Clinical Decision Support Systems Market Size, Growth, Share & Trends Analysis

Clinical Decision Support Systems (CDSS) Market by Component (Services, Software), Delivery (On-premise, Cloud), Product (Standalone, Integrated), Application (Advanced, Therapeutic, Diagnostic), Interactivity (Active, Passive) - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The clinical decision support system market is projected to reach USD 3.89 billion by 2030 from USD 2.46 billion in 2025, at a CAGR of 9.6% from 2025 to 2030. The rising adoption of healthcare IT solutions, increasing demand for better clinical outcomes, and concerns over medication errors and patient safety are driving the growth of CDSS. Advancements in AI, machine learning, and natural language processing are improving the accuracy and efficiency of CDSS tools, while government initiatives, widespread EHR use, and investments in digital health infrastructure are further fueling market expansion worldwide.

KEY TAKEAWAYS

- The North America Clinical Decision Support Systems market accounted for a 58.7% revenue share in 2024.

- By component, the software segment is expected to register the highest CAGR of 10.4%.

- By product, the integrated CDSS segment is expected to dominate the market with 74.7% market share in 2024.

- By type, the theraputic CDSS is anticipated to register the highest growth rate.

- By Model, the knowledge-based CDSS segment is projected to grow at the fastest rate from 2025 to 2030.

- By delivery mode, the on-premises is expected to dominate the market.

- By application, the advanced CDSS iss anticipated to register the highest growth rate.

- By level of interactivity, the active CDSS companies segment is projected to grow at the fastest rate from 2025 to 2030.

- By setting, the inpatient setting is expected to dominate the market in 2024.

- Epic Systems Corporation, Wolters Kluwer N.V., Oracle, Merative, Change Healthcare,Veradigm LLC, athenahealth, Koninklijke Philips N.V. were identified as some of the star players in the IoT medical devices market, given their strong market share and product footprint

- The Medical Algorithms Company, RAMPmedical, Hera-MI, CareCloud, Inc., VisualDx, Stanson Health, First Databank, Inc., Strata Decision Technology, and Alcidion among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The clinical decision support system market is experiencing robust growth, driven by the increasing need for data-driven, evidence-based healthcare solutions that enhance clinical decision-making, improve patient outcomes, and optimize operational efficiency. Rising adoption of electronic health records (EHRs), AI-enabled analytics, and personalized care tools is accelerating market expansion. Recent developments, including strategic partnerships between CDSS vendors and healthcare providers, integration with telehealth platforms, and innovations in predictive analytics and workflow automation, are reshaping the market landscape and enabling more precise, timely, and patient-centric care delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of clinical decision support system platform providers, and target applications are clients of clinical decision support system platform providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of clinical decision support system platform providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing government regulations for HCIT implementation

-

Growing adoption of CDSS-enabled electronic health records

Level

-

Data security concerns

-

Inadequate interoperability for patient management solutions

Level

-

High growth potential in emerging economies

-

Development of big data and mHealth tools

Level

-

High capital investments for CDSS infrastructure

-

Shortage of skilled IT professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing government regulations for HCIT implementation

Recent global regulations and government initiatives are accelerating the adoption of clinical decision support systems (CDSS). In the US, the CMS Interoperability and Prior Authorization Rule (2024) enhances data exchange for CDSS deployment. Europe’s EHDS regulation (2025) promotes standardized, cross-border EHR use. The USD 8.34 billion Health Innovation Plan of France and the USD 40 million NHS tech of the UK pledge further support CDSS integration through investments in digital health and advanced care technologies. These efforts are creating a unified digital infrastructure, improving care delivery, and enabling AI-powered clinical insights at scale.

Restraint: Data security concerns

Data security concerns remain a major barrier to the adoption of cloud-based CDSS, with healthcare providers cautious about exposing sensitive patient data to cyber threats. In 2023, over 167 million Americans were affected by healthcare data breaches, prompting the US to propose stricter HIPAA cybersecurity rules, including encryption and multifactor authentication. Germany followed in 2024 with enhanced regulations for health data in the cloud. Despite these efforts, concerns around data sovereignty, regulatory complexity, and unauthorized access continue to limit widespread adoption.

Opportunity: High growth potential in emerging economies

Emerging markets in the Asia Pacific region, such as India and China, offer significant growth opportunities for CDSS. The Ayushman Bharat Digital Mission (ABDM) in India has created over 73 crore health accounts and registered 5 lakh healthcare professionals, driving digital healthcare transformation. Similarly, China’s digital healthcare market reached 195.4 billion CNY in 2022, with 90% of tertiary hospitals implementing EMRs. These initiatives, along with rising healthcare spending and a skilled IT workforce, support the growth of CDSS in the region.

Challenge: High capital investments for CDSS infrastructure

Most healthcare providers lack the necessary infrastructure, such as technology, data, and resources, to implement complex IT solutions like CDSS. To deploy these systems successfully, providers must invest in enhancing their IT infrastructure, including data storage and processing capabilities. Additionally, the ongoing costs of maintenance and software updates can sometimes exceed the initial software cost, with support services accounting for up to 30% of the total cost of ownership.

Clinical Decision Support Systems (CDSS) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

EHR-integrated CDS modules embedded within Epic’s platform deliver real-time alerts, reminders, and evidence-based guidelines directly at the point of care. | Reduced medication errors, improves adherence to clinical guidelines, enhances diagnostic accuracy, and supports timely interventions. |

|

UpToDate and Medi-Span provide evidence-based knowledge, drug interaction alerts, and clinical recommendations integrated with EHR/EMR systems to guide care decisions. | Improved clinician decision-making, reduces adverse drug events, accelerates clinical workflows, and standardizes evidence-based care delivery. |

|

Oracle Cerner’s AI-driven CDS solutions offered predictive alerts, risk stratification, and guideline-based recommendations across care settings to enable proactive and personalized care. | Supported early risk detection, reduces hospital readmission rates, improves population health management, and optimizes resource utilization. |

|

Merative’s CDS solutions leverage AI, NLP, and real-world evidence generated personalized, evidence-based treatment recommendations for complex cases such as oncology and cardiology. | Enhanced precision in clinical decision-making, supports evidence-based treatment planning, improves diagnostic accuracy, reduces care variability, and enables early risk detection. |

|

Cloud-based EHR platform integrates real-time CDS capabilities, including automated alerts, best-practice recommendations, medication interaction checks, and preventive care reminders. | Improved care quality and patient safety, enhances adherence to clinical guidelines and preventive care protocols, reduces medication errors and adverse events, streamlines clinical workflows, and supports value-based care initiatives. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The clinical decision support system market ecosystem consists of software providers, analytical tool providers, key startups, and end users. Software providers like Epic, Oracle, athenahealth, Merative, and Wolters Kluwer develop core CDSS platforms that enable clinical decision-making and workflow optimization. Analytical tool providers such as Microsoft, Red Hat, JMP, and Tableau offer supporting analytics, data visualization, and reporting capabilities to enhance insights. Key startups including Medecipher, Cohesic, Pathway, and Macusoft drive innovation with niche solutions and novel functionalities. End users, such as Northern Nevada Medical Center and Cleveland Clinic, implement these systems to improve patient care, enhance operational efficiency, and support evidence-based clinical decisions. Collaboration across software providers, enablers, and end users is critical for innovation, integration, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CLINICAL DECISION SUPPORT SYSTEM BY COMPONENT

The clinical decision support systems market, based on component, is segmented into software, hardware and services. The software segment accounted for the fastest growth in the clinical decision support systems market for the forecast period driven by the increasing adoption of AI-powered and cloud-based software solutions that enable real-time, personalized clinical decision-making, seamless integration with electronic health records (EHRs), and improved workflow efficiency.

CLINICAL DECISION SUPPORT SYSTEM BY PRODUCT

The clinical decision support systems market is segmented by product into integrated CDSS and standalone CDSS. In 2024, the integrated CDSS segment accounted for the largest share & the fastest growth for the forecast period. Driven by the large share of the CDSS segment can be attributed to the growing deployment of integrated CDSS by providers in healthcare settings to improve health outcomes and reduce medication errors.

CLINICAL DECISION SUPPORT SYSTEM BY TYPE

The clinical decision support systems market is segmented based on type into therapeutic CDSS and diagnostic CDSS. The therapeutic CDSS segment accounted for the largest share. This segment is also estimated to grow at a higher CAGR of 9.9% during the forecast period. The large share and the high growth rate of the therapeutic CDSS segment can be attributed to the growing preference for therapeutic CDSS by clinicians owing to benefits such as seamless integration into clinical workflows, high convenience, and user-friendly features.

CLINICAL DECISION SUPPORT SYSTEM BY MODEL

The clinical decision support systems market is segmented based on model are segmented into knowledge-based CDSS & non-knowledge-based CDSS. In 2024, the knowledgebased CDSS segment accounted for the largest share of 61.6% of the market. This segment is also projected to register the highest CAGR of 10.6% during the forecast period. The large share and high growth of this segment can be attributed to the several beneficial functionalities of these systems, such as assisting clinicians with knowledge-based reasoning to make informed clinical decisions in uncertainties. These systems can also be integrated into clinical workflows and are less prone to errors than nonknowledge-based systems.

CLINICAL DECISION SUPPORT SYSTEM BY DELIVERY MODE

Clinical decision support systems are delivered to end users through on-premise and cloud-based modes.The cloud based CDSS mode of delivery acheieved the fastest growth in the forecast perid driven by he increasing demand for scalable, cost-effective, and remotely accessible solutions that enable real-time data sharing, seamless integration with electronic health records (EHRs), and support for multi-site healthcare networks.

CLINICAL DECISION SUPPORT SYSTEM BY APPLICATION

Based on application, the clinical decision support systems market is segmented into conventional CDSS and advanced CDSS.Advanced CDSS segment achieved the fastest growth for the forecast period driven by the increasing adoption of AI- and machine learning-enabled decision support tools that provide predictive analytics, personalized treatment recommendations, and enhanced diagnostic accuracy, helping healthcare providers improve patient outcomes and operational efficiency.

CLINICAL DECISION SUPPORT SYSTEM BY INTERACTIVITY LEVEL

Based on the interactivity level, the CDSS market can be segmented into active CDSS and passive CDSS.The active CDSS segment accounted for the largest share as well as fastest growth in the market. The large share and high growth rate of this segment can be attributed to the feedback control mechanisms employed by active CDSS that supply clinicians with information and guidance without additional time and effort. These systems are also prone to fewer errors than passive CDSS.

CLINICAL DECISION SUPPORT SYSTEM BY SETTING

Based on setting, the CDSS market is segmented into inpatient settings and ambulatory care settings. The ambulatory care settings segment achieved the fastest growt for the forecast period driven by the increasing adoption of outpatient services, rise in chronic disease management, growing emphasis on preventive care, and the need for real-time clinical decision support to enhance patient care efficiency in outpatient and primary care facilities.

CLINICAL DECISION SUPPORT SYSTEM BY REGION

Based on region, the clinical decision support systems market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America led the clinical decision support systems market. This is attributed to its advanced healthcare infrastructure, strong presence of key industry players, and supportive regulatory initiatives promoting health IT adoption. In the US, rising concerns about medication errors and increasing efforts to enhance clinical efficiency have accelerated the deployment of CDSS solutions.als products.

REGION

Asia Pacific to be fastest-growing region in global clinical decision support system market during forecast period

The Asia Pacific clinical decision support system market is expected to register the highest CAGR during the forecast period, driven by a large patient population, rising chronic diseases, increasing adoption of EHRs, and strong investments in health IT. Government digital health initiatives and the rise of big data in healthcare further support this growth across emerging economies.

Clinical Decision Support Systems (CDSS) Market: COMPANY EVALUATION MATRIX

Wolters Kluwer (Star) leads with a strong market share and extensive product footprint, driven by its AI-enabled decision support software, seamless EHR integration, and widespread adoption across hospitals and ambulatory care settings. GE Healthcare (Emerging Leader) is gaining visibility with its advanced analytics and cloud-based CDSS solutions, strengthening its position through innovation and targeted offerings for specialty care. While Wolters Kluwer dominates through scale and a diverse portfolio, GE Healthcare shows significant potential to move toward the leaders' quadrant as demand for AI-driven, interoperable, and cloud-enabled clinical decision support systems continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.25 Billion |

| Market Forecast in 2030 (Value) | USD 3.89 Billion |

| Growth Rate | CAGR of 9.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Clinical Decision Support Systems (CDSS) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Neurology CDSS Market Assessment | Comprehensive TAM assessment for the global Neurology Clinical Decision Support Systems (CDSS) market segmented by key geographies, with detailed insights into market dynamics and emerging trends | Enabled the client to identify regional market opportunities, assess growth potential, and gain a clear view of emerging trends shaping the neurology CDSS landscape |

| Oncology CDSS Market Assesment | Comprehensive TAM assessment for global neurology cdds market across different geographies along with market dynamics and emergng technology trends. The analysis includes profiling of leading vendors based on their product portfolio, AI and clinical decision support capabilities, and system integration strategies. It further covers tier-wise pricing structures, cost–benefit assessment of deployment models, and mapping of core oncology use cases, operational efficiencies, and implementation barriers. |

|

RECENT DEVELOPMENTS

- March 2025 : EvidenceCare acquired Agathos to enhance physician enablement and reduce clinical variation by integrating Agathos's analytics into its platform for more personalized, data-driven insights.

- March 2025 : Elsevier enhanced ClinicalKey by integrating AI-powered decision support with Epic EHR and DrFirst’s iPrescribe, alongside a new mobile app and CME/MOC tracking, streamlining clinician workflows and care delivery.

- May 2024 : Radiometer & Etiometry entered into an agreement to assist caregivers in making appropriate decisions and enhancing workflow in critical care areas by integrating patient data and AI on a unified platform.

- April 2023 : Microsoft and Epic Systems expanded their strategic collaboration to integrate generative AI into healthcare, combining Azure OpenAI Service with Epic's EHR software to enhance healthcare solutions.

Table of Contents

Methodology

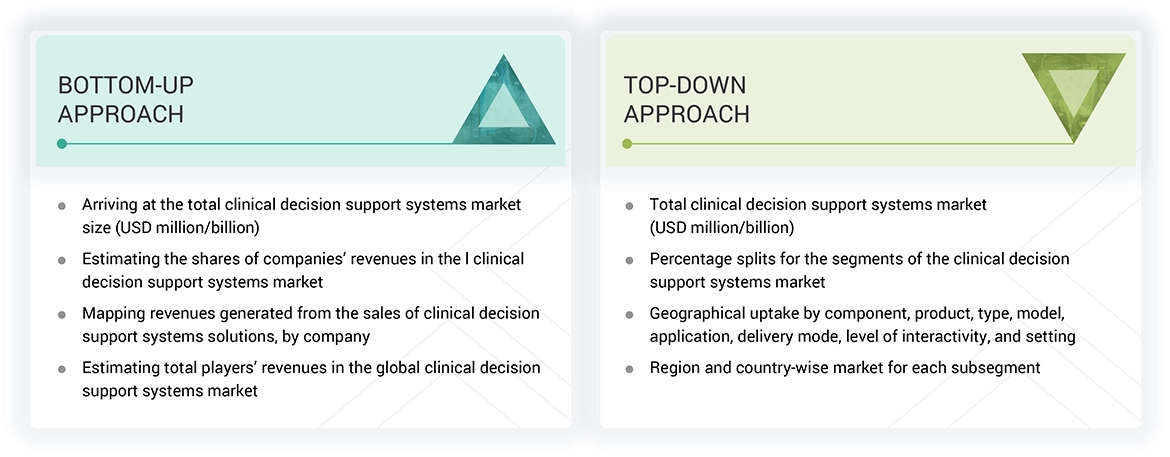

The study involved several key activities to estimate the current size of the clinical decision support systems market. Extensive secondary research was conducted to gather information on this market. The next step was to validate the findings, assumptions, and size estimates by consulting industry experts throughout the value chain through primary research. Various methods, including top-down and bottom-up approaches, were employed to estimate the overall market size. Following this, market segmentation and data triangulation techniques were utilized to determine the size of specific segments and subsegments.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing clinical decision support systems solutions is assessed using secondary data from paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of life science analytics vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of life science analytics solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

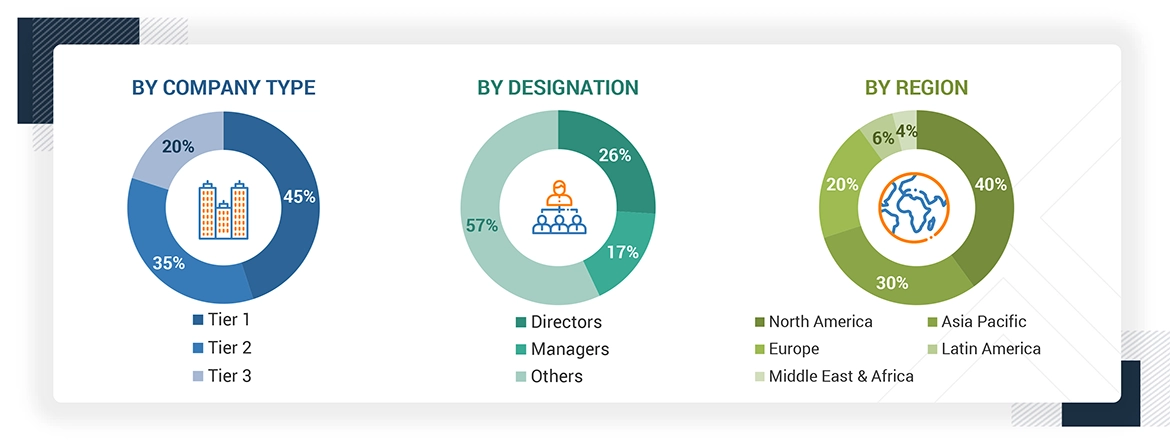

Breakdown of Primary Respondents

Note 1: Other designations include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by type, component, application, end user, and region).

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the clinical decision support systems market.

Market Definition

Clinical decision support systems are designed to aid in clinical decision-making. These healthcare information technology (HCIT) systems provide timely and person-specific information to healthcare providers to make appropriate clinical decisions based on a patient's circumstances. These platforms ensure healthcare professionals provide evidence-based care to their patients.

Stakeholders

- Senior Management

- Supply Chain Manager

- Research & Development Team

- Product Manager/Sales Manager

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Surgeons, Physicians, and Operating Room Staff

- Platform Providers

- Technology Providers

- System Integrators

- Healthcare IT Service Providers

Report Objectives

- To define, describe, and forecast the global clinical decision support systems market based on component, product, type, model, delivery mode, application, interactivity level, setting, and region

- To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall life science analytics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the clinical decision support systems market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

- To track and analyze competitive developments such as product launches, expansions, partnerships, agreements, collaborations, and acquisitions in the clinical decision support systems market

- To benchmark players within the clinical decision support systems market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Key Questions Addressed by the Report

What is the projected market of the global clinical decision support systems market in 2030?

The projected global clinical decision support systems market is USD 3.89 billion by 2030.

Which are the top leading players in the global clinical decision support systems market?

Wolters Kluwer N.V. (Netherlands), Oracle Cerner (US), Merative (US), Change Healthcare (US), Veradigm Inc. (US), athenahealth (US), Epic Systems Corporation (US), Elsevier B.V. (Netherlands), and Koninklijke Philips N.V. (Netherlands).

What are the major components of the clinical decision support systems market?

Services, Software, Hardware

Which geographical region dominates the global clinical decision support systems market?

North America dominated the global clinical decision support systems market in 2024.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Clinical Decision Support Systems (CDSS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Clinical Decision Support Systems (CDSS) Market

James

Dec, 2022

Which segment accounted for the largest market share for the clinical decision support systems market?.

Kahlill

Dec, 2022

Which factors are major growth restraints for the global clinical decision support system market?.