Biosurgery Market Size, Growth by Product Type (Sealants, Hemostats, Adhesion Barrier, Soft Tissue Attachments, Biological Meshes, DBM, Bone Graft Substitutes), Application (Orthopedic, Cardiovascular), End User (Hospitals, Clinics) - Global Forecasts to 2026

The biosurgery market size is projected to reach USD 16.0 billion by 2026, at a CAGR of 5.7%. Growth in this market is majorly driven by the growing prevalence and incidence of various disorders such as obesity and CVD, increasing incidence of trauma, and growth in the number of accidents and sports-related injuries. Also, the need to manage blood loss in patients and R&D being undertaken to bring innovative products to the market are aiding the market growth. On the other hand, the high cost of these products is expected to restrain the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Biosurgery Market Growth Dynamics

Growth Drivers: Increasing volume of surgeries and growing prevalence of severe trauma injuries

Adhesion formation is a major post-surgical complication, which results in healthcare complications and generally requires repeat surgeries for the treatment of affected patients. Post-surgical adhesion formation leads to different complications in different surgeries, such as severe abdominal pain in the case of abdominal surgeries, infertility in women after gynecological surgeries, and physical impairment of patients after neurological surgeries. Considering the severe effects of post-surgery adhesion formation in patients, the importance of products such as adhesion barriers is increasing in the market. Also, considering the growth in the number of surgeries performed globally, the importance of these products will be more pronounced in the coming years.

Growth Opportunities: Growing adoption of advanced biosurgery products in emerging markets

The penetration of biosurgery products is increasing across emerging countries, specifically based in the Asia Pacific, Latin America, and the Middle East and Africa. In the coming years, countries such as China, India, and Brazil are expected to offer significant growth opportunities for players operating in the biosurgery market. This is because the markets in these countries are characterized by a large patient base for target indications (such as cardiovascular, orthopedic, general/abdominal, and gynecological disorders), rising health awareness, growing healthcare expenditure, rising medical tourism, and rapidly developing healthcare infrastructure. Over the last few decades, countries such as India and Malaysia have emerged as hubs for medical tourism. This is because the cost of medical procedures across these emerging countries is significantly less in comparison to developed countries such as the US, Germany, France, and the UK. Moreover, government agencies in several Asia Pacific and Middle East countries are undertaking initiatives to support their respective healthcare systems, which is providing lucrative growth opportunities to the biosurgery product manufacturers across emerging countries.

Restraints: High price of biosurgery products and the rising cost of surgical procedures

The biosurgery market is extremely competitive in terms of pricing, owing to the high competitive intensity among existing players. Most of the products available in this market are priced at a premium. The high cost, coupled with the unfavorable reimbursement scenario for these products in emerging countries, makes them unaffordable for a large section of the target patient population. Due to the high cost of biosurgery products, conventional procedures such as sutures and ligature-based procedures are preferred during surgeries across emerging countries. Also, the biosurgery products currently available in the market are made of complicated reconstitutes with a poor shelf life. Hence, there is a growing need for low-priced products that are easy to handle and have a better shelf life.

Challenges: Stringent regulatory framework

The development of new biosurgery products requires significant investments, and new products generally take more than 7–8 years for gaining marketing approval. For instance, in the US, the FDA has made it mandatory for biosurgery product manufacturers to obtain Premarket Approval (PMA) for their products before they are introduced in the market. For this, the product has to demonstrate proper clinical trial data, which has to be submitted along with the application for PMA. The cost and time required for a product to enter the clinical trial step and then clear the clinical trials are very high, with minimum chances of the product gaining approval. Also, the possibility of obtaining clinically significant data showing clinical trial clearance has been low for biosurgery products such as adhesion barriers, semi-synthetic sealants, and hemostatic agents. Biosurgery products such as hemostats are considered Class III products, owing to which these products require strict adherence to regulatory guidelines. Hence, despite huge investments in R&D, the risk of failure is very high in the case of biosurgery products. This is a major factor limiting the development of novel biosurgery products in the market.

The bone graft substitutes dominates the product segment in biosurgery market

Based on the product, the bone graft substitute segment accounted for the largest share of the global market in 2020. The large share of this segment is attributed to the increasing use of bone-graft substitutes across different types of orthopedic surgeries as they reduce surgical time.

The reconstructive surgery is expected to show fast growth in the biosurgery market, by application

Based on application, the reconstructive surgery is expected to grow at the highest CAGR. This is due to the increasing adoption of biosurgery products for cosmetic procedures and burn treatment surgeries. The increasing number of facial cosmetic surgeries, increasing cases of skin injuries, growing incidence of burn injuries, and an increasing number of breast cancer patients undergoing mastectomy and breast reconstruction procedures are the major factors driving the growth of this application segment.

Hospitals segment accounted for the largest share of the biosurgery market, in 2020

The biosurgery market, by end-user, is segmented into hospitals, clinics and others. The hospital segment accounted for the largest market share in 2020. This is primarily attributed to the increasing number of surgeries taking place across the globe due to the rising geriatric population and the incidence of various diseases. Moreover, the increasing need to control blood loss and achieve efficient hemostasis and wound closure in trauma cases, injuries, or surgical procedures is leading to the increasing adoption of biosurgery products by surgeons.

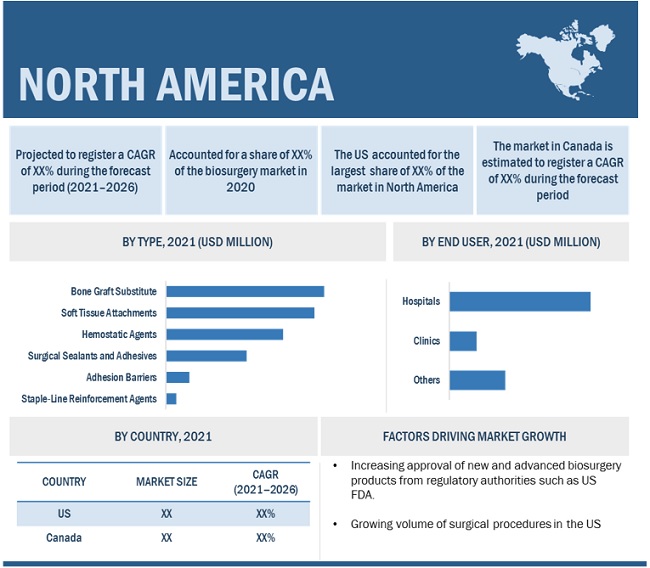

North America accounted for the largest share of the biosurgery market in 2020

In 2020, North America accounted for the largest share of the global market, followed by Europe, Asia Pacific, Latin America, and Middle East & Africa. The large share of the North American market is attributed to the presence of an advanced healthcare system in the region, high and growing number of surgical procedures, higher adoption of advanced products, and the presence of several leading market players in the US.

To know about the assumptions considered for the study, download the pdf brochure

Biosurgery Market Key Players

The prominent players in this market are Johnson & Johnson (US), Baxter International Inc. (US), Medtronic Plc (Ireland), Becton, Dickinson & Co. (US), B. Braun Melsungen AG (Germany), Stryker Corp. (US), Integra Lifesciences Holdings Corp. (US), CSL Ltd. (Australia), Hemostasis LLC. (US), Pfizer Inc. (US), Cyrolife Inc. (US), Zimmer Biomet (US), Kuros Biosciences AG (Switzerland), Orthofix Medical Inc. (US), and Smiths & Nephew Plc. (UK).

Biosurgery Market Scope

|

Report Metrics |

Details |

|

Market Size value 2026 |

USD 16.0 Billion |

|

Growth Rate |

5.7% CAGR |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Forecasts up to |

2026 |

|

Market Segmentation |

Product, Application, End User, And Regional And Global Level |

|

Biosurgery Market Growth Drivers |

Increasing volume of surgeries and growing prevalence of severe trauma injuries |

|

Biosurgery Market Growth Opportunities |

Growing adoption of advanced biosurgery products in emerging markets |

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

The study categorizes the biosurgery market based on product, application, end user, and regional and global level.

By Product

-

Bone Graft Substitutes

- Demineralized bone matrix

- Synthetic Bone Grafts

- Bone Morphogenetic Proteins

- Other Bone-Graft Substitutes

-

Soft-tissue attachments

- Synthetic meshes

-

Biological meshes

- Allografts

- Xenografts

-

Hemostatic agents

- Thrombin-based hemostatic agents

- Oxidized regenerated cellulose-based hemostatic agents

- Combination hemostatic agents

-

Surgical sealants and adhesives

-

Natural/Biological Sealants and Adhesives

-

Natural/Biological Sealants and Adhesives, By Type

- Fibrin Sealants

- Collagen-Based Sealants

- Gelatin-Based Sealants

- Albumin-Based Sealants

- Other Natural/Biological Sealants

-

Natural/Biological Sealants and Adhesives, By Origin

- Human Blood-Based Sealants and Adhesives

- Animal-Based Sealants and Adhesives

-

Natural/Biological Sealants and Adhesives, By Type

-

Synthetic and Semi-Synthetic Sealants and Adhesives

- Peg Hydrogels

- Cyanoacrylate-Based Sealants and Adhesives

- Urethane-Based Sealants and Adhesives

- Other Synthetic and Semi-Synthetic Sealants and Adhesives

-

Natural/Biological Sealants and Adhesives

-

Adhesion Barriers

-

Synthetic Adhesion Barriers

- Hyaluronic Acid-Based Adhesion Barriers

- Regenerated Cellulose-Based Adhesion Barriers

- Peg-Based Adhesion Barriers

- Other Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

- Collagen & Protein Adhesion Barriers

- Fibrin-Based Adhesion Barriers

-

Synthetic Adhesion Barriers

- Staple-Line Reinforcement Agents

By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Urological Surgery

- Thoracic Surgery

- Others

By End User

- Hospitals

- Clinics

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Switzerland

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments:

- In February 2020, Baxter announced 510 (k) clearance from US FDA for Peri-Strips Dry with Veritas Collagen Matrix product with Secure Grip. The product is a staple line reinforcement agent and is indicated for mitigating the bleeding during bariatric surgeries and other surgical procedures.

- In February 2020, Integra LifeSciences Holdings Corp. launched AmnioExcel Plus Placental Allograft Membrane for use across soft tissue repair.

- In October 2020, Orthofix Medical Inc. (US) announced the launch of O-GENESIS Graft Delivery System and AlloQuent Structural Allograft Q-Pack, a ready-to-use cervical and lumbar spacers for allograft procedures.

- In December 2019, Johnson & Johnson announced the launch of next generation sealant solution, VISTASEAL Fibrin Sealant (Human), that helps the surgeons to manage bleeding during surgery.

- In September 2019, Medtronic launched several new procedural solutions for spine surgery, to reinforce company's product portfolio in spine surgeries.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global biosurgery market?

The top market players in the global biosurgery market include Johnson & Johnson (US), Baxter International Inc. (US), Medtronic Plc (Ireland), Becton, Dickinson & Co. (US), B. Braun Melsungen AG (Germany), Stryker Corp. (US), Integra Lifesciences Holdings Corp. (US), CSL Ltd. (Australia), Hemostasis LLC. (US), Pfizer Inc. (US), Cyrolife Inc. (US), Zimmer Biomet (US), Kuros Biosciences AG (Switzerland), Orthofix Medical Inc. (US), and Smiths & Nephew Plc. (UK).

Which products have been included in the biosurgery market report?

This report contains the following biosurgery products:

- Bone-graft substitutes

- Soft-tissue attachements

- Hemostatic agents

- Surgical sealants and adhesives

- Adhesion barriers

- Staple-line reinforcement agents

Which geographical region is dominating in the global biosurgery market?

The global biosurgery market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America is the largest regional market for biosurgery products. The large share of the region can be attributed to the increasing number of healthcare settings, increasing growth in surgeries, presence of significant number of prominent vendors, and highly developed healthcare system. Furthermore, rising prevalence of chronic diseases and favorable reimbursement policies for biosurgery product are also supporting the market growth.

Which is the leading segment by product?

The bone graft substitute segment accounted for the largest market share. The demand for bone graft substitute product such as demineralized bone matrix and allograft is increasing owing to the rising volume of spinal fusion and joint reconstruction and replacement surgeries, improved accessibility towards the latest bone graft substitute products, and low risk of infection. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 50)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKET SEGMENTATION

FIGURE 1 BIOSURGERY MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 56)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

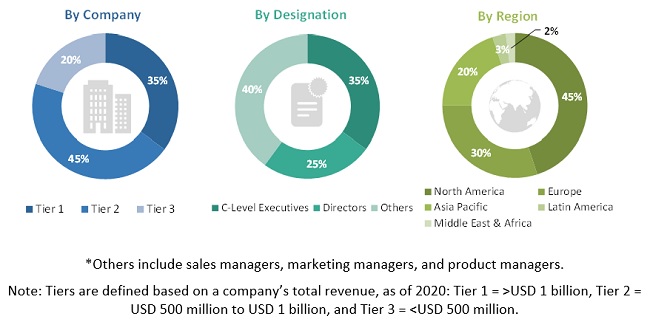

2.2.2.3 Breakdown of primary interviews: Supply-side and demand-side participants

2.2.2.4 Breakdown of primary interviews: By company, designation, and region

2.3 MARKET SIZE ESTIMATION: BIOSURGERY MARKET

FIGURE 3 REVENUE SHARE ANALYSIS – HEMOSTATIC AGENTS MARKET

FIGURE 4 REVENUE SHARE ANALYSIS ILLUSTRATION—BAXTER INTERNATIONAL, INC.

FIGURE 5 REVENUE ANALYSIS OF THE TOP 3 PUBLIC COMPANIES: SURGICAL SEALANTS AND ADHESIVES SEGMENT (2020)

FIGURE 6 BOTTOM-UP APPROACH—SEGMENTAL EXTRAPOLATION

FIGURE 7 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE BIOSURGERY MARKET (2021–2026)

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: BIOSURGERY MARKET

3 EXECUTIVE SUMMARY (Page No. - 70)

FIGURE 10 BIOSURGERY MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 BIOSURGERY MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 BIOSURGERY MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE BIOSURGERY MARKET

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 BIOSURGERY MARKET OVERVIEW

FIGURE 14 INCREASING NEED TO MANAGE BLOOD LOSS IN PATIENTS AND FOCUS ON THE LAUNCH OF NEW PRODUCTS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: BIOSURGERY MARKET FOR NATURAL SEALANTS & ADHESIVES, BY TYPE AND COUNTRY (2020)

FIGURE 15 FIBRIN-BASED SEALANTS & ADHESIVES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 BIOSURGERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.4 BIOSURGERY MARKET, BY REGION (2019–2026)

FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE THE BIOSURGERY MARKET DURING THE FORECAST PERIOD

4.5 BIOSURGERY MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 78)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing volume of surgeries and growing prevalence of severe trauma injuries

TABLE 2 UK: INCREASE IN THE NUMBER OF CARDIAC SURGICAL PROCEDURES PERFORMED

5.2.1.2 Strong focus on R&D leading to the launch of technologically advanced products

5.2.1.3 Rising need for effective blood loss management in patients

5.2.2 MARKET RESTRAINTS

5.2.2.1 High price of biosurgery products and the rising cost of surgical procedures

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Growing use of combination materials for enhancing product efficacy

5.2.3.2 Growing adoption of advanced biosurgery products in emerging markets

TABLE 3 COST OF SURGICAL PROCEDURES: US VS. INDIA (USD)

5.2.3.3 Growing adoption of adhesive dentistry procedures

5.2.4 MARKET CHALLENGES

5.2.4.1 Stringent regulatory framework

5.2.4.2 Requirement of skilled personnel for the effective use of biosurgery products

6 INDUSTRY INSIGHTS (Page No. - 86)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 GROWING FOCUS ON ORGANIC GROWTH STRATEGIES

TABLE 4 NUMBER OF PRODUCT LAUNCHES BY KEY PLAYERS (JANUARY 2018 TO JUNE 2021)

6.2.2 GROWING DEMAND FOR DENTAL BONE-GRAFT SUBSTITUTES

6.2.3 GROWING PREFERENCE FOR GELATIN-BASED ADHESIVES & HYDROGELS IN SURGICAL PROCEDURES

6.2.4 USE OF NANOTECHNOLOGY FOR DEVELOPING NEXT-GENERATION ADHESIVES

6.3 REGULATORY ANALYSIS

TABLE 5 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING BIOSURGERY PRODUCTS

6.3.1 NORTH AMERICA

6.3.1.1 US

TABLE 6 US FDA: CLASSIFICATIONS OF MEDICAL DEVICES

FIGURE 19 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

6.3.1.2 Canada

FIGURE 20 CANADA: CLASS III MEDICAL DEVICES APPROVAL PROCESS

6.3.2 EUROPE

FIGURE 21 EUROPE: CE APPROVAL PROCESS FOR BIOSURGERY PRODUCTS

6.3.3 ASIA PACIFIC

6.3.3.1 Japan

TABLE 7 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

6.3.3.2 China

TABLE 8 NMPA MEDICAL DEVICES CLASSIFICATION

6.3.3.3 India

TABLE 9 INDIA: CLASSIFICATION OF BIOSURGERY PRODUCTS

6.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF SUPPLIERS

6.4.4 BARGAINING POWER OF BUYERS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 PRICING ANALYSIS

TABLE 11 AVERAGE SELLING PRICE FOR BIOSURGERY PRODUCTS

6.6 TECHNOLOGY ANALYSIS

6.7 ECOSYSTEM ANALYSIS

FIGURE 22 BIOSURGERY MARKET: ECOSYSTEM ANALYSIS

6.8 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE MANUFACTURING PHASE

6.9 PATENT ANALYSIS

6.9.1 PATENT PUBLICATION TRENDS FOR BIOSURGERY

FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2011–JUNE 2021)

6.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 25 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR BIOSURGERY PATENTS (JANUARY 2011 TO JUNE 2021)

FIGURE 26 TOP APPLICANT COUNTRIES/REGIONS FOR BIOSURGERY PATENTS (JANUARY 2011 TO JUNE 2021)

TABLE 12 LIST OF FEW PATENTS IN THE BIOSURGERY MARKET, 2020–2021

6.10 COVID-19 IMPACT ON THE BIOSURGERY MARKET

7 BIOSURGERY MARKET, BY PRODUCT (Page No. - 105)

7.1 INTRODUCTION

TABLE 13 BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

7.2 BONE-GRAFT SUBSTITUTES

TABLE 14 GLOBAL MARKET FOR BONE-GRAFT SUBSTITUTES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 15 BIOSURGERY MARKET FOR BONE-GRAFT SUBSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 DEMINERALIZED BONE MATRIX

7.2.1.1 DBM is used extensively as a void filler in joint reconstruction and spinal fusion procedures

TABLE 16 MAJOR PRODUCTS IN THE DBM MARKET

TABLE 17 DEMINERALIZED BONE MATRIX MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 SYNTHETIC BONE GRAFTS

7.2.2.1 Development of standard materials for synthetic bone grafts to drive the growth of this market segment

TABLE 18 MAJOR PRODUCTS IN THE SYNTHETIC BONE GRAFTS MARKET

TABLE 19 SYNTHETIC BONE GRAFTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 BONE MORPHOGENETIC PROTEINS

7.2.3.1 Regulatory approval for the use of BMP in spinal fusion procedures to drive the growth of this market segment

TABLE 20 MAJOR PRODUCTS IN THE BONE MORPHOGENETIC PROTEINS MARKET

TABLE 21 BONE MORPHOGENETIC PROTEINS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 OTHER BONE-GRAFT SUBSTITUTES

TABLE 22 MAJOR PRODUCTS IN THE OTHER BONE-GRAFT SUBSTITUTES MARKET

TABLE 23 OTHER BONE-GRAFT SUBSTITUTES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 SOFT-TISSUE ATTACHMENTS

TABLE 24 BIOSURGERY MARKET FOR SOFT-TISSUE ATTACHMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 BIOSURGERY MARKET FOR SOFT-TISSUE ATTACHMENTS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 SYNTHETIC MESHES

7.3.1.1 Vendors are focusing on developing new composite synthetic meshes to gain a competitive edge

TABLE 26 MAJOR PRODUCTS IN THE SYNTHETIC MESHES MARKET

TABLE 27 SYNTHETIC MESHES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 BIOLOGICAL MESHES

TABLE 28 MAJOR PRODUCTS IN THE BIOLOGICAL MESHES MARKET

TABLE 29 BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 30 BIOLOGICAL MESHES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2.1 Allografts

7.3.2.1.1 Advancements in deriving products from new allograft sources to drive market growth

TABLE 31 ALLOGRAFTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2.2 Xenografts

7.3.2.2.1 Efficacy of xenografts against allografts is not proven

TABLE 32 XENOGRAFTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 HEMOSTATIC AGENTS

TABLE 33 MAJOR PRODUCTS IN THE HEMOSTATIC AGENTS MARKET

TABLE 34 BIOSURGERY MARKET FOR HEMOSTATIC AGENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 BIOSURGERY MARKET FOR HEMOSTATIC AGENTS, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1 THROMBIN-BASED HEMOSTATIC AGENTS

7.4.1.1 Developments in recombinant thrombin products to support the growth of this market segment

TABLE 36 MAJOR PRODUCTS IN THE THROMBIN-BASED HEMOSTATIC AGENTS MARKET

TABLE 37 THROMBIN-BASED HEMOSTATIC AGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATIC AGENTS

7.4.2.1 Vendors are expanding the availability of their ORC-based hemostatic agents across untapped markets in APAC

TABLE 38 MAJOR PRODUCTS IN THE OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATIC AGENTS MARKET

TABLE 39 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATIC AGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.3 COMBINATION HEMOSTATIC AGENTS

7.4.3.1 Advancements in combination materials would contribute to the growth of this market segment

TABLE 40 MAJOR PRODUCTS IN THE COMBINATION HEMOSTATIC AGENTS MARKET

TABLE 41 COMBINATION HEMOSTATIC AGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 SURGICAL SEALANTS & ADHESIVES

TABLE 42 BIOSURGERY MARKET FOR SURGICAL SEALANTS & ADHESIVES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 BIOSURGERY MARKET FOR SURGICAL SEALANTS & ADHESIVES, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1 NATURAL/BIOLOGICAL SEALANTS & ADHESIVES

7.5.1.1 Natural/biological sealants & adhesives, by type

TABLE 44 BIOSURGERY MARKET FOR NATURAL/BIOLOGICAL SEALANTS & ADHESIVES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 BIOSURGERY MARKET FOR NATURAL/BIOLOGICAL SEALANTS & ADHESIVES, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.1.1 Fibrin-based sealants & adhesives

7.5.1.1.1.1 Fibrin-based sealants & adhesives to dominate the market during the forecast period

TABLE 46 MAJOR PRODUCTS IN THE FIBRIN-BASED SEALANTS & ADHESIVES MARKET

TABLE 47 FIBRIN-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.1.2 Collagen-based sealants & adhesives

7.5.1.1.2.1 Low-cost and reduced risk of disease transmission are promoting the adoption of collagen-based sealants & adhesives

TABLE 48 MAJOR PRODUCTS IN THE COLLAGEN BASED-SEALANTS & ADHESIVES MARKET

TABLE 49 COLLAGEN-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.1.3 Gelatin-based sealants & adhesives

7.5.1.1.3.1 Combination products are creating promising growth opportunities for gelatin-based sealants & adhesives

TABLE 50 MAJOR PRODUCTS IN THE GELATIN BASED-SEALANTS & ADHESIVES MARKET

TABLE 51 GELATIN-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.1.4 Albumin-based sealants

7.5.1.1.4.1 Adoption of albumin-based sealants & adhesives is increasing in cardiovascular and cardiothoracic procedures

TABLE 52 MAJOR PRODUCTS IN THE ALBUMIN BASED-SEALANTS & ADHESIVES MARKET

TABLE 53 ALBUMIN-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.1.5 Other natural/biological sealants & adhesives

TABLE 54 OTHER NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.2 Natural/biological sealants & adhesives, by origin

TABLE 55 NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

7.5.1.2.1 Animal-based sealants & adhesives

7.5.1.2.1.1 Animal-based sealants and adhesives are not intended for intravascular and cerebrovascular repair due to the risk of disease transfer

TABLE 56 ANIMAL-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1.2.2 Human blood-based sealants & adhesives

7.5.1.2.2.1 Human blood-based sealants are finding significant applications in endovascular and laparoscopic vascular procedures

TABLE 57 HUMAN BLOOD-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES

TABLE 58 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2.1 PEG hydrogel-based sealants & adhesives

7.5.2.1.1 Rapid sealing abilities of PEG hydrogels to drive their adoption in spinal surgeries

TABLE 60 MAJOR PRODUCTS IN THE PEG HYDROGEL-BASED SEALANTS & ADHESIVES MARKET

TABLE 61 PEG HYDROGEL-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2.2 Cyanoacrylate-based sealants & adhesives

7.5.2.2.1 Cyanoacrylate-based sealants are preferred in dermatology and plastic surgeries

TABLE 62 MAJOR PRODUCTS IN THE CYANOACRYLATE-BASED SEALANTS & ADHESIVES MARKET

TABLE 63 CYANOACRYLATE-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2.3 Urethane-based sealants & adhesives

7.5.2.3.1 Urethane-based sealants can be used across wet environments

TABLE 64 URETHANE-BASED SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2.4 Other synthetic and semi-synthetic sealants & adhesives

TABLE 65 MAJOR PRODUCTS IN THE OTHER SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET

TABLE 66 OTHER SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 ADHESION BARRIERS

TABLE 67 BIOSURGERY MARKET FOR ADHESION BARRIERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 BIOSURGERY MARKET FOR ADHESION BARRIERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.1 SYNTHETIC ADHESION BARRIERS

TABLE 69 SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 SYNTHETIC ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.1.1 Hyaluronic acid-based adhesion barriers

7.6.1.1.1 Hyaluronic acid-based adhesion barriers dominate the synthetic adhesion barriers market

TABLE 71 MAJOR PRODUCTS IN THE HYALURONIC ACID-BASED ADHESION BARRIERS MARKET

TABLE 72 HYALURONIC ACID-BASED ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.1.2 Regenerated cellulose-based adhesion barriers

7.6.1.2.1 Regenerated cellulose-based adhesion barriers are finding increasing use in C-section surgeries

TABLE 73 MAJOR PRODUCTS IN THE REGENERATED CELLULOSE-BASED ADHESION BARRIERS MARKET

TABLE 74 REGENERATED CELLULOSE-BASED ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.1.3 PEG-based adhesion barriers

7.6.1.3.1 Demand for PEG-based adhesion barriers is driven by the rising number of peritoneal and abdominal surgeries

TABLE 75 MAJOR PRODUCTS IN THE PEG-BASED ADHESION BARRIERS MARKET

TABLE 76 PEG-BASED ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.1.4 Other synthetic adhesion barriers

TABLE 77 MAJOR PRODUCTS IN THE OTHER SYNTHETIC ADHESION BARRIERS MARKET

TABLE 78 OTHER SYNTHETIC ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.2 NATURAL ADHESION BARRIERS

TABLE 79 NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 NATURAL ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.2.1 Collagen and protein adhesion barriers

7.6.2.1.1 Collagen and protein adhesion barriers to dominate the natural adhesion barriers market during the forecast period

TABLE 81 MAJOR PRODUCTS IN THE COLLAGEN AND PROTEIN ADHESION BARRIERS MARKET

TABLE 82 COLLAGEN AND PROTEIN ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6.2.2 Fibrin-based adhesion barriers

7.6.2.2.1 Fibrin-based adhesion barriers are finding increasing applications in laparotomy procedures

TABLE 83 MAJOR PRODUCTS IN THE FIBRIN-BASED ADHESION BARRIERS MARKET

TABLE 84 FIBRIN-BASED ADHESION BARRIERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 STAPLE-LINE REINFORCEMENT AGENTS

7.7.1 RISING FOCUS ON SEALANTS AND HEMOSTATS MAY RESTRAIN THE GROWTH OF THIS MARKET

TABLE 85 MAJOR PRODUCTS IN THE STAPLE-LINE REINFORCEMENT AGENTS MARKET

TABLE 86 BIOSURGERY MARKET FOR STAPLE-LINE REINFORCEMENT AGENTS, BY COUNTRY, 2019–2026 (USD MILLION)

8 BIOSURGERY MARKET, BY APPLICATION (Page No. - 163)

8.1 INTRODUCTION

TABLE 87 BIOSURGERY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 ORTHOPEDIC SURGERY

8.2.1 ORTHOPEDIC SURGERY IS THE LARGEST APPLICATION SEGMENT FOR BIOSURGERY PRODUCTS

TABLE 88 GLOBAL MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 GENERAL SURGERY

8.3.1 INCREASING NUMBER OF HERNIA REPAIR PROCEDURES TO DRIVE THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 89 BIOSURGERY MARKET FOR GENERAL SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 NEUROLOGICAL SURGERY

8.4.1 GROWING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 90 GLOBAL MARKET FOR NEUROLOGICAL SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 CARDIOVASCULAR SURGERY

8.5.1 BIOSURGERY PRODUCTS ARE INCREASINGLY REPLACING CONVENTIONAL SUTURE-BASED METHODS IN CARDIOVASCULAR PROCEDURES

TABLE 91 BIOSURGERY MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 RECONSTRUCTIVE SURGERY

8.6.1 SOFT-TISSUE ATTACHMENT PRODUCTS ARE FINDING INCREASING USE IN BREAST AUGMENTATION AND RECONSTRUCTIVE PROCEDURES

TABLE 92 GLOBAL MARKET FOR RECONSTRUCTIVE SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.7 GYNECOLOGICAL SURGERY

8.7.1 BIOSURGERY PRODUCTS ARE OFFERING PROMISING POTENTIAL IN C-SECTION SURGERIES

TABLE 93 C-SECTION SURGERIES PER 1,000 BIRTHS (2018 OR LATEST AVAILABLE)

TABLE 94 BIOSURGERY MARKET FOR GYNECOLOGICAL SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.8 UROLOGICAL SURGERY

8.8.1 USE OF BIOSURGERY PRODUCTS IN COMPLEX RECONSTRUCTIVE UROLOGICAL SURGERIES TO STIMULATE SEGMENT GROWTH

TABLE 95 GLOBAL MARKET FOR UROLOGICAL SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.9 THORACIC SURGERY

8.9.1 GROWTH IN THIS APPLICATION SEGMENT IS DRIVEN BY THE INCREASING INCIDENCE OF PULMONARY DISEASES AND LUNG CANCER

TABLE 96 BIOSURGERY MARKET FOR THORACIC SURGERY, BY COUNTRY, 2019–2026 (USD MILLION)

8.10 OTHER APPLICATIONS

TABLE 97 GLOBAL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

9 BIOSURGERY MARKET, BY END USER (Page No. - 178)

9.1 INTRODUCTION

TABLE 98 BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 HOSPITALS

9.2.1 HOSPITALS ARE THE LARGEST END USERS OF BIOSURGERY PRODUCTS

TABLE 99 GLOBAL MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 CLINICS

9.3.1 QUICKER CONSULTATION SERVICES AND MINIMAL PATIENT STAYS ARE ADVANTAGES OFFERED BY CLINICS OVER HOSPITALS

TABLE 100 GLOBAL MARKET FOR CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 OTHER END USERS

TABLE 101 BIOSURGERY MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 BIOSURGERY MARKET, BY REGION (Page No. - 184)

10.1 INTRODUCTION

FIGURE 27 GEOGRAPHIC SNAPSHOT: MARKETS IN ASIA PACIFIC ARE EMERGING HOTSPOTS

TABLE 102 BIOSURGERY MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: BIOSURGERY MARKET SNAPSHOT

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: BIOSURGERY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate the North American biosurgery market during the forecast period

TABLE 118 US: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 119 US: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 US: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 US: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 US: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 US: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 US: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 US: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 126 US: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 US: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 US: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 US: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 US: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing geriatric population and the increasing volume of surgeries to drive the demand for biosurgery products in Canada

TABLE 132 CANADA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 133 CANADA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 CANADA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 CANADA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 CANADA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 CANADA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 CANADA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 CANADA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 140 CANADA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 CANADA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 CANADA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 CANADA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 145 CANADA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 146 EUROPE: BIOSURGERY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 148 EUROPE: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 EUROPE: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 EUROPE: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 EUROPE: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 EUROPE: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 EUROPE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 EUROPE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 155 EUROPE: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 EUROPE: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 EUROPE: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 EUROPE: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 EUROPE: BIOSURGERY MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 160 EUROPE: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany dominated the European biosurgery market in 2020

TABLE 161 GERMANY: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 162 GERMANY: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 GERMANY: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 GERMANY: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 GERMANY: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 GERMANY: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 GERMANY: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 168 GERMANY: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 169 GERMANY: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 GERMANY: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 GERMANY: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 172 GERMANY: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 173 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 174 GERMANY: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Growing volume of hernia repair surgeries and cardiovascular surgeries in the UK stimulating market growth

TABLE 175 UK: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 176 UK: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 UK: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 UK: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 UK: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 UK: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 181 UK: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 UK: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 183 UK: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 UK: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 UK: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 186 UK: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 188 UK: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Presence of a well-established healthcare system and growing geriatric population to boost market growth

TABLE 189 FRANCE: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 190 FRANCE: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 FRANCE: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 192 FRANCE: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 FRANCE: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 194 FRANCE: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 195 FRANCE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 FRANCE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 197 FRANCE: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 198 FRANCE: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 FRANCE: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 200 FRANCE: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 202 FRANCE: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing volume of surgeries to drive the demand for biosurgery products in the country

TABLE 203 ITALY: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 204 ITALY: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 ITALY: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 206 ITALY: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 ITALY: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 208 ITALY: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 209 ITALY: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 210 ITALY: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 211 ITALY: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 212 ITALY: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 ITALY: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 214 ITALY: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 215 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 216 ITALY: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 SWITZERLAND

10.3.5.1 Increasing public health insurance coverage to drive the number of surgical procedures

TABLE 217 SWITZERLAND: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 218 SWITZERLAND: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 SWITZERLAND: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 220 SWITZERLAND: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 SWITZERLAND: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 222 SWITZERLAND: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 223 SWITZERLAND: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 224 SWITZERLAND: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 225 SWITZERLAND: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 226 SWITZERLAND: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 227 SWITZERLAND: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 228 SWITZERLAND: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 229 SWITZERLAND: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 230 SWITZERLAND: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 SPAIN

10.3.6.1 Growing healthcare budget and rising efforts for boosting the local manufacturing of medical products to drive market growth

TABLE 231 SPAIN: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 232 SPAIN: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 233 SPAIN: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 234 SPAIN: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 235 SPAIN: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 236 SPAIN: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 SPAIN: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 238 SPAIN: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 239 SPAIN: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 240 SPAIN: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 241 SPAIN: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 242 SPAIN: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 243 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 244 SPAIN: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 245 ROE: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 246 ROE: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 247 ROE: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 248 ROE: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 249 ROE: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 250 ROE: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 251 ROE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 252 ROE: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 253 ROE: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 254 ROE: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 255 ROE: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 256 ROE: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 257 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 258 ROE: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 29 APAC: BIOSURGERY MARKET SNAPSHOT

TABLE 259 ASIA PACIFIC: BIOSURGERY MARKET, BY COUNTRY0, 2019–2026 (USD MILLION)

TABLE 260 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 261 ASIA PACIFIC: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 262 ASIA PACIFIC: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 263 ASIA PACIFIC: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 264 ASIA PACIFIC: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 265 ASIA PACIFIC: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 266 ASIA PACIFIC: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 267 ASIA PACIFIC: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 268 ASIA PACIFIC: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 269 ASIA PACIFIC: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 270 ASIA PACIFIC: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 271 ASIA PACIFIC: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 272 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 273 ASIA PACIFIC: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Strong healthcare system and rising geriatric population to support market growth in Japan

TABLE 274 JAPAN: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 275 JAPAN: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 276 JAPAN: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 277 JAPAN: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 278 JAPAN: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 279 JAPAN: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 280 JAPAN: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 281 JAPAN: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 282 JAPAN: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 283 JAPAN: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 284 JAPAN: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 285 JAPAN: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 286 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 287 JAPAN: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Growing number of hospitals and healthcare policy reforms stimulating the growth of the biosurgery market

TABLE 288 CHINA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 289 CHINA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 290 CHINA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 291 CHINA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 292 CHINA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 293 CHINA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 294 CHINA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 295 CHINA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 296 CHINA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 297 CHINA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 298 CHINA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 299 CHINA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 300 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 301 CHINA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising healthcare awareness and favorable government support to stimulate market growth in India

TABLE 302 INDIA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 303 INDIA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 304 INDIA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 305 INDIA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 306 INDIA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 307 INDIA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 308 INDIA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 309 INDIA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 310 INDIA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 311 INDIA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 312 INDIA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 313 INDIA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 314 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 315 INDIA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Growing number of cosmetic surgeries to drive the demand for surgical sealants and soft-tissue attachment products in South Korea

TABLE 316 SOUTH KOREA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 317 SOUTH KOREA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 318 SOUTH KOREA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 319 SOUTH KOREA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 320 SOUTH KOREA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 321 SOUTH KOREA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 322 SOUTH KOREA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 323 SOUTH KOREA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 324 SOUTH KOREA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 325 SOUTH KOREA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 326 SOUTH KOREA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 327 SOUTH KOREA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 328 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 329 SOUTH KOREA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 330 REST OF ASIA PACIFIC: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 331 REST OF ASIA PACIFIC: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 332 REST OF ASIA PACIFIC: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 333 REST OF ASIA PACIFIC: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 334 REST OF ASIA PACIFIC: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 335 REST OF ASIA PACIFIC: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 336 REST OF ASIA PACIFIC: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 337 REST OF ASIA PACIFIC: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 338 REST OF ASIA PACIFIC: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 339 REST OF ASIA PACIFIC: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 340 REST OF ASIA PACIFIC: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 341 REST OF ASIA PACIFIC: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 342 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 343 REST OF ASIA PACIFIC: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 344 LATIN AMERICA: BIOSURGERY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 345 LATIN AMERICA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 346 LATIN AMERICA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 347 LATIN AMERICA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 348 LATIN AMERICA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 349 LATIN AMERICA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 350 LATIN AMERICA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 351 LATIN AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 352 LATIN AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 353 LATIN AMERICA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 354 LATIN AMERICA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 355 LATIN AMERICA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 356 LATIN AMERICA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 357 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 358 LATIN AMERICA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Brazil accounted for the largest share of the LATAM market in 2020

TABLE 359 BRAZIL: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 360 BRAZIL: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 361 BRAZIL: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 362 BRAZIL: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 363 BRAZIL: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 364 BRAZIL: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 365 BRAZIL: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 366 BRAZIL: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 367 BRAZIL: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 368 BRAZIL: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 369 BRAZIL: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 370 BRAZIL: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 371 BRAZIL: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 372 BRAZIL: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Low-cost surgeries are driving medical tourism in Mexico

TABLE 373 MEXICO: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 374 MEXICO: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 375 MEXICO: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 376 MEXICO: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 377 MEXICO: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 378 MEXICO: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 379 MEXICO: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 380 MEXICO: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 381 MEXICO: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 382 MEXICO: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 383 MEXICO: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 384 MEXICO: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 385 MEXICO: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 386 MEXICO: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 387 REST OF LATIN AMERICA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 388 REST OF LATIN AMERICA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 389 REST OF LATIN AMERICA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 390 REST OF LATIN AMERICA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 391 REST OF LATIN AMERICA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 392 REST OF LATIN AMERICA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 393 REST OF LATIN AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 394 REST OF LATIN AMERICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 395 REST OF LATIN AMERICA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 396 REST OF LATIN AMERICA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 397 REST OF LATIN AMERICA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 398 REST OF LATIN AMERICA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 399 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 400 REST OF LATIN AMERICA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST AND AFRICA

10.6.1 MEA IS THE SMALLEST REGIONAL MARKET FOR BIOSURGERY PRODUCTS

TABLE 401 MIDDLE EAST AND AFRICA: BIOSURGERY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 402 MIDDLE EAST AND AFRICA: BONE-GRAFT SUBSTITUTES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 403 MIDDLE EAST AND AFRICA: SOFT-TISSUE ATTACHMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 404 MIDDLE EAST AND AFRICA: BIOLOGICAL MESHES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 405 MIDDLE EAST AND AFRICA: HEMOSTATIC AGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 406 MIDDLE EAST AND AFRICA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 407 MIDDLE EAST AND AFRICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 408 MIDDLE EAST AND AFRICA: NATURAL/BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY ORIGIN, 2019–2026 (USD MILLION)

TABLE 409 MIDDLE EAST AND AFRICA: SYNTHETIC & SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 410 MIDDLE EAST AND AFRICA: ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 411 MIDDLE EAST AND AFRICA: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 412 MIDDLE EAST AND AFRICA: NATURAL ADHESION BARRIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 413 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 414 MIDDLE EAST AND AFRICA: BIOSURGERY MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 303)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

11.4.1 SURGICAL SEALANTS AND ADHESIVES

FIGURE 31 SURGICAL SEALANTS AND ADHESIVES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.4.2 HEMOSTATIC AGENTS

FIGURE 32 HEMOSTATIC AGENTS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.4.3 BONE-GRAFT SUBSTITUTES

FIGURE 33 BONE-GRAFT SUBSTITUTES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.4.4 ADHESION BARRIERS

FIGURE 34 ADHESION BARRIERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.4.5 SOFT-TISSUE ATTACHMENTS

FIGURE 35 SOFT-TISSUE ATTACHMENTS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.5 COMPETITIVE BENCHMARKING

11.5.1 FOOTPRINT OF COMPANIES IN THE BIOSURGERY MARKET

TABLE 415 PRODUCT FOOTPRINT OF COMPANIES (25 MARKET PLAYERS)

TABLE 416 REGIONAL FOOTPRINT OF COMPANIES (25 MARKET PLAYERS)

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 36 BIOSURGERY MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

11.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

11.7.1 PROGRESSIVE COMPANIES

11.7.2 DYNAMIC COMPANIES

11.7.3 STARTING BLOCKS

11.7.4 RESPONSIVE COMPANIES

FIGURE 37 BIOSURGERY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2020)

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES & APPROVALS

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 319)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 BAXTER INTERNATIONAL INC.

TABLE 420 BAXTER INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 38 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2020)

12.1.2 B. BRAUN MELSUNGEN AG

TABLE 421 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 39 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2020)

12.1.3 BECTON, DICKINSON & COMPANY

TABLE 422 BECTON, DICKINSON & COMPANY: BUSINESS OVERVIEW

FIGURE 40 BECTON, DICKINSON & COMPANY: COMPANY SNAPSHOT (2020)

12.1.4 JOHNSON & JOHNSON

TABLE 423 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 41 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2020)

12.1.5 MEDTRONIC PLC

TABLE 424 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 42 MEDTRONIC PLC: COMPANY SNAPSHOT (2020)

12.1.6 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

TABLE 425 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 43 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

12.1.7 COMMONWEALTH SERUM LABORATORIES LIMITED

TABLE 426 COMMONWEALTH SERUM LABORATORIES LIMITED: BUSINESS OVERVIEW

FIGURE 44 COMMONWEALTH SERUM LABORATORIES LIMITED: COMPANY SNAPSHOT (2020)

12.1.8 HEMOSTASIS LLC

TABLE 427 HEMOSTASIS LLC: BUSINESS OVERVIEW

12.1.9 PFIZER INC.

TABLE 428 PFIZER INC.: BUSINESS OVERVIEW

FIGURE 45 PFIZER INC.: COMPANY SNAPSHOT (2020)

12.1.10 STRYKER CORPORATION

TABLE 429 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 46 STRYKER CORPORATION: COMPANY SNAPSHOT (2020)

12.1.11 CRYOLIFE, INC.

TABLE 430 CRYOLIFE, INC.: BUSINESS OVERVIEW

FIGURE 47 CRYOLIFE, INC.: COMPANY SNAPSHOT (2020)

12.1.12 ZIMMER BIOMET

TABLE 431 ZIMMER BIOMET: BUSINESS OVERVIEW

FIGURE 48 ZIMMER BIOMET: COMPANY SNAPSHOT (2020)

12.1.13 KUROS BIOSCIENCES AG

TABLE 432 KUROS BIOSCIENCES AG: BUSINESS OVERVIEW

FIGURE 49 KUROS BIOSCIENCES AG: COMPANY SNAPSHOT (2020)

12.1.14 ORTHOFIX MEDICAL INC.

TABLE 433 ORTHOFIX MEDICAL INC.: BUSINESS OVERVIEW

FIGURE 50 ORTHOFIX MEDICAL INC.: COMPANY SNAPSHOT (2020)

12.1.15 SMITH & NEPHEW PLC

TABLE 434 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 51 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2020)

12.1.16 TISSUE REGENIX GROUP PLC

TABLE 435 TISSUE REGENIX GROUP PLC: BUSINESS OVERVIEW

FIGURE 52 TISSUE REGENIX GROUP PLC: COMPANY SNAPSHOT (2020)

12.1.17 BETATECH MEDICAL

TABLE 436 BETATECH MEDICAL: BUSINESS OVERVIEW

12.1.18 MERIL LIFE SCIENCES PVT. LTD.

TABLE 437 MERIL LIFE SCIENCES PVT. LTD.: BUSINESS OVERVIEW

12.1.19 RTI SURGICAL

TABLE 438 RTI SURGICAL: BUSINESS OVERVIEW

12.1.20 SAMYANG HOLDINGS CORPORATION

TABLE 439 SAMYANG HOLDINGS CORPORATION: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 AROA BIOSURGERY LTD.

12.2.2 MEYER-HAAKE GMBH

12.2.3 BIOM’UP

12.2.4 BIOCER ENTWICKLUNGS-GMBH

12.2.5 HANNOX INTERNATIONAL CORP.

13 APPENDIX (Page No. - 380)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global biosurgery market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the biosurgery market. The primary sources from the demand side include medical practitioners and hospital managers.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Biosurgery Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, application, end user, and region).

Data Triangulation

After arriving at the market size, the total biosurgery market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the biosurgery market by product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall biosurgery market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the biosurgery market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To profile the key players in the biosurgery market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions; new product launches; expansions; collaborations, agreements, and partnerships; and R&D activities of the leading players in the biosurgery market

- To benchmark players within the biosurgery market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific biosurgery market into Australia, New Zealand and others

- Further breakdown of the Rest of Europe biosurgery market into The Netherlands, Sweden, Norway and others

Market outlook for the top 10 for Maggot Therapy Market

Increasing prevalence of chronic wounds: Chronic wounds, such as diabetic foot ulcers and venous leg ulcers, are a major driver of the maggot therapy market. As the prevalence of chronic wounds continues to increase, the demand for alternative wound care treatments such as maggot therapy is expected to grow.

Rising awareness about the benefits of maggot therapy: Maggot therapy has been shown to be an effective treatment for a variety of wounds, including those that are resistant to traditional treatments. As more healthcare providers become aware of the benefits of maggot therapy, its adoption is expected to increase.

Advancements in maggot breeding and production: Advancements in maggot breeding and production technologies have made it easier and more cost-effective to produce maggots for use in therapy. This is expected to increase the availability of maggots for use in therapy, which will in turn drive market growth.

Growing demand for natural and alternative therapies: The growing trend towards natural and alternative therapies is expected to drive demand for maggot therapy, which is a natural and non-invasive treatment option.

The top 10 players in the maggot therapy market as of 2021 were:

- BioMonde

- Monarch Labs

- Medical Grade maggots

- Monash University

- Innova Biosciences

- Zoology Enterprises

- BioTherapeutics

- MDT Global Solutions

- Mibelle Biochemistry

- MTI BioTech

Growth drivers for Maggot Therapy Market from macro to micro

Macro factors:

- Increasing prevalence of chronic wounds: Chronic wounds are a major driver of the maggot therapy market. The prevalence of chronic wounds is increasing globally, which is expected to drive demand for maggot therapy.

- Growing demand for natural and alternative therapies: There is a growing trend towards natural and alternative therapies, which is expected to drive demand for maggot therapy.

- Technological advancements in maggot breeding and production: Technological advancements have made it easier and more cost-effective to breed and produce maggots, which is expected to increase the availability of maggots for use in therapy.

Micro factors:

- Effectiveness of maggot therapy: Maggot therapy has been shown to be an effective treatment for a variety of wounds, including those that are resistant to traditional treatments. This effectiveness is driving demand for maggot therapy.

- Growing awareness of the benefits of maggot therapy: As more healthcare providers become aware of the benefits of maggot therapy, its adoption is expected to increase.

- Favorable reimbursement policies: Reimbursement policies are an important factor in the adoption of maggot therapy. Favorable reimbursement policies can increase demand for maggot therapy.

- Increasing availability of maggot therapy products: The availability of maggot therapy products is increasing, which is expected to drive market growth.

Hypothetic challenges of Maggot Therapy Market in future

Lack of standardization: There is currently a lack of standardization in maggot therapy, which could potentially limit its adoption. Inconsistent production methods, differing treatment protocols, and variable patient outcomes may hinder its acceptance as a mainstream therapy.

Limited awareness among healthcare providers: Despite the growing awareness of maggot therapy, many healthcare providers may still be unfamiliar with its benefits and use cases. This could limit its adoption and market growth.