C4ISR Market by Application (Command and Control, Communications, Computers, ISR, Electronic Warfare), Platform (Airborne, Land, Naval, Space), Solution (Hardware, Application Software, Services), End User, Installation and Region - Global Forecast to 2028

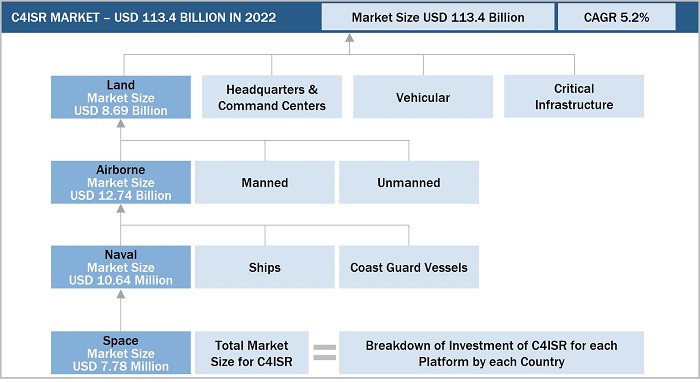

[307 Pages Report] The C4ISR Market is projected to grow from USD 113.4 billion in 2022 to USD 154.0 billion by 2028, at a CAGR of 5.2%. Over the world, the C4ISR market is expanding significantly, and during the forecast period, a similar trend is anticipated. The extensive use of small, efficient, and advanced C4ISR systems has raised demand for them all around the world. On the other side, concerns like escalating terrorism, hostile threats, and rising territorial disputes globally are pushing military to improve their ability to share data on the battlefield. Throughout the projected period, the C4ISR industry growth is anticipated to increase due to the rising need for asymmetric warfare and new technologies like network-centric battle management and unmanned vehicles. To improve the effectiveness and situational awareness of military troops, there is an increasing emphasis on increasing expenditures in integrating cutting-edge technology like machine learning and artificial intelligence into C4ISR solutions. In the upcoming years, this is also anticipated to fuel market expansion.

C4ISR Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

C4ISR Market Dynamics

Driver: Need for enhanced integrated situational awareness to support decision making

In any mission, decision-making and directing of forces that command and control require the support of effective computer and communication systems for situational awareness. Situational awareness (SA) refers to the ability of decision-makers to identify, process, and analyze critical information from various sources. Thus, it plays a key role in air, naval, and military operations. Advanced ISR technologies integrated with C4 capabilities provide air, ground, and maritime solutions with real-time SA information for strategic decision-making. High-bandwidth sensor processing, video management systems, secure network routers, and switches play a crucial role in effective decision-making in a mission.

The US government is currently planning to invest in the development of small satellite constellations into the low Earth orbit (LEO) to obtain enhanced space-based SA capabilities. These investments are targeted at overcoming the shortcomings of traditional large satellites and airborne sensors that cannot provide continuous surveillance. On this note, in January 2023, Raytheon Intelligence & Space (RI&S), a business unit of Raytheon Technologies Corporation (US), was awarded a prime contract to develop a prototype Missile Track Custody (MTC) system for the US Space Force. MTC is the US Space Force's first medium earth orbit missile tracking system.

Several other manufacturers are also upgrading their product offerings and conducting R&D to develop new technologies to address the evolving needs of their clientele. For instance, in August 2021, Lockheed Martin Corporation (US) invented the Wide Angle ESA Fed Reflector (WAEFR) antenna, a hybrid of a phased array electronically steerable antenna (ESA) and a parabolic dish that increases coverage area by 190% compared to traditional phased array antennas at a much lower cost. Such developments are anticipated to drive the adoption of C4ISR systems by armed forces across the globe, thereby boosting the growth of the market in focus during the forecast period.

Restraints: High development and maintenance costs of C4 systems

C4 is essential in modern warfare; however, the high R&D and implementation cost of these systems must be borne by the defense arms of countries. C4 means the integration of various air defense, communication, computer, command, and control systems and intelligence, surveillance, and reconnaissance systems on a functional multidomain platform. These systems are expensive to develop, install, and maintain. Therefore, the cost and time required to develop and implement these systems are important factors that limit the development of these systems.

Opportunities: Increasing need for interoperability between military devices/technologies

The legacy devices traditionally used by defense forces were typically incompatible with one another and required significant effort for the assimilation and management of data for analysis. This resulted in the advent of control systems designed to effectively perform the task. New generation control systems are integrated into a single system that increases the situational awareness of defense forces. Data from all sensors combine to provide an overall picture of any situation. In military systems, data fusion from air defense radar systems and electro-optical, acoustic, and infrared systems increases surveillance capabilities and provides mission planning capabilities. For example, the global command and control system (GCCS) provides information-sharing capabilities for US armed forces. This enables armed forces to undertake data analysis and leverage mission planning capabilities.

The large volume of data generated has also necessitated the development of a centralized battle management system that can assist users of AI capabilities for effective decision-making considering the influence and impact of several parameters, both macro and micro, within a short span. Hence, companies are developing advanced battle management systems that can assimilate data from multiple devices and platforms. For instance, in December 2022, RI&S (US) was selected to develop a common tactical edge network (CTEN) in support of the US Air Force's Advanced Battle Management System. RI&S is one of nine companies selected to demonstrate portions of the network. CTEN would provide edge networking to help operators enable distributable battle management command and control in highly contested environments to support joint all-domain command and control (JADC2).

Challenges: Inability of existing electronic warfare systems to address diverse threats

The utilization of the electromagnetic spectrum is expanding, which makes it feasible for various electronic equipment to operate at different frequencies, making it challenging to identify some. The electronic warfare domain is therefore crucial for defensive forces. The military of different nations use tactical indicators to identify danger categories, transmission frequencies, signal characteristics, detection signals, and other relevant data. They also concentrate on gathering threat intelligence through frequency hopping detection. Threats can be detected by interrupting, searching, identifying, and locating hostile electromagnetic radiation sources, which will make it easier to deploy security troops. Existing EW systems must be technically improved nevertheless in order to implement these functions properly. In contemporary EW Systems, the threat of asymmetric warfare is a real issue. The difficulties experienced by standard EW systems on the battlefield have also been made worse by the availability of many delivery vehicles for stealth weapons, such as airplanes and frigates.

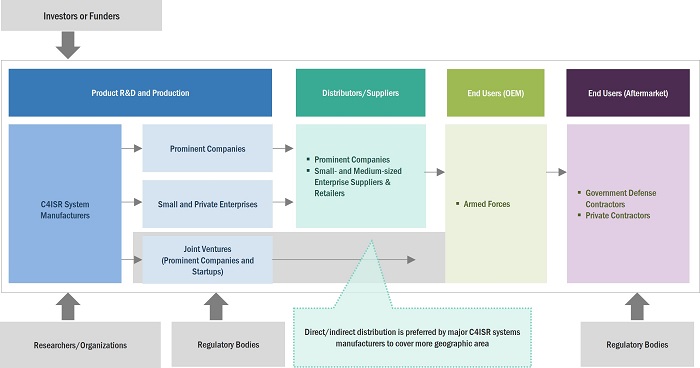

C4isr Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of C4ISR systems and platforms. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Northrop Grumman Corporation (US), BAE Systems plc (UK), Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), and General Dynamics Corporation (US).

Based on Solution, hardware segment is estimated to account for the largest market share of the C4ISR market

Based on solution, the hardware market is estimated to account for the largest market share. The demand for wired communication devices for underwater and subsurface military applications, the need for 5G networks for faster wireless data transfer, the need for sensors in next-generation airborne intelligence, surveillance, and reconnaissance systems, the demand for tactical navigation systems for unmanned platforms, the demand for potable, rugged devices for dismounted soldiers, as well as the growing need for intelligence gathering, will all contribute to the market growth.

Based on application, The intelligence, surveillance, and reconnaissance segment are anticipated to dominate the market

Based on application, the market is segmented into the intelligence, surveillance and reconnaissance, communications, command and control, computers and electronic warfare. ISR offers situational awareness and access to mission-critical data without blocking tactical communication networks. High-volume data obtained from surveillance and reconnaissance platforms are analyzed and shared with operational groups. In June 2021, Northrop Grumman Corporation (US) received a newly expanded role as a system integrator for C5ISR and control systems on the US Coast Guard Offshore Patrol Cutter (OPC) by Eastern Shipbuilding Group (ESG), the prime contractor for the OPC program.

Naval segment of the C4ISR market by platform is projected to witness the highest CAGR during the forecast period.

Based on platform, the naval segment estimated to account for the highest growth rate. With an increase in the number of sensors on ships and advancements in radar technology, naval C4ISR systems have been upgraded with data analytics solutions such as artificial intelligence and cloud computing. Companies such as Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), THALES (France), Lockheed Martin Corporation (US), and BAE Systems plc (UK) are involved in the development and production of advanced signal processing and naval warfare systems. These systems include various types of shipboard radars, track management systems, communication systems, and electronic warfare systems to counter sea-based threats. Thus, Enhanced systems for tactical information management and improved efficiency to drive the market growth.

Defense and space segment of the C4ISR market by end user is projected to witness the highest market share of the C4ISR market.

The Defense and space segment Is to hold the highest market share. This can be linked to improvements in C4ISR capabilities for improved combat situational awareness. The C4ISR improves the capability of armed forces across the world. By situational awareness, understanding of the enemy and environment, and reducing the lag between sensing and reacting, advanced C4ISR capabilities give an advantage. Thus the department of defense worldwide are adopting the C4ISR Systems to enhance their capabilities.

New Installations segment of the C4ISR market by installations is projected to dominate the market.

The growing emphasis on the deployment of advanced C4ISR capabilities across commercial and military sectors is driving the growth of the market for new installations. Militaries across the world are focusing on integrating newer generation platforms, including airborne, naval, and land vehicles and equipment, which, in turn, is driving the need for state-of-the-art C4ISR technologies to enhance interoperability and situational awareness in modern warfare.

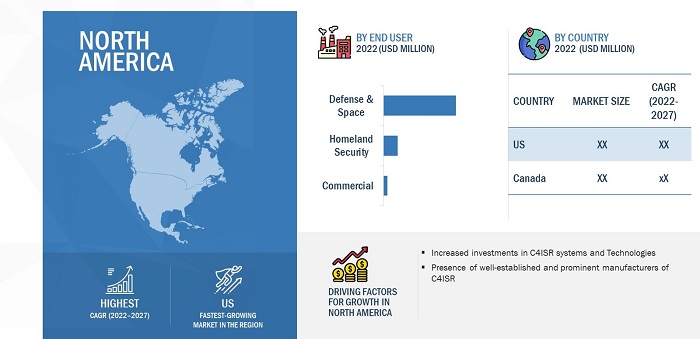

The North American market is projected to contribute the largest share for the C4ISR market.

North America is expected to lead the C4ISR market in 2022. The US is the largest market for C4ISR in North America. Due to the United States' significant investment in military systems, the North American market is predicted to be considerable. Comparing defense budgets amongst nations reveals that between 30 and 40% of all military gear purchased globally is purchased by the United States. Cyber warfare has changed the military battlefield, necessitating significant expenditures from both civilian and military institutions in data processing and secure communication infrastructure. As a result, a key component of the U.S. military's war strategy is the development of creative C4ISR solutions. For the United States government, developing new and enhanced land, air, and sea platforms with cutting-edge situational awareness and communication technologies is a major priority.

C4ISR Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top C4ISR Companies - Key Market Players

The C4ISR companies are dominated by a few globally established players such as Northrop Grumman (US), Lockheed Martin Corporation (US), BAE Systems (UK), Raytheon Technologies Corporation (US) and General Dynamics Corporation (US), among others, are the key manufacturers that secured C4ISR contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security and defense & space users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Market Size |

USD 113.4 billion in 2022 |

|

Projected Market Size |

USD 154.0 billion by 2028 |

|

Growth Rate |

5.2% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Solution, By Application, By Platform, By End User, By Installation |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), BAE Systems Inc. (UK), General Dynamics Corporation (US), and Northrop Grumman (US). |

C4ISR Market Highlights

The study categorizes the C4ISR market based on Application, End User, Installation, Platform, Solution and Region.

|

Segment |

Subsegment |

|

By Application |

|

|

By End User |

|

|

By Installation |

|

|

By Platform |

|

|

By Solution |

|

|

By Region |

|

Recent Developments

- In June 2021, Northrop Grumman Corporation received a contract to install more life-saving Large Aircraft Infrared Countermeasure (LAIRCM) systems on the US and international fixed-wing and rotary-wing aircraft under a USD 146 million order from the US Air Force.

- In June 2021, Raytheon Intelligence & Space (RI&S) signed a contract to offer logistics and repair services for all US Marine Corps (USMC) ground equipment.

- In March 2021, Raytheon Technologies signed a contract worth USD 178 Million to support the US Air Force intel-sharing system transition, the service’s primary intelligence-sharing system.

- In February 2021, The French defense procurement agency (DGA) awarded Thales and Airbus a contract for the new joint tactical signals intelligence (SIGINT) system to upgrade the French forces' critical signal monitoring, direction finding, and spectrum analysis capabilities.

Frequently Asked Questions (FAQ):

Which are the major companies in the C4ISR market? What are their major strategies to strengthen their market presence?

Some of the key players in the C4ISR market are Northrop Grumman (US), Lockheed Martin Corporation (US), BAE Systems (UK), Raytheon Technologies Corporation (US), and General Dynamics Corporation (US), among others, are the key manufacturers that secured C4ISR contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their C4ISR market presence.

What are the drivers and opportunities for the C4ISR market?

The need for C4ISR has increased significantly around the world, but particularly in Asia Pacific, where the development of new technologies and the purchase of new aircraft in countries like China, India, and South Korea will present several prospects for companies in the C4ISR industry. Rising R&D efforts to create C4ISR solutions are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2022, showcasing strong demand from C4ISR in the region. Defense forces of countries in the North American region are involved in the development of technologically advanced C4ISR systems. Well-established and prominent manufacturers in this region include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), L3Harris Technologies, Inc. (US), and Raytheon Technologies Corporation (US).

Which are the key technology trends prevailing in the C4ISR market?

The two main technologies dominating the C4ISR industry are autonomous mission management systems for UGVs and weapon integrated C4ISR systems. Also, it is anticipated that the advent of C4ISR businesses that create and provide clients with strategic cloud solutions would result in a revision of the economic model for the battlefield/combat sector.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

|

USD 26.1 billion by 2028 |

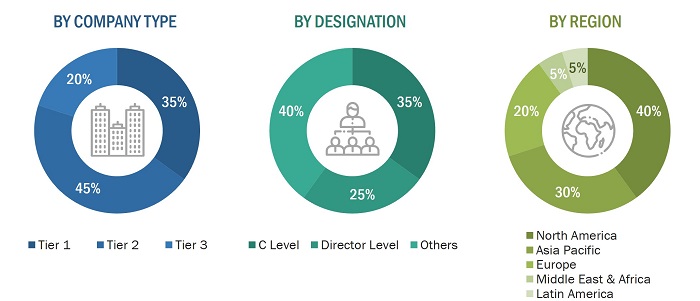

The study involved four major activities in estimating the current size of the C4ISR market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering C4ISR and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the C4ISR market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the C4ISR market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from C4ISR vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using C4ISR were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of C4ISR and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Command and Control Technology |

Individual Industry Expert |

|

The Homeland Security Consulting Group, LLC |

Director |

|

Mirion Technologies, Inc |

Project Manager |

|

Ansys, Inc. |

Director |

Market Size Estimation

The research methodology used to estimate the size of the C4ISR market includes the following details.

The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the land, airborne, naval, and space platforms at a regional level. Such procurements provide information on the demand aspects of C4ISR systems, software, and services in each platform. For each platform, all possible application areas where C4ISR is integrated or installed were mapped.

Global C4ISR Market Size: Botton Up Approach

Global C4ISR Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the C4ISR market based on Solution, Application, Platform, End User, Installation and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the C4ISR market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the C4ISR market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the C4ISR Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in C4ISR Market