Bonding Sheet Market by Adhesive Material (Polyesters, Polyimides, Acrylics, Modified Epoxies), Application (Electronics/Optoelectronics, Telecommunication/5G Communication, Automotive, Building & Construction and Region - Global Forecast to 2027

Updated on : March 20, 2024

Bonding Sheet Market

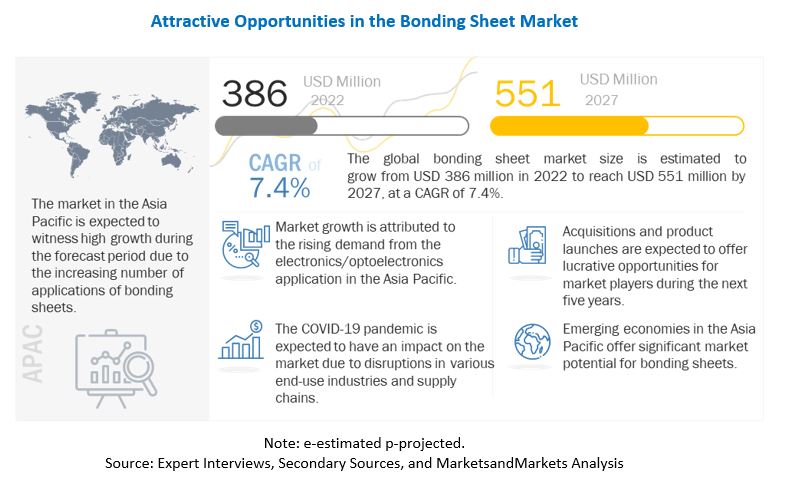

The global bonding sheet market was valued at USD 386 million in 2022 and is projected to reach USD 551 million by 2027, growing at 7.4% cagr from 2022 to 2027. Increasing demand for bonding sheet from various applications and government incentive and schemes is driving its market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global bonding sheet market

During the COVID-19 pandemic every country in the world entered some form of lockdown and this has had a considerable impact on the world’s manufacturing industry. The disruptions in the production and supply chain have had a negative impact on the bonding sheet market.

The bonding sheet market is significantly concentrated in Asian countries, with China, South Korea, and Japan leading the market in terms of manufacturing volume. Given that these countries became virus hotspots in the early outbreak of the COVID-19 pandemic, most of their manufacturing hubs remained under lockdowns to restrict the spread of the virus. The entire region houses manufacturers such as Dexerials Corporation, NIKKAN INDUSTRIES Co., Ltd., and various others that faced aggravated conditions with people showing reactivated COVID-19 symptoms. Hence, the region underwent an intensive social distancing campaign, further affecting its manufacturing industries.

The COVID-19 pandemic spread to the Japanese mainland through China, with the capital city of Tokyo becoming the epicenter of the contagion. As a result, Tokyo, along with five other prefectures of the country were sealed to contain the spread of the virus. As a cascading effect of Chinese factories being forced into lockdown, there were supply chain disruptions in Japanese manufacturing industries, with exports to the country decreasing by almost 50% in 2020. China is the global hub for the manufacture of electronic devices, with Apple, Huawei, Xiaomi, Oppo, and Vivo having production facilities in the country, while also being the heart of the COVID-19 pandemic in early 2020. The pandemic has not only caused production line disruptions and supply-chain stalls but also labor shortages and inactive logistics owing to mass lockdowns by countries across the world.

Bonding Sheet Market Dynamics

Driver: Miniaturization of electronic and semiconductor components

Bonding sheet are primarily used for bonding flexible inner layers or rigid cap layers in multi-layer lamination, for bonding flexible circuits and rigid boards, as well as bonding stiffeners and heat sinks. Adhesives play a crucial role in bonding the different elements in electronic components. The use of the type of adhesive is dependent upon factors such as bonding area, operating temperature, chemical exposure, and shelf life of the component. Ongoing technological developments in electronics and semiconductors to facilitate the miniaturization of electronic components enables compact design and design freedom. These technological developments in the electronics sector are enabled through the replacement of soldered joints with the use of state-of-the-art adhesives. The electronics market includes diverse industry verticals such as computers & servers, communications, consumer goods, industrial, medical, and automotive. Varied electronic products need bonding sheet. The increasing demand for the miniaturization/automation of mobile devices, touch screens & displays, and medical electronic systems is a factor driving the global electronics industry. The rising demand for these products has led to an increase in the consumption of bonding sheet.

Restraint: Geopolitical uncertainties hamper free flow of goods in semiconductor industry

The electronics and semiconductor industry is booming due to the emergence of AI, IoT, and telecom infrastructure. The industry is highly dependent upon the supply of semiconductor components. These components are primarily manufactured in Southeast Asia and China. International trade disputes as well as conflicts between the US and China for technology dominance are impacting the semiconductor industry. The industry has also been affected by uncertainties due to the COVID-19 pandemic. The supply chain of semiconductors is uncertain due to the involvement of overseas collaborations and high competition.

The dependence of the semiconductor supply chain on geopolitical situations could lead to disruptions, hindering the growth of the bonding sheet market.

Opportunity: Lightweighting transportation equipment

The automotive industry is gradually shifting towards ultra-high strength steels, composites, low-density alloys such as aluminum and magnesium to lightweight vehicles. Lightweight vehicles require less energy to accelerate than heavier ones, and hence offer significant potential for increasing vehicle efficiency. These new materials require novel bonding technologies. Consumer demand and government regulations are the major factors further increasing trends in lightweighting. For instance, the US Council for Automotive Research LLC, DTE Energy Company, Southern California Edison Company, Electric Power Research Institute, American Electric Power, Duke Energy, US Department of Energy, BP America, Chevron Corporation, Phillips 66 Company, ExxonMobil Corporation, and Shell Oil Products partnered for the US DRIVE program. The US DRIVE program focuses on developments in the US in technical aspects such as advanced combustion and emission control, electric drive and power electronics, electrochemical energy storage, fuel cells, and lightweight materials.

Adhesive bonding of automotive components offers various advantages over mechanical fastening. Bonding sheet offers design freedom, protection against vehicle shocks and vibrations, and longer shelf life. The use of bonding sheet can significantly reduce the requirement for the numbers of vehicle parts such as fasteners.

Challenge: Stringent environmental regulations

The chemical industry is facing challenges from regulatory authorities such as COSHH EU, REACH, GHS, and EPA in Europe and North America. Manufacturers in these regions are adhering to regulations regarding the production as well as usage of bonding sheet for various applications to reduce VOC emissions. This has affected production in companies which were majorly manufacturing bonding sheet through the use of the solvent-based technology. These regulations require manufacturers to shift from the solvent-based to water-based bonding sheet technology, which is a major challenge for manufacturers.

Bonding Sheet Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Polyimides was the most extensively consumed adhesive material in the bonding sheet market in 2020.

Based on adhesive material, the polyimides segment accounted for the largest market share in 2021, and the segment is projected to reach USD 365.5 million by 2027, growing at a CAGR of 7.3% during the forecast period. This growth is attributed to their superior thermal and mechanical properties in comparison to other polymers. Increased demand from the electronics industry coupled with strong demand from the growing automotive industry is expected to fuel the growth of this adhesive material during the forecast period.

12 µM adhesive thickness to witness the second largest market growth during the forecast period.

Rising production of multi-layer FPCs is driving the demand for bonding sheet for the adhesion of flexible circuits to rigid boards, rigid-flex circuits, stiffeners, and other materials. Leading manufacturers such as DuPont are developing acrylic-based 12 µM bonding sheet under the brand, Pyralux FR Sheet Adhesive primarily for FPC applications. It offers the ability to withstand multiple lamination cycles and provides superior bonding strength for electronic applications. Toray Industries, Inc. also offers polyimide-/epoxy-based bonding sheet for the telecommunication, automotive, and electronic applications.

Bonding sheet are extensively used in electronics industry.

Bonding sheet provide instant adhesion owing to their even adhesive coverage characteristics on various surfaces. They are ideal materials for rigid substrates, interlayer insulating materials for FPCs, and also for plating and laser processing. Adhesion by bonding sheet is not impacted in hot and humid environments and provides enhanced appearance. However, storage in clean and dry environments is advisable. Bonding sheet possesses various properties such as dielectric contact, thermal resistance, anti-migration, and others. They are developed for demanding applications in electronics such as fixing CPUs to heat sinks or heat radiation fans, multi-layer FPCs, LED modules, hard disk drives, miniature electronic components such as bonding chips and base cards of small memory cards, and others. Modified epoxies, acrylics, and polyimide adhesives are used to develop bonding sheet for electronics/optoelectronics applications. Leading manufacturers of bonding sheet primarily for electronics/optoelectronics applications are Dexerials Corporation, Arisawa Manufacturing Co., Ltd., DuPont, Nitto Denko Corporation, Hanwha Solutions Advanced Materials Division, ITEQ Corporation, and others.

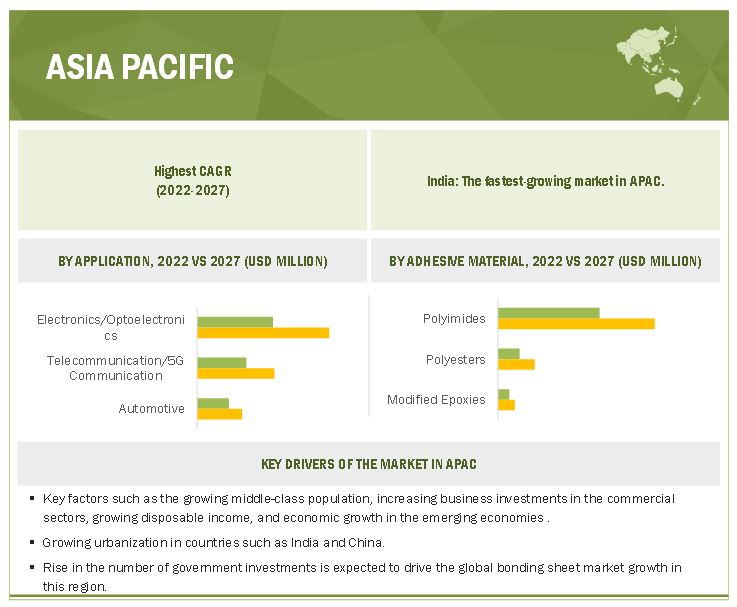

Asia Pacific is the leading bonding sheet market, globally, in 2020.

APAC is the largest and fastest-growing region for bonding sheet market. The growth in demand for bonding sheet in the region can be largely attributed to factors such as high population, increasing industrial growth, and stringent environmental norms. Moreover, the rising number of applications in the region is also leading to innovations and developments in the field of bonding sheet, thereby fueling the growth of the APAC bonding sheet market.

Key Market Players

Major players operating in the global bonding sheet market include Arisawa Manufacturing Co. (Japan), DuPont (US), NIKKAN INDUSTRIES Co., Ltd. (Japan), Dexerials Corporation (Japan), Nitto Denko Corporation (Japan), Showa Denko Materials Co., Ltd. (Japan), Toray Industries, Inc. (Japan), NAMICS Corporation (Japan), and Shin-Etsu Polymer Co., Ltd. (Japan) among many others.

Bonding Sheet Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 386 Million |

|

Revenue Forecast in 2027 |

USD 551 Million |

|

CAGR |

7.4% |

|

Years considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million), Volume (Million Square Meter) |

|

Segments |

By adhesive material , adhesive thickness, application, and Region |

|

Regions |

North America, APAC, Europe, South America, and the Middle East & Africa |

|

Companies |

Arisawa Manufacturing Co.(Japan), DuPont (US), NIKKAN INDUSTRIES Co., Ltd. (Japan), Dexerials Corporation (Japan), Nitto Denko Corporation (Japan), Showa Denko Materials Co., Ltd. (Japan), Toray Industries, Inc. (Japan), NAMICS Corporation (JAPAN), and Shin-Etsu Polymer Co., Ltd. (Japan). Total 25 major players covered |

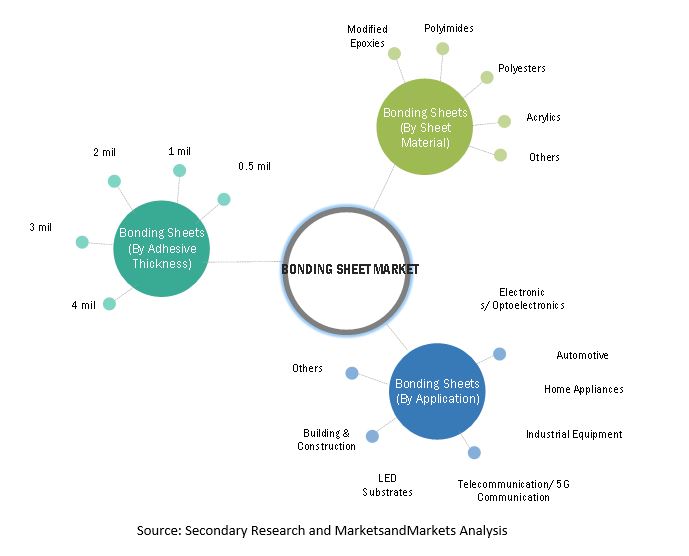

This research report categorizes the bonding sheet market is segmented by adhesive material , adhesive thickness, application, and region.

Based on the adhesive material:

- Polyesters (PET)

- Polyimides (PI)

- Acrylics

- Modified Epoxies

- Others

Based on the adhesive thickness:

- 12µM (0.5MIL)

- 25µM (1MIL)

- 50µM (2MIL)

- 75µM (3MIL)

- 100µM (4MIL)

Based on the application:

- Electronics/Optoelectronics

- Telecommunication/5G Communication

- Automotive

- Building & Construction

- Others

Based on the region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2020, Dexerials Corporation collaborated with SemsoTec Group, a Germany-based automotive solutions provider for in-vehicle displays and dashboard design. Dexerials Corporation has adopted the collaborations strategy to provide technology support for automotive display in Germany. Dexerials Corporation is expected to provide high-quality optical materials and SemsoTec is expected to design automotive display to cater automotive manufacturers in Germany.

- In May 2022, DuPont established a new production line for manufacturing Kapton polyimide film and Pyralux flexible circuit materials in the Ohio, US manufacturing facility. The company invested USD 250 million to expand the Electronics & Industrial business segment to cater the rising demand for polyimide films from the automotive, electronics, telecommunications, industrial, and defense industries.

- In February 2022, Shin-Etsu Chemical, the parent organization of Shin-Etsu Polymer Co., Ltd. is investing approximately USD 680 million in manufacturing facilities in Japan. The company has adopted the investments & expansions strategy to increase the production capacity of silicon-based products including silicon resins, fluids, and other related products. The facility is expected to increase production capacities and become operational by 2025.

- In April 2021, DuPont is establishing a new adhesive manufacturing facility in Zhangjiagang, China. The company invested USD 30 million for the production of bonding adhesives for electric vehicles and lightweight construction. The new facility is expected to manufacture thermal interface materials, thermal conductive adhesives, multi-material bonding adhesives, and structural adhesives. DuPont is witnessing rising demand for hybrid and electric automobiles in the China and Asia Pacific markets. The new production plant is expected to become operational by 2023.

FAQs:

What is the current size of the global bonding sheet market?

The global bonding sheet market is estimated to be USD 360 million in 2021 and is projected to reach USD 551 million by 2027, at a CAGR of 7.4%.

What are the factors influencing the growth of bonding sheet market?

The growth of this market can be attributed to rising demand from the key applications.

What is the biggest restraint for bonding sheet?

The volatile raw material prices is restraining the growth of the market.

Who are the major manufacturers?

Major manufacturers include Arisawa Manufacturing Co. (Japan), DuPont (US), NIKKAN INDUSTRIES Co., Ltd. (Japan), Dexerials Corporation (Japan), Nitto Denko Corporation (Japan), Showa Denko Materials Co., Ltd. (Japan), Toray Industries, Inc. (Japan), NAMICS Corporation (Japan), and Shin-Etsu Polymer Co., Ltd. (Japan), among others.

What is the impact of COVID-19 on the overall bonding sheet market?

Bonding sheet are used in applications, such as electronics/optoelectronics, telecommunication/5G communication, automotive, building & construction, and others. Due to the ongoing pandemic, these industries has been severely affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions have slowed the growth of the industry in a considerable manner.

What will be the growth prospects of the bonding sheet market?

Growing electronics industry is expected to offer significant growth opportunities to manufacturers of bonding sheet.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 BONDING SHEET MARKET SEGMENTATION

1.4.1 REGIONAL SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 BONDING SHEET MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 PRIMARY INTERVIEWS

2.1.3.1 Primary interviews – demand and supply sides

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION APPROACH

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for arriving at market size using top-down analysis

FIGURE 4 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 5 BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 BONDING SHEET MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 7 POLYIMIDES SEGMENT TO LEAD BONDING SHEET MARKET DURING FORECAST PERIOD

FIGURE 8 25µM (1MIL) ADHESIVE THICKNESS SEGMENT TO LEAD MARKET

FIGURE 9 ELECTRONICS/OPTOELECTRONICS APPLICATION SEGMENT TO LEAD BONDING SHEET MARKET DURING FORECAST PERIOD

FIGURE 10 EUROPE ACCOUNTED FOR LARGEST SHARE OF BONDING SHEET MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN BONDING SHEET MARKET

FIGURE 11 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN BONDING SHEET MARKET DURING FORECAST PERIOD

4.2 BONDING SHEET MARKET, BY ADHESIVE MATERIAL

FIGURE 12 POLYESTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 BONDING SHEET MARKET, BY ADHESIVE THICKNESS

FIGURE 13 25µM (1MIL) SEGMENT TO GROW AT HIGHEST CAGR

4.4 BONDING SHEET MARKET, BY APPLICATION

FIGURE 14 ELECTRONICS/OPTOELECTRONICS APPLICATION TO LEAD MARKET BY 2027

4.5 BONDING SHEET MARKET, BY COUNTRY

FIGURE 15 MARKET IN INDIA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BONDING SHEET MARKET

5.2.1 DRIVERS

5.2.1.1 Miniaturization of electronic and semiconductor components

5.2.1.2 Rising demand for electric vehicles

FIGURE 17 GLOBAL ELECTRIC CAR SALES

5.2.2 RESTRAINTS

5.2.2.1 Geopolitical uncertainties hamper free flow of goods in semiconductor industry

5.2.2.2 Volatility in prices of raw materials

FIGURE 18 BRENT CRUDE OIL PRICE FLUCTUATIONS

5.2.3 OPPORTUNITIES

5.2.3.1 Lightweighting transportation equipment

5.2.3.2 Developments in telecommunications industry

5.2.4 CHALLENGES

5.2.4.1 Paper/tissue-backed bonding sheet prone to be affected by moisture

5.2.4.2 Stringent environmental regulations

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 BONDING SHEET MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 1 BONDING SHEET MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM MAPPING

FIGURE 20 BONDING SHEET ECOSYSTEM

5.6 TRADE ANALYSIS

TABLE 2 IMPORT DATA FOR SELF-ADHESIVE PLATES, SHEETS, FILMS, FOILS, TAPES, STRIPS, AND OTHER FLAT SHAPES OF PLASTICS, WHETHER OR NOT IN ROLLS IMPORT DATA (USD THOUSAND)

TABLE 3 EXPORT DATA FOR SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP, AND OTHER FLAT SHAPES, OF PLASTICS, WHETHER OR NOT IN ROLLS IMPORT DATA (USD THOUSAND)

5.7 PRICING ANALYSIS

FIGURE 21 AVERAGE PRICING ANALYSIS, BY REGION

5.8 IMPACT OF COVID-19 ON BONDING SHEET MARKET

5.8.1 IMPACT OF COVID-19 ON ELECTRONICS INDUSTRY

5.8.2 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 DOCUMENT TYPE

FIGURE 23 GRANTED PATENTS

FIGURE 24 PUBLICATION TRENDS - LAST TEN YEARS

5.10.3 INSIGHTS

5.10.4 LEGAL STATUS OF PATENTS

FIGURE 25 LEGAL STATUS

FIGURE 26 TOP JURISDICTION-BY DOCUMENT

5.10.5 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 4 LIST OF PATENTS BY NITTO DENKO CORPORATION

TABLE 5 LIST OF PATENTS BY SHENGYI TECHNOLOGY CO., LTD.

TABLE 6 LIST OF PATENTS OF LINTEC CORPORATION

TABLE 7 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

5.11 TECHNOLOGY ANALYSIS

5.11.1 5G TELECOMMUNICATIONS AND BONDING SHEETS

5.11.2 ELECTRIC VEHICLES AND BONDING SHEETS

5.12 MARKETING CHANNELS

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 BONDING SHEET MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 OPERATIONAL DATA

5.15.1 TRENDS IN ELECTRONICS INDUSTRY

FIGURE 28 MARKET SHARE OF SEMICONDUCTOR MANUFACTURING COUNTRIES (2018-2020)

TABLE 12 GOVERNMENT INCENTIVES FOR SEMICONDUCTOR MANUFACTURING IN 2021, BY COUNTRY

5.15.2 TRENDS IN AUTOMOTIVE INDUSTRY

FIGURE 29 PROJECTED PRODUCTION OF ELECTRIC VEHICLES AND PLUG-IN HYBRID ELECTRIC VEHICLES BY MAJOR COUNTRIES (THOUSAND UNITS)

TABLE 13 GOVERNMENT INCENTIVES FOR ELECTRIC VEHICLES IN 2020, BY COUNTRY

5.16 KEY FACTORS AFFECTING BUYING DECISIONS

5.16.1 QUALITY

TABLE 14 GOVERNMENT INCENTIVES FOR ELECTRIC VEHICLES IN 2020, BY COUNTRY,

5.16.2 SERVICE

FIGURE 30 KEY STAKEHOLDERS & BUYING CRITERIA

5.17 MACROECONOMIC ANALYSIS

TABLE 15 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

6 BONDING SHEET MARKET, BY ADHESIVE MATERIAL (Page No. - 76)

6.1 INTRODUCTION

FIGURE 31 POLYESTERS TO BE FASTEST-GROWING SEGMENT, BY ADHESIVE MATERIAL

TABLE 16 BONDING SHEET MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 17 BONDING SHEET MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

6.2 POLYESTERS

6.2.1 POLYESTER BONDING SHEET IS APT FOR INSULATION APPLICATIONS REQUIRING THIN AND DURABLE MATERIALS WITH HIGH DIELECTRIC STRENGTH

TABLE 18 POLYESTERS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 POLYESTERS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.3 POLYIMIDES

6.3.1 PREFERENCE FOR POLYIMIDE BONDING SHEET FOR FLEXIBLE DISPLAY AND OPTOELECTRONICS TO BOOST MARKET

TABLE 20 POLYIMIDES: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 POLYIMIDES: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.4 ACRYLICS

6.4.1 INCREASING USE OF ACRYLIC BONDING SHEETS IN AUTOMOTIVE APPLICATIONS EXPECTED TO FUEL DEMAND

TABLE 22 ACRYLICS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 ACRYLICS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.5 MODIFIED EPOXIES

6.5.1 THESE ADHESIVES ARE WIDELY USED FOR BONDING ELECTRONIC COMPONENTS

TABLE 24 MODIFIED EPOXIES: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 MODIFIED EPOXIES: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.6 OTHERS

TABLE 26 OTHER ADHESIVE MATERIALS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 OTHER ADHESIVE MATERIALS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

7 BONDING SHEET MARKET, BY ADHESIVE THICKNESS (Page No. - 85)

7.1 INTRODUCTION

FIGURE 32 25µM ADHESIVE THICKNESS SEGMENT TO CONTINUE TO BE LEADING SEGMENT DURING FORECAST PERIOD

TABLE 28 BONDING SHEET MARKET SIZE, BY ADHESIVE THICKNESS, 2020–2027 (USD MILLION)

TABLE 29 BONDING SHEET MARKET SIZE, BY ADHESIVE THICKNESS, 2020–2027 (MILLION SQUARE METER)

7.2 12µM

7.3 25µM

7.4 50µM

7.5 75µM

7.6 100µM

8 BONDING SHEET MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 33 ELECTRONICS/OPTOELECTRONICS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2022

TABLE 30 BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 31 BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.2 ELECTRONICS/OPTOELECTRONICS

TABLE 32 ELECTRONICS/OPTOELECTRONICS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 ELECTRONICS/OPTOELECTRONICS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

8.2.1 HOME APPLIANCES

8.2.2 LED SUBSTRATES

8.2.3 INDUSTRIAL EQUIPMENT

8.2.4 OTHERS

8.3 TELECOMMUNICATION/5G COMMUNICATION

TABLE 34 TELECOMMUNICATION/5G COMMUNICATION: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 TELECOMMUNICATION/5G COMMUNICATION: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

8.4 AUTOMOTIVE

TABLE 36 AUTOMOTIVE: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 AUTOMOTIVE: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

8.5 BUILDING & CONSTRUCTION

TABLE 38 BUILDING & CONSTRUCTION: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 BUILDING & CONSTRUCTION: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

8.6 OTHERS

TABLE 40 OTHER APPLICATIONS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 OTHER APPLICATIONS: BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

9 BONDING SHEET MARKET, BY REGION (Page No. - 97)

9.1 INTRODUCTION

FIGURE 34 INDIA PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 42 BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 BONDING SHEET MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: BONDING SHEET MARKET SNAPSHOT

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.2.1 US

9.2.1.1 Trend in miniaturization of electronic devices create potential demand for bonding sheet in US

TABLE 50 US: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 51 US: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.2.2 CANADA

9.2.2.1 Canadian companies are leading in developing transformative automotive technologies

TABLE 52 CANADA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.2.3 MEXICO

9.2.3.1 Mexico is an attractive destination for investments in electronics sector

TABLE 54 MEXICO: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: BONDING SHEET MARKET SNAPSHOT

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.1 CHINA

9.3.1.1 China to continue to be dominant Asia Pacific bonding sheet market

TABLE 62 CHINA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 63 CHINA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.2 JAPAN

9.3.2.1 Increasing government initiatives to drive market

TABLE 64 JAPAN: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.3 INDIA

9.3.3.1 Rising demand from electronics industry to drive bonding sheet market

TABLE 66 INDIA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 67 INDIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.4 SOUTH KOREA

9.3.4.1 Rapid economic growth and strong electronics sector expected to boost market in South Korea

TABLE 68 SOUTH KOREA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.5 MALAYSIA

9.3.5.1 High demand from electronics and automotive industries expected to drive bonding sheet market in Malaysia

TABLE 70 MALAYSIA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 MALAYSIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.6 AUSTRALIA

9.3.6.1 Investments by government in Australian electronics industry increase opportunities for bonding sheet market

TABLE 72 AUSTRALIA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.3.7 REST OF ASIA PACIFIC

TABLE 74 REST OF ASIA PACIFIC: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4 EUROPE

FIGURE 37 ELECTRONICS/OPTOELECTRONICS TO BE FASTEST-GROWING APPLICATION IN EUROPE

TABLE 76 EUROPE: BONDING SHEET MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

TABLE 78 EUROPE: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

TABLE 80 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.1 GERMANY

9.4.1.1 Smart manufacturing in German electronics industry to boost bonding sheet market

TABLE 82 GERMANY: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 83 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.2 UK

9.4.2.1 Significant applications of bonding sheets in electronics/optoelectronics drive demand

TABLE 84 UK: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 UK: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.3 FRANCE

9.4.3.1 Demand for bonding sheets in electronics industry expected to boost market

TABLE 86 FRANCE: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 87 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.4 ITALY

9.4.4.1 Recovery of economy and moderate growth in electronics industry contribute to demand for bonding sheets

TABLE 88 ITALY: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 ITALY: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.5 RUSSIA

9.4.5.1 Government support and investments in domestic electronics industry to drive market

TABLE 90 RUSSIA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.6 SPAIN

9.4.6.1 Innovative process chains for optoelectronic devices expected to boost bonding sheet market

TABLE 92 SPAIN: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 SPAIN: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.4.7 REST OF EUROPE

TABLE 94 REST OF EUROPE: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5 MIDDLE EAST & AFRICA

TABLE 96 MIDDLE EAST & AFRICA: BONDING SHEET MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

TABLE 98 MIDDLE EAST & AFRICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

TABLE 100 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5.1 SAUDI ARABIA

9.5.1.1 Positive trends in industrial exports of electrical machines and equipment & tools to drive market

TABLE 102 SAUDI ARABIA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5.2 SOUTH AFRICA

9.5.2.1 Market expected to be driven due to high sales of low-priced smartphones, wherein bonding sheets are key materials utilized

TABLE 104 SOUTH AFRICA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 105 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5.3 UAE

9.5.3.1 Rising demand for portable consumer electronics and supportive government initiatives to attract manufacturers

TABLE 106 UAE: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 UAE: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5.4 QATAR

9.5.4.1 Developments by electronics manufacturers to drive bonding sheet market

TABLE 108 QATAR: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 QATAR: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.5.5 REST OF THE MIDDLE EAST & AFRICA

TABLE 110 REST OF MIDDLE EAST & AFRICA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 111 REST OF MIDDLE EAST & AFRICA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.6 SOUTH AMERICA

TABLE 112 SOUTH AMERICA: BONDING SHEET MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 113 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

TABLE 114 SOUTH AMERICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (USD MILLION)

TABLE 115 SOUTH AMERICA: MARKET SIZE, BY ADHESIVE MATERIAL, 2020–2027 (MILLION SQUARE METER)

TABLE 116 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 117 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.6.1 BRAZIL

9.6.1.1 Large numbers of electronics manufacturers have established their plants in Brazil

TABLE 118 BRAZIL: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.6.2 ARGENTINA

9.6.2.1 Rising government support to promote manufacture of electronics

TABLE 120 ARGENTINA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9.6.3 REST OF SOUTH AMERICA

TABLE 122 REST OF SOUTH AMERICA: BONDING SHEET MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 123 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

10 COMPETITIVE LANDSCAPE (Page No. - 146)

10.1 INTRODUCTION

10.2 MARKET EVALUATION MATRIX

FIGURE 38 INVESTMENTS & EXPANSIONS WAS HIGHEST ADOPTED STRATEGY BY BONDING SHEET MANUFACTURERS

TABLE 124 MARKET EVALUATION MATRIX

10.3 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 125 BONDING SHEET MARKET: REVENUE ANALYSIS (USD)

10.4 MARKET RANKING ANALYSIS

FIGURE 39 RANKING OF TOP FIVE PLAYERS IN BONDING SHEET MARKET, 2021

10.4.1 ARISAWA MANUFACTURING CO., LTD.

10.4.2 NITTO DENKO CORPORATION

10.4.3 DUPONT

10.4.4 DEXERIALS CORPORATION

10.4.5 NIKKAN INDUSTRIES CO., LTD.

10.5 COMPANY EVALUATION MATRIX

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 40 BONDING SHEET MARKET: COMPANY EVALUATION MATRIX, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 126 COMPANY PRODUCT OFFERINGS

TABLE 127 COMPANY APPLICATION FOOTPRINT

TABLE 128 COMPANY ADHESIVE MATERIAL FOOTPRINT

TABLE 129 COMPANY REGION FOOTPRINT

FIGURE 41 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 BUSINESS STRATEGY EXCELLENCE

10.7 COMPANY EVALUATION MATRIX (STARTUPS/SMES)

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

10.7.4 DYNAMIC COMPANY

FIGURE 43 BONDING SHEET MARKET: STARTUPS AND SMES MATRIX, 2021

10.8 COMPETITIVE BENCHMARKING (STARTUPS/SMES)

TABLE 130 DETAILED LIST OF STARTUPS/SMES

TABLE 131 COMPANY PRODUCT OFFERINGS

10.9 COMPETITIVE SCENARIO

10.9.1 NEW PRODUCT LAUNCHES

TABLE 132 NEW PRODUCT LAUNCHES, 2017–2022

10.9.2 DEALS

TABLE 133 DEALS, 2017—2022

10.9.3 OTHER DEVELOPMENTS

TABLE 134 OTHER DEVELOPMENTS, 2017–2022

11 COMPANY PROFILES (Page No. - 168)

11.1 KEY PLAYERS

(Business overview, Products/solutions offered, Recent Developments, MNM view)*

11.1.1 ARISAWA MANUFACTURING CO., LTD.

TABLE 135 ARISAWA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

FIGURE 44 ARISAWA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

TABLE 136 ARISAWA MANUFACTURING CO., LTD.: PRODUCT OFFERINGS

11.1.2 NITTO DENKO CORPORATION

TABLE 137 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 45 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 138 NITTO DENKO CORPORATION: PRODUCT OFFERINGS

11.1.3 DUPONT

TABLE 139 DUPONT: COMPANY OVERVIEW

FIGURE 46 DUPONT: COMPANY SNAPSHOT

TABLE 140 DUPONT: PRODUCT OFFERINGS

TABLE 141 DUPONT: PRODUCT LAUNCHES

TABLE 142 DUPONT: OTHERS

11.1.4 DEXERIALS CORPORATION

TABLE 143 DEXERIALS CORPORATION: COMPANY OVERVIEW

FIGURE 47 DEXERIALS CORPORATION: COMPANY SNAPSHOT

TABLE 144 DEXERIALS CORPORATION: PRODUCT OFFERINGS

TABLE 145 DEXERIALS CORPORATION: DEALS

11.1.5 NIKKAN INDUSTRIES CO., LTD.

TABLE 146 NIKKAN INDUSTRIES CO., LTD.: COMPANY OVERVIEW

TABLE 147 NIKKAN INDUSTRIES CO., LTD.: PRODUCT OFFERINGS

11.1.6 SHOWA DENKO MATERIALS CO., LTD.

TABLE 148 SHOWA DENKO MATERIALS CO., LTD.: COMPANY OVERVIEW

FIGURE 48 SHOWA DENKO MATERIALS CO., LTD.: COMPANY SNAPSHOT

TABLE 149 SHOWA DENKO MATERIALS CO., LTD.: PRODUCT OFFERINGS

TABLE 150 SHOWA DENKO MATERIALS CO., LTD.: DEALS

11.1.7 TORAY INDUSTRIES, INC.

TABLE 151 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 49 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 152 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

TABLE 153 TORAY INDUSTRIES, INC.: OTHERS

11.1.8 NAMICS CORPORATION

TABLE 154 NAMICS CORPORATION: COMPANY OVERVIEW

TABLE 155 NAMICS CORPORATION: PRODUCT OFFERINGS

11.1.9 SHIN-ETSU POLYMER CO., LTD.

TABLE 156 SHIN-ETSU POLYMER CO., LTD.: COMPANY OVERVIEW

FIGURE 50 SHIN-ETSU POLYMER CO., LTD.: COMPANY SNAPSHOT

TABLE 157 SHIN-ETSU POLYMER CO., LTD.: PRODUCT OFFERINGS

TABLE 158 SHIN-ETSU POLYMER CO., LTD.: OTHERS

*Details on Business overview, Products/solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 TAIFLEX SCIENTIFIC CO., LTD.

TABLE 159 TAIFLEX SCIENTIFIC CO., LTD.: COMPANY OVERVIEW

11.2.2 SHENGYI TECHNOLOGY CO., LTD.

TABLE 160 SHENGYI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

11.2.3 INNOX ADVANCED MATERIALS CO., LTD.

TABLE 161 INNOX ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

11.2.4 ITEQ CORPORATION

TABLE 162 ITEQ CORPORATION: COMPANY OVERVIEW

11.2.5 MICROCOSM TECHNOLOGY CO., LTD.

TABLE 163 MICROCOSM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

11.2.6 SHANDONG GOLDING ELECTRONICS MATERIALS CO., LTD

TABLE 164 SHANDONG GOLDING ELECTRONICS MATERIALS CO., LTD: COMPANY OVERVIEW

11.2.7 HANWHA SOLUTIONS ADVANCED MATERIALS DIVISION

TABLE 165 HANWHA SOLUTIONS ADVANCED MATERIALS DIVISION: COMPANY OVERVIEW

11.2.8 NIPPON MEKTRON, LTD.

TABLE 166 NIPPON MEKTRON, LTD.: COMPANY OVERVIEW

11.2.9 RISHO KOGYO CO., LTD.

TABLE 167 RISHO KOGYO CO., LTD.: COMPANY OVERVIEW

11.2.10 DONGYI

TABLE 168 DONGYI: COMPANY OVERVIEW

11.2.11 TERAOKA SEISAKUSHO CO., LTD.

TABLE 169 TERAOKA SEISAKUSHO CO., LTD.: COMPANY OVERVIEW

11.2.12 FUJIKURA LTD.

TABLE 170 FUJIKURA LTD.: COMPANY OVERVIEW

11.2.13 QINGLONG ADHESIVES

TABLE 171 QINGLONG ADHESIVES: COMPANY OVERVIEW

11.2.14 PANASONIC INDUSTRY CO., LTD.

TABLE 172 PANASONIC INDUSTRY CO., LTD.: COMPANY OVERVIEW

11.2.15 LINTEC CORPORATION

TABLE 173 LINTEC CORPORATION: COMPANY OVERVIEW

12 APPENDIX (Page No. - 203)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

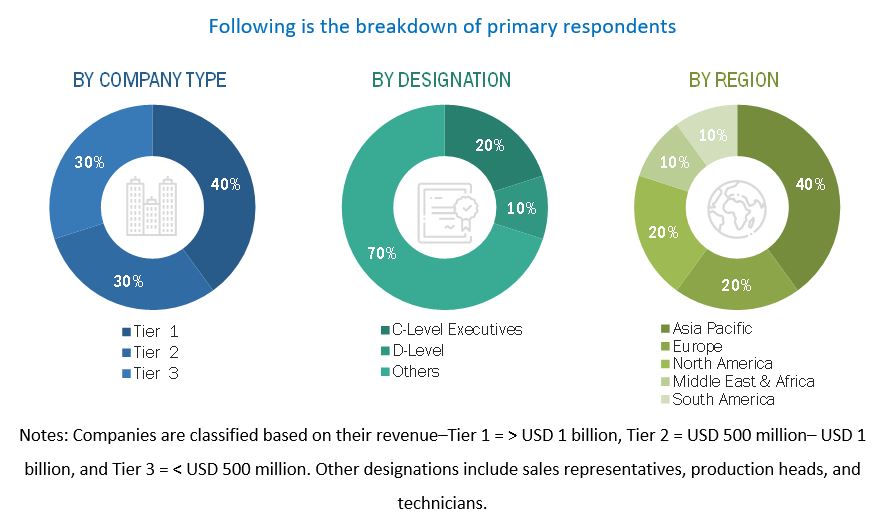

The study involved four major activities to estimate the current market size of bonding sheet. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as Canadian Printable Electronics Industry Association (CPEIA), Electronic Manufacturers’ Association (ZVEI), and others.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the bonding sheet market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (bonding sheet manufacturers) and supply-side (end-product manufacturers, buyers, and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of bonding sheet market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Bonding Sheet Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the bonding sheet market size, terms of value, and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market by adhesive material, adhesive thickness, and application.

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa (MEA), along with their countries

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their revenue and core competencies.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the bonding sheet market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the bonding sheet market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bonding Sheet Market