Cancer Profiling Market by Technology (Immunoassay, NGS, PCR), Cancer Type (Breast, Lung, Colorectal), Biomarker Type (Genomic Biomarkers, Protein Biomarkers), Application (Biomarker Discovery, Diagnostics, Prognostics) - Global Forecast to 2027

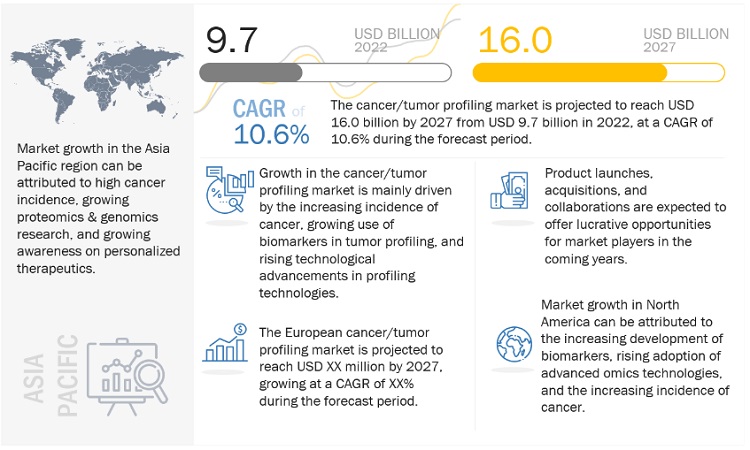

The global cancer profiling market in terms of revenue was estimated to be worth $9.7 billion in 2022 and is poised to reach $16.0 billion by 2027, growing at a CAGR of 10.6% from 2022 to 2027. The growth in this market is driven by rising funding investments in cancer research and technological advancements in profiling technologies. In addition, the growing need for point-of-care diagnostics is expected to offer significant growth opportunities for market players. On the other hand, a low biomarker discovery-to-approval ratio and a poor regulatory and reimbursement scenario challenge the growth of the cancer profiling market.

Global Cancer Profiling Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cancer Profiling Market Dynamics

Driver: Increasing use of biomarkers in cancer profiling

The last decade has seen significant advances in the development of biomarkers in oncology that play a critical role in understanding molecular and cellular mechanisms that drive tumor initiation, maintenance, and progression. Clinical molecular diagnostics and biomarker discoveries in oncology are advancing rapidly and have fueled the development of novel drug targets and new treatment strategies. In clinical research, biomarkers are widely used for disease diagnosis, personalized medication, and surrogate endpoints. The growth in basic and clinical research in various therapeutic areas in the past years has drawn attention toward potential new biomarkers that are more sensitive and specific than conventional ones. Thus, the proven efficacy of biomarkers in effective cancer diagnostics is expected to increase the utilization of biomarkers in the cancer/tumor profiling market.

Restraint: High capital investments for biomarker discovery & development

Many research efforts are aimed at identifying novel biomarkers within the current paradigm of personalized medicine or precision medicine. Significant capital investments are required to discover, develop, and validate biomarkers used in cancer detection and prognosis. Once a candidate biomarker is developed, evidence is required for its adoption in the clinical field. The discovery of candidate biomarkers far outpaces the current ability to validate them. Akin to clinical trials for pharmaceuticals, translational research is a long and complex trajectory requiring large financial investments and results in the rejection of several biomarker candidates. Owing to the high costs, it becomes difficult for patients to afford these tests, thus expecting to limit the usage of biomarkers in the cancer profiling market.

Opportunity: Growing preference for personalized medicine

Personalized medicine, which has become a core area of research in the healthcare industry, has entered mainstream clinical practice and is changing disease identification, classification, and treatment. Tumor behavior is often guided by more than a single genetic or molecular marker. Rapid advances in tumor genomic profiling have profoundly expanded tumor behavior knowledge and guided tailored chemotherapeutic regimens for patients. The result has been a societal and clinical push toward treatment guided by personalized medicine or precision oncology. Thus, the growing demand for effective personalized medicine is expected to increase the adoption of tumor profiling techniques as diagnostic tools and in the drug development process, propelling the overall market growth.

Challenge: Low biomarker discovery-to-approval ratio

Research has resulted in the identification of thousands of candidate biomarkers. Despite the advances in biomarkers in the last few years, a lack of clarity regarding several basic elements restricts biomarkers from reaching their full potential in human medicine. Insufficient acceptance of robust clinical biomarker tests is one of the major challenges. Too often, biomarkers identified in initial discovery studies have not shown reproducible activity during subsequent validation. Existing biomarkers are far from comprehensive and often lack specificity, while new biomarkers are being developed slowly. This leads to the need for better biomarkers to improve diagnosis, guide molecularly targeted therapy, and monitor activity and therapeutic response for various cancer types.

The next-generation sequencing (NGS) segment is expected to grow at the highest CAGR during the forecast period, based on technology

Based on technology, the cancer profiling market has been segmented into immunoassays, in situ hybridization, polymerase chain reaction (PCR), microarrays, next-generation sequencing (NGS), mass spectrometry, and other technologies. The next-generation sequencing (NGS) segment is expected to register the highest CAGR during the forecast period. This growth is attributed to the benefits of effectively exploring genetic alterations in a wide range of cancers and the identification of several differentially expressed genes and genetic/epigenetic variants as potential targets to aid in the development of new biomarkers for early diagnosis of the disease.

The breast cancer segment accounted for the largest share of the cancer profiling market

Based on cancer type, the cancer/tumor profiling market has been segmented into breast cancer, lung cancer, prostate cancer, melanoma, colorectal cancer, and other cancers. In 2021, the breast cancer segment accounted for the largest share of the cancer/tumor profiling market. The largest share is attributed to the rising research collaborations on breast cancer diagnostics and high prevalence of breast cancer worldwide.

The genomic biomarker segment accounted for the largest share of the cancer profiling market

Based on biomarker type, the global cancer/tumor profiling market is segmented into genomic, protein, and other biomarkers. In 2021, the genomic biomarkers segment accounted for the largest share of the cancer/tumor profiling market. The large share of this segment can be attributed to the high potential for the identification of indicators that guide the decision-making for targeted therapies in patients, thus aiding in the advancement of personalized medicine.

The biomarker discovery segment accounted for the largest share of the cancer profiling market for research applications, by application type

Based on application, the cancer/tumor profiling market for research applications has been segmented into biomarker discovery and personalized medicine. In 2021, the biomarker discover segment accounted for the largest share of the cancer/tumor profiling market for research applications. The large share of the biomarker discovery segment can be attributed to the wide applications of biomarkers in the drug discovery & development process are expected to fuel market growth for this segment.

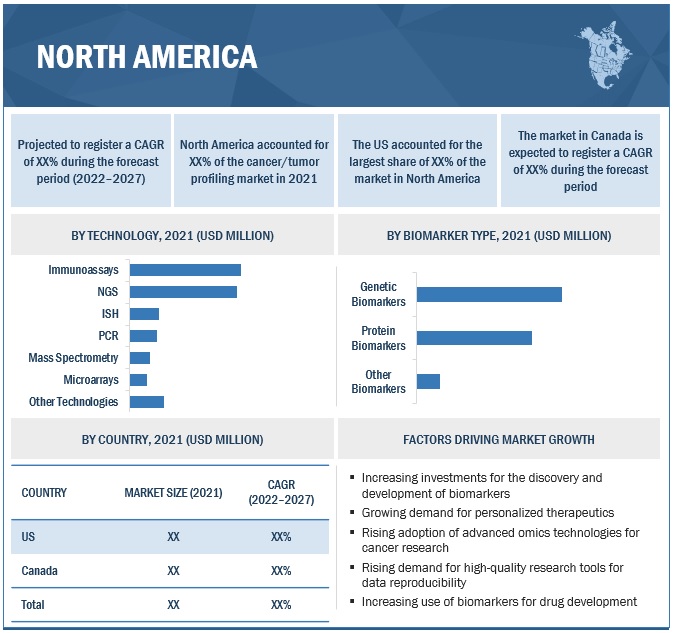

North America will dominate the cancer/tumor profiling market

Geographically, the cancer/tumor profiling market is broadly segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the cancer/tumor profiling market in 2021. The high share of the North American market is attributed to the increasing adoption of biomarkers for drug development, the increasing incidence of cancer, and presence of a large number of global players in this region.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are Illumina, Inc. (US), QIAGEN N.V. (Germany), NeoGenomics, Inc. (US), Sysmex Corporation (Japan), HTG Molecular Diagnostics, Inc. (US), Predictive Oncology, Inc. (US), Caris Life Sciences (US), NanoString Technologies, Inc. (US), Guardant Health, Inc. (US), Foundation Medicine (US), F. Hoffmann-La Roche Ltd. (Switzerland), Thermo Fisher Scientific Inc. (US), Genscript Biotech Corporation (US), Tempus Labs (US), and Hologic, Inc. (US).

Scope of the Cancer Profiling Market Report

|

Report Metrics |

Details |

|

Market Size value 2027 |

USD 16.0 billion |

|

Growth Rate |

10.6% Compound Annual Growth Rate (CAGR) |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Table of Content |

|

|

Market Segmentation |

Technology, Cancer Type, Biomarker Type, Application and Region |

|

Cancer Profiling Market Growth Drivers |

Increasing use of biomarkers in cancer profiling |

|

Cancer Profiling Market Growth Opportunities |

Growing preference for personalized medicine |

|

Report Highlights |

|

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

The study categorizes the Cancer/Tumor Profiling Market based on technology, cancer type, biomarker type, application, and regional and global level.

By Technology

- Immunoassays

- Next-Generation Sequencing

- Polymerase Chain Reaction

- Mass Spectrometry

- In-Situ Hybridization

- Microarrays

- Other Technologies

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma Cancer

- Other Cancer

By Biomarker Type

- Genomic Biomarker

- Protein Biomarker

- Other Biomarker

By Application

-

Research Application

- Biomarker Discovery

- Personalized Medicine

-

Clinical Application

- Diagnostics

- Prognostics

- Screening

- Treatment & Monitoring

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In May 2022, QIAGEN launched the therascreen EGFR Plus RGQ PCR Kit, a new in-vitro diagnostic test for sensitive EGFR mutation analysis, empowering oncologists to guide non-small cell lung cancer (NSCLC) treatment better.

- In January 2022, Illumina entered into a partnership with Agendia to advance next-generation sequencing for decentralized oncology testing. This development is expected to deliver improved insights to breast cancer patients worldwide.

- In June 2021, NeoGenomics, Inc. (US) acquired Inivata Ltd. (England) a liquid biopsy platform firm. This acquisition is expected to enhance NeoGenomic's position in the cancer profiling market and further establish the firm in the rapidly evolving liquid biopsy testing space.

Frequently Asked Questions (FAQ):

What is the size of Cancer Profiling Market?

The cancer profiling market size is projected to reach USD 16.0 billion by 2027, growing at a CAGR of 10.6%

What are the major growth factors of Cancer Profiling Market ?

Growth in this market is majorly driven by the rising incidence of cancer across the globe, increasing use of biomarkers in cancer profiling, rising funding investments in cancer research and technological advancements in profiling technologies are also propelling the growth of the cancer/tumor profiling market. The growing preference for personalized medicine, and growing need for point-of-care diagnostics are expected to offer significant growth opportunities for market players during the forecast period. However, high capital investment for biomarker discovery and technical issues related to sample collection & storage are expected to limit market growth to some extent in the coming years.

Who all are the prominent players of Cancer Profiling Market ?

the major players governing the overall cancer/tumor profiling market include Illumina, Inc. (US), QIAGEN N.V. (Germany), NeoGenomics Laboratories, Inc. (US), Sysmex Corporation (Japan), HTG Molecular Diagnostics, Inc. (US), Predictive Oncology (US), Caris Life Sciences (US), NanoString Technologies, Inc. (US), Guardant Health, Inc. (US), Foundation Medicine (US), F. Hoffmann-La Roche Ltd. (Switzerland), Thermo Fisher Scientific Inc. (US), Genscript Biotech Corporation (US), Tempus Labs (US), Hologic, Inc. (US), Exact Sciences (US), Personalis, Inc. (US), Boreal Genomics, Inc. (Canada), Strand Life Sciences (India), Lucence Health, Inc. (US)..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 CANCER/TUMOR PROFILING MARKET

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

TABLE 1 AVERAGE ANNUAL EXCHANGE RATES USED IN THIS REPORT FOR CURRENCY CONVERSIONS TO USD ARE AS FOLLOWS:

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

2.1.2.3 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZING & VALIDATION APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 CANCER/TUMOR PROFILING MARKET: SEGMENTAL SHARE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 CAGR PROJECTIONS

FIGURE 9 IMPACT ON MARKET GROWTH & CAGR: ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

2.3 DATA TRIANGULATION APPROACH

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.6.2 SCOPE-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: CANCER/TUMOR PROFILING MARKET

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 11 CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 CANCER/TUMOR PROFILING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE CANCER/TUMOR PROFILING MARKET

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 CANCER/TUMOR PROFILING: MARKET OVERVIEW

FIGURE 16 INCREASING INCIDENCE OF CANCER AND RISING PREFERENCE FOR PERSONALIZED MEDICINE TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE AND COUNTRY (2021)

FIGURE 17 GENETIC BIOMARKERS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

4.3 CANCER/TUMOR PROFILING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 CANCER/TUMOR PROFILING MARKET: REGIONAL MIX (2022–2027)

FIGURE 19 APAC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4.5 CANCER/TUMOR PROFILING MARKET: DEVELOPED VS. EMERGING ECONOMIES (2022 VS. 2027)

FIGURE 20 EMERGING ECONOMIES TO REGISTER A HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 CANCER/TUMOR PROFILING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising incidence of cancer

FIGURE 22 GLOBAL CANCER INCIDENCE, 2008–2030

5.2.1.2 Increasing use of biomarkers in cancer profiling

5.2.1.3 Growing investments in cancer research

5.2.1.4 Technological advancements in cancer profiling techniques

5.2.2 RESTRAINTS

5.2.2.1 High capital investments for biomarker discovery & development

TABLE 3 TIMEFRAME FOR BIOMARKER DEVELOPMENT

5.2.2.2 Technical issues related to sample collection & storage

5.2.3 OPPORTUNITIES

5.2.3.1 Growing preference for personalized medicine

FIGURE 23 FDA-APPROVED PERSONALIZED MEDICINES, 2015–2021

5.2.3.2 Rising need for point-of-care diagnostics

TABLE 4 POC DETECTION TOOLS FOR CANCER (BY CANCER & SAMPLE TYPE)

5.2.4 CHALLENGES

5.2.4.1 Low biomarker discovery-to-approval ratio

FIGURE 24 KEY ISSUES AND CHALLENGES IN CLINICAL TRANSLATION OF BIOMARKERS

5.2.4.2 Poor regulatory and reimbursement scenario

TABLE 5 CANCER/TUMOR PROFILING MARKET: DRIVES, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 INTEGRATION OF OMICS DATA

TABLE 6 CANCER-SPECIFIC MULTI-OMICS DATA RESOURCES

5.3.2 ADVANCES IN LIQUID BIOPSY

5.3.3 ORGANOIDS FOR PERSONALIZED MEDICINE

TABLE 7 CLINICAL TRIALS CONDUCTED FOR ASSESSING DRUG SENSITIVITY USING ORGANOID METHODS (2021)

5.3.4 INCREASING R&D INVESTMENTS FOR DEVELOPING NOVEL ACTIVE SUBSTANCES

6 CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY (Page No. - 80)

6.1 INTRODUCTION

TABLE 8 CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 9 CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027(USD MILLION)

6.2 IMMUNOASSAYS

6.2.1 PROVISION OF IMPROVED THERAPEUTIC CHOICES FOR DISEASE ASSESSMENT & DIAGNOSIS TO DRIVE MARKET

TABLE 10 CANCER/TUMOR PROFILING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 11 CANCER/TUMOR PROFILING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022–2027 (USD MILLION)

6.3 NEXT-GENERATION SEQUENCING

6.3.1 RISING ADVANCEMENTS IN NGS TESTS TO DRIVE MARKET

TABLE 12 CANCER/TUMOR PROFILING MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 13 CANCER/TUMOR PROFILING MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2022–2027 (USD MILLION)

6.4 POLYMERASE CHAIN REACTION

6.4.1 REAL-TIME PCR USED FOR BIOMARKER VALIDATION TO DRIVE MARKET

TABLE 14 CANCER/TUMOR PROFILING MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 15 CANCER/TUMOR PROFILING MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2022–2027 (USD MILLION)

6.5 IN SITU HYBRIDIZATION

6.5.1 FISH EVALUATION FOR KEY BIOMARKERS TO DRIVE MARKET

TABLE 16 CANCER/TUMOR PROFILING MARKET FOR IN SITU HYBRIDIZATION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 17 CANCER/TUMOR PROFILING MARKET FOR IN SITU HYBRIDIZATION, BY COUNTRY, 2022–2027 (USD MILLION)

6.6 MICROARRAYS

6.6.1 PREDICTING RECURRENCE OF CANCER POST-TREATMENT TO DRIVE MARKET

TABLE 18 CANCER/TUMOR PROFILING MARKET FOR MICROARRAYS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 19 CANCER/TUMOR PROFILING MARKET FOR MICROARRAYS, BY COUNTRY, 2022–2027 (USD MILLION)

6.7 MASS SPECTROMETRY

6.7.1 RISING TECHNOLOGICAL ADVANCEMENTS FOR RAPID & RELIABLE DIAGNOSTICS TO DRIVE MARKET

TABLE 20 CANCER/TUMOR PROFILING MARKET FOR MASS SPECTROMETRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 21 CANCER/TUMOR PROFILING MARKET FOR MASS SPECTROMETRY, BY COUNTRY, 2022–2027 (USD MILLION)

6.8 OTHER TECHNOLOGIES

TABLE 22 CANCER/TUMOR PROFILING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 23 CANCER/TUMOR PROFILING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

7 CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE (Page No. - 97)

7.1 INTRODUCTION

TABLE 24 CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 25 CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

7.2 BREAST CANCER

7.2.1 RISING RESEARCH COLLABORATIONS ON BREAST CANCER DIAGNOSTICS TO DRIVE MARKET

TABLE 26 BREAST CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 27 CANCER/TUMOR PROFILING MARKET FOR BREAST CANCER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 28 CANCER/TUMOR PROFILING MARKET FOR BREAST CANCER, BY COUNTRY, 2022–2027 (USD MILLION)

7.3 LUNG CANCER

7.3.1 MOLECULAR CHARACTERIZATION OF TUMORS USING NGS TO DRIVE MARKET

FIGURE 25 GLOBAL LUNG CANCER INCIDENCE, 2012−2030

TABLE 29 LUNG CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 30 CANCER/TUMOR PROFILING MARKET FOR LUNG CANCER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 31 CANCER/TUMOR PROFILING MARKET FOR LUNG CANCER, BY COUNTRY, 2022–2027 (USD MILLION)

7.4 COLORECTAL CANCER

7.4.1 MOLECULAR PROFILING OF PRIMARY CRC TUMORS WITH ADJUVANT THERAPY TO DRIVE MARKET

FIGURE 26 COLORECTAL CANCER INCIDENCE RATE FOR KEY COUNTRIES (2018)

TABLE 32 COLORECTAL CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 33 CANCER/TUMOR PROFILING MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 34 CANCER/TUMOR PROFILING MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2022–2027 (USD MILLION)

7.5 PROSTATE CANCER

7.5.1 DEVELOPMENT OF DIAGNOSTIC & PROGNOSTIC MOLECULAR BIOMARKER TESTS TO DRIVE MARKET

FIGURE 27 PROSTATE CANCER INCIDENCE RATE, BY REGION (2020)

TABLE 35 CANCER/TUMOR PROFILING MARKET FOR PROSTATE CANCER, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 36 CANCER/TUMOR PROFILING MARKET FOR PROSTATE CANCER, BY COUNTRY, 2022–2027 (USD MILLION)

7.6 MELANOMA

7.6.1 USAGE OF RT-QPCR FOR DETECTION OF MELANOMAS TO DRIVE MARKET

TABLE 37 MELANOMA INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 38 CANCER/TUMOR PROFILING MARKET FOR MELANOMA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 39 CANCER/TUMOR PROFILING MARKET FOR MELANOMA, BY COUNTRY, 2022–2027 (USD MILLION)

7.7 OTHER CANCERS

FIGURE 28 LEUKEMIA MORTALITY RATE, BY REGION (2020)

TABLE 40 CANCER/TUMOR PROFILING MARKET FOR OTHER CANCERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 41 CANCER/TUMOR PROFILING MARKET FOR OTHER CANCERS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

8 CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE (Page No. - 113)

8.1 INTRODUCTION

TABLE 42 CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 43 CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

8.2 GENETIC BIOMARKERS

8.2.1 DECISION-MAKING CAPABILITIES FOR TARGETED THERAPIES

TABLE 44 CANCER/TUMOR PROFILING MARKET FOR GENETIC BIOMARKERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 CANCER/TUMOR PROFILING MARKET FOR GENETIC BIOMARKERS, BY COUNTRY, 2022–2027 (USD MILLION)

8.3 PROTEIN BIOMARKERS

8.3.1 HIGH SPECIFICITY FOR CANCER DETECTION & DIAGNOSIS

TABLE 46 CANCER/TUMOR PROFILING MARKET FOR PROTEIN BIOMARKERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 CANCER/TUMOR PROFILING MARKET FOR PROTEIN BIOMARKERS, BY COUNTRY, 2022–2027 (USD MILLION)

8.4 OTHER BIOMARKERS

TABLE 48 CANCER/TUMOR PROFILING MARKET FOR OTHER BIOMARKERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 49 CANCER/TUMOR PROFILING MARKET FOR OTHER BIOMARKERS, BY COUNTRY, 2022–2027 (USD MILLION)

9 CANCER/TUMOR PROFILING MARKET, BY APPLICATION (Page No. - 121)

9.1 INTRODUCTION

TABLE 50 CANCER/TUMOR PROFILING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 CANCER/TUMOR PROFILING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 RESEARCH APPLICATIONS

TABLE 52 CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 BIOMARKER DISCOVERY

9.2.1.1 Development of personalized medicine and drug development to support market

TABLE 56 CANCER/TUMOR PROFILING MARKET FOR BIOMARKER DISCOVERY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 CANCER/TUMOR PROFILING MARKET FOR BIOMARKER DISCOVERY, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 PERSONALIZED MEDICINE

9.2.2.1 Rising funding activities in precision medicine to support market

TABLE 58 CANCER/TUMOR PROFILING MARKET FOR PERSONALIZED MEDICINE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 CANCER/TUMOR PROFILING MARKET FOR PERSONALIZED MEDICINE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3 CLINICAL APPLICATIONS

TABLE 60 CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 DIAGNOSTICS

9.3.1.1 Rising need for early-stage disease diagnosis and innovative product launches to drive market

TABLE 64 CANCER/TUMOR PROFILING MARKET FOR DIAGNOSTICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 CANCER/TUMOR PROFILING MARKET FOR DIAGNOSTICS, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 PROGNOSTICS

9.3.2.1 Advancements in molecular biology to drive uptake of tumor profiling

TABLE 66 CANCER/TUMOR PROFILING MARKET FOR PROGNOSTICS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 CANCER/TUMOR PROFILING MARKET FOR PROGNOSTICS, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.3 MONITORING & TREATMENT

9.3.3.1 Multiplatform profiling analysis for cancer patients to drive market

TABLE 68 CANCER/TUMOR PROFILING MARKET FOR MONITORING & TREATMENT, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 CANCER/TUMOR PROFILING MARKET FOR MONITORING & TREATMENT, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.4 SCREENING

9.3.4.1 Screening tests to help high-risk patients ascertain outcomes

TABLE 70 CANCER/TUMOR PROFILING MARKET FOR SCREENING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 CANCER/TUMOR PROFILING MARKET FOR SCREENING, BY COUNTRY, 2022–2027 (USD MILLION)

10 CANCER/TUMOR PROFILING MARKET, BY REGION (Page No. - 138)

10.1 INTRODUCTION

FIGURE 29 CANCER/TUMOR PROFILING MARKET: GEOGRAPHIC SNAPSHOT (2021)

TABLE 72 CANCER/TUMOR PROFILING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 CANCER/TUMOR PROFILING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

TABLE 74 NORTH AMERICA: NEW CANCER CASES, BY CANCER TYPE (2020)

FIGURE 30 NORTH AMERICA: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 31 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET SNAPSHOT

TABLE 75 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 High R&D investments for cancer biomarker research to drive market

TABLE 87 US: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 88 US: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 89 US: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 90 US: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 91 US: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 92 US: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 93 US: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 94 US: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 US: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 US: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 US: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising government initiatives for discovery & development of cancer biomarkers to drive market

TABLE 98 CANADA: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 99 CANADA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 100 CANADA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 101 CANADA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 102 CANADA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 103 CANADA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 104 CANADA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 105 CANADA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 CANADA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 CANADA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 108 CANADA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 32 EUROPE: CANCER INCIDENCE & MORTALITY, 2012–2035

TABLE 109 EUROPE: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 EUROPE: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 114 EUROPE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 116 EUROPE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 EUROPE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 120 EUROPE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Favorable government health policies to drive market

TABLE 121 GERMANY: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 122 GERMANY: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 123 GERMANY: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 124 GERMANY: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 125 GERMANY: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 126 GERMANY: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 127 GERMANY: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 128 GERMANY: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 129 GERMANY: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 GERMANY: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 131 GERMANY: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Availability of government funding and strategic collaborations with biotech firms to drive market

TABLE 132 UK: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 133 UK: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 134 UK: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 135 UK: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 136 UK: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 137 UK: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 138 UK: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 139 UK: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 140 UK: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 UK: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 142 UK: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Growing government investments in genomics & proteomics research to drive market

TABLE 143 FRANCE: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 144 FRANCE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 145 FRANCE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 146 FRANCE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 147 FRANCE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 148 FRANCE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 149 FRANCE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 150 FRANCE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 151 FRANCE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 152 FRANCE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 153 FRANCE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising research activities for discovery of novel cancer biomarkers using tissue diagnostics to drive market

TABLE 154 ITALY: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 155 ITALY: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 156 ITALY: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 157 ITALY: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 158 ITALY: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 159 ITALY: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 160 ITALY: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 161 ITALY: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 162 ITALY: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 163 ITALY: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 164 ITALY: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising incidence of cancer to drive demand for biomarkers

TABLE 165 SPAIN: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 166 SPAIN: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 167 SPAIN: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 168 SPAIN: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 169 SPAIN: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 170 SPAIN: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 171 SPAIN: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 172 SPAIN: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 173 SPAIN: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 174 SPAIN: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 175 SPAIN: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 176 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 177 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 179 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 180 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 181 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 182 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 183 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 185 REST OF EUROPE: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 34 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET SNAPSHOT

TABLE 186 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 188 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 189 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 191 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 193 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 195 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, Y TYPE, 2022–2027 (USD MILLION)

TABLE 196 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 197 ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Increasing initiatives to boost genomic research to support market

TABLE 198 JAPAN: CANCER INCIDENCE BY CANCER TYPE, 2020 VS. 2040

TABLE 199 JAPAN: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 200 JAPAN: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 201 JAPAN: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 202 JAPAN: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 203 JAPAN: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 204 JAPAN: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 205 JAPAN: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 206 JAPAN: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 207 JAPAN: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 208 JAPAN: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Rising government investments in genomics technologies to drive demand for tumor profiling products

TABLE 209 CHINA: CANCER INCIDENCE BY CANCER TYPE, 2020 VS. 2040

TABLE 210 CHINA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 211 CHINA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 212 CHINA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 213 CHINA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 214 CHINA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 215 CHINA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 216 CHINA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 217 CHINA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 218 CHINA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 219 CHINA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising demand for early cancer diagnosis due to increasing cancer burden to support market

TABLE 220 INDIA: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

TABLE 221 INDIA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 222 INDIA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 223 INDIA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 224 INDIA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 225 INDIA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 226 INDIA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 227 INDIA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 228 INDIA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 229 INDIA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 230 INDIA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 231 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 232 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 233 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 234 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 235 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 236 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING RESEARCH ACTIVITIES IN PRECISION ONCOLOGY TO SUPPORT MARKET

TABLE 241 LATIN AMERICA: CANCER INCIDENCE BY CANCER TYPE, 2020 VS. 2040

TABLE 242 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 243 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 244 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 245 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 246 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 247 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 248 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 249 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 250 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 251 LATIN AMERICA: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 GROWING ESTABLISHMENT OF PHARMA RESEARCH COMPANIES TO DRIVE DEMAND FOR CANCER DIAGNOSTICS

TABLE 252 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 253 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 254 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2018–2021 (USD MILLION)

TABLE 255 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY CANCER TYPE, 2022–2027 (USD MILLION)

TABLE 256 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2018–2021 (USD MILLION)

TABLE 257 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET, BY BIOMARKER TYPE, 2022–2027 (USD MILLION)

TABLE 258 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 259 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 260 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 261 MIDDLE EAST: CANCER/TUMOR PROFILING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 227)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

FIGURE 36 NEXT-GENERATION SEQUENCING MARKET SHARE, BY KEY PLAYER (2021)

FIGURE 37 PCR TECHNOLOGIES MARKET SHARE, BY KEY PLAYER (2021)

FIGURE 38 IMMUNOASSAYS MARKET SHARE, BY KEY PLAYER (2021)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 39 CANCER/TUMOR PROFILING MARKET: COMPANY EVALUATION QUADRANT (2021)

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES & APPROVALS

TABLE 262 PRODUCT LAUNCHES & APPROVALS (JANUARY 2019–OCTOBER 2022)

11.6.2 DEALS

TABLE 263 DEALS (JANUARY 2019–OCTOBER 2022)

11.6.3 OTHERS

TABLE 264 OTHERS (JANUARY 2019–OCTOBER 2022)

12 COMPANY PROFILES (Page No. - 234)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 ILLUMINA, INC.

TABLE 265 ILLUMINA, INC: BUSINESS OVERVIEW

FIGURE 40 ILLUMINA, INC: COMPANY SNAPSHOT (2021)

12.1.2 QIAGEN N.V.

TABLE 266 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 41 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

12.1.3 NEOGENOMICS, INC.

TABLE 267 NEOGENOMICS, INC: BUSINESS OVERVIEW

FIGURE 42 NEOGENOMICS, INC: COMPANY SNAPSHOT (2021)

12.1.4 SYSMEX CORPORATION

TABLE 268 SYSMEX CORPORATION: BUSINESS OVERVIEW

FIGURE 43 SYSMEX CORPORATION: COMPANY SNAPSHOT (2021)

12.1.5 HTG MOLECULAR DIAGNOSTICS, INC.

TABLE 269 HTG MOLECULAR DIAGNOSTICS, INC.: BUSINESS OVERVIEW

FIGURE 44 HTG MOLECULAR DIAGNOSTICS, INC: COMPANY SNAPSHOT (2021)

12.1.6 PREDICTIVE ONCOLOGY, INC. (HELOMICS CORPORATION)

TABLE 270 PREDICTIVE ONCOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 45 PREDICTIVE ONCOLOGY, INC: COMPANY SNAPSHOT (2021)

12.1.7 CARIS LIFE SCIENCES

TABLE 271 CLARIS LIFE SCIENCES: BUSINESS OVERVIEW

12.1.8 NANOSTRING TECHNOLOGIES, INC.

TABLE 272 NANOSTRING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 46 NANOSTRING TECHNOLOGIES, INC: COMPANY SNAPSHOT (2021)

12.1.9 GUARDANT HEALTH, INC.

TABLE 273 GUARDANT HEALTH, INC: BUSINESS OVERVIEW

FIGURE 47 GUARDANT HEALTH, INC: COMPANY SNAPSHOT (2021)

12.1.10 FOUNDATION MEDICINE, INC.

TABLE 274 FOUNDATION MEDICINE, INC.: BUSINESS OVERVIEW

12.1.11 F. HOFFMANN-LA ROCHE LTD

TABLE 275 F. HOFFMANN-LA ROCHE LTD: BUSINESS OVERVIEW

FIGURE 48 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT (2021)

12.1.12 THERMO FISHER SCIENTIFIC INC.

TABLE 276 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 49 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT (2021)

12.1.13 GENSCRIPT BIOTECH CORPORATION

TABLE 277 GENSCRIPT BIOTECH CORPORATION: BUSINESS OVERVIEW

FIGURE 50 GENSCRIPT BIOTECH CORPORATION: COMPANY SNAPSHOT (2021)

12.1.14 TEMPUS LABS

TABLE 278 TEMPUS LABS: BUSINESS OVERVIEW

12.1.15 HOLOGIC, INC.

TABLE 279 HOLOGIC, INC: BUSINESS OVERVIEW

FIGURE 51 HOLOGIC, INC: COMPANY SNAPSHOT (2021)

12.1.16 EXACT SCIENCES

TABLE 280 EXACT SCIENCES: BUSINESS OVERVIEW

FIGURE 52 EXACT SCIENCES: COMPANY SNAPSHOT (2021)

12.1.17 LABORATORY CORPORATION OF AMERICA HOLDINGS

TABLE 281 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

FIGURE 53 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2021)

12.1.18 PERSONALIS, INC.

TABLE 282 PERSONALIS, INC: BUSINESS OVERVIEW

FIGURE 54 PERSONALIS, INC.: COMPANY SNAPSHOT (2021)

12.2 OTHER PLAYERS

12.2.1 BOREAL GENOMICS INC.

TABLE 283 BOREAL GENOMICS, INC: BUSINESS OVERVIEW

12.2.2 STRAND LIFE SCIENCES

TABLE 284 STRAND LIFE SCIENCES: BUSINESS OVERVIEW

12.2.3 LUCENCE HEALTH, INC.

TABLE 285 LUCENCE HEALTH, INC.: BUSINESS OVERVIEW

12.2.4 ACT GENOMICS CO., LTD.

TABLE 286 ACT GENOMICS CO., LTD.: BUSINESS OVERVIEW

12.2.5 IMB DX, INC.

TABLE 287 IMB DX, INC.: BUSINESS OVERVIEW

12.2.6 PERTHERA

TABLE 288 PERTHERA: BUSINESS OVERVIEW

12.2.7 AGENDIA

TABLE 289 AGENDIA: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 297)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

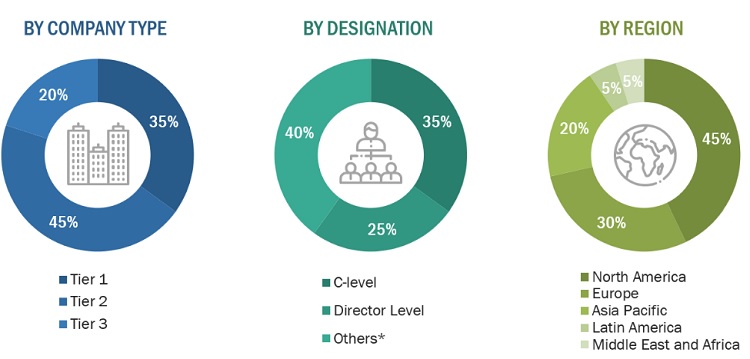

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study used widespread secondary sources; directories; databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global cancer/tumor profiling market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the cancer/tumor profiling market. Primary sources from the demand side include scientists, pathologists, doctors, and purchase managers of research institutes, government & private hospitals, biotechnology industries, and academic institutes.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2021: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by technology, cancer type, biomarker type, application, and region).

Data Triangulation

To complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments, data triangulation, and market breakdown procedures were employed wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the global cancer/tumor profiling market by technology, cancer type, biomarker type, application, and region.

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall cancer/tumor profiling market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the cancer/tumor profiling market in five main regions along with their respective key countries (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa)

- To profile key players in the global cancer/tumor profiling market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions; new product launches and approvals; expansions; collaborations, partnerships, and agreements; and R&D activities of the leading players in the cancer/tumor profiling market

- To benchmark players within the cancer/tumor profiling market using the "Company Evaluation Quadrant" framework, which analyzes market players on various parameters within the broad categories of business and product strategies

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the Latin American cancer/tumor profiling market into Brazil, Mexico, and the Rest of Latin America

- A further breakdown of the European cancer/tumor profiling market into Switzerland, Netherlands, and the Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cancer Profiling Market