Agricultural Microbials Market

Agricultural Microbials Market by Function (Soil Amendment and Crop Protection), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Type (Bacteria, Fungi, Virus, Protozoa), Application, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market for agricultural microbials is estimated to be USD 9.45 billion in 2025 and is projected to register a CAGR of 14.7% from 2025 to 2030, reaching USD 18.75 billion by 2030. The use of agricultural microbial products is highly increased globally, specifically in European and American regions.

KEY TAKEAWAYS

- North America dominated the agriculture microbials market, with a share of 34.3% in 2024.

- By function, the crop protection segment is expected to register the highest CAGR of 15.3%.

- By type, the fungi segment is projected to grow at the fastest rate from 2025 to 2030.

- By mode of application, the seed treatment segment will grow at the fastest rate during the forecast period.

- By formulation, the liquid segment is expected to dominate the market, growing at the highest CAGR of 15.1%.

- By crop type, the fruits & vegetables segment is expected to dominate the market.

- Syngenta Group, Corteva, UPL, and Koppert were identified as Star players in the agricultural microbials market, as they have focused on innovation, have broad industry coverage, and possess strong operational & financial strength.

- IPL Biologicals, Nordic Microbes A/S, Aphea.Bio, BioConsortia, and Andermatt Group AG have distinguished themselves among startups and SMEs due to their strong product portfolios and effective business strategies.

The agricultural microbials market is driven by a combination of factors emphasizing sustainability, efficiency, and environmental safety. The increasing demand for sustainable agricultural practices is a primary driver, as governments and regulatory bodies push for reduced use of synthetic fertilizers and pesticides due to their environmental and health impacts. Microbial solutions offer eco-friendly alternatives that enhance soil health, biodiversity, and crop productivity while reducing chemical inputs. Rising consumer preference for organic and pesticide-free food further boosts the adoption of these products, especially in organic farming.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of agricultural microbials manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in sustainable agriculture

-

Expansion of integrated pest and nutrient management programs

Level

-

Shorter shelf life and complex storage requirements

-

Lack of standardized regulations and quality benchmarks

Level

-

Government support and subsidies

-

Integration with precision agriculture and digital farming platforms

Level

-

Inconsistency and variable performance

-

Low farmer awareness in developing regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in sustainable agriculture

Increasing focus on sustainable agriculture is driving the agricultural microbials market, as farmers and agribusinesses increasingly seek eco-friendly solutions to comply with regulations and the increasing demand of consumers for sustainable food production. Agricultural microbials, including biopesticides, biofertilizers, and biostimulants, offer alternative methods of using organic and natural means in controlling pests and diseases, thus keeping crops healthy, fertility of the soil, and reducing the impact on the environment. Policies such as the European Union's Farm to Fork Strategy and the Common Agricultural Policy (CAP) are important for transitioning to sustainable food systems. The policy seeks to ensure that 25% of EU agricultural land is under organic farming by 2030, significantly increase organic aquaculture, and reduce nutrient losses by 50%, with a 20% reduction in fertilizer use by the same year. Moreover, international efforts have been made toward the sustainability of agriculture. For example, in March 2024, Ecuador, India, Kenya, Laos, the Philippines, Uruguay, and Vietnam launched a USD 379 million program funded by the Global Environment Facility. Supported by UNEP, UNDP, UNIDO, and the African Development Bank, the initiative seeks to reduce pollution due to pesticides and plastics in agriculture, thereby fueling the need for microbial technologies as a sustainable option.

Restraint: Shorter shelf life and complex storage requirements

One of the restraints in the agricultural microbials market is the short shelf life and intricate storage needs of microbial products. In contrast to synthetic agrochemicals, microbials are made up of living organisms that need controlled conditions, such as optimal temperature, humidity, and protection from environmental stressors, to maintain their effectiveness. These products' quality and efficacy begin to degrade when not stored appropriately, thus being less reliable for agricultural use. For example, the shelf life of effective microorganisms decreases rapidly after 60-75 days of storage; their shelf life is hardly more than three months. In addition to storage problems, microbial products are also susceptible to biotic factors, such as field conditions, temperature, and competition for microbes in the field, which may persistently reduce their activity. Such limitations make logistical supply more complicated, especially for those regions without a cold chain network that has a proper capacity for the suppliers to raise costs.

Opportunity: Government support and subsidies

Governmental support along with subsidies help propel the development in agricultural microbials through fostering sustainable practices and reducing usage of synthetic chemical, and with initiatives like Europe's Farm-to-Fork strategy the food, along with agribusiness is reformed on more ecological lines. The policy has set targets, such as 50% reduced pesticide use and organic farming areas that are at least 25% of the total agricultural area by 2030. These are the types of goals that support the adoption of microbial solutions. That aligns well with the overall aims of the strategy for minimizing the environment footprint and increasing the healthiness of the soil. International organizations and programs, such as the Global Environment Facility (GEF), United Nations Environment Programme (UNEP), as well as multiple regional agricultural development programs, continue to finance programs that support use of microbial products in sustainable farm systems. Such broad governmental support lowers financial barriers for adopting agricultural microbials while promoting innovation and market expansion, thereby increasing accessibility for farmers across the globe.

Challenge: Inconsistency and variable performance

Inconsistencies in field performances plague the agricultural microbials market because these products are living organisms whose effectiveness is dramatically manipulated by a myriad of biotic and abiotic factors found on farms. The bacteria and other microorganisms' performance depends on such factors as soil type, pH level, temperature, moisture level, and competing microbes. For example, a microbial inoculant may provide optimal performance under controlled conditions, but such performance may not be produced in diverse field conditions where drought, excessive rainfall, extreme temperatures might negatively affect activity. Variability in the soil microbial community and nutrient availability may also influence the performance of introduced microorganisms.

Agricultural Micraobials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses microbial-treated crops in coffee and dairy sourcing to enhance soil health. | Improves soil fertility and supports regenerative sourcing goals. |

|

Applies microbial inputs in potato and corn supply chains. | Boosts yield, reduces fertilizer use, and improves water efficiency. |

|

Sources grains from farms using microbial biostimulants. | Strengthens soil microbiome and supports regenerative practices. |

|

Advanced aluminum-lithium alloys in military aircraft structures. | Enhanced durability, lower structural weight, and improved payload capacity. |

|

Integrates microbials in feed and crop production for dairy farms. | Enhances soil organic matter and reduces carbon footprint. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of agricultural microbials. These companies have been operational in the market for more than a decade and have diversified portfolios, latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Corteva (US), and FMC Corporation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Agricultural Microbials Market, By Function

The crop protection segment holds the largest market share in the agricultural microbials market, driven by the increasing need for effective and sustainable solutions to combat pests, diseases, and weeds. Microbials are widely adopted in this segment due to their ability to target specific pathogens and pests while being environmentally friendly and residue-free. The rising prevalence of crop losses caused by biotic stressors, coupled with stringent regulations on chemical pesticides, has further fueled the demand for microbial-based crop protection products. Additionally, advancements in microbial formulations and growing awareness among farmers about their long-term benefits have solidified the dominance of this segment.

Agricultural Microbials Market, By Type

Bacteria dominate the agricultural microbials market, holding the highest market share due to their extensive application in promoting plant growth, enhancing nutrient availability, and providing effective pest and disease control. Bacterial strains, such as Bacillus and Pseudomonas, are widely used for their ability to fix nitrogen, solubilize phosphorus, and produce bioactive compounds that improve crop yield and resilience. The versatility, cost-effectiveness, and ease of formulation of bacterial-based products have made them a preferred choice among farmers. Furthermore, advancements in microbial research and increased adoption of sustainable farming practices have further solidified bacteria's leading position in the market.

Agricultural Microbials Market, By Application

Foliar spray holds the highest share in the application segment of the agricultural microbials market, driven by its efficiency in delivering nutrients and microbial solutions directly to plant leaves for rapid absorption and immediate effect. This method is widely preferred for its ability to enhance plant health, improve resistance to pests and diseases, and optimize crop yield with minimal resource wastage. The ease of application, compatibility with other agrochemicals, and suitability for various crop types further contribute to its dominance in the market. Additionally, the growing focus on precision farming techniques has increased the adoption of foliar spray methods, solidifying their leading position in this segment.

Agricultural Microbials Market, By Formulation

Liquid formulation holds the highest share in the agricultural microbials market due to its ease of application, uniform coverage, and compatibility with existing farming equipment, such as sprayers and irrigation systems. These formulations are highly effective in delivering active microbial ingredients to crops, ensuring better absorption and faster results. The growing preference for liquid formulations is further driven by their extended shelf life, ease of storage, and suitability for various application methods, including foliar spray, seed treatment, and soil drenching. Additionally, advancements in formulation technologies have enhanced the stability and efficacy of liquid microbial products, solidifying their leading position in the market.

Agricultural Microbials Market, By Crop Type

Fruits and vegetables hold the highest market share in the agricultural microbials market, driven by the rising demand for high-value crops and the need to improve their yield, quality, and shelf life. The perishability and susceptibility of fruits and vegetables to pests, diseases, and nutrient deficiencies have increased the adoption of microbial solutions that enhance plant health and resilience. Additionally, the growing consumer preference for organic and residue-free produce, coupled with stringent food safety regulations, has further fueled the demand for microbial products in this segment. This trend is supported by advancements in microbial formulations tailored to address the specific needs of fruit and vegetable crops, ensuring their dominance in the market.

REGION

Europe to be fastest-growing region in global agricultural microbials market during forecast period

Europe is growing at highest rate due to rise in sustainable agriculture and increase in organic farming in the region. Government initiatives like The Farm to Fork Strategy and The Common Agricultural Policy (CAP) is driving the agricultural microbials market, for example the Farm to Fork Strategy establishes a target of reducing pesticide use by 50% and of bringing 25% of agricultural land under organic farming by 2030 and CAP provides subsidies for sustainable agriculture. Germany, France, Spain, and Italy are ahead of the rest in taking all the measures as consumers are looking more and more towards residue-free, organic produce, to which compliance by farmers has seen a great uptake of biopesticides, biofertilizers, and biostimulants. Advances in research and technology related to microorganisms, along with government support and subsidies, have been the key drivers of innovation and increased availability of products in the region. Awareness of soil health and the contribution of microbials to increasing soil fertility and crop resilience to environmental stresses has also increased demand. Europe's mature agricultural infrastructure and strong distribution networks enable the swift uptake of microbial products.

Agricultural Micraobials Market: COMPANY EVALUATION MATRIX

In the agricultural microbials market matrix, Syngenta (Star) leads the market with its comprehensive portfolio of plant health solutions, including seaweed extracts, microbial biostimulants, and nutrient-enhancing products that enable growers to improve crop resilience, yield, and sustainability outcomes. Novonesis Group (Emerging Leader), meanwhile, is emerging as a strong player by expanding its range of microbial solutions, focusing on innovative formulations, precision application technologies, and environmental sustainability, positioning itself as a key innovator in modern crop management practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.27 Billion |

| Market Forecast in 2030 (value) | USD 18.75 Billion |

| Growth Rate | CAGR of 14.7% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Agricultural Micraobials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Agricultural Microbials Manufacturers |

|

|

| Asia-Pacific Agricultural Microbials Innovators |

|

|

| Global Agricultural Microbials Distributor |

|

|

RECENT DEVELOPMENTS

- December 2024 : Koppert, and Amoéba, a Greentech company specializing in microbiological solutions, announced partnership to introduce an innovative biofungicide, AXPERA. Based on Amoéba's patented amoeba lysate technology, AXPERA is designed to combat fungal diseases effectively.

- May 2024 : Bioceres Crop Solutions Corp announced that Brazil's Ministry of Agriculture and Livestock (MAPA - Ministério da Agricultura e Pecuária) has approved three new bio-insecticidal and bio-nematocidal solutions derived from inactivated cells of the company’s proprietary Burkholderia platform.

- April 2024 : Bayer signed an agreement with UK-based AlphaBio Control on a new biological insecticide. This strategic move should strengthen Bayer's product portfolio. This new insecticide will be the first of its kind made available for arable crops, such as oilseed, rapeseed, and cereals, enabling Bayer to enhance its offerings in the field of sustainable crop protection.

- March 2024 : BASF invested in building a new fermentation plant for biological and biotechnology-based crop protection products at the Ludwigshafen site. The plant is expected to start operating in the second half of 2025. It will include microbial fungicides and seed treatments, among other valuable products, to help farmers.

Table of Contents

Methodology

The study involved two major approaches in estimating the current size of the agricultural microbials market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural microbials market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to agricultural microbials type, function, formulation, crop type, application, and region. Stakeholders from the demand side, such as research institutions and universities agrochemical distributors and retailers, and food processing companies were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of agricultural microbials and the outlook of their business, which will affect the overall market.

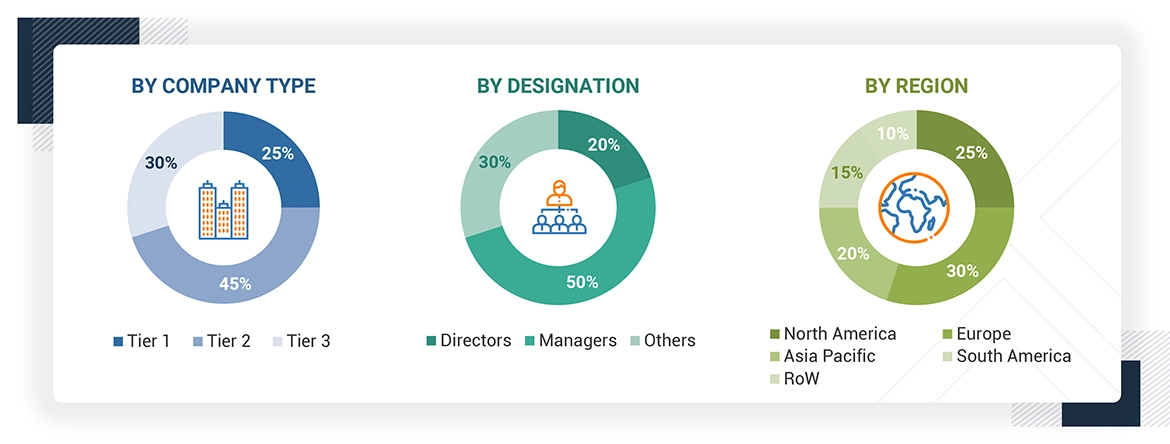

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD

1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Koppert (Netherlands) |

General Manager |

|

BASF SE (Germany) |

Sales Manager |

|

Bayer AG (Germany) |

Manager |

|

BioConsortia (US) |

Sales Manager |

|

IPL Biologicals (India) |

Marketing Manager |

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

Market Size Estimation Methodology- Top-down approach

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural microbials market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Agricultural Microbials Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agricultural microbials market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the European Commission, “biological plant protection products contain micro-organisms which provide farmers with tools to substitute chemical plant protection products. Biological plant protection products can be used in organic agriculture, thereby presenting new sustainable alternatives available to EU organic farmers for controlling plant pests.”

Agricultural microbials are a group of agricultural products that include active ingredients of microbial origin, which may be bacteria, fungi, viruses, or protozoa. They cover a wide range of applications that include not only soil amendments for enhancing soil health and ecology but also crop protection to improve plant immunity and resistance to many pests and diseases, thus providing a holistic approach toward crop health. They significantly contribute to plant health by improving processes such as efficient nutrient uptake, disease resistance, pest protection, and improved immunity under stress and drought conditions.

Stakeholders

- Key manufacturers of microbial pesticides, microbial fertilizers, and microbial biostimulants

- Key companies in the agricultural microbials market

- Traders, distributors, and suppliers in the agricultural microbials market

- Technology providers to agricultural microbial companies

- Farmer organizations and crop protection product manufacturers

- Associations and industry bodies such as the Food and Agriculture Organization (FAO), Biopesticide Industry Alliance (BPIA), International Biocontrol Manufacturers Association (IBMA), and Association of American Plant Food Control Officials (AAPFCO)

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

Report Objectives

MARKET INTELLIGENCE

- To determine and project the size of the agricultural microbials market with respect to the type, function, formulation, application, crop type, and regions in terms of value over five years, ranging from 2025 to 2030.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the agricultural microbials market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe agricultural microbials market into key countries.

- Further breakdown of the Rest of Asia Pacific agricultural microbials market into key countries.

- Further breakdown of the Rest of South America agricultural microbials market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of agricultural microbials market?

The agricultural microbials market is estimated to be USD 9.45 billion in 2025 and is projected to reach USD 18.75 billion by 2030, registering a CAGR of 14.7% during the forecast period.

Which are the key players in the market, and how intense is the competition?

BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Corteva (US), and FMC Corporation are some of the key market players.

The market for agricultural microbials is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the agricultural microbials market?

North America holds highest share in agricultural microbials market due to increasing needs for sustainable farm solutions, upsurge organic farming practices in place, as well as rise in soil health concerns. Increasing controls over synthetic agrochemical usage along with ever-increasing concern among consumers who seek residue free and organic farm produce has greatly driven the increased adoption of such microbial-based agricultural solutions such as biopesticides and biofertilizers. Other growth factors for the market in the region include advancement in microbial research, strong government support, and the presence of key market players.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the agricultural microbials market?

Increasing demand for sustainable and organic agricultural practices, strict regulations on synthetic pesticides, and growing consumer awareness regarding environmental and health effects have favored the switch to eco-friendly alternatives.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agricultural Microbials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agricultural Microbials Market