Clinical Trial Management System Market by Product (Software, Services), Delivery (Web-hosted, On-premise, Cloud-based), Deployment (Enterprise, On-site), End User (Pharma, Medical Device Manufacturers, CROs) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global clinical trial management system market growth forecasted to transform from $801 million in 2020 to $1.59 billion by 2025, driven by a CAGR of 14.7%. The growth of this market is driven by the increasing number of clinical trials and government support for research trials. However, budget constraints and limited knowledge about advanced CTMS solutions restrain the market's growth.

Clinical Trial Management System Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Trial Management System Market Dynamics

Driver: The rising number of clinical trials and the availability of advanced CTMS solutions

The increasing number of clinical trials has resulted in the demand for efficient and advanced clinical trial management systems. Clinical trials are subject to increasing scrutiny and are more complicated in nature due to the increasing complexity of the studies. Furthermore, technological advancements in the field of software and hardware have enabled the development of advanced CTMS solutions. The latest clinical trial management systems are capable of managing complex trials with ease. Moreover, advanced clinical trial management systems are designed with features that can help reduce costs, streamline trial processes, and improve data accuracy.

Opportunity: Investment in effective digital infrastructure and agility in technological adoption

Clinical Trial Management System (CTMS) are designed to streamline clinical trial processes and provide real-time data and analytics to enable the efficient and effective management of clinical trials. The market is expected to grow significantly in the coming years with an increasing focus on digital infrastructure and agility in technological adoption. As CTMS is increasingly adopted by pharmaceutical companies, clinical research organizations (CROs), and non-profit organizations, the market is expected to grow significantly.

The investment in digital infrastructure and agility in technological adoption is expected to be the key driver in the growth of the market. The increasing digitization of clinical trial processes and the emergence of cloud-based CTMS are expected to further drive the growth of the market. The emergence of specialized CTMS vendors and the increasing focus on automation and integration of clinical trial processes are also expected to contribute to the growth of the CTMS market.

The rising demand for real-time data and analytics to support data-driven decisions and the need for better patient engagement are expected to be other key drivers of the market. Moreover, increasing investments in R&D and the need for efficient clinical trial management are expected to create significant opportunities for the market.

The market is expected to witness significant growth in the coming years due to the increasing investments in digital infrastructure, agility in technological adoption, and the emergence of specialized CTMS vendors. The increasing focus on automation and integration of clinical trial processes and the need for real-time data and analytics to support data-driven decisions and patient engagement are also expected to create opportunities for the market.

Restraint: Budget Constraints

Clinical trial management systems are essential for managing and streamlining complex clinical trial processes and ensuring data accuracy, but the cost of such systems can be a major deterrent for potential customers. Clinical trials are already expensive, and the cost of a clinical trial management system can often exceed the trial budget. Additionally, many clinical trial sponsors are unwilling to invest in a long-term system, making it difficult to justify the cost of an expensive clinical trial management system. This budget constraint is a major restraint in the growth of the CTMS market.

Challenge: Lack of skilled professionals

The lack of skilled professionals is one of the major challenges faced by the CTMS market. This is due to the complexity of the technology and the need for specialized skills to effectively manage clinical trials. Moreover, the lack of personnel trained in the field of clinical trials can lead to delays in the trial process, resulting in higher costs and decreased efficiency. As such, organizations require skilled professionals to effectively manage clinical trials and ensure accuracy and precision of data collection. Furthermore, with the increasing complexity of clinical trials, organizations are finding it hard to recruit and retain skilled professionals. This is restraining the growth of the market.

By deployment mode, an enterprise-wide segment is expected to register significant growth in the clinical trial management system industry during the forecast period.

Based on the deployment mode, the clinical trial management system market is segmented into enterprise-wide and on-site CTMS. The enterprise-wide segment accounted for the largest share in 2019. The large share of this segment can be attributed to its widespread adoption by the majority of end users due to its benefits.

By delivery mode, the web-based (on demand) segment is expected to register significant growth in the clinical trial management system industry during the forecast period.

Based on the delivery mode, the clinical trial management system market is segmented into web-based (on-demand), licenced enterprise (on-premises), and cloud-based (SaaS) clinical trial management systems. Among these, the web-based segment dominated the market in 2019. The large share of this segment can be attributed to the advantages offered by web-based software, such as easy access, improved productivity, and time and cost efficiency.

By products and services, the software segment is expected to register significant growth in the clinical trial management system industry during the forecast period.

Based on product and service, the clinical trial management system market is segmented into software and services. Rising R&D expenditure, an increasing number of clinical trials, and the growing adoption of clinical trial management solutions are some of the key factors driving the growth of the market.

The large pharma-biotech companies segment is expected to account for the largest share of the clinical trial management system industry among end users.

Based on end users, the clinical trial management system market has been segmented based on end-user category—large pharma-biotech companies, small & mid-sized pharma-biotech companies, CROs, medical device manufacturers, and other end users. One of the key factors driving the use of CTMS is an increasing emphasis on R&D. For instance, PhRMA member companies in the US increased their R&D expenditure from ~USD 26.0 billion in 2000 to USD 58.8 billion in 2015 (Source: Pharmaceutical Research and Manufacturers of America). Due to rising pressure of R&D costs, outcomes-based reimbursement, and stricter regulations imposed on large pharma companies, a part of their R&D functions is outsourced to smaller pharmaceutical companies, which increases the growth of companies in this category.

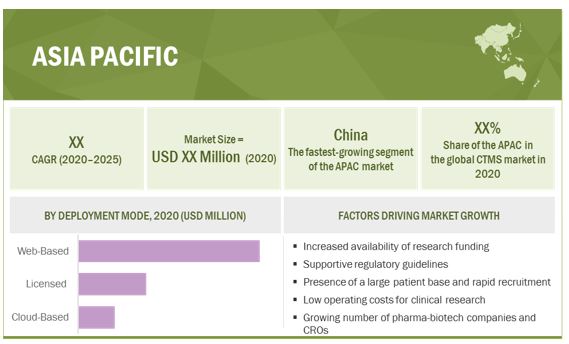

The Asia Pacific market is expected to grow at the highest CAGR of the global clinical trial management system market during the forecast period.

The Asia Pacific market is projected to register the highest CAGR during the forecast period. The Asia Pacific region is expected to offer significant opportunities for the growth of the market. The major factors driving the growth of the Asia Pacific market include increasing government funding to support clinical trials, the presence of less stringent regulatory guidelines as compared to developed nations, a large patient base, a faster rate of patient recruitment for clinical trials than mature nations, low operating costs for conducting clinical trials, a shortage of trial volunteers in Europe and North America, and the growing number of pharmaceutical companies and CROs in the region.

Oracle Corporation (US), Medidata Solutions (US), Parexel International (US), Bioclinica (US), and IBM (US), Bio-Optronics (US), Datatrak (US), Veeva Systems (US), DSG (US), MasterControl (US), ERT (US), Advarra Technology Solutions (US), MedNet Solutions (US), ArisGlobal (US), DZS Clinical Services (US), Crucial Data Solutions (US), Ennov (France), DataStat (US), and RealTime Software Solutions LLC (US) among others are some of the major players operating in the global clinical trial management system market, among others.

Scope of the Clinical Trial Management System Industry

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$801 Million |

|

Projected Revenue by 2025 |

$1,590 Million |

|

Revenue Rate |

Poised to grow at a CAGR of 14.7% |

|

Market Driver |

The rising number of clinical trials and the availability of advanced CTMS solutions |

|

Market Opportunity |

Investment in effective digital infrastructure and agility in technological adoption |

This research report categorizes the clinical trial management system market to forecast revenue and analyze trends in each of the following submarkets:

By Deployment

- Enterprise-wide CTMS

- On-Site CTMS

By Delivery

- Web-based (On-demand)

- Licensed Enterprise (On-premises)

- Cloud-based (SaaS)

By Product & Service

- Software

- Services

By End User

- Large Pharma-biotech Companies

- CROs

- Medical Device Manufacturers

- Small & Mid-sized Pharma-biotech Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments of Clinical Trial Management System Industry

- Accenture’s Acquisition of Zafgen: In April 2021, Accenture announced its acquisition of Zafgen, a provider of Clinical Trial Management Systems (CTMS). The deal expands Accenture’s capabilities in clinical trial management and analytics.

- Oracle’s Acquisition of ICON: In November 2020, Oracle Corporation announced its acquisition of ICON, a provider of CTMS services. The deal expands Oracle’s global presence in the life sciences industry and helps organizations to accelerate the development of new treatments and therapies.

- IQVIA’s Acquisition of Medidata Solutions: In May 2019, IQVIA Technologies announced its acquisition of Medidata Solutions, a provider of cloud-based CTMS solutions. The deal expanded IQVIA’s presence in the clinical trial management market.

- Oracle’s Acquisition of Comprehend Systems: In March 2019, Oracle Corporation announced its acquisition of Comprehend Systems, a provider of cloud-based clinical trial management solutions. The deal expands Oracle’s capabilities in the healthcare and life sciences industries.

- Veeva’s Acquisition of CloudNine: In December 2018, Veeva Systems announced its acquisition of CloudNine, a provider of cloud-based clinical trial management solutions. The deal strengthens Veeva’s portfolio of clinical trial management solutions.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical trial management system market?

The global clinical trial management system market boasts a total revenue value of $1,590 million by 2025.

What is the estimated growth rate (CAGR) of the global clinical trial management system market?

The global clinical trial management system market has an estimated compound annual growth rate (CAGR) of 14.7% and a revenue size in the region of $801 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 MAJOR MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 END USER-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: GLOBAL MARKET

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 6 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY PRODUCT AND SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET, BY DEPLOYMENT MODE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY DELIVERY MODE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY OVERVIEW

FIGURE 11 INCREASING RESEARCH PARTNERSHIPS AND OUTSOURCING ARE DRIVING GROWTH IN THE CTMS MARKET

4.2 GLOBAL MARKET, BY DEPLOYMENT MODE

FIGURE 12 ENTERPRISE-WIDE DEPLOYMENT DOMINATES THE MARKET

4.3 ASIA PACIFIC CTMS MARKET

FIGURE 13 LARGE PHARMA-BIOTECH COMPANIES FORM THE LARGEST END-USER SEGMENT IN THE ASIA PACIFIC MARKET

4.4 GLOBAL MARKET, BY REGION

FIGURE 14 APAC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD (2020–2025)

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Significant operational costs and regulatory requirements associated with clinical research

5.2.1.2 Research partnerships between pharma-biopharma companies and CROs

5.2.1.3 The rising number of clinical trials and the availability of advanced CTMS solutions

5.2.1.4 Expansion of the target customer base

5.2.1.5 Rising government funding and grants to support clinical trials

5.2.2 RESTRAINTS

5.2.2.1 Budget constraints

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing outsourcing of research processes

5.2.3.2 Greater integration with Platform-as-a-service (PaaS) and mobile computing

5.2.3.3 Investment in effective digital infrastructure and agility in technological adoption

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled professionals

5.2.4.2 Fragmented and highly regulated industry

5.2.4.3 Patient privacy

5.2.4.4 Limited awareness among researchers about associated advantages

5.2.5 KEY TRENDS

5.2.5.1 Integration of CTMS with software such as HIS, EMR, and EDC

5.2.5.2 Mergers and acquisitions

5.2.5.3 Shift from manual data interpretation to real-time data analysis during clinical studies

5.3 IMPACT OF COVID-19 ON THE CTMS MARKET

5.4 ECOSYSTEM COVERAGE: PARENT MARKET (HEALTHCARE IT SOLUTIONS)

5.4.1 ECOSYSTEM COVERAGE: CTMS MARKET

5.5 MAJOR USE CASES: PARENT MARKET (LIFE SCIENCE ANALYTICS SOLUTIONS)

6 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY DEPLOYMENT TYPE (Page No. - 47)

6.1 INTRODUCTION

TABLE 1 CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

6.2 ENTERPRISE-WIDE CTMS

6.2.1 ENTERPRISE-WIDE CTMS IS PREFERRED BY END USERS

TABLE 2 ENTERPRISE-WIDE CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 ON-SITE CTMS

6.3.1 ON-SITE CTMS SUPPORTS IMPROVED CLINICAL TRAILS

TABLE 3 ON-SITE CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY DELIVERY MODE (Page No. - 50)

7.1 INTRODUCTION

TABLE 4 CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

7.2 WEB-BASED (ON-DEMAND) CTMS

7.2.1 PROVISION OF CENTRALIZED MANAGEMENT IN CLINICAL TRIALS TO AID THE ADOPTION OF WEB-BASED CTMS

TABLE 5 WEB-BASED (ON-DEMAND) CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 LICENSED ENTERPRISE (ON-PREMISES) CTMS

7.3.1 MINIMIZED RISK OF DATA BREACHES AND EXTERNAL ATTACKS SUPPORTS THE USE OF ON-PREMISES CTMS MODELS

TABLE 6 LICENSED ENTERPRISE (ON-PREMISES) CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 CLOUD-BASED (SAAS)

7.4.1 HIGH ADAPTABILITY AND RELIABILITY TO AID ADOPTION OF CLOUD-BASED SOLUTIONS

TABLE 7 CLOUD-BASED (SAAS) CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

8 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY PRODUCT & SERVICE (Page No. - 55)

8.1 INTRODUCTION

TABLE 8 CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

8.2 SOFTWARE

8.2.1 RISING NUMBER OF CLINICAL TRIALS TO SUPPORT MARKET GROWTH

TABLE 9 CTMS MARKET FOR SOFTWARE, BY REGION, 2018–2025 (USD MILLION)

8.3 SERVICES

8.3.1 NEED FOR CONTINUOUS UPGRADATION OF CTMS SOFTWARE HAS INCREASED THE DEMAND FOR SERVICES

TABLE 10 CTMS MARKET FOR SERVICES, BY REGION, 2018–2025 (USD MILLION)

9 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY END USER (Page No. - 58)

9.1 INTRODUCTION

TABLE 11 CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2 LARGE PHARMA-BIOTECH COMPANIES

9.2.1 LARGE PHARMA-BIOTECH COMPANIES DOMINATE THE END-USER MARKET

FIGURE 16 ACTIVE PHARMACEUTICAL PIPELINE, 2009–2019

TABLE 12 CTMS MARKET FOR LARGE PHARMA-BIOTECH COMPANIES, BY REGION, 2018–2025 (USD MILLION)

9.3 CONTRACT RESEARCH ORGANIZATIONS

9.3.1 RISING OUTSOURCING AND GROWING CRO PRESENCE ARE KEY GROWTH DRIVERS

TABLE 13 CTMS MARKET FOR CROS, BY REGION, 2018–2025 (USD MILLION)

9.4 MEDICAL DEVICE MANUFACTURERS

9.4.1 NEED TO COMPLY WITH REGULATIONS AND ENSURE PRODUCT SAFETY AND QUALITY HAVE SUPPORTED USE OF CTMS

FIGURE 17 R&D SPENDING OF LEADING MEDICAL DEVICE COMPANIES (2018)

TABLE 14 CTMS MARKET FOR MEDICAL DEVICE MANUFACTURERS, BY REGION,2018–2025 (USD MILLION)

9.5 SMALL & MID-SIZED PHARMA-BIOTECH COMPANIES

9.5.1 RISE IN OUTSOURCING TO SMALLER PHARMA COMPANIES IS A KEY DRIVER OF MARKET GROWTH

TABLE 15 CTMS MARKET FOR SMALL & MID-SIZED PHARMA-BIOTECH COMPANIES,BY REGION, 2018–2025 (USD MILLION)

9.6 OTHER END USERS

TABLE 16 CTMS MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

10 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY, BY REGION (Page No. - 65)

10.1 INTRODUCTION

TABLE 17 CTMS MARKET, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 18 NORTH AMERICA: CTMS MARKET SNAPSHOT

TABLE 18 NORTH AMERICA: CTMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 NORTH AMERICA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 20 NORTH AMERICA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 22 NORTH AMERICA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2.1 US

TABLE 23 NUMBER OF CLINICAL TRIALS STARTED IN THE US, BY COMPANY, 2017

TABLE 24 US: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 25 US: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 26 US: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 27 US: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Preference of pharmaceutical companies to conduct clinical trials in Canada to support market growth

TABLE 28 CANADA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 29 CANADA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 30 CANADA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 31 CANADA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 32 EUROPE: CTMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 EUROPE: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 34 EUROPE: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 35 EUROPE: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 36 EUROPE: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High investments and initiatives in Germany to boost market growth

TABLE 37 GERMANY: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 38 GERMANY: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 39 GERMANY: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 40 GERMANY: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Favorable R&D scenario in the country to boost software adoption

TABLE 41 UK: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 42 UK: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 43 UK: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 44 UK: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High number of oncology clinical trials in France to drive market growth

TABLE 45 FRANCE: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 46 FRANCE: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 47 FRANCE: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 48 FRANCE: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Low drug approval times have driven the adoption of CTMS, supporting market growth

TABLE 49 NUMBER OF CLINICAL TRIALS STARTED IN ITALY, BY COMPANY, 2017

TABLE 50 ITALY: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 51 ITALY: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 52 ITALY: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 53 ITALY: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising R&D expenditure to propel the growth of the Spanish market

TABLE 54 SPAIN: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 55 SPAIN: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 56 SPAIN: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 57 SPAIN: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 58 ROE: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 59 ROE: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 60 ROE: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 61 ROE: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 19 APAC: CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY SNAPSHOT

TABLE 62 ASIA PACIFIC: CTMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Low cost of clinical trials and large pharmaceutical R&D base in China to drive market growth

TABLE 67 CHINA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 68 CHINA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 69 CHINA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 70 CHINA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Stringent regulatory scenario in Japan to restrain the market growth

TABLE 71 JAPAN: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 72 JAPAN: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 73 JAPAN: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 74 JAPAN: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Favorable pharmaceutical R&D scenario to drive software adoption

TABLE 75 INDIA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 76 INDIA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 77 INDIA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 78 INDIA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Government support for clinical trials to boost the market in Australia

TABLE 79 AUSTRALIA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 80 AUSTRALIA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 81 AUSTRALIA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 82 AUSTRALIA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Growth of the contract research sector indicates opportunities for CTMS providers

TABLE 83 SOUTH KOREA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 84 SOUTH KOREA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 85 SOUTH KOREA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 86 SOUTH KOREA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 87 ROAPAC: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 88 ROAPAC: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 89 ROAPAC: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 90 ROAPAC: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 RISING INVESTMENTS AND HEALTHCARE EXPENDITURE SHOW POTENTIAL FOR MARKET GROWTH

TABLE 91 LATAM: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 92 LATAM: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 93 LATAM: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 94 LATAM: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.6 MIDDLE EAST AND AFRICA

10.6.1 GROWING AVAILABILITY OF FUNDING IN THE MIDDLE EAST INDICATES OPPORTUNITIES FOR MARKET GROWTH

TABLE 95 MEA: CTMS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 96 MEA: CTMS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 97 MEA: CTMS MARKET, BY DELIVERY MODE, 2018–2025 (USD MILLION)

TABLE 98 MEA: CTMS MARKET, BY END USER, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 103)

11.1 OVERVIEW

FIGURE 20 KEY DEVELOPMENTS IN THE CTMS MARKET (2017–2020)

11.2 GLOBAL MARKET SHARE ANALYSIS (2019)

FIGURE 21 ORACLE HELD THE LEADING POSITION IN THE CTMS MARKET IN 2019

11.3 COMPETITIVE SCENARIO (2017–2020)

11.3.1 KEY PRODUCT LAUNCHES AND PRODUCT DEPLOYMENTS (2017–2020)

11.3.2 KEY EXPANSIONS (2017–2020)

11.3.3 KEY MERGERS, DIVESTITURES, AND ACQUISITIONS (2017–2020)

11.3.4 KEY AGREEMENTS, CONTRACTS, AND PARTNERSHIPS (2017–2020)

11.4 COMPETITIVE LEADERSHIP MAPPING

11.5 VENDOR INCLUSION CRITERIA

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 22 CLINICAL TRIAL MANAGEMENT SYSTEM INDUSTRY: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019

11.6 COMPETITIVE LEADERSHIP MAPPING: EMERGING COMPANIES/SMES/START-UPS (2019)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 23 CTMS MARKET: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019 (SMES/START-UPS)

12 COMPANY PROFILES (Page No. - 111)

12.1 ORACLE

FIGURE 24 ORACLE: COMPANY SNAPSHOT

12.2 MEDIDATA SOLUTIONS

FIGURE 25 MEDIDATA SOLUTIONS: COMPANY SNAPSHOT

12.3 PAREXEL INTERNATIONAL CORPORATION

12.4 IBM

FIGURE 26 IBM: COMPANY SNAPSHOT

12.5 BIOCLINICA

12.6 BIO-OPTRONICS

12.7 DATATRAK INTERNATIONAL

FIGURE 27 DATATRAK INTERNATIONAL: COMPANY SNAPSHOT

12.8 VEEVA SYSTEMS

FIGURE 28 VEEVA SYSTEMS: COMPANY SNAPSHOT

12.9 MASTERCONTROL

12.10 DSG

12.11 ERT

12.12 ADVARRA TECHNOLOGY SOLUTIONS

12.13 MEDNET SOLUTIONS

12.14 ARISGLOBAL

12.15 DZS CLINICAL SERVICES (WDB HOLDINGS CO. LTD)

12.16 EMERGING PLAYERS/START-UPS

12.16.1 CRUCIAL DATA SOLUTIONS (CDS)

12.16.2 ENNOV

12.16.3 DATASTAT

12.16.4 BSI

12.16.5 REALTIME SOFTWARE SOLUTIONS LLC

13 APPENDIX (Page No. - 141)

13.1 RESEARCH DATA

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical trial management system market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

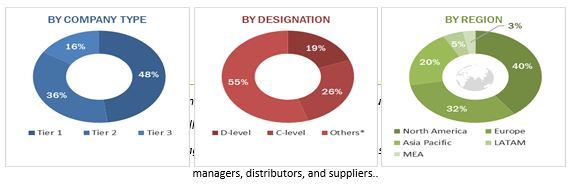

Primary research was conducted after acquiring extensive knowledge about the global clinical trial management system market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, ambulatory surgery centers, outpatient facilities, clinics, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below

To know about the assumptions considered for the study, download the pdf brochure

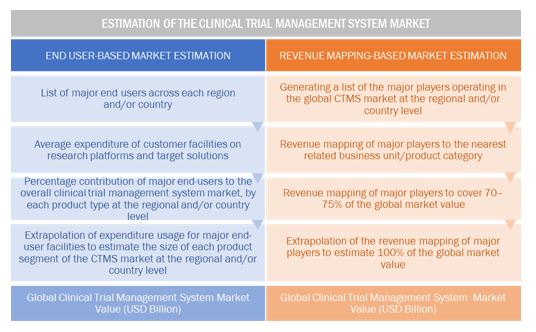

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global clinical trial management system market and other dependent submarkets.

- The key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall clinical trial management system market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the clinical trial management system market based on product & service, deployment mode, deployment type, and end user

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To estimate the size & growth potential of the market segments and subsegments with respect to five key regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa—and key countries

- To profile the key players in the market and comprehensively analyze their global revenue shares and core competencies

- To track and analyze competitive developments, such as product launches and approvals, partnerships, agreements, collaborations, and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the global clinical trial management system market report:

Product analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

CROs Market Segmentation, by Clinical Trial Phase

- Further segmentation of the CROs market, by clinical trial phase (phases I to IV)

Company information

- Detailed analysis and profiling of additional market players (up to five)

Geographic analysis

- Further breakdown of the Rest of Europe CTMS market into Belgium, Austria, Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific CTMS market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America CTMS market into Argentina and Colombia, among other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Trial Management System Market