Centesis Catheters Market Size by Type (Small and Large bore), Procedure (Paracentesis, Thoracentesis, Amniocentesis), Application (Diagnosis, Therapeutics and Palliative care), End user (Hospitals, Ambulatory surgery centers), Region - Global Forecasts to 2025

Updated on : September 24, 2024

Overview of the Centesis Catheters Market

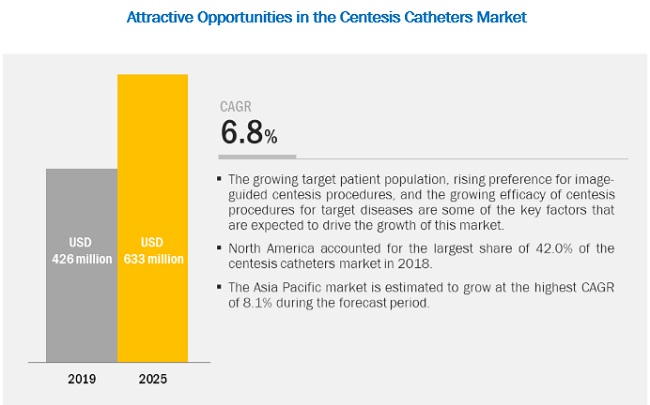

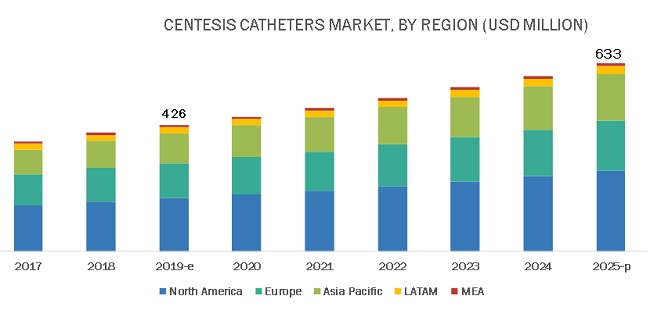

The size of centesis catheters market in terms of revenue was estimated to be worth $426 million in 2019 and is poised to reach $633 million by 2025, growing at a CAGR of 6.8% from 2019 to 2025. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in the global centesis catheters market can be attributed to factors such as the rising target patient population (particularly patients suffering from cancer, TB, and cardiovascular diseases), growing preference for image-guided centesis procedures, and the increasing evidence for the efficacy of centesis procedures for target diseases. However, premium product pricing and complexities associated with centesis procedures are some of the major factors that are expected to restrain the growth of this market in the coming years.

Small-bore centesis catheters segment to grow at the highest rate in the centesis catheters market, by type, during the forecast period

Based on type, the market is segmented into small-bore and large-bore centesis catheters. The small-bore centesis catheters segment accounted for the largest share of this market in 2018. The large share of this segment can be attributed to the wide availability of small-bore centesis catheters, growing number of target procedures that require small-bore centesis catheters, increasing evidence of the efficacy and safety of small-bore centesis catheters over large-bore centesis catheters, and their higher adoption in diagnostic centesis procedures.

Paracentesis procedures segment accounted for the largest share of the centesis catheters market, by procedure, in 2018

Based on procedure, the market is segmented into paracentesis, thoracentesis, arthrocentesis, amniocentesis, and other procedures. The paracentesis segment accounted for the largest share of this market in 2018. The rising incidence of target conditions such as gastrointestinal malignancies, liver cirrhosis, cystic fibrosis, intestinal tuberculosis, chronic liver failure, formation of cysts in the peritoneal cavity, and serious forms of hepatitis is expected to drive the growth of this market segment in the coming years. However, the thoracentesis segment is expected to grow at the highest rate during the forecast period.

Asia Pacific market is estimated to grow at the highest CAGR in the coming years

Geographically, this market is classified into North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. In 2018, North America was the largest regional market for centesis catheters. This can primarily be attributed to the high number of cardiovascular, neurovascular, and other target procedures performed in the region. Factors such as the large patient pool, the presence of a well-established healthcare system, and on-going investments by hospitals to upgrade their operating rooms are driving the growth of this regional market.

The Asia Pacific market is estimated to grow at the highest CAGR during the forecast period. This can be attributed to the presence of a large patient pool, increasing incidence and prevalence of target diseases, improving healthcare infrastructure in Asian countries, and the favorable government initiatives for improving access to healthcare.

The key players operating in the global centesis catheters market are AngioDynamics, Inc. (US), ARGON MEDICAL (US), Avanos Medical Devices (US), Axiom Medical, Inc. (US), B. Braun Melsungen AG (Germany), Becton, Dickinson and Company (US), Blue Neem Medical Devices Pvt. Ltd. (India), Boston Scientific Corporation (US), Canadian Hospital Specialties Ltd. (Canada), Cardinal Health (US), Cook Medical (US), Galt Medical Corp. (US), Guangzhou Leadgem Medical Device Co., Ltd. (China), KM Medical (US), Medical Components, Inc. (US), Medtronic (Ireland), Merit Medical Systems (US), Mermaid Medical A/S (Denmark), MoFlo Medical Technology Co., Ltd. (China), Neuromedex GmbH (Germany), Ningbo Honde Medical Instruments Co., Ltd. (China), PFM Medical, Inc. (US), Polymedicure (India), REDAX (Italy), Rocket Medical plc. (UK), Romsons (India), Smiths Medical (US), Teleflex Incorporated (US), UreSil, LLC (US), and Utah Medical Products, Inc. (US).

Public companies such as Cardinal Health, Medtronic, Boston Scientific, and BD accounted for a significant share of this market in 2018. However, private companies such as Cook Medical, UreSil, Galt Medical, Axiom Medical, Mermaid Medical, PFM Medical, and REDAX Medical, among other companies, are also estimated to have a strong presence in this market and are competing with the major public companies for market share. Major companies in this market, such as Cook Medical and Merit Medical, are focusing on strategic expansions to strengthen their presence in various geographies and expand their customer base.

Scope of the Centesis Catheters Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2019 |

$426 million |

|

Projected Revenue Size by 2025 |

$633 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.8% |

|

Market Driver |

Growth in the target patient population |

|

Market Opportunity |

Emerging countries |

This research report categorizes the centesis catheters market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Small-bore Centesis Catheters

- Large-bore Centesis Catheters

By Procedure

- Paracentesis

- Thoracentesis

- Arthrocentesis

- Amniocentesis

- Other procedures

By Application

- Diagnostic Applications

- Therapeutic Applications

- Palliative Care Applications

By End User

- Hospitals

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of the Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (Rest of LATAM)

- Middle East and Africa

Recent Developments

- In 2019, Galt Medical Corp (US) acquired Arrotek Medical Limited (Ireland) that expanded the former’s minimally invasive devices portfolio.

- In 2019, Merit Medical (US) launched the ReSolve Mini Locking Drainage Catheter with a 42% smaller pigtail design (as compared to the other ReSolve Mini drainage catheters offered by the company).

- In 2017, Teleflex Incorporated (US) acquired Vascular Solutions, Inc. (US).

- In 2017, Cardinal Health (US) acquired the Patient Care, Deep Vein Thrombosis, and Nutrient Insufficiency business lines from Medtronic, plc (Ireland).

Key questions addressed by the report:

- What are the growth opportunities related to the adoption of centesis catheters across major regions in the future?

- What is the prevailing competitive scenario among the key players in the centesis catheters market?

- What are the various medical procedures and applications wherein centesis catheters find a high adoption rate?

- What are the new research findings with regard to centesis catheter-based procedural applications?

- What will be the future trends that will shape the global centesis catheters market over the next five years?

Frequently Asked Questions (FAQ):

What is the expected addressable market value of centesis catheters market over a 5-year period?

Based on the prevailing trends and estimated market value data as of 2019, the total market value of centesis catheters is estimated to be about USD 0.43 billion; and is expected to reach a value of USD 0.63 billion by 2025.

What are the major challenges faced by the players operating in the centesis catheters market?

Device recalls, clinical complications associated with centesis procedures, complexities related to product development and manufacture, taxation policies, and trade barriers are few major challenges faced by players active in centesis catheters market.

What are the major end use applications of centesis catheters globally?

Centesis catheters are used in diagnostic, therapeutic, and palliative care applications. Some of the centesis procedures that are performed as a part of these applications include thoracentesis, paracentesis, amniocentesis, arthrocentesis, and pericardiocentesis. The diagnostic application segment has larger estimated market share in 2019. Similarly, the paracentesis procedure segment accounted for the largest share in the same year.

What are the opportunities available for new entrants as well as existing market players in the centesis catheters market space?

Growing preference for image-guided centesis procedures, growth in the target patient population, growing evidence of the efficacy of centesis procedures in target diseases, and increasing adoption of centesis based procedures in emerging countries for addressing target diseases are some of the key available opportunities for players in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 USAGE-BASED MARKET ESTIMATION

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 CENTESIS CATHETERS MARKET OVERVIEW

4.2 MARKET, BY PROCEDURE AND REGION (USD MILLION)

4.3 MARKET SHARE, BY END USER, 2019 VS. 2025

4.4 GEOGRAPHICAL SNAPSHOT OF THE MARKET

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in the target patient population

5.2.1.2 Growing preference for image-guided centesis procedures

5.2.1.3 Growing evidence of the efficacy of centesis procedures for target diseases

5.2.2 RESTRAINTS

5.2.2.1 Premium product pricing

5.2.2.2 Taxation policies and trade barriers

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries

5.2.4 CHALLENGES

5.2.4.1 Complexities related to product development and manufacturing

5.2.4.2 Complications associated with centesis procedures

5.2.4.3 Product failure and recalls

6 CENTESIS CATHETERS MARKET, BY TYPE (Page No. - 41)

6.1 INTRODUCTION

6.2 SMALL-BORE CENTESIS CATHETERS

6.2.1 INCREASING EVIDENCE OF THE EFFICACY AND SAFETY OF SMALL-BORE CENTESIS CATHETERS OVER LARGE-BORE CENTESIS CATHETERS TO SUPPORT MARKET GROWTH

6.3 LARGE-BORE CENTESIS CATHETERS

6.3.1 NECESSITY OF LARGE-VOLUME CENTESIS DRIVING THE NEED FOR LARGE-BORE CENTESIS CATHETERS

7 CENTESIS CATHETERS MARKET, BY PROCEDURE (Page No. - 49)

7.1 INTRODUCTION

7.2 PARACENTESIS

7.2.1 PARACENTESIS IS THE LARGEST PROCEDURE SEGMENT IN THE MARKET

7.3 THORACENTESIS

7.3.1 RISING INCIDENCE OF LUNG AND GASTROINTESTINAL MALIGNANCIES TO INCREASE THE NUMBER OF THORACENTESIS PROCEDURES

7.4 ARTHROCENTESIS

7.4.1 RISING INCIDENCE OF ARTHRITIS AND JOINT DISORDERS TO INCREASE THE NUMBER OF ARTHROCENTESIS PROCEDURES

7.5 AMNIOCENTESIS

7.5.1 GROWING NUMBER OF DIAGNOSTIC PROCEDURES THROUGH AMNIOCENTESIS IN PREGNANT WOMEN TO SUPPORT THE GROWTH OF THIS MARKET SEGMENT

7.6 OTHER CENTESIS PROCEDURES

8 CENTESIS CATHETERS MARKET, BY APPLICATION (Page No. - 56)

8.1 INTRODUCTION

8.2 DIAGNOSTIC APPLICATIONS

8.2.1 GROWING DEPENDENCY ON CENTESIS PROCEDURES AS A MEANS OF DIAGNOSING TARGET DISEASES TO SUPPORT MARKET GROWTH

8.3 THERAPEUTIC APPLICATIONS

8.3.1 GROWING EVIDENCE SUPPORTING THE USE OF CENTESIS PROCEDURES FOR THE TREATMENT OF TARGET DISEASES TO DRIVE MARKET GROWTH

8.4 PALLIATIVE CARE APPLICATIONS

8.4.1 CENTESIS PROCEDURES ARE USED IN THE PALLIATIVE CARE OF PATIENTS SUFFERING FROM MALIGNANCIES

9 CENTESIS CATHETERS MARKET, BY END USER (Page No. - 61)

9.1 INTRODUCTION

9.2 HOSPITALS

9.2.1 MAJORITY OF CENTESIS PROCEDURES ARE PERFORMED IN HOSPITALS

9.3 AMBULATORY SURGICAL CENTERS

9.3.1 GROWING PATIENT VOLUMES IN AMBULATORY SURGICAL CENTERS TO DRIVE MARKET GROWTH

9.4 OTHER END USERS

10 CENTESIS CATHETERS MARKET, BY REGION (Page No. - 65)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 High burden of target diseases and large number of surgical procedures to support market growth

10.2.2 CANADA

10.2.2.1 Rising public-private investments to drive market growth in Canada

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Germany accounted for the largest share of the European market in 2018

10.3.2 FRANCE

10.3.2.1 France to witness the highest growth in the European market during the forecast period

10.3.3 UK

10.3.3.1 High burden of chronic diseases to drive the adoption of centesis catheters

10.3.4 SPAIN

10.3.4.1 High burden of chronic diseases and the large volume of surgical procedures performed to support market growth in Spain

10.3.5 ITALY

10.3.5.1 High burden of chronic diseases to drive market growth in Italy

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 JAPAN

10.4.1.1 Rising geriatric population is a major factor supporting market growth in Japan

10.4.2 CHINA

10.4.2.1 Market in China to grow at the highest CAGR during the forecast period

10.4.3 INDIA

10.4.3.1 Growing availability of advanced surgical treatments to drive the adoption of centesis catheters

10.4.4 AUSTRALIA

10.4.4.1 Increasing target disease burden to support market growth in Australia

10.4.5 SOUTH KOREA

10.4.5.1 Growing incidence of malignancies of lung and liver are expected to support market growth in South Korea

10.4.6 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.5.1 BRAZIL

10.5.1.1 Growing disease burden and rising awareness about advanced diagnostic and treatment procedures to support market growth in Brazil

10.5.2 MEXICO

10.5.2.1 Favorable investment scenario for medical device manufacturers to drive market growth in Mexico

10.5.3 REST OF LATIN AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 LOW DISPOSABLE INCOME AND NEED FOR INFRASTRUCTURAL DEVELOPMENT TO HINDER MARKET GROWTH

11 COMPETITIVE LANDSCAPE (Page No. - 111)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

11.3 COMPETITIVE SCENARIO (2016–2019)

11.3.1 PRODUCT LAUNCHES AND ENHANCEMENTS (2016–2019)

11.3.2 KEY ACQUISITIONS (2016–2019)

11.3.3 KEY EXPANSIONS (2016–2019)

11.4 GLOBAL CENTESIS CATHETERS MARKET SHARE ANALYSIS (2018)

12 COMPANY PROFILES (Page No. - 116)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 CARDINAL HEALTH, INC.

12.2 MEDTRONIC PLC

12.3 BOSTON SCIENTIFIC CORPORATION

12.4 BECTON, DICKINSON AND COMPANY

12.5 B. BRAUN MELSUNGEN AG

12.6 MERIT MEDICAL SYSTEMS, INC.

12.7 TELEFLEX INCORPORATED

12.8 ANGIODYNAMICS

12.9 COOK MEDICAL

12.11 URESIL LLC.

12.11 REDAX S.P.A.

12.12 MERMAID MEDICAL A/S

12.13 ARGON MEDICAL

12.14 GALT MEDICAL CORP.

12.15 ROCKET MEDICAL PLC

12.16 PFM MEDICAL, INC.

12.17 MEDICAL COMPONENTS, INC.

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.18 OTHER COMPANIES

12.18.1 KM MEDICAL, INC.

12.18.2 BLUE NEEM MEDICAL DEVICES PVT. LTD.

12.18.3 CANADIAN HOSPITAL SPECIALTIES, LTD.

13 APPENDIX (Page No. - 145)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (118 Tables)

TABLE 1 CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 2 SMALL-BORE CENTESIS CATHETERS OFFERED BY KEY MARKET PLAYERS

TABLE 3 SMALL-BORE CENTESIS CATHETERS MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 4 SMALL-BORE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 5 SMALL-BORE MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 6 SMALL-BORE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 7 LARGE-BORE CENTESIS CATHETERS OFFERED BY KEY MARKET PLAYERS

TABLE 8 LARGE-BORE CENTESIS CATHETERS MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 9 LARGE-BORE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 10 LARGE-BORE MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 11 LARGE-BORE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 CENTESIS CATHETERS MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 13 MARKET FOR PARACENTESIS, BY REGION, 2017–2025 (USD MILLION)

TABLE 14 MARKET FOR THORACENTESIS, BY REGION, 2017–2025 (USD MILLION)

TABLE 15 MARKET FOR ARTHROCENTESIS, BY REGION, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR AMNIOCENTESIS, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR OTHER PROCEDURES, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 19 MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 20 MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 21 MARKET FOR PALLIATIVE CARE APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 23 MARKET FOR HOSPITALS, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR OTHER END USERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: CENTESIS CATHETERS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 32 US: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 33 US: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 34 US: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 35 US: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 36 CANADA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 37 CANADA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 38 CANADA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 39 CANADA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 40 EUROPE: CENTESIS CATHETERS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 41 EUROPE: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 43 EUROPE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 45 GERMANY: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 46 GERMANY: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 47 GERMANY: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 48 GERMANY: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 49 FRANCE: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 50 FRANCE: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 51 FRANCE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 52 FRANCE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 53 UK: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 54 UK: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 55 UK: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 56 UK: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 57 SPAIN: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 58 SPAIN: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 59 SPAIN: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 60 SPAIN: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 61 ITALY: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 62 ITALY: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 63 ITALY: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 64 ITALY: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 65 ROE: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 66 ROE: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 67 ROE: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 68 ROE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 69 APAC: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 70 APAC: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 71 APAC: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 72 APAC: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 73 APAC: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 74 JAPAN: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 75 JAPAN: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 76 JAPAN: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 78 CHINA: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 79 CHINA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 80 CHINA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 81 CHINA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 82 INDIA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 83 INDIA: CATHETERS MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 84 INDIA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 85 INDIA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 86 AUSTRALIA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 87 AUSTRALIA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 88 AUSTRALIA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 89 AUSTRALIA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 90 SOUTH KOREA: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 91 SOUTH KOREA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 92 SOUTH KOREA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 93 SOUTH KOREA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 94 ROAPAC: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 95 ROAPAC: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 96 ROAPAC: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 97 ROAPAC: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 98 LATAM: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 99 LATAM: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 100 LATAM: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 101 LATAM: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 102 LATAM: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 103 BRAZIL: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 104 BRAZIL: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 105 BRAZIL: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 106 BRAZIL: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 107 MEXICO: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 108 MEXICO: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 109 MEXICO: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 110 MEXICO: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 111 ROLA: MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 112 ROLA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 113 ROLA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 114 ROLA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 115 MEA: CENTESIS CATHETERS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 116 MEA: MARKET, BY PROCEDURE, 2017–2025 (USD MILLION)

TABLE 117 MEA: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 118 MEA: MARKET, BY END USER, 2017–2025 (USD MILLION)

LIST OF FIGURES (30 Figures)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 4 MARKET SIZE ESTIMATION: CENTESIS CATHETERS MARKET

FIGURE 5 GLOBAL MARKET: DATA TRIANGULATION

FIGURE 6 MARKET, BY TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 7 MARKET, BY PROCEDURE, 2019 VS. 2025 (USD MILLION)

FIGURE 8 MARKET, BY APPLICATION, 2019 VS. 2025 (USD MILLION)

FIGURE 9 MARKET, BY END USER, 2019 VS. 2025 (USD MILLION)

FIGURE 10 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 11 GROWING TARGET PATIENT POPULATION TO SUPPORT MARKET GROWTH IN THE COMING YEARS

FIGURE 12 PARACENTESIS PROCEDURES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2018

FIGURE 13 HOSPITALS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 14 MARKET IN CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 17 EUROPE: MARKET SNAPSHOT

FIGURE 18 APAC: MARKET SNAPSHOT

FIGURE 19 LATAM: MARKET SNAPSHOT

FIGURE 20 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 21 KEY DEVELOPMENTS IN THE MARKET, 2016–2019

FIGURE 22 GLOBAL MARKET SHARE ANALYSIS (2018)

FIGURE 23 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

FIGURE 24 MEDTRONIC PLC: COMPANY SNAPSHOT

FIGURE 25 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 26 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

FIGURE 27 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 28 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 29 TELEFLEX INCORPORATED: COMPANY SNAPSHOT

FIGURE 30 ANGIODYNAMICS: COMPANY SNAPSHOT

This research study involved four major activities to estimate the current size of the global centesis catheters market. Exhaustive secondary research was done to collect information on the market and subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases (such as D&B, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

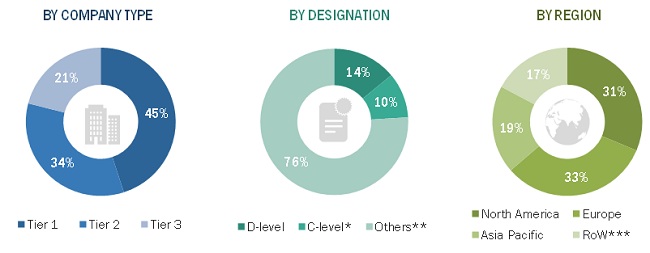

Extensive primary research was conducted after acquiring a detailed understanding of the centesis catheters market scenario through secondary research. A significant number of primary interviews were conducted with both the demand side (such as hospitals, cancer research laboratories, research universities, and government institutions) and supply-side respondents (such as product manufacturers and distributors). The primaries interviewed for this study include experts from the centesis catheters industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering centesis catheters products and services across the globe; administrators and purchase managers of centesis catheter products; and academic research institutes. Approximately 65% and 35% of primary interviews were conducted with supply- and demand-side respondents, respectively. This primary data was collected through questionnaires, emails, web-based surveys, and telephonic interviews. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the centesis catheters market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the centesis catheters market were identified through secondary research, and their market shares at a global and/or regional level were determined through primary and secondary research.

- The research methodology included the study of the regulatory filings (such as annual and quarterly financial reports) of the major market players as well as interviews with industry experts for key insights on the centesis catheters market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the expected macro-indicators affecting the growth of the respective segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and/or qualitative data.

- The above-mentioned data was consolidated and added to detailed inputs, analyzed, and presented in this report.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the centesis catheters industry.

Report Objectives

- To define, describe, and forecast the centesis catheters market on the basis of procedure, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the centesis catheters market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to their individual growth trends, prospects, and contributions to the overall centesis catheters market

- To analyze opportunities in the global centesis catheters market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the market value data for various market segments and sub-segments with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key global players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, mergers & acquisitions, expansions, partnerships, collaborations, and agreements in the global centesis catheters market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the centesis catheters market

Company Information

- Detailed analysis and profiling of additional market companies (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Centesis Catheters Market