Fireproofing Materials Market by Coating Type (Intumescent coatings- Thin film and Thick film, and Cementitious coatings- Cement-based and Gypsum based), End-use (Commercial, Industrial, and Residential) and by Region - Global Forecast to 2026

Updated on : September 03, 2025

Fireproofing Materials Market

The global fireproofing materials market was valued at USD 0.9 billion in 2021 and is projected to reach USD 1.5 billion by 2026, growing at 9.8% cagr from 2021 to 2026. The market is mainly driven by the rising demand for fireproofing materials in end use industries such as commercial, industrial and residential. Increasing fire safety regulations & stringent building codes, and the rising number of fire accidents are driving the fireproofing materials market. North America is the key market for fireproofing materials, globally, in terms of value. APAC and Middle East & Africa are the fastest-growing regions in the fireproofing materials market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Fireproofing Materials Market

The global pandemic has affected almost every sector in the world. The fireproofing materials market has shown negative growth as it was affected due to disruptions in the global supply chain and fluctuation in the raw material prices. This situation arised due to fall in demand from the construction sector. The market is highly dependent on the commercial, industrial and residential industries. North America is the largest region in terms of value for the fireproofing materials market.

North America has always been a strong market for fireproofing materials. Globally, North America has been one of the leaders in demand and product innovation, in terms of quality and application development. Key countries in the North American market are the US (the most dominant market, accounting for a significant regional market share), Canada, and Mexico. The fireproofing materials market is experiencing significant growth due to the increasing demand for advanced materials in the construction industry. The North American market is highly regulated, with several associations playing a key role in the monitoring and commercialization of fireproofing materials.

Fireproofing materials market is highly influenced by the strict regulations in this region. Various regulatory bodies including FPA, NFPA and CFPA are observing the building codes in the region. The builders and contractors adhere to these standards. North America is also a highly industrialized region, which plays an important role in the growth of this market. The growth of commercial and industrial infrastructure plays a key role in this market.

Fireproofing Materials Market Dynamics

Driver: Increasing fire safety regulations

The fireproofing materials market is strongly influenced by the stringent legal framework and industry standards/regulations, especially in Europe and North America regions. These regulations are leading to the development of innovative fireproofing materials. They are varied across different regions, depending on the corresponding national regulations for health and environmental security.

The stringent fire regulations defined by the regulatory agencies of different countries, such as NFPA (U.S), VFDB (Germany), FPA (UK), and FPAA (Australia) is driving the demand for fireproofing materials such as intumescent coatings and cementitious coatings in the construction materials.

All these factors collectively are driving the demand for fireproofing materials in the various end-use industries.

Restraints: Price sensitivity in the emerging regions

APAC, Africa, and South America are price-sensitive markets. Pricing plays a huge role in product placement and marketing in APAC. 3M & Akzo Nobel N.V. are the leading global market players. However, in the Indian subcontinent regional players are leading the market, as per industry experts, the reason behind this is the cost-effective products provided by these companies. Various residential projects tend to evade few fire compliances to reduce the cost of the project as the fireproofing materials are provided at a high cost. This has a negative impact on the market for fireproofing material despite the strict fire safety regulations. It has also been observed that contractors tend to avoid or do not comply with building codes to reduce the cost of construction.

Opportunities: Growing demand for developed intumescent fireproof and water-based coatings in construction projects

Fireproof coatings are not only used in new construction projects but also in the maintenance of old projects and buildings for commercial and residential purposes. Apart from protection against fires, these coatings provide resistance against weather and corrosion. They require less maintenance and also provide extended service life. People are becoming aware of their benefits and are including these coatings in both renovation and new construction projects. Water-based intumescent coatings are safer than solvent-based coatings as they do not contain harmful solvents and have low odor and VOC emissions. Also, water-based coatings can withstand high humidity levels during application. These coatings have been developed to enable customers to meet the stringent emission standards set by various agencies such as REACH. In high ambient temperatures, these coatings take less drying time as compared to solvent-based coatings. Water-based fireproof coatings can bear a small amount of moisture on the substrate as these coatings will absorb this moisture during their drying process. On the other hand, solvent-based intumescent coatings do not absorb the moisture and leave it as an incomplete layer between the coating and the substrate, resulting in the loss of adhesion. End users are becoming aware of the harmful effects of solvent-based or epoxy-based intumescent coatings, which have high VOC emissions. To solve this high VOC emission problem, manufacturers are coming up with hybrid technologies, such as a combination of water and epoxy-based coatings that are eco-friendly. All the above benefits of water-based coatings are boosting their demand in construction projects.

Challenges: Lack of awareness and non-compliance to regulations in the emerging markets

Developing economies have recently begun the use of PFP coatings in construction projects. These economies include China, India, Brazil, and the countries in Eastern Europe and Africa. The use of fireproofing materials is new in these countries, where active fire protection techniques are used. Many potential end users are not aware of the benefits of using fireproofing materials in various applications. Contractors tend to avoid building codes or do not comply with the mandatory fire safety regulations due to high prices and lack of a regulatory body or proper inspection procedures

Intumescent coatings is estimated to be the fastest-growing coating type in the fireproofing materials market between 2021 and 2026.

Intumescent coatings are broadly divided into thin film and thick film coatings. Thin film intumescent coatings are either solvent-based or water-based and consist of three components a primer, a base coat, and a sealer coat. These coatings are majorly used to provide fire resistance in buildings. Thick film intumescent coatings are usually epoxy-based and typically have higher dry film thickness than thin film coatings. These materials are tough and durable and were originally developed for use for hydrocarbon fires wherein the test heating regime is significantly severe than that used for most industrial and commercial applications. These are majorly used for external steel in high-rise buildings and structures exposed to marine environments. These properties are expected to drive the demand of intumescent coatings during the forecast period.

Commercial construction was the largest end-use for fireproofing materials market in 2020

Commercial construction is the largest application of fireproofing materials. It is also known as institutional construction. It comprises healthcare facilities (hospitals and laboratories), banks, hotels, education institutions (schools and colleges), and government-owned offices. Commercial construction is increasing in developed and developing countries. In developed countries, the construction of grocery stores, drugstore, and quick service restaurants are increasing, while in developing countries, the construction of hospitals, schools and colleges, and retail stores is driving the commercial construction segment.

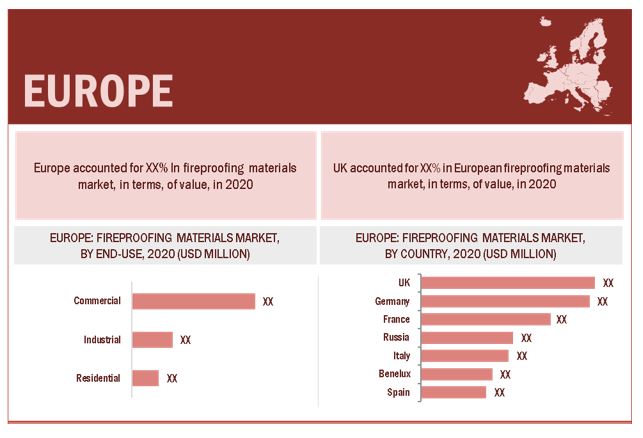

Europe was estimated to be the second-largest fireproofing market in 2020

Europe is the second-largest market for fireproofing materials in the world. In 2020, the region accounted for the second-largest region for the global fireproofing materials market. Key countries in the region include Germany, France, the UK, Italy, Spain, Benelux, and Russia. After North America, Europe is the largest consumer of fire-stopping materials. Stringent regulations and codes for building and construction in the region drive the demand of the market. Various regulatory bodies like CFPA-Europe and EAPFP monitor the fire safety guidelines for commercial and residential buildings. Moreover, the increased awareness regarding fire safety is driving the market in the construction and industrial sector. Concerns regarding loss of inventory due to fire-related hazards is rising leading to the construction of fire-safe infrastructures.

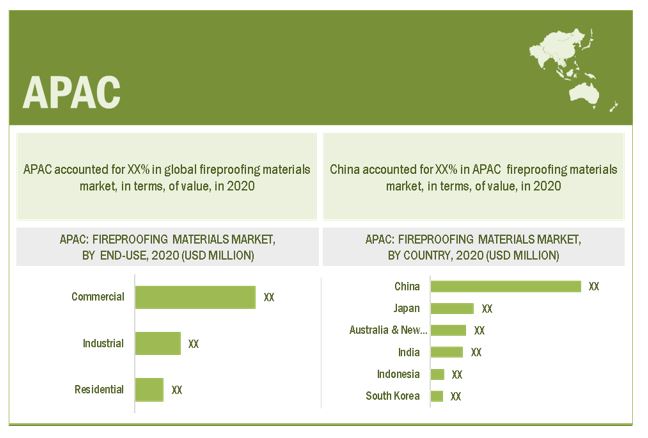

APAC was estimated to be the third-largest fireproofing market in 2020 and the fastest-growing region in this market in the forecast period

APAC consists of major developing nations such as China and India. Hence, there is wide scope for development for most of the industries in these emerging countries. The fireproofing materials industry is a significantly growing industry, and it offers high growth opportunities for manufacturers. The increasing population in the region, accompanied by the development of new technologies and products are projected to make this region an ideal destination for the growth of fireproofing materials. Improved lifestyle and increasing income also help the market to flourish in developing economies of the region. However, setting up new plants, implementing new technologies, creating a supply chain between raw material providers and manufacturing industries in the developing regions of APAC would be a challenge for the industry players as urbanization and industrialization rate is slower in few countries. On the other hand, the industry experts expects to see a boost in APAC’s infrastructural developments as many foreign players are investing in the APAC construction industry. This gives a huge lift to ongoing developments. Thus, the market for fireproofing

Fireproofing Materials Market Players

The key market players profiled in the report include 3M (US), Akzo Nobel N.V. (Netherlands), Isolatek International (US), Sika AG (Switzerland), Etex Group (Belgium), PPG Industries, Inc (US), BASF SE (Germany), Carboline (US), RPM International Inc. (US), Jotun Group (Norway), Iris Coatings S.r.l (Italy), Knauf Insulation (US), Hempel Group (Denmark), W.R. Grace & Co.(US), Rolf Kuhn GmbH (Germany), Rockwool International AS (Denmark), No-Burn Inc. (US), The Sherwin-Williams Company (US), Contego International Inc. (US), Den Braven (Netherlands), Encon Insulation Ltd (UK), Ugam Chemicals (India), Intumescent Systems Ltd (UK), PK Companies (US), FlameOFF Coatings Inc.(US).

Fireproofing Materials Market Report Scope

|

Report Metric |

Details |

| Years considered for the study | 2016-2026 |

| Base Year | 2021 |

| Forecast period | 2021–2026 |

| Units considered | Value (USD Million) |

| Segments | Coating Type, End-Use and Region |

| Regions | APAC, North America, Europe, Middle East & Africa, and South America |

| Companies | 3M (US), Akzo Nobel N.V. (Netherlands), Isolatek International (US), Sika AG (Switzerland), Etex Group (Belgium), PPG Industries, Inc (US), BASF SE (Germany), Carboline (US), RPM International Inc. (US), Jotun Group (Norway), Iris Coatings S.r.l (Italy), Knauf Insulation (US), Hempel Group (Denmark), W.R. Grace & Co.(US), Rolf Kuhn GmbH (Germany), Rockwool International AS (Denmark), No-Burn Inc. (US), The Sherwin-Williams Company (US), Contego International Inc. (US), Den Braven (Netherlands), Encon Insulation Ltd (UK), Ugam Chemicals (India), Intumescent Systems Ltd (UK), PK Companies (US), FlameOFF Coatings Inc.(US). |

This report categorizes the global fireproofing materials market based on coating type, end-use, and region.

On the basis of coating type, the fireproofing materials market has been segmented as follows:

- Intumescent coatings

- Thin film

- Thick film

- Cementitious coatings

- Cement-based

- Gypsum based

On the basis of end-use, the fireproofing materials market has been segmented as follows:

- Commercial

- Industrial

- Onshore

- Offshore

- Residential

On the basis of region, the fireproofing materials market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In June 2021, Carboline announced the acquisition of the Dudick Inc., a global leader in high-performance coatings, flooring, and tank linings, headquartered in Streetsboro, Ohio. Dudick has provided solutions in corrosion resistance and chemical containment systems for various applications such as food processing, steel production, chemical processing, power, pulp & paper, electronics, and biological research labs.

- In January 2021, Firetherm, a smart passive fire protection company, moved under the brand Nullifire (a part of RPM International Inc.) and started delivering across the UK under the same brand name.

Key questions addressed by the report

What are the factors influencing the growth of fireproofing materials?

Increasing fire safety regulations in the developed regions and growing number of fire incidents are driving this market.

What are different type of major types of fireproofing materials?

It is classified into two categories- intumescent coatings and cementitious coatings

What is the biggest restraint for fireproofing materials?

Price sensitivity in the emerging regions is a major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 FIREPROOFING MATERIALS MARKET: DEFINITION AND INCLUSIONS, BY COATING TYPE

1.2.3 MARKET: DEFINITION AND INCLUSIONS, BY END-USE

1.3 MARKET SCOPE

1.3.1 FIREPROOFING MATERIALS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 FIREPROOFING MATERIALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews –demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 –BOTTOM-UP (DEMAND SIDE): APPLICATIONS SERVED

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 –TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 6 FIREPROOFING MATERIALS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM THE SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 FIREPROOFING MATERIALS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 9 COMMERCIAL END-USE TO DOMINATE THE FIREPROOFING MATERIALS MARKET DURING THE FORECAST PERIOD

FIGURE 10 THIN FILM INTUMESCENT COATING TO BE THE LARGEST COATING TYPE OF FIREPROOFING MATERIALS DURING THE FORECAST PERIOD

FIGURE 11 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR FIREPROOFING MATERIAL MANUFACTURERS

FIGURE 12 INCREASE IN FIRE SAFETY REGULATIONS PROPELLING THE MARKET FOR FIREPROOFING MATERIALS

4.2 FIREPROOFING MATERIALS MARKET, BY REGION

FIGURE 13 NORTH AMERICA TO BE THE LARGEST FIREPROOFING MATERIALS MARKET BETWEEN 2021 AND 2026

4.3 FIREPROOFING MATERIALS MARKET, BY REGION AND END-USE

FIGURE 14 COMMERCIAL END-USE SEGMENT DOMINATED THE FIREPROOFING MATERIALS MARKET IN ALL REGIONS

4.4 NORTH AMERICA: FIREPROOFING MATERIALS MARKET, BY COATING TYPE AND COUNTRY, 2020

FIGURE 15 US AND THE INTUMESCENT COATINGS SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.5 FIREPROOFING MATERIALS MARKET ATTRACTIVENESS

FIGURE 16 ARGENTINA TO BE THE FASTEST-GROWING MARKET FOR FIREPROOFING MATERIALS BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FIREPROOFING MATERIALS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing fire safety regulations

5.2.1.2 Increasing preference for lightweight materials in the building & construction industry

5.2.1.3 Rising number of fire incidents

FIGURE 18 NUMBER OF STRUCTURAL FIRE INCIDENTS FOR 2018?

5.2.1.4 New rules for green and smart buildings and growing focus on obtaining green certifications

TABLE 2 TOP GREEN CERTIFICATION SCHEMES (2019)

5.2.2 RESTRAINTS

5.2.2.1 Economic slowdown and the impact of COVID-19 on the construction industry

TABLE 3 COVID-19 IMPACT ON RESIDENTIAL CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

TABLE 4 COVID-19 IMPACT ON NON-RESIDENTIAL CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

TABLE 5 COVID-19 IMPACT ON HEAVY & CIVIL ENGINEERING CONSTRUCTION MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

5.2.2.2 Rising environmental and health concerns due to the use of conventional chemicals in fireproofing materials

5.2.2.3 Price sensitivity in the emerging regions

5.2.3 OPPORTUNITIES

5.2.3.1 Development of more effective synergist compounds

5.2.3.2 Growing demand for developed intumescent fireproof and water-based coatings in construction projects

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and non-compliance to regulations in the emerging markets

5.2.4.2 Concerns related to coating application and durability

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS OF FIREPROOFING MATERIALS MARKET

TABLE 6 FIREPROOFING MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 20 FIREPROOFING MATERIALS MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIAL

5.4.2 MANUFACTURING OF FIREPROOFING MATERIALS

5.4.3 DISTRIBUTION TO END USERS

5.5 TECHNOLOGY ANALYSIS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.6.1 REVENUE SHIFTS & REVENUE POCKETS FOR FIREPROOFING MATERIAL MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR FIREPROOFING MATERIALS MARKET

5.7 ECOSYSTEM/ MARKET MAP

FIGURE 22 FIREPROOFING MATERIALS MARKET: ECOSYSTEM

TABLE 7 FIREPROOFING MATERIALS MARKET: SUPPLY CHAIN

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 APPROACH

5.8.3 DOCUMENT TYPE

TABLE 8 THE GRANTED PATENTS ARE 7% OF THE TOTAL COUNT BETWEEN 2010 AND 2020

FIGURE 23 PATENTS REGISTERED FOR FIREPROOFING MATERIALS, 2010–2020

FIGURE 24 PATENT PUBLICATION TRENDS FOR FIREPROOFING MATERIALS, 2010–2020

5.8.4 INSIGHTS

5.8.5 JURISDICTION ANALYSIS

FIGURE 25 MAXIMUM PATENTS FILED BY COMPANIES IN US

5.8.6 TOP APPLICANTS

FIGURE 26 AKZO NOBEL COATINGS INTERNATIONAL BV REGISTERED THE HIGHEST NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 9 TOP 10 PATENT OWNERS IN THE US, 2010-2020

5.9 CASE STUDIES

5.9.1 A CASE STUDY ON COATINGS USED IN BEIJING DAXING INTERNATIONAL AIRPORT TERMINAL

5.9.2 A CASE STUDY ON COATINGS USED FOR A LARGE LNG PROJECT

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON FIREPROOFING MATERIALS MARKET

5.10.1.1 US

5.10.1.2 Australia

5.10.1.3 Europe

5.10.1.4 South Africa

5.11 MACROECONOMIC INDICATORS

5.11.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

TABLE 10 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2018 –2026 (USD BILLION)

5.12 FIREPROOFING MATERIALS: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 27 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

TABLE 11 FIREPROOFING MATERIALS MARKET: MARKET FORECAST SCENARIOS, 2018- 2026 (USD MILLION)

5.12.1 NON-COVID-19 SCENARIO

5.12.2 OPTIMISTIC SCENARIO

5.12.3 PESSIMISTIC SCENARIO

5.12.4 REALISTIC SCENARIO

5.13 TRADE DATA

5.13.1 IMPORT SCENARIO OF FIREPROOFING MATERIALS

FIGURE 28 FIREPROOFING MATERIAL IMPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 12 FIREPROOFING MATERIAL IMPORTS, BY REGION, 2017–2020 (USD MILLION)

5.13.2 EXPORT SCENARIO OF FIREPROOFING MATERIALS

FIGURE 29 FIREPROOFING MATERIAL EXPORTS, BY KEY COUNTRIES, 2017–2020

TABLE 13 FIREPROOFING MATERIAL EXPORTS, BY REGION, 2017-2020 (USD MILLION)

5.14 COVID-19 IMPACT

5.14.1 INTRODUCTION

5.14.2 COVID-19 HEALTH ASSESSMENT

FIGURE 30 COUNTRY-WISE SPREAD OF COVID-19

5.14.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 31 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.14.3.1 COVID-19 Impact on Economy—Scenario Assessment

FIGURE 32 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 33 SCENARIOS OF COVID-19 IMPACT

6 FIREPROOFING MATERIALS MARKET, BY COATING TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 34 INTUMESCENT COATING SEGMENT TO LEAD THE FIREPROOFING MATERIALS MARKET DURING THE FORECAST PERIOD

TABLE 14 FIREPROOFING MATERIALS MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

6.2 INTUMESCENT COATING

TABLE 16 INTUMESCENT COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 INTUMESCENT COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.1 THIN FILM INTUMESCENT COATING

TABLE 18 THIN FILM INTUMESCENT COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 THIN FILM INTUMESCENT COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 THICK FILM INTUMESCENT COATING

TABLE 20 THICK FILM INTUMESCENT COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 THICK FILM INTUMESCENT COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 CEMENTITIOUS COATING

TABLE 22 CEMENTITIOUS COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 CEMENTITIOUS COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1 CEMENT BASED

TABLE 24 CEMENT BASED CEMENTITIOUS COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 CEMENT BASED CEMENTITIOUS COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 GYPSUM BASED

TABLE 26 GYPSUM-BASED CEMENTITIOUS COATING: FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 GYPSUM-BASED CEMENTITIOUS COATING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 FIREPROOFING MATERIALS MARKET, BY END-USE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 35 COMMERCIAL TO BE THE LARGEST END-USE SEGMENT IN THE FIREPROOFING MATERIALS MARKET

TABLE 28 FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 29 MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

7.2 COMMERCIAL

7.2.1 HIGH GROWTH IN COMMERCIAL CONSTRUCTION DRIVING THE FIREPROOFING MATERIALS MARKET

TABLE 30 FIREPROOFING MATERIALS MARKET SIZE IN THE COMMERCIAL END-USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 MARKET SIZE IN THE COMMERCIAL END-USE, BY REGION, 2020–2026 (USD MILLION)

7.3 INDUSTRIAL

7.3.1 INDUSTRIAL GROWTH IN EMERGING ECONOMIES TO DRIVE THE MARKET

TABLE 32 FIREPROOFING MATERIALS MARKET SIZE IN THE INDUSTRIAL END-USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET SIZE IN THE INDUSTRIAL END-USE, BY REGION, 2020–2026 (USD MILLION)

TABLE 34 MARKET SIZE IN THE ONSHORE INDUSTRIAL END-USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 MARKET SIZE IN THE ONSHORE INDUSTRIAL END-USE, BY REGION, 2020–2026 (USD MILLION)

TABLE 36 MARKET SIZE IN THE OFFSHORE INDUSTRIAL END-USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 MARKET SIZE IN THE OFFSHORE INDUSTRIAL END-USE, BY REGION, 2020–2026 (USD MILLION)

7.4 RESIDENTIAL

7.4.1 RISING GDP AND RISE IN INCOME DRIVING THE RESIDENTIAL AND HOUSING APPLICATIONS

TABLE 38 FIREPROOFING MATERIALS MARKET SIZE IN THE RESIDENTIAL END-USE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 MARKET SIZE IN THE RESIDENTIAL END-USE, BY REGION, 2020–2026 (USD MILLION)

8 FIREPROOFING MATERIALS MARKET, BY REGION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 36 NORTH AMERICA TO BE THE LARGEST FIREPROOFING MATERIALS MARKET DURING THE FORECAST PERIOD

TABLE 40 FIREPROOFING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: FIREPROOFING MATERIALS MARKET SNAPSHOT

8.2.1 NORTH AMERICA: MARKET, BY COATING TYPE

TABLE 42 NORTH AMERICA: FIREPROOFING MATERIALS MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

8.2.2 NORTH AMERICA: FIREPROOFING MATERIALS MARKET, BY END-USE

TABLE 44 NORTH AMERICA: MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.2.3 NORTH AMERICA: FIREPROOFING MATERIALS MARKET, BY COUNTRY

FIGURE 38 US TO BE THE LARGEST MARKET FOR FIREPROOFING MATERIALS IN NORTH AMERICA

TABLE 46 NORTH AMERICA: FIREPROOFING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.2.3.1 US

8.2.3.1.1 Increased emphasis on passive fire protection and certified fire protection experts driving the market in the US

TABLE 48 US: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.2.3.2 Canada

8.2.3.2.1 Growth in all construction segments leading to the growth of the market in Canada

TABLE 50 CANADA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.2.3.3 Mexico

8.2.3.3.1 Increased government investments on industrial and commercial infrastructure leading to market growth

TABLE 52 MEXICO: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 53 MEXICO: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3 EUROPE

FIGURE 39 EUROPE: FIREPROOFING MATERIALS MARKET SNAPSHOT

8.3.1 EUROPE: FIREPROOFING MATERIALS MARKET, BY COATING TYPE

TABLE 54 EUROPE: MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

8.3.2 EUROPE: FIREPROOFING MATERIALS MARKET, BY END-USE

TABLE 56 EUROPE: MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3 EUROPE: FIREPROOFING MATERIALS MARKET, BY COUNTRY

FIGURE 40 UK TO BE THE LARGEST MARKET FOR FIREPROOFING MATERIALS IN EUROPE

TABLE 58 EUROPE: FIREPROOFING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.3.3.1 Germany

8.3.3.1.1 Various global players and stringent building codes favoring the market for fireproofing materials

TABLE 60 GERMANY: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 61 GERMANY: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.2 UK

8.3.3.2.1 Increased construction activities and fire safety awareness to drive demand

TABLE 62 UK: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 63 UK: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.3 France

8.3.3.3.1 New opportunities in the construction industry due to the flourishing economy to lead to the growth of the market

TABLE 64 FRANCE: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 65 FRANCE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.4 Italy

8.3.3.4.1 Growth of the tourism industry and commercial construction activities are leading to the growth of the market

TABLE 66 ITALY: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 67 ITALY: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.5 Russia

8.3.3.5.1 Growth in infrastructure to drive market in Russia

TABLE 68 RUSSIA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 69 RUSSIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.6 Spain

8.3.3.6.1 Increased demand from residential end-use to lead to the growth of the market

TABLE 70 SPAIN: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 71 SPAIN: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.3.3.7 Benelux

8.3.3.7.1 Increased investments in the construction industry and growing tourism industry to boost the demand for fireproofing materials

TABLE 72 BENELUX: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 73 BENELUX: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4 APAC

FIGURE 41 APAC: FIREPROOFING MATERIALS MARKET SNAPSHOT

8.4.1 APAC: MARKET, BY COATING TYPE

TABLE 74 APAC: FIREPROOFING MATERIALS MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 75 APAC: MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

8.4.2 APAC: FIREPROOFING MATERIALS MARKET, BY END-USE

TABLE 76 APAC: MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 77 APAC: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3 APAC: MARKET, BY COUNTRY

FIGURE 42 CHINA TO BE THE LARGEST FIREPROOFING MATERIALS MARKET IN APAC

TABLE 78 APAC: FIREPROOFING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 79 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.4.3.1 China

8.4.3.1.1 The growing Chinese economy and ongoing infrastructural boom are leading to the high growth of the market

TABLE 80 CHINA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 81 CHINA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3.2 Japan

8.4.3.2.1 Stringent fire safety rules leading to the growth of the market for fireproofing materials

TABLE 82 JAPAN: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 83 JAPAN: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3.3 India

8.4.3.3.1 Increased emphasis on stringent fire safety codes spurring demand for fireproofing materials in the Indian market

TABLE 84 INDIA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 85 INDIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3.4 South Korea

8.4.3.4.1 Ongoing boom in the construction industry is a major driver for the market

TABLE 86 SOUTH KOREA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 87 SOUTH KOREA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3.5 Indonesia

8.4.3.5.1 Increased spending in better building materials, a key factor driving the market in the country

TABLE 88 INDONESIA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 89 INDONESIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.4.3.6 Australia & New Zealand

8.4.3.6.1 Increased infrastructure projects to drive the fireproofing materials market

TABLE 90 AUSTRALIA & NEW ZEALAND: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA: FIREPROOFING MATERIALS MARKET, BY COATING TYPE

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

8.5.2 MIDDLE EAST & AFRICA: MARKET, BY END-USE

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.5.3 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY

TABLE 96 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.5.3.1 South Africa

8.5.3.1.1 Economic growth after decades of political turmoil largely boosting the growth of the market

TABLE 98 SOUTH AFRICA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 99 SOUTH AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA: FIREPROOFING MATERIALS MARKET, BY COATING TYPE

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY COATING TYPE, 2016–2019 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY COATING TYPE, 2020–2026 (USD MILLION)

8.6.2 SOUTH AMERICA: MARKET, BY END-USE

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 103 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.6.3 SOUTH AMERICA: MARKET, BY COUNTRY

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.6.3.1 Brazil

8.6.3.1.1 Significant increase in government spending on national infrastructure expected to drive the market in the country

TABLE 106 BRAZIL: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 107 BRAZIL: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

8.6.3.2 Argentina

8.6.3.2.1 High demand for new constructions to act as the market driver in the country

TABLE 108 ARGENTINA: FIREPROOFING MATERIALS MARKET SIZE, BY END-USE, 2016–2019 (USD MILLION)

TABLE 109 ARGENTINA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 140)

9.1 INTRODUCTION

9.2 STRATEGIES ADOPTED BY KEY PLAYERS

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY FIREPROOFING MATERIAL MANUFACTURERS

9.3 MARKET SHARE ANALYSIS

9.3.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN FIREPROOFING MATERIALS MARKET, 2020

9.3.2 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 110 FIREPROOFING MATERIALS MARKET: DEGREE OF COMPETITION

FIGURE 44 FIREPROOFING MATERIALS MARKET SHARE, BY COMPANY, 2020

9.3.2.1 Akzo Nobel N.V.

9.3.2.2 PPG Industries Inc.

9.3.2.3 Etex Group

9.3.2.4 Jotun Group

9.3.2.5 Sika AG

9.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2016-2020

FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

9.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 46 FIREPROOFING MATERIALS MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 111 MARKET: COATING TYPE FOOTPRINT

TABLE 112 MARKET: END-USE FOOTPRINT

TABLE 113 MARKET: COMPANY REGION FOOTPRINT

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 EMERGING LEADER

FIGURE 47 FIREPROOFING MATERIALS MARKET: COMPANY EVALUATION MATRIX (TIER 1), 2020

9.6 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.6.1 RESPONSIVE COMPANIES

9.6.2 STARTING BLOCKS

FIGURE 48 START-UP/SMES EVALUATION MATRIX FOR FIREPROOFING MATERIALS MARKET

9.7 COMPETITIVE SITUATIONS AND TRENDS

9.7.1 NEW PRODUCT LAUNCHES

TABLE 114 FIREPROOFING MATERIALS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019 TO DECEMBER 2020

9.7.2 DEALS

TABLE 115 FIREPROOFING MATERIALS MARKET: DEALS, JANUARY 2019 TO JUNE 2021

9.7.3 OTHER DEVELOPMENTS

TABLE 116 FIREPROOFING MATERIALS MARKET: OTHER DEVELOPMENTS, JANUARY 2019 TO DECEMBER 2020

10 COMPANY PROFILES (Page No. - 153)

10.1 MAJOR PLAYERS

(Business Overview, Products/services/solutions offered, MnM View, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats)*

10.1.1 3M

FIGURE 49 3M: COMPANY SNAPSHOT

TABLE 117 3M: BUSINESS OVERVIEW

10.1.2 AKZO NOBEL N.V.

FIGURE 50 AKZO NOBEL N.V.: COMPANY SNAPSHOT

TABLE 118 AKZO NOBEL N.V.: BUSINESS OVERVIEW

10.1.3 ISOLATEK INTERNATIONAL

TABLE 119 ISOLATEK INTERNATIONAL: BUSINESS OVERVIEW

10.1.4 SIKA AG

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

TABLE 120 SIKA AG: BUSINESS OVERVIEW

10.1.5 ETEX GROUP

FIGURE 52 ETEX GROUP: COMPANY SNAPSHOT

TABLE 121 ETEX GROUP: BUSINESS OVERVIEW

10.1.6 PPG INDUSTRIES, INC.

FIGURE 53 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 122 PPG INDUSTRIES, INC.: BUSINESS OVERVIEW

10.1.7 BASF SE

FIGURE 54 BASF SE: COMPANY SNAPSHOT

TABLE 123 BASF SE: BUSINESS OVERVIEW

10.1.8 CARBOLINE

TABLE 124 CARBOLINE: BUSINESS OVERVIEW

10.1.9 RPM INTERNATIONAL INC.

FIGURE 55 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 125 RPM INTERNATIONAL INC.: BUSINESS OVERVIEW

10.1.10 JOTUN GROUP

FIGURE 56 JOTUN GROUP: COMPANY SNAPSHOT

TABLE 126 JOTUN GROUP: BUSINESS OVERVIEW

10.2 OTHER KEY MARKET PLAYERS

10.2.1 IRIS COATINGS S.R.L.

TABLE 127 IRIS COATINGS S.R.L.: COMPANY OVERVIEW

10.2.2 KNAUF INSULATION GMBH

TABLE 128 KNAUF INSULATION GMBH: COMPANY OVERVIEW

10.2.3 HEMPEL GROUP

TABLE 129 HEMPEL GROUP: COMPANY OVERVIEW

10.2.4 W. R. GRACE & CO.

TABLE 130 W. R. GRACE & CO.: COMPANY OVERVIEW

10.2.5 ROLF KUHN GMBH

TABLE 131 ROLF KUHN GMBH: COMPANY OVERVIEW

10.2.6 ROCKWOOL INTERNATIONAL AS

TABLE 132 ROCKWOOL INTERNATIONAL AS: COMPANY OVERVIEW

10.2.7 NO-BURN INC.

TABLE 133 NO-BURN INC.: COMPANY OVERVIEW

10.2.8 THE SHERWIN-WILLIAMS COMPANY

TABLE 134 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

10.2.9 CONTEGO INTERNATIONAL INC.

TABLE 135 CONTEGO INTERNATIONAL INC.: COMPANY OVERVIEW

10.2.10 DEN BRAVEN

TABLE 136 DEN BRAVEN: COMPANY OVERVIEW

10.2.11 ENCON INSULATION LTD

TABLE 137 ENCON INSULATION LTD: COMPANY OVERVIEW

10.2.12 UGAM CHEMICALS

TABLE 138 UGAM CHEMICALS: COMPANY OVERVIEW

10.2.13 INTUMESCENT SYSTEMS LTD

TABLE 139 INTUMESCENT SYSTEMS LTD.: COMPANY OVERVIEW

10.2.14 PK COMPANIES (US)

TABLE 140 PK COMPANIES: COMPANY OVERVIEW

10.2.15 FLAMEOFF COATINGS INC (US)

TABLE 141 FLAMEOFF COATINGS INC: COMPANY OVERVIEW

*Details on Business Overview, Products/services/solutions offered, MnM View, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 189)

11.1 INTRODUCTION

11.2 LIMITATION

11.3 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.4 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY REGION

TABLE 142 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2018–2025 (THOUSAND LITER)

TABLE 143 CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.4.1 NORTH AMERICA

11.4.1.1 By country

TABLE 144 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 145 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.1.2 By type

TABLE 146 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 147 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.4.1.3 By end-use

TABLE 148 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END-USE, 2018–2025 (THOUSAND LITER)

TABLE 149 NORTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET, BY END-USE, 2018–2025 (USD MILLION)

11.4.2 EUROPE

11.4.2.1 By country

TABLE 150 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 151 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.2.2 By type

TABLE 152 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 153 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.4.2.3 By end-use

TABLE 154 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (THOUSAND LITER)

TABLE 155 EUROPE: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (USD MILLION)

11.4.3 APAC

11.4.3.1 By country

TABLE 156 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 157 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.3.2 By type

TABLE 158 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 159 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.4.3.3 By end-use

TABLE 160 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (THOUSAND LITER)

TABLE 161 APAC: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (USD MILLION)

11.4.4 MIDDLE EAST & AFRICA

11.4.4.1 By country

TABLE 162 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 163 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.4.2 By type

TABLE 164 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 165 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.4.4.3 By end-use

TABLE 166 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (THOUSAND LITER)

TABLE 167 MIDDLE EAST & AFRICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (USD MILLION)

11.4.5 SOUTH AMERICA

11.4.5.1 By country

TABLE 168 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND LITER)

TABLE 169 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.5.2 By type

TABLE 170 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND LITER)

TABLE 171 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11.4.5.3 By end-use

TABLE 172 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (THOUSAND LITER)

TABLE 173 SOUTH AMERICA: CELLULOSIC FIRE PROTECTION INTUMESCENT COATINGS MARKET SIZE, BY END-USE, 2018–2025 (USD MILLION)

12 APPENDIX (Page No. - 203)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size for fireproofing materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The fireproofing materials market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as automotive, power generation, construction, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fireproofing materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the fireproofing materials market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the fireproofing materials market on the basis of coating type and end use

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as new product launch, merger & acquisition in the fireproofing materials market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fireproofing Materials Market