Biopesticides Market by Type (Bioinsecticides, Biofungicides, Bionematicides), Crop Type (Cereals & Grains, Oilseeds & Pulses), Formulation (Liquid and Dry), Source (Microbials, Biochemicals) Mode of Application, Region - Global Forecast to 2028

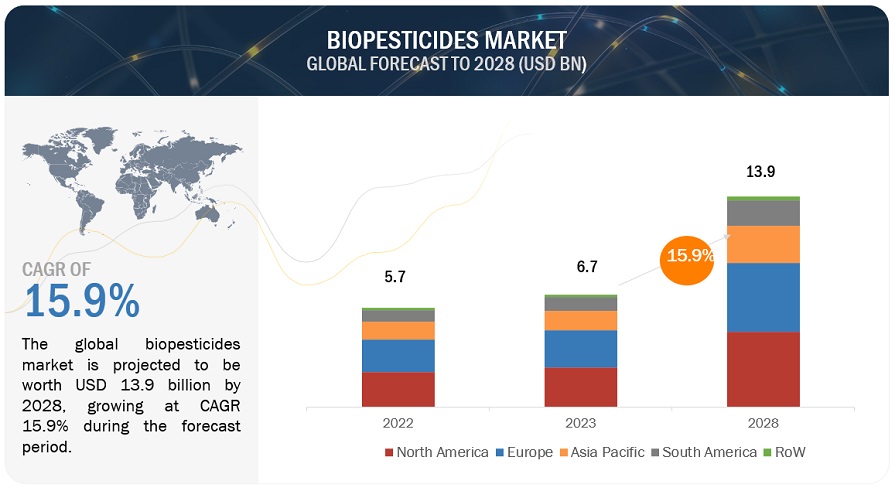

[319 Pages Report] According to MarketsandMarkets, the biopesticides market is projected to reach USD 13.9 billion by 2028 from USD 6.7 billion by 2023, at a CAGR of 15.9% during the forecast period in terms of value. The growing awareness about the harmful effects of synthetic pesticides on human health and the environment has led to a rising demand for biopesticides.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER : Increase in acceptance of organic food

The organic food industry is growing due to a rise in health awareness among consumers and an increase in the adoption of organic fruits & vegetables. Prominent supermarket chains such as Aldi, Wal-Mart, Tesco, and Safeway are increasing their organic food offerings. This increased distribution in the retail sector is catering to the demands of health-conscious consumers. Restaurants in developed countries offer organic menus to serve health-conscious consumers. Thus, a strong supply chain in the organic food market further enhances the growth of this industry.

According to the Organic Trade Association, the total organic sales in the US amounted to USD 61.9 billion in 2021, which showed an increase of 12.4% from 2019. Significant growth in the organic food industry worldwide is projected to fuel the growth of the biopesticides market. This trend is projected to continue from 2017 to 2022. The US, China, and Canada were the leading markets for organic food as of 2016.

The organic food & beverages market is also expected to benefit from subsidies, financial aid, and R&D programs conducted by different government and non-government organizations, such as the Research Institute of Organic Agriculture (FiBL) (Switzerland), Agricultural and Processed Food Products Export Development Authority (India), and United States Department of Agriculture (US), to support conventional farmers’ switch to organic farming. Exposure to chemical pesticides can cause a range of neurological health problems such as memory loss, loss of coordination, reduced speed of response to stimuli, reduced visual ability, altered moods, and reduced motor skills. As biopesticides are chemical-free, they do not have any residual effect that harms humans, animals, or the environment. Hence, the market demand for bioinsecticides is increasing with the growing popularity of organic foods and beverages.

Restraint : Technological limitations for the use of biological products

Biological products have a short or limited shelf life and a high probability of contamination. According to an article published in the International Journal of Pharmaceutical & Biological Archives 2015, one of the major problems with agricultural inoculation technology is the survival of microorganisms during storage. The other problematic parameters include exposure to sunlight, culture mediums, physiological state of microorganisms when harvested, temperature maintenance during storage, and water activity of inoculants that have an influence on their shelf life. Another problem with the use of microbial inoculants in the soil is their compatibility with other agricultural products, such as chemical fungicides and herbicides. Some of the major technological constraints with the use of biological products include the following:

- Use of improper and inefficient strains for production

- Lack of experienced, skilled, and technical personnel

- Unavailability of high-quality carrier materials or the use of different carrier materials by producers without ascertaining the quality of the material

- Short shelf life due to the influence of various abiotic and biotic stress factors

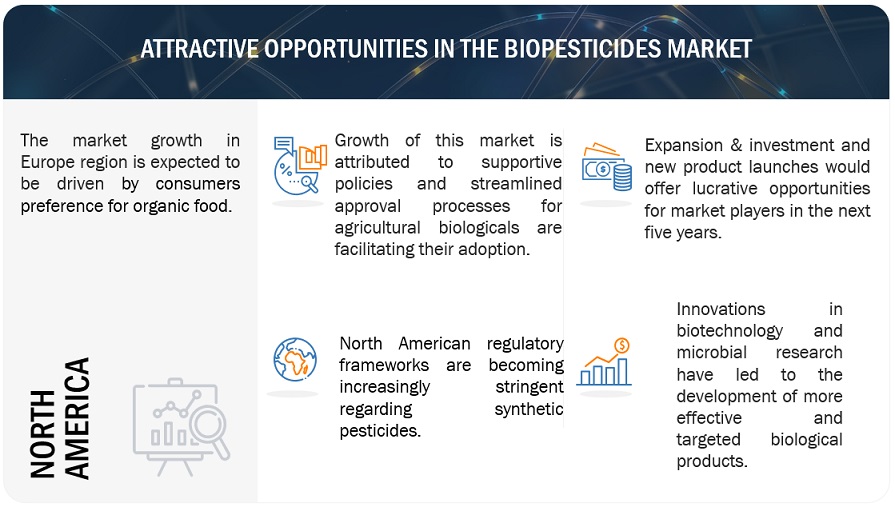

Opportunity: Growth opportunities in developing regions such as Asia Pacific and South America

According to FAOSTAT, China, India, Brazil, and Argentina have emerged as major consumers of pesticides. The demand for food has risen in these regions due to factors such as population growth, the expansion of middle-class families, and increased disposable income. Consequently, the use of pesticides has increased to achieve higher crop yields. However, pollution and soil contamination, along with concerns about the harmful effects of chemical pesticides on the food chain, have become significant issues in these areas. To address these concerns, governments are promoting the adoption of integrated pest management practices.

Several factors influence the adoption of biopesticides in these regions. These include the availability of biopesticide products, the extent of organic farming, awareness levels among farmers, the cultivation of high-value cash crops, and effective promotion and marketing of biopesticides.

In countries like India and China, where farmers typically have smaller landholdings and face economic challenges, government agencies provide subsidies and implement favorable regulatory policies to support large-scale production and encourage the use of biopesticides. A similar trend is observed in South America. The biopesticide market in these regions presents opportunities for new entrants due to a relatively small number of producers and low entry barriers. Major players in the agricultural sector are already investing in emerging markets within these regions. As awareness among farmers about the benefits of biopesticide applications continues to grow, the consumption of biopesticides is expected to increase in the Asia Pacific and South American regions.

Challenge: Preference for chemical pesticides among farmers in developing countries

The crop protection industry has experienced significant growth in recent decades. According to Phillip McDougall's 2018 report on the Evolution of the Crop Protection Industry since 1960, there are over 600 active ingredients available to farmers globally, distributed across more than 40 chemical groups. These chemical groups offer diverse modes of action to combat resistance issues associated with insecticides, herbicides, and fungicides.

While the demand for conventional pesticides remains strong, the introduction of new products has slowed down. Farmers continue to show a preference for conventional pesticides due to their well-established market presence, resulting in steady growth. However, there is an increasing awareness of biological crop protection in developing countries, which has helped identify registered products and dispel misconceptions about counterfeit or spurious biopesticides. Despite this progress, farmers remain cautious about adopting biologicals due to their reliance on chemical pesticides. There is a perception among farmers that chemical pesticides provide higher yields and greater efficiency. Additionally, many farmers believe that biological crop protection products are costlier and take longer to show effects compared to their conventional counterparts. These factors pose significant challenges to the widespread adoption of biopesticides.

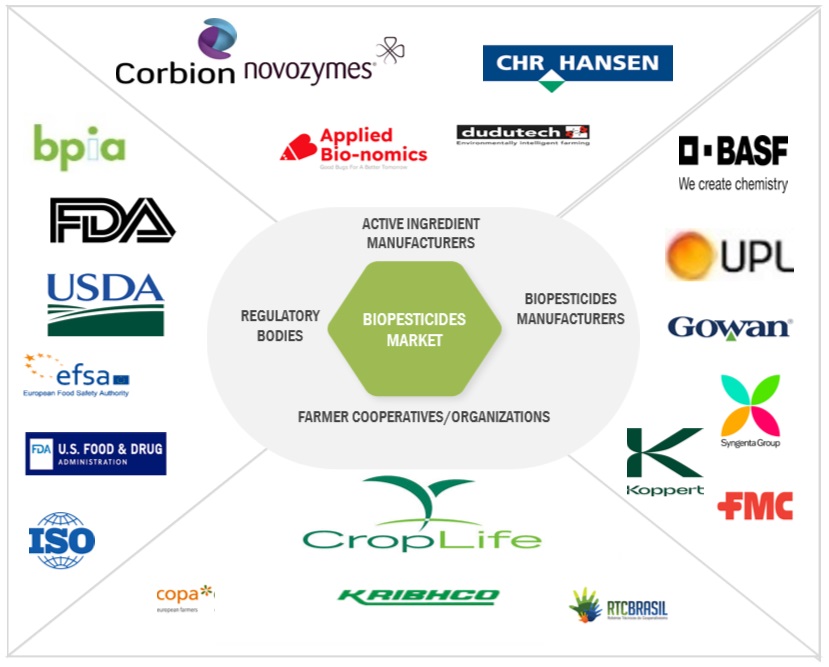

Biopesticides Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of biopesticides. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), UPL Limited (India), FMC Corporation (US), Pro Farm Group Inc. (US), Novozymes (Denmark), Nufarm (Australia), Isagro S.p.A (Italy), Certis USA L.L.C. (US), Koppert (Netherlands), Biobest Group NV (Belgium), SOM Phytopharma (India) Limited (India), Valent BioSciences LLC (US) and STK Bio-Ag Technologies (Israel).

Adoption of foliar application is projected to drive the demand for biopesticides market

The foliar segment refers to the application of biopesticides products directly to the leaves of the grass plant. This method of application has become increasingly popular in recent years as it allows for more targeted and efficient use of inputs.

One way in which the foliar segment is helping to grow the biopesticides market is by improving the effectiveness of biopesticides products. When applied directly to the leaves of the grass plant, these products can be absorbed more quickly and efficiently, allowing for faster results and better overall performance.

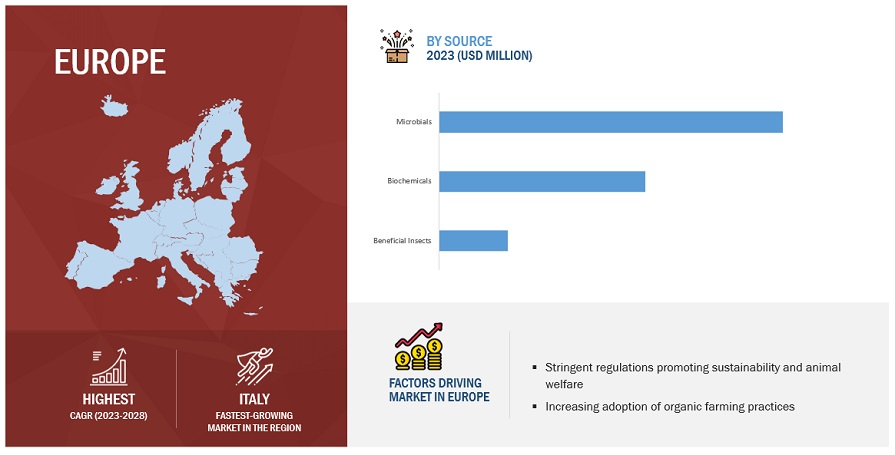

Use of microbial products in biopesticides is expected to boost the market growth

The use of microbial products is anticipated to be a key driver for the biopesticides market. Microbial, including bacteria, fungi, viruses, and protozoa, play a vital role in the development of biopesticides. These microorganisms can act as natural enemies of pests, either by directly infecting and killing them or by interfering with their life cycles and behavior. Microbial-based biopesticides offer several advantages over traditional chemical pesticides. They are highly specific in their action, targeting only the pests they are designed to control while leaving beneficial insects and organisms unharmed. This targeted approach helps preserve the ecological balance and reduces the risk of resistance development in pests. Additionally, microbial products have a lower environmental impact, as they degrade naturally without leaving harmful residues in the soil, water, or air.

Europe is expected to hold a significant market share during the forecast period

Countries such as the France, Germany, Spain, Italy, UK, Netherlands, Russia and Rest of Europe have been considered in this study. Biopesticides refer to the use of various products and techniques to protect crops from damage caused by environmental factors, heavy foot traffic, and other factors. The demand for biopesticides is driven by several factors, including Biopesticides offer a safer and more sustainable alternative for pest control in agriculture and the increasing adoption of organic farming practices, driven by consumer demand for chemical-free food and sustainable agricultural practices, has boosted the demand for biopesticides.

The demand for biopesticides is particularly strong in developed countries with large and growing sports and landscaping industries. For example, in France, the demand for biopesticides is driving due to governments and regulatory bodies are imposing stricter regulations on the use of synthetic pesticides due to their potential adverse effects. This has created a favorable environment for the biopesticides market to flourish.

Key Market Players

The key players in this include BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), UPL Limited (India), FMC Corporation (US), Marrone Bio Innovations, Inc. (US), Novozymes (Denmark), Nufarm (Australia), Isagro S.p.A (Italy), Certis USA L.L.C. (US), Koppert (Netherlands), Biobest Group NV (Belgium), SOM Phytopharma (India) Limited (India), Valent BioSciences LLC (US) and STK Bio-Ag Technologies (Israel). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Crop Type, Source, Mode of Application, Formulation, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

This research report categorizes the biopesticides market, based on type, crop type, source, mode of application, formulation, and region.

Target Audience

- Biopesticide traders, retailers, and distributors

- Agriculture pesticide manufacturers & suppliers

- Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA government agencies & NGOs, and other regulatory bodies

- Regulatory bodies, including government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Government and research organizations

- Venture capitalists and investors

- Technology providers to biopesticide & microbial companies

- Associations and industry bodies

Report Scope:

Biopesticides Market:

By Type

- Bioinsecticides

- Biofungicides

- Bionematicides

- Bioherbicides

- Other Types

By Crop Type

- Cereals & Grains

- Oil Seeds & Pulses

- Fruits & Vegetables

- Other Crop Types

By Source

- Microbials

- Biochemicals

- Beneficial Insects

By Mode of Application

- Seed Treatment

- Soil Treatment

- Foliar Spray

- Other Modes of Applications

By Formulation

- Liquid

- Dry

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In May 2022 UPL Group acquired OptiCHOS, a naturally derived fungicide from BioCHOS, a spin-off of the Norwegian University of Life Sciences. BioCHOS was formulated as a biodegradable broad-spectrum disease control solution with low environmental and human impact. The product acquisition would help UPL expand its NPP portfolio and target markets suitable to the product to address farmers' needs.

- In May 2022, A strategic partnership was announced between UPL limited and AgBiTech, a world leader in ag biologicals innovation. Through this collaboration, UPL would distribute AgBiTech’s biosolutions, starting with two bioinsecticides, Heligen and Fawligen. Through this collaboration, UPL would distribute AgBiTech’s biosolutions, starting with two bioinsecticides, Heligen and Fawligen. This would ultimately help UPL expand its bioinsecticides portfolio.

- In July 2021, BASF SE announced the introduction of Encartis, a new dual-active fungicide for golf course superintendents, turfgrass managers, and lawn care operators. Encartis combines the active ingredients of Intrinsic and Xzemplar fungicides, delivering a powerful tool for the control of turfgrass diseases, including anthracnose, brown patch, and dollar spot. This product launch expanded the company’s product portfolio for the turf protection market.

- In April 2021, FMC introduced its new brand, Biológicos da FMC, on a global scale during Brazil's National Biological Week in March. The launch comprised various activities, including an industry event that facilitated the exchange of insights and knowledge regarding management and trends in the Brazilian biological market.

- In February 2021, FMC Corporation entered a strategic collaboration with Novozymes to co-develop and commercialize biological enzyme-based crop protection solutions targeting fungal and insect pests. The companies would combine their respective R&D facilities with FMC and Novozymes serving as commercial and manufacturing partners.

Frequently Asked Questions (FAQ):

Which are the major companies in the biopesticides market? What are their major strategies to strengthen their market presence?

The key players in this include BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), UPL Limited (India), FMC Corporation (US), Marrone Bio Innovations, Inc. (US), Novozymes (Denmark), Nufarm (Australia), Isagro S.p.A (Italy), Certis USA L.L.C. (US), Koppert (Netherlands), Biobest Group NV (Belgium), SOM Phytopharma (India) Limited (India), Valent BioSciences LLC (US) and STK Bio-Ag Technologies (Israel). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the biopesticides market?

The biopesticides market is expected to witness significant growth in the future with an increasing trend of integrated pest management. Developing markets such as China, Brazil, Argentina, and India are emerging as growth prospects for biopesticides fueled by increasing investments in the agriculture sector. However, lack of awareness of biopesticides in developing countries will hamper the growth of this market during the forecast period.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2022, showcasing strong demand from biopesticides products in the region. As consumers become more health-conscious and environmentally aware, there is a growing demand for biopesticides. Biopesticides products are expected to grow in the coming years, driven by increasing population and changing lifestyle. Mexico has a significant market for biopesticides due to its large agricultural sector and a growing demand for organic agricultural produce.

Which are the key technology trends prevailing in the biopesticides market?

The development and use of biopesticides may be revolutionized by nanotechnology. These tiny particles may have properties like larger surface area, better solubility, and higher stability. Using nanotechnology in crop protection has several benefits, like improved delivery of the active components to the desired pests or illnesses.

What is the total CAGR expected to be recorded for the biopesticides market during 2023-2028?

The CAGR is expected to record a CAGR of 15.9 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

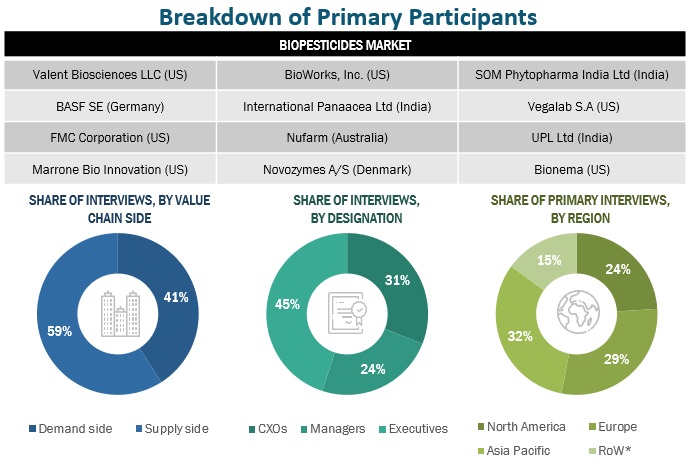

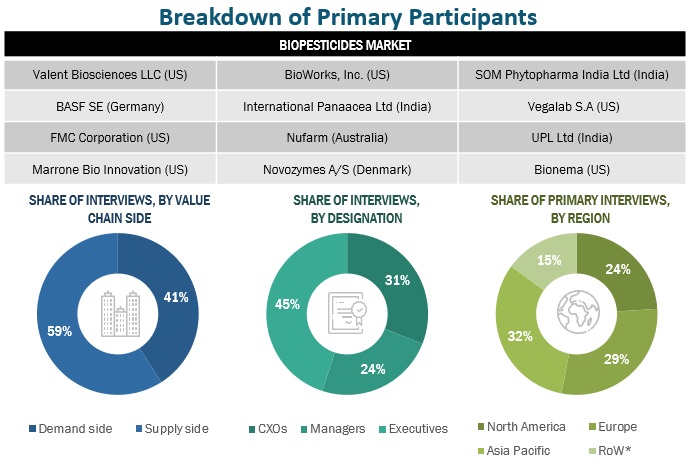

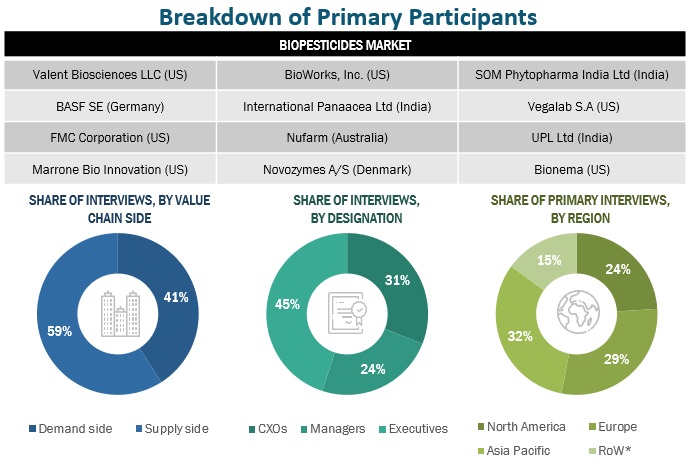

The study involved four major activities in estimating the current size of the biopesticides market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biopesticides market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, agriculture journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biopesticides market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the biopesticides market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to types of biopesticides, type, mode of application, source, formulation, crop type, and region. Stakeholders from the demand side, such as opinion leaders, growers, farmers, and agronomists who are using biopesticides were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of biopesticides and the future outlook of their business which will affect the overall market

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biopesticides market. These approaches were also used extensively to determine the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The parent market—the crop protection market—was considered further to validate the details of the biopesticides market

Global Biopesticides Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biopesticides Market: Top-Down Approach

With the data triangulation procedure done both through the bottom-up approach (demand side, by type segment) and top-down approach (supply side, by competitor sales revenues), and validation of data through primaries, the overall size of the parent market size and size of each market were determined.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall biopesticides market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Biopesticides have pesticidal properties that originate from natural living organisms, including microorganisms, plants, and animals. Biopesticides are gaining prominence due to their safer and ecofriendly nature.

The Environmental Protection Agency has defined Biopesticides as follows:

“Biopesticides include naturally occurring substances that control pests (biochemical pesticides), microorganisms that control pests (microbial pesticides), and pesticidal substances produced by plants containing added genetic material (plant-incorporated protectants) or PIPs. “

Key Stakeholders

- Agriculture pesticide manufacturers & suppliers

- Associations and industry bodies

- Biopesticide manufacturers & suppliers

- Biopesticide traders, retailers, and distributors

- Commercial research & development (R&D) institutions

- Venture capitalists and investors

- Government, regulatory bodies, and research organizations

- Technology providers to biopesticide & microbial companies

- Public hygiene organizations, government regulatory institutions, and food safety agencies

- Associations and industry bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the biopesticides market, based on type, formulation, mode of application, source, crop type, and regional markets, over a five-year period, ranging from 2023 to 2028

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the biopesticides market

- Determining the share of key players operating in the biopesticides market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying major growth strategies adopted by the key companies

- Analyzing the patents registered and regulatory frameworks across the regions and their impact on prominent market players

- Analyzing the market dynamics and competitive situations & trends across the regions and their impact on prominent market players

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Greece, Poland, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific into New Zealand and Vietnam.

- Further breakdown of the Rest of South America into Colombia, Paraguay, Peru, and other South American countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biopesticides Market

Looking for global biopesticides market and African share in consumption of biopesticides.

Want to develop an understanding regarding the global trend of Biopesticide - especially bacteria and microbials.

In addition to the sample report, I would like to know if you can provide the integrated table showing the market size of Beauveria Bassiana by soil treatment to berries in US.

Interested in the global biopesticide market

Want to know a detailed information about bio-insecticide.

By 2013/2014 Brazilian crop season a great amount of Dipel biospesticide was used against Helicoverpa armigera outbreaks. This represents a significant increase in Bacillus thuringiensis based biopesticides worldwide. I would like to know how important was this event to the whole biopesticide market.

Interested in the Indian market for Bacillus thuringiensis.

Need information on the availability, mode of action and application of biopesticides in the UK.

Need information on the availability, mode of action and application of biopesticides in the UK.

I would like to know the market outlook of microbial-based pesticides.

Looking for information regarding growth of global biopesticides market.

Interested in the global biopesticide market

Looking for the bio pesticides (Bio-herbicides, Bio-insecticides, Bio-fungicides and others) details falong with bio pesticides list, explaining the active ingredient, doses, targeted crop, and targeted pest, mode of action, using methodology and price.

Interested in knowing the market potential for bio-oil from tobacco stem as biopesticide.

Interested in Global Biopesticides Market

Interested in global statistics of biopesticide market

Very useful and interesting information. Thank you for your effort!

Interested in obtaining the sales data of OBERÓN and REQUIEM biopesticides.

Need information on Biopesticide market in Vietnam with deep dive on Key critical factors of the industry; key player profiles; value chain analysis and business models

Interested in knowing about products offered by various companies in the market

Im looking for some data about biopesticides sales in Brazil in the last 10 years.

Need a profound analysis on Brazil´s market for biopesticides and agrochemicals that can be combined with biopesticides.