Cardiac Safety Services Market Size, Share & Trends by Type (Standalone, Integrated), Services (ECG/Holter Measurement, Blood Pressure Measurement, Cardiac Imaging, Thorough QT Studies), End User (Pharmaceutical & Biopharma, CROs) & Region - Global Forecast to 2028

Cardiac Safety Services Market Size, Share & Trends

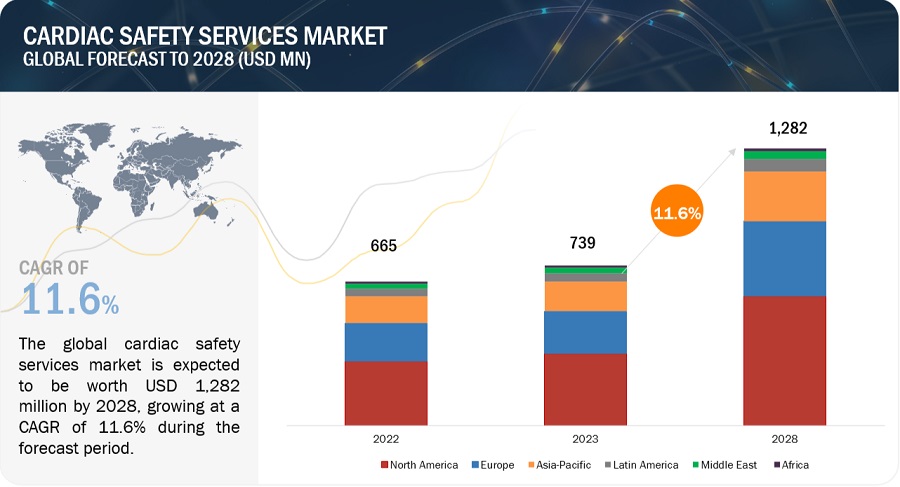

The size of global cardiac safety services market in terms of revenue was estimated to be worth $739 million in 2023 and is poised to reach $1,282 million by 2028, growing at a CAGR of 11.6% from 2023 to 2028. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

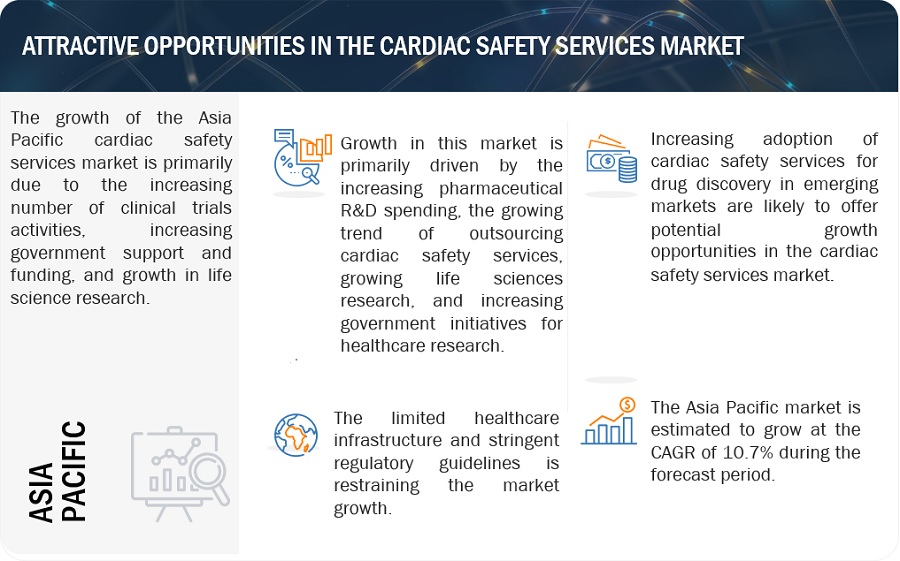

The growth of this market is majorly driven by the rising pace of R&D and growing expenditure. On the other hand, inadequacy of cardiotoxicity testing is a major factor restraining market growth to a certain extent.

Cardiac Safety Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cardiac Safety Services Market Dynamics

DRIVER: Rising incidence of cardiovascular diseases

The increasing incidence of cardiovascular diseases directly amplifies the demand for cardiac safety services by pharmaceutical companies and Contract Research Organizations (CROs) in various ways. For instance, According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives annually. Similarly, according to AstraZeneca report (UK) around 523 million people live with CVD globally. Moreover, according to the Centers for Disease Control and Prevention (CDC), heart disease is the leading cause of death for men, women, and people of most racial & ethnic groups in the US, about 695,000 people in the US died from heart disease in 2021—that’s one in every five deaths. Therefore, the rising incidence of cardiovascular diseases ensures the critical role of cardiac safety services in ensuring patient safety, regulatory compliance, and the success of cardiovascular drug development initiatives.

RESTRAINT: Inadequacy of cardiotoxicity testing

Inadequacy of cardiotoxicity testing represents a critical bottleneck in the market, with far-reaching implications. Patient safety is compromised when potential cardiac risks associated with drugs or treatments go undetected, potentially resulting in severe health consequences. For instance, when cardiotoxicity testing is not properly done, it can lead to the approval of drugs that later show serious cardiovascular side effects. For example, the FDA approved Vioxx, but it was later withdrawn from the market due to concerns about its heart-related risks. Such occurrences can cause delays in new drug approvals as regulatory agencies become more cautious. Regulatory hurdles become pronounced, as regulatory agencies like the FDA and EMA demand comprehensive cardiac safety evaluations for drug approvals. Thus, an inadequacy in testing can lead to delays in drug development and market entry. Furthermore, the repercussions extend to research & development, with companies hesitant to invest in drugs that may carry cardiac side effects, stifling innovation. Moreover, this situation can tarnish the reputation of pharmaceutical companies and CROs, affecting their competitiveness.

OPPORTUNITY: Emergence of new methods to curb cardiotoxicity

The evolution of mechanistic preclinical strategies for the detection of drug-induced electrophysiological and structural cardiotoxicity, mainly using in vitro human ion channel assays, human-based in silico reconstructions, and human stem cell-derived cardio¬myocytes. New methods such as digital twin technology, non-invasive electrocardiographic imaging (ECGI), high-throughput screening assays are gaining popularity in the market, and it presents a paradigm shift from traditional approaches that rely on simplistic in vitro assays. These new strategies can improve sensitivity and specificity in the early detection of genuine cardiotoxicity risks, thereby reducing the likelihood of mistakenly discarding viable drug candidates and expediting the progression of worthy drugs to the clinical trial stage. The introduction of these new methods, given their high efficiency and their growing usage, will provide significant opportunities for cardiac safety services to expand in the coming years. Furthermore, these methods encompass advancements in drug formulations, delivery systems, and targeted therapies, as well as more sensitive biomarkers and in vitro models for early cardiotoxicity detection. For cardiac safety services providers, these new methods represent a vital role in offering specialized guidance to pharmaceutical companies and researchers by facilitating comprehensive cardiac safety assessments, including monitoring during clinical trials, data analysis, and adherence to regulatory standards.

CHALLENGE: High cost of cardiac safety evaluation services

The US FDA’s Critical Path Initiative emerged with the general recognition that the rising costs of drug development and the decline in the number of new drugs approved in the US are significant problems that threaten public health. For example, cardiac safety evaluations of off-target drug effects are generally expensive, time-consuming, and contribute to the termination of many new molecular entities. cardiac safety evaluation thus constitutes an area that fits the core mission of the FDA’s Critical Path. However, the high cost remains a challenge for pharmaceutical & biopharmaceutical companies, as conducting the usual stand-alone Thorough QT (TQT) can cost USD 2–4 million, a huge investment before the commercialization of a new molecule/drug. This cost challenge encompasses several aspects of cardiac safety assessment, including the need for specialized equipment, extensive data analysis, and compliance with stringent regulatory requirements. Some cardiac safety evaluations entail the continuous monitoring of patients, particularly in clinical trials for drugs with potential cardiovascular side effects. This ongoing monitoring involves dedicated staffing and resources, further contributing to overall expenditure. For instance, in a clinical trial for a novel hypertension treatment, the continuous monitoring of participants' blood pressure and heart rate is essential, necessitating the deployment of dedicated personnel and equipment.

Cardiac Safety Services Market Ecosystem

The cardiac safety services market is a complex ecosystem involving various stakeholders, including supply side i.e companies providing cardiac safety services and demand side i.e. pharmaceutical & biopharmaceutical companies and contract research organization (CROs).

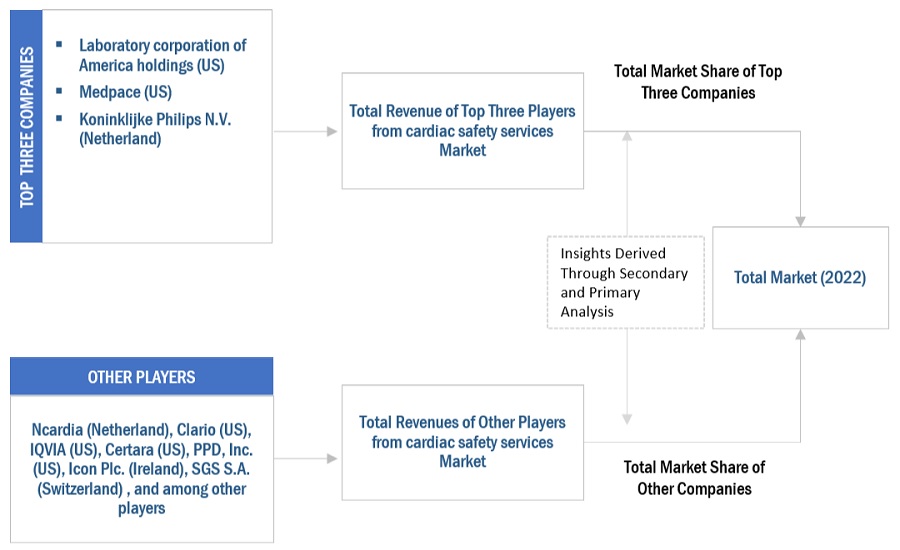

Several key companies provide cardiac safety services . For example, Laboratory Corporation of America Holdings (US) is the leading market player. LabCorp has built its expertise in entering new markets and successfully impacting them. The company has pursued competitive strategies such as acquisitions and expansions to solidify its market presence. The company provides cardiac safety services through its LabCorp Drug Development or DD segment. This segment provides end-to-end drug development, medical device, and companion diagnostic development solutions from early-stage research to clinical development and commercial market access. Other service providers include Medpace (US), Koninklijke Philips N.V. (Netherland), Clario (US), Ncardia (Netherlands), and others.

The integrated services segment dominated cardiac safety services industry by type

Integrated cardiac safety services refer to a comprehensive collection of clinical & medical services that help monitor and assessing the potential effects of a drug in the cardiovascular system. Integrated services are provided as a bundle of services to pharmaceutical & biopharmaceutical companies. These include cardiac safety services, such as cardiovascular imaging services, blood pressure measurement, ECG/ Holter measurement TQT studies, and profile QT studies. Integrated services offer multiple benefits as compared to standalone services. For instance, TQT services of MedPace monitor off-target cardiovascular liability and onsite multichannel telemetry conducted by certified nurses to aid in the real-time assessment of heart rate and rhythm. As a result, these services help enhance and expedite clinical trials in the pharmaceutical and biopharmaceutical development cycle.

The ECG/Holter measurement services segment dominated cardiac safety services industry by service type

ECG is a widely used diagnostic tool for assessing cardiac arrhythmias, acute & old cardiac ischemia, and left ventricular hypertrophy. Further analysis allows differentiating between physiological & pathological bradycardia & tachycardia and changes in conduction times (QT time or bundle branch block). As such, ECG continues to plays a critical role in many clinical trials studying the cardiac safety of a drug across all clinical study phases. Holter measurements are continuous ECG measurements that allow for extended analysis outside the pre-specified windows, including arrhythmia analysis, trends assessment, and enhanced quality metrics. These services help in the R&D of novel methods for clinical trials and drug discovery. For instance, ECG/ Holter data can serve as sources for identifying novel biomarkers associated with cardiac health or specific disease conditions.

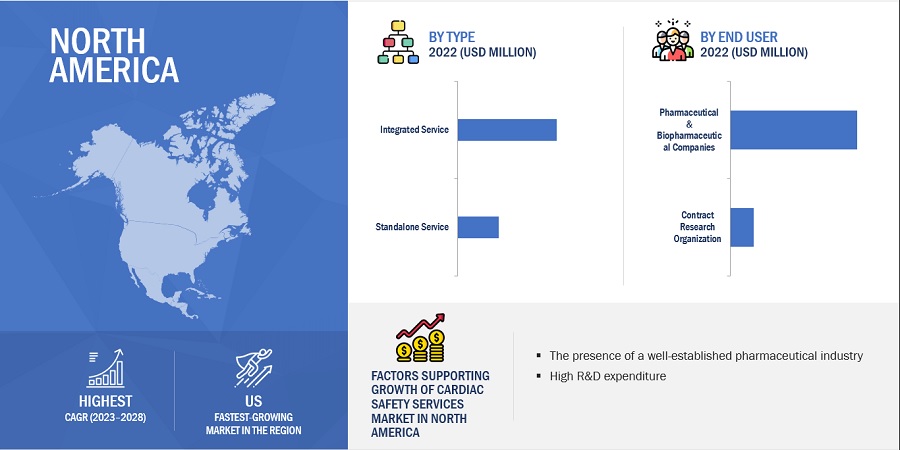

North America region of the cardiac safety services industry is estimated to register the highest CAGR during the forecast period.

North America offers lucrative growth potential for the cardiac safety services market. This can be attributed to the presence of a well-established pharmaceutical industry, many ongoing clinical trial studies, high R&D expenditure, growth in the biosimilars and generics market, and rising outsourcing of preclinical, clinical, and laboratory testing services by pharmaceutical and biopharmaceutical companies.

According to ClinicalTrials.gov, as of December 2022, around 31% of registered and 33% of recruiting clinical studies are conducted in the US. This can be attributed to the presence of world-class facilities for conducting clinical trials in the country and the significant investments in R&D for drug development. Moreover, North America is the largest pharmaceutical market in the world with many global pharmaceutical and medical device giants, such as Pfizer (US), AbbVie (US), Abbott Laboratories (US), and Johnson & Johnson (US), headquartered in the region.

Some of the major players operating in the North American cardiac safety services market are IQVIA (US), Laboratory Corporation of America Holdings (US), ICON (US), and PPD, Inc. (US)

To know about the assumptions considered for the study, download the pdf brochure

Key players in the cardiac safety services market include Laboratory Corporation of America Holdings (US), Medpace (US), Koninklijke Philips N.V. (Netherland), Clario (US), Ncardia (Netherlands), IQVIA (US), Certara (US), PPD Inc. (Part of Thermo Fisher Scientific, Inc.) (US), SGS S.A. (Switzerland), ICON Plc (Ireland), WuXi AppTec (China), Charles River Laboratories (US), Eurofins Scientific (Luxembourg), Frontage Labs (US), Banook Group (France), Biotrial (France), Celerion (US), Richmond Pharmacology (UK), PhysioStim (France), Shanghai Medicilon Inc. (China), ACM Global Laboratories (India), Worldwide Clinical Trials (US), Nova Research Laboratories LLC (US), Biobeat (Israel), and CRS. Experts. Early Phase. (Germany).

Scope of the Cardiac Safety Services Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$739 million |

|

Projected Revenue Size by 2028 |

$1,282 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 11.6% |

|

Market Driver |

Rising incidence of cardiovascular diseases |

|

Market Opportunity |

Emergence of new methods to curb cardiotoxicity |

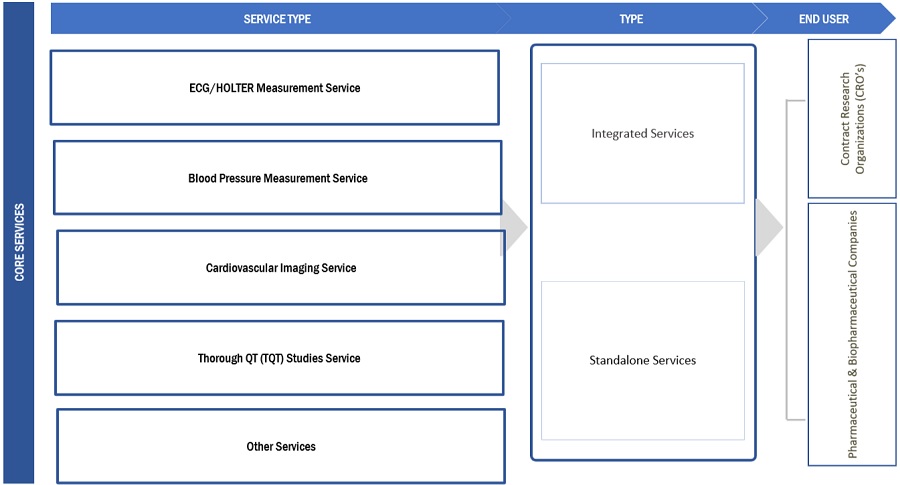

This report categorizes the Cardiac Safety Services Market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Integrated Services

- Standalone Services

By Service Type

- ECG/Holter Measurement Services

- Blood Pressure Measurement Services

- Cardiovascular Imaging Services

- Thorough QT Studies Services

- Other Cardiac Safety Services

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organization (CROs)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- Rest of Asia Pacific (RoAPAC)

-

Latin America (LATAM)

- Brazil

- Rest of Latin America (RoLATAM)

- Middle East

- Africa

Recent Developments of Cardiac Safety Services Industry

- In August 2023, Clarion (US) collaborated with Dr. Vince Clinical Research (DVCR) (US). The strategic collaboration helps Clario (US) deliver accurate and cost-efficient cardiac safety data in the early clinical development stages.

- In October 2022, IQVIA (US) launched its first self-collection safety lab panel for US clinical trial participants by a leading global clinical trial laboratory.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cardiac safety services market?

The global cardiac safety services market boasts a total revenue value of $1,282 million by 2028.

What is the estimated growth rate (CAGR) of the global cardiac safety services market?

The global cardiac safety services market has an estimated compound annual growth rate (CAGR) of 11.6% and a revenue size in the region of $739 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of Secondary sources, directories, and databases were used extensively to identify and collect helpful information for this technical, market-oriented, and financial study of the global cardiac safety services market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess the market growth prospects. The global size of the market (estimated through various secondary research approaches) was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include directories; databases such as Bloomberg Businessweek, Factiva, and Wall Street Journal; white papers; and clinicaltrial.gov, among others. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research. Some of the key secondary sources referred to for this study include, World Health Organization (WHO), Food and Drug Administration (FDA), Association of Clinical Research Organizations (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICROS), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Pharmaceutical Research and Manufacturers of America (PhRMA), European Medicines Agency (EMA), International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), Safety Pharmacology Society (SPS) and Cardiac Safety Research Consortium (CSRC).

Primary Research

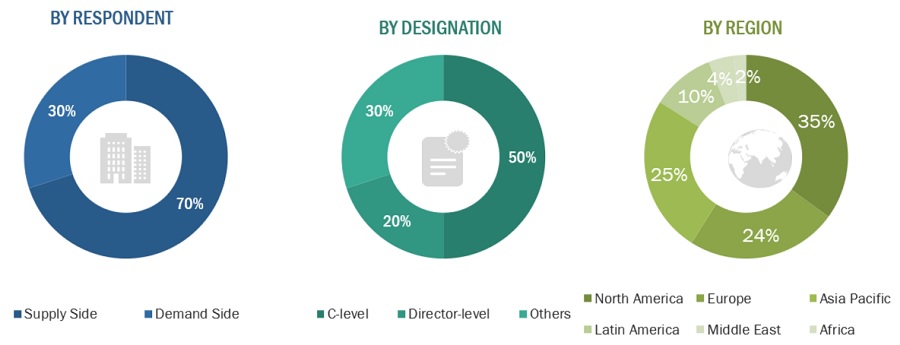

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand-side personnel (such as contract research organizations (specialists), academic medical researchers, scientists, and pharmaceutical and biopharmaceutical company experts) and supply-side (such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market) across six major regions—North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants respectively. This preliminary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

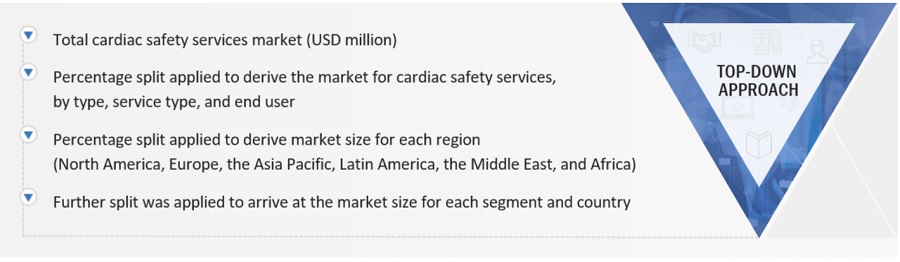

Market Size Estimation

The global size of the market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the Cardiac Safety Services Market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the cardiac safety services business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Cardiac Safety Services Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Cardiac Safety Services Market: Top Down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Cardiac safety services encompass a specialized range of services conducted within the pharmaceutical & biopharmaceutical industries. These services aim to assess the safety of new drugs and monitor the potential effects on the cardiovascular system. This market involves services such as continuous cardiac monitoring during clinical trials, electrocardiography (ECG) services, cardiovascular risk assessment, regulatory compliance, data management, consulting, arrhythmia detection, and QT interval analysis. Its primary purpose is to support pharmaceutical & biopharmaceutical companies in adhering to regulatory standards, assessing the cardiac safety of their products, and ultimately safeguarding patient well-being while advancing medical innovations.

Key Stakeholders

- Pharmaceutical & Biopharmaceutical Companies

- Cardiac Safety Service Providers

- Hospitals

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Government Associations

- Healthcare Associations/Institutes

- Business Research & Consulting Service Providers

- Venture Capitalists & Investors

Report Objectives

- To define, describe, and forecast the global Cardiac Safety Services Market based on type, service type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, service launches, expansions, agreements, partnerships, and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the Rest of Europe Market, by country

- Further breakdown of the Rest of Asia Pacific Market, by country

- Further breakdown of the Latin America and Middle East & Africa Market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Segment Analysis

- Further breakdown of the services segment as per the service portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiac Safety Services Market

The following categories can be used to broadly group the macro to micro growth drivers for the cardiac safety services market:

Macro drivers:

Micro drivers:

What are the macro to micro growth drivers for the cardiac safety services industry?