Dental Bone Graft Substitutes Market Size, Growth, Share & Trends Analysis

Dental Bone Graft Substitutes Market by Type (Xenograft, Allograft, Synthetic Bone Grafts, Alloplast), Application (Sinus Lift, Ridge Augmentation, Socket Preservation), Product (BioOss, Osteograf, Grafton), End User, Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global dental bone graft substitutes market, valued at USD 1.30 billion in 2025, stood at USD 1.40 billion in 2026 and is projected to advance at a resilient CAGR of 6.5% from 2026 to 2031, culminating in a forecasted valuation of USD 2.04 billion by the end of the period. This market has been expanding rapidly due to rising oral diseases, including tooth loss, edema, and periodontal disease, particularly among the aging population. As a result, there is a growing demand for implant surgeries, which require bone enhancement procedures before the actual implant can be placed. Recent advancements in materials science have led to the development of modern bone graft materials, including synthetic, xenogenic, and allogenic options, as well as bioactive materials. These innovations have significantly improved the efficacy, safety, and usability of bone graft materials, making them easier to adopt in dental procedures and surgeries. Additionally, the trend toward better oral health is supported by the rise of cosmetic and performance dentistry, as well as minimally invasive and time-efficient procedures. Increased spending on dental care and favorable healthcare conditions, particularly in developed countries, are driving this market's growth. At the same time, there is a rapid expansion of dental clinics and laboratories in emerging nations.

KEY TAKEAWAYS

-

BY REGIONBased on region, North America accounted for the largest share of 40.0% of the dental bone graft substitutes market in 2025.

-

BY PRODUCTBased on product, the Bio OSS segment accounted for the largest share of 26.7% of the dental bone graft substitutes market in 2025.

-

BY TYPEBased on type, the xenografts segment accounted for the largest share of the dental bone graft substitutes market in 2025.

-

BY MECHANISMBased on mechanism, the osteoconduction segment accounted for the largest share of the dental bone graft substitutes market in 2025.

-

BY APPLICATIONBased on application, the socket preservation segment accounted for the largest share of the dental bone graft substitutes market in 2025.

-

BY END USERBased on end user, the hospitals segment held the largest share of the dental bone graft substitutes market in 2025.

-

COMPETITIVE LANDSCAPEDentsply Sirona and Envista were recognized as star players due to their strong product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies such as Biocomposites have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The dental bone graft substitutes market is experiencing rapid growth due to a higher incidence of tooth loss, periodontal diseases, and maxillofacial defects. These conditions have increased the demand for bone tissue regeneration. Recently, awareness has grown regarding advanced restorative dentistry methods and the use of dental implants, which has further boosted the demand for dental bone grafting materials. Additionally, the introduction of innovative dental bone grafting options, such as xenografts, allografts, and synthetic materials, has enhanced their acceptability for replacing damaged tissues in the maxillofacial region. Furthermore, the global demand for dental bone grafting materials has risen, partly due to more people seeking dental tourism services.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The major trends, challenges, and disruptions in the dental bone graft substitutes market indicate a shift in revenue sources. This shift moves away from a heavy reliance on traditional graft types, such as xenografts, allografts, and alloplasts, toward a more innovative combination that includes nano implants, surface implants, artificial intelligence, advanced dental treatments, high-performance polymers, and minimally invasive correction techniques. Furthermore, end users—such as hospitals, dental clinics, research laboratories, and academic institutions—have specific requirements for graft materials. They seek standardized, user-friendly, and innovative options that ultimately lead to faster treatments, predictable regenerative outcomes, cost-effective healthcare solutions, and improved training.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising cases of dental caries and subsequent increase in tooth repair procedures

-

Growing market for dental tourism in emerging countries

Level

-

Stringent regulations pertaining to medical devices used in dentistry

-

Dearth of trained dental practitioners

Level

-

Increasing demand from customers and rising inclination toward cosmetic dentistry

-

Growing demand for bone graft substitutes from emerging markets

Level

-

Pricing pressure faced by prominent market players

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising cases of dental caries and subsequent increase in tooth repair procedures

The increasing incidence of dental caries and the subsequent rise in tooth repair procedures have significantly influenced the market for dental bone graft substitutes. As the issue of dental decay worsens due to poor oral hygiene, unhealthy diets, and limited preventive care, the demand for restorative treatments—such as dental implants, bone grafts, and periodontal surgeries—continues to grow. Bone graft substitutes play a crucial role in the healing and regeneration of the jawbone that may have been lost due to tooth decay or extraction, thereby ensuring successful implant placement and maintaining oral function over the long term. Additionally, the growing awareness among both patients and clinicians regarding effective dental restoration methods has further contributed to the increased demand for these advanced graft materials, driving market growth worldwide.

Restraint: Stringent regulations pertaining to medical devices used in dentistry

The presence of stringent government regulations regarding medical devices in the field of dentistry is one of the significant constraints on the dental bone graft substitutes market. Organizations such as the FDA in the US, CE in Europe, and other regional authorities implement strict guidelines to ensure the efficacy and safety of bone graft substitutes. Adhering to these regulations can delay product launches and hinder operational activities. The approval process may be costly and may require clinical testing, which can create operational challenges for companies in the bone graft substitutes market. Additionally, there may be restrictions on modifying the composition of bone graft substitutes, which could impact innovation and the overall operational activities of organizations.

Opportunity: Increasing demand from customers and rising inclination toward cosmetic dentistry

The growing demand from consumers, along with the increasing popularity of cosmetic dentistry, presents a valuable opportunity for the dental bone graft substitutes market to expand. Currently, individuals seeking aesthetically pleasing and functional dental restorations, such as implants and surgeries, often encounter challenges that require bone grafting to ensure proper functionality. To address this, it is important to raise awareness about advancements in dental procedures and treatments that offer bone grafting services to these individuals, thereby enhancing the use of bone graft substitutes. This trend encourages dental clinics to adopt newer materials for bone grafting procedures, ultimately increasing their market share in the bone graft substitutes sector.

Challenge: Pricing pressure faced by prominent market players

The main challenge restricting the growth of leading companies in the dental bone graft substitutes market is pricing. These companies face intense competition from established firms and new entrants offering lower-cost products. As a result, they are compelled to adopt competitive pricing strategies while maintaining high quality standards. Additionally, the significant costs associated with research, development, and manufacturing also hinder their progress. This situation is further complicated by the high price sensitivity observed in dental clinics, particularly in emerging markets.

DENTAL BONE GRAFT SUBSTITUTE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Symbios Xenograft Granules are used for bone regeneration in implant dentistry, including socket preservation, ridge augmentation, and sinus lift procedures. | High osteoconductivity, natural bone-like structure, predictable bone regeneration, and strong clinical acceptance in implant workflows. |

|

Creos Xenoprotect is a collagen-based xenograft membrane used in guided bone regeneration (GBR) and guided tissue regeneration (GTR) procedures. | Effective barrier function, controlled resorption, improved soft-tissue healing, and enhanced graft stability. |

|

The ChronOS Bone Graft Substitute is a synthetic calcium phosphate-based graft used for bone void filling and regenerative dental applications. | Consistent quality, biocompatibility, eliminates donor-related risks, and predictable resorption and bone remodeling. |

|

Straumann xenograft bone substitutes are used for implant site development, socket preservation, and sinus augmentation procedures. | Excellent volume stability, long-term scaffold support, high implant success rates, and strong integration with the Straumann implant system. |

|

The IngeniOs HA Bone Graft Substitute is a synthetic hydroxyapatite-based graft used in dental implant and periodontal bone regeneration. | High structural stability, slow resorption for volume maintenance, reliable handling characteristics, and suitable for load-bearing sites. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the dental bone graft substitutes market provides a comprehensive overview of the key stakeholders involved in this sector. These stakeholders can be categorized into four main groups: manufacturers, distributors, end users, and regulatory bodies. Manufacturers in the dental bone graft substitutes market include prominent companies such as ZimVie, Dentsply Sirona, Medtronic, Johnson & Johnson, Envista, Henry Schein, Straumann, and RTI Surgical. Distributors in this market feature major players like Eurodontic, McKesson, Medline, Henry Schein, CADCAM Lösungen, and Cardinal Health. End users consist of leading healthcare institutions such as AdventHealth, Mount Sinai, Mayo Clinic, Cleveland Clinic, Johns Hopkins Medicine, and NHS Barts Health. Regulatory bodies overseeing the dental bone graft substitutes market include organizations like the FDA, the European Medicines Agency, and GOV.UK. The ecosystem illustrates the interconnected components of the dental bone graft substitutes market, highlighting the relationships among stakeholders.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dental Bone Graft Substitutes Market, By Product

Bio Oss has established itself as a leading product in the market due to its long-term clinical acceptability, strong scientific backing, and effectiveness in guided bone generation procedures. Extracted from bovine sources, Bio Oss exhibits high osteoconductive properties similar to human bone tissue, ensuring the growth of new bone and long-term volume stability. Its versatility in various applications—such as dental implantology, periodontal tissue regeneration, and oral surgeries—has made Bio Oss a favored choice among dentists worldwide. Additionally, it is often used in conjunction with Bio Gide collagen membranes, significantly enhancing treatment outcomes. This combination of brand loyalty, extensive documentation, and strong performance has solidified Bio Oss' top position in the market.

Dental Bone Graft Substitutes Market, By Type

In the dental bone graft substitutes market, xenografts are the leading type, capturing significant market share due to their widespread clinical acceptance, reliable performance, and cost-effectiveness compared to other graft types. Bovine-derived xenografts, in particular, closely resemble the natural mineral structure of human bone, providing excellent osteoconductive properties that enhance predictable bone regeneration and long-term volume stability. These grafts are commonly used in surgical procedures such as implant site preparation, sinus lifts, and periodontal defect repair, where maintaining good bone volume is essential. Unlike autografts, xenografts do not require the harvesting of tissue from a secondary surgical site, leading to reduced patient morbidity and shorter operation times. Additionally, they are more readily available than allografts. The strong clinical validation, ease of handling, compatibility with collagen membranes, and recent innovations from major manufacturers have all contributed to the ongoing dominance of xenografts in the dental bone graft substitutes market.

Dental Bone Graft Substitutes Market, By Application

Socket preservation commands the largest share of the application segment in the dental bone graft substitutes market. This procedure is essential after tooth extractions, as it helps maintain alveolar bone volume. If the bone is quickly resorbed after extraction, it can hinder the placement of future implants and negatively affect aesthetic outcomes. Therefore, socket preservation has become a widely accepted preventive procedure. Dental bone graft substitutes are typically used immediately following tooth extraction to stabilize the socket, promote the formation of new bone, and reduce the need for complex augmentation procedures later on. The high number of tooth extractions worldwide—stemming from dental caries, periodontal disease, and trauma—drives the demand for socket preservation treatments. Additionally, because socket preservation is a straightforward, cost-effective, and reliable treatment, it is commonly utilized by both general dentists and specialists. As a result, it has consistently maintained its dominant share in the dental bone graft substitutes market.

Dental Bone Graft Substitutes Market, By Mechanism

In the mechanism segment of dental bone graft substitutes, osteoconduction holds the largest share due to its essential role in predictable and effective bone regeneration during dental procedures. Osteoconductive graft materials provide a scaffold that supports the migration, attachment, and growth of new bone cells, making them particularly suitable for common applications like dental implant placement, sinus augmentation, and periodontal defect repair. Most widely used graft types, such as xenografts, allografts, and synthetic materials, primarily rely on osteoconduction, which contributes to their widespread use in clinical practice. Clinicians favor these materials because they offer consistent performance, long-lasting volume stability, and fewer biological risks when compared to osteoinductive or osteogenic alternatives. Furthermore, the availability of extensive clinical evidence, ease of handling, and compatibility with guided bone regeneration techniques have enhanced the prominence of osteoconductive mechanisms in the dental bone graft substitutes market.

Dental Bone Graft Substitutes Market, By End User

The hospitals segment leads the dental bone graft substitutes market due to their established clinical infrastructure and the high volume of patients they treat. Various dental and oral procedures, which can range in complexity, are performed in these facilities. Many dental procedures that involve bone grafting require precise and careful interventions, especially in the context of dental implants, periodontal treatments, and reconstructive surgeries that necessitate specialized care. To ensure the effective use of high-quality bone graft materials for these dental procedures, hospitals typically have dedicated dental and maxillofacial departments that address all patient dental concerns. These departments also have access to advanced equipment and technical resources, enabling them to carry out procedures successfully. As a result, these factors collectively position hospitals as the primary end users of dental bone graft substitutes.

REGION

Asia Pacific to be fastest-growing region in global dental bone graft substitutes market during forecast period

The Asia Pacific region is projected to experience the fastest growth in the market for dental bone graft substitutes, driven by several key factors. The rising population and improving living standards are expected to lead to increased spending on advanced dental treatments. This trend creates significant opportunities in various Asia Pacific countries, including China, India, Japan, and South Korea, where the demand for dental treatments is on the rise. In addition to this, dental disorders, such as tooth loss, periodontal diseases, and facial defects, are becoming more prevalent, which further accelerates the need for bone graft substitutes. Other contributing factors include an increase in dental clinics offering reconstructive procedures, clinics utilizing implanted devices, advancements in dental technologies, government initiatives supporting dental care, and the presence of global dental biomaterial brands. All these elements are expected to position the Asia Pacific region as the fastest-growing segment in the market for dental bone graft substitutes.

DENTAL BONE GRAFT SUBSTITUTE MARKET: COMPANY EVALUATION MATRIX

In the dental bone graft substitutes market matrix, Dentsply Sirona (US) and Envista (US) are leading with their strong global presence, brand recognition, and wide range of products. Both companies are recognized as star players. Meanwhile, Dentium (US) is emerging as a leader with its versatile offerings in dental bone graft substitutes, catering to various therapeutic and diagnostic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.30 Billion |

| Market Forecast in 2031 (Value) | USD 2.04 Billion |

| Growth Rate | CAGR of 6.5% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

| Related Segment & Geographic Reports | Europe Dental Bone Graft Substitutes Market |

WHAT IS IN IT FOR YOU: DENTAL BONE GRAFT SUBSTITUTE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental products used in the dental bone graft substitutes ecosystem |

|

| Product Analysis | Further breakdown of other applications in the market | Insights on other applications involved in the market |

| Company Information |

|

Insights on market share analysis by country |

| Geographic Analysis |

|

Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- November 2025 : Geistlich introduced Geistlich Bio-Gide Forte, which was presented at the AAP annual meeting. This new product offers increased firmness, improving handling during bone regeneration procedures. Additionally, Geistlich announced a flowable version of Geistlich Bio Oss, expected to launch in 2026. This product will contain a blend of the collagen found in both Geistlich Bio Oss and Geistlich Bio Gide, enabling quicker application in bone regeneration procedures.

- February 2026 : LifeNet Health developed OraGen to provide viable dental bone allograft tissue. This includes cryopreserved corticocancellous bone with a demineralized bone matrix and viable cells, resulting in improved osteogenic, osteoconductive, and osteoinductive outcomes for dental reconstruction surgeries.

Table of Contents

Methodology

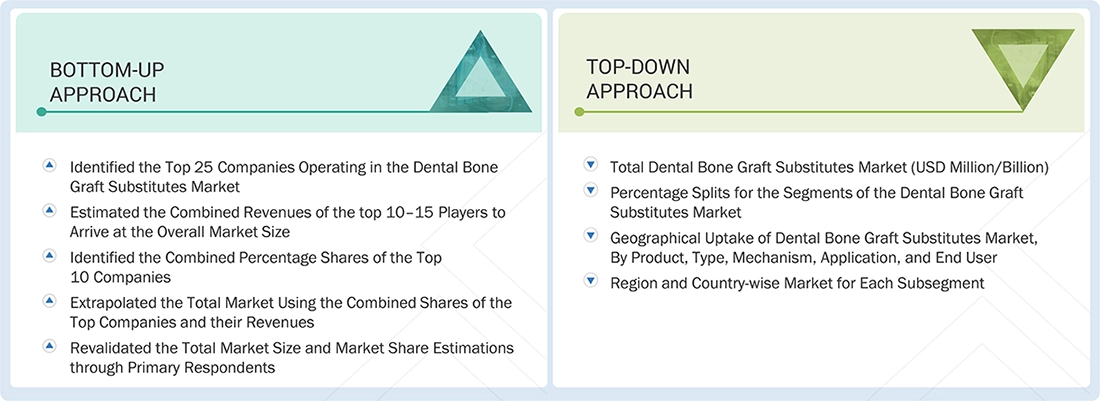

This study involved four major activities to estimate the current size of the global Dental Bone Graft Substitutes market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the global Dental Bone Graft Substitutes market. It was also used to obtain important information on key players, market classification, and segmentation aligned with industry trends to the bottom-most level, and key developments from market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from various companies and organizations operating in the global Dental Bone Graft Substitutes market. The primary sources on the demand side included industry experts, purchasing & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

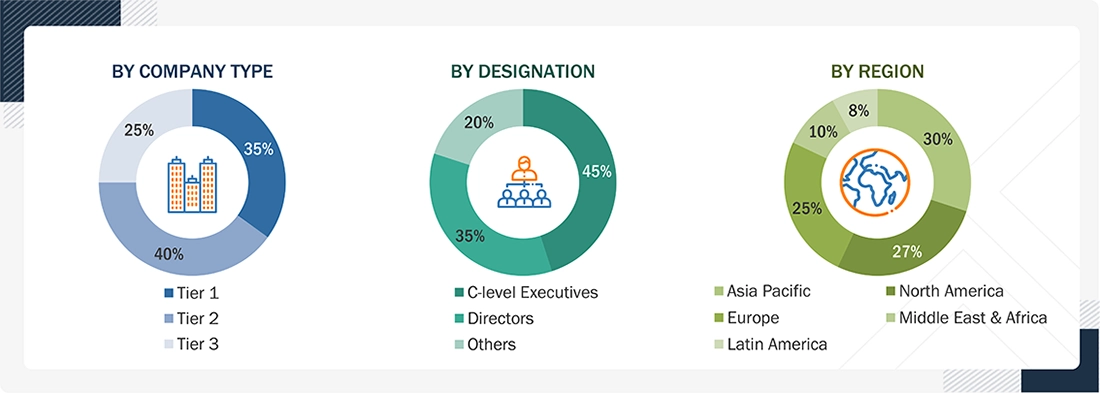

Breakdown of the primary respondents for the global Dental Bone Graft Substitutes market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Source: MarketsandMarkets Analysis

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global Dental Bone Graft Substitutes market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. Also, the global Dental Bone Graft Substitutes market was split into various segments and subsegments based on the:

- List of major players operating in the global Dental Bone Graft Substitutes market at the regional and/or country level

- Product mapping of various dental bone graft substitute manufacturers at the regional and/or country level in the global Dental Bone Graft Substitutes market

- Mapping of annual revenue generated by listed major players from dental bone graft substitutes (or the nearest reported business unit/product category) in the global Dental Bone Graft Substitutes market

- Revenue mapping of major players operating in the global Dental Bone Graft Substitutes market

- Extrapolation of the revenue mapping of the listed major players to derive the market value of the respective segments/subsegments in the global global Dental Bone Graft Substitutes market

- Summation of the market value of all segments/subsegments to arrive at the global global Dental Bone Graft Substitutes market

Dental Bone Graft Substitute Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the global global Dental Bone Graft Substitutes market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

A dental bone graft substitute is a biocompatible material used by dentists to rebuild or augment jawbone tissue lost due to various reasons. These substitutes act as a scaffold or supportive structure to promote the growth of new bone tissue in the jaw. They essentially fill the defect or gap where bone loss has occurred.

Key Stakeholders

- Manufacturers and distributors of dental bone graft substitutes

- Manufacturers and distributors of dental bone graft substitute components

- Dental bone graft substitute companies

- Healthcare institutes

- Diagnostic laboratories

- Dental hospitals and clinics

- Academic institutes

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global global Dental Bone Graft Substitutes market by type, application, mechanism, product, end user, and region

- To provide detailed information about the factors influencing the global global Dental Bone Graft Substitutes market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall global global Dental Bone Graft Substitutes market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players in the global global Dental Bone Graft Substitutes market

- To forecast the size of the global global Dental Bone Graft Substitutes market in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global global Dental Bone Graft Substitutes market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the global Dental Bone Graft Substitutes market

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Europe Dental Bone Graft Substitutes market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific Dental Bone Graft Substitutes market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America Dental Bone Graft Substitutes market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia Dental Bone Graft Substitutes market into Malaysia, Singapore, New Zealand, and others

COMPETITIVE LANDSCAPE ASSESSMENT

- Market share analysis, by region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa), which provides market shares of the top 3–5 key players in the Dental Bone Graft Substitutes market

- Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental Bone Graft Substitutes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dental Bone Graft Substitutes Market