Blind Spot Monitor Market by Product Type (BSD, Park Assist, Backup Camera, Surround View & Virtual Pillar), Technology (Camera, radar & Ultrasonic), End Market (OE & Aftermarket), Electric Vehicle, Vehicle Type and Region - Global Forecast to 2027

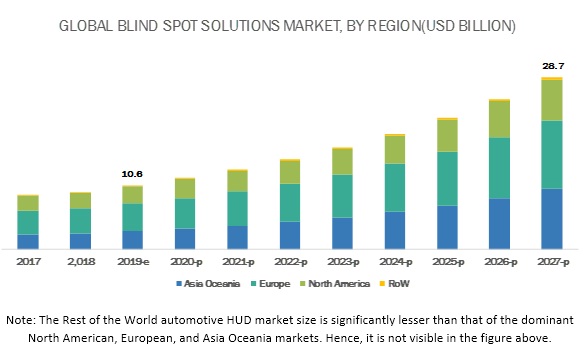

[177 Pages Report] The blind spot monitor market is estimated to be USD 10.6 billion in 2019 and is projected to reach USD 28.6 billion by 2027, at a CAGR of 13.2% from 2019 to 2027. The key drivers of the market are increasing adoption rate of advanced technologies by OEMs, the introduction of stringent government programs pertaining to vehicle safety, growing consumer demand for active safety systems, rising adoption of smart mirrors in the automotive industry, and increasing demand for premium vehicles.

The backup camera system is estimated to account for the largest market size during the forecast period

Currently, a backup/rearview camera is most commonly used in vehicles. Most of the vehicles are equipped with the rearview digital camera that assists the driver while parking a vehicle. Moreover, the US and Canadian governments have mandated the rearview camera because of its safety benefits. Canada has made rearview camera systems mandatory in new cars since May 2018. In line with government mandates related to backup cameras in North America, the governments in BRIC countries and Europe may issue mandates supporting backup/rearview camera functions soon which is likely to drive the market for backup cameras in the respective geographies.

Radar-based system segment system is projected to be the fastest growing market during the forecast period

Pulse-doppler radar is the most commonly used variant of radar sensors used in the present active safety systems and ADAS. It functions by sending short pulses of radio energy and concurrently listens for the echo from objects using the same antenna. There are three types of radars, namely, short range, mid-range, and long-range used in the automotive industry as per functional requirements. As the name suggests, short-range radar can be used for detecting nearby objects in systems such as park assist. Mid-range radar can be used in a blind spot detection system for object detection in the vehicle’s blind spot. Generally, more than one radars are fitted in a vehicle to overcome its narrow field of view and reduced angular resolution. Many sensor manufacturers are focusing their developments on reducing the cost of radars so that it would be cost-effective to fit four radars in a vehicle to provide all-around object detection. These factors will boost the market growth of blind spot monitor market.

Europe is estimated to account for the largest market size during the forecast period.

Europe is estimated to be the largest market with the highest share of the global blind spot monitor market, by value. The regional market is dominated by the demand from Germany, Rest of Europe and the UK. The adoption of blind spot monitor in the Russian market is estimated to be low but is projected to increase in the future. Russian blind spot monitor market is forecasted to be the fastest growing. The major growth drivers of the blind spot monitor market in the region include growing demand for the technology, rising need for safe & secure driving experience, and increasing development of semi-autonomous vehicles.

Key Market Players

The blind spot monitor market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Denso (Japan), Continental (Germany), Bosch (Germany), and Magna (Canada). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive range of products in the aftermarket. The key strategies adopted by these companies to sustain their market position are new product developments, merger & acquisitions, and expansions.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2027 |

|

Forecast units |

Value (USD million) and Volume (Thousand Units) |

|

Segments covered |

Product type, technology, end market, electric vehicle type, vehicle type, dimension type, and region |

|

Geographies covered |

North America, Asia Oceania, Europe, and RoW |

|

Companies covered |

Bosch (Germany), Continental (Germany), Magna (Canada), Gentex (US), Denso (Japan), ZF (Germany), Ficosa (Spain), and Valeo (France), |

This research report categorizes the blind spot monitor market based on product type, technology type, electric vehicle type, end market type, vehicle type, and region.

Blind spot monitor Market, by Technology

- Camera-based system

- Radar-based system

- Ultrasonic-based system

Blind spot monitor Market, by Product Type

- Blind spot detection system

- Park assist system

- Backup camera system

- Surround view system

Blind spot monitor Market, by Electric Vehicle Type

- BEV

- FCEV

- HEV

- PHEV

Blind spot monitor Market, by End Market Type

- OE Market

- Aftermarket

Blind spot monitor Market, by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

Blind spot monitor Market, By Region

- Asia Oceania (China, Japan, India, South Korea, and Rest of Asia Oceania)

- Europe (Germany, France, Spain, Russia, Turkey, the UK, and Rest of Europe)

- North America (Canada, Mexico, and the US)

- Rest of World (Brazil, Iran, and Rest of RoW)

Recent Developments

- In October 2018, Continental informed announced that it developed a Virtual A-Pillar to help remove forward blind spots, making wide A-pillars virtually see-through. Continental’s Virtual A-Pillar is designed to address the growing problem for vehicles that need widened front pillars to meet mandatory safety testing. With new flexible OLED displays and advanced head tracking, Continental is bringing enhanced visibility to the driver’s view with new flexible OLED displays and advanced head tracking. It tracks the movements using an interior camera mounted just above the steering wheel. At the same time, Continental’s SurroundView camera, mounted on the vehicle’s exterior, feeds a live video of the vehicle’s external environment to the OLED displays embedded in the A-pillars.

- In September 2018, Ficosa developed the digital rear-view system of the Audi e-Tron. The digital rear-view system uses cameras and displays instead of the traditional external side mirrors and offers a whole new driving experience, which is safer, more efficient, and comfortable. This system has been developed and manufactured at the Viladecavalls Technology Center (Spain) and the Wolfenbuttel Center (Germany).

- Magna and Renesas announced a new cost-efficient 3D surround view system designed for entry- and mid-range vehicles. Magna’s 3D surround view camera system adopts Renesas’ high-performance, low-power system-on-chip (SoC) solution to provide a 360-degree panoramic view to assist drivers when parking or performing low-speed operations.

- Autoliv announced that, together with its software joint venture Zenuity, it had been selected to develop and produce the first Level 3 advanced driver assistance systems for Geely. Autoliv was selected as the supplier for Geely’s Level 3 project, which includes ADAS electronic control units and software, radar systems, as well as monovision and stereo vision camera systems.

- ZF and HELLA entered into a strategic partnership for sensor technology, particularly for front camera systems, imaging, and radar systems. The first joint development project in camera technology will start immediately, with the objective of a market launch in 2020.

Critical Questions:

- How will vehicle sales trends impact the market in the long term?

- How will the industry cope with the challenge of the high cost of blind spot solutions?

- How do you see the impact of government regulations on the blind spot monitor market?

- What are the upcoming trends in the blind spot monitor market? What impact would they make post 2025?

- What are the key strategies adopted by top players to increase their revenue?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Blind Spot Monitor Market

4.2 Blind Spot Monitor Market: Major Countries

4.3 Blind Spot Monitor Market in Europe, By Product Type and Country

4.4 Blind Spot Monitor Market, By Technology Type

4.5 Blind Spot Monitor Market, By End Market

4.6 Blind Spot Monitor Market, By Electric Vehicle Type

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Introduction of Stringent Government Programs Pertaining to Vehicle Safety

5.2.1.2 Increasing Consumer Demand for Active Safety Systems

5.2.1.3 Increasing Adoption of Smart Mirrors in Automotive Industry

5.2.1.4 Increasing Demand for Premium Vehicles

5.2.2 Restrains

5.2.2.1 Regulations Pertaining to Mirrorless Vehicles

5.2.2.2 Usage of Radar Detectors Considered Illegal in Some Countries

5.2.3 Opportunities

5.2.3.1 Advent of Autonomous Vehicles and Increasing Demand for Semi-Autonomous Vehicle

5.2.3.2 High Growth Potential of Multicamera Systems in Emerging Markets

5.2.4 Challenges

5.2.4.1 Constraints in Real-Time Image Processing in Surround View Systems

5.2.4.2 Threat of Security and Environmental Constrains

6 Industry Trends (Page No. - 48)

6.1 Value Chain Analysis

6.2 Impact of Semi-Autonomous and Autonomous Vehicles on Blind Spot Monitor Market

6.3 Marco Indicator Analysis

6.3.1 Introduction

6.3.2 Macro Indicators Influencing the Automotive Blind Spot Monitor Market for Top 3 Countries

6.3.2.1 United States

6.3.2.2 Germany

6.3.2.3 Japan

6.4 Porter’s 5 Forces

7 Blind Spot Monitor Market, By Product Type (Page No. - 55)

7.1 Introduction

7.2 Research Methodology

7.3 Blind Spot Detection System

7.3.1 Presence of Many Luxury Vehicle Manufacturer in the Europe is Expected to Drive the Market

7.4 Backup Camera System

7.4.1 The Mandate for Backup Camera System in US and Canada Will Propel the North American Market.

7.5 Park Assist System

7.5.1 OEMs are Offering Park Assist System as A Standard Feature in European Region

7.6 Surround View System

7.6.1 Increasing Acceptance of Semi-Autonomous Vehicle Across Globe to Drive Surround View System Market

7.7 Virtual Pillars

7.7.1 Demand for Safety Features to Drive the Virtual Pillar Market

7.8 Key Industry Insights

8 Blind Spot Monitor Market, By Technology Type (Page No. - 65)

8.1 Introduction

8.2 Research Methodology

8.3 Camera-Based Systems

8.3.1 Fast Paced Development of Camera Technology in Automotive Industry to Drive the Camera Based System Market

8.4 Radar-Based Systems

8.4.1 High Accuracy and Efficiency of Radars to Drive Radar Based Blind Spot Monitor Market

8.5 Ultrasonic-Based Systems

8.5.1 Rising Adoption of Park Assist System to Propel Ultrasonic Based System Market

8.6 Industry Insights

9 Blind Spot Monitor Market, By End Market (Page No. - 71)

9.1 Introduction

9.2 Research Methodology

9.3 OE Market

9.3.1 Government Mandates to Drive the OE Blind Spot Monitor Market

9.4 Aftermarket

9.4.1 Asia Oceania is Estimated to Lead the Blind Spot Solutions Aftermarket

9.5 Key Industry Insights

10 Blind Spot Monitor Market, By Electric Vehicle Type (Page No. - 76)

10.1 Introduction

10.2 Research Methodology

10.3 BEV

10.3.1 Rising Concern About Automotive Emission to Drive BEV Market

10.4 FCEV

10.4.1 North America to Lead FCEV Blind Spot Monitor Market

10.5 HEV

10.5.1 Asia Oceania to Lead the HEV Blind Spot Monitor Market

10.6 PHEV

10.6.1 North America to Lead PHEV Blind Spot Monitor Market

10.7 Key Industry Insights

11 Blind Spot Monitor Market, By Vehicle Type (Page No. - 84)

11.1 Introduction

11.2 Research Methodology

11.3 Passenger Car

11.3.1 Europe to Lead Passenger Car Blind Spot Monitor Market

11.4 Light Commercial Vehicle (LCV)

11.4.1 High Demand of Lcvs in US to Drive North American Blind Spot Market for LCV

11.5 Truck

11.5.1 Blind Spot Monitor Market for Truck Segment is Projected to Grow the Fastest

11.6 Bus

11.6.1 High Demand for Public Transportation to Drive Bus Blind Spot Monitor Market

11.7 Key Industry Insights

12 Blind Spot Monitor Market, By Region (Page No. - 93)

12.1 Introduction

12.2 Asia Oceania

12.2.1 China

12.2.1.1 Growing Vehicle Production in China is Expected to Drive the Blind Spot Monitor Market in the Country

12.2.2 India

12.2.2.1 Increasing Government Focus on Vehicle Safety to Drive the Indian Blind Spot Monitor Market

12.2.3 Japan

12.2.3.1 Rising Adoption of Advance Technology in Vehicles in Japan to Drive the Market

12.2.4 South Korea

12.2.4.1 OEMs Focus on Safety Related System in South Korea to Drive the Market

12.2.5 Thailand

12.2.5.1 Backup Camera System to Lead Thailand Market

12.2.6 Rest of Asia Oceania

12.2.6.1 Backup Camera System to Lead Rest of Asia Oceania Market

12.3 Europe

12.3.1 France

12.3.1.1 Increasing Demand for Premium Segment Vehicles to Drive Blind Spot Monitor Market in France

12.3.2 Germany

12.3.2.1 The Presence of Major Automobile Manufacturers and Its Focus on the Development of Advanced Technology to Drive German Blind Spot Monitor Market

12.3.3 Russia

12.3.3.1 Increasing Focus of OEMs to Cater to the Demand in the Russian Market has Propelled the Russian Automotive Industry

12.3.4 Spain

12.3.4.1 Backup Camera System Market in Terms of Volume to Lead Spain Market

12.3.5 Turkey

12.3.5.1 Increasing Per Capita Income Will Increase the Purchasing Power

12.3.6 UK

12.3.6.1 Increased Production of Vehicles Equipped With Advanced Electronic Components to Drive UK Market

12.3.7 Rest of Europe

12.3.7.1 Significant Vehicle Production and Technologically Advanced Automotive Industry to Drive Rest of Europe Market

12.4 North America

12.4.1 Canada

12.4.1.1 Canadian Backup Camera System Market is Driven By the Mandate the System

12.4.2 Mexico

12.4.2.1 Growing Vehicle Production and Rising Vehicle Export is Expected to Drive Mexican Market

12.4.3 US

12.4.3.1 Fast Pace Development of Semi-Autonomous and Autonomous Vehicle to Drive Us Market

12.5 Rest of the World (RoW)

12.5.1 Brazil

12.5.1.1 Surround View System Market is Projected to Be the Fastest Growing

12.5.2 Iran

12.5.2.1 Backup Camera System Market is Estimated to Be the Largest

12.5.3 Rest of RoW

12.5.3.1 Park Assist Market is Estimated to Be Second Largest

13 Competitive Landscape (Page No. - 126)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 New Product Developments

13.3.2 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

13.3.3 Expansions

13.3.4 Mergers & Acquisitions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

14 Company Profiles (Page No. - 135)

(Overview, Products Offerings, Recent Developments & SWOT Analysis)*

14.1 Bosch

14.2 Continental

14.3 Denso

14.4 Valeo

14.5 Aptiv

14.6 Magna

14.7 Autoliv

14.8 Ficosa

14.9 ZF Friedrichshafen

14.10 Gentex

14.11 Samvardhana Motherson

14.12 Other Key Players

14.12.1 Asia Oceania

14.12.1.1 Murakami Corporation

14.12.1.2 Renesas

14.12.1.3 Hyundai Mobis

14.12.1.4 Samsung Electro Mechanics

14.12.1.5 Sl Corporation

14.12.1.6 Stonkam

14.12.2 Europe

14.12.2.1 Wabco

14.12.2.2 Hella

14.12.3 North America

14.12.3.1 Ambarella Inc.

14.12.3.2 Harman

14.12.3.3 Muth Mirror Systems

14.12.3.4 Voxx International

14.12.4 Rest of the World

14.12.4.1 Mobileye

14.12.4.2 Logigo Automotive

*Details on Overview, Products Offerings, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 171)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 Detailed Analysis and Profiling of Additional Countries (Up to 3)

15.4.2 Detailed Analysis and Profiling of Additional Market Players (Up to 3)

15.4.3 Detailed Country Level Analysis and Profiling Segments (1-2)

15.5 Related Reports

15.6 Author Details

List of Tables (95 Tables)

Table 11 Surround View System: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 12 Virtual Pillars: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 13 Virtual Pillar: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 14 Blind Spot Monitor Market, By Technology Type, 2017–2027 (Thousand Units)

Table 15 Camera: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 16 Radar: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 17 Ultrasonic: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 18 Blind Spot Monitor Market, By End Market, 2017–2027 (Thousand Units)

Table 19 Blind Spot Monitor Market, By End Market, 2017–2027 (USD Million)

Table 20 OE Market: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 21 OE Market: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 22 Aftermarket: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 23 Aftermarket: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 24 Blind Spot Monitor Market, By Electric Vehicle Type, 2017–2027 (Thousand Units)

Table 25 Blind Spot Monitor Market, By Electric Vehicle Type, 2017–2027 (USD Million)

Table 26 BEV: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 27 BEV: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 28 FCEV: Blind Spot Monitor Market, By Region, 2017–2027 (Units)

Table 29 FCEV: Blind Spot Monitor Market, By Region, 2017–2027 (USD Thousand)

Table 30 HEV: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 31 HEV: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 32 PHEV: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 33 PHEV: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 34 Blind Spot Monitor Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 35 Blind Spot Monitor Market, By Vehicle Type, 2017–2027 (USD Million)

Table 36 Passenger Car: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 37 Passenger Car: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 38 Light Commercial Vehicle: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 39 Light Commercial Vehicle: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 40 Truck: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 41 Truck: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 42 Bus: Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 43 Bus: Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 44 Blind Spot Monitor Market, By Region, 2017–2027 (Thousand Units)

Table 45 Blind Spot Monitor Market, By Region, 2017–2027 (USD Million)

Table 46 Asia Oceania: Blind Spot Monitor Market, By Country, 2017–2027 (Thousand Units)

Table 47 Asia Oceania: Blind Spot Monitor Market, By Country, 2017–2027 (USD Million)

Table 48 China: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 49 China: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 50 India: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 51 India: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 52 Japan: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 53 Japan: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 54 South Korea: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 55 South Korea: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 56 Thailand: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 57 Thailand: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 58 Rest of Asia Oceania: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 59 Rest of Asia Oceania: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 60 Europe: Blind Spot Monitor Market, By Country, 2017–2027 (Thousand Units)

Table 61 Europe: Blind Spot Monitor Market, By Country, 2017–2027 (USD Million)

Table 62 France: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 63 France: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 64 Germany: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 65 Germany: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 66 Russia: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 67 Russia: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 68 Spain: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 69 Spain: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 70 Turkey: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 71 Turkey: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 72 UK: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 73 UK: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 74 Rest of Europe: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 75 Rest of Europe: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 76 North America: Blind Spot Monitor Market, By Country, 2017–2027 (Thousand Units)

Table 77 North America: Blind Spot Monitor Market, By Country, 2017–2027 (USD Million)

Table 78 Canada: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 79 Canada: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 80 Mexico: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 81 Mexico: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 82 US: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 83 US: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 84 RoW: Blind Spot Monitor Market, By Country, 2017–2027 (Thousand Units)

Table 85 RoW: Blind Spot Monitor Market, By Country, 2017–2027 (USD Million)

Table 86 Brazil: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 87 Brazil: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 88 Iran: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 89 Iran: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 90 Rest of RoW: Blind Spot Monitor Market, By Product Type, 2017–2027 (Thousand Units)

Table 91 Rest of RoW: Blind Spot Monitor Market, By Product Type, 2017–2027 (USD Million)

Table 92 New Product Developments, 2016–2018

Table 93 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements, 2016–2018

Table 94 Expansions, 2016–2018

Table 95 Mergers & Acquisitions, 2016–2018

List of Figures (54 Figures)

Figure 1 Blind Spot Monitor Market: Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Global Blind Spot Monitor Market Size: Bottom-Up Approach

Figure 5 Global Blind Spot Monitor Market Size: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Blind Spot Monitor Market: Market Outlook

Figure 8 Blind Spot Monitor Market: Market Dynamics

Figure 9 Europe to Hold the Largest Share in Blind Spot Solutions Market in 2019

Figure 10 Passenger Car to Hold the Largest Share in the Blind Spot Monitor Market in 2019

Figure 11 Backup Camera to Hold the Largest Share in the Blind Spot Monitor Market in 2019

Figure 12 BEV to Hold the Largest Share in the Blind Spot Monitor Market By 2027

Figure 13 Rising Demand for Safety and Convenience Feature By Consumers and Stringent Government Mandates Likely to Boost the Blind Spot Monitor Market

Figure 14 India to Grow at the Fastest Rate During the Forecast Period

Figure 15 Backup Camera and Rest of Europe Accounted for the Largest Share in the European Blind Spot Monitor Market, By Product & Country, Respectively

Figure 16 Camera-Based Blind Spot Solutions Held the Largest Share in Blind Spot Monitor Market, By Technology

Figure 17 OE Market to Hold the Largest Share in Blind Spot Monitor Market, By End Market

Figure 18 HEV to Hold Largest Market Share in Blind Spot Monitor Market, By Electric Vehicle Type

Figure 19 Blind Spot Monitor Market: Market Dynamics

Figure 20 Countries Where Private & Commercial Use of Radar Detectors and Sensors are Illegal

Figure 21 Most Value-Added During the Assembly& Manufacturing Stage in the Blind Spot Monitor Market

Figure 22 Rising Gni Per Capita and Increased Consumer Spending are Expected to Have A Positive Impact on the Demand for Premium Vehicles

Figure 23 The German Automotive Industry Would Be Positively Impacted By Reduced Costs and Technological Innovations

Figure 24 Improving Gdp and Increasing Focus on Innovation in the Automotive Industry Have Made Japan A Strong Market for Exporting Vehicles

Figure 25 High Rivalry Among Existing Competitors Due to Difference in Terms of Quality

Figure 26 Blind Spot Monitor Market, By Product Type, 2019 vs. 2027 (USD Million)

Figure 27 Blind Spot Monitor Market, By Technology Type, 2019 vs. 2027 (USD Million)

Figure 28 Blind Spot Monitor Market, By End Market, 2019 vs. 2027 (USD Million)

Figure 29 Blind Spot Monitor Market, By Electric Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 30 Blind Spot Monitor Market, By Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 31 Europe to Dominate the Market During the Forecast Period in Terms of Value

Figure 32 Asia Oceania: Blind Spot Monitor Market Snapshot

Figure 33 Europe: Blind Spot Monitor Market Snapshot

Figure 34 North America: Blind Spot Monitor Market Snapshot

Figure 35 RoW: Blind Spot Monitor Market, By Country, 2019 vs. 2027 (USD Million)

Figure 36 Key Developments By Leading Players in the Market, 2016–2018

Figure 37 Continental Lead the Blind Spot Monitor Market in 2018

Figure 38 Blind Spot Monitor Market (Global): Competitive Leadership Mapping, 2019

Figure 39 Bosch: Company Snapshot

Figure 40 Bosch: SWOT Analysis

Figure 41 Continental: Company Snapshot

Figure 42 Continental: SWOT Analysis

Figure 43 Denso: Company Snapshot

Figure 44 Valeo: Company Snapshot

Figure 45 Valeo: SWOT Analysis

Figure 46 Aptiv: Company Snapshot

Figure 47 Aptiv: SWOT Analysis

Figure 48 Magna: Company Snapshot

Figure 49 Magna: SWOT Analysis

Figure 50 Autoliv: Company Snapshot

Figure 51 Ficosa: Company Snapshot

Figure 52 ZF: Company Snapshot

Figure 53 Gentex: Company Snapshot

Figure 54 Samvardhana Motherson: Company Snapshot

Secondary Research

The study involves country-level OEM and model-wise analysis of blind spot monitor. This analysis includes historical trends as well as existing penetrations by country as well as by vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and regulations or mandates on the implementation of automotive electronics, which drive the blind spot monitor market. In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, automobile OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the Department of Transportation (DOT)], automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical reports, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global blind spot monitor market.

Primary Research

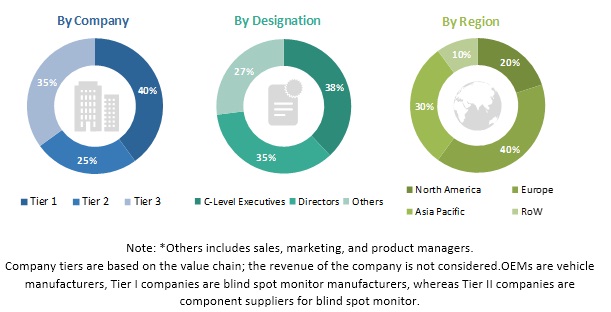

Extensive primary research has been conducted after acquiring an understanding of the blind spot monitor market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, North America, Europe, Asia Oceania, and rest of the World. Approximately 40% and 60% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents:

The figure given below illustrates the break-up of the profile of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the blind spot monitor market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides.

Report Objectives

- To define, describe, and project (2019–2027) the blind spot monitor market by volume (thousand units) and value (USD million)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the blind spot monitor market

- To analyze and forecast the demand for blind spot monitorand forecast the market size, by value, based on product type (blind spot detection system, park assist system, backup camera, virtual pillar, and surround view system)

- To analyze and forecast the market for blind spot monitor and forecast the market size, by volume and value, based on technology type (camera, radar, and ultrasonic)

- To analyze and forecast the market for blind spot monitor and forecast the market size, by volume and value, based on vehicle type (passenger car, LCV, truck, and bus)

- To analyze and forecast the market for blind spot monitor and forecast the market size, by value, based on electric vehicle type (BEV, HEV, PHEV, and FCEV)

- To analyze and forecast the market for blind spot monitorand forecast the market size, by value, based on end market type (OE market and aftermarket)

- To forecast the market size, by volume and value, of the blind spot monitor market with respect to four regions, namely, North America, Europe, Asia Oceania, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the blind spot monitor market

Available Customizations

- Detailed analysis and profiling of additional countries (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed country-level analysis and profiling segments (1-2)

Growth opportunities and latent adjacency in Blind Spot Monitor Market