Multichannel Order Management Market by Component (Software & Services), Deployment Mode, Application, Organization Size, Vertical (Retail, e-commerce, and Wholesale, Manufacturing, and Transportation & Logistics) and Region - Global Forecast to 2027

Multichannel Order Management Market Share, Forecast & Growth Analysis

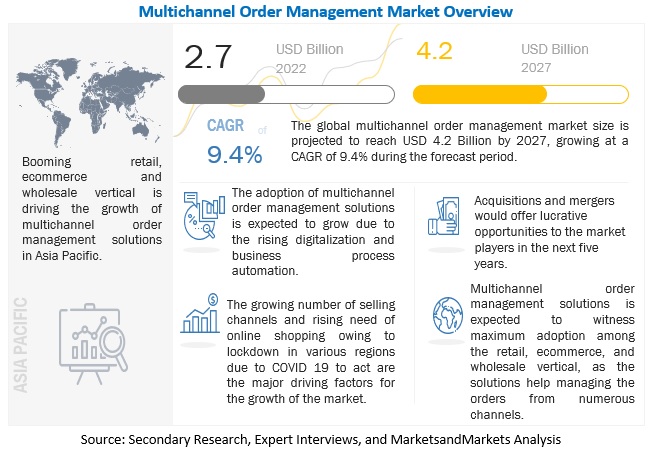

The global Multichannel Order Management Market size in terms of revenue was reasonably estimated at $2.7 billion in 2022 and is poised to expand at an faster Compound Annual Growth Rate (CAGR) of 9.4% to reach over $4.2 billion by the end of 2027. The base year considered for estimation is 2021 and the historical data spans in between 2022 to 2027.

The multichannel order management software offers real-time visibility into the whole order life cycle and prevent orders from being lost, delayed, or corrupted throughout the fulfilment process. The multichannel order management software organizes data dynamically, which increases order fulfilment efficiency, decreases delays, enhance tracking, and makes it simple to access all order information.

To know about the assumptions considered for the study, Request for Free Sample Report

Multichannel Order Management Market Growth Dynamics

Driver: Growth in multichannel selling

Businesses are changing as a result of customer preferences, technological developments, and competition. Retailers, wholesalers, fashion brands, food & beverage companies, and health & wellness providers have been forced to become more responsive and integrate robust customer experience management tools in their business systems due to the unpredictable nature of customers and the market as well. Customers are more willing to use online channels globally as a result of the development of digital technologies, the internet ecosystem, the widespread use of smartphones & social media, and next-generation networks. In order to attract more customers and increase income, businesses are quickly expanding their sales channels, including websites, social media, commerce, marketplaces, and offline storefronts. Therefore, in order to manage, centralize, and streamline orders, organizations require a reliable and customized order management solution.

Restraint: Businesses require stronger confidentiality and data safety

Protecting the security and confidentiality of corporate data is a major consideration when introducing new technology. As loT and cloud technology proliferate quickly, businesses will seek enhanced confidentiality and safety to protect against cyberattacks and security issues. The issue of information security and privacy is becoming more severe as cloud-based and loT-enabled services are used more frequently. As more loT-enabled gadgets enter the market and become increasingly vulnerable to hazards and attacks, security and confidentiality concerns are predicted to rise. Furthermore, retrieving company data can be made easier via handheld devices. Therefore, for the proper implementation of digital advance technology, appropriate information security protections are needed.

Opportunity: Organization’s willingness to use advanced technologies

Due to considerable technical breakthroughs and a constantly shifting legal environment, businesses and governmental institutions are entering a new phase of consumer engagement where emergent revolutions are playing a big role. Businesses employ cutting-edge technologies such as big data, cloud computing, and others to emulate organisational growth. Due to advance technologies the modern business strategies have changed from the previous business model approach. Utilizing cutting-edge technology opens up a number of possibilities and equips companies to implement customer-focused marketing tactics. Due to this, demand for multichannel order management solutions has surged across numerous business sectors.

Challenge: Data gaps and inconsistencies

Because of the increased competition, ecommerce's capacity to plan and complete orders efficiently is becoming more crucial. At this moment, order management systems are essential for delivering top-notch customer service in e-commerce. A capable e-commerce order management system enables effective stock management, which indirectly reducing the liability of cancellations and returns. When an e-commerce company grows and serves numerous markets through various channels, millions of interactions become subject to data gaps and discrepancies. Due to human error and flawed logic, even the best order management software for online stores may not perform at its best. Data gaps could lead to order cancellations, poor order fulfilment, and a worse customer experience.

The order fulfillment segment is expected to register the largest market share during the forecast period

Technology for order fulfilment automates the labor-intensive processes of order picking order processing, and shipping. In today's online culture, the customers want their providers to fulfil their orders quickly and precisely. A multichannel order management system may automate order fulfilment depending on a company's operations. Among the applications, the order fulfillment segment is anticipated to register the largest markets during the forecast period.

The retail, e-commerce and wholesale segment to account for the largest market size during the forecast period

The retail vertical is expanding as a result of the increasing use of ML, loT, and cognitive computing. To improve customer experiences, retailers and eCommerce businesses must manage their customer data. In order to increase customer happiness, retailers are now focused on developing a 360-degree view of their customers. By providing order management software and services that meet the demands of businesses in the retail, eCommerce, and wholesale industry verticals, multichannel order management software vendors and service providers are increasingly playing a crucial role. The retail, ecommerce and wholesale is expected to register the largest market share during the forecast period.

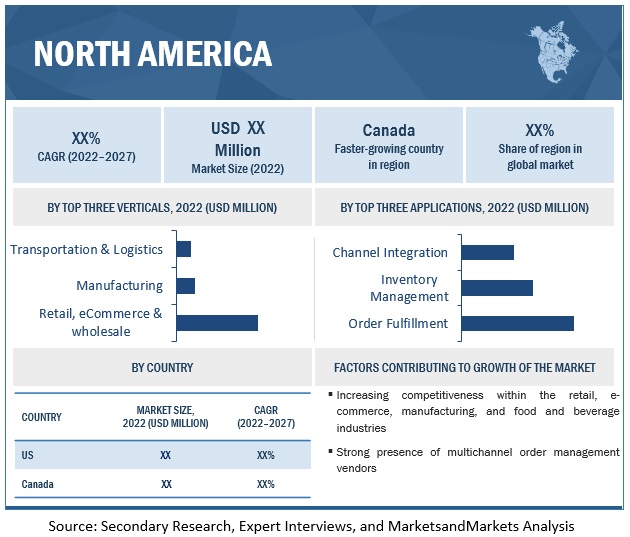

North America to account for the largest market size during the forecast period

North America is expected to register the largest market share during the forecast period. The multichannel order management market in North America is established and mature, with a good appetite for risk and an inclination for technical advancements. It presents many opportunities for multichannel order management vendors and service providers. The majority of multichannel order management vendors are well-represented in this region. Through acquisitions, agreements, and collaborations with system integrators, distributors, and resellers, these vendors are increasing their market share across region. The multichannel order management market is anticipated to offer substantial growth potential for vendors operating in the region due to huge investment in the retail, eCommerce, and manufacturing industries for adopting cutting-edge technologies.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The bot service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the multichannel order management market include IBM (US), Oracle (US), SAP (Germany), Salesforce (US), HCL Technologies (India), Zoho (India), Brightpearl (US), Square (US), Selro (England), Linnworks (England), Vinculum (India), Freestyle Solutions (US), Aptean (US), Etail Solutions (US), SellerActive (US), Delhivery (India), Cloud Commerce Pro (England), QuickBooks Commerce (India), Unicommerce (India), SalesWarp (US), Contalog (India), Browntape (India), Appian(US).

Scope of the Report

|

Report Metrics |

Details |

|

Market Size in 2022 |

$2.7 billion |

|

Revenue Forecast Size in 2027 |

$4.2 billion |

|

Growth Rate |

CAGR of 9.4% 2022 to 2027 |

|

Key Market Growth Drivers |

Growth in multichannel selling |

|

Key Market Opportunities |

Organization’s willingness to use advanced technologies |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Million/Billion) |

|

Segments covered |

Component, Application, Organization Size, Deployment Mode, Verticals, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), SAP (Germany), Salesforce (US), HCL Technologies (India), Zoho (India), Brightpearl (US), Square (US), Selro (England), Linnworks (England), Vinculum (India), Freestyle Solutions (US), Aptean (US), Etail Solutions (US), SellerActive (US), Delhivery (India), Cloud Commerce Pro (England), QuickBooks Commerce (India), Unicommerce (India), SalesWarp (US), Contalog (India), Browntape (India), Appian (US), Multiorders (England), ManageEcom (India), Appian(US), Evanik (India), GeekSeller (US), SkuSuite (US), Newfold Digital (US), and EMERGE App (Singapore). |

This research report categorizes the Multichannel Order Management Market based on component, type, infrastructure type, deployment type, organization size, vertical, and region.

By Component

- Software

- Services

By Application:

- Order Fulfillment

- Inventory Management

- Channel Integration

- Workflow Automation

- Integrated POS

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- On-premises

- Cloud

By Verticals:

- Retail, eCommerce, and Wholesale

- Manufacturing

- Transportation & Logistics

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2022, Oracle collaborated with Big Ray’s which is a multi-channel business that is well ingrained in its community. Big Ray's would be able to handle its financial operations, inventory and order management, point-of-sale operations, and e-commerce operations on a single platform due to Oracle NetSuite. It also enables Big Ray’s to strengthen business insights, agility, and the customer experience by integrating all of its essential functions.

- In September 2021, Salesforce announced a partnership with FedEx, which incorporates Salesforce Commerce Cloud and Salesforce Order Management with cutting-edge capabilities of FedEx and ShopRunner, its e-commerce platform and subsidiary.

- In June 2021, IBM collaborated with Pandora, with an intent to transform and scale Pandora's omnichannel e-commerce capabilities with IBM Sterling Order Management. It enables Pandora to increase its supply chain resiliency and business agility, and better mitigate disruptions and risks.

- In February 2021, SAP collaborated with Sundiro Honda and Virgin Megastore to deliver an exceptional shopping experience. Sundiro Honda and Virgin Megastore have selected the SAP Commerce Cloud solution to offer their clients a top-notch e-commerce experience.

- In November 2020, SAP announced the acquisition of a leading omnichannel customer engagement platform provider called Emarsys. Adding Emarsys to the SAP Customer Experience portfolio revolutionizes how digital commerce is managed by delivering hyper-personalized, multichannel interactions in real-time and assisting enterprises in ensuring every interaction is meaningful and relevant.

Frequently Asked Questions (FAQ):

What does Multichannel Order Management mean?

What is the projected market value of the Multichannel Order Management Market?

What is the estimated growth rate (CAGR) of the global Multichannel Order Management Market for the next five years?

What are the major revenue pockets in the Multichannel Order Management Market currently?

Which are the Leading vendors in the Telecom Cloud Market?

Which are the key growth drivers for Multichannel Order Management Market?

What are opportunities in the Multichannel Order Management Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE, 2019–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 MULTICHANNEL ORDER MANAGEMENT: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MULTICHANNEL ORDER MANAGEMENT: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF MULTICHANNEL ORDER MANAGEMENT

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MULTICHANNEL ORDER MANAGEMENT

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MULTICHANNEL ORDER MANAGEMENT

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF MULTICHANNEL ORDER MANAGEMENT THROUGH OVERALL MULTICHANNEL ORDER MANAGEMENT SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 4 GLOBAL MULTICHANNEL ORDER MANAGEMENT MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 10 SOFTWARE SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 11 PROFESSIONAL SERVICES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 12 ORDER FULFILMENT SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 13 CLOUD SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 14 LARGE ENTERPRISES SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 15 RETAIL, ECOMMERCE, AND WHOLESALE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 16 FOOD & BEVERAGES SEGMENT EXPECTED TO DOMINATE RETAIL, ECOMMERCE, AND WHOLESALE MARKET IN 2022

FIGURE 17 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MULTICHANNEL ORDER MANAGEMENT MARKET

FIGURE 18 GROWING DIGITALIZATION AND SELLING PLATFORMS TO BOOST MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 19 RETAIL, ECOMMERCE, AND WHOLESALE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 20 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.4 MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 21 SOFTWARE AND CLOUD SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MULTICHANNEL ORDER MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Booming retail and eCommerce vertical

5.2.1.2 Growth in multichannel selling

5.2.1.3 Low initial and operational costs

5.2.1.4 Growing number of internet users

5.2.2 RESTRAINTS

5.2.2.1 Data breaches over internet

5.2.2.2 Requirement for stronger confidentiality and data safety

5.2.3 OPPORTUNITIES

5.2.3.1 Potential for online sales

5.2.3.2 Increasing adoption by SMEs

5.2.3.3 Technological advancements

5.2.3.4 Organizations’ willingness to use advanced technologies

5.2.4 CHALLENGES

5.2.4.1 Lack of technical expertise

5.2.4.2 Issues related to IT modernization

5.2.4.3 Data gaps and inconsistencies

5.3 EVOLUTION

FIGURE 23 EVOLUTION OF MULTICHANNEL ORDER MANAGEMENT

5.4 MULTICHANNEL ORDER MANAGEMENT MARKET: ECOSYSTEM

FIGURE 24 ECOSYSTEM OF MULTICHANNEL ORDER MANAGEMENT

TABLE 6 MARKET: ECOSYSTEM

5.5 CASE STUDY ANALYSIS

5.5.1 RETAIL, ECOMMERCE, AND WHOLESALE

5.5.1.1 Food & Beverages

5.5.1.1.1 Use Case 1: Graeter’s Ice Cream automates 100% of orders with custom functionality backed by SkuNexus

5.5.1.1.2 Use Case 2: Square helps Boston Beer launch and increase sales of its new brands online

5.5.1.2 Health & Wellness

5.5.1.2.1 Use Case 1: Orderhive has been a turning point for Wholesome Goods

5.5.1.3 White Goods

5.5.1.3.1 Use Case 1: Shopify makes it simpler for small enterprises to set up stores online

5.5.1.4 Automotive

5.5.1.4.1 Use Case 1: Increasing sales and event registrations using personalized, multichannel automotive marketing campaigns

5.5.1.5 Apparel

5.5.1.5.1 Use Case 1: TCNS Clothing Co. Ltd. achieves 9x growth in sales using Unicommerce

5.5.2 MANUFACTURING

5.5.2.1 Use Case 1: Brightpearl takes the weight off Strength Shop with advanced automation and turbocharged order processing

5.5.3 TRANSPORTATION & LOGISTICS

5.5.3.1 Use Case 1: Reynolds Towing uses mobile payments to help 30% more customers a day

5.5.3.2 Use case 2: Software interface made it easier for clients to use the Hubbed service

5.6 TECHNOLOGY ANALYSIS

5.6.1 MULTICHANNEL ORDER MANAGEMENT AND BIG DATA ANALYTICS

5.6.2 MULTICHANNEL ORDER MANAGEMENT, ARTIFICIAL INTELLIGENCE (AI), AND MACHINE LEARNING (ML)

5.6.3 MULTICHANNEL ORDER MANAGEMENT AND CLOUD COMPUTING

5.6.4 MULTICHANNEL ORDER MANAGEMENT AND BLOCKCHAIN

5.6.5 MULTICHANNEL ORDER MANAGEMENT AND INTERNET OF THINGS (IOT)

5.7 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 25 SUPPLY/VALUE CHAIN ANALYSIS

5.8 REVENUE SHIFT – YC/YCC SHIFT FOR MULTICHANNEL ORDER MANAGEMENT MARKET

FIGURE 26 MARKET: YC/YCC SHIFT

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 MULTICHANNEL ORDER MANAGEMENT: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 PRICING MODEL ANALYSIS

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2018–2021

5.11.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 28 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.11.3.1 Top applicants

FIGURE 29 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 9 TOP TEN PATENT OWNERS (US) IN MULTICHANNEL ORDER MANAGEMENT MARKET, 2018–2021

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 NORTH AMERICA: REGULATIONS

5.13.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

5.13.2.2 Gramm-Leach-Bliley (GLB) Act

5.13.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

5.13.2.4 Federal Information Security Management Act (FISMA)

5.13.2.5 Federal Information Processing Standards (FIPS)

5.13.2.6 California Consumer Privacy Act (CCPA)

5.13.3 EUROPE: TARIFFS AND REGULATIONS

5.13.3.1 GDPR 2016/679 regulation in EU

5.13.3.2 General Data Protection Regulation

5.13.3.3 European Committee for Standardization (CEN)

5.13.3.4 European Technical Standards Institute (ETSI)

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.14.2 BUYING CRITERIA

TABLE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT (Page No. - 86)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 30 SERVICES SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOFTWARE

6.2.1 GROWING NEED TO PROVIDE BETTER CUSTOMER EXPERIENCE AND GAIN SUPPLY CHAIN VISIBILITY

TABLE 20 SOFTWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 31 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 SERVICES: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 23 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 32 CONSULTING SEGMENT EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 27 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 28 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Consulting

6.3.1.1.1 Enables companies to lower risk, reduce complexity, and increase RoI

TABLE 30 CONSULTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Support and Maintenance

6.3.1.2.1 Need to manage order fulfillment process

TABLE 32 SUPPORT AND MAINTENANCE: MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.3 Integration and deployment

6.3.1.3.1 Ensure minimum risk and offer cost optimization

TABLE 34 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Growing concern to manage workflow management process

TABLE 36 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MULTICHANNEL ORDER MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 99)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 33 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 39 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 INCREASING CONCERNS ABOUT OPERATORS MANAGING MULTIPLE ORDERS FROM SALES CHANNELS

TABLE 40 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 PROBLEMS WITH DELIVERY OF MULTICHANNEL CUSTOMER EXPERIENCE

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MULTICHANNEL ORDER MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 104)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 34 CLOUD SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 44 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 45 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 ON-PREMISES

8.2.1 NEED TO ENHANCE CONTROL OVER SUPPLY CHAIN ACCESSIBILITY

TABLE 46 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CLOUD

8.3.1 COST-EFFECTIVENESS, EASE OF ACCESS, AND SCALABILITY TO BOOST ADOPTION OF CLOUD

TABLE 48 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MULTICHANNEL ORDER MANAGEMENT MARKET, BY APPLICATION (Page No. - 110)

9.1 INTRODUCTION

9.1.1 APPLICATION: MARKET DRIVERS

FIGURE 35 ORDER FULFILMENT SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 50 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 51 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 ORDER FULFILLMENT

9.2.1 DOCUMENTING

9.2.2 BULK PRINTING

TABLE 52 ORDER FULFILLMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 ORDER FULFILLMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 INVENTORY MANAGEMENT

9.3.1 SALES FORECASTING

9.3.2 INVENTORY ANALYSIS

9.3.3 BARCODE SCANNING

TABLE 54 INVENTORY MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 INVENTORY MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CHANNEL INTEGRATION

9.4.1 NETWORK INVENTORY OPTIMIZATION

9.4.2 SALES CHANNEL OPTIMIZATION

9.4.3 CENTRALIZED DATA REPOSITORY

TABLE 56 CHANNEL INTEGRATION: MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 CHANNEL INTEGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 WORKFLOW AUTOMATION

9.5.1 ORDER ROUTING OPTIMIZATION

9.5.2 AUTOMATIC INVOICING

TABLE 58 WORKFLOW AUTOMATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 WORKFLOW AUTOMATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 INTEGRATED POS

9.6.1 CASH MANAGEMENT

9.6.2 ADVANCE PRODUCT SEARCH FILTERS

9.6.3 PAYMENT INTEGRATION

TABLE 60 INTEGRATED POS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 INTEGRATED POS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHER APPLICATIONS

TABLE 62 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MULTICHANNEL ORDER MANAGEMENT MARKET, BY VERTICAL (Page No. - 121)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 MULTICHANNEL ORDER MANAGEMENT: ENTERPRISE USE CASES

FIGURE 36 RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 64 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 65 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 RETAIL, ECOMMERCE, AND WHOLESALE

TABLE 66 RETAIL, ECOMMERCE, AND WHOLESALE: USE CASES

TABLE 67 RETAIL, ECOMMERCE, AND WHOLESALE: MARKET, BY MODE OF BUSINESS, 2016–2021 (USD MILLION)

TABLE 68 RETAIL, ECOMMERCE, AND WHOLESALE: MARKET, BY MODE OF BUSINESS, 2022–2027 (USD MILLION)

TABLE 69 RETAIL, ECOMMERCE, AND WHOLESALE: MARKET, BY PRODUCT TYPE, 2016–2021 (USD MILLION)

TABLE 70 RETAIL, ECOMMERCE, AND WHOLESALE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 71 RETAIL, ECOMMERCE, AND WHOLESALE: MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 RETAIL, ECOMMERCE, AND WHOLESALE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.1 MODE OF BUSINESS

10.2.1.1 Online

10.2.1.2 Offline

10.2.2 PRODUCT TYPE

10.2.2.1 Health & wellness

10.2.2.1.1 Integrated order and inventory management to facilitate better health and wellness services for consumers

TABLE 73 HEALTH & WELLNESS: USE CASES

TABLE 74 HEALTH & WELLNESS: MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 HEALTH & WELLNESS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2.2 Food & beverages

10.2.2.2.1 Growing need for real-time visibility into order status and delivery of foods items

TABLE 76 FOOD & BEVERAGES: USE CASES

TABLE 77 FOOD & BEVERAGES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2.3 White goods

10.2.2.3.1 Growing urbanization in retail industry to drive demand for white goods

TABLE 79 WHITE GOODS: USE CASES

TABLE 80 WHITE GOODS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 WHITE GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2.4 Automotive

10.2.2.4.1 Need to understand customers and improve performance

TABLE 82 AUTOMOTIVE: USE CASES

TABLE 83 AUTOMOTIVE: MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 84 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2.5 Other product types

TABLE 85 OTHER PRODUCT TYPES: USE CASES

TABLE 86 OTHER PRODUCT TYPES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 87 OTHER PRODUCT TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 MANUFACTURING

10.3.1 GROWING NEED TO IMPROVE PRODUCTIVITY AND PROVIDE EFFECTIVE CUSTOMER SERVICE

TABLE 88 MANUFACTURING: USE CASES

TABLE 89 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TRANSPORTATION & LOGISTICS

10.4.1 MULTICHANNEL LOGISTICS HELP ORGANIZATIONS OPERATE AT LOWER RISK DURING UNANTICIPATED SUPPLY CHAIN DELAYS

TABLE 91 TRANSPORTATION & LOGISTICS: USE CASES

TABLE 92 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 93 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MULTICHANNEL ORDER MANAGEMENT MARKET, BY REGION (Page No. - 138)

11.1 INTRODUCTION

FIGURE 37 INDIA EXPECTED TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38 ASIA PACIFIC EXPECTED TO ATTAIN HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 94 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 96 NORTH AMERICA: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2016–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Presence of global players and high adoption of technologies

TABLE 114 US: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 115 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 116 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 117 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Rapid technological advancements in business verticals to enhance productivity and customer satisfaction

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

TABLE 118 EUROPE: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 132 EUROPE: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2016–2021 (USD MILLION)

TABLE 133 EUROPE: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Growing need to analyze high-volume information across several verticals

TABLE 136 UK: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 137 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 138 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 139 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Increased adoption of multichannel order management solutions

TABLE 140 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 141 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 143 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Rapid adoption of multichannel order management solutions to address need for rising digital savvy consumer base

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MULTICHANNEL ORDER MANAGEMENT MARKET DRIVERS

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 144 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2016–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Growing investments in multichannel order management market to enhance business operations

TABLE 162 CHINA: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 163 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 165 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Changing business landscape and need to deliver enhanced experience to customers

TABLE 166 JAPAN: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 167 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 169 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Rapid adoption of modern technologies and government initiatives

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MULTICHANNEL ORDER MANAGEMENT MARKET DRIVERS

TABLE 170 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2016–2021 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Growing focus on customer engagement and investments

11.5.3 AFRICA

11.5.3.1 Growing industrial and retail sector to create growth opportunities for multichannel order management

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MULTICHANNEL ORDER MANAGEMENT DRIVERS

TABLE 188 LATIN AMERICA: MULTICHANNEL ORDER MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2016–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET FOR RETAIL, ECOMMERCE, AND WHOLESALE VERTICAL, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Enhanced customer experience and offering by retailers due to rising eCommerce industry

11.6.3 MEXICO

11.6.3.1 Growing trade and customer base and rising demand for multichannel order management

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 183)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 206 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MULTICHANNEL ORDER MANAGEMENT MARKET

12.3 REVENUE ANALYSIS

FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES, 2018-2021

12.4 MARKET SHARE ANALYSIS

FIGURE 42 MARKET SHARE ANALYSIS FOR KEY PLAYERS IN 2022

TABLE 207 MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 43 KEY MULTICHANNEL ORDER MANAGEMENT MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

12.6 STARTUP/SME EVALUATION MATRIX

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 44 MARKET EVALUATION MATRIX FOR STARTUPS/SMES, 2022

12.7 COMPETITIVE BENCHMARKING

TABLE 208 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 209 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 210 PRODUCT LAUNCHES, 2018–2022

12.8.2 DEALS

TABLE 211 DEALS, 2018–2022

12.8.3 OTHERS

TABLE 212 OTHERS, 2018–2022

13 COMPANY PROFILES (Page No. - 196)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business Overview, Products, Solutions & Services offered, Recent Developments, MnM View)*

13.2.1 IBM

TABLE 213 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 214 IBM: PRODUCTS OFFERED

TABLE 215 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 216 IBM: DEALS

13.2.2 SAP

TABLE 217 SAP: BUSINESS OVERVIEW

FIGURE 46 SAP: COMPANY SNAPSHOT

TABLE 218 SAP: PRODUCTS OFFERED

TABLE 219 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 220 SAP: DEALS

TABLE 221 SAP: OTHERS

13.2.3 ORACLE

TABLE 222 ORACLE: BUSINESS OVERVIEW

FIGURE 47 ORACLE: COMPANY SNAPSHOT

TABLE 223 ORACLE: PRODUCTS OFFERED

TABLE 224 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 225 ORACLE: DEALS

13.2.4 SALESFORCE

TABLE 226 SALESFORCE: BUSINESS OVERVIEW

FIGURE 48 SALESFORCE: COMPANY SNAPSHOT

TABLE 227 SALESFORCE: PRODUCTS OFFERED

TABLE 228 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 229 SALESFORCE: DEALS

TABLE 230 SALESFORCE: OTHERS

13.2.5 HCL TECHNOLOGIES

TABLE 231 HCL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 HCL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 232 HCL TECHNOLOGIES: PRODUCTS OFFERED

TABLE 233 HCL TECHNOLOGIES: DEALS

13.2.6 ZOHO

TABLE 234 ZOHO: BUSINESS OVERVIEW

TABLE 235 ZOHO: SOLUTIONS OFFERED

TABLE 236 ZOHO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 ZOHO: DEALS

TABLE 238 ZOHO: OTHERS

13.2.7 BRIGHTPEARL

TABLE 239 BRIGHTPEARL: BUSINESS OVERVIEW

TABLE 240 BRIGHTPEARL: PRODUCTS OFFERED

TABLE 241 BRIGHTPEARL: DEALS

TABLE 242 BRIGHTPEARL: OTHERS

13.2.8 SQUARE

TABLE 243 SQUARE: BUSINESS OVERVIEW

TABLE 244 SQUARE: PRODUCTS OFFERED

TABLE 245 SQUARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 246 SQUARE: DEALS

TABLE 247 SQUARE: OTHERS

13.2.9 SELRO

TABLE 248 SELRO: BUSINESS OVERVIEW

TABLE 249 SELRO: PRODUCTS OFFERED

TABLE 250 SELRO: DEALS

13.2.10 LINNWORKS

TABLE 251 LINNWORKS: BUSINESS OVERVIEW

TABLE 252 LINNWORKS: PRODUCTS OFFERED

TABLE 253 LINNWORKS: DEALS

TABLE 254 LINNWORKS: OTHERS

13.2.11 VINCULUM

TABLE 255 VINCULUM: BUSINESS OVERVIEW

TABLE 256 VINCULUM: PRODUCTS OFFERED

TABLE 257 VINCULUM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 258 VINCULUM: DEALS

13.2.12 FREESTYLE SOLUTIONS

TABLE 259 FREESTYLE SOLUTIONS: BUSINESS OVERVIEW

TABLE 260 FREESTYLE SOLUTIONS: PRODUCTS OFFERED

TABLE 261 FREESTYLE SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 262 FREESTYLE SOLUTIONS: DEALS

13.2.13 APTEAN

TABLE 263 APTEAN: BUSINESS OVERVIEW

TABLE 264 APTEAN: PRODUCTS OFFERED

TABLE 265 APTEAN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 266 APTEAN: DEALS

TABLE 267 APTEAN: OTHERS

13.2.14 ETAIL SOLUTIONS

TABLE 268 ETAIL SOLUTIONS: BUSINESS OVERVIEW

TABLE 269 ETAIL SOLUTIONS: PRODUCTS OFFERED

TABLE 270 ETAIL SOLUTIONS: DEALS

13.2.15 SELLERACTIVE

TABLE 271 SELLERACTIVE: BUSINESS OVERVIEW

TABLE 272 SELLERACTIVE: PRODUCTS OFFERED

TABLE 273 SELLERACTIVE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 274 SELLERACTIVE: DEALS

13.2.16 DELHIVERY

TABLE 275 DELHIVERY: BUSINESS OVERVIEW

TABLE 276 DELHIVERY: PRODUCTS OFFERED

TABLE 277 DELHIVERY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 278 DELHIVERY: DEALS

TABLE 279 DELHIVERY: OTHERS

13.2.17 CLOUD COMMERCE PRO

TABLE 280 CLOUD COMMERCE PRO: BUSINESS OVERVIEW

TABLE 281 CLOUD COMMERCE PRO: PRODUCTS OFFERED

TABLE 282 CLOUD COMMERCE PRO: DEALS

13.2.18 QUICKBOOKS COMMERCE

13.2.19 UNICOMMERCE

13.2.20 SALESWARP

13.2.21 CONTALOG

13.2.22 BROWNTAPE

13.2.23 APPIAN

13.3 STARTUP/SME PROFILES

13.3.1 MULTIORDERS

13.3.2 MANAGEECOM

13.3.3 EVANIK

13.3.4 GEEKSELLER

13.3.5 SKUSUITE

13.3.6 SKUNEXUS

13.3.7 NEWFOLD DIGITAL

13.3.8 EMERGE APP

*Details on Business Overview, Products, Solutions & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 263)

14.1 INTRODUCTION

14.2 SUPPLY CHAIN MANAGEMENT MARKET - GLOBAL FORECAST TO 2027

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.3 SUPPLY CHAIN MANAGEMENT MARKET, BY COMPONENT

TABLE 283 SUPPLY CHAIN MANAGEMENT MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 284 SUPPLY CHAIN MANAGEMENT MARKET, BY COMPONENT, 2019–2027 (USD MILLION)

14.2.4 SUPPLY CHAIN MANAGEMENT MARKET, BY DEPLOYMENT MODEL

TABLE 285 SUPPLY CHAIN MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 286 SUPPLY CHAIN MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019–2027 (USD MILLION)

14.2.5 SUPPLY CHAIN MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 287 SUPPLY CHAIN MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 288 SUPPLY CHAIN MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

14.2.6 SUPPLY CHAIN MANAGEMENT MARKET, BY VERTICAL

TABLE 289 SUPPLY CHAIN MANAGEMENT MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 290 SUPPLY CHAIN MANAGEMENT MARKET, BY VERTICAL, 2019–2027 (USD MILLION)

14.2.7 SUPPLY CHAIN MANAGEMENT MARKET, BY REGION

TABLE 291 SUPPLY CHAIN MANAGEMENT MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 292 SUPPLY CHAIN MANAGEMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

14.3 SMART WAREHOUSING MARKET - GLOBAL FORECAST TO 2026

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 293 GLOBAL SMART WAREHOUSING MARKET AND GROWTH RATE, 2017–2020 (USD MILLION, Y-O-Y %)

TABLE 294 GLOBAL SMART WAREHOUSING MARKET AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y %)

14.3.3 SMART WAREHOUSING MARKET, BY COMPONENT

TABLE 295 SMART WAREHOUSING MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 296 SMART WAREHOUSING MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

14.3.4 SMART WAREHOUSING MARKET, BY ORGANIZATION SIZE

TABLE 297 SMART WAREHOUSING MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 298 SMART WAREHOUSING MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

14.3.5 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE

TABLE 299 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 300 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

14.3.6 SMART WAREHOUSING MARKET, BY APPLICATION

TABLE 301 SMART WAREHOUSING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 302 SMART WAREHOUSING MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

14.3.7 SMART WAREHOUSING MARKET, BY VERTICAL

TABLE 303 SMART WAREHOUSING MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 304 SMART WAREHOUSING MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

14.3.8 SMART WAREHOUSING MARKET, BY REGION

TABLE 305 SMART WAREHOUSING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 306 SMART WAREHOUSING MARKET, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 274)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

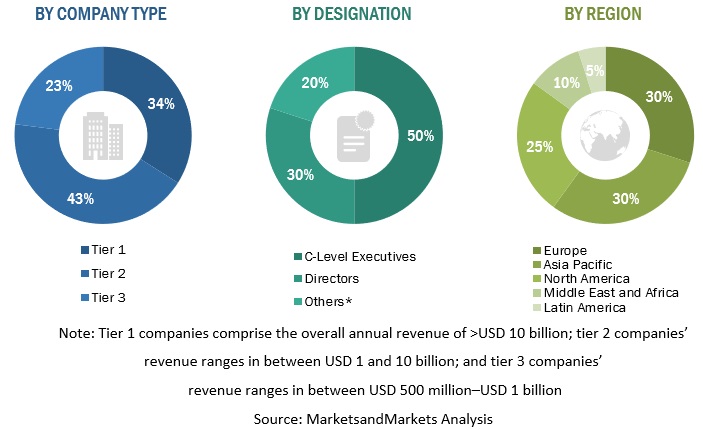

The research study for multichannel order management involved the use of extensive secondary sources, directories, and several journals, including best practices in strategic multichannel fulfillment; Journal of Multichannel Order Management Research; and A Brief History of Multichannel Order Management - SAGE Journals and publications, such as adapting warehouse operations and design to omnichannel logistics: A literature review and research agenda, Annals of Mathematics and Multichannel Order Management. 0.778 Impact Factor 2019, and International Journal of Information Systems and Supply Chain Management (IJISSCM), to identify and collect information useful for this comprehensive market research study. Primary sources included industry experts from the core and related industries, preferred multichannel order management providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering multichannel order management solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as Omni-channel management in the new retailing era: A systematic review and future research agenda Journals and magazines, Journal/Forums for Machine Learning (ML), AI India magazine, Customer Experience magazine, and other magazines. The multichannel order management spending of various countries was extracted from respective sources. Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players; industry trends related to solutions, services, deployment modes, applications, verticals, and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, product development/innovation teams; related key executives from multichannel order management solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using multichannel order management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of multichannel order management solutions and services, which would impact the overall multichannel order management.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the Multichannel Order Management market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage share, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the Multichannel Order Management market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on multichannel order management based on some of the key use cases. These factors for the multichannel order management industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the multichannel order management by component (software and services), application, deployment mode, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the market growth.

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the multichannel order management.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Multichannel Order Management market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle Eastern and African market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multichannel Order Management Market