Catalog Management Systems Market by Type (Product Catalogs and Service Catalogs), Component, Deployment Type, Organization Size (Large Enterprises and SMEs), Vertical, and Region - Global Forecast to 2026

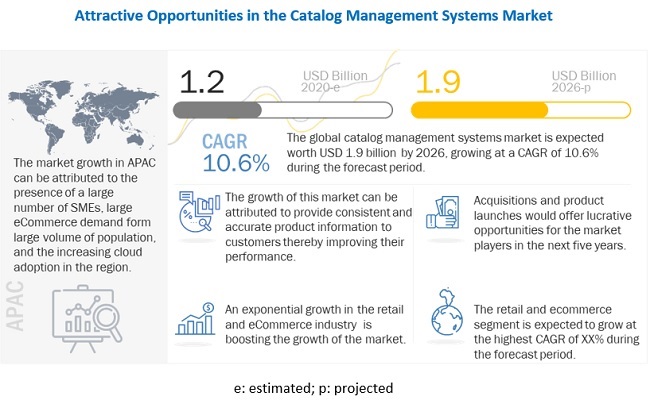

[251 Pages Report] The global catalog management systems market size is expected to grow at a CAGR of 10.6% during the forecast period, to reach USD 1.9 billion by 2026 from USD 1.2 billion in 2020. Key factors that are expected to drive the growth of the market are the rising consumer demand for products, growing internet access, and rising penetration of smartphones demand which is acting as a catalyst for catalog management solutions from the e-commerce industries. The catalog management systems market is fragmented as there is presence of large number players across market. The major factors that are expected to drive the adoption of catalog management software among enterprises as well as SMEs across several verticals, including retail and e-commerce, media and entertainment, telecom, IT, and travel and hospitality are increasing adoption of cloud and digital transformation is significantly increasing. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market. In current times, the market is profitable for catalog management software vendors as several companies from diverse verticals are progressively adopting digital transformation across their businesses. During the COVID, the catalog management systems market is profitable for catalog management software vendors as such software and solution help organizations in categorizing and consolidating product or service data into a single digital point of location for organizations and their end customers, i.e., buyers. The systems maintain and store product and service information for organizations which save time and reduce manual work.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the catalog management systems market. COVID-19 has led to digital transformation across multiple industries, including retail and eCommerce, telecom, and media and entertainment. These solutions provide a quick snapshot of products in a channel, and capture and upload data and map it to customer needs. They also help in validating, enriching, and augmenting the data in real-time and automate the creation of catalog information using data from multiple sources to improve product assortment and achieve faster syndication of product data across channels.

Market Dynamics

Driver: Rising demand for catalog management solutions from the eCommerce industry

The eCommerce industry has been growing at a tremendous pace, owing to the rising consumer demand for products, growing internet access, and rising penetration of smartphones. Worldwide online sales have increased. In countries such as the Philippines, Mexico, India, and China, the eCommerce industry is growing rapidly. Catalog management helps reduce the cost of service delivery, improve the customer experience, enhance employee efficiency, and boost the overall functioning of businesses. Catalog management system solutions deliver a better shopping experience to customers by offering detailed information on any product. These benefits help businesses to reduce time and offer automation to update product information on eCommerce platforms.

Restraint: Misapprehensions related to data security and privacy risks

Catalog management involves data collection and transmission from one channel to another. The synchronization and publishing of data across channels are also involved with catalog management systems. Due to the lack of proper knowledge about security frameworks and their implementation, many companies have the perception that catalog management solutions might lead to data breaches in their highly abstracted data sets.

Apprehensions about data security are the prime reasons for hindering the adoption of catalog management solutions. Users concisely refrain from using these solutions, fearing losing their crucial master data and reference data due to data errors occurring during compilation or upgradation. Users are under the impression that the privacy of their data is at risk, and there would be no accountability for their data losses or thefts or any mitigation would not be provided. Moreover, users fear losing the authenticity of their data. Therefore, companies prefer vendors who can customize their existing systems to manage their product information and withstand competition.

Opportunity: Incorporation of AI and ML capabilities to improve information management and customer experience

Organizations across industries such as healthcare, retail, and BFSI have been investing and adopting new technologies, such as AI and ML, to grow and stay ahead of their competitors. AI-powered catalog management offers the automatic classification of products, anomaly detection, enrichment processes through the selection of data from trusted sources, scoring of products, and contextual recommendations. AI-powered catalog management solutions can generate automated insights about data issues and create an integrated view of the data present across multiple systems for helping customers understand their products better. Furthermore, AI-embedded chatbots can also improve customer experience and satisfaction, resulting in enhanced revenues and profits. ML-enabled catalog management solutions help organizations in managing compliance, driving data-based digital transformation, and achieving better operational efficiency by sensing upcoming data quality issues and suggesting appropriate solutions to improve data matching and avoid data inconsistencies. Companies such as IBM have started offering ML-enabled catalog management solutions. It is expected that the demand for such solutions can increase, which would encourage new developments in catalog management solutions.

Challenge: Absence of the standardized catalog format among enterprises

Catalog requirements differ for each enterprise based on products or services offered. There is no standardized format that is followed by enterprises. Despite the cleansing, consolidation, and enrichment benefits of catalog management solutions, companies are required to establish a proper governance policy that ensures consistency across product catalogs for achieving standardized data. Similarly, for better integrations with existing systems, the data coming from systems containing poor information or data inconsistencies must also be taken into consideration while formulating such policies.

Services segment to hold a larger market size during the forecast period

The services segment for catalog management systems is expected to grow at a higher CAGR due to the need of professional and managed services for ensuring smooth functioning of product information and manage data in a single repository. Enterprises across various regions requires active support from skilled professionals to minimize their downtime during the pre-and post-installation of catalog management solutions. These services provide the necessary support to uphold the efficiency of business processes, increase enterprise growth, and reduce unwanted operational expenses.

Cloud deployment type to hold a larger market size in 2021

The cloud segment is expected to hold a higher share of the catalog management systems market as organizations across various regions are adopting cloud for digital transformation rapidly. The on-premises model is adopted specifically by large enterprises as the budget allocation generally is high for installing catalog management software products and services in companies’ equipment compared with SMEs.

Small enterprises to hold a majority of the market share during the forecast period

SMEs are defined as organizations with an employee strength ranging from 1 to 1,000. SMEs have a low marketing budget and often lack the resources and capabilities for effective marketing orchestration. These enterprises face greater challenges of limited budget as compared to large enterprises and require better methods to resolve complexities for improving the cost optimization of their business processes. However, the SMEs segment is expected to grow at a higher CAGR during the forecast period, due to rising adoption of cloud-based catalog management systems. Cloud-based software and services offers benefits such as reliability, scalability, user-friendly capabilities, easy integration, increased agility, and improved efficiency which are expected to encourage SMEs to adopt cloud-based catalog management system solutions and services at a rapid pace.

Retail and eCommerce industry vertical to grow at the highest CAGR during the forecast period

Retail and e-commerce is one of the fastest-growing verticals with respect to the adoption of advanced technologies and services due to the enormous volume of product data. Digital transformation initiatives have led to the boom in the retail and eCommerce vertical to meet customers’ dynamic requirements. Today, customers demand rich and consistent product information; therefore, catalog manager ensures the quality of product data across all the sales channels. It includes how merchants organize, standardize, and publish their product data using each sales channel. Whether the product data is created in-house or is from third parties such as suppliers, organizations need to manage its accuracy.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

Asia Pacific has witnessed the advanced and dynamic adoption of new technologies and is projected to record the highest CAGR during the forecast period. In addition, the IT spending across organizations in the region is gradually increasing, which is projected to lead to a surge in the adoption of catalog management software solutions. China, India, Japan, and Australia and New Zealand (ANZ) are the leading countries in terms of the adoption of catalog management software solutions and services in the region. While the expenditure on technology solutions in APAC has increased, a setback is witnessed due to the recent COVID-19 pandemic. The COVID-19 pandemic makes it more urgent for business leaders across APAC to increase their rate of cloud adoption and digital transformation, thereby embracing great market opportunities for catalog management system vendors across the region. However, the current pandemic has forced the retail vertical across APAC to shift toward digital innovation and eCommerce, thereby driving huge market opportunities for catalog management system vendors.

Catalog Management Systems Companies

The catalog management system vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering catalog management systems solutions and services globally are IBM (US), SAP (Germany), Oracle (US), Salsify (US), Coupa Software (US), ServiceNow (US), Proactis (England), Broadcom (US), Fujitsu (Japan), Comarch (Poland), Zycus (US), GEP (US), Ericsson (Sweden), Amdocs (US), Episerver (US), Hansen Technologies (Australia), Vinculum (India), Claritum (UK), eJeeva (US), SunTec (India), Plytix (Denmark), Mirakl (France), Sellercloud (US), Vroozi (US), CatBase (UK), Akeneo (France), nChannel (US), Contalog (India), and Sales Layer (Spain).

The study includes an in-depth competitive analysis of key players in the catalog management systems market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Type (Product Catalogs and Service Catalogs), Component (Solutions and Services), Deployment Type, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

List of Companies in Catalog Management Systems |

IBM (US), SAP (Germany), Oracle (US), Salsify (US), Coupa Software (US), ServiceNow (US), Proactis (England), Broadcom (US), Fujitsu (Japan), Comarch (Poland), Zycus (US), GEP (US), Ericsson (Sweden), Amdocs (US), Episerver (US), Hansen Technologies (Australia), Vinculum (India), Claritum (UK), eJeeva (US), SunTec (India), Plytix (Denmark), Mirakl (France), Sellercloud (US), Vroozi (US), CatBase (UK), Akeneo (France), nChannel (US), Contalog (India), and Sales Layer (Spain). |

This research report categorizes the catalog management systems market based on type, component, deployment type, organization size, vertical, and region.

Based on the type:

- Product Catalogs

- Service Catalogs

Based on the component:

- Solutions

-

Services

- Managed Services

- Professional Services

Based on the deployment type:

- On-premises

- Cloud

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- Retail and eCommerce

- Telecom

- IT

- Media and Entertainment

- Travel and Hospitality

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2020, Salsify formed a partnership with e-Comas, an Amazon consulting, account management, and content optimization firm. The aim behind the partnership is to provide Amazon digital shelf excellence to brand manufacturers in Europe, Middle East, and Africa (EMEA) by using Salsify’s solutions.

- In June 2020, Oracle released the implementation guide for Oracle Product Information Management version 12.1. This new version allows users to efficiently define responsibilities, users, suppliers, customers, setting up item catalogs and categories, item templates, manage item statuses, change policies for item catalogs, define new item requests, manage display formats, and define report templates.

- In July 2019, SAP launched its Product Content Hub, which is a cloud-based PIM solution. Its capabilities include product data management, product catalog management, product data model management, users and workflows, and data feed management. This new product offers master product data for customer-facing systems, including the SAP Commerce Cloud Solution, and its user interface allows business users to effectively create and manage high quality product data across marketing channels.

- In March 2019, Salsify introduced PXM platform for automated content submission. The new features specific to Amazon include automated content submission, creation, and publishing of content across the entire product catalog and automated inventory alerts.

Frequently Asked Questions (FAQ):

What is the projected market value of the global catalog management systems market?

The global Catalog management systems market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.6% during the forecast period, to reach USD 1.9 billion by 2026 from USD 1.2 billion in 2020.

Which region has the highest market share in the catalog management systems market?

North America and Europe region have the highest market share in the catalog management systems market, where these two regions together contribute more than half of the global catalog management systems market in the year 2020.

Who are the major vendors in the catalog management systems market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as I IBM (US), SAP (Germany), Oracle (US), Salsify (US), Coupa Software (US), ServiceNow (US), Proactis (England), Broadcom (US), Fujitsu (Japan), Comarch (Poland), Zycus (US), GEP (US), Ericsson (Sweden), Amdocs (US), Episerver (US), Hansen Technologies (Australia), Vinculum (India), Claritum (UK), eJeeva (US), SunTec (India), Plytix (Denmark), Mirakl (France), Sellercloud (US), Vroozi (US), CatBase (UK), Akeneo (France), nChannel (US), Contalog (India), and Sales Layer (Spain).

What are some of the latest trends that will shape the catalog management systems market in the future?

Emergence of IoT, BI and analytics, AI and cloud enabled offerings which significantly improve the catalog management systems market is expected to shape the market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 6 CATALOG MANAGEMENT SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 List of primary profiles

2.1.2.2 Key industry insights

2.1.2.3 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 CATALOG MANAGEMENT SYSTEMS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING CATALOG MANAGEMENT SYSTEM SOLUTIONS AND SERVICES (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING CATALOG MANAGEMENT SYSTEM SOLUTIONS AND SERVICES (2/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM SOLUTIONS AND SERVICES

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET REVENUE ESTIMATION

FIGURE 13 ILLUSTRATION OF COMPANY CATALOG MANAGEMENT SYSTEMS REVENUE ESTIMATION

2.5 GROWTH FORECAST ASSUMPTIONS

2.6 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.7 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 14 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 15 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.9 RESEARCH ASSUMPTIONS

TABLE 3 ASSUMPTIONS FOR THE STUDY

2.10 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE IN THE CATALOG MANAGEMENT SYSTEMS MARKET IN 2021

FIGURE 17 CLOUD, LARGE ENTERPRISES, AND PROFESSIONAL SERVICES SEGMENTS TO HOLD LARGE SHARES IN THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CATALOG MANAGEMENT SYSTEMS MARKET

FIGURE 18 INCREASING NEED OF CATALOG MANAGEMENT SYSTEMS FOR TACKLING HIGH DEMAND FROM ECOMMERCE TO DRIVE THE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY VERTICAL AND COUNTRY

FIGURE 19 RETAIL AND ECOMMERCE VERTICAL AND UNITED STATES TO ACCOUNT FOR LARGE SHARES IN NORTH AMERICAN MARKET IN 2021

4.3 ASIA PACIFIC: MARKET, BY COMPONENT AND COUNTRY

FIGURE 20 SOLUTIONS SEGMENT AND REST OF ASIA PACIFIC TO ACCOUNT FOR LARGE SHARES IN ASIA PACIFIC MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CATALOG MANAGEMENT SYSTEMS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for catalog management solutions from the eCommerce industry

FIGURE 22 CHALLENGES FACED BY ECOMMERCE COMPANIES

5.2.1.2 Growing need to gain real-time visibility into data to reduce TTM

5.2.1.3 Indispensable requirement of data hubs for better data syndication

FIGURE 23 MAJOR BENEFITS OFFERED BY CATALOG MANAGEMENT TO BUSINESSES

5.2.1.4 Compelling need for eliminating data inconsistencies across multiple data silos

5.2.2 RESTRAINTS

5.2.2.1 Misapprehensions related to data security and privacy risks

5.2.3 OPPORTUNITIES

5.2.3.1 Incorporation of AI and ML capabilities to improve information management and customer experience

5.2.3.2 Rising investments in automation to enable quicker decisions

5.2.4 CHALLENGES

5.2.4.1 Absence of the standardized catalog format among enterprises

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: NON-STOP DOGWEAR

5.3.2 CASE STUDY 2: KT CORPORATION

5.3.3 CASE STUDY 3: FLOOR MY PLACE

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS: CATALOG MANAGEMENT SYSTEMS MARKET

FIGURE 24 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 COVID-19-DRIVEN MARKET DYNAMICS

FIGURE 25 CATALOG MANAGEMENT SYSTEMS MARKET: PRE AND POST COVID-19 IMPACT

5.5.1 DRIVERS AND OPPORTUNITIES

5.5.2 RESTRAINTS AND CHALLENGES

5.6 TECHNOLOGICAL OUTLOOK

5.6.1 ARTIFICIAL INTELLIGENCE AND AUTOMATION

5.6.1.1 Robotic process automation

5.6.1.2 Machine learning and natural language processing

5.7 PRICING ANALYSIS

TABLE 5 CATALOG MANAGEMENT SYSTEMS MARKET: PRICING LEVELS

5.8 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN

5.9 MARKET ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM

5.10 PATENT ANALYSIS

TABLE 6 MARKET: PATENTS

TABLE 7 TOP 10 PATENT OWNERS (US)

5.11 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION/ INTERNATIONAL ELECTROTECHNICAL COMMISSION 27000 STANDARDS

5.11.3 CLOUD SECURITY ALLIANCE CONTROLS

5.11.4 SYSTEM AND ORGANIZATION CONTROL REPORTS

5.11.4.1 System and Organization Control 1

5.11.4.2 System and Organization Control 2

5.11.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.12 REVENUE SHIFT – YC/YCC SHIFT

FIGURE 28 MARKET: YC/YCC SHIFT

6 CATALOG MANAGEMENT SYSTEMS MARKET, BY TYPE (Page No. - 86)

6.1 INTRODUCTION

6.1.1 TYPES: MARKET DRIVERS

6.1.2 TYPES: COVID-19 IMPACT

FIGURE 29 SERVICE CATALOGS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 10 TYPES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 TYPES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.1.3 INCREASING DIGITAL TRANSFORMATION ACCELERATING THE ADOPTION OF SERVICE CATALOGS TO STORE PRODUCT INFORMATION AND MEDIA ASSETS

TABLE 12 SERVICE CATALOGS: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 SERVICE CATALOGS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2 PRODUCT CATALOGS

6.2.1 NEED FOR DIGITAL ASSET MANAGEMENT, CONTENT SYNDICATION, AND PRODUCT INFORMATION MANAGEMENT DRIVES THE DEMAND FOR PRODUCT CATALOGS

TABLE 14 PRODUCT CATALOGS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 PRODUCT CATALOGS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 CATALOG MANAGEMENT SYSTEMS MARKET, BY COMPONENT (Page No. - 92)

7.1 INTRODUCTION

7.1.1 COMPONENTS: MARKET DRIVERS

7.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 18 COMPONENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 COMPONENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.2 SOLUTIONS

7.2.1 NEED FOR MANAGING PRODUCT INFORMATION IN A COST-EFFECTIVE MANNER TO STREAMLINE SALES AND MARKETING EFFORTS TO ACCELERATE THE ADOPTION OF CATALOG MANAGEMENT SOLUTIONS

TABLE 20 SOLUTIONS: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SERVICES

7.3.1 PROVISION OF TRAINING AND SUPPORT SERVICES TO FUEL THE DEMAND FOR CATALOG MANAGEMENT SERVICES

FIGURE 31 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 22 COMPONENT: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 23 COMPONENTS: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 SERVICES: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.2 PROFESSIONAL SERVICES

TABLE 26 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.3 MANAGED SERVICES

TABLE 28 MANAGED SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 MANAGED SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 CATALOG MANAGEMENT SYSTEMS MARKET, BY ORGANIZATION SIZE (Page No. - 101)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 32 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 REQUIREMENT OF DATA CONSISTENCY AND SYNDICATION TO CATER TO CUSTOMERS IN A BETTER WAY TO ACCELERATE THE DEMAND FOR CATALOG MANAGEMENT SOLUTIONS AMONG LARGE ENTERPRISES

TABLE 32 LARGE ENTERPRISES: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 35 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 36 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 37 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 38 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 39 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 41 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 REDUCED COSTS AND OPERATIONAL EXPENSES TO STORE AND MANAGE PRODUCT INFORMATION TO ACCELERATE THE ADOPTION OF CATALOG MANAGEMENT SOLUTIONS AMONG SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 48 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 49 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 51 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 53 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9 CATALOG MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT TYPE (Page No. - 113)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPES: COVID-19 IMPACT

FIGURE 33 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 56 CATALOG MANAGEMENT SYSTEMS SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 57 CATALOG MANAGEMENT SYSTEMS SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

9.2 ON-PREMISES

9.2.1 TRADITIONAL COMPANIES WITH LARGE BUDGETS AND TEAMS DRIVE ON-PREMISES CATALOG MANAGEMENT SOLUTION ADOPTION TO OVERCOME SECURITY CONCERNS OVER SENSITIVE DATA

TABLE 58 ON-PREMISES: CATALOG MANAGEMENT SYSTEMS SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 ON-PREMISES: CATALOG MANAGEMENT SYSTEM SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 CLOUD

9.3.1 CLOUD BENEFITS TO SURGE THE DEMAND FOR CLOUD-BASED CATALOG MANAGEMENT SOLUTIONS

TABLE 60 CLOUD: CATALOG MANAGEMENT SYSTEMS SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 CLOUD: CATALOG MANAGEMENT SYSTEMS SIZE, BY REGION, 2021–2026 (USD MILLION)

10 CATALOG MANAGEMENT SYSTEMS MARKET, BY VERTICAL (Page No. - 118)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 34 RETAIL AND ECOMMERCE VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 62 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 63 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 RISE IN DIGITAL BANKING TO BOOST THE ADOPTION OF CATALOG MANAGEMENT SYSTEMS IN THE VERTICAL

TABLE 64 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 BANKING, FINANCIAL SERVICES AND INSURANCE: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 RETAIL AND ECOMMERCE

10.3.1 RAPID DIGITAL TRANSFORMATION AND THE NEED TO MANAGE ENORMOUS VOLUMES OF PRODUCT DATA TO ACCELERATE THE ADOPTION OF CATALOG MANAGEMENT SYSTEMS ACROSS THE VERTICAL

TABLE 66 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 TELECOM

10.4.1 RISE IN GLOBAL DIGITAL BSS MARKET TO DRIVE THE ADOPTION OF CATALOG MANAGEMENT SYSTEMS ACROSS THE VERTICAL

TABLE 68 TELECOM: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 INFORMATION TECHNOLOGY

10.5.1 NEED TO AUTOMATE WORKFLOW TO ENHANCE CUSTOMER EXPERIENCE TO DRIVE THE ADOPTION OF CATALOG MANAGEMENT SYSTEMS

TABLE 70 INFORMATION AND TECHNOLOGY: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 INFORMATION AND TECHNOLOGY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 MEDIA AND ENTERTAINMENT

10.6.1 RISE IN THE ADOPTION OF OTT PLATFORMS AND THE NEED TO ACCELERATE CONTENT CREATION, MEDIA ASSET MANAGEMENT, VIDEO CATALOG MANAGEMENT, AND SUBSCRIBER MANAGEMENT TO DRIVE THE MARKET ACROSS THE VERTICAL

TABLE 72 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 TRAVEL AND HOSPITALITY

10.7.1 PRODUCT INFORMATION MANAGEMENT FOR BOOKING ENGINE, RESERVATION AND PNR, AVAILABILITY, AND PASSENGER RECORDS TO BOOST THE ADOPTION OF CATALOG MANAGEMENT ACROSS THE VERTICAL

TABLE 74 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHERS

TABLE 76 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 77 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 CATALOG MANAGEMENT SYSTEMS MARKET, BY REGION (Page No. - 129)

11.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 78 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 79 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 36 NORTH AMERICA: SNAPSHOT

TABLE 80 NORTH AMERICA: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

11.2.4.1 Rising adoption of advanced digital technologies to reduce manual tasks involved in the management of data and digital files to drive the adoption of catalog management systems

TABLE 94 UNITED STATES: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.2.5 CANADA

11.2.5.1 Rising adoption of cloud-based technologies and data compliance practices to boost the growth of the market in Canada

TABLE 98 CANADA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 100 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 101 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: CATALOG MANAGEMENT SYSTEMS MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 102 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.4.1 Rising technology adoption and increasing demand for robust solutions to improve supplier and customer experiences to drive the adoption of catalog management systems in the UK

TABLE 116 UNITED KINGDOM: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.5 GERMANY

11.3.5.1 Growing need to improve customer experiences and streamline sales operations to create the demand for catalog management systems in Germany

TABLE 120 GERMANY: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.6 FRANCE

11.3.6.1 Increase in digitalization, rapid surge in mobile devices and mobile content, and advent of cloud services driving the adoption of catalog management systems in France

TABLE 124 FRANCE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 125 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 126 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 127 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 128 REST OF EUROPE: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 37 ASIA PACIFIC: SNAPSHOT

TABLE 132 ASIA PACIFIC: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2016–2020 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Imminent need for standardizing catalogs to boost the growth of the catalog management systems market in China

TABLE 146 CHINA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 147 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 148 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 149 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.5 JAPAN

11.4.5.1 Enterprises’ shift toward digital transformation and focus on customers to drive the adoption of catalog management systems in Japan

TABLE 150 JAPAN: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 151 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 152 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 153 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.6 INDIA

11.4.6.1 High-income economy and rise in technology assimilation to boost the growth of catalog management systems in India

TABLE 154 INDIA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 155 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 156 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 157 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 158 REST OF APAC: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 159 REST OF APAC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 160 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 161 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2016–2020 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 UNITED ARAB EMIRATES

11.5.4.1 Rising focus on saving time and money and providing enhanced customer experiences creating growth opportunities in the catalog management systems market in the UAE

TABLE 176 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 177 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 179 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Increase in purchasing power and influx of cloud services to fuel the growth of the catalog management systems market in South Africa

TABLE 180 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 181 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 182 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 183 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 184 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 185 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 186 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CATALOG MANAGEMENT SYSTEMS MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 188 LATIN AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2016–2020 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

11.6.4.1 Price-conscious consumers to compel organizations to adopt catalog management systems in Brazil

TABLE 202 BRAZIL: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 203 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 204 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 205 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.5 MEXICO

11.6.5.1 Increasing internet penetration to create growth opportunities for catalog management system vendors in Mexico

TABLE 206 MEXICO: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 207 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 208 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 209 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 210 REST OF LATIN AMERICA: CATALOG MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 211 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 212 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 213 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 180)

12.1 INTRODUCTION

12.2 MARKET SHARE OF TOP VENDORS

TABLE 214 CATALOG MANAGEMENT SYSTEMS MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

12.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.3.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CATALOG MANAGEMENT SYSTEM VENDORS

12.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 39 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN THE MARKET, 2016-2020

12.5 COMPANY EVALUATION QUADRANT, 2021

12.5.1 DEFINITIONS AND METHODOLOGY

TABLE 215 COMPANY EVALUATION QUADRANT: CRITERIA

12.5.2 STAR

12.5.3 EMERGING LEADERS

12.5.4 PERVASIVE

12.5.5 PARTICIPANTS

FIGURE 40 CATALOG MANAGEMENT SYSTEMS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 216 COMPANY PRODUCT FOOTPRINT

TABLE 217 COMPANY VERTICAL FOOTPRINT

TABLE 218 COMPANY REGION FOOTPRINT

12.6 SMES/STARTUP EVALUATION QUADRANT

12.6.1 DEFINITIONS AND METHODOLOGY

TABLE 219 SME EVALUATION QUADRANT: CRITERIA

12.6.2 PROGRESSIVE COMPANIES

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

12.6.5 STARTING BLOCKS

FIGURE 41 CATALOG MANAGEMENT SYSTEMS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

12.7 COMPETITIVE SCENARIO

TABLE 220 MARKET: NEW PRODUCT/SERVICE LAUNCHES, MARCH 2019 - JUNE 2020

TABLE 221 MARKET: DEALS, MAY 2018- NOVEMBER 2020

13 COMPANY PROFILES (Page No. - 191)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business overview, Products Offered, Recent developments, COVID-19 strategies, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.2.1 IBM

FIGURE 42 IBM: COMPANY SNAPSHOT

TABLE 222 IBM: BUSINESS OVERVIEW

TABLE 223 IBM: PRODUCTS OFFERED

TABLE 224 IBM: CATALOG MANAGEMENT SYSTEMS MARKET: NEW PRODUCT LAUNCHES

TABLE 225 IBM: MARKET: OTHERS

13.2.2 SAP

FIGURE 43 SAP: COMPANY SNAPSHOT

TABLE 226 SAP: BUSINESS OVERVIEW

TABLE 227 SAP: PRODUCTS OFFERED

TABLE 228 SAP: MARKET: NEW PRODUCT LAUNCHES

13.2.3 ORACLE

FIGURE 44 ORACLE: COMPANY SNAPSHOT

TABLE 229 ORACLE: BUSINESS OVERVIEW

TABLE 230 ORACLE: PRODUCTS OFFERED

TABLE 231 ORACLE: CATALOG MANAGEMENT SYSTEM MARKET: NEW PRODUCT LAUNCHES

13.2.4 SALSIFY

TABLE 232 SALSIFY: BUSINESS OVERVIEW

TABLE 233 SALSIFY: PRODUCTS OFFERED

TABLE 234 SALSIFY: CATALOG MANAGEMENT SYSTEM MARKET: NEW PRODUCT LAUNCHES

TABLE 235 SALSIFY: CATALOG MANAGEMENT SYSTEM MARKET: DEALS

13.2.5 COUPA SOFTWARE

FIGURE 45 COUPA SOFTWARE: COMPANY SNAPSHOT

TABLE 236 COUPA SOFTWARE: BUSINESS OVERVIEW

TABLE 237 COUPA SOFTWARE: PRODUCTS OFFERED

TABLE 238 COUPA SOFTWARE: CATALOG MANAGEMENT SYSTEM MARKET: DEALS

13.2.6 SERVICENOW

FIGURE 46 SERVICENOW: COMPANY SNAPSHOT

TABLE 239 SERVICENOW: BUSINESS OVERVIEW

TABLE 240 SERVICENOW: PRODUCTS OFFERED

TABLE 241 SERVICENOW: CATALOG MANAGEMENT SYSTEMS MARKET: DEALS

13.2.7 PROACTIS

FIGURE 47 PROACTIS: COMPANY SNAPSHOT

TABLE 242 PROACTIS: BUSINESS OVERVIEW

TABLE 243 PROACTIS: PRODUCTS OFFERED

13.2.8 BROADCOM

FIGURE 48 BROADCOM: COMPANY SNAPSHOT

TABLE 244 BROADCOM: BUSINESS OVERVIEW

TABLE 245 BROADCOM: PRODUCTS OFFERED

13.2.9 FUJITSU

FIGURE 49 FUJITSU: COMPANY SNAPSHOT

TABLE 246 FUJITSU: BUSINESS OVERVIEW

TABLE 247 FUJITSU: PRODUCTS OFFERED

13.2.10 COMARCH

FIGURE 50 COMARCH: COMPANY SNAPSHOT

TABLE 248 CORMARCH: BUSINESS OVERVIEW

TABLE 249 COMARCH: PRODUCTS OFFERED

13.3 OTHER VENDORS

13.3.1 ZYCUS

13.3.2 GEP

13.3.3 ERICSSON

13.3.4 AMDOCS

13.3.5 EPISERVER

13.3.6 HANSEN TECHNOLOGIES

13.3.7 VINCULUM

13.3.8 CLARITUM

13.3.9 EJEEVA

13.3.10 SUNTEC

13.4 STARTUP / SME PLAYERS

13.4.1 PLYTIX

13.4.2 MIRAKL

13.4.3 SELLERCLOUD

13.4.4 VROOZI

13.4.5 CATBASE

13.4.6 AKENEO

13.4.7 NCHANNEL

13.4.8 CATALOG BAR

13.4.9 CONTALOG

13.4.10 SALES LAYER

*Details on Business overview, Products Offered, Recent developments, COVID-19 strategies, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 230)

14.1 INTRODUCTION

14.1.1 RELATED MARKETS

14.1.2 LIMITATIONS

14.2 PRODUCT INFORMATION MANAGEMENT MARKET

TABLE 250 PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 251 PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 252 BANKING, FINANCIAL SERVICES, AND INSURANCE: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 253 BANKING, FINANCIAL SERVICES, AND INSURANCE: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 254 CONSUMER GOODS AND RETAIL: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 255 CONSUMER GOODS AND RETAIL: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 256 MANUFACTURING: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 257 MANUFACTURING: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 258 IT AND TELECOM: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 259 IT AND TELECOM: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 260 MEDIA AND ENTERTAINMENT: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 261 MEDIA AND ENTERTAINMENT: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 262 HEALTHCARE AND LIFE SCIENCES: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 263 HEALTHCARE AND LIFE SCIENCES: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 264 TRANSPORTATION AND LOGISTICS: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 265 TRANSPORTATION AND LOGISTICS: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 266 OTHER VERTICALS: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 267 OTHER VERTICALS: PRODUCT INFORMATION MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.3 MASTER DATA MANAGEMENT MARKET

TABLE 268 MASTER DATA MANAGEMENT MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 269 MASTER DATA MANAGEMENT MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 270 BANKING, FINANCIAL SERVICES, AND INSURANCE: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 271 BANKING, FINANCIAL SERVICES, AND INSURANCE: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 272 GOVERNMENT: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 273 GOVERNMENT: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 274 RETAIL: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 275 RETAIL: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 276 IT AND TELECOM: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 277 IT AND TELECOM: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 278 ENERGY AND UTILITY: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 279 ENERGY AND UTILITY: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 280 HEALTHCARE AND LIFE SCIENCES:: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 281 HEALTHCARE AND LIFE SCIENCES: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 282 OTHERS: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 283 OTHERS: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 243)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

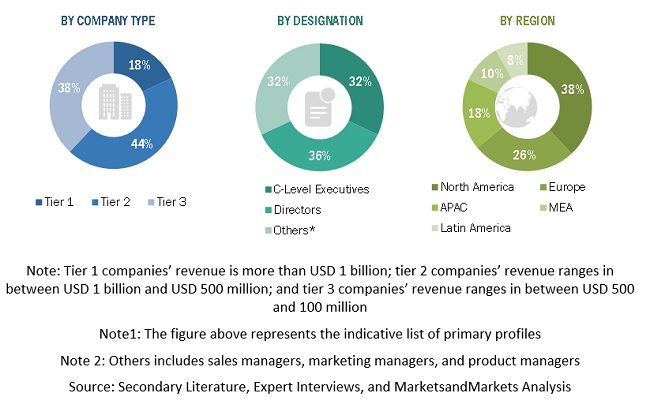

The study involved four major activities in estimating the current size of the global Catalog management systems market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total catalog management systems market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the catalog management systems market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the catalog management systems market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global catalog management systems market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the catalog management systems market based on type, components, verticals, organization size, deployment types, and regions.

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the impact of COVID-19 on type, components, verticals, organization size, deployment types, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the catalog management systems market

- To profile key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Catalog Management Systems Market