eClinical Solutions Market Size, Growth, Share & Trends Analysis

eClinical Solutions Market by Product (CDMS, EDC, CTMS, eCOA, RTSM, eTMF, RIMS, eConsent), Application (Collection, Operation, Analytics), Trial Phase, End User (CRO, Pharma, Biotech, Medtech), Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global eclinical solutions market, valued at USD 11.62 billion in 2024, stood at USD 13.18 billion in 2025 and is projected to advance at a resilient CAGR of 13.9% from 2025 to 2030, culminating in a forecasted valuation of USD 25.22 billion by the end of the period. The market is driven by the increasing adoption of digital technologies to improve clinical trial efficiency, data accuracy, and regulatory compliance. Additionally, the growing use of decentralized and hybrid trials, rising trial complexity, demand for real-time data capture and analytics, and the need to enhance patient recruitment and retention are key factors accelerating adoption of eClinical platforms.

KEY TAKEAWAYS

-

By RegionNorth America dominated the eClinical solutions market, with a share of 47.7% in 2024.

-

By ProductThe electronic data capture & clinical data management solutions segment dominated the eClinical solutions market, with a share of 20.8% in 2024.

-

By Deployment ModelThe web-based & cloud-based models segment is projected to register a higher CAGR (14.0%) than the on-premise model segment during the forecast period.

-

By ApplicationThe data collection segment is projected to dominate the market during the forecast period.

-

By Clinical Trial PhaseThe phase IV segment is projected to register the highest CAGR during the forecast period.

-

By End UserThe pharmaceutical & biopharmaceutical companies segment is projected to dominate the eClinical solutions market during the forecast period.

-

Competitive Landscape - Key PlayersVeeva Systems, Oracle, and IQVIA were identified as some of the star players in the eClinical solutions market (global), given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsCastor, Medrio, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The eClinical solutions market is driven by the need to modernize clinical trial operations through automation, cloud-based platforms, and integrated data management. Moreover, the increasing regulatory scrutiny, pressure to shorten trial timelines, and the shift toward patient-centric and remote trial models are pushing sponsors and CROs to adopt eClinical technologies for better visibility, control, and data quality.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The eClinical solutions market is shifting from license-based models to AI-driven, usage-based platforms, expanding beyond core suites into analytics and interoperable ecosystems. This disruption is driven by end users, pharmaceutical and biopharmaceutical companies, CROs, healthcare providers, and academic institutes, seeking faster trial execution, improved compliance, and data-driven outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Favorable government support and funding

-

Growing focus on cost-effective processes

Level

-

High implementation cost

-

Lack of skilled professionals

Level

-

Increasing number of clinical trials

-

Outsourcing of clinical trials

Level

-

Limited adoption of eClinical solutions in developing and underdeveloped countries

-

Software reliability issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Favorable government support and funding

Various regional governments worldwide recognize the role of eClinical solutions in streamlining clinical research studies and improving financial and clinical viability. The adoption of eClinical solutions has resulted in growing government support (such as research funding, grants, and supportive legislation) for clinical research studies. In 2024, the Australian Government Department of Health and Aged Care launched the Clinical Trials Activity initiative to provide USD 750 million between 2024–2025 and 2033–2034 throughout a ten-year period to boost clinical trial activities in Australia.

Restraint: High implementation cost

eClinical solutions help researchers efficiently organize, standardize, and manage their clinical research data and metadata during their research lifecycle. Several integrated eClinical solutions (such as CTMS and CDMS) provide end-to-end solutions to clinical researchers for all clinical trial processes. However, these software solutions are expensive and priced at a premium. The installation and maintenance of eClinical solutions cost approximately USD 2 million, with additional costs for technical assistance for cloud-based solutions. The high cost associated with advanced eClinical software solutions is expected to restrain optimal adoption among price-sensitive and small-sized end users, including pharma-biotech companies, independent researchers, and CROs.

Opportunity: Increasing number of clinical trials

The life science industry is witnessing a global increase in the number of clinical trials conducted each year. An increasing number of industry and government sponsors across developed countries are outsourcing their clinical trial processes to developing countries owing to procedural affordability and efficiency, lower operational costs, availability of a large population base, faster patient recruitment, limited regulatory barriers, effective compliance with regulatory guidelines, and stronger intellectual property protections. Asian countries are emerging as key outsourcing destinations for clinical trials primarily due to a large and genetically diverse population, high disease prevalence, and availability of low-cost outsourcing services. Additionally, the growing number of pharmaceutical companies in developing Asian countries such as China, India, Taiwan, and Korea have also created growth opportunities for the eClinical solutions market in the region.

Challenge: Limited adoption of eClinical solutions in developing and underdeveloped countries

Due to limited technology usage and knowledge, the adoption of eClinical solutions is relatively low in emerging nations. However, there is higher utilization in Asia Pacific than in the Middle East & Africa. Low adoption in several developing and underdeveloped markets results from the high costs involved in implementing, maintaining, and upgrading IT solutions that the healthcare IT industry witnesses. Healthcare organizations have to try to attain budgetary approvals in advance and respond to emerging HCIT solutions. Additionally, several issues burden the accessibility of Internet connectivity of medical devices for smaller healthcare organizations. These issues include technical difficulties in the implementation of multiple networks in health setups, poor wireless connectivity, and enhanced need to install security layers to avoid data breaches.

ECLINICAL SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provide end-to-end clinical data capture and management (EDC), integrated data review, and analytics across global trials | Fast study build and database lock | Improved data quality | Centralized data visibility. |

|

Provide a unified cloud platform (EDC, CTMS, eTMF) to manage clinical operations and trial documentation | Single cloud repository for documents and operational data | Easy audits and inspection readiness |

|

Enable orchestrated clinical trials by integrating EDC, eCOA, RTSM, analytics, and patient engagement tools | Accelerate trial execution | Provide better patient recruitment/retention | Enable data-driven decision-making |

|

|

Combine eClinical technologies (EDC, eCOA, RTSM) with full-service CRO trial execution | Reduce operational complexity | Enable quick timelines end-to-end trial accountability |

|

Support clinical trial management through CTMS, clinical data, and safety systems integrated at enterprise level | Obtain standardized trial operations, strong system integration, enhanced regulatory compliance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The eClinical solutions market ecosystem consists of companies that offer eClinical technologies. These companies include key players, such as EDC, eCOA/ePRO, IRT/RTSM and key startups, such as Medrio and Castor. The ecosystem also includes cloud service providers (Amazon Web Service, IBM Cloud) that support scalable deployment, secure data exchange, and provide enterprise-wide access across multi-site healthcare networks. The ecosystem is also strengthened by end users that rely on these platforms to digitize and standardize clinical trial operations, enabling faster study startup, real-time data capture, and centralized trial oversight. Some of the end users included are Novartis, Roche, and Pfizer.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

eClinical Solutions Market, By Product

The electronic data capture (EDC) & clinical data management (CDM) solutions segment accounted for the largest market share in 2024. These solutions represent the primary infrastructure supporting modern clinical trials, allowing for real-time data capture. Additionally, the popularity of these technologies is underpinned by widespread adoption in all clinical trial phases regarding real-time data capture, automatic validation, and centralized management. Moreover, the increasing complexity of clinical trials, along with the stringent demands of regulatory authorities regarding quick database lock and high-quality data delivery, has given a major boost to the demand equation supporting the incorporation of EDC & CDM into contemporary clinical research.

eClinical Solutions Market, By Deployment Model

The web-hosted & cloud-based models segment accounted for the largest market share in 2024. This growth is owing to the scalability of these models, rapid implementation time, and lower infrastructure costs when contrasted with the on-premises systems. These models offer access to real-time data, collaboration between sponsors, CROs, and the site for studies. Moreover, they provide better updates with higher security measures for data as well as robust regulatory compliance for the conduct of global or decentralized clinical trials.

eClinical Solutions Market, By Application

In 2024, the data collection segment accounted for the largest market share. This phase encompasses the core function that enables all activities related to clinical trials. Its leadership is being fueled by the widespread use of EDC, eCOA, as well as eSource solutions for real-time capture of study-related data from patients or sites as well as devices for all trial phases. Additionally, its focus on decentralized as well as hybrid trials, the use of wearables for remote monitoring, and the need to reduce manual entry of the collected data will further escalate the use of data collection as the most widely used segment of the different solutions related to eClinical.

eClinical Solutions Market, By Clinical Trial Phase

In 2024, the phase III segment accounted for the largest market share due to high volume, complexity, and scale associated with late-stage clinical trials for obtaining regulatory approvals. Such clinical trials engage large patient bases, various global locations, and voluminous data generation, resulting in high demands for efficient eClinical solutions like EDC, CDM, eCOA, and RTSM. Additionally, the decisive nature of phase III outcomes in deciding product approvals and launches has resulted in high investment in advanced digital platforms to address accuracy, compliance, and timelines in clinical trials.

eClinical Solutions Market, By End User

In 2024, the pharmaceutical & biopharmaceutical companies segment accounted for the largest market share. These companies are key sponsors of clinical trials and also the biggest spenders on eClinical solutions. This is because they have huge R&D pipelines, high numbers of Phase II and Phase III trials, as well as challenging management needs in relation to complex multi-regional trials that must meet strict regulatory needs. At the same time, with increased uses of decentralized and digitalized models of clinical trials, there is heavy dependence on sophisticated eClinical solutions to support successful drug approvals.

REGION

Asia Pacific to be fastest-growing market in eClinical solutions market during forecast period

Asia Pacific is projected to be the fastest-growing region in the eClinical solutions market, aided by the rising number of clinical trials as well as the rapid adoption of technology in trials, such as decentralized trials. The region is also supported by the rising investments in the pharmaceutical as well as the biotech industry. The investment helps companies in the region improve infrastructure in the field of healthcare and increase number of treatment-naïve patients who can easily enroll in trials.

ECLINICAL SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the eClinical solutions market evaluation matrix, Veeva Systems (Star) leads with a dominant market position, due to its strong adoption among pharmaceutical and biopharmaceutical companies and its unified, cloud-native Vault Clinical Suite. At the same time, Clario (Emerging Leader) provides regulatory-grade clinical evidence, endpoint-driven data collection, and digital biomarker solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Medidata (Dassault Systèmes Company) (US)

- Veeva Systems (US)

- IQVIA (US)

- ICON Plc (Ireland)

- Oracle (US)

- Signant Health (US)

- Clario (US)

- eClinical Solutions LLC (US)

- Clinion (US)

- MaxisIT (US)

- 4G Clinical (US)

- Fountayn (US)

- Saama (US)

- Suvoda LLC (US)

- Advarra (US)

- Caidya (US)

- OpenClinica, LLC (US)

- EvidentIQ (US)

- Ennov (France)

- Perceptive (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.62 Billion |

| Market Forecast in 2030 (value) | USD 25.22 Billion |

| Growth Rate | CAGR of 13.9% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

US eClinical Solutions Market Asia Pacific eClinical Solutions Market Europe eClinical Solutions Market |

WHAT IS IN IT FOR YOU: ECLINICAL SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of leading eClinical vendors (ICON, IQVIA, Oracle) covering platform capabilities, interoperability, cloud vs on-premise deployment models, AI/analytics maturity, and pricing structures |

|

| Regional Market Entry Strategy | Assessment of region-wise clinical trial maturity, site readiness, investigator adoption, data standards, interoperability with EHRs, and regulatory frameworks (FDA 21 CFR Part 11, EMA, PMDA, CDSCO) across the North America, Europe, Asia Pacific, and emerging markets |

|

| Local Risk & Opportunity Assessment | Evaluation of data integrity and privacy risks, electronic consent requirements, cybersecurity standards, decentralized trial readiness, reimbursement impact, and growth opportunities in phase II–IV and real-world evidence studies |

|

| Technology Adoption by Region | Mapping adoption of EDC, eCOA, eSource, RTSM, cloud-based CDMS, and AI-enabled analytics, along with integration maturity across sponsor, CRO, and site ecosystems |

|

RECENT DEVELOPMENTS

- January 2025 : Medidata signed a multi-year agreement with Bristol Myers Squibb to continue using its platform for clinical trial data management and optimization.

- October 2024 : Medidata's launch of bundled solutions for oncology and vaccine trials focuses on streamlining study design and execution through advanced digital tools.

- September 2024 : Signant Health partnered with IQVIA to streamline clinical trial operations, improve site access to digital tools, and enhance patient engagement.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies in the global eclinical solutions market.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies' house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the eClinical solutions market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the eClinical solutions market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, government organizations, research institutes and hospitals (small, medium-sized, and large hospitals).

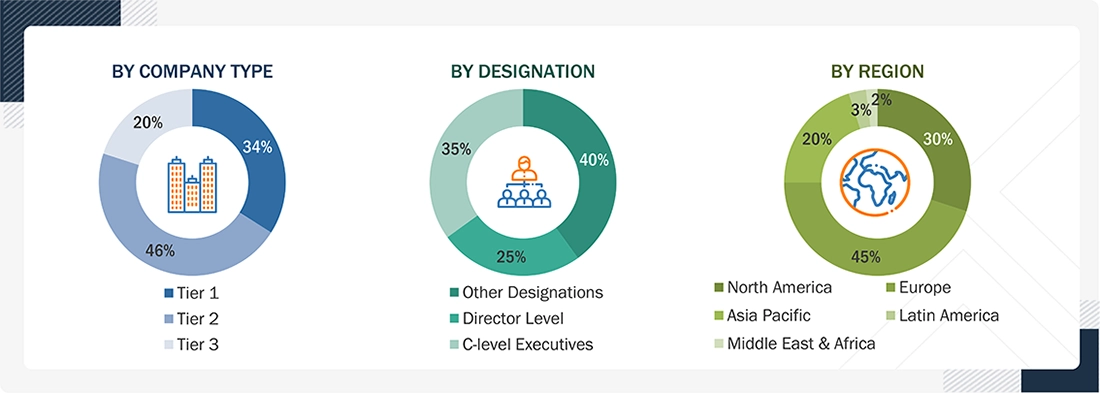

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

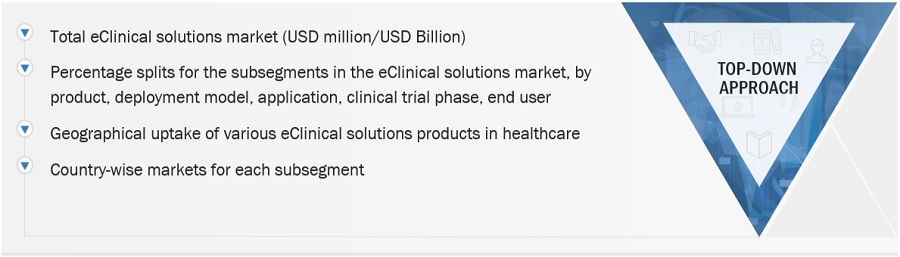

The total size of the eClinical solutions market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Global eClinical Solutions Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

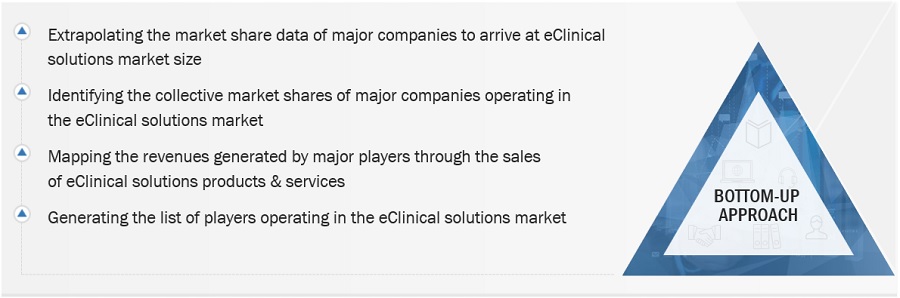

Global eClinical Solutions Market Size: Bottom-Up Approach

Data Triangulation

The size of the eClinical solutions market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below: -

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the eClinical solutions market were gathered from secondary sources to the extent available. In certain cases, shares of eClinical solutions businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the eClinical solutions market was determined by extrapolating the market share data of major companies.

Market Definition

eclinical solutions are the software/platform that changes the paper-based clinical research model into an electronic form. Such technologies help the researcher in facilitating the process of data collection, its transmission, and surveillance of the clinical trial process and provide enhanced options for better planning and execution of a clinical trial. eClinical technologies fast-track the study by reducing the risk and maximizing resources.

Key Stakeholders

- Healthcare IT Service Providers

- eClinical Solution Vendors

- Clinical Research Organizations

- Pharmaceutical/Biopharmaceutical Companies

- Research and Development (R&D) Companies

- Business Research and Consulting Service Providers

- Medical Research Laboratories

- Government agencies

- Healthcare startups, consultants, and regulators

- Academic Medical Centers/Universities/Hospitals

Objectives of the Study

- To define, describe, and forecast the global eClinical solutions market based on product, deployment model, application, clinical trial phase, end user, and region

- To provide detailed information regarding the major factors influencing the global eClinical solutions market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall eClinical solutions market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders in the global eClinical solutions market

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa.

- To profile the key players and analyze their market shares and core competencies in the global eClinical solutions market

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations in the overall global eClinical solutions market

- To benchmark players within the market using the proprietary "Company Evaluation Matrix" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific global eClinical solutions market into Australia, Taiwan, New Zealand, Thailand, Singapore, Malaysia, and other countries

- Further breakdown of the Rest of Europe global eClinical solutions market into Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the eClinical Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in eClinical Solutions Market

Jonathan

Mar, 2022

Looking to gain more insights on the global eClinical Solutions Market.

Stephen

Mar, 2022

What are the growth opportunities in eClinical Solutions Market?.

Larry

Mar, 2022

Can you enlighten us on geographical growth analysis in eClinical Solutions Market?.