This study involved four major activities in estimating the current size of the carbon footprint management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and Magazine, to identify and collect information useful for a technical, market-oriented, and commercial study of the global carbon footprint management market. Other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

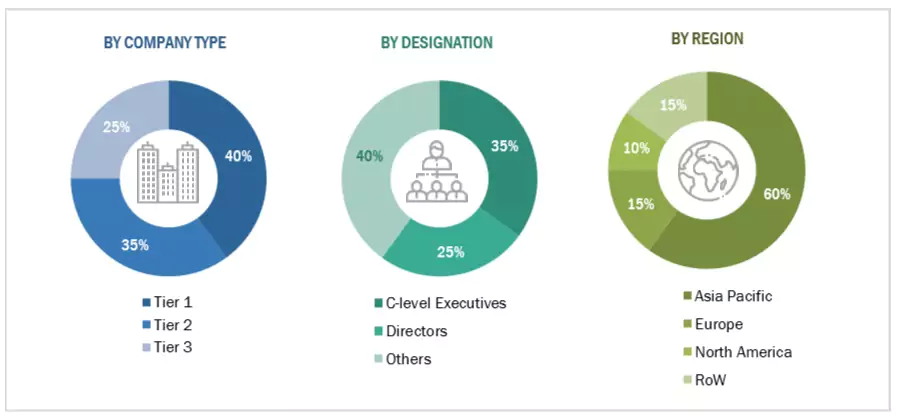

The carbon footprint management market comprises stakeholders, such as end-product manufacturers, service providers, and end users in the supply chain. This market’s demand side is characterized by its end users, such as manufacturing, energy and utilities, residential and commercial buildings, transportation and logistics, IT and telecom, financial services, and government. The supply side is characterized by carbon footprint management system manufacturers and others. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1

billion, Tier 2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global carbon footprint management market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

-

The industry and market’s key players have been identified through extensive secondary research, and their market share in the respective regions has been determined through primary and secondary research.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Carbon footprint management software is a tool to help raise awareness, measure emissions, data collection, enable sustainability reporting, reduce costs, and engage staff in the carbon management program. The carbon footprint is an environmental indicator representing the total amount of greenhouse gas (GG) emissions caused by an individual, event, organization, service, place, or product. It measures both direct and indirect emissions of compounds such as methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and carbon dioxide (CO2). The carbon footprint management software is designed to assist manufacturing companies and corporate organizations in maintaining compliance. It assesses the carbon footprint of organizations’ products according to international standards.

Stakeholders

-

Utilities

-

Environmental Research Institutions

-

Energy Service Providers (Private/Government)

-

Heavy Industries

-

Government and Research Organizations

-

State and National Regulatory Authorities

-

Carbon Footprint Management Solutions and Services Providers

-

Organizations, Forums, Alliances, and Associations Related to Various Verticals

-

Investors/Shareholders

-

Investment Banks

Report Objectives

-

To define, describe, segment, and forecast the carbon footprint management market, by component, by deployment mode, by organization size, by vertical, and region, in terms of value.

-

To provide comprehensive information about drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

-

To strategically analyze the global carbon footprint management market with respect to individual growth trends, future expansions, and each segment’s contribution to the market.

-

To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

-

To forecast the growth of the global carbon footprint management market with respect to the five main regions, namely Asia Pacific, North America, Europe, the Middle East & Africa, and South America

-

To profile and rank key players and comprehensively analyze their market share

-

To analyze competitive developments, such as contracts & agreements, product launches, and mergers & acquisitions, in the carbon footprint management market

-

This report covers the global carbon footprint management market size in terms of value.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakdown of the carbon footprint management market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Carbon Footprint Management Market