Cellulosic Fire Protection Intumescent Coatings Market by Type (Water-borne, Solvent-borne), End-use, Material Type (Acrylic, Epoxy, Alkyd, VAE), Substrate Type (Structural Steel & Cast Iron, Wood), and Region - Global Forecast to 2028

Updated on : November 11, 2025

Cellulosic Fire Protection Intumescent Coatings Market

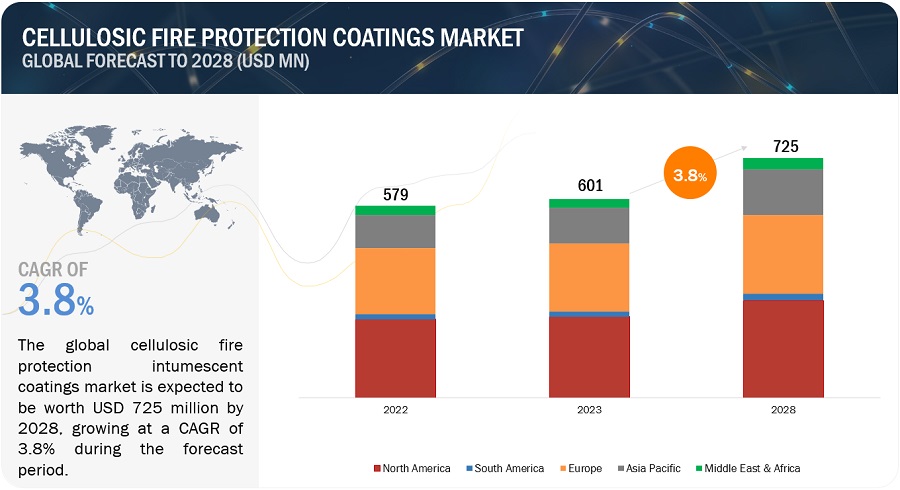

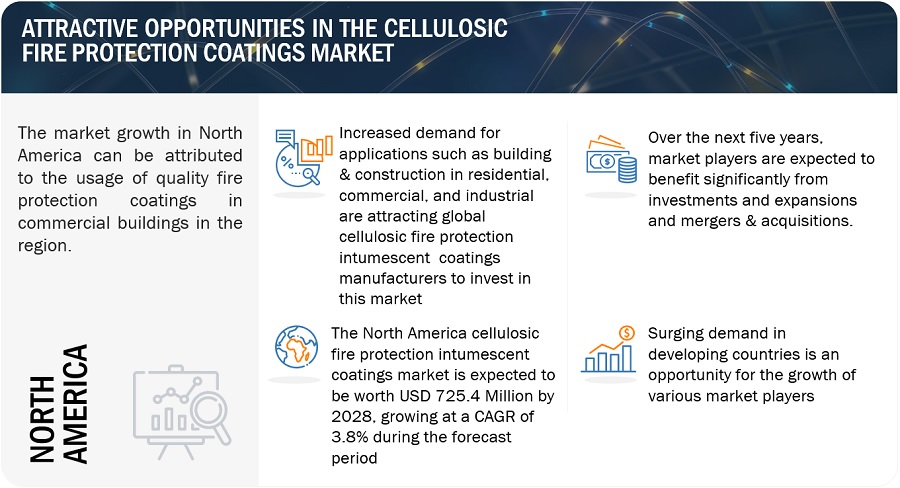

The global cellulosic fire protection intumescent coatings market was valued at USD 601 million in 2023 and is projected to reach USD 725 million by 2028, growing at 3.8% cagr from 2023 to 2028. The growth prospects for cellulosic fire protection intumescent coatings are exceptionally promising, driven by a confluence of factors. Heightened safety regulations, particularly in industries like construction, transportation, and manufacturing, are compelling businesses to adopt advanced fire protection solutions. The ongoing global trend of urbanization and infrastructure development underscores the need for robust fire safety measures, offering a significant market opportunity. Continuous advancements in formulation and application techniques are expected to further enhance the effectiveness of these coatings. Businesses, recognizing the importance of risk mitigation and continuity planning, are inclined to embrace these solutions. Moreover, the growing emphasis on sustainability is poised to boost demand for eco-friendly fire protection options, positioning cellulosic intumescent coatings as a preferred choice.

Attractive Opportunities in the Cellulosic Fire Protection Intumescent Coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Cellulosic Fire Protection Intumescent Coatings Market Dynamics

Driver: The surging preference for lightweight materials within the building and construction industry serves as a compelling catalyst for the adoption of cellulosic fire protection intumescent coatings. This burgeoning trend towards lighter construction materials, such as composite panels and engineered woods, stems from their numerous advantages, including enhanced energy efficiency, faster construction timelines, and reduced transportation costs. However, this shift towards lighter materials has also raised concerns about their inherent fire susceptibility, potentially compromising structural integrity and safety standards.

Herein lies the pivotal role of cellulosic fire protection intumescent coatings. These coatings offer a strategic solution that bridges the gap between lightweight construction preferences and stringent fire safety requisites. By providing an efficient barrier against the heat and flames generated during fires, these coatings effectively shield the underlying lightweight materials from rapid degradation. This not only safeguards the structural integrity of buildings but also ensures compliance with stringent fire safety codes and regulations.

Furthermore, these coatings align seamlessly with the evolving architectural landscape, allowing for their discreet integration into designs without hampering the aesthetic appeal. As the construction industry continues to prioritize weight reduction in pursuit of efficiency and sustainability, the indispensability of cellulosic fire protection intumescent coatings becomes increasingly evident. These coatings serve as a proactive and essential solution, enabling the utilization of lightweight materials while fortifying fire safety measures, thus addressing a critical concern and fostering the advancement of modern construction practices.

Restraints: In the realm of implementing cellulosic fire protection intumescent coatings, it is imperative for stakeholders to acknowledge and address potential restraints that may impact their deployment and effectiveness. One significant restraint lies in the complexity of application and adherence. Proper application of these coatings demands a meticulous and precise process, often involving multiple layers and specific environmental conditions. Any deviation from recommended application procedures could compromise the coatings' ability to intumesce effectively and provide the desired fire protection.

Moreover, as the construction industry embraces rapid advancements in material science and technology, the compatibility of cellulosic fire protection intumescent coatings with a wide array of innovative building materials may pose a challenge. Ensuring that these coatings perform optimally across various substrates and materials requires thorough testing and validation, potentially adding complexity to the selection and implementation process. Additionally, cost considerations constitute another vital restraint. The incorporation of cellulosic fire protection intumescent coatings could entail a higher initial financial investment compared to conventional fire protection methods. This cost differential may prompt some stakeholders to prioritize more cost-efficient alternatives, potentially hindering the widespread adoption of these coatings.

Opportunity: The escalating need for fire-resistant coatings in the realm of renovation projects presents a compelling avenue for the prominence and proliferation of cellulosic fire protection intumescent coatings. As the renovation landscape evolves, there is an increasing emphasis on enhancing the fire safety attributes of existing structures while simultaneously revitalizing their aesthetic and functional aspects. This growing demand for comprehensive fire protection solutions aligns seamlessly with the unique capabilities offered by cellulosic intumescent coatings, positioning them as a strategic and innovative response to the market's evolving requirements.

In the context of renovation projects, where preserving the integrity of the original structure is paramount, cellulosic fire protection intumescent coatings offer a non-invasive and efficient solution. These coatings can be applied without necessitating major alterations to the building's architecture, enabling seamless integration with ongoing renovation activities. This inherent adaptability caters to the need for unobtrusive fire safety enhancements, thereby capitalizing on the aesthetic and historical significance of the structure. Furthermore, the compatibility of cellulosic intumescent coatings with a wide spectrum of substrates, including steel, wood, and concrete, bolsters their attractiveness in renovation scenarios. As buildings undergoing renovation often consist of diverse materials, the versatility of these coatings ensures a consistent and effective fire protection solution across the entire structure.

Challenges: In the ever-evolving domain of fire safety solutions, the growth trajectory of cellulosic fire protection intumescent coatings encounters a formidable challenge in the intricate realm of regulatory compliance. The fire safety sector is characterized by a complex web of evolving standards, codes, and regulations that span diverse jurisdictions and applications. This intricacy presents a substantial hurdle for the seamless adoption and widespread incorporation of cellulosic intumescent coatings.

Given the diverse substrates and applications across industries such as construction, manufacturing, and transportation, ensuring steadfast adherence to the fluid and often region-specific fire safety requisites requires a concerted and comprehensive approach. This challenge is further compounded by the necessity to consistently meet rigorous performance criteria, as any deviation could compromise the coatings' efficacy in preserving structures and assets during fire incidents. The nuanced process of deciphering and aligning with multifaceted regulations mandates an in-depth grasp of the intricacies within each market segment. Furthermore, it necessitates a proactive stance in accommodating evolving standards, potentially entailing resource-intensive endeavors like continuous research, testing, and formulation refinement to ensure ongoing compliance.

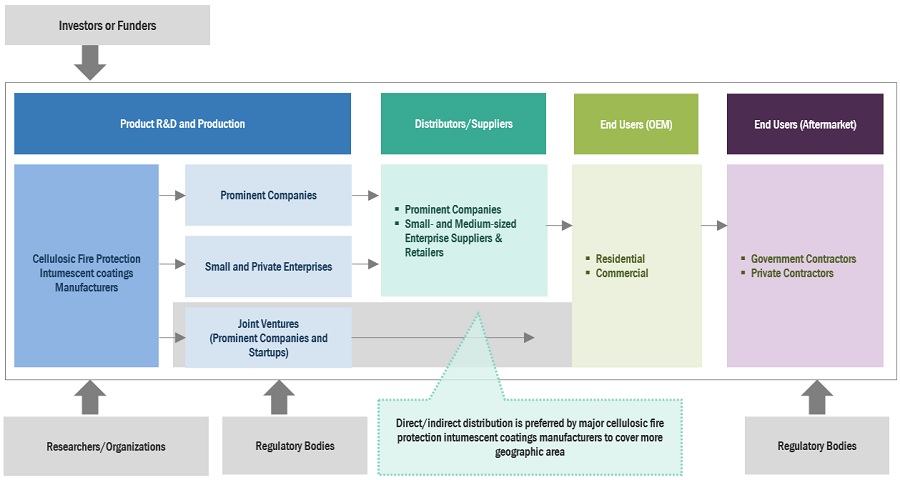

Cellulosic Fire Protection Intumescent Coatings Market Ecosystem

Based on end use, the commercial segment is estimated to account for the highest CAGR in cellulosic fire protection intumescent coatings market

The expanding commercial sector is propelling the worldwide cellulosic fire prevention intumescent coatings market. Commercial construction encompasses all commercial constructions as well as public and private infrastructure. The need for cellulosic fire prevention intumescent coatings in commercial building has grown due to growing commercialization and customer awareness. Recent advancements in building material composition and technology have improved the endurance, wearability, and tolerance to high temperatures of cellulosic fire prevention intumescent coatings. Commercial construction includes the development and building of office spaces, shopping malls, restaurants and hotels, retail outlets, and entertainment centres. These structures must be well-maintained and have a pleasing appearance. Growing economies are encouraging new commercial construction refurbishment, which will enhance the cellulosic fire prevention intumescent coatings market.

Based on material type, the epoxy segment is estimated to account for second highest market share in the fire protection intumescent coatings market

Intumescent coatings based on epoxy materials are an important protective coating technology in a variety of industrial applications. For decades, epoxy coatings have been used effectively to offer corrosion protection in harsh climatic circumstances, but its primary function is to create an insulating barrier in the case of a fire. Epoxy coatings are adaptable, long-lasting, visually appealing, thin, and light. Because of these features, epoxy coating has a wide range of industrial uses, including steelwork preparation, surface preparation and blast profile, primer usage and compatibility, topcoat layer in materials to protect against environmental exposure, and targeted thickness and rate of application.

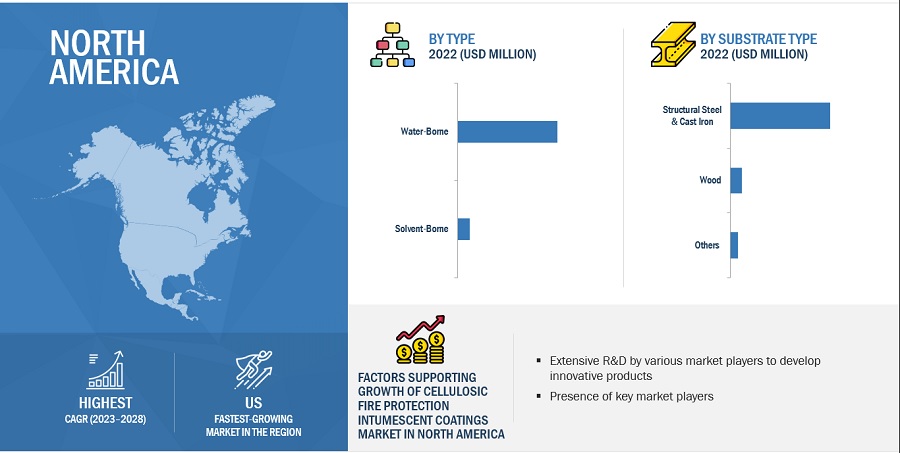

The North America market is projected to contribute one of the largest shares of the cellulosic fire protection intumescent coatings market.

The Environment Protection Agency (EPA) is heavily regulating the North American market, which is projected to restrict the market share of solvent-borne technology in the intumescent coatings industry since it produces VOCs throughout the formulation and coating phases. In addition, government programmes for sustainable development encourage the use of water-borne intumescent coatings around the world. Water-borne intumescent coatings are primarily used in the United States and Canada, but solvent-borne coatings are favored in Mexico due to poor purchasing capacity, lax laws, and a lack of knowledge. The region's intumescent coatings business is growing thanks to stringent restrictions. The high efficacy, eco-friendliness, applicability to all fire types and application regions, and longer fire protection are just a few of the reasons why intumescent coatings are preferred over cementitious coatings in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Kansai Paints Co. Ltd (Japan), ETEX Group (Belgium), Sika AG (Switzerland), RPM International Inc (US), Jotun (Norway), PPG Industries, Inc (US), The Sherwin-Williams Company (US), and AkzoNobel N.V. (Netherlands) are the key players operating in the global market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Type, By Material Type, By End Use, By Substrate, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Kansai Paints Co. Ltd (Japan), ETEX Group (Belgium), Sika AG (Switzerland), RPM International Inc (US), Jotun (Norway), PPG Industries, Inc (US), The Sherwin-Williams Company (US), and AkzoNobel N.V. (Netherlands) |

Based on type, the cellulosic fire protection intumescent coatings market has been segmented as follows:

- Water-Borne

- Solvent-Borne

Based on material types, the cellulosic fire protection intumescent coatings market has been segmented as follows:

- Epoxy

- Acrylic

- Alkyd

- VAE

- Others

Based on the end use, the cellulosic fire protection intumescent coatings market has been segmented as follows:

- Residential

- Commercial

Based on the substrate, the cellulosic fire protection intumescent coatings market has been segmented as follows:

- Structural Steel & Cast Iron

- Wood

- Others

Based on the region, the cellulosic fire protection intumescent coatings market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the cellulosic fire protection intumescent coatings market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the cellulosic fire protection intumescent coatings market?

US, UK, China, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the cellulosic fire protection intumescent coatings market during 2023-2028?

The CAGR is expected to record 3.8% from 2023-2028

Does this report cover the different type of the cellulosic fire protection intumescent coatings market?

Yes, the report covers the different type of cellulosic fire protection intumescent coatings.

Does this report cover the different material type of cellulosic fire protection intumescent coatings?

Yes, the report covers different material type of cellulosic fire protection intumescent coatings. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent safety regulations- Increased preference for lightweight materials in building & construction sector- Regulations for green and smart buildings and focus on obtaining green certificationRESTRAINTS- Issues pertaining to material compatibility and costOPPORTUNITIES- Rise in demand for fire-resistant coatings in renovation projects- Increased demand for water-borne intumescent coatingsCHALLENGES- Navigating regulatory complexity

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATOR ANALYSISINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

-

5.6 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHRUSSIA–UKRAINE WARCHINA- Debt issues- Trade war with Australia- Environmental commitmentsEUROPE- Energy crisis

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

-

5.9 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- 5.10 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023

-

5.16 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 SOLVENT-BORNEINCREASED DEMAND FROM EMERGING COUNTRIES TO DRIVE SEGMENT

-

6.3 WATER-BORNESTRINGENT REGULATIONS AND INCREASED DEMAND FOR ECO-FRIENDLY COATINGS TO SPUR SEGMENT

- 7.1 INTRODUCTION

-

7.2 STRUCTURAL STEEL & CAST IRONINCREASED USE OF STEEL IN CONSTRUCTION ACTIVITIES TO DRIVE SEGMENT

-

7.3 WOODGROWING PENETRATION OF WOOD AS BUILDING MATERIAL IN DEVELOPED COUNTRIES TO DRIVE SEGMENT

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 ACRYLICINCREASED DEMAND FROM CONSTRUCTION SECTOR TO DRIVE SEGMENT

-

8.3 EPOXYEXTENSIVE USE IN VARIOUS INDUSTRIAL APPLICATIONS TO PROPEL SEGMENT

-

8.4 ALKYDHIGH-PERFORMANCE CHARACTERISTICS TO DRIVE DEMAND ACROSS INDUSTRIES

-

8.5 VAEENHANCED FIRE SAFETY AND DURABILITY PROPERTIES TO PROPEL SEGMENT

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 RESIDENTIALGROWING CONSTRUCTION SPENDING IN RESIDENTIAL SEGMENT TO BOOST MARKET

-

9.3 COMMERCIALINCREASED INVESTMENTS IN DEVELOPMENT OF COMMERCIAL OFFICE SPACES TO DRIVE DEMAND

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Foreign investments to drive marketINDIA- Boom in real estate industry to drive marketJAPAN- Investments by government in commercial construction to boost demandSOUTH KOREA- Support from government as well as private sector to drive marketTAIWAN- Growth in semiconductor industry to spur marketOCEANIA- Regulations related to safety and sustainability to drive marketREST OF ASIA PACIFIC

-

10.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increased private residential and non-residential construction spending to boost marketCANADA- Significant rise in residential constructions to propel marketMEXICO- Increased investments in energy and commercial construction projects to drive market

-

10.4 EUROPEEUROPE: RECESSION IMPACTGERMANY- Technological advancements and rise in demand from residential sector to boost demandRUSSIA- Growing population to fuel demand in residential constructionsUK- Growing construction sector to boost demandFRANCE- Improved housing affordability and developed renewable energy infrastructure to drive demandITALY- New project finance rules and investment policies in construction sector to support market growthSPAIN- Government investments in infrastructure and housing development to boost marketTURKEY- Rapid urbanization to drive demandREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Increased government investment in housing sector to propel demandSOUTH AFRICA- Rapid urbanization and opportunities in building & construction sector to drive demandUAE- Growing industrial activities to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Rise in investment from government to drive marketARGENTINA- Increased population and improved economic conditions to drive demandREST OF SOUTH AMERICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

11.3 START-UPS/SMES EVALUATION MATRIXRESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.4 STRENGTH OF PRODUCT PORTFOLIO

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 MARKET SHARE ANALYSIS

- 11.7 MARKET RANKING ANALYSIS

- 11.8 REVENUE ANALYSIS

-

11.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 11.10 STRATEGIC DEVELOPMENTS

-

12.1 KEY PLAYERSAKZONOBEL N.V.- Business overview- Products offered- Recent developments- MnM viewTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products offered- Recent developments- MnM viewPPG INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewJOTUN- Business overview- Products offered- Recent developments- MnM viewHEMPEL A/S- Business overview- Products offered- Recent developments- MnM viewRPM INTERNATIONAL INC.- Business overview- Products offered- Recent developments- MnM viewSIKA AG- Business overview- Products offered- Recent developments- MnM viewETEX GROUP- Business overview- Products offered- Recent developments- MnM viewKANSAI PAINT CO., LTD.- Business overview- Products offeredTEKNOS GROUP- Business overview- Products offered

-

12.2 OTHER PLAYERSGCP APPLIED TECHNOLOGIESRUDOLF HENSEL GMBHCONTEGO INTERNATIONAL INC.ARABIAN VERMICULITE INDUSTRIESISOLATEK INTERNATIONALALBI PROTECTIVE COATINGSJF AMONN SRLBOLLOMDEKOTERMINTUMESCENT SYSTEMS LTD.COATINGS & SPECIALTIES SOLUTIONSSTANCOLAC S.A.UNITED SUPREME GROUP

- 13.1 INTRODUCTION

- 13.2 FIRE-RESISTANT COATINGS MARKET LIMITATIONS

- 13.3 FIRE-RESISTANT COATINGS MARKET OVERVIEW

- 13.4 FIRE-RESISTANT COATINGS MARKET, BY TYPE

- 13.5 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY

- 13.6 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE

- 13.7 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE

- 13.8 FIRE-RESISTANT COATINGS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- TABLE 2 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- TABLE 5 TRENDS AND FORECAST OF GDP, 2020–2027 (% CHANGE)

- TABLE 6 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 9 TOP PATENT OWNERS

- TABLE 10 C1–C5 CLASSIFICATION SCHEME

- TABLE 11 INTUMESCENT COATINGS FOR FIRE PROTECTION–BS EN 16623:2015 CLASSIFICATION

- TABLE 12 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 18 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 20 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 21 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 22 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 24 SOLVENT-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 25 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 26 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 28 WATER-BORNE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 29 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 30 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 31 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 32 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 33 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 34 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 36 STRUCTURAL STEEL & CAST IRON: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 37 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 38 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 40 WOOD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 41 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 42 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 44 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 45 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 46 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 47 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 48 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 49 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 50 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 52 ACRYLIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 53 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 54 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 56 EPOXY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 57 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 58 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 60 ALKYD: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 61 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 62 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 64 VAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 65 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 66 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 68 OTHERS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 69 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 70 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 71 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 72 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 73 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 74 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 RESIDENTIAL CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 76 RESIDENTIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 77 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 78 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 80 COMMERCIAL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 81 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 82 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2021–2022 (THOUSAND LITER)

- TABLE 84 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION, 2023–2028 (THOUSAND LITER)

- TABLE 85 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (THOUSAND LITER)

- TABLE 88 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (THOUSAND LITER)

- TABLE 89 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 92 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 93 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 96 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 97 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 100 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 101 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 104 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 105 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 106 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 108 CHINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 109 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 110 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 112 INDIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 113 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 114 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 116 JAPAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 117 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 118 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 120 SOUTH KOREA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 121 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 122 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 124 TAIWAN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 125 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 126 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 128 OCEANIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 129 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 132 REST OF ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 133 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (THOUSAND LITER)

- TABLE 136 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (THOUSAND LITER)

- TABLE 137 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 140 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 141 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 144 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 145 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 148 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 149 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 152 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 153 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 154 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 156 US: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 157 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 158 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 160 CANADA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 161 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 162 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 164 MEXICO: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 165 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 166 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (THOUSAND LITER)

- TABLE 168 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (THOUSAND LITER)

- TABLE 169 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 170 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 171 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 172 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 173 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 174 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 175 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 176 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 177 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 178 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 179 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 180 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 181 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 182 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 183 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 184 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 185 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 186 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 187 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 188 GERMANY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 189 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 190 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 192 RUSSIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 193 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 194 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 195 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 196 UK: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 197 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 198 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 199 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 200 FRANCE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 201 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 202 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 204 ITALY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 205 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 206 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 207 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 208 SPAIN: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 209 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 210 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 211 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 212 TURKEY: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 213 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 214 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 215 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 216 REST OF EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 217 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (THOUSAND LITER)

- TABLE 220 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (THOUSAND LITER)

- TABLE 221 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 224 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 225 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 228 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 229 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 232 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 233 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 236 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 237 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 238 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 239 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 240 SAUDI ARABIA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 241 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 242 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 243 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 244 SOUTH AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 245 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 246 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 248 UAE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 249 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 253 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 254 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 255 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2021–2022 (THOUSAND LITER)

- TABLE 256 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY COUNTRY, 2023–2028 (THOUSAND LITER)

- TABLE 257 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 258 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 259 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 260 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 261 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 262 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 264 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 265 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (USD MILLION)

- TABLE 266 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2021–2022 (THOUSAND LITER)

- TABLE 268 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY SUBSTRATE, 2023–2028 (THOUSAND LITER)

- TABLE 269 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (USD MILLION)

- TABLE 270 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 271 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2021–2022 (THOUSAND LITER)

- TABLE 272 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END USE, 2023–2028 (THOUSAND LITER)

- TABLE 273 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 274 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 275 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 276 BRAZIL: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 277 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 278 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 280 ARGENTINA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 281 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (USD MILLION)

- TABLE 282 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 283 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2021–2022 (THOUSAND LITER)

- TABLE 284 REST OF SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2023–2028 (THOUSAND LITER)

- TABLE 285 OVERVIEW OF STRATEGIES ADOPTED BY KEY CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS PLAYERS (2018–2023)

- TABLE 286 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: KEY START-UPS/SMES

- TABLE 287 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 288 COMPANY EVALUATION MATRIX: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- TABLE 289 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 290 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 291 HIGHEST ADOPTED GROWTH STRATEGIES

- TABLE 292 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 293 COMPANY FOOTPRINT: BY END USE

- TABLE 294 COMPANY FOOTPRINT: BY REGION

- TABLE 295 COMPANY FOOTPRINT

- TABLE 296 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: PRODUCT LAUNCHES, 2018–2023

- TABLE 297 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: DEALS, 2018–2023

- TABLE 298 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 299 AKZONOBEL N.V.: DEALS

- TABLE 300 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 301 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 302 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 303 THE SHERWIN-WILLIAMS COMPANY: EXPANSIONS

- TABLE 304 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 305 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 306 PPG INDUSTRIES, INC.: DEALS

- TABLE 307 PPG INDUSTRIES, INC: PRODUCT LAUNCHES

- TABLE 308 JOTUN: COMPANY OVERVIEW

- TABLE 309 JOTUN: EXPANSION

- TABLE 310 HEMPEL A/S: COMPANY OVERVIEW

- TABLE 311 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 312 HEMPEL A/S: EXPANSION

- TABLE 313 HEMPEL A/S: DEALS

- TABLE 314 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 315 RPM INTERNATIONAL INC.: EXPANSION

- TABLE 316 SIKA AG: COMPANY OVERVIEW

- TABLE 317 SIKA AG: DEALS

- TABLE 318 SIKA AG: PRODUCT LAUNCHES

- TABLE 319 ETEX GROUP: COMPANY OVERVIEW

- TABLE 320 ETEX GROUP: DEALS

- TABLE 321 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 322 TEKNOS GROUP: COMPANY OVERVIEW

- TABLE 323 GCP APPLIED TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 324 RUDOLF HENSEL GMBH: COMPANY OVERVIEW

- TABLE 325 CONTEGO INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 326 ARABIAN VERMICULITE INDUSTRIES: COMPANY OVERVIEW

- TABLE 327 ISOLATEK INTERNATIONAL: COMPANY OVERVIEW

- TABLE 328 ALBI PROTECTIVE COATINGS: COMPANY OVERVIEW

- TABLE 329 JF AMONN SRL: COMPANY OVERVIEW

- TABLE 330 BOLLOM: COMPANY OVERVIEW

- TABLE 331 DEKOTERM: COMPANY OVERVIEW

- TABLE 332 INTUMESCENT SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 333 COATINGS & SPECIALTIES SOLUTIONS: COMPANY OVERVIEW

- TABLE 334 STANCOLAC S.A.: COMPANY OVERVIEW

- TABLE 335 UNITED SUPREME GROUP: COMPANY OVERVIEW

- TABLE 336 FIRE-RESISTANT COATINGS MARKET DEFINITION

- TABLE 337 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2016–2018 (TON)

- TABLE 338 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2019–2026 (TON)

- TABLE 339 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2016–2018 (USD MILLION)

- TABLE 340 FIRE-RESISTANT COATINGS MARKET, BY TYPE, 2019–2026 (USD MILLION)

- TABLE 341 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2016–2018 (TON)

- TABLE 342 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2019–2026 (TON)

- TABLE 343 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2016–2018 (USD MILLION)

- TABLE 344 FIRE-RESISTANT COATINGS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

- TABLE 345 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2016–2018 (TON)

- TABLE 346 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2019–2026 (TON)

- TABLE 347 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2016–2018 (USD MILLION)

- TABLE 348 FIRE-RESISTANT COATINGS MARKET, BY APPLICATION TECHNIQUE, 2019–2026 (USD MILLION)

- TABLE 349 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2016–2018 (TON)

- TABLE 350 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2019–2026 (TON)

- TABLE 351 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2016–2018 (USD MILLION)

- TABLE 352 FIRE-RESISTANT COATINGS MARKET, BY SUBSTRATE, 2019–2026 (USD MILLION)

- FIGURE 1 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SEGMENTATION

- FIGURE 2 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TECHNOLOGY

- FIGURE 8 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 11 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: DATA TRIANGULATION

- FIGURE 12 ACRYLIC CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 WATER-BORNE TYPE TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 14 STRUCTURAL STEEL & CAST IRON TO BE FASTEST-GROWING APPLICATION OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- FIGURE 15 COMMERCIAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA DOMINATED MARKET IN 2022

- FIGURE 17 HIGH DEMAND FROM COMMERCIAL SECTOR IN DEVELOPED ECONOMIES TO DRIVE MARKET

- FIGURE 18 ACRYLIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 SOLVENT-BORNE TYPE SEGMENT AND CHINA ACCOUNTED FOR FASTEST GROWTH IN 2022

- FIGURE 20 MARKET IN DEVELOPED COUNTRIES TO GROW FASTER THAN EMERGING COUNTRIES

- FIGURE 21 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 25 KEY BUYING CRITERIA FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS

- FIGURE 26 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 27 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY REGION, 2022

- FIGURE 29 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY TYPE, 2022

- FIGURE 30 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY MATERIAL TYPE, 2022

- FIGURE 31 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY END USE, 2022

- FIGURE 32 AVERAGE SELLING PRICES OF CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS, BY COMPANY, 2023

- FIGURE 33 PAINTS & COATINGS ECOSYSTEM

- FIGURE 34 ECOSYSTEM EXTENSION TO INTUMESCENT COATINGS MARKET

- FIGURE 35 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 36 PATENTS PUBLISHED BY JURISDICTION, 2018–2023

- FIGURE 37 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018–2023

- FIGURE 38 WATER-BORNE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 STRUCTURAL STEEL & CAST IRON SUBSTRATE TO DOMINATE MARKET

- FIGURE 40 ACRYLIC TO BE LARGEST MATERIAL TYPE FOR CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS DURING FORECAST PERIOD

- FIGURE 41 COMMERCIAL SEGMENT TO LEAD OVERALL CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 43 ASIA PACIFIC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- FIGURE 44 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- FIGURE 45 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SNAPSHOT

- FIGURE 46 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 47 BRAZIL TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 48 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 49 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET: SME MATRIX, 2022

- FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

- FIGURE 51 MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 52 MARKET RANKING ANALYSIS, 2022

- FIGURE 53 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 54 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 55 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 56 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 57 JOTUN: COMPANY SNAPSHOT

- FIGURE 58 HEMPEL A/S: COMPANY SNAPSHOT

- FIGURE 59 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 SIKA AG: COMPANY SNAPSHOT

- FIGURE 61 ETEX GROUP: COMPANY SNAPSHOT

- FIGURE 62 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 TEKNOS GROUP: COMPANY SNAPSHOT

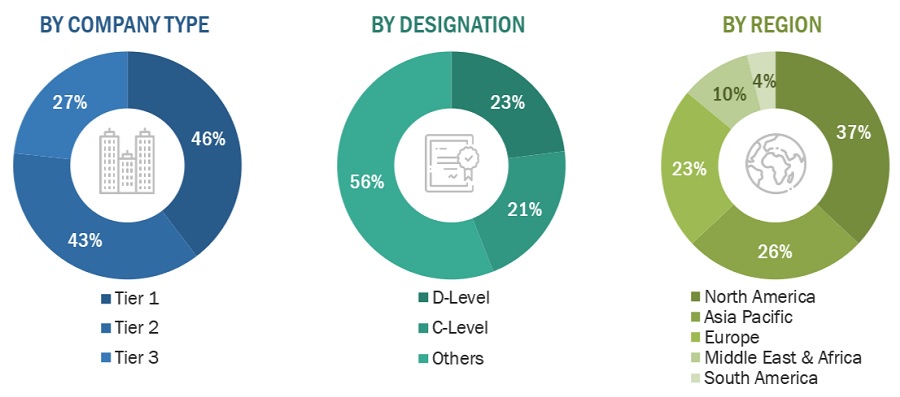

The study involved four major activities in estimating the current size of the cellulosic fire protection intumescent coatings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering cellulosic fire protection intumescent coatings information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the cellulosic fire protection intumescent coatings market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the cellulosic fire protection intumescent coatings market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from cellulosic fire protection intumescent coatings vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to material type, type, substrate, end use, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using cellulosic fire protection intumescent coatings were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of cellulosic fire protection intumescent coatings and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

Sika AG |

Director |

|

PPG Industries, Inc |

Project Manager |

|

RPM International Inc |

Individual Industry Expert |

|

Jotun |

Director |

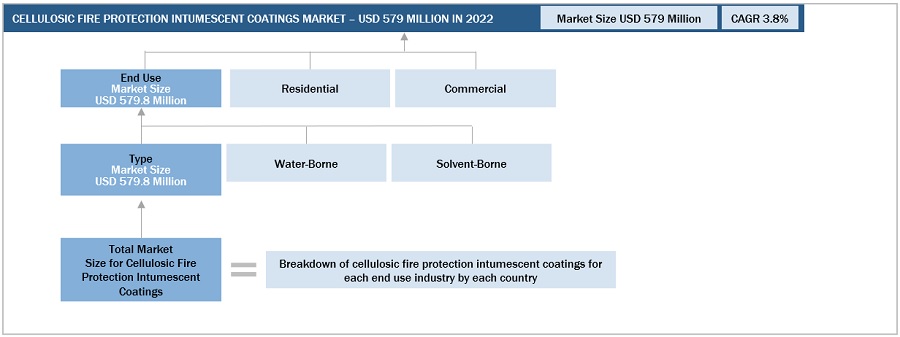

Market Size Estimation

The research methodology used to estimate the size of the cellulosic fire protection intumescent coatings market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of cellulosic fire protection intumescent coatings.

Global Cellulosic Fire Protection Intumescent Coatings Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Cellulosic Fire Protection Intumescent Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Intumescent coatings are applied to structural steelwork, which forms an impervious layer, such as char, when exposed to fire. The layer protects steelwork from fire and maintains its structural integrity. When the coated part of steel is exposed to heat, intumescent coating swells and forms a protective barrier, which, in turn, delays the heating steel. Intumescent coatings must comply with standards set by the German Institute for Standardization (DIN), the American Society for Testing and Materials (ASTM), and others.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the cellulosic fire protection intumescent coatings market based on type, material type, substrate, end use, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the cellulosic fire protection intumescent coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the cellulosic fire protection intumescent coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the cellulosic fire protection intumescent coatings Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cellulosic Fire Protection Intumescent Coatings Market