Biomass Gasification Market by Source (Agricultural, Forest, Animal, Municipal), Gasifier Technology (Fixed-bed, Fluidized-bed, Entrained Flow), Application (Power, Chemicals, Hydrogen, Transportation, Ethanol, Biochar) - Region - Forecast to 2027

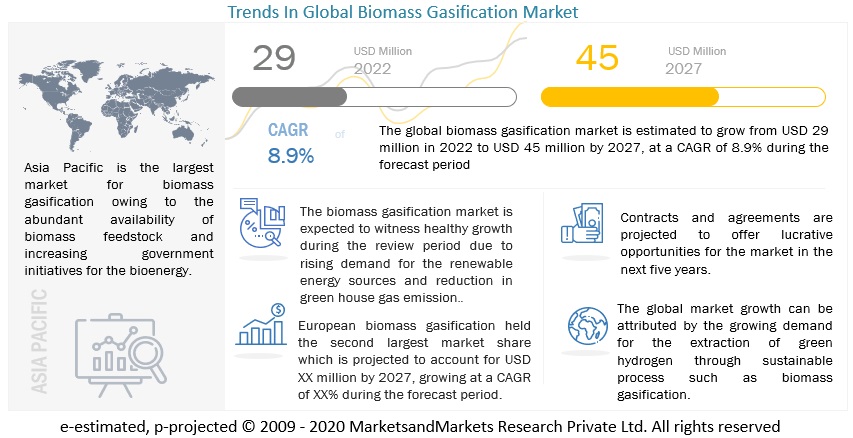

[237 Pages Report] The global biomass gasification market in terms of revenue was estimated to be worth $29 million in 2022 and is poised to reach $45 million by 2027, growing at a CAGR of 8.9% from 2022 to 2027. The factors driving the market include the demand for syngas from green chemicals producers and the power generation industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Trends

Market Dynamics

Driver: Abundant availability of biomass feedstock

The growing population has increased the demand for food and other essential resources. This has consequently increased industrial and agricultural activities, giving rise to waste mismanagement. The waste generated is either burned in the open or left in the field to decompose, resulting in adverse environmental impacts. Hence, rational utilization of abundant biomass waste is gaining attention. Biomass wastes such as agricultural wastes, forest residues, industrial wastes, animal wastes, and municipal solid wastes (MSW) are expected to increase with urbanization. According to the IRENA, the availability of world sustainable biomass is expected to rise continuously from 2,500 million tons of oil equivalent/year (Mtoe/year) in 2020 to 5,700–7,000 Mtoe/year by 2050. Hence, the availability of biomass feedstocks is expected to rise, which, in turn, will lead to an increase in biomass generation and drive the growth of the biomass gasification market.

Restraints: Technical issues due to tar formation

Tar is the organics produced under thermal or partial-oxidation regimes (gasification) of any organic material. Many experts define tar as a compound with a molecular weight higher than that of benzene. It can be classified into primary, secondary, and tertiary based on the process conditions in which the compounds are formed. When the building blocks of biomass decompose, it gives rise to primary tars containing a significant amount of oxygen. The destruction of primary tar compounds and the recombination of fragments form secondary and tertiary tars. Updraft, downdraft, and fluidized-bed gasifiers produce primary, tertiary, and a mixture of secondary and tertiary tar compounds, respectively. Tar concentrations in biomass producer gas are 100 g/Nm3 for updraft gasifiers, 10 g/Nm3 for fluidized-bed gasifiers, and 1 g/Nm3 for downdraft gasifiers. Biomass gasification gives rise to tar formation, which is a problem. This causes many issues, such as lower system efficiency, poor quality gas output, equipment blockages, and increased maintenance. Although many tar removal methods are employed currently, this issue poses a major technical challenge and hampers the market growth.

Opportunities: Growing demand for biofuels

Global biofuel demand has been increasing gradually due to the rising focus of countries on achieving net zero-emission targets. According to Statistical Review of World Energy 2022, the total biofuel consumption in 2021 was 1,837 thousand barrels of oil equivalent per day worldwide. Biofuels reduce greenhouse emissions by up to 65%. The demand for suitable biofuel crops is rising due to the increasing biofuel production, supporting the agricultural industry. Biofuels are less expensive for buildings, companies, and automobiles.

Several countries worldwide are trying to move away from dependence on oil imports. According to the Renewable Energy Directive (RED), the European Union had set a goal of covering at least 20% of its total energy demand from renewable sources by 2020. Similarly, the US Renewable Fuels Standards Program was created to reduce greenhouse gas emissions and expand the US renewable fuel sector. Biofuels are the most efficient alternative to fossil fuels because they can be produced locally.

Challenges: Requirement for high capital and operational expenditure

The capital required for developing a biomass gasification plant includes the cost of a biomass preparation unit, a modified engine gen-set, site construction, a gasifier reactor, a modified engine, an electricity distribution network, and subsidies for the dissemination and commercialization of the technology. Since biomass gasification technology requires a large investment, an inclination toward energy production from conventional sources hinders its growth. High-budget gasification projects require regular maintenance, which raises operational costs. Moreover, research and development costs also have to be considered to stay at par with technological advancements and sustainable development of clean energy resources. Subsidies sanctioned for biomass gasification projects cannot ensure technology implementation in most developing countries

By gasifier technology, fixed-bed gasifier segment to witness largest market share during forecast period

The fixed-bed gasifier segment is expected to witness largest market share from 2022 to 2027, as it witnesses higher demand for electricity generation in rural areas Asia Pacific, which drives the growth of the fixed-bed gasifier segment during the forecasted period.

Biomass Gasification Market Size

The biomass gasification market size refers to the total market value of biomass gasification systems, which are used to transform biomass feedstocks such as wood chips, agricultural waste, and municipal solid waste into a clean-burning fuel gas. Biomass gasification is a sustainable alternative to fossil fuels, reducing greenhouse gas emissions and promoting energy independence. Government support for renewable energy, the need for energy security and rural development, and the growing need for clean energy solutions are driving the biomass gasification market. The global biomass gasification market is predicted to expand rapidly over the next few years, owing to technological developments, increased investment in bioenergy projects, and rising demand for sustainable energy solutions.

By source, forest waste segment is expected to hold largest share during forecast period

The forest waste segment is expected to continue to hold the largest share of the biomass gasification market during the forecast period. The growth of the forest waste segment is driven largely due to the increasing number of projects for combined heat and power plants which uses forest waste as feedstock largely due to its high content of macromolecules such as cellulose and organic matter which helps in generation of heat.

By application, ethanol segment to witness fastest CAGR during forecast period

By application, transportation fuel segment will be the second fastest growing segment during the forecast period. The growth of segment is attributed to increase in towards the use of sustainable fuel and trying to achieve net zero CO2 emissions.

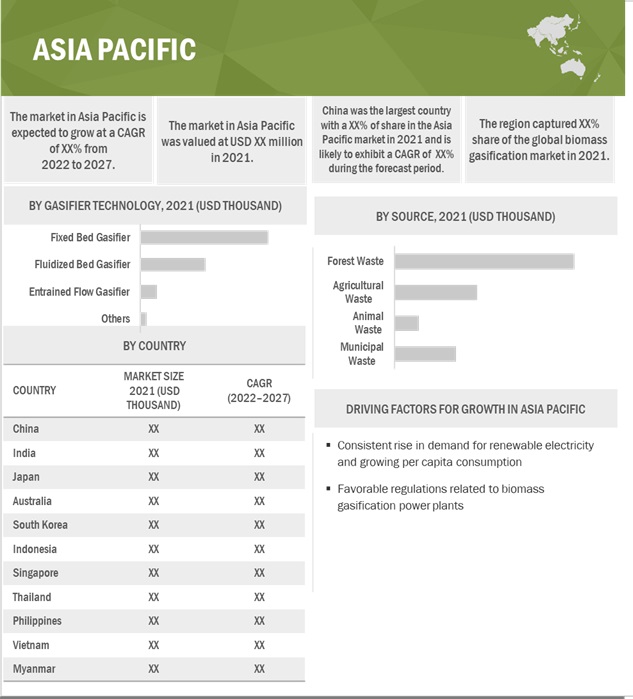

Asia Pacific is expected to be the largest market during the forecast period.

Europe is the largest and fastest-growing region in the biomass gasification market during the forecast period. The growth of the Asia Pacific market is characterized by the increase in the production of electricity for rural areas and green fuel due to higher demand from the petrochemical industry.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

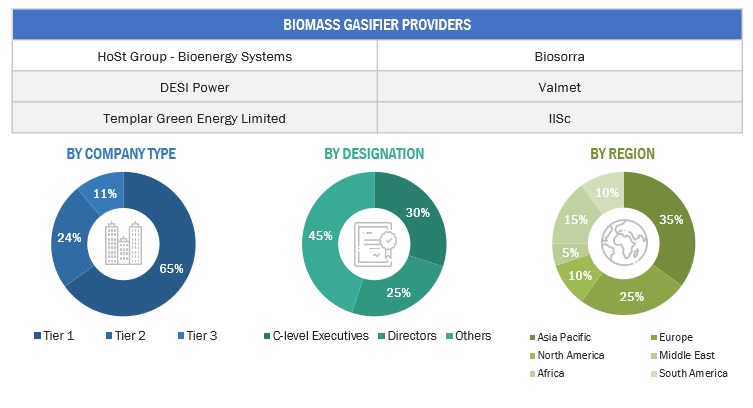

The major players in the global biomass gasification market are Valmet (Finland), EQTEC (Ireland), thyssenkrupp AG (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Enerkem (Canada), and Ankur Scientific Technology (India).

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2020–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million) |

| Segments covered | Source, Gasifier Technology, and Application |

| Geographies covered | Europe, Asia Pacific, North America, South America, Africa, and Middle East |

| Companies covered | Synthesis Energy Systems Inc. (US), Bellwether Recuperative Gasification Ltd (Germany), Valmet (Finland), SHANGHAI HAIQI ENVIRONMENTAL PROTECTION TECHNOLOGY CO.,LTD. (China), Chanderpur Group (India), Infinite Energy (India), EQTEC (Ireland), Ankur Scientific Energy Technologies (India), Enersol Biopower Pvt.Ltd (India), thyssenkrupp AG (Germany), SG H2 Energy (US), Bio Energy Netherlands BV (Netherlands), Yosemite Clean Energy (US), SYNCRAFT (Austria), ReGaWatt GmbH (Germany), SynTech Bioenergy, LLC (US), BIOS BIOENERGIESYSTEME GmbH (Austria), Enerkem (Canada), Fulcrum BioEnergy (US), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan),DP CleanTech (Poland), ReCor (South Africa), Urja Gasifiers (India), Husk Power Systems (India), West Biofuels, LLC (US), Organics Group (UK), Energy Works (UK) |

This research report categorizes the biomass gasification market by source, gasifier technology, application and region.

On the basis of by source, the market has been segmented as follows:

- Agricultural Waste

- Forest Waste

- Animal Waste

- Municipal Waste

On the basis of by gasifier technology, the market has been segmented as follows:

- Fixed Bed Gasifier

- Fluidized Bed Gasifier

- Entrained Flow Gasifier

- Others

On the basis of by application, the market has been segmented as follows:

- Power Generation

- Chemicals

- Transportation fuels

- Hydrogen Generation

- Ethanol

- Biochar

On the basis of region, the market has been segmented as follows:

- Europe

- Asia Pacific

- North America

- South America

- Africa

- Middle East

Recent Developments

- In May 2022, Valmet's new pre-treatment Biotrac pilot plant opened at the fiber technology center in Sundsvall, Sweden. The pilot facility investment would help Valmet enhance its research and development skills in the field of biomass pre-treatment, as well as respond to the market need for bioenergy, biofuels, and biochemicals.

- In December 2021, Tahara Biomass Power LLC contracted with Valmet. Valmet contribution consisted of a biomass-fired 112 MWe Valmet circulating fluidized bed boiler and a flue gas cleaning system. The Tahara biomass power plant would produce 770 million kWh per year, with wood pellets serving as the primary fuel. In Japan, all electricity generated is supplied to grid companies via a feed-in tariff scheme.

- In October 2019, Synthesis Energy Systems, Inc. signed a definitive merger agreement to merge and acquire 100% shares in Australian Future Energy Pty Ltd (Australia). SES already owned 35% shares in Australian Future Energy and now plans to merge it with its wholly owned subsidiary. The strategy will expand the company’s product offerings and enhance its position in the syngas and derivatives market.

Frequently Asked Questions (FAQ):

What is the current size of the biomass gasification market?

The current market size of the global biomass gasification market is estimated at USD 29 million in 2022.

What are the major drivers for the biomass gasification market?

Rising demand for sustainable transportation fuel

Which is the fastest-growing region during the forecasted period in the biomass gasification market?

The Asia Pacific biomass gasification market is estimated to be the largest and the fastest-growing region, during the forecast period.

Which is the fastest-growing segment, by source during the forecasted period in the biomass gasification market?

The forest waste segment is estimated to be the the fastest-growing segment, by location. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 BIOMASS GASIFICATION MARKET: SEGMENTATION

1.4.2 MARKET: REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 BIOMASS GASIFICATION MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 BIOMASS GASIFICATION MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE METRICS

FIGURE 6 MARKET: DEMAND-SIDE ANALYSIS

FIGURE 7 METRICS CONSIDERED FOR ANALYZING DEMAND FOR BIOMASS GASIFIERS

2.3.3.1 Assumptions for demand-side analysis

2.3.3.2 Calculations for demand-side analysis

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF BIOMASS GASIFIERS

FIGURE 9 MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Assumptions for supply-side analysis

FIGURE 10 INDUSTRY CONCENTRATION, 2021

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 BIOMASS GASIFICATION MARKET: SNAPSHOT

FIGURE 11 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 12 FOREST WASTE SEGMENT TO LEAD MARKET, BY SOURCE, DURING FORECAST PERIOD

FIGURE 13 FIXED-BED GASIFIER SEGMENT TO HOLD LARGEST MARKET SHARE, BY GASIFIER TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 14 POWER GENERATION SEGMENT TO DOMINATE BIOMASS GASIFICATION MARKET, BY APPLICATION, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN BIOMASS GASIFICATION MARKET

FIGURE 15 GROWING DEMAND FOR RENEWABLE ELECTRICITY

4.2 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO RECORD HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY SOURCE AND COUNTRY

FIGURE 17 FOREST WASTE SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2021

4.4 MARKET, BY SOURCE

FIGURE 18 FOREST WASTE SEGMENT DOMINATED MARKET IN 2021

4.5 MARKET, BY TECHNOLOGY

FIGURE 19 FIXED-BED GASIFIER SEGMENT DOMINATED MARKET IN 2021

4.6 MARKET, BY APPLICATION

FIGURE 20 POWER GENERATION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 BIOMASS GASIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Abundant availability of biomass feedstocks

FIGURE 22 CUMULATIVE GENERATION POTENTIAL OF AGRICULTURAL RESIDUES IN SELECTED COUNTRIES

FIGURE 23 MAJOR GLOBAL PRODUCERS OF FOREST RESIDUES

5.2.1.2 Government-led initiatives to boost bioenergy production

FIGURE 24 NUMBER OF POLICIES ISSUED IN CHINA RELATED TO BIOMASS POWER GENERATION, 2006–2021

5.2.1.3 Increasing employment rate in agriculture industry and rural developments

FIGURE 25 EMPLOYMENT RATE IN BIOENERGY INDUSTRY

5.2.1.4 Benefits associated with green hydrogen production through biomass gasification

5.2.1.5 Development of hybrid micro/mini-grids

5.2.2 RESTRAINTS

5.2.2.1 Variability in biomass properties

TABLE 2 PROXIMATE ANALYSIS OF BIOMASS MATERIALS

5.2.2.2 High moisture content in feedstocks

TABLE 3 MOISTURE CONTENT IN DIFFERENT BIOMASS FEEDSTOCKS

5.2.2.3 Technical issues attributed to tar formation

5.2.3 OPPORTUNITIES

5.2.3.1 Green urea production through decentralized mode

FIGURE 26 BLOCK FLOW DIAGRAM OF GREEN UREA PRODUCTION

5.2.3.2 Growing demand for biofuels

FIGURE 27 GLOBAL BIODIESEL PRODUCTION, 2010–2026

FIGURE 28 GLOBAL BIOETHANOL PRODUCTION, 2010–2026

FIGURE 29 GLOBAL RENEWABLE DIESEL PRODUCTION, 2010–2026

FIGURE 30 GLOBAL BIOJET PRODUCTION, 2018–2026

5.2.3.3 Potential of biomass gasification to be circular economy enabler

FIGURE 31 GASIFICATION WITH CIRCULAR ECONOMY PERSPECTIVE

5.2.4 CHALLENGES

5.2.4.1 Supply chain management issues

TABLE 4 CROPS AND THEIR HARVESTING IN INDIA

TABLE 5 BIOMASS COLLECTION SYSTEMS AND THEIR COSTS IN DIFFERENT REGIONS

5.2.4.2 Requirement for high capital and operational expenditure

5.2.4.3 Limited focus on biomass gasification compared with other renewable energy technologies

5.2.4.4 Lack of linking of local decarbonization with national decarbonization

5.3 VALUE AND SUPPLY CHAIN ANALYSES

FIGURE 32 BIOMASS GASIFICATION MARKET: SUPPLY CHAIN ANALYSIS

TABLE 6 MARKET: ROLE IN SUPPLY CHAIN

5.3.1 BIOMASS FEEDSTOCK PROVIDERS

5.3.2 BIOMASS TRANSPORTATION PROVIDERS

5.3.3 BIOMASS GASIFIER MANUFACTURERS

5.3.4 ENGINEERING PROCUREMENT AND CONSTRUCTION (EPC) CONTRACTORS

5.3.5 END USERS

5.4 REGIONAL VALUE/SUPPLY CHAIN ANALYSIS AND CONSTRAINTS

5.4.1 EUROPE

5.4.1.1 Value/Supply chain analysis

TABLE 7 EUROPE BIOMASS GASIFICATION MARKET: ROLE IN SUPPLY CHAIN

5.4.1.2 Supply chain constraints

5.4.2 ASIA PACIFIC

5.4.2.1 Value/Supply chain analysis

TABLE 8 ASIA PACIFIC MARKET: ROLE IN SUPPLY CHAIN

5.4.2.2 Supply chain constraints

5.4.3 AFRICA

5.4.3.1 Value/Supply chain analysis

TABLE 9 AFRICA MARKET: ROLE IN SUPPLY CHAIN

5.4.3.2 Supply chain constraints

5.4.4 NORTH AMERICA

5.4.4.1 Value/Supply chain analysis

TABLE 10 NORTH AMERICA MARKET: ROLE IN SUPPLY CHAIN

5.4.4.2 Supply chain constraints

5.4.5 SOUTH AMERICA

5.4.5.1 Value/Supply chain analysis

TABLE 11 SOUTH AMERICA MARKET: ROLE IN SUPPLY CHAIN

5.4.5.2 Supply chain constraints

5.4.6 MIDDLE EAST

5.4.6.1 Value/Supply chain analysis

TABLE 12 MIDDLE EAST MARKET: ROLE IN SUPPLY CHAIN

5.4.6.2 Supply chain constraints

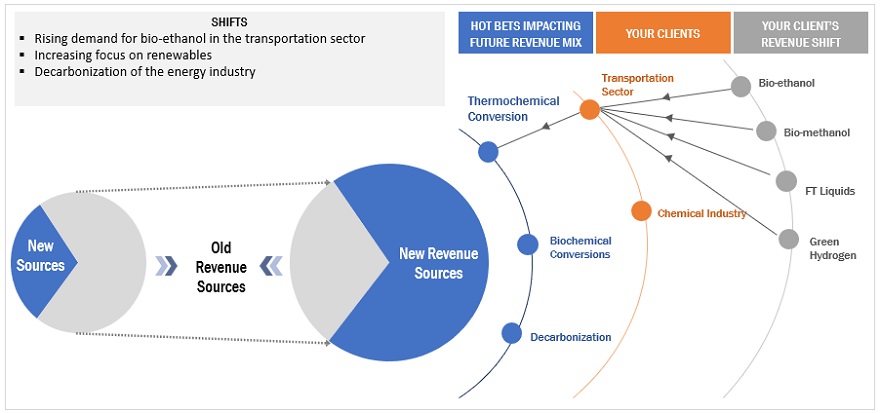

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BIOMASS GASIFIER PROVIDERS

FIGURE 33 REVENUE SHIFT FOR BIOMASS GASIFIER PROVIDERS

5.6 TRADE ANALYSIS

TABLE 13 IMPORT SCENARIO FOR HS CODE: 2303, BY COUNTRY, 2019–2021 (USD)

FIGURE 34 IMPORT DATA FOR TOP FIVE COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT SCENARIO FOR HS CODE: 2303, BY COUNTRY, 2019–2021 (USD)

FIGURE 35 EXPORT DATA FOR TOP FIVE COUNTRIES, 2017–2021 (USD THOUSAND)

5.7 MARKET MAP

FIGURE 36 BIOMASS GASIFICATION: MARKET MAP

5.8 TECHNOLOGY ANALYSIS

TABLE 15 ENDEAVOUR MICROWAVE GASIFICATION

TABLE 16 HELIOSTORM GASIFIER – IONIC GASIFICATION

TABLE 17 MOVING INJECTION FIXED-BED GASIFICATION

5.9 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 18 MARKET: CONFERENCES AND EVENTS

5.10 PRICING ANALYSIS

TABLE 19 AVERAGE SELLING PRICE OF BIOMASS GASIFICATION PLANT, BY CAPACITY (2020)

TABLE 20 INDICATIVE PRICE OF 100 KW BIOMASS GASIFICATION PLANT FOR HYDROGEN GENERATION

TABLE 21 GASIFIER TECHNOLOGY PRICE, BY APPLICATION

TABLE 22 GASIFIER TECHNOLOGY PRICE, BY REGION

5.11 REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 26 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.2 BIOMASS GENERATION MARKET: REGULATORY FRAMEWORK

TABLE 27 REGULATORY FRAMEWORK: BIOMASS GENERATION MARKET, BY REGION

5.12 CASE STUDY ANALYSIS

5.12.1 DECENTRALIZED ENERGY SYSTEMS OF INDIA (DESI POWER) HELPED COMMUNITIES IN RURAL AREAS IN HARNESSING POWER FOR ECONOMIC PURPOSES

5.12.2 VALMET PROVIDED TURNKEY BIOPOWER PLANT TO SALZBURG AG TO GENERATE GREEN ELECTRICITY AND HEAT

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 37 BIOMASS GASIFICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 28 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 BARGAINING POWER OF BUYERS

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 THREAT OF SUBSTITUTES

5.13.4 INTENSITY OF COMPETITIVE RIVALRY

5.13.5 THREAT OF NEW ENTRANTS

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY GASIFIER TECHNOLOGY

TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TECHNOLOGIES (%)

5.14.2 BUYING CRITERIA

FIGURE 39 KEY BUYING CRITERIA FOR TOP TECHNOLOGY-BASED BIOMASS GASIFICATION SYSTEMS

TABLE 30 KEY BUYING CRITERIA, BY TECHNOLOGY

6 BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY (Page No. - 91)

6.1 INTRODUCTION

FIGURE 40 MARKET, BY GASIFIER TECHNOLOGY, 2021

TABLE 31 MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD MILLION)

6.2 FIXED-BED GASIFIER

6.2.1 GROWING DEPLOYMENT OF FIXED-BED GASIFIERS IN COMBINED HEAT AND POWER (CHP) PLANTS

TABLE 32 FIXED-BED GASIFIER: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

6.3 FLUIDIZED-BED GASIFIER

6.3.1 RISING PRODUCTION OF TRANSPORTATION FUEL USING FLUIDIZED-BED GASIFIERS

TABLE 33 FLUIDIZED-BED GASIFIER: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

6.4 ENTRAINED FLOW GASIFIER

6.4.1 HIGHER CARBON CONVERSION EFFICIENCY OF ENTRAINED FLOW GASIFIER

TABLE 34 ENTRAINED FLOW GASIFIER: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

6.5 OTHERS

6.5.1 PLASMA GASIFIER

6.5.1.1 Increasing installation of power plants to convert municipal solid waste to energy

6.5.2 INDIRECTLY HEATED GASIFIER

6.5.2.1 Increasing government-led R&D initiatives

TABLE 35 OTHERS: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

7 BIOMASS GASIFICATION MARKET, BY SOURCE (Page No. - 97)

7.1 INTRODUCTION

FIGURE 41 MARKET, BY SOURCE, 2021

TABLE 36 BIOMASS GASIFICATION MARKET, BY SOURCE, 2020–2027 (USD MILLION)

7.2 AGRICULTURAL WASTE

7.2.1 GROWING NEED TO MEET ENERGY DEMANDS IN RURAL AREAS

TABLE 37 AGRICULTURAL WASTE: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

7.3 FOREST WASTE

7.3.1 RISING DEMAND FOR WOOD BIOMASS

TABLE 38 FOREST WASTE: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

7.4 ANIMAL WASTE

7.4.1 INCREASING DEMAND FOR BIOFERTILIZERS

TABLE 39 ANIMAL WASTE: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

7.5 MUNICIPAL WASTE

7.5.1 INDUSTRIAL WASTE

7.5.1.1 Increasing investments in development of biofuel plants utilizing industrial waste as feedstock

7.5.2 SOLID WASTE AND SEWAGE

7.5.2.1 Growing demand for ethanol as fuel source

TABLE 40 MUNICIPAL WASTE: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8 BIOMASS GASIFICATION MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 42 MARKET, BY APPLICATION, 2021

TABLE 41 BIOMASS GASIFICATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 POWER GENERATION

8.2.1 SURGING ELECTRICITY DEMAND FROM RURAL AREAS

TABLE 42 POWER GENERATION: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8.3 HYDROGEN GENERATION

8.3.1 INCREASING DEMAND FOR SUSTAINABLE HYDROGEN

TABLE 43 HYDROGEN GENERATION: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8.4 CHEMICALS

8.4.1 GROWING AGRICULTURE AND FERTILIZER INDUSTRIES

TABLE 44 CHEMICALS: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8.5 TRANSPORTATION FUEL

8.5.1 GROWING DEMAND FOR SUSTAINABLE FUEL IN TRANSPORTATION SECTOR

TABLE 45 TRANSPORTATION FUEL: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8.6 ETHANOL

8.6.1 GROWING NEED TO REDUCE CO2 EMISSIONS FROM GASOLINE

TABLE 46 ETHANOL: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

8.7 BIOCHAR

8.7.1 INCREASING DEMAND FOR BIOCHAR TO BOOST AGRICULTURAL PRODUCTIVITY

TABLE 47 BIOCHAR: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

9 BIOMASS GASIFICATION MARKET, BY REGION (Page No. - 109)

9.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION, 2021 (%)

FIGURE 44 ASIA PACIFIC MARKET TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 48 MARKET, BY REGION, 2020–2027 (KW)

TABLE 49 MARKET, BY REGION, 2020–2027 (USD THOUSAND)

9.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: SNAPSHOT OF MARKET

TABLE 50 ASIA PACIFIC: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 51 ASIA PACIFIC MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 52 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 53 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 54 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

9.2.1 CHINA

9.2.1.1 Rising private investments to decarbonize industrial sector

TABLE 55 CHINA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 56 CHINA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 57 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.2 JAPAN

9.2.2.1 Increasing number of waste-to-energy projects

TABLE 58 JAPAN: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 59 JAPAN: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 60 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.3 INDIA

9.2.3.1 Increasing financial assistance from government and rising rural electrification and captive power requirements

TABLE 61 INDIA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 62 INDIA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 63 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.4 AUSTRALIA

9.2.4.1 Rising demand for clean fuel

TABLE 64 AUSTRALIA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 65 AUSTRALIA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 66 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.5 SOUTH KOREA

9.2.5.1 Prospects to substitute coal with biomass in existing gasification plants

TABLE 67 SOUTH KOREA: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 68 SOUTH KOREA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 69 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.6 INDONESIA

9.2.6.1 Rising investments in setting up waste-to-energy projects

TABLE 70 INDONESIA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 71 INDONESIA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 72 INDONESIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.7 SINGAPORE

9.2.7.1 Government-led initiatives related to solid waste management

TABLE 73 SINGAPORE: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 74 SINGAPORE: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 75 SINGAPORE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.8 THAILAND

9.2.8.1 Increasing foreign investments in setting up gasification projects

TABLE 76 THAILAND: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 77 THAILAND: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 78 THAILAND MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.9 PHILIPPINES

9.2.9.1 Rising political and structural reforms

TABLE 79 PHILIPPINES: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 80 PHILIPPINES: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 81 PHILIPPINES: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.10 VIETNAM

9.2.10.1 Growing need for energy and reducing rural pollution

TABLE 82 VIETNAM: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 83 VIETNAM: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 84 VIETNAM: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.2.11 MYANMAR

9.2.11.1 Implementation of renewable energy policies

TABLE 85 MYANMAR: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 86 MYANMAR: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 87 MYANMAR: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.3 EUROPE

TABLE 88 EUROPE: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 89 EUROPE: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 90 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

FIGURE 46 EUROPE: SNAPSHOT OF MARKET

9.3.1 GERMANY

9.3.1.1 Government-led initiatives for energy transition

TABLE 93 GERMANY: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 94 GERMANY: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 95 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.3.2 UK

9.3.2.1 Advancements in green hydrogen technologies

TABLE 96 UK: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 97 UK: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 98 UK: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.3.3 FINLAND

9.3.3.1 Increasing renewable electricity generation through forest waste

TABLE 99 FINLAND: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 100 FINLAND: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 101 FINLAND: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.3.4 NETHERLANDS

9.3.4.1 Government-led efforts to decarbonize transportation sector

TABLE 102 NETHERLANDS: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 103 NETHERLANDS: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 104 NETHERLANDS: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.3.5 REST OF EUROPE

TABLE 105 REST OF EUROPE: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 106 REST OF EUROPE: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 107 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.4 NORTH AMERICA

FIGURE 47 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 108 NORTH AMERICA: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 109 NORTH AMERICA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 110 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

9.4.1 US

9.4.1.1 High demand for transportation fuels

TABLE 113 US: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 114 US: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 115 US: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.4.2 CANADA

9.4.2.1 Favorable policies promoting installation of gasification plants

TABLE 116 CANADA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 117 CANADA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 118 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.4.3 MEXICO

9.4.3.1 Increasing generation of renewable electricity through agricultural residue

TABLE 119 MEXICO: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 120 MEXICO: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 121 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.5 MIDDLE EAST

TABLE 122 MIDDLE EAST: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 123 MIDDLE EAST: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 124 MIDDLE EAST: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 125 MIDDLE EAST: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 126 MIDDLE EAST: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

9.5.1 TURKEY

9.5.1.1 Increasing use of forest waste to produce sustainable fuel and electricity

TABLE 127 TURKEY: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 128 TURKEY: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 129 TURKEY: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.5.2 EGYPT

9.5.2.1 Government-led initiatives to increase investments in construction of biomass power plants

TABLE 130 EGYPT: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 131 EGYPT: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 132 EGYPT: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.5.3 REST OF MIDDLE EAST

TABLE 133 REST OF MIDDLE EAST: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 134 REST OF MIDDLE EAST: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 135 REST OF MIDDLE EAST: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.6 AFRICA

TABLE 136 AFRICA: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 137 AFRICA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 138 AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 139 AFRICA: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 140 AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

9.6.1 TANZANIA

9.6.1.1 Growing need for rural electrification

TABLE 141 TANZANIA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 142 TANZANIA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 143 TANZANIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.6.2 UGANDA

9.6.2.1 Rising demand for off-grid power

TABLE 144 UGANDA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 145 UGANDA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 146 UGANDA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.6.3 SOUTH AFRICA

9.6.3.1 Rising number of public–private partnerships (PPPs)

TABLE 147 SOUTH AFRICA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 148 SOUTH AFRICA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 149 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.6.4 KENYA

9.6.4.1 Implementation of legislations to promote efficient bioenergy technologies

TABLE 150 KENYA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 151 KENYA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 152 KENYA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.6.5 NIGERIA

9.6.5.1 Rising foreign investments in transformation of power sector

TABLE 153 NIGERIA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 154 NIGERIA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 155 NIGERIA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.7 SOUTH AMERICA

TABLE 156 SOUTH AMERICA: BIOMASS GASIFICATION MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 157 SOUTH AMERICA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 158 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

TABLE 159 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (KW)

TABLE 160 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD THOUSAND)

9.7.1 BRAZIL

9.7.1.1 Increasing initiatives to decarbonize industrial sector

TABLE 161 BRAZIL: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 162 BRAZIL: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 163 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.7.2 ARGENTINA

9.7.2.1 Growing demand for green ammonia in agriculture industry

TABLE 164 ARGENTINA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 165 ARGENTINA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 166 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

9.7.3 REST OF SOUTH AMERICA

TABLE 167 REST OF SOUTH AMERICA: MARKET, BY GASIFIER TECHNOLOGY, 2020–2027 (USD THOUSAND)

TABLE 168 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2020–2027 (USD THOUSAND)

TABLE 169 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 173)

10.1 OVERVIEW

TABLE 170 KEY DEVELOPMENTS IN BIOMASS GASIFICATION MARKET, 2018–2022

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

TABLE 171 MARKET: DEGREE OF COMPETITION

FIGURE 48 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

10.3 MARKET EVALUATION FRAMEWORK

TABLE 172 MARKET EVALUATION FRAMEWORK, 2018–2021

10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 49 SEGMENTAL REVENUE ANALYSIS, 2017–2021

10.5 RECENT DEVELOPMENTS

10.5.1 DEALS

TABLE 173 BIOMASS GASIFICATION: DEALS, 2018–2022

10.5.2 OTHERS

TABLE 174 MARKET: OTHERS, 2018–2022

10.6 COMPETITIVE LEADERSHIP MAPPING, 2021

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 50 BIOMASS GASIFICATION MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 175 COMPANY SOURCE FOOTPRINT

TABLE 176 COMPANY TECHNOLOGY FOOTPRINT

TABLE 177 COMPANY APPLICATION FOOTPRINT

TABLE 178 COMPANY REGIONAL FOOTPRINT

10.7 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2021

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 51 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

10.8 COMPETITIVE BENCHMARKING

TABLE 179 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 180 COMPANY SOURCE FOOTPRINT: START-UPS

TABLE 181 COMPANY TECHNOLOGY FOOTPRINT: START-UPS

TABLE 182 COMPANY APPLICATION FOOTPRINT: START-UPS

TABLE 183 COMPANY REGIONAL FOOTPRINT: START-UPS

11 COMPANY PROFILES (Page No. - 190)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)*

11.1.1 VALMET

TABLE 184 VALMET: COMPANY OVERVIEW

FIGURE 52 VALMET: COMPANY SNAPSHOT

TABLE 185 VALMET: DEALS

TABLE 186 VALMET: OTHERS

11.1.2 EQTEC

TABLE 187 EQTEC: COMPANY OVERVIEW

FIGURE 53 EQTEC: COMPANY SNAPSHOT

TABLE 188 EQTEC: DEALS

11.1.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

TABLE 189 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 54 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 190 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

11.1.4 THYSSENKRUPP AG

TABLE 191 THYSSENKRUPP AG: COMPANY OVERVIEW

FIGURE 55 THYSSENKRUPP AG: COMPANY SNAPSHOT

11.1.5 ENERKEM

TABLE 192 ENERKEM: COMPANY OVERVIEW

11.1.6 SYNTHESIS ENERGY SYSTEMS, INC.

TABLE 193 SYNTHESIS ENERGY SYSTEMS, INC.: COMPANY OVERVIEW

TABLE 194 SYNTHESIS ENERGY SYSTEMS, INC.: DEALS

11.1.7 SHANGHAI HAIQI ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

TABLE 195 SHANGHAI HAIQI ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

11.1.8 SYNTECH BIOENERGY, LLC

TABLE 196 SYNTECH BIOENERGY, LLC: COMPANY OVERVIEW

11.1.9 FULCRUM BIOENERGY

TABLE 197 FULCRUM BIOENERGY: COMPANY OVERVIEW

11.1.10 RECOR

TABLE 198 RECOR: COMPANY OVERVIEW

11.1.11 DP CLEANTECH

TABLE 199 DP CLEANTECH: COMPANY OVERVIEW

11.1.12 CHANDERPUR GROUP

TABLE 200 CHANDERPUR GROUP: COMPANY OVERVIEW

11.1.13 INFINITE ENERGY

TABLE 201 INFINITE ENERGY: COMPANY OVERVIEW

11.1.14 ANKUR SCIENTIFIC

TABLE 202 ANKUR SCIENTIFIC: COMPANY OVERVIEW

11.1.15 ENERSOL BIOPOWER

TABLE 203 ENERSOL BIOPOWER: COMPANY OVERVIEW

11.1.16 SG H2 ENERGY

TABLE 204 SG H2 ENERGY: COMPANY OVERVIEW

TABLE 205 SG H2 ENERGY: DEALS

11.1.17 BIO ENERGY NETHERLANDS BV

TABLE 206 BIO ENERGY NETHERLANDS BV: COMPANY OVERVIEW

TABLE 207 BIO ENERGY NETHERLANDS BV: DEALS

11.1.18 SYNCRAFT

TABLE 208 SYNCRAFT: COMPANY OVERVIEW

TABLE 209 SYNCRAFT: DEALS

11.1.19 REGAWATT GMBH

TABLE 210 REGAWATT GMBH: COMPANY OVERVIEW

TABLE 211 REGAWATT GMBH: DEALS

* Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 YOSEMITE CLEAN ENERGY

11.2.2 URJAGEN PVT LTD

11.2.3 BELLWETHER RECUPERATIVE GASIFICATION LTD.

11.2.4 COSMO POWERTECH PVT. LTD.

11.2.5 HUSK POWER SYSTEMS

12 APPENDIX (Page No. - 226)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the biomass gasification market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and UNESCO Institute of Statistics to identify and collect information useful for a technical, market-oriented, and commercial study of the utility communication market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all the segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global biomass gasification market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Biomass Gasification Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the biomass gasification market.

Objectives of the Study

- To forecast and describe the biomass gasification market size, by source, gasifier technology, application, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the biomass gasification market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America, Middle East, and Africa

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, contracts & agreements, and joint ventures & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biomass Gasification Market