Syngas & Derivatives Market by Production Technology, Gasifier Type, Feedstock (Coal, Natural Gas, Petroleum Byproducts, Biomass/Waste), Application (Chemicals, Fuel, and Electricity), and Region - Global Forecast to 2025

Syngas Market

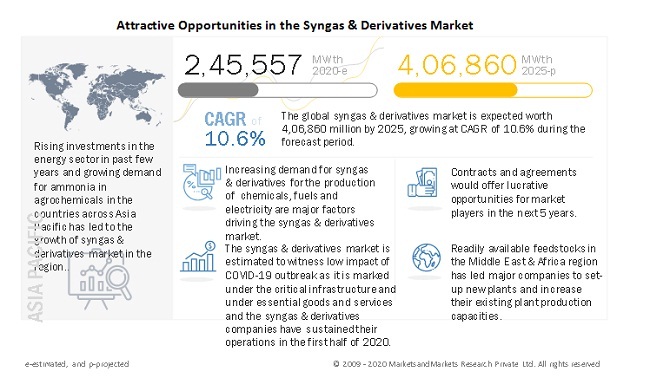

The global syngas market size registered 2,45,557 MWth in 2020 and is projected to reach 4,06,860 MWth by 2025, growing at 10.6% cagr during the forecast period. Rising environmental concerns have been the major drivers for the growth of the syngas & derivatives market in order to provide alternative methods of fuel production. Syngas as a clean and renewable energy is estimated to be adopted widely to replace traditional forms of energy. In addition, high demand for chemical intermediaries in the production of hygiene and sanitization and pharmaceutical products due to outbreak of COVID-19 is anticipated to fuel the growth of syngas and its derivatives in the chemical segment.

Based on application, the chemicals segment is projected to lead the market, during the forecast period

The chemicals segment is estimated to lead the syngas & derivatives market in 2020, owing to the increasing demand for green chemicals for the synthesis and production of chemical intermediates. Depending on the H2/CO ratio, syngas & derivatives are widely used in the processing of chemicals for manufacturing fertilizers, petrochemicals, and oxo chemicals, among others. The chemicals segment is further segmented by derivative into methanol, ammonia, and FT synthesis products. Ammonia is the most idely manufactured chemical in the world, and it is primarily consumed in the production of nitrogenous fertilizers.

Based on feedstock, coal segment is projected to lead the syngas & derivatives market, during the forecast period

Coal was the largest feedstock segment in the production of syngas & derivatives, and it is estimated to lead the market during the forecast period as well. The high availability of coal for energy production and the excellent compatibity of the feedstock with various syngas production technologies drives the growth of the coal segment in the syngas & derivatives market. In addition, the growth is attributed to the high availability of coal reserves in countries such as China, the US, and Russia. Markets such as China and India are majorly engaged in the production of coal-based syngas & derivatives. This fuels the growth of the coal segment in the Asia Pacific region, which is the largest market for syngas & derivatives.

Asia Pacific is expected to witness the highest growth in the syngas & derivatives market during the forecast period

The syngas & derivatives market in the Asia Pacific region is projected to grow at the highest CAGR between 2020 and 2025. The growth can be attributed to the high demand for syngas & derivatives in countries such as China, India, and Japan in applications such as chemicals, fuel, and electricity. The region being the largest consumer in the chemical industry offers high growth opportunities for chemical applications for use in fertilizers and petrochemicals. In addition, the region is rapidly growing in the fuel and electricity applications, with increasing demand for syngas & derivatives in liquid fuel, gaseous fuel, and hydrogen-based electricity.

Syngas Market Players

Sasol Limited (South Africa), Haldor Topsoe A/S (Denmark), Air Liquide S.A.(France), Siemens AG (Germany), Air Products and Chemicals Inc. (US), KBR Inc. (US), Linde plc (UK), BASF SE (Germany), TechnipFMC PLC (UK), McDermott International, Inc. (US), Mitsubishi Heavy Industries, Ltd. (Japan), Chiyoda Corporation (Japan), Synthesis Energy Systems, Inc. (US), Yara International ASA (Norway), Methanex Corporation (Canada), CF Industries Holdings, Inc. (US), Dow Inc. (US), and John Wood Group PLC (UK), among others, are the major players in the syngas & derivatives market. These players have been focusing on strategies such as expansions, acquisitions, partnerships, and new product developments, which have helped them expand their businesses in untapped and potential markets. They have also been adopting various organic and inorganic growth strategies, such as contracts, agreements, new product developments, acquisitions, and expansions, to enhance their current position in the syngas & derivatives market.

Syngas Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (MWth) |

|

Segments covered |

Production Technology, Gasifier Type, Feedstock, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Sasol Limited (South Africa), Haldor Topsoe A/S (Denmark), Air Liquide S.A.(France), Siemens AG (Germany), Air Products and Chemicals Inc. (US), KBR Inc. (US), Linde plc (UK), BASF SE (Germany), TechnipFMC PLC (UK), McDermott International, Inc. (US), Mitsubishi Heavy Industries, Ltd. (Japan), Chiyoda Corporation (Japan), Synthesis Energy Systems, Inc. (US), Yara International ASA (Norway), Methanex Corporation (Canada), CF Industries Holdings, Inc. (US), Dow Inc. (US), John Wood Group PLC (UK) and others. |

On the basis of production technology, the syngas & derivatives market is segmented as follows:

- Steam Reforming

- Partial Oxidation

- Autothermal Reforming

- Biomass Gasification

- Others (Plasma Gasification, Heat Exchange Reforming, and Underground Coal Gasification)

On the basis of gasifier type, the syngas & derivatives market is segmented as follows:

- Fixed (Moving) Bed Gasifier

- Entrained Flow Gasifier

- Fluidized Bed Gasifier

- Others (Plasma Arc Gasifier and Black Liquor Gasifier)

On the basis of feedstock, the syngas & derivatives market is segmented as follows:

- Coal

- Natural Gas

- Petroleum Byproducts

- Biomass/Waste

- Others (Petcoke, Plastic Waste, and Medical Waste)

On the basis of application, the syngas & derivatives market is segmented as follows:

-

Chemicals, by derivative

- Methanol

- Ammonia

- FT Synthesis Products

-

Fuels, by form

- Liquid Fuels

- Gaseous Fuels

-

Electricity, by source

- Hydrogen

- Direct Syngas Consumption

On the basis of Region, the syngas & derivatives market is segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2020, Siemens AG was awarded a contract by Malaysia Marine and Heavy Engineering (Malaysia) to supply three SGT-300 industrial gas turbine generators (GTG), three mechanical-drive SGT-300 gas turbines and three DATUM centrifugal compressors for the PETRONAS Kasawari Gas Field Development Project in the South China Sea, offshore Sarawak in Malaysia. The industrial gas turbines will power 900 million cubic feet per day offshore Central Processing Platform (CPP) for PETRONAS Carigali Sdn Bhd.

- In May 2020, Linde plc has started up a new state-of-the-art syngas processing plant in Geismar, Louisiana. The new plant will supply carbon monoxide and hydrogen to a top global chemical company as well as other refining and chemical customers along Linde's hydrogen pipeline network in Southern Louisiana, all under long-term supply agreements.

- In March 2020, Haldor Topsoe A/S has signed an agreement with Nacero Inc. (US) for basic engineering and license for a planned natural-gas-to-gasoline facility in Casa Grande, Arizona, with a capacity of 35,000 barrels-per-day of finished gasoline. The plant will use company’s proven TIGAS gas-to-gasoline technology to produce clean, high-value gasoline from low-cost natural gas. The natural gas-to-gasoline plant is valued for USD 3.0 billion.

- In January 2020, Air Products and Chemicals Inc. has made a largest-ever US investment of USD 500.0 million to build, own and operate its largest-ever steam methane reformer (SMR) to produce hydrogen, an air separation unit (ASU) to supply nitrogen and utilities facilities and won a long-term contract to supply gulf coast ammonia’s new world-scale Texas Production Plant.

Frequently Asked Questions (FAQ):

What is synthesis gas/syngas?

Synthesis gas or syngas, is a versatile fuel gas mixture primarily comprising hydrogen and carbon monoxide. It is produced using the gasification process. Syngas is widely used in the production of chemical intermediaries, fuels, and power generation.

What is gasification?

Gasification is the process of breaking down any carbon-based organic matter into a gas called synthesis gas or syngas.

What is the major product of syngas and what is the its major application?

Hydrogen is the largest byproduct of syngas, which can be produced from any carbonaceous feedstock using gasification technology. Hydrogen is widely used in the production of chemicals such as ammonia, methanol, and various Fischer–Tropsch synthesis products. Liquid and gaseous fuels such as SNG and LNG are produced from hydrogen. Hydrogen act as a clean fuel for automobiles. Hydrogen is used for generating electricity as well.

How does production of syngas from gasification process help in the reduction of CO2 emission in the environment?

Syngas is produced using feedstocks such as coal, natural gas, petroleum byproducts, and biomass. These hydrocarbon-based feedstocks are gasified into syngas which is a composition of hydrogen, carbon monoxide and some amount of carbon dioxide. Syngas and/or its byproducts such as hydrogen, carbon monoxide, and carbon dioxide are used in the production of chemicals, fuels, and power generation. This factor leads to reduced emission of carbon dioxide in the environment and utilization in commercial application.

What is major feedstock used in the production of syngas?

Coal is the major feedstock in the production of syngas. However, coal is being rapidly replace by natural gas as feedstock in major markets such as the US and China and coal gasification is already banned in some European countries.

Who are the leading syngas and its derivatives provider in the world?

Key players such as Sasol Limited (South Africa), Haldor Topsoe A/S (Denmark), Air Liquide S.A.(France), Siemens AG (Germany), Air Products and Chemicals Inc. (US), KBR Inc. (US), and Linde plc (UK) are engaged in providing syngas and its derivatives. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 SYNGAS & DERIVATIVES MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 SYNGAS & DERIVATIVES MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.2.3 MARKET SCOPE

1.2.4 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 UNITS CONSIDERED

1.5 STAKEHOLDERS

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 MARKET DEFINITION AND SCOPE

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primary interviews

2.2.2.3 Key industry insights

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 1 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 BASE NUMBER CALCULATION

2.4.1 SUPPLY SIDE APPROACH

2.5 FORECAST NUMBER CALCULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 3 STEAM REFORMING SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET FROM 2020 TO 2025

FIGURE 4 ENTRAINED FLOW GASIFIER SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET FROM 2020 TO 2025

FIGURE 5 COAL SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET FROM 2020 TO 2025

FIGURE 6 CHEMICALS SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET FROM 2020 TO 2025

FIGURE 7 SYNGAS & DERIVATIVES MARKET IN ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SYNGAS & DERIVATIVES MARKET

FIGURE 8 GROWTH OF CHEMICALS SEGMENT TO DRIVE THE MARKET FOR SYNGAS & DERIVATIVES

4.2 SYNGAS & DERIVATIVES MARKET, BY FEEDSTOCK & APPLICATION

FIGURE 9 COAL SEGMENT ACCOUNTS FOR THE LARGEST SHARE OF THE SYNGAS & DERIVATIVES MARKET IN 2020

4.3 SYNGAS & DERIVATIVES MARKET, BY COUNTRY

FIGURE 10 SYNGAS & DERIVATIVES MARKET IN CHINA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 SYNGAS & DERIVATIVES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for electricity

FIGURE 12 GLOBAL ELECTRICITY CONSUMPTION, 2014–2018 (TWH)

5.2.1.2 Environmental regulations to drive the adoption of clean technology

5.2.1.3 Combined production of chemicals, fuels, and power along with feedstock flexibility

5.2.2 RESTRAINTS

5.2.2.1 Significant capital investment

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for hydrogen as a clean fuel in transportation

5.2.3.2 Adoption of Underground Coal Gasification (UCG) process

5.2.3.3 Reducing dependency on crude oil and fuels

5.2.4 CHALLENGES

5.2.4.1 Safety concerns over syngas technologies and derivatives

5.3 VALUE CHAIN ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF BUYERS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACROECONOMIC INDICATORS BEFORE COVID-19 OUTBREAK

5.5.1 ENERGY & POWER

TABLE 1 CRUDE OIL PRODUCTION, 2014–2018 (METRIC TONS)

TABLE 2 PRIMARY ENERGY CONSUMPTION, 2014–2018 (MILLION TONNES OIL EQUIVALENT)

5.5.2 CHEMICALS

FIGURE 14 CHEMICAL PRODUCTION GROWTH OUTLOOK (EXCLUDING PHARMACEUTICALS), 2017-2018

5.6 IMPACT OF COVID-19 ON THE APPLICATIONS OF SYNGAS & DERIVATIVES

5.6.1 DISRUPTION IN APPLICATIONS OF SYNGAS & DERIVATIVES

5.6.2 COVID-19 IMPACT ON THE CHEMICAL INDUSTRY

FIGURE 15 CHEMICAL PRODUCTION GROWTH OUTLOOK (EXCLUDING PHARMACEUTICALS)

5.6.3 COVID-19 IMPACT ON THE ENERGY & POWER INDUSTRY

FIGURE 16 PROJECTED PRIMARY ENERGY DEMAND, BY FUEL, 2020

6 SYNGAS & DERIVATIVES MARKET, BY PRODUCTION TECHNOLOGY (Page No. - 69)

6.1 INTRODUCTION

FIGURE 17 STEAM REFORMING TO BE THE MOST WIDELY USED PRODUCTION TECHNOLOGY FOR SYNGAS

TABLE 3 SYNGAS & DERIVATIVES MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2017—2019 (MWTH) - PRE COVID-19

TABLE 4 SYNGAS & DERIVATIVES MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2020—2025 (MWTH) - POST COVID-19

6.2 STEAM REFORMING

TABLE 5 STEAM REFORMING ADVANTAGES AND DISADVANTAGES

6.3 PARTIAL OXIDATION

TABLE 6 PARTIAL OXIDATION ADVANTAGES AND DISADVANTAGES

6.4 AUTOTHERMAL REFORMING

TABLE 7 AUTOTHERMAL REFORMING ADVANTAGES AND DISADVANTAGES

6.5 BIOMASS GASIFICATION

6.6 OTHERS

6.6.1 PLASMA GASIFICATION

6.6.2 HEAT EXCHANGE REFORMING

6.6.3 UNDERGROUND COAL GASIFICATION (UCG)

7 SYNGAS & DERIVATIVES MARKET, BY GASIFIER TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 18 ENTRAINED FLOW GASIFIER SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET DURING THE FORECAST PERIOD

TABLE 8 SYNGAS & DERIVATIVES MARKET SIZE, BY GASIFIER TYPE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 9 SYNGAS & DERIVATIVES MARKET SIZE, BY GASIFIER TYPE, 2020—2025 (MWTH) – POST COVID-19

7.2 FIXED (MOVING) BED GASIFIER

TABLE 10 FIXED (MOVING) BED GASIFIER: ADVANTAGES AND DISADVANTAGES

7.3 ENTRAINED FLOW GASIFIER

TABLE 11 ENTRAINED FLOW GASIFIER ADVANTAGES AND DISADVANTAGES

7.4 FLUIDIZED BED GASIFIER

TABLE 12 FLUIDIZED BED GASIFIER ADVANTAGES AND DISADVANTAGES

7.5 OTHERS

7.5.1 ADVANCED COAL GASIFIER

7.5.2 PLASMA ARC GASIFIER

7.5.3 BLACK LIQUOR GASIFIER

8 SYNGAS & DERIVATIVES MARKET, BY FEEDSTOCK (Page No. - 79)

8.1 INTRODUCTION

FIGURE 19 COAL TO BE THE DOMINANT FEEDSTOCK DURING THE FORECAST PERIOD

TABLE 13 SYNGAS & DERIVATIVES MARKET, BY FEEDSTOCK, 2017–2019 (MWTH) – PRE COVID-19

TABLE 14 SYNGAS & DERIVATIVES MARKET, BY FEEDSTOCK, 2020–2025 (MWTH) – POST COVID-19

8.2 COAL

8.2.1 ASIA PACIFIC IS THE LARGEST MARKET FOR COAL-BASED SYNGAS & DERIVATIVES

TABLE 15 COAL SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017–2029 (MWTH) - PRE COVID-19

TABLE 16 COAL SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020–2025 (MWTH) - POST COVID-19

8.3 NATURAL GAS

8.3.1 NATURAL GAS-BASED SYNGAS IS A SUBSTITUTE FOR CONVENTIONAL FUEL

TABLE 17 NATURAL GAS SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017–2019 (MWTH) - PRE COVID-19

TABLE 18 NATURAL GAS SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020–2025 (MWTH) - POST COVID-19

8.4 PETROLEUM BYPRODUCTS

8.4.1 HIGH AVAILABILITY OF PETROLEUM BYPRODUCTS IN ASIA PACIFIC TO DRIVE THE GROWTH

TABLE 19 PETROLEUM BYPRODUCTS SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017–2019 (MWTH) - PRE COVID-19

TABLE 20 PETROLEUM BYPRODUCTS SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020–2025 (MWTH) - POST COVID-19

8.5 BIOMASS/WASTE

8.5.1 INCREASING FOCUS ON CLEAN ENERGY GENERATION DRIVES SEGMENT GROWTH

TABLE 21 BIOMASS/WASTE SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017–2019 (MWTH) - PRE COVID-19

TABLE 22 BIOMASS/WASTE SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020–2025 (MWTH) - POST COVID-19

8.6 OTHERS

8.6.1 HIGH DEMAND FOR SYNGAS DERIVED FROM PETCOKE IN ASIA PACIFIC TO DRIVE THE SEGMENT

TABLE 23 OTHER FEEDSTOCK SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017–2019 (MWTH) - PRE COVID-19

TABLE 24 OTHER FEEDSTOCK SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020–2025 (MWTH) - POST COVID-19

9 SYNGAS & DERIVATIVES MARKET, BY APPLICATION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 20 CHEMICALS SEGMENT TO LEAD THE SYNGAS & DERIVATIVES MARKET DURING THE FORECAST PERIOD

TABLE 25 SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 26 SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

9.2 CHEMICALS

TABLE 27 SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY REGION, 2017—2019 (MWTH) -PRE COVID-19

TABLE 28 SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY REGION, 2020—2025 (MWTH) – POST COVID-19

TABLE 29 SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 30 SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

9.2.1 METHANOL

9.2.1.1 Methanol used as natural gas and feedstock makes it an important chemical for syngas production

TABLE 31 METHANOL: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 32 METHANOL: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.2.2 AMMONIA

9.2.2.1 Growing agricultural and fertilizer industries in China and India drive the growth

TABLE 33 AMMONIA: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 34 AMMONIA: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.2.3 FT SYNTHESIS PRODUCTS

9.2.3.1 Flexibility is the key benefit that drives the segment

TABLE 35 FT SYNTHESIS PRODUCTS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 36 FT SYNTHESIS PRODUCTS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.3 FUEL

TABLE 37 SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY REGION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 38 SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY REGION, 2020—2025 (MWTH) – POST COVID-19

TABLE 39 SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) - PRE COVID-19

TABLE 40 SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

9.3.1 LIQUID FUELS

9.3.1.1 Gasoline and diesel prepared from syngas can help store and transport energy

TABLE 41 LIQUID FUELS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 42 LIQUID FUELS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.3.2 GASEOUS FUELS

9.3.2.1 Acute natural gas demand to create dependency on gaseous fuels produced from syngas

TABLE 43 GASEOUS FUELS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 44 GASEOUS FUELS: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.4 ELECTRICITY

TABLE 45 SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY REGION, 2017—2019 (MWTH) -PRE COVID-19

TABLE 46 SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY REGION, 2020—2025 (MWTH) – POST COVID-19

TABLE 47 SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH) - PRE COVID-19

TABLE 48 SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH) - POST COVID-19

9.4.1 HYDROGEN

9.4.1.1 Demand for hydrogen as an alternative to fossil fuel, coal, and natural gas to increase significantly

TABLE 49 HYDROGEN: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 50 HYDROGEN: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

9.4.2 DIRECT SYNGAS CONSUMPTION

9.4.2.1 Growing environmental hazards make direct syngas consumption and utilization a favorable alternative

TABLE 51 DIRECT SYNGAS CONSUMPTION: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 52 DIRECT SYNGAS CONSUMPTION: SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

10 REGIONAL ANALYSIS (Page No. - 101)

10.1 INTRODUCTION

FIGURE 21 SYNGAS & DERIVATIVES MARKET IN CHINA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 22 ASIA PACIFIC TO LEAD THE SYNGAS & DERIVATIVES MARKET DURING THE FORECAST PERIOD

TABLE 53 SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 54 SYNGAS & DERIVATIVES MARKET SIZE, BY REGION, 2020—2025 (MWTH) – POST COVID-19

10.2 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SNAPSHOT

10.2.1 BY COUNTRY

TABLE 55 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2017—2019 (MWTH) – PRE COVID-19

TABLE 56 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2020—2025 (MWTH) – POST COVID-19

10.2.2 BY FEEDSTOCK

TABLE 57 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2017—2019 (MWTH) – PRE COVID-19

TABLE 58 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2020—2025 (MWTH) – POST COVID-19

10.2.3 BY APPLICATION

TABLE 59 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 60 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) - POST COVID-19

10.2.3.1 Chemicals, by Derivative

TABLE 61 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 62 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

10.2.3.2 Fuel, by Form

TABLE 63 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) – PRE COVID-19

TABLE 64 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

10.2.3.3 Electricity, by Source

TABLE 65 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH)

TABLE 66 ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH)

10.2.4 CHINA

10.2.4.1 Increasing demand for ammonia and methanol in chemical applications to drive the growth

TABLE 67 CHINA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 68 CHINA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.5 INDIA

10.2.5.1 Growing application areas to drive the growth of the market

TABLE 69 INDIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 70 INDIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.6 JAPAN

10.2.6.1 Stringent regulations for green chemicals to drive the market growth

TABLE 71 JAPAN: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 72 JAPAN: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.7 SOUTH KOREA

10.2.7.1 Increasing government interventions to drive the growth

TABLE 73 SOUTH KOREA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 74 SOUTH KOREA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.8 AUSTRALIA

10.2.8.1 Growth of the chemical industry is fueling the demand

TABLE 75 AUSTRALIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 76 AUSTRALIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.9 SINGAPORE

10.2.9.1 Growing demand from the chemical industry to drive the market

TABLE 77 SINGAPORE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 78 SINGAPORE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.10 INDONESIA

10.2.10.1 Rising demand for clean fuel to drive the market

TABLE 79 INDONESIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 80 INDONESIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.2.11 REST OF ASIA PACIFIC

TABLE 81 REST OF ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 82 REST OF ASIA PACIFIC: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3 EUROPE

FIGURE 24 EUROPE: SYNGAS & DERIVATIVES MARKET SNAPSHOT

10.3.1 BY COUNTRY

TABLE 83 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2017—2019 (MWTH) – PRE COVID-19

TABLE 84 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2020—2025 (MWTH) – POST COVID-19

10.3.2 BY FEEDSTOCK

TABLE 85 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2017—2019 (MWTH) – PRE COVID-19

TABLE 86 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2020—2025 (MWTH) – POST COVID-19

10.3.3 BY APPLICATION

TABLE 87 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 88 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) - POST COVID-19

10.3.3.1 Chemicals, by Derivative

TABLE 89 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 90 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

10.3.3.2 Fuel, by Form

TABLE 91 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) – PRE COVID-19

TABLE 92 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

10.3.3.3 Electricity, by Source

TABLE 93 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH)

TABLE 94 EUROPE: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH)

10.3.4 GERMANY

10.3.4.1 Presence of leading manufacturers drives the growth

TABLE 95 GERMANY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 96 GERMANY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.5 FRANCE

10.3.5.1 Rising demand from the chemical industry drives the growth

TABLE 97 FRANCE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 98 FRANCE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.6 UK

10.3.6.1 Growth of the chemical industry fuels market

TABLE 99 UK: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 100 UK: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.7 RUSSIA

10.3.7.1 Growing fuel applications to drive the demand

TABLE 101 RUSSIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 102 RUSSIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.8 ITALY

10.3.8.1 Demand for clean electricity to drive the market

TABLE 103 ITALY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 104 ITALY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.9 SPAIN

10.3.9.1 Demand for clean energy to drive the market

TABLE 105 SPAIN: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 106 SPAIN: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.10 TURKEY

10.3.10.1 Demand for renewable energy to drive the market

TABLE 107 TURKEY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 108 TURKEY: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.11 NETHERLANDS

10.3.11.1 Increasing biomass gasification projects to drive the market

TABLE 109 NETHERLANDS: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 110 NETHERLANDS: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.12 BELGIUM

10.3.12.1 Demand for syngas as clean energy to drive the market

TABLE 111 BELGIUM: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 112 BELGIUM: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.3.13 REST OF EUROPE

TABLE 113 REST OF EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 114 REST OF EUROPE: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.4 NORTH AMERICA

FIGURE 25 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SNAPSHOT

10.4.1 BY COUNTRY

TABLE 115 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2017—2019 (MWTH) – PRE COVID-19

TABLE 116 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2020—2025 (MWTH) – POST COVID-19

10.4.2 BY FEEDSTOCK

TABLE 117 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2017—2019 (MWTH) – PRE COVID-19

TABLE 118 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2020—2025 (MWTH) – POST COVID-19

10.4.3 BY APPLICATION

TABLE 119 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 120 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) - POST COVID-19

10.4.3.1 Chemicals, by Derivative

TABLE 121 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 122 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

10.4.3.2 Fuel, by Form

TABLE 123 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) – PRE COVID-19

TABLE 124 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

10.4.3.3 Electricity, by Source

TABLE 125 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH)

TABLE 126 NORTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH)

10.4.4 US

10.4.4.1 Growing refinery industry and ammonia production drive chemical applications

TABLE 127 US: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 128 US: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.4.5 CANADA

10.4.5.1 Increasing demand from fuel applications drives the growth

TABLE 129 CANADA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 130 CANADA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.4.6 MEXICO

10.4.6.1 Growing demand from chemical applications to boost the growth

TABLE 131 MEXICO: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 132 MEXICO: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.5 MIDDLE EAST & AFRICA

FIGURE 26 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SNAPSHOT

10.5.1 BY COUNTRY

TABLE 133 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2017—2019 (MWTH) – PRE COVID-19

TABLE 134 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2020—2025 (MWTH) – POST COVID-19

10.5.2 BY FEEDSTOCK

TABLE 135 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2017—2019 (MWTH) – PRE COVID-19

TABLE 136 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2020—2025 (MWTH) – POST COVID-19

10.5.3 BY APPLICATION

TABLE 137 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 138 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) - POST COVID-19

10.5.3.1 Chemicals, by Derivative

TABLE 139 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 140 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

10.5.3.2 Fuel, by Form

TABLE 141 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) – PRE COVID-19

TABLE 142 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

10.5.3.3 Electricity, by Source

TABLE 143 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH)

TABLE 144 MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH)

10.5.4 SOUTH AFRICA

10.5.4.1 Demand for clean fuel to drive the market

TABLE 145 SOUTH AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 146 SOUTH AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.5.5 SAUDI ARABIA

10.5.5.1 Need to reduce sulfur content in petrochemical products to drive the market

TABLE 147 SAUDI ARABIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 148 SAUDI ARABIA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 149 REST OF MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 150 REST OF MIDDLE EAST & AFRICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.6 SOUTH AMERICA

FIGURE 27 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SNAPSHOT

10.6.1 BY COUNTRY

TABLE 151 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2017—2019 (MWTH) – PRE COVID-19

TABLE 152 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY COUNTRY, 2020—2025 (MWTH) – POST COVID-19

10.6.2 BY FEEDSTOCK

TABLE 153 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2017—2019 (MWTH) – PRE COVID-19

TABLE 154 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY FEEDSTOCK, 2020—2025 (MWTH) – POST COVID-19

10.6.3 BY APPLICATION

TABLE 155 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) - PRE COVID-19

TABLE 156 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) - POST COVID-19

10.6.3.1 Chemicals, by Derivative

TABLE 157 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2017—2019 (MWTH) – PRE COVID-19

TABLE 158 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR CHEMICALS, BY DERIVATIVE, 2020—2025 (MWTH) – POST COVID-19

10.6.3.2 Fuel, by Form

TABLE 159 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2017—2019 (MWTH) – PRE COVID-19

TABLE 160 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR FUEL, BY FORM, 2020—2025 (MWTH) - POST COVID-19

10.6.3.3 Electricity, by Source

TABLE 161 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2017—2019 (MWTH)

TABLE 162 SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE FOR ELECTRICITY, BY SOURCE, 2020—2025 (MWTH)

10.6.4 BRAZIL

10.6.4.1 Need to increase agricultural output drives market

TABLE 163 BRAZIL: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 164 BRAZIL: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.6.5 ARGENTINA

10.6.5.1 Increasing demand for ammonia to drive the growth of the market

TABLE 165 ARGENTINA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 166 ARGENTINA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

10.6.6 REST OF SOUTH AMERICA

TABLE 167 REST OF SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2017—2019 (MWTH) – PRE COVID-19

TABLE 168 REST OF SOUTH AMERICA: SYNGAS & DERIVATIVES MARKET SIZE, BY APPLICATION, 2020—2025 (MWTH) – POST COVID-19

11 COMPETITIVE LANDSCAPE (Page No. - 157)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

FIGURE 28 SYNGAS & DERIVATIVES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 29 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SYNGAS & DERIVATIVES MARKET

11.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 30 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SYNGAS & DERIVATIVES MARKET

11.5 MARKET SHARE OF KEY PLAYERS IN THE SYNGAS & DERIVATIVES MARKET

FIGURE 31 AIR PRODUCTS AND CHEMICALS, INC. LED THE SYNGAS & DERIVATIVES MARKET IN 2019

12 COMPANY PROFILES (Page No. - 163)

(Business Overview, Products Offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, winning imperatives, Current Focus and Strategies, Right to Win )*

12.1 SASOL LIMITED

FIGURE 32 SASOL LIMITED: COMPANY SNAPSHOT

FIGURE 33 SASOL LIMITED: SWOT ANALYSIS

12.2 HALDOR TOPSOE A/S

FIGURE 34 HALDOR TOPSOE A/S: COMPANY SNAPSHOT

FIGURE 35 HALDOR TOPSOE A/S: SWOT ANALYSIS

12.3 AIR LIQUIDE S.A.

FIGURE 36 AIR LIQUIDE S.A.: COMPANY SNAPSHOT

FIGURE 37 AIR LIQUIDE S.A.: SWOT ANALYSIS

12.4 SIEMENS AG

FIGURE 38 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 39 SIEMENS AG: SWOT ANALYSIS

12.5 AIR PRODUCTS AND CHEMICALS INC.

FIGURE 40 AIR PRODUCTS AND CHEMICALS INC.: COMPANY SNAPSHOT

FIGURE 41 AIR PRODUCTS AND CHEMICALS INC.: SWOT ANALYSIS

12.6 KBR INC.

FIGURE 42 KBR INC.: COMPANY SNAPSHOT

FIGURE 43 KBR INC.: SWOT ANALYSIS

12.7 LINDE PLC

FIGURE 44 LINDE PLC: COMPANY SNAPSHOT

FIGURE 45 LINDE PLC: SWOT ANALYSIS

12.8 BASF SE

FIGURE 46 BASF SE: COMPANY SNAPSHOT

FIGURE 47 BASF SE: SWOT ANALYSIS

12.9 TECHNIPFMC PLC

FIGURE 48 TECHNIPFMC PLC: COMPANY SNAPSHOT

FIGURE 49 TECHNIPFMC PLC: SWOT ANALYSIS

12.10 MCDERMOTT INTERNATIONAL, INC.

FIGURE 50 MCDERMOTT INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 51 MCDERMOTT INTERNATIONAL, INC.: SWOT ANALYSIS

12.11 MITSUBISHI HEAVY INDUSTRIES, LTD.

FIGURE 52 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 53 MITSUBISHI HEAVY INDUSTRIES, LTD.: SWOT ANALYSIS

12.12 CHIYODA CORPORATION

FIGURE 54 CHIYODA CORPORATION: COMPANY SNAPSHOT

12.13 SYNTHESIS ENERGY SYSTEMS, INC.

FIGURE 55 SYNTHESIS ENERGY SYSTEMS, INC.: COMPANY SNAPSHOT

12.14 YARA INTERNATIONAL ASA

FIGURE 56 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

12.15 METHANEX CORPORATION

FIGURE 57 METHANEX CORPORATION: COMPANY SNAPSHOT

12.16 CF INDUSTRIES HOLDINGS, INC.

FIGURE 58 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

12.17 DOW INC.

FIGURE 59 DOW INC.: COMPANY SNAPSHOT

12.18 JOHN WOOD GROUP PLC

FIGURE 60 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

12.19 OTHER KEY PLAYERS

12.19.1 SYNGAS TECHNOLOGY LLC (SGT)

12.19.2 KT - KINETICS TECHNOLOGY SPA

12.19.3 OQ CHEMICALS GMBH (FORMERLY OXEA GMBH)

12.19.4 CALORIC ANLAGENBAU GMBH

12.19.5 IHI E&C INTERNATIONAL CORPORATION

12.19.6 SYNGAS PRODUCTS HOLDINGS LIMITED

12.19.7 MEMBRANE TECHNOLOGY AND RESEARCH, INC.

*Details on Products Offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, winning imperatives, Current Focus and Strategies, Right to Win, might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS TO THE SYNGAS & DERIVATIVES MARKET (Page No. - 230)

13.1 INTRODUCTION

TABLE 169 TOP ADJACENT MARKETS: ENERGY & POWER

TABLE 170 TOP ADJACENT MARKETS: CHEMICALS & MATERIAL

TABLE 171 TOP ADJACENT MARKETS: SEMICONDUCTOR & ELECTRONICS

13.2 SYNGAS & DERIVATIVES ECOSYSTEM AND INTERCONNECTED MARKETS

13.3 HYDROGEN GENERATION MARKET

13.3.1 OBJECTIVES OF THE STUDY

13.3.2 MARKET DEFINITION

13.3.3 MARKET SEGMENTATION

13.3.4 YEARS CONSIDERED FOR THE STUDY

13.3.5 LIMITATIONS IN THE HYDROGEN GENERATION MARKET

13.3.6 MARKET OVERVIEW

FIGURE 61 HYDROGEN GENERATION MARKET IS EXPECTED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

13.4 HYDROGEN GENERATION MARKET, BY TECHNOLOGY

FIGURE 62 STEAM METHANE REFORMING SEGMENT LED THE HYDROGEN GENERATION MARKET, BY TECHNOLOGY, IN 2017

TABLE 172 HYDROGEN GENERATION MARKET SIZE, BY TECHNOLOGY, 2016–2023 (THOUSAND METRIC TON)

TABLE 173 HYDROGEN GENERATION MARKET SIZE, BY TECHNOLOGY, 2016–2023 (USD MILLION)

13.5 HYDROGEN GENERATION MARKET, BY APPLICATION

FIGURE 63 PETROLEUM REFINERY SEGMENT LED THE HYDROGEN GENERATION MARKET, BY APPLICATION, IN 2017

TABLE 174 HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 175 HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.5.1 PETROLEUM REFINERY

TABLE 176 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TON)

TABLE 177 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.5.2 AMMONIA PRODUCTION

TABLE 178 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TON)

TABLE 179 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.5.3 METHANOL PRODUCTION

TABLE 180 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TONS)

TABLE 181 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.5.4 TRANSPORTATION

TABLE 182 TRANSPORTATION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TON)

TABLE 183 TRANSPORTATION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.5.5 POWER GENERATION

TABLE 184 POWER GENERATION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TON)

TABLE 185 POWER GENERATION: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.5.6 OTHER APPLICATIONS

TABLE 186 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (THOUSAND METRIC TON)

TABLE 187 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.6 HYDROGEN GENERATION MARKET, BY REGION

13.6.1 NORTH AMERICA

TABLE 188 NORTH AMERICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 189 NORTH AMERICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.6.2 EUROPE

TABLE 190 EUROPE: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 191 EUROPE: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.6.3 ASIA PACIFIC

TABLE 192 ASIA PACIFIC: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 193 ASIA PACIFIC: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.6.4 MIDDLE EAST

TABLE 194 MIDDLE EAST: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 195 MIDDLE EAST: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.6.5 AFRICA

TABLE 196 AFRICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 197 AFRICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.6.6 SOUTH AMERICA

TABLE 198 SOUTH AMERICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (THOUSAND METRIC TON)

TABLE 199 SOUTH AMERICA: HYDROGEN GENERATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 251)

14.1 EXCERPTS FROM EXPERT INTERVIEWS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for syngas & derivatives. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. Other secondary sources included annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

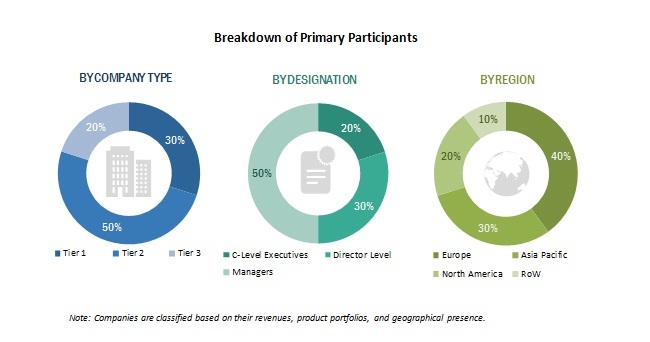

The syngas & derivatives market comprises stakeholders such as producers, suppliers, and distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in applications such as chemicals, fuel, and electricity. The supply side is characterized by market consolidation activities undertaken by syngas & derivative producers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the syngas & derivatives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size - using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.Report Objectives:

- To define and describe the syngas & derivatives market by production technology, gasifier type, feedstock, application, and region

- To estimate and forecast the size of the syngas & derivatives market, in terms of volume (MWth)

- To analyze region-specific trends in Europe, North America, Asia Pacific, the Middle East & Africa, and South America

- To identify and analyze the key drivers, restraints, opportunities, and challenges impacting the growth of the syngas & derivatives market across the globe

- To strategically identify and profile key market players, and analyze their core competencies in the market

- To analyze competitive developments such as acquisitions, new product launches, and expansions that have taken place in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional syngas & derivatives market to the country level by end-use industry

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Syngas & Derivatives Market