Carbon Offset/Carbon Credit Market by Type (Voluntary Market, Compliance Market), Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects (Nature-based, Technology-based)), End-User and Region - Global Forecast to 2028

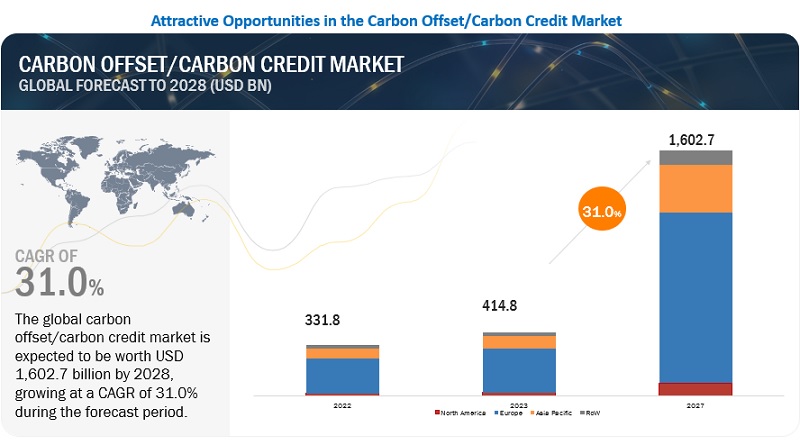

[191 Pages Report] The global carbon offset/carbon credit market in terms of revenue was estimated to be worth $414.8 billion in 2023 and is poised to reach $1,602.7 billion by 2028, growing at a CAGR of 31.0% from 2023 to 2028. The voluntary carbon market continues to play a critical role in that transition by helping to channel funding into projects that reduce carbon emissions or remove carbon from the atmosphere. Since, the need to curb global warming has significantly increased, the carbon offsetting have become fundamental to achieving net-zero greenhouse-gas emissions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Carbon Offset/Carbon Credit Market Dynamics

Driver: Rise in partial use of carbon credits by companies

As the world moves toward net zero targets, companies are putting considerable effort and capital into decarbonization. Climate change usually requires a complete economic shift. The demand for carbon credit market will significantly grow in the coming decades as the companies are focused on net zero targets and are working toward reducing carbon emissions. A carbon credit represents the right to emit greenhouse gases equivalent to one ton of carbon dioxide. Several businesses are now adopting this technique of partially using carbon credits, which is benefitting them significantly. They are getting involved in projects and activities that are helping them generate offsets. They use as many credits as they want according to the limit set for a project and if they have a few left, they are used later for another project. This not only helps them save a significant amount of money, which can aid them in investing in more such credits in the future when required. Hence, these factors help in driving the market for carbon credits.

Restraint: Restoration of carbon emissions from one location to another

Forestry projects are particularly prone to leakage of offsets, which is difficult to quantify for forestry (and other offsets) projects. Different protocols indicate various approaches to quantify leakage so there is less consensus on the validity of any approach. For instance, there is a reduction in the harvest in North Carolina due to an improved forest management project. The project intensifies forest harvest in the Pacific Northwest or Indonesia. In this case, the project has only shifted the location of emissions, not leading to a net reduction. Hence, the location of emissions has changed and has caused emissions at another place, leading to the non-removal of carbon from the atmosphere.

Opportunities: Rising financial support to local communities

The demand for carbon credits will grow significantly in the coming decades. The voluntary carbon offset market offers an opportunity to achieve global greenhouse emission reductions while addressing the development needs of developing countries. Involving developing nations in climate protection allows them to achieve carbon emission reduction and avoidance while earning revenues from selling their offsets. They can then use the revenues to finance development projects for the poor communities in their countries. Carbon projects are designed to maximize nature’s contribution to the fight against climate change. By protecting and restoring forests, grasslands, and other ecosystems, the increased carbon storage can be measured and turned into carbon credits, which leading companies and individuals can buy to help them meet their climate goals. The goal is to develop bankable carbon initiatives to show they can deliver conservation, community, and financial returns, to encourage others to replicate the model, and together achieve large-scale wins for climate, biodiversity, and livelihood across Africa.

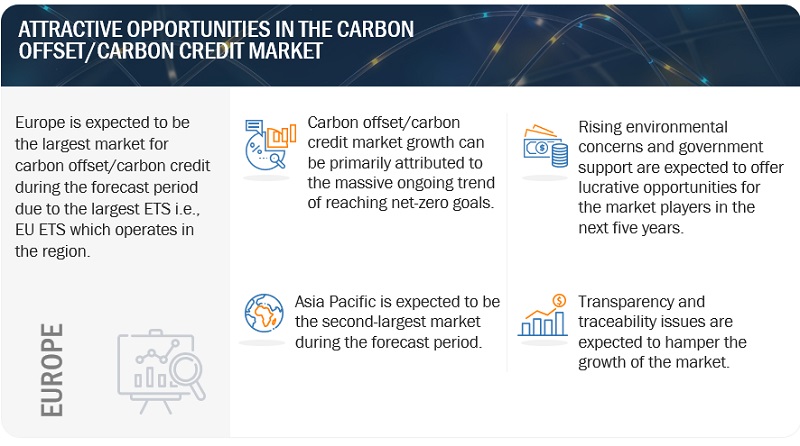

Challenges: Fluctuating prices of carbon credits

The increasing price of carbon credits may act as a market challenge during the forecast period. For humankind to sustain a livable atmosphere on the planet, several countries have committed to achieving carbon neutralization. Countries mainly reduce carbon emissions by regulations through a carbon tax or by establishing a carbon market using economic stimuli. Energy factors had a long-term impact on the carbon market, and economic factors had a short-term shock on the carbon market, whereas the economic recession has led to fluctuations in the carbon market. According to the World Bank, carbon prices have risen sharply in the past year, and this is mostly due to the increased demand as decarbonization efforts accelerate. The rapid increase in the value of offsets reflects both the rising prices and the rising demand from corporate buyers leading to higher transacted offset volumes.

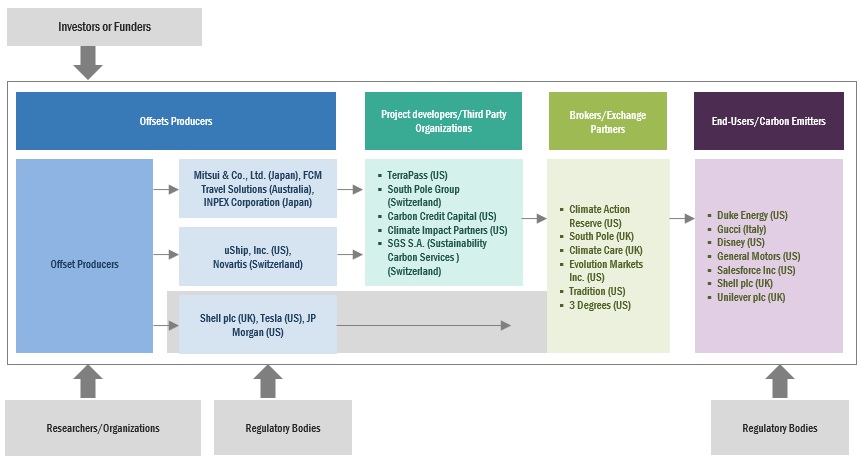

Carbon Offset Market Ecosystem

Prominent companies in this market include well-established, project developers and exchange partners. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include South Pole Group (Switzerland), 3Degrees (US), Finite Carbon (US), EKI Energy Services Ltd. (India), and NativeEnergy (US).

The voluntary segment, by type, is expected to be the fastest market during the forecast period.

This carbon credit market report segments based on type into voluntary and compliance. Voluntary market is free from regulations compelled by authorities in the compliance market. With the improvement in the transparency and clarity surrounding the quality of credits, the participants can actively participate in the voluntary market with reliability.

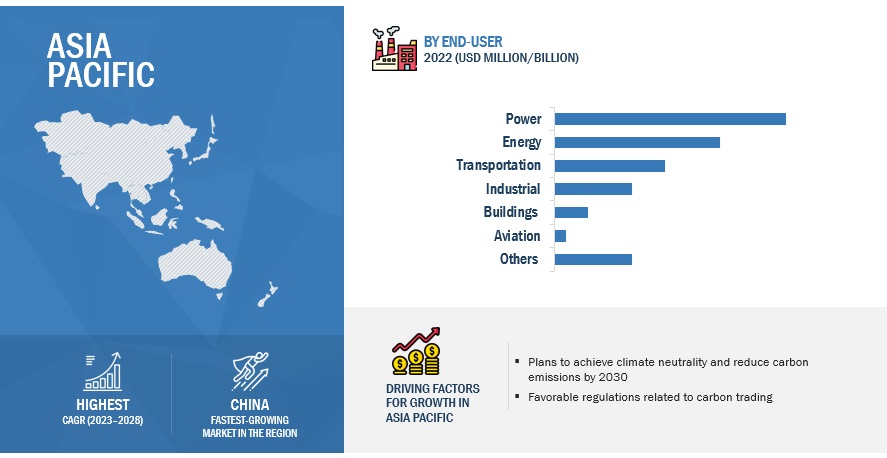

By End-User, the power segment is expected to be the largest during the forecast period

This report segments the carbon credit market size based on end-user into industrial, power, energy, transportation, buildings, aviation, and others. Other end-users include forestry, agriculture, and waste. The power segment is expected to be the largest segment during the forecast period. The power sector is a large emitting sector and uses low-GHG technologies that are commercially available and hence they are the largest segment adopting carbon offsetting projects and schemes.

“Asia Pacific”: The fastest in the carbon offset/carbon credit market”

Asia Pacific is expected to fastest growing region in the global carbon credit market between 2023–2028, followed by the Europe. ETS could become a major climate policy tool to help China realize its Nationally Determined Contribution (NDC) to the Paris Agreement on climate change and its long-term low-carbon strategy. Hence, these factors are expected to fuel the growth of the market in the Asia Pacific region.

Key Market Players

The carbon credit market is dominated by a few major players that have a wide regional presence. The major players in the carbon offset market are South Pole Group (Switzerland), 3Degrees (US), Finite Carbon (US), EKI Energy Services Ltd. (India), and NativeEnergy (US). Strategies such as partnerships, collaborations, and mergers are followed by these companies to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Carbon Offset/Carbon Credit Market by type, project type, end-user, and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, RoW |

|

Companies covered |

South Pole Group (Switzerland), 3Degrees (US), Finite Carbon (US), EKI Energy Services Ltd. (India), and NativeEnergy (US), CarbonBetter (US), Carbon Care Asia Limited (China), Terrapass (US), Climetrek Ltd. (US), Carbon Credit Capital (US), Natureoffice GmbH (Germany), Climate Partner GmbH (Germany), Climate Trade (US), ForestCarbon (UK), Moss.Earth (Brazil), Bluesource LLC (US), TEM (Tasman Environmental Markets (Australia), Climate Impact Partners (US), Carbonfund (US), Climeco LLC (US) |

This research report categorizes the carbon offset market size by type, project type, end-user, and region.

On the basis of by type, the carbon offset/carbon credit market has been segmented as follows:

- Compliance Market

- Voluntary Market

On the basis of project type, the carbon credit market has been segmented as follows:

- Avoidance/Reduction projects

-

Removal/Sequestration projects

- Nature-based

- Technology-based

On the basis of end-user, the carbon credit market has been segmented as follows:

- Power

- Energy

- Aviation

- Transportation

- Industrial

- Buildings

- Others

On the basis of region, the carbon offsets market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- RoW

Recent Developments

- In November 2022, 3Degrees partnered with Merge Electric Fleet Solutions to provide actionable analysis and decades of expertise to existing and new fleet customers. 3Degrees will monetize Merge’s charging in the clean fuels states (CA, OR, WA) and offset all EV charging with RECs.

- In August 2022, Johnson Controls collaborated with 3Degrees to accelerate the race to net zero. The collaboration fast-tracks net zero goals through carbon reduction services.

- In August 2022, Siemens Smart Infrastructure and South Pole partnered to offer a full range of solutions and financing models for companies to reduce energy-related emissions.

- In August 2021, South Pole partnered with Landcare NSW, to develop climate action projects across New South Wales, Australia. The partnership brings together South Pole’s global and local expertise as a project developer with Landcare NSW’s strong community network, creating opportunities for Landcare members across the whole state via the range of carbon and biodiversity project options available.

Frequently Asked Questions (FAQ):

What is the current size of the carbon offset/carbon credit market?

The current market size of the carbon offset/carbon credit market is 331.8 billion in 2022.

What are the major drivers for the carbon offset/carbon credit market?

Increasing investments in carbon capture technologies is the major driving factor for the carbon offset/carbon credit market.

Which is the largest region during the forecasted period in the carbon offset/carbon credit market?

Europe is expected to dominate the carbon offset/carbon credit market between 2023–2028, followed by Asia Pacific. The EU ETS which is the largest ETS in the world, has a strong presence in Europe and hence the market in Europe has the largest share in the market.

Which is the largest segment, by project type, during the forecasted period in the carbon offset/carbon credit market?

The avoidance/reduction projects segment is expected to be the largest market during the forecast period. Advancements in various carbon dioxide removal technologies through research and development and government policies are major drivers for carbon offsetting projects.

Which is the fastest segment, by the end-user during the forecasted period in the carbon offset/carbon credit market?

The transportation segment is expected to be the fastest market during the forecast period. The use of electric vehicles is expected to contribute to greater emission reductions in the coming decades because the sector is projected to continue to become progressively less carbon-intensive.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved major activities in estimating the current size of the carbon offset/carbon credit market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the carbon offset/carbon credits market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the carbon offset market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

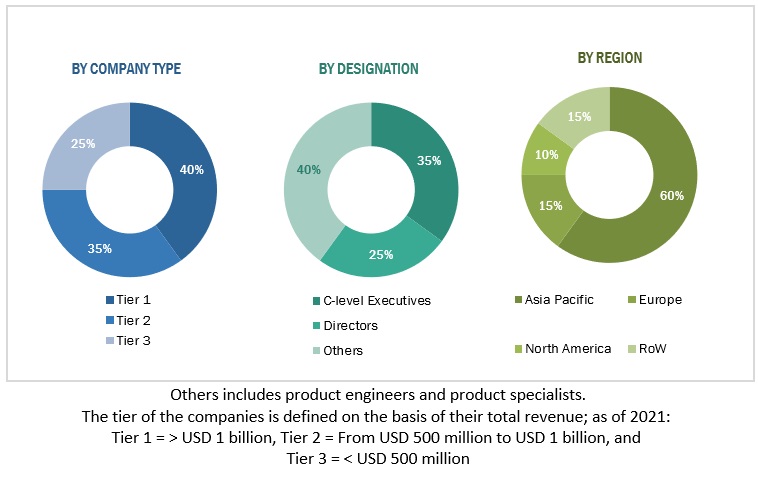

The carbon offset/carbon credit market comprises several stakeholders such as offset producers, project developers/third-party organizations, brokers/exchange partners, end users/carbon emitters in the supply chain. The demand side of this market is characterized by the rising demand for reducing and removing carbon from the atmosphere. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

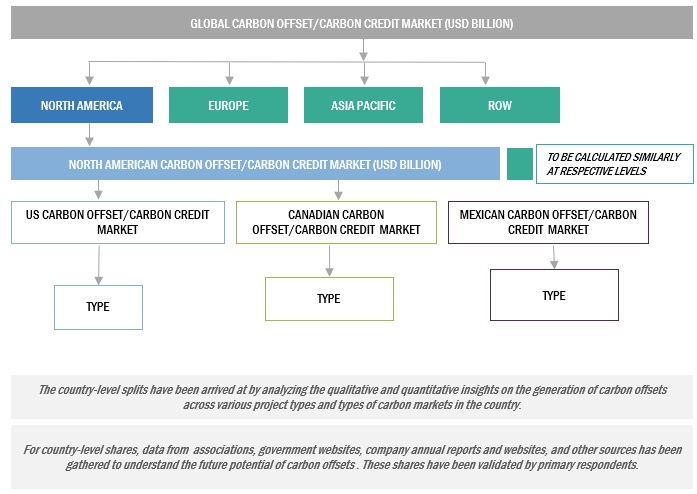

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the carbon offset/carbon credits market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Carbon Offset/Carbon Credit Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

Carbon offset are tradeable credits that allow companies and countries to compensate hard-to-abate emissions by investing in projects, which avoid or remove emissions from the atmosphere elsewhere. There are two varieties of carbon projects such as carbon removal and carbon avoidance projects, either of which can generate credits an organization can purchase to offset their emissions.

Key Stakeholders

- Government and research organizations

- Energy service providers (private/government)

- Utility platform and analytics vendors

- System design and development vendors

- System integrators/migration service providers

- Consultants/consultancies/advisory firms

- Environmental research institutes

- Private or investor-owned utilities

- Government and research organizations

- State and national regulatory authorities

- Investors/shareholders

- Investment banks

Objectives of the Study

- To define, describe, and forecast the carbon offset/carbon credit market, by type, project type, and end-user, in terms of value and volume

- To describe and forecast the market size for four key regions: North America, Europe, Asia Pacific, and RoW, along with country-level market analysis

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To describe the market value chain and several government regulations contributing to the growth of market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as agreements, product launches, partnerships, collaborations, and acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Carbon Offset/Carbon Credit Market