Cell Culture Media Market by Type (Serum-free (CHO, BHK, Vero Cell), Stem Cell, Chemically Defined, Classical, Specialty), Application (Biopharmaceutical (mAbs, Vaccine), Diagnostics, Tissue Engineering), End User (Pharma, Biotech) & Region - Global Forecast to 2028

Updated on : Aug 22, 2024

Attractive Opportunities in the Cell Culture Media Market

To know about the assumptions considered for the study, Request for Free Sample Report

Cell Culture Media Market Dynamics

DRIVER: Increasing demand for serum and animal component-free media

Fetal bovine serum (FBS) is the most widely used and preferred media supplement for cells culture. FBS contains several growth factors and hormones that can help for cell growth, but there are several disadvantages of using FBS such as batch-to-batch variability in serum composition, limited availability, impact on performance and safety of a cell product, potential pathogen transmission and animal welfare considerations. This has driven the shift towards the development and adoption of serum-free cell culture processes.

Some of the advantages of using serum- and animal component-free media includes reduced batch-to-batch variability, precise evaluations of cellular function, increased growth and/or productivity, elimination of potential viral contaminants, simplified purification and downstream processing, consistency in performance. Moreover, serum-free medium is more chemically defined and includes a limited number of traceable constituents, resulting in regulatory benefits and faster time-to-market. Owing to such advantages the demand for serum- and animal component-free media has significantly increased for recombinant proteins and regenerative medicine development. Many companies Thermo Fisher Scientific (US), Merck KGaA (Germany), HiMedia Laboratories (India), STEMCELL Technologies Inc. (Canada) have already ventured into the development of serum-free media. Thus, shift towards the development and adoption of serum- and animal component-free media support the market growth.

RESTRAINT: Expensive cell biology research products

Cell biology involves extensive research on the development of new therapies, such as stem cell and gene therapies. The media, reagents, and other products associated with this research are required to be of high quality in order to obtain accurate results. Owing to the need to maintain high-quality standards and comply with guidelines set up by regulatory authorities, the cost of research in cell biology is high.

Due to budget constraints, various institutes and small-scale companies find it difficult to afford expensive products required for cell biology research. In developing countries, underdeveloped infrastructure facilities and low healthcare expenditure restrict the use of advanced equipment and consumables. The use of advanced media and kits is more expensive as compared to conventional ones. Specific media offer significant benefits like the simplification of expansion processes, reduced working times, and high throughput. However, the high cost of these media is restraining their adoption.

OPPORTUNITY: Increasing incidence of infectious diseases and outbreaks of pandemics

Cell culture has a wide range of applications in providing diagnostic/prognostic information as well as during research related to HIV/AIDS, cancer, and various infectious diseases. Several factors, such as the growth in the population, climate change, and increasing contact between humans and animals, have increased the threat of new virus outbreaks. Cancer, which has become the leading cause of death globally, accounted for 9.96 million deaths in 2020. According to GLOBOCAN, the number of cancer cases will rise to approximately 30 million by 2040. The growth in the prevalence of this disease has resulted in a need to conduct extensive research for diagnosis and treatment. This in turn offers growth opportunities for cell culture technologies and cell culture media products.

Influenza pandemics are unpredictable and recurring events that pose a significant economic and social burden. According to the CDC, from October 1, 2022, through April 30, 2023, there have been 27-54 million flu illnesses, 12-26 million flu medical visits, 3,00,000-6,50,000 flu hospitalizations, and 19,000-58,000 flu deaths. According to the WHO, in 2021, there were an estimated 128 000 measles deaths globally, mostly among unvaccinated or under vaccinated children under the age of 5 years. In 2021, about 81% of the world's children received one dose of measles vaccine by their first birthday through routine health services – the lowest since 2008. The increasing incidence of such communicable diseases and the growing risk of pandemics are the major factors driving the demand for diagnostics across the globe. This, in turn, is expected to offer potential growth opportunities for players operating in the cell culture media market during the forecast period.

CHALLENGE: Survival of small players and new entrants

The survival of small players and new entrants in the cell culture media industry is a significant challenge. Established players such as Thermo Fisher Scientific, Inc. (US), Lonza Group AG (Switzerland), Sartorius AG (Germany), Merck KGaA (Germany), and Danaher Corporation (US) account for a major share of the market. These players have a strong brand recognition and robust product portfolio. It is difficult for small players and new entrants to compete in this market, considering the strong presence of major players. Also, as established players that have large R&D budgets it is difficult for small players to sustain their operations and compete with established players as large investments are required for the R&D and launch of innovative products.

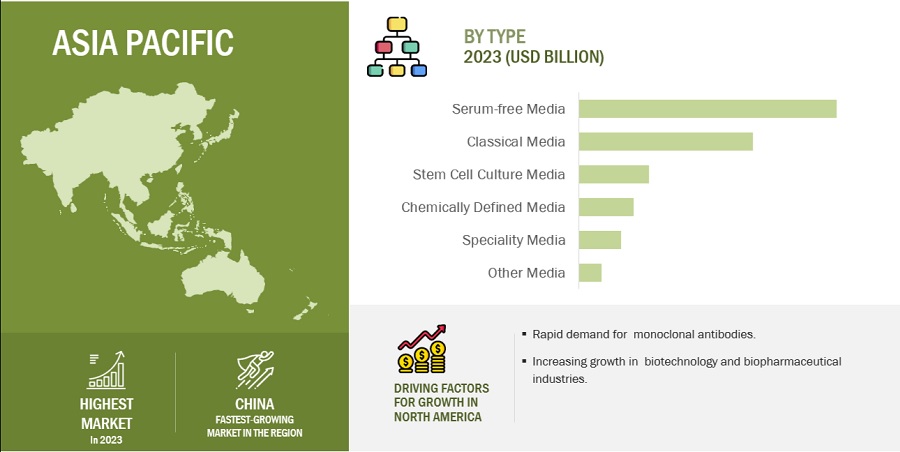

On the basis of type, the cell culture media market is segmented into serum-free media, classical media & salts, stem cell culture media, specialty media, chemically defined media, and other cell culture media. The serum-free media segment accounted for the largest share of the cell culture media industry in 2022. This can be attributed to the benefits of serum-free media over other different types of media, such as less risk of contamination in cell culture, and high growth & productivity.

On the basis of application, the cell culture media market is segmented into drug discovery & development, tissue engineering & regenerative medicine, biopharmaceutical production, diagnostics, and other applications. During the forecast period the biopharmaceutical production segment of the cell culture media industry will grow the highest. Factors responsible for the growth of this segment includes high R&D investments and expansion of pharmaceutical and biotechnology companies.

On the basis of end user, the cell culture media market is segmented into pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, research & academic institutes, and other end users which includes cell banks, CDMOs, and CROs. In 2022, the pharmaceutical & biotechnology companies segment accounted for the largest share and highest growth rate of the cell culture media industry during the forecast period.

On the basis of region, global cell culture media market has been segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific region of the cell culture media industry is expected to register the highest growth during the forecast period due to an increase in populations and a rise in the burden of diseases.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the cell culture media market are Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), Corning Incorporated (US), FUJIFILM Irvine Scientific, Inc. (Japan), Lonza Group (Switzerland), Becton, Dickinson and Company (US), Miltenyi Biotec (Germany), HiMedia Laboratories Pvt. Ltd. (India), STEMCELL Technologies Inc. (Canada), Biologos LLC (US),

Scope of the Cell Culture Media Industry

|

Report Metric |

Details |

|

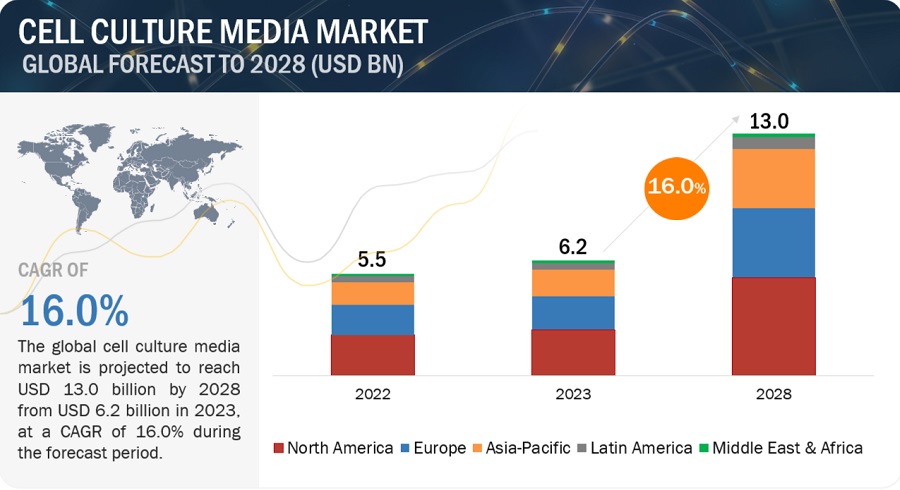

Market Revenue in 2023 |

$6.2 billion |

|

Projected Revenue by 2028 |

$13.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 16.0% |

|

Market Driver |

Increasing demand for serum and animal component-free media |

|

Market Opportunity |

Increasing incidence of infectious diseases and outbreaks of pandemics |

This report categorizes the cell culture media market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Serum-free Media

- CHO Media

- HEK 293 Media

- BHK Media

- VERO Cell Media

- Insect Cell Media

- Serum-free Stem Cell Media

- Immune cell Media

- Other Serum-free Media

- Classical Media & Salts

- Stem Cell Culture Media

- Specialty Media

- Chemically defined Media

- Other Cell Culture Media

By Application

-

Biopharmaceutical Production

- Monoclonal antibodies

- Vaccines production

- Other therapeutic proteins

- Diagnostics

- Drug Screening & Development

-

Tissue Engineering & Regenerative Medicine

- Cell and gene therapy

- Other tissue engineering & regenerative medicine applications

- Other Applications

By End user

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America (LATAM)

- Brazil

- Mexico

- RoLATAM

- Middle East and Africa (MEA)

Recent Developments of Cell Culture Media Industry

- In June 2023, Thermo fisher launched Tumoroid Culture Medium to accelerate development of novel cancer therapies.

- In April 2023, FUJIFILM Irvine Scientific launched BalanCD CHO Media Platform Portfolio for Bioprocessing.

- In March 2022, FUJIFILM Irvine Scientific acquired Shenandoah Biotechnology. The deal would help the company to provide customers with a single point of access for their life science research, discovery, and cell and gene therapy needs.

- In January 2022, Cytiva and Nucleus Biologics LLC collaborated to enhance custom cell media development for cell and gene therapies.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cell culture media market?

The global cell culture media market boasts a total revenue value of $13.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global cell culture media market?

The global cell culture media market has an estimated compound annual growth rate (CAGR) of 16.0% and a revenue size in the region of $6.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Emerging cell culture technologies for cell-based vaccines- Increasing demand for monoclonal antibodies and biosimilars- Launch of new cell culture media products by market players- Rising R&D investments by pharmaceutical companies- Increasing demand for serum- and animal component-free media- Growth in stem cell research- Growing focus on personalized medicineRESTRAINTS- Expensive cell biology research products- Ethical concerns regarding cell biology researchOPPORTUNITIES- Advancements in 3D cell culture- Increasing incidence of infectious diseases and outbreaks of pandemics- Emerging marketsCHALLENGES- Survival of small players and new entrants

- 5.3 IMPACT OF UNCERTAINTIES ON CELL CULTURE MEDIA MARKET

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 PATENT ANALYSIS

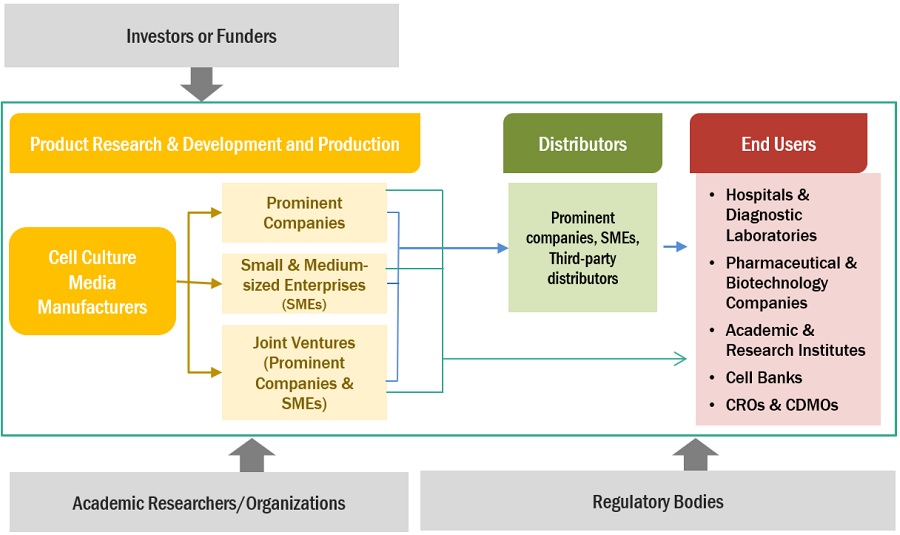

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 CELL CULTURE MEDIA MARKET: ECOSYSTEM ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF DIFFERENT TYPES OF MEDIA/1000L IN DEVELOPED AND DEVELOPING REGIONS (2022)

- 5.11 TRADE ANALYSIS (HS CODES)

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

5.13 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR CELL CULTURE MEDIA

-

6.1 INTRODUCTIONSERUM-FREE MEDIA- CHO media- HEK 293 media- BHK media- Vero cell media- Serum-free stem cell media- Immune cell media- Insect cell media- Other serum-free mediaCLASSICAL MEDIA & SALTS- Wide use of classical media & salts across all types of cell culture applications to boost marketSTEM CELL CULTURE MEDIA- Increasing collaborations for stem cell research to bolster marketCHEMICALLY DEFINED (CD) MEDIA- Ability of CD media to increase reproducibility to drive marketSPECIALTY MEDIA- Ability of primary cells to proliferate in specialty media to fuel marketOTHER CELL CULTURE MEDIA

- 7.1 INTRODUCTION

-

7.2 BIOPHARMACEUTICAL PRODUCTIONMONOCLONAL ANTIBODY PRODUCTION- Growing demand for monoclonal antibody production to fuel market growthVACCINE PRODUCTION- Growing government support for vaccine production to boost marketOTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS

-

7.3 DIAGNOSTICSINCREASING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE MARKET

-

7.4 TISSUE ENGINEERING & REGENERATIVE MEDICINECELL & GENE THERAPY- Increasing adoption of cell and gene therapies for treating patients to propel marketOTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS

-

7.5 DRUG SCREENING & DEVELOPMENTADOPTION OF CELL-BASED ASSAYS IN DRUG DISCOVERY TO BOOST MARKET

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING RESEARCH EXPENDITURE BY PHARMA AND BIOTECH COMPANIES TO DRIVE MARKET

-

8.3 HOSPITALS & DIAGNOSTIC LABORATORIESINCREASING APPLICATIONS OF CELL CULTURE MEDIA IN DISEASE DIAGNOSIS TO BOOST MARKET

-

8.4 RESEARCH & ACADEMIC INSTITUTESGROWING PREVALENCE OF CANCER AND INCREASING RESEARCH FUNDING TO PROPEL MARKET

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACTUS- Growing pharmaceutical and biotechnology sector to drive marketCANADA- Increase in stem cell research funding in Canada to fuel market growth

-

9.3 EUROPERECESSION IMPACTGERMANY- Strong growth in biotechnology industry in Germany to drive market growthUK- Advancements in life sciences sector to boost marketFRANCE- Increase in government funding for life science research to drive marketITALY- Growing support for life science research in Italy to fuel market growthSPAIN- Advancement of translational personalized medicine to support market growth in SpainREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACTCHINA- Increasing demand for monoclonal antibodies to propel marketJAPAN- Strategic developments by companies to contribute to market growthINDIA- Favorable government regulations and support to augment market growthSOUTH KOREA- Increasing pharmaceutical and biotech R&D investment to bolster marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICARECESSION IMPACTBRAZIL- Expanding pharmaceutical market in Brazil to boost marketMEXICO- Growth in pharmaceutical market to spur cell culture in MexicoREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAGROWING FUNDING INITIATIVES AND STRATEGIC PARTNERSHIPS TO PROPEL MARKETRECESSION IMPACT

- 10.1 INTRODUCTION

- 10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE SHARE ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKING OF TOP 26 PLAYERSPRODUCT FOOTPRINT OF COMPANIES (26 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (26 COMPANIES)

-

10.7 COMPANY EVALUATION QUADRANT: START-UPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewDANAHER- Business overview- Products offered- Recent developments- MnM viewSARTORIUS AG- Business overview- Products offered- Recent developmentsCORNING INCORPORATED- Business overview- Products offeredFUJIFILM HOLDINGS CORPORATION- Business overview- Products offered- Recent developmentsLONZA- Business overview- Products offered- Recent developmentsBECTON, DICKINSON AND COMPANY (BD)- Business overview- Products offeredSTEMCELL TECHNOLOGIES- Business overview- Products offered- Recent developmentsMILTENYI BIOTEC- Business overview- Products offeredHIMEDIA LABORATORIES- Business overview- Products offeredBIOLOGOS- Business overview- Products offered

-

11.2 OTHER PLAYERSCELL APPLICATIONS, INC.CAISSON LABS INC.PROMOCELL GMBHCELL BIOLOGICS, INC.INVIVOGENPAN-BIOTECHCELLULAR TECHNOLOGY LIMITEDZENBIO, INC.ATHENA ENVIRONMENTAL SCIENCES, INC.CYAGEN BIOSCIENCESBIOWESTAKRON BIOTECHKCELL BIOSCIENCESWELGENE INC.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2022–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2030 (USD MILLION)

- TABLE 4 CELL CULTURE MEDIA MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 5 APPROVED CELL CULTURE-BASED VACCINES FOR INFLUENZA

- TABLE 6 APPROVED MONOCLONAL ANTIBODIES BY US FDA FOR THERAPEUTIC USE

- TABLE 7 GROWTH IN NUMBER OF PERSONALIZED MEDICATIONS, 2015–2022

- TABLE 8 PROJECTED INCREASE IN COUNT OF CANCER PATIENTS, 2015 VS. 2018 VS. 2020 VS. 2035

- TABLE 9 ESTIMATED COUNT OF NEW CASES OF CANCER, EXCLUDING NON-MELANOMA SKIN CANCER, AGE (0–85+), 2020–2040

- TABLE 10 CELL CULTURE MEDIA MARKET: INDICATIVE LIST OF PATENTS

- TABLE 11 CELL CULTURE MEDIA MARKET: ECOSYSTEM

- TABLE 12 CELL CULTURE MEDIA MARKET: CONFERENCES AND EVENTS

- TABLE 13 AVERAGE SELLING PRICE OF DIFFERENT TYPES OF MEDIA (2022)

- TABLE 14 EXPORT DATA FOR PREPARED CULTURE MEDIA, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR PREPARED CULTURE MEDIA, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 16 CELL CULTURE MEDIA MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 SERUM-FREE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 19 SERUM-FREE MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 LATIN AMERICA: SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 SERUM-FREE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 CHO MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 26 CHO MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: CHO MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: CHO MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: CHO MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 LATIN AMERICA: CHO MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 HEK 293 MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 32 HEK 293 MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: HEK 293 MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 EUROPE: HEK 293 MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: HEK 293 MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 LATIN AMERICA: HEK 293 MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 BHK MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 38 BHK MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: BHK MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: BHK MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BHK MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 LATIN AMERICA: BHK MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 VERO CELL MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 44 VERO CELL MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: VERO CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: VERO CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: VERO CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 LATIN AMERICA: VERO CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 SERUM-FREE STEM CELL MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 50 SERUM-FREE STEM CELL MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: SERUM-FREE STEM CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: SERUM-FREE STEM CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SERUM-FREE STEM CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 LATIN AMERICA: SERUM-FREE STEM CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 IMMUNE CELL MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 56 IMMUNE CELL MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: IMMUNE CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: IMMUNE CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: IMMUNE CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 LATIN AMERICA: IMMUNE CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 INSECT CELL MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 62 INSECT CELL MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: INSECT CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 EUROPE: INSECT CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: INSECT CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 LATIN AMERICA: INSECT CELL MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 OTHER SERUM-FREE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 68 OTHER SERUM-FREE MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: OTHER SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: OTHER SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: OTHER SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 LATIN AMERICA: OTHER SERUM-FREE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 CLASSICAL MEDIA & SALTS OFFERED BY KEY MARKET PLAYERS

- TABLE 74 CLASSICAL MEDIA & SALTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: CLASSICAL MEDIA & SALTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: CLASSICAL MEDIA & SALTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CLASSICAL MEDIA & SALTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 LATIN AMERICA: CLASSICAL MEDIA & SALTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 STEM CELL CULTURE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 80 STEM CELL CULTURE MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: STEM CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: STEM CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: STEM CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 LATIN AMERICA: STEM CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 CHEMICALLY DEFINED MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 86 CHEMICALLY DEFINED MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: CHEMICALLY DEFINED MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 EUROPE: CHEMICALLY DEFINED MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CHEMICALLY DEFINED MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 LATIN AMERICA: CHEMICALLY DEFINED MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 SPECIALTY MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 92 SPECIALTY MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: SPECIALTY MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: SPECIALTY MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SPECIALTY MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: SPECIALTY MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 OTHER CELL CULTURE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 98 OTHER CELL CULTURE MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: OTHER CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: OTHER CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: OTHER CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: OTHER CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 104 CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 INDICATIVE LIST OF APPROVED ANTIBODY PRODUCTS PRODUCED IN CHO CELLS

- TABLE 111 INDICATIVE LIST OF MONOCLONAL ANTIBODIES WITH FDA AUTHORIZATION

- TABLE 112 CELL CULTURE MEDIA MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 114 EUROPE: CELL CULTURE MEDIA MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 NIH FUNDING FOR VACCINE RESEARCH, 2020–2024 (USD MILLION)

- TABLE 118 CELL CULTURE MEDIA MARKET FOR VACCINE PRODUCTION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 EUROPE: CELL CULTURE MEDIA MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 CELL CULTURE MEDIA MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 EUROPE: CELL CULTURE MEDIA MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 CELL CULTURE MEDIA MARKET FOR DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 130 EUROPE: CELL CULTURE MEDIA MARKET FOR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 135 EUROPE: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 CELL CULTURE MEDIA MARKET FOR CELL & GENE THERAPY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 EUROPE: CELL CULTURE MEDIA MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 CELL CULTURE MEDIA MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 EUROPE: CELL CULTURE MEDIA MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 149 CELL CULTURE MEDIA MARKET FOR DRUG SCREENING & DEVELOPMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 151 EUROPE: CELL CULTURE MEDIA MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 CELL CULTURE MEDIA MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 156 EUROPE: CELL CULTURE MEDIA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 159 CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 160 PHARMA & BIOTECH SECTOR: RECENT DEVELOPMENTS

- TABLE 161 CELL CULTURE MEDIA MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 162 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 163 EUROPE: CELL CULTURE MEDIA MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 165 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 166 CELL CULTURE MEDIA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 167 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 168 EUROPE: CELL CULTURE MEDIA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 171 CELL CULTURE MEDIA MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 172 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 173 EUROPE: CELL CULTURE MEDIA MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 176 CELL CULTURE MEDIA MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 177 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 178 EUROPE: CELL CULTURE MEDIA MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 181 CELL CULTURE MEDIA MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 183 NORTH AMERICA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 NORTH AMERICA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 NORTH AMERICA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 NORTH AMERICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 NORTH AMERICA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 189 US: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 US: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 US: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 US: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 US: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 194 US: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 195 CANADA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 CANADA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 CANADA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 198 CANADA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 199 CANADA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 CANADA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 201 EUROPE: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 202 EUROPE: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 EUROPE: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 EUROPE: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 205 EUROPE: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 EUROPE: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 EUROPE: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 208 GERMANY: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 GERMANY: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 GERMANY: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 211 GERMANY: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 GERMANY: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 GERMANY: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 214 UK: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 UK: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 UK: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 217 UK: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 UK: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 UK: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 220 FRANCE: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 FRANCE: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 FRANCE: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 223 FRANCE: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 FRANCE: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 FRANCE: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 226 ITALY: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 ITALY: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 ITALY: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 229 ITALY: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 ITALY: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 ITALY: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 232 SPAIN: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 SPAIN: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 SPAIN: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 235 SPAIN: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 SPAIN: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 SPAIN: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 238 REST OF EUROPE: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 REST OF EUROPE: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 240 REST OF EUROPE: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 241 REST OF EUROPE: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 REST OF EUROPE: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 REST OF EUROPE: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 244 ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 245 ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 ASIA PACIFIC: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 248 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 250 ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 251 CHINA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 CHINA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 CHINA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 254 CHINA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 CHINA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 256 CHINA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 257 JAPAN: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 JAPAN: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 JAPAN: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 260 JAPAN: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 261 JAPAN: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 JAPAN: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 263 INDIA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 INDIA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 INDIA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 266 INDIA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 267 INDIA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 268 INDIA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 269 SOUTH KOREA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 270 SOUTH KOREA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 271 SOUTH KOREA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 272 SOUTH KOREA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 273 SOUTH KOREA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 SOUTH KOREA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 281 LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 283 LATIN AMERICA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 287 LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 288 BRAZIL: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 289 BRAZIL: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 290 BRAZIL: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 291 BRAZIL: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 292 BRAZIL: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 293 BRAZIL: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 294 MEXICO: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 295 MEXICO: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 296 MEXICO: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 297 MEXICO: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 298 MEXICO: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 299 MEXICO: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: SERUM-FREE CELL CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 308 MIDDLE EAST AND AFRICA: CELL CULTURE MEDIA MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: CELL CULTURE MEDIA MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: CELL CULTURE MEDIA MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: CELL CULTURE MEDIA MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 312 CELL CULTURE MEDIA MARKET: DEGREE OF COMPETITION

- TABLE 313 CELL CULTURE MEDIA MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 314 CELL CULTURE MEDIA MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 315 CELL CULTURE MEDIA MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

- TABLE 316 CELL CULTURE MEDIA MARKET: COMPANY EVALUATION QUADRANT OF START-UP/SME PLAYERS

- TABLE 317 CELL CULTURE MEDIA MARKET: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 318 CELL CULTURE MEDIA MARKET: DEALS, JANUARY 2020 TO JUNE 2023

- TABLE 319 CELL CULTURE MEDIA MARKET: OTHER DEVELOPMENTS, JANUARY 2020 TO JUNE 2023

- TABLE 320 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 321 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 322 THERMO FISHER SCIENTIFIC INC.: OTHER DEVELOPMENTS

- TABLE 323 MERCK KGAA: COMPANY OVERVIEW

- TABLE 324 MERCK KGAA: DEALS

- TABLE 325 DANAHER: COMPANY OVERVIEW

- TABLE 326 DANAHER: DEALS

- TABLE 327 DANAHER: OTHER DEVELOPMENTS

- TABLE 328 SARTORIUS AG: BUSINESS OVERVIEW

- TABLE 329 SARTORIUS AG: PRODUCT LAUNCHES

- TABLE 330 SARTORIUS AG: DEALS

- TABLE 331 SARTORIUS AG: OTHER DEVELOPMENTS

- TABLE 332 CORNING INCORPORATED: BUSINESS OVERVIEW

- TABLE 333 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 334 FUJIFILM HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 335 FUJIFILM HOLDINGS CORPORATION: DEALS

- TABLE 336 FUJIFILM HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 337 LONZA: BUSINESS OVERVIEW

- TABLE 338 LONZA: PRODUCT LAUNCHES

- TABLE 339 LONZA: OTHER DEVELOPMENTS

- TABLE 340 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 341 STEMCELL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 342 STEMCELL TECHNOLOGIES: DEALS

- TABLE 343 MILTENYI BIOTEC: BUSINESS OVERVIEW

- TABLE 344 HIMEDIA LABORATORIES: BUSINESS OVERVIEW

- TABLE 345 BIOLOGOS: BUSINESS OVERVIEW

- TABLE 346 CELL APPLICATIONS, INC.: COMPANY OVERVIEW

- TABLE 347 CAISSON LABS INC.: COMPANY OVERVIEW

- TABLE 348 PROMOCELL GMBH: COMPANY OVERVIEW

- TABLE 349 CELL BIOLOGICS, INC.: COMPANY OVERVIEW

- TABLE 350 INVIVOGEN: COMPANY OVERVIEW

- TABLE 351 PAN-BIOTECH: COMPANY OVERVIEW

- TABLE 352 CELLULAR TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 353 ZENBIO, INC.: COMPANY OVERVIEW

- TABLE 354 ATHENA ENVIRONMENTAL SCIENCES, INC.: COMPANY OVERVIEW

- TABLE 355 CYAGEN BIOSCIENCES: COMPANY OVERVIEW

- TABLE 356 BIOWEST: COMPANY OVERVIEW

- TABLE 357 AKRON BIOTECH.: COMPANY OVERVIEW

- TABLE 358 KCELL BIOSCIENCES: COMPANY OVERVIEW

- TABLE 359 WELGENE INC.: COMPANY OVERVIEW

- FIGURE 1 CELL CULTURE MEDIA MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES: CELL CULTURE MEDIA MARKET

- FIGURE 3 CELL CULTURE MEDIA MARKET SIZE ESTIMATION, 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1—COMPANY REVENUE ANALYSIS-BASED ESTIMATION, 2022

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF MERCK KGAA: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 CELL CULTURE MEDIA MARKET (SUPPLY-SIDE): CAGR PROJECTIONS

- FIGURE 8 CELL CULTURE MEDIA MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 CELL CULTURE MEDIA MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CELL CULTURE MEDIA MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CELL CULTURE MEDIA MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CELL CULTURE MEDIA MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 14 RISING R&D SPENDING IN PHARMA COMPANIES AND EMERGING CELL CULTURE TECHNOLOGIES FOR CELL-BASED VACCINES TO DRIVE MARKET

- FIGURE 15 SERUM-FREE MEDIA SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN CELL CULTURE MEDIA MARKET IN 2022

- FIGURE 16 BIOPHARMACEUTICAL PRODUCTION SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2028

- FIGURE 17 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES SEGMENT DOMINATED MARKET IN 2022

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 CELL CULTURE MEDIA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014–2028

- FIGURE 21 CELL CULTURE MEDIA MARKET: SPECTRUM OF SCENARIOS BASED ON IMPACT OF UNCERTAINTIES ON GROWTH

- FIGURE 22 REVENUE SHIFT & NEW REVENUE POCKETS FOR CELL CULTURE MEDIA PROVIDERS

- FIGURE 23 CELL CULTURE MEDIA MARKET: PATENT APPLICATIONS, JANUARY 2012–JUNE 2023

- FIGURE 24 VALUE CHAIN ANALYSIS OF CELL CULTURE MEDIA MARKET: RAW MATERIAL AND MANUFACTURING PHASE CONTRIBUTES MAXIMUM VALUE

- FIGURE 25 CELL CULTURE MEDIA MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF CELL CULTURE MEDIA PRODUCTS

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 NORTH AMERICA: CELL CULTURE MEDIA MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: CELL CULTURE MEDIA MARKET SNAPSHOT

- FIGURE 30 CELL CULTURE MEDIA MARKET: STRATEGIES ADOPTED

- FIGURE 31 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS (2019–2022)

- FIGURE 33 CELL CULTURE MEDIA MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 CELL CULTURE MEDIA MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 35 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 37 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 38 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- FIGURE 39 CORNING INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 40 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 41 LONZA: COMPANY SNAPSHOT (2022)

- FIGURE 42 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

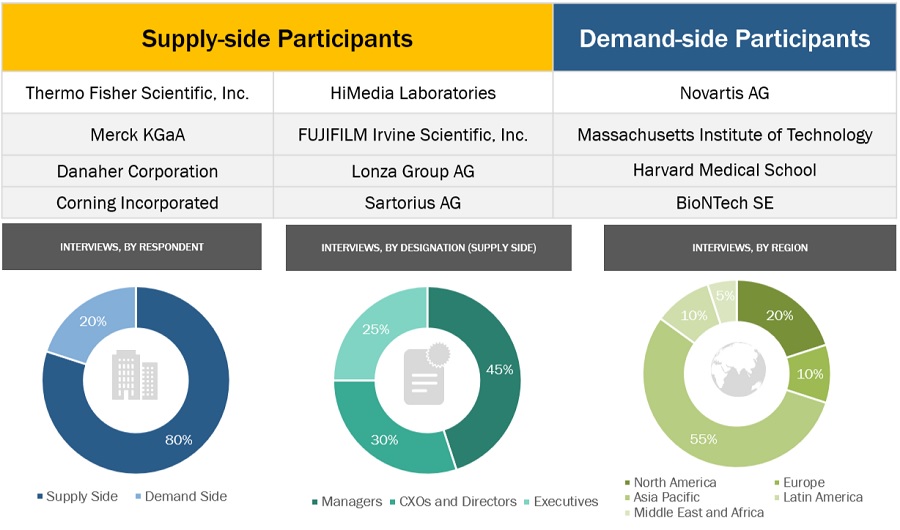

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global cell culture media market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as the World Health Organization (WHO), American Society for Cell Biology (ASCB), American Society for Gene and Cell Therapy (ASGCT), Centers of Disease Control and Prevention (CDC), International Serum Industry Association (ISIA), International Society for Vaccines (ISV), International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the Society for In Vitro Biology (SIVB), European Society for Animal Cell Technology (ESACT), Pharmaceutical Research and Manufacturers of America (PhRMA), Department of Biotechnology (DBT), French National Research Agency, Ministry of Education, University and Research (MIUR), National Institute of Statistics (INE), Japan Agency for Medical Research and Development, Department of Regenerative Medicine and Cell and Gene Therapies, and Ministry of Health and Welfare (MoHW). Secondary sources also include corporate & regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global cell culture media market, which was validated through primary research.

Primary Research

Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Extensive primary research was conducted after acquiring basic knowledge about the global cell culture media market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical & biopharmaceutical industries, academic & research institutes, and experts from the supply side, such as C-level & D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 80% and 20% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report presents a detailed assessment of the cell culture media market and qualitative inputs and insights from MarketsandMarkets. The global size of the cell culture media market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the cell culture media and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the cell culture media business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top- Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Approach: MnM Repository Analysis

For the estimation of the cell culture media market, related market reports in the MnM Repository, including the cell culture market, cell expansion market, regenerative medicine market, stem cell manufacturing market, and stem cell therapy market, were considered. The global and regional market values of cell culture media and dependent submarkets were extracted from the MnM repository and validated through secondary and primary research. The final global market size was triangulated through the average of all approaches and validated through primary interviews with industry experts.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition:

A cell culture medium (also known as growth medium) is a liquid or gel designed to support the growth of cells. The cell culture media is a composition of nutrients like amino acids, carbohydrates, vitamins, and other ingredients that regulate the cell cycle and help the cells proliferate.

Key Stakeholders

- Cell culture media manufacturers

- Academic research institutes

- Pharmaceutical & biotechnology companies

- Life science companies

- Venture capitalists and investors

- Government organizations

- Private research firms

- Research & development companies

- Contract research organizations (CROs)

- Contract development and manufacturing organizations (CDMOs)

Report Objectives

- To define, describe, and forecast the global cell culture media market based on type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall cell culture media market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze competitive developments such as acquisitions; new product launches; expansions; and agreements, partnerships, and collaborations in the cell culture media market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the RoE cell culture media market, by country

- Further breakdown of the RoAPAC cell culture media market, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Segment Analysis

- Further breakdown of the therapeutic area segment as per the product portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Culture Media Market