGFA SCI. & TECH. CO., LTD.: COMPANY OVERVIEW

11.2.7 LAYFIELD GROUP. LTD.

TABLE 190 LAYFIELD GROUP. LTD.: COMPANY OVERVIEW

11.2.8 POLYSTAR PLASTICS LTD.

TABLE 191 POLYSTAR PLASTICS LTD.: COMPANY OVERVIEW

11.2.9 AVERY DENNISON CORPORATION

TABLE 192 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

11.2.10 PACO LABEL

TABLE 193 PACO LABEL: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 167)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 BIODEGRADABLE FILMS INTERCONNECTED MARKETS

12.4 BIODEGRADABLE PLASTICS MARKET

12.4.1 MARKET DEFINITION

12.4.2 MARKET OVERVIEW

12.4.3 BIODEGRADABLE PLASTICS MARKET, BY END USE

12.5 PACKAGING

12.6 CONSUMER GOODS

12.7 TEXTILE

12.8 AGRICULTURE & HORTICULTURE

12.9 OTHERS

TABLE 194 BIODEGRADABLE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 195 BIODEGRADABLE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.10 AGRICULTURE FILMS MARKET

12.10.1 MARKET DEFINITION

12.10.2 MARKET OVERVIEW

12.10.3 AGRICULTURAL FILMS MARKET, BY APPLICATION TYPE

12.11 GREENHOUSE FILMS

12.12 MULCH FILMS

12.13 SILAGE FILMS

TABLE 196 AGRICULTURAL FILMS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 197 AGRICULTURAL FILMS MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

13 APPENDIX (Page No. - 172)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

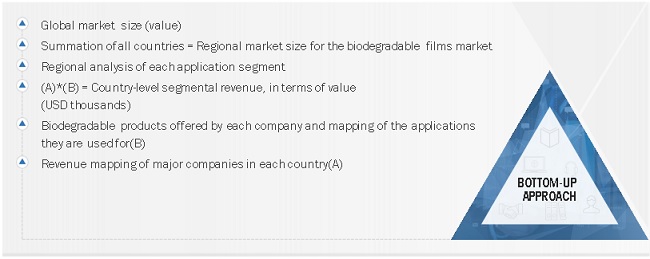

The study involved four major activities in estimating the current size of the biodegradable films market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the biodegradable films value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The biodegradable films market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, microencapsulation service providers, end-product manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the biodegradable films market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the biodegradable films market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biodegradable films market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the biodegradable films market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Biodegradable Films Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the biodegradable films market with respect to type, and application, over five years, from 2021 to 2026

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across key regions

- To project the size of the market segments, in terms of value and volume, with respect to five regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as acquisitions, new product launches, collaborations, expansions, partnerships, and contracts in the biodegradable films market

- To analyze the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- To identify and profile key players in the biodegradable films market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by market players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe and the Rest of Asia Pacific biodegradable films market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biodegradable Films Market